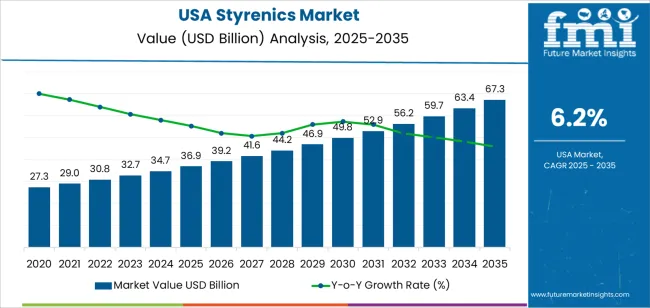

The demand for styrenics in the USA is anticipated to grow from USD 36.9 billion in 2025 to USD 67.1 billion by 2035, demonstrating a compound annual growth rate (CAGR) of 6.2%. Styrenics, which are polymers derived from styrene, are widely utilized across industries such as automotive, construction, electronics, and consumer goods. Known for their cost-effectiveness, versatility, and durability, styrenics are increasingly sought after as industries prioritize lightweight and eco-friendly materials. With the growing emphasis on high-performance plastics, styrenic polymers are expected to be key in addressing the rising demand for materials that offer strength, resilience, and environmental benefits.

Technological advancements in the formulation of styrenic materials will lead to improved properties, such as increased heat resistance, enhanced UV stability, and better recyclability. As industries evolve and focus on reducing carbon footprints, the growing popularity of eco-friendly materials will further boost the use of styrenics in automotive, construction, and consumer electronics. Manufacturers in these sectors are increasingly looking for materials that are both cost-efficient and durable, and styrenics are well-positioned to meet these demands. The automotive industry's push toward electric vehicles (EVs) and light weighting will significantly contribute to the rise in styrenic demand, along with advancements in smart devices and wearable technologies.

Between 2025 and 2030, the demand for styrenics in the USA will grow from USD 36.9 billion to USD 39.2 billion, reflecting steady year-on-year (YoY) growth. The demand will be driven by increasing use in the automotive and construction sectors, where styrenics offer lightweight and energy-efficient solutions for vehicle components, building materials, and insulation products. This growth will be supported by the continued focus on improving fuel efficiency and durability in the automotive sector, as well as the construction industry's push for energy-efficient materials. The increasing demand for consumer electronics and packaging materials will also contribute to the rising consumption of styrenic polymers during this period.

From 2030 to 2035, the demand for styrenics is projected to rise more sharply, increasing from USD 39.2 billion to USD 67.1 billion. The accelerated growth will be driven by advancements in polymer technologies and expanding applications in electronics, consumer goods, and packaging. The automotive industry’s shift toward electric vehicles (EVs) and the demand for lightweight materials to improve performance and energy efficiency will further fuel the need for styrenics. Eco-conscious packaging and durability-driven product development will continue to promote the growth of styrenic polymers in packaging, as companies seek to replace traditional plastics with eco-friendlier options.

| Metric | Value |

|---|---|

| Demand for Styrenics in USA Value (2025) | USD 36.9 billion |

| Demand for Styrenics in USA Forecast Value (2035) | USD 67.1 billion |

| Demand for Styrenics in USA Forecast CAGR (2025 to 2035) | 6.2% |

The demand for styrenics in the USA is growing due to their wide range of applications across industries such as automotive, packaging, electronics, and construction. Styrenics, including materials like polystyrene, ABS (Acrylonitrile Butadiene Styrene), and SAN (Styrene Acrylonitrile), are valued for their versatility, ease of processing, and cost-effectiveness. These properties make styrenic polymers ideal for producing products ranging from packaging materials and consumer goods to automotive parts and electronics, driving their increasing demand in multiple sectors.

A major driver behind the growth of styrenics is the expanding packaging industry, where lightweight, durable, and cost-efficient materials are needed to meet consumer demand for eco-friendly and high-performance products. As e-commerce continues to rise, particularly with the increasing demand for online shopping and food delivery, styrenics are becoming a preferred material for packaging, particularly for protective packaging in transit. The growing focus on lightweight materials in automotive manufacturing to improve fuel efficiency and reduce carbon emissions is further boosting the demand for styrenics in the automotive sector.

The rise of new technologies and innovations in the electronics sector is contributing to the demand for styrenic polymers. The development of advanced electronic devices, including smartphones, home appliances, and wearable tech, requires materials that offer both strength and electrical insulation. As industries continue to push for greater performance, durability, and cost efficiency, the demand for styrenics in the USA is expected to grow steadily through 2035, supported by their broad applicability and continuous technological advancements.

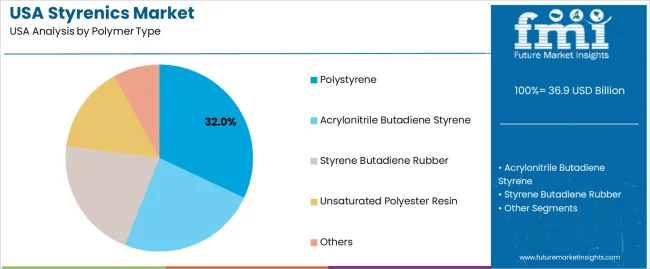

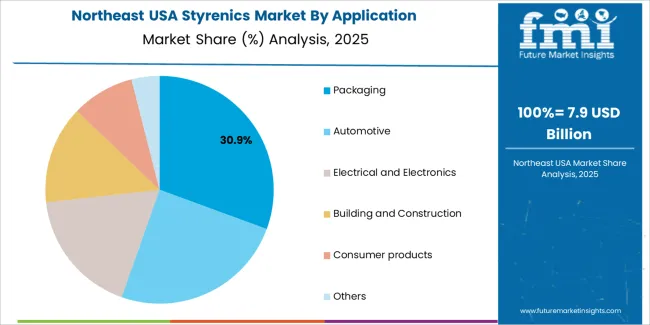

Demand for styrenics in the USA is segmented by polymer type, application, and region. By polymer type, demand is divided into polystyrene, acrylonitrile butadiene styrene (ABS), styrene butadiene rubber (SBR), unsaturated polyester resin, and others, with polystyrene leading the demand at 32%. The demand is also segmented by application, including packaging, automotive, electrical and electronics, building and construction, consumer products, and others, with packaging leading the demand at 30%. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Polystyrene accounts for 32% of the demand for styrenics in the USA. This polymer is preferred due to its affordability, ease of processing, and versatility in multiple applications. Polystyrene is particularly valued in the production of packaging materials, disposable containers, and consumer products because of its lightweight, rigid structure, and clarity. It is also widely used in automotive and electrical components that require low-cost, high-performance solutions. Its ability to be molded into various shapes and its excellent transparency and insulation properties make it suitable for a wide range of products. Polystyrene is a popular choice due to its cost-effectiveness, ease of production, and ability to meet industry requirements for clear, durable products. As industries continue to look for affordable and efficient materials, polystyrene’s continued dominance in the styrenics industry in the USA remains assured.

Packaging accounts for 30% of the demand for styrenics in the USA. Styrenic polymers, especially polystyrene and ABS, are commonly used in packaging due to their ability to provide durable, cost-effective, and versatile solutions. Styrenics are used to create a range of packaging products, including containers, cups, trays, and protective packaging materials. Their excellent clarity, impact resistance, and ease of fabrication make them ideal for packaging applications that require both functionality and aesthetic appeal. The growing demand for convenience products, such as single-use containers and food packaging, further drives the use of styrenics in packaging. As concerns about durability grow, there is also increasing interest in recyclable and eco-friendly packaging options that use styrenic materials. The combination of practical performance and affordability ensures that packaging remains the largest application area for styrenic materials in the USA.

Demand for styrenics in the USA is growing as industries such as packaging, automotive, consumer goods, electronics, and construction increasingly rely on styrene‑based polymers due to their lightweight, moldability, durability, and cost‑effectiveness. The rise of e‑commerce and the need for protective, lightweight packaging boost the use of polystyrene and expandable‑ps foams. Automakers and electronics manufacturers use styrenic polymers like ABS and SAN for components that benefit from impact resistance, dimensional stability, and ease of production. The demand faces restraints due to environmental concerns, regulatory pressures on plastic waste, and the growing need for eco-friendly and recyclable materials.

Why is Demand for Styrenics Growing in the USA?

Demand for styrenics is rising in the USA as industries balance performance and cost while meeting shifting consumer and regulatory expectations. For packaging, especially in food, electronics, and e‑commerce, styrenic polymers offer lightweight, low‑cost, protective packaging that reduces shipping costs and protects goods. The consumer electronics, home appliance, and automotive sectors favor styrenics like ABS and SAN for housings, panels, and interior parts due to their strength, molding flexibility, and durability. The growing awareness of recycling and durability is driving the demand for recycled styrenics, where post‑consumer or post‑industrial styrenics are reused, reducing reliance on virgin materials while maintaining functional benefits.

How are Technological & Industry Innovations Driving Styrenics Demand in the USA?

Technological advances and evolving industry practices are boosting demand for styrenics in the USA by improving material performance and aligning with durability trends. Improved recycling technologies for mechanical and chemical processes are making recycled styrenics like rABS and rPS more viable for reuse in packaging, automotive, and electronics applications, reducing waste and reliance on virgin materials. Better formulations of styrenic polymers, such as enhanced mechanical strength, heat resistance, and impact resistance, expand their applications in demanding industries like automotive, electronics, appliances, and construction. This makes styrenics a competitive alternative to heavier materials and other plastics where weight, cost, and processing ease matter.

What are the Key Challenges and Risks That Could Limit Styrenics Demand in the USA?

Despite strong demand drivers, there are significant challenges limiting styrenics adoption in the USA. Environmental concerns and regulatory pressure are at the forefront, with traditional styrenics like polystyrene facing criticism for their non‑biodegradability and recycling difficulties. This has led to restrictions on single‑use plastics and a push for more recyclable or bio‑based materials. Fluctuations in raw material costs for styrene monomer and feedstock can result in price instability, affecting planning for manufacturers. Lastly, while recycled styrenics are gaining popularity, issues with quality performance and recycling infrastructure can limit their adoption in high‑spec applications, potentially suppressing growth in certain segments.

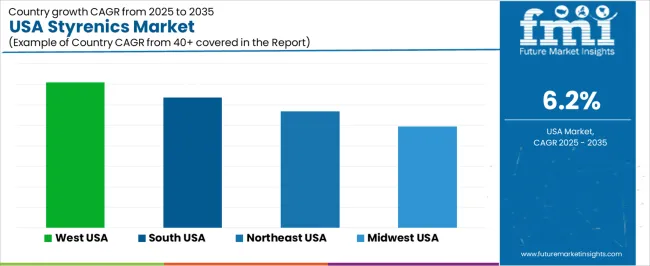

| Region | CAGR (%) |

|---|---|

| West USA | 7.1% |

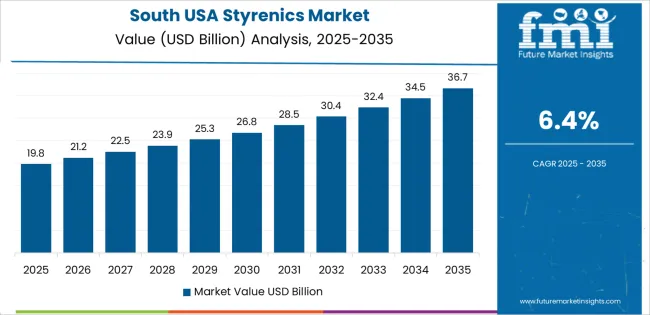

| South USA | 6.4% |

| Northeast USA | 5.7% |

| Midwest USA | 4.9% |

Demand for styrenics in the USA is growing steadily, with West USA leading at a 7.1% CAGR, driven by its strong industrial base in automotive, electronics, and packaging sectors. The region’s focus on technological innovation and durability trends is supporting the growth of styrenic materials in manufacturing and consumer products. South USA follows with a 6.4% CAGR, benefiting from a booming construction and manufacturing sector, particularly in packaging and automotive industries. Northeast USA shows a 5.7% CAGR, fueled by its large consumer goods, healthcare, and packaging industries. Styrenics like ABS and HIPS are key components in packaging materials and medical applications. Midwest USA experiences a 4.9% CAGR, with demand driven by automotive and industrial manufacturing, particularly in components and packaging.

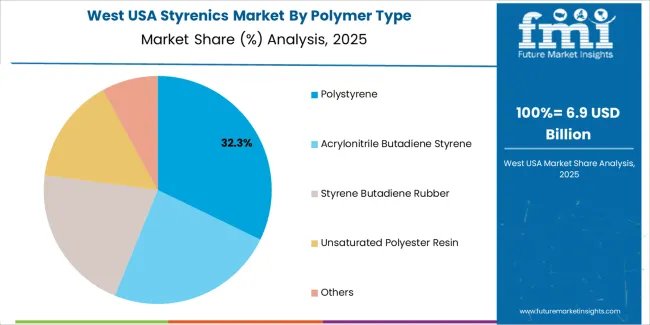

West USA is leading the demand for styrenics, growing at a 7.1% CAGR. This growth is driven by the region's strong industrial sectors, particularly automotive, electronics, and packaging industries, which are major consumers of styrenic polymers. With the continuous development of eco-friendly packaging solutions and the growth of the automotive and electronics industries, the demand for styrenics is expected to remain high in West USA. The region's focus on innovation and technological advancements further supports the use of styrenics in manufacturing processes, with products such as high-impact polystyrene (HIPS) and expandable polystyrene (EPS) gaining traction for a wide range of applications.

West USA's vast consumer industry, particularly in California, which leads in production and consumption of consumer goods, is contributing to the increasing demand for styrenics in packaging and consumer products. As durability trends and recycling initiatives continue to rise, styrenics' applications in both traditional and eco-friendly packaging solutions are expanding, ensuring steady growth for the region's styrenics industry.

South USA is witnessing significant demand for styrenics, with a 6.4% CAGR, primarily due to its booming construction and manufacturing industries. The region has become a hub for industrial development, including the production of packaging materials, consumer goods, and durable products that require styrenic polymers like polystyrene and acrylonitrile-butadiene-styrene (ABS). Styrenics are crucial in these sectors due to their versatile properties, such as impact resistance and ease of molding, which make them ideal for use in a wide range of applications, from packaging to construction materials.

South USA's strong presence in the petrochemical sector is helping to bolster the supply and demand for styrenics. The region's industrial infrastructure, including a number of chemical manufacturing facilities, supports the production of styrenic products, meeting the increasing demand for both traditional and innovative styrenic applications. With growth in key industries such as automotive, healthcare, and consumer goods, South USA’s demand for styrenics is projected to continue rising, driven by both domestic consumption and regional industrial growth.

Northeast USA is experiencing steady demand for styrenics, with a 5.7% CAGR. This region is a major center for consumer goods, healthcare, and packaging industries, all of which rely on styrenic polymers for a variety of applications. Styrenics such as high-impact polystyrene (HIPS) and ABS are widely used in packaging materials for food, pharmaceuticals, and consumer products. As demand for eco-friendly and cost-effective packaging solutions continues to rise, styrenics are being increasingly adopted in this sector due to their strength, durability, and recyclability.

The Northeast's well-established industrial base, particularly in cities like New York, New Jersey, and Pennsylvania, is also driving the demand for styrenics in manufacturing applications. The region’s growing focus on innovative products for the medical and healthcare industries, as well as the expansion of e-commerce and logistics, is further pushing the need for lightweight, high-strength materials. As these trends continue to gain momentum, styrenics will play an essential role in the region's industrial and packaging applications, sustaining long-term demand.

Midwest USA is seeing moderate growth in the demand for styrenics, with a 4.9% CAGR, driven largely by the region’s strong automotive and industrial manufacturing sectors. Styrenics are widely used in automotive parts, including interior components and bumpers, due to their durability, strength, and impact resistance. The region's automotive industry, especially in Michigan, Ohio, and Indiana, relies heavily on styrenic polymers for various applications, including lightweight, cost-effective, and high-performance components. As the demand for energy-efficient and cost-effective materials in automotive manufacturing grows, styrenics will continue to be a key material in meeting these needs.

Midwest USA’s industrial base, including heavy machinery, consumer goods, and packaging, is also driving the need for styrenics. Styrenic materials like HIPS, EPS, and ABS are used extensively in packaging and industrial components, offering benefits such as ease of molding, versatility, and high-performance characteristics. With the region’s ongoing focus on industrial innovation and development, the demand for styrenics is expected to grow steadily, further supporting Midwest USA's manufacturing sectors.

The demand for styrenics in the USA is growing due to their wide range of applications in industries such as automotive, construction, electronics, packaging, and consumer goods. Styrenics, including polystyrene (PS), acrylonitrile butadiene styrene (ABS), and styrene acrylonitrile (SAN), are known for their versatility, cost-effectiveness, and excellent mechanical properties. These materials are essential for producing lightweight, durable, and high-performance products, driving their continued adoption in manufacturing and production processes. As industries focus on enhancing product quality, reducing costs, and meeting durability goals, the demand for styrenics remains strong.

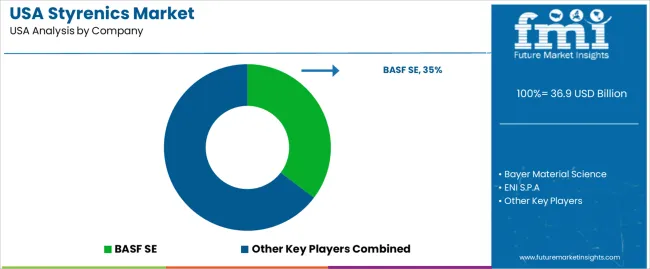

Leading companies in the styrenics industry in the USA include BASF SE, Bayer Material Science, ENI S.P.A, Ineos Group AG, and Royal DSM. BASF SE holds the largest share of the industry at 35.3%, offering a wide variety of styrenic polymers used across multiple industries, including packaging, automotive, and electronics. Bayer Material Science (now part of Covestro) provides styrenics with advanced properties for high-performance applications in various sectors. ENI S.P.A and Ineos Group AG offer styrenic materials used in industrial applications, packaging, and electronics, with a focus on high-quality production processes. Royal DSM is another key player, providing styrenic products focused on improving durability, performance, and efficiency across its product lines.

The competitive dynamics in the styrenics industry are driven by factors such as material performance, cost efficiency, and the increasing need for environmentally friendly solutions. Companies compete by offering innovative styrenic solutions that meet the growing demand for lightweight, durable, and high-performance products. The ability to provide tailored solutions, improve manufacturing processes, and meet industry-specific requirements gives companies a competitive edge in this growing industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Polymer Type | Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Unsaturated Polyester Resin, Others |

| Application | Packaging, Automotive, Electrical and Electronics, Building and Construction, Consumer Products, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | BASF SE, Bayer Material Science, ENI S.P.A, Ineos Group AG, Royal DSM |

| Additional Attributes | Dollar sales by polymer type and application; regional CAGR and adoption trends; demand trends in styrenics; growth in packaging, automotive, and electronics sectors; technology adoption for polymer applications; vendor offerings including styrenic resins and related materials; regulatory influences and industry standards |

The demand for styrenics in USA is estimated to be valued at USD 36.9 billion in 2025.

The market size for the styrenics in USA is projected to reach USD 67.3 billion by 2035.

The demand for styrenics in USA is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in styrenics in USA are polystyrene, acrylonitrile butadiene styrene, styrene butadiene rubber, unsaturated polyester resin and others.

In terms of application, packaging segment is expected to command 30.0% share in the styrenics in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA