The USA tackifier demand is valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, reflecting a CAGR of 5.2%. Growth is supported by adhesive consumption in packaging, automotive components, construction materials, and hygiene products requiring improved bonding strength, cohesive performance, and heat resistance. Increased use of hot-melt and pressure-sensitive adhesive systems reinforces demand, particularly where faster assembly cycles are required. Hydrocarbon resins lead product USAge due to their compatibility with major adhesive chemistries, stable performance across temperature variations, and suitability for flexible packaging, labels, woodworking, and tapes. Continuous formulation improvements target low-odour, low-VOC, and food-contact compliance to align with regulatory expectations and ecofriendly goals.

West USA, South USA, and Northeast USA register the highest utilization, supported by end-use clustering in consumer packaged goods, automotive supply chains, hygiene product converters, and construction activity demanding reliable adhesive solutions. Key suppliers include Eastman Chemical Company, ZEON CORPORATION, Arkema, Kolon Industries, and H.B. Fuller Company. These companies provide diverse hydrocarbon, rosin, and terpene-based tackifiers for industrial adhesives, enabling consistent tack performance, substrate versatility, and productivity in high-volume converting environments.

Demand for tackifiers in the United States shows steady expansion, driven by adhesive USAge in packaging, automotive interiors, hygiene products, and construction materials. Growth during the first half of the ten-year period is supported by strong packaging demand from e-commerce, increased bonding applications in lightweight automotive components, and consistent consumption in tapes and labels. Hygiene adhesives, linked to diaper and medical disposables, reinforce early momentum and create a reliable demand base.

During the latter half of the period, the growth profile evolves as ecofriendly influences resin selection and regulatory pressure increases for solvent-based or high-VOC adhesives. Bio-based and hydrogenated tackifiers become stronger contributors to incremental value, while traditional hydrocarbon variants experience slower penetration due to environmental constraints. Industrial manufacturing and infrastructure upgrades maintain stable utilization, balancing moderation in mature packaging segments. The comparison indicates stronger initial tailwinds with modest deceleration later, yet the cumulative ten-year expansion remains positive. The shift toward renewable feedstocks and performance-enhanced adhesive systems prevents major stagnation, ensuring a controlled long-term growth trajectory across U.S. tackifier applications.

| Metric | Value |

|---|---|

| USA Tackifier Sales Value (2025) | USD 1.6 billion |

| USA Tackifier Forecast Value (2035) | USD 2.6 billion |

| USA Tackifier Forecast CAGR (2025-2035) | 5.2% |

Demand for tackifiers in the USA is increasing because adhesive manufacturers and product formulators require stronger bonding performance for packaging, tapes, labels and hygiene applications. Hot-melt adhesives used in case and carton sealing rely on tackifiers to improve initial grip and quick setting, which supports high-speed packaging lines serving groceries, e-commerce and consumer goods. Growth in disposable hygiene products, including baby diapers and adult incontinence items, strengthens demand for low-odour, skin-safe tackifiers that support elastic attachment and secure closure. The building and automotive sectors use pressure-sensitive adhesives with tackifiers to support trim bonding and lightweight component assembly, which aligns with energy-efficiency and material-reduction goals.

Innovation in hydrogenated and bio-based tackifiers also contributes to industry expansion, as U.S. manufacturers seek improved thermal stability, lower volatility and compatibility with new polymer systems. Domestic resin suppliers invest in upgraded processing capacity to ensure consistent adhesive performance across varied climatic conditions. Constraints include volatility in raw material prices, especially terpene and petroleum derivatives, and formulation challenges when switching to ecofriendly alternatives. Smaller converters may delay adoption of advanced tackifiers until performance and cost balance is clearly demonstrated.

Demand for tackifiers in the United States is influenced by growth in pressure-sensitive adhesives, packaging, automotive assembly, and hygiene product manufacturing. Selection focuses on adhesion strength, compatibility with varied polymer systems, and performance under temperature exposure common in U.S. logistics environments. Manufacturers prioritize formulations that support faster line speeds, low odor, and stable bonding to diverse substrates including paper, plastics, and metals.

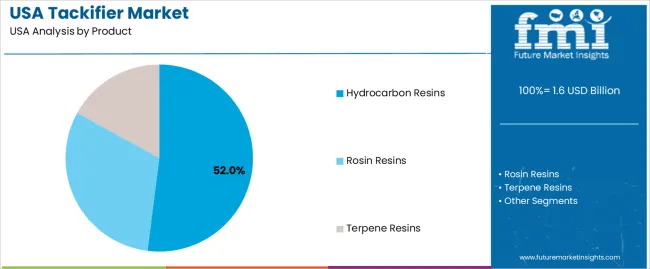

Hydrocarbon resins account for 52.0%, reflecting their wide compatibility with hot-melt adhesives used in packaging, tapes, labels, and hygiene goods. These resins offer controlled viscosity and cost-effective tack performance, supporting high-volume U.S. industrial use. Rosin resins hold 31.0%, driven by applications requiring enhanced adhesion to polar substrates and interest in partially renewable chemical inputs. Terpene resins represent 17.0%, adopted where strong compatibility with elastomers and improved fragrance characteristics are needed, such as in specialty consumer goods. Product selection aligns with performance consistency, heat resistance, and polymer compatibility across converting and assembly operations in domestic manufacturing.

Key points:

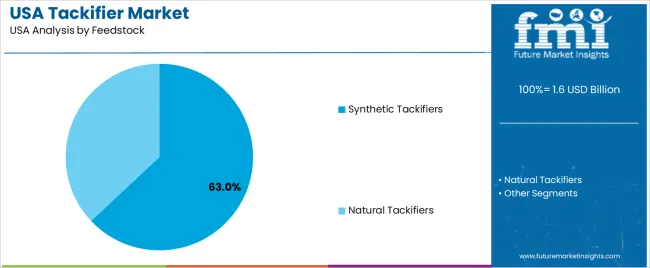

Synthetic tackifiers represent 63.0%, supported by dependable supply, tailored molecular structures, and compatibility with a broad range of polymer systems used in U.S. manufacturing. These materials maintain stability during storage and extended processing at elevated temperatures. Natural tackifiers account for 37.0%, influenced by demand for eco-aligned ingredients and regulatory shifts in product stewardship. Applications requiring low-odor, lower VOC content contribute to gradual adoption of natural sources where price parity is achievable. Decision-making reflects durability expectations in construction adhesives and the cost advantages of synthetic raw materials in large-volume packaging operations.

Key points:

Growth of pressure-sensitive adhesives in packaging and labels, expansion of construction sealants and rising demand for hot-melt adhesives in e-commerce logistics are driving demand.

In the United States, tackifiers see strong USAge in pressure-sensitive adhesives that support labels, tapes and graphics used across major retail supply chains. Rising e-commerce shipments require durable carton-sealing and pallet-stabilization adhesives, strengthening procurement among packaging converters. Construction activity in southern and western states leads to growing demand for sealants and weather-resistant bonding products used in insulation, flooring and window installation. Consumer goods manufacturers adopt hot-melt adhesives in hygiene products and disposable packaging to meet high-speed production needs, maintaining consistent tackifier demand across large-scale converting and assembly operations.

Volatile pricing for pine-based and petroleum-derived feedstocks, environmental compliance costs and limited adoption among small converters restrain growth.

Feedstock costs for rosin esters and hydrocarbon resins often fluctuate with seasonal supply and crude-oil industry shifts, creating pricing uncertainty for U.S. adhesive producers. Compliance with environmental and worker-safety regulations increases production costs for high-VOC or solvent-based systems, which may limit formula updates for budget-sensitive customers. Small and mid-sized converters may continue using legacy adhesives if upgrade costs outweigh performance benefits, slowing penetration of advanced tackifier systems in niche segments. These constraints contribute to uneven adoption across the adhesives industry.

Shift toward low-VOC and food-contact-safe formulations, increased use in green packaging and rising integration in high-performance tapes define key trends.

The U.S. packaging companies are adopting tackifiers designed for low-emission, low-odor processing to align with ecofriendly goals and indoor-air standards. Food-contact-compliant tackifiers are gaining traction as packaged food producers expand resealable and shelf-ready labeling innovations. Advanced polymer-enhanced resin systems support high-performance tapes used in industrial assembly, electronics and automotive applications where temperature and stress resistance are critical. Recycled and paper-forward packaging growth encourages new adhesive chemistries that improve tack on fiber-based substrates. These trends point to continued modernization and diversified demand for tackifiers across the United States.

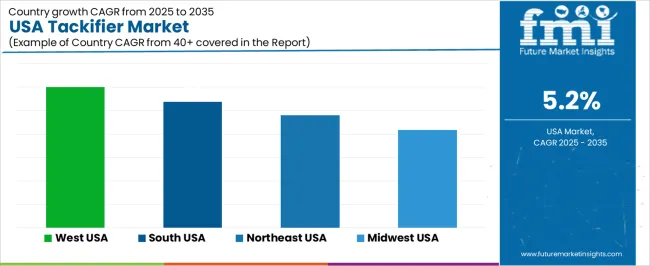

Demand for tackifiers in the United States is supported by adhesive formulations used in packaging, woodworking, construction materials, hygiene products, and automotive component assembly. Performance improvement in pressure-sensitive adhesives shapes procurement volumes in commercial manufacturing zones. Resin sourcing, logistics access, and end-user production concentration influence regional growth rates. West USA leads at 6.0% CAGR, followed by South USA (5.4%), Northeast USA (4.8%), and Midwest USA (4.2%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 6.0% |

| South USA | 5.4% |

| Northeast USA | 4.8% |

| Midwest USA | 4.2% |

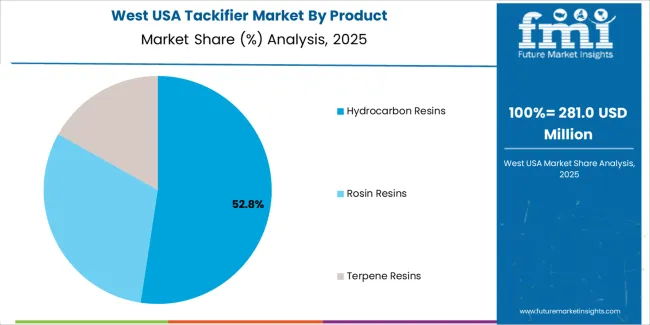

West USA grows at 6.0% CAGR, driven by strong adhesive USAge in packaging, electronics, and composite material bonding across California, Washington, and Oregon. Distribution networks for e-commerce fulfillment require high-performance pressure-sensitive adhesive labels supporting rapid logistics timelines. West-coast consumer goods brands depend on hot-melt formulations utilizing tackifiers to ensure secure sealing for multipack and protective packaging. Electronics facilities incorporate tackifier-modified adhesives in device assembly where precision bonding supports resistance to vibration and temperature shifts. Renewable-chemistry programs enhance interest in bio-based terpene tackifiers due to sustainability policies across coastal states. Packaging converters and adhesive compounders located near port infrastructure maintain consistent access to feedstock imports, strengthening sourcing stability. Performance metrics such as initial tack strength and clean removal influence product development decisions within regional adhesive manufacturing.

South USA records 5.4% CAGR, influenced by hygiene product manufacturing, construction adhesive USAge, and automotive component bonding across Texas, Georgia, Florida, and North Carolina. Diaper and sanitary pad production uses tackifiers in hot-melt adhesives for secure substrate bonding under humidity exposure. Building product suppliers require strong tack performance for flooring, insulation attachment, and sealant applications in high-temperature environments. Automotive assembly plants rely on modified adhesives where vibration resistance and long-term durability guide formulation stability. Resin production facilities along the Gulf Coast supply feedstocks supporting cost-efficient compound development for adhesive producers. Consumer-goods and packaging distribution centers increase volumes for tape and label adhesives used across retail channels.

Northeast USA expands at 4.8% CAGR, affected by consumer-goods packaging, pharmaceutical labeling, and specialty adhesive coating used in regulated production environments. New York, New Jersey, and Massachusetts operate significant printing and converting facilities where pressure-sensitive adhesives with improved quick-stick behavior ensure secure application on small-format packaging. Pharmaceutical distributors require compliant adhesive materials enabling traceability and secure label retention. Population density sustains demand for packaged goods where shelf-ready solutions mandate reliable sealing and peel performance. Adhesive manufacturers focus on consistent tack behavior under cold-chain distribution conditions common in regional logistics.

Midwest USA posts 4.2% CAGR, reinforced by automotive supply, furniture production, and corrugated packaging operations across Illinois, Michigan, Ohio, and Indiana. Hot-melt adhesives with tackifier components secure interior trim and sealing materials across regional assembly plants. The furniture sector applies bonding solutions for laminated wood, upholstery, and foam attachment during large-batch production. Corrugated packaging operations require pressure-sensitive adhesive solutions ensuring box label adherence throughout long-distance transport. Industrial buyers evaluate tackifier selections based on durability and process compatibility with installed adhesive-dispensing equipment.

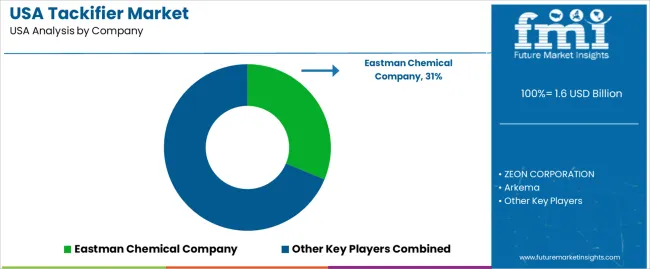

Demand for tackifiers in the USA is shaped by chemical suppliers supporting adhesive formulators in packaging, automotive interiors, construction sealing systems, and hygiene products. Eastman Chemical Company holds an estimated 31.3% share, supported by controlled resin chemistry, consistent softening-point stability, and widespread supply to pressure-sensitive adhesive producers in U.S. converting and assembly operations. ZEON CORPORATION, operating through its U.S. subsidiary, maintains strong participation with specialty elastomer-compatible tackifiers used in automotive and industrial adhesives. Its materials deliver predictable compatibility with synthetic rubber systems and controlled viscosity behaviour in continuous production. Arkema contributes meaningful share through rosin-based and hydrogenated tackifiers that support balanced adhesion and oxidation resistance in hygiene and tape applications, ensuring steady consumption across U.S. converters.

Kolon Industries supplies hydrocarbon-resin tackifiers valued for consistent bonding performance in hot-melt adhesives used in packaging and woodworking. U.S. distributors maintain reliable access to stable production grades suited for large-scale formulation. H.B. Fuller Company adds depth as a formulator and user of tackifiers within its adhesive systems, reinforcing demand through vertical integration and consistent sourcing for consumer and industrial applications. Competition in the USA centers on resin purity, oxidative stability, colour consistency, bond durability, formulation compatibility, and supply-chain reliability. Demand continues to expand as U.S. manufacturers require tackifier systems that maintain stable adhesion across variable substrates and processing temperatures within packaging, hygiene, and engineered-material operations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product | Hydrocarbon Resins, Rosin Resins, Terpene Resins |

| Feedstock | Synthetic Tackifiers, Natural Tackifiers |

| End Use | Pressure Sensitive Adhesives (PSA), Hot Melt Adhesives, Tire & Rubber, Bookbinding, Packaging, Hygiene Products, Construction Adhesives |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Eastman Chemical Company, ZEON CORPORATION, Arkema, Kolon Industries, H.B. Fuller Company |

| Additional Attributes | Demand influenced by automotive lightweighting, adhesive consumption in packaging and hygiene products, transition toward bio-based tackifiers, regulatory compliance in VOC-restricted applications, and continuous innovation in hot-melt and PSA technologies across U.S. industrial and consumer segments. |

The demand for tackifier in USA is estimated to be valued at USD 1.6 billion in 2025.

The market size for the tackifier in USA is projected to reach USD 2.6 billion by 2035.

The demand for tackifier in USA is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in tackifier in USA are hydrocarbon resins, rosin resins and terpene resins.

In terms of feedstock, synthetic tackifiers segment is expected to command 63.0% share in the tackifier in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Tackifier Market Analysis by Product, Feedstock, and Region 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA