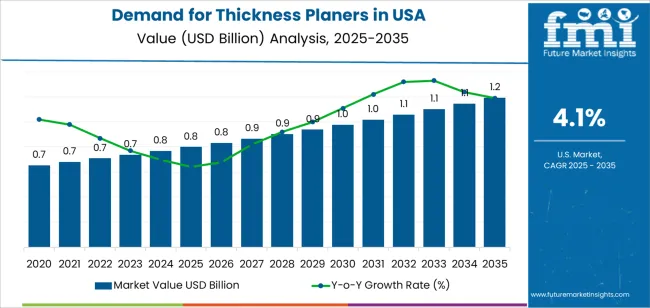

The USA thickness planers demand is valued at USD 0.8 billion in 2025 and is projected to reach USD 1.2 billion by 2035, growing at a CAGR of 4.1%. Demand is supported by steady activity in residential woodworking, furniture production, and small-scale fabrication. Thickness planers remain essential for achieving uniform board dimensions, surface accuracy, and consistent material preparation across hobbyist, professional, and light-industrial settings. Increased participation in home woodworking and the expansion of small workshops continue to reinforce purchase volumes across retail and e-commerce channels.

Bench-top thickness planers represent the leading product type due to their compact size, portability, and suitability for small to mid-scale operations. These systems provide adequate cutting width, adjustable feed rates, and stable depth control, making them practical for general wood preparation tasks. Improvements in cutterhead design, noise reduction, chip extraction, and blade durability are strengthening performance and long-term reliability.

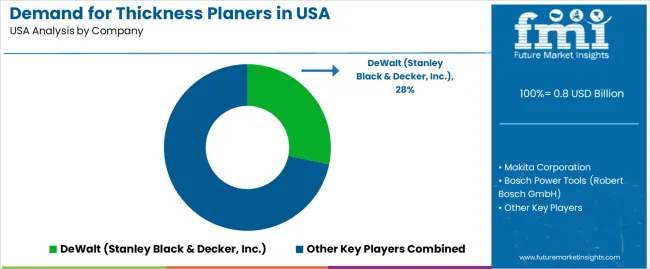

Demand is strongest in the West, South, and Northeast, supported by active residential renovation, home workshop growth, and increased sales through specialty tool outlets. Key suppliers include DeWalt, Makita, Bosch, JET Tools, and Grizzly Industrial, focusing on build quality, precision cutting capability, and enhanced user safety features.

The acceleration and deceleration pattern shows an early period of firm expansion followed by steady normalization as the industry matures. Between 2025 and 2029, the segment will move through an acceleration phase driven by demand from woodworking shops, home-renovation activity, and small-scale manufacturing. Increased adoption of compact, dust-controlled, and energy-efficient planer models will reinforce early growth across professional and hobbyist applications.

From 2030 to 2035, the segment will enter a mild deceleration phase as penetration stabilizes and procurement aligns more closely with replacement cycles rather than new installations. Demand will remain consistent due to ongoing renovation projects and routine equipment upgrading, though without the sharper gains seen earlier in the period. Incremental improvements in blade systems, vibration control, and digital depth-setting features will support steady purchasing. The overall pattern reflects a durable tools segment transitioning from early expansion to stable, process-driven maturity supported by continuous use in woodworking and light industrial environments.

| Metric | Value |

|---|---|

| USA Thickness Planers Sales Value (2025) | USD 0.8 billion |

| USA Thickness Planers Forecast Value (2035) | USD 1.2 billion |

| USA Thickness Planers Forecast CAGR (2025 to 2035) | 4.1% |

Demand for thickness planers in the USA is increasing as wood-working businesses, cabinet manufacturers and home-improvement hobbyists require reliable equipment to produce uniform boards and smooth finishes. Growth in residential construction and renovation is driving materials consumption in interior trim, flooring and furniture manufacturing. The surge in do-it-yourself (DIY) woodworking among urban homeowners boosts the industry for benchtop and portable planers designed for smaller workshops and garages. Technological advances such as digital depth controls, dust extraction systems and quieter operation enhance appeal to professional and semi-professional users.

North American demand continues to rise with a projected compound annual growth rate of about 4 % to 6 % for the next few years. The rise of small and medium-sized woodworking enterprises also supports heightened tool purchases. The industry faces constraints due to high equipment cost compared with simpler hand tools, skilled labour shortages in the woodworking industry and fluctuations in raw-material pricing which affect wood fabrication budgets. Adoption may be slower in price-sensitive regions or among occasional users who rent rather than purchase equipment.

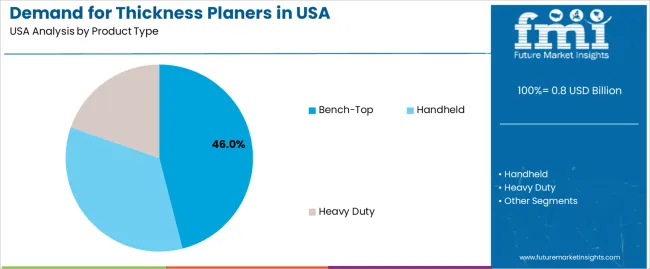

Demand for thickness planers in the United States is distributed across product formats, power sources, and end-use industries. Buying patterns reflect workshop requirements, mobility needs, and production volume. Manufacturers supply models across hobby, commercial, and industrial settings, with distinct preferences shaping industry share for each segment.

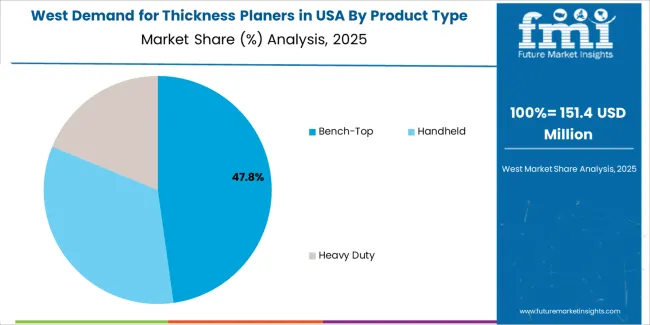

Bench-top thickness planers hold an estimated 46.0% share of USA demand and represent the leading product category. These units provide reliable performance, consistent cutting depth, and durability suited to small professional shops, hobbyists, and light industrial users. Their compact size and affordability widen adoption across retail and e-commerce channels. Heavy-duty thickness planers account for 34.0%, serving furniture factories, large commercial workshops, and industrial production floors where continuous operation and wider cutting widths are required. Handheld thickness planers represent 20.0%, used for quick adjustments, small-scale site tasks, and on-the-go carpentry.

Key drivers and attributes:

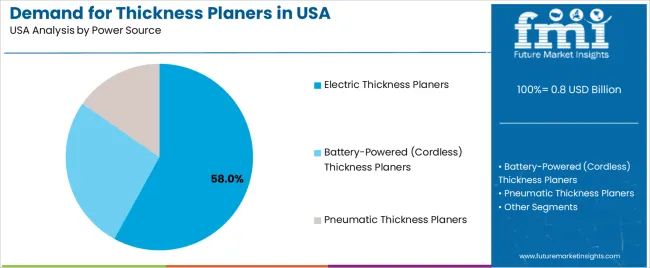

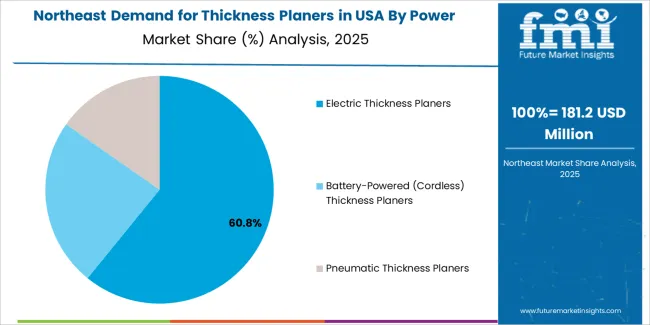

Electric thickness planers hold an estimated 58.0% share of USA demand. These corded units provide consistent power output, longer operational life, and stable cutting performance suited to furniture shops, construction sites, and industrial settings. They are widely used in sustained workloads where uninterrupted power supply is essential. Battery-powered thickness planers account for 27.0%, driven by rising interest in cordless tools for mobility and convenience. Their adoption is particularly strong among contractors and hobby users who value portability. Pneumatic planers represent 15.0%, serving niche applications requiring continuous, high-torque output in workshops equipped with robust air systems.

Key drivers and attributes:

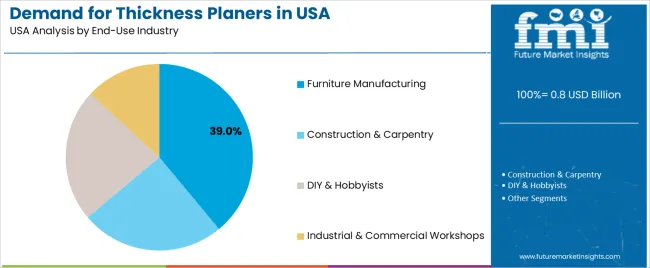

Furniture manufacturing represents an estimated 39.0% of USA demand for thickness planers. This industry requires precise surface preparation, uniform board thickness, and controlled finishing for hardwood, engineered wood, and specialty materials. Construction and carpentry account for 28.0%, reflecting frequent use on job sites for structural timber, framing components, and project-specific adjustments. DIY and hobbyists represent 21.0%, supported by increased home workshop activity and accessible bench-top planer models. Industrial and commercial workshops hold 12.0%, including specialty fabrication units, cabinet shops, and production-support facilities using planers for prototype or small-batch runs.

Key drivers and attributes:

Growing woodworking activity, expansion of home improvement projects, and rising demand for precision finishing are driving industry growth.

Demand for thickness planers in the United States is increasing as professional woodshops, custom furniture manufacturers, and millwork facilities seek consistent board thickness and improved surface quality. Growth in residential renovation and remodeling supports higher use of planers for cabinetry, flooring preparation, and specialty carpentry. The rise of hobbyist woodworking and small garage workshops also contributes to strong interest in portable and benchtop planers that offer affordable precision for home users. Manufacturers are improving machine performance through refined cutter head designs, enhanced feed systems, digital thickness indicators, and better dust collection interfaces. These upgrades help users increase productivity and achieve consistent results across a wide range of wood species and project types.

High equipment cost, limited replacement frequency, and competition from alternative finishing tools are restraining adoption.

Thickness planers represent a significant investment for small workshops or casual hobbyists, especially when considering ongoing costs for blades, maintenance, and dust control accessories. Many facilities rely on older machines for long periods, and replacement cycles tend to be slow due to the durability of well-built units. Some users choose alternatives such as wide belt sanders, drum sanders, or outsourced milling services when high-volume surfacing is not required, which reduces the number of planers purchased in certain segments. Fluctuations in lumber availability and wood prices can also influence equipment purchasing decisions at professional shops that adjust workloads during industry shifts.

Growth in compact planer designs, rising interest in custom wood products, and increased online equipment distribution are shaping industry trends.

Manufacturers are releasing lighter and more portable planers aimed at home workshops and small professional settings. Custom wood furniture, reclaimed wood projects, and handcrafted décor items are gaining popularity, which supports demand for planers that handle varied board dimensions and surface conditions. Online platforms are becoming a major sales channel for woodworking machinery, making it easier for buyers to compare models, access replacement parts, and purchase accessories. These developments support continued expansion of thickness planer demand across both professional and home woodworking industries.

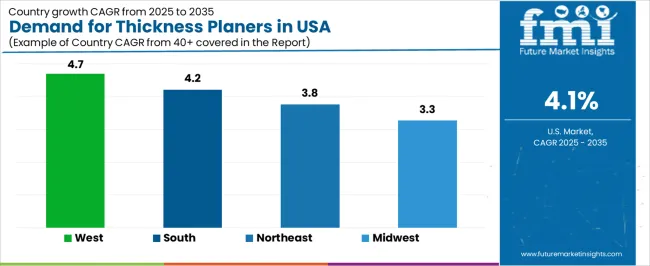

Demand for thickness planers in the United States is rising through 2035 as woodworking activity expands across hobbyist, semi-professional, and professional segments. Growth is influenced by home-improvement trends, increased adoption of small and mid-size workshops, and broader availability of portable benchtop planers through retail and e-commerce channels. Commercial wood-processing facilities and job-site carpentry teams continue to use heavier-duty planers for dimensional accuracy and surface preparation. The West leads with a 4.7% CAGR, followed by the South (4.2%), the Northeast (3.8%), and the Midwest (3.3%). Demand reflects project volume, workshop density, and regional construction patterns.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.7% |

| South | 4.2% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The West grows at 4.7% CAGR, supported by a large population of hobby woodworkers, widespread home-renovation activity, and strong adoption of planers in small and mid-scale workshops. States such as California, Arizona, Washington, and Colorado show sustained interest in benchtop planers due to versatile USAge in cabinetry, furniture projects, and DIY construction tasks. Broader e-commerce activity allows consumers to access a wide range of planer sizes, cutter-head configurations, and dust-collection-compatible models. Construction and remodeling firms also adopt portable units to support site-level material preparation.

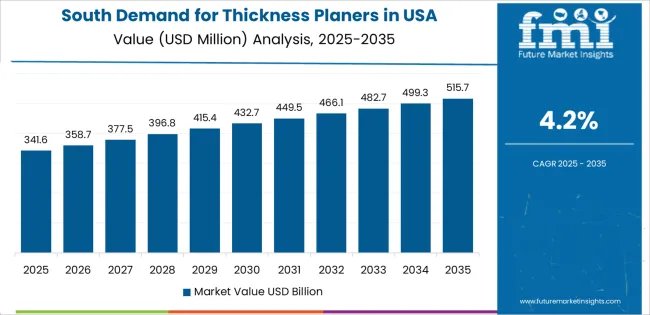

The South grows at 4.2% CAGR, driven by growing residential construction, expanding small-business woodworking shops, and rising demand for planers among hobby users. States including Texas, Florida, Georgia, and North Carolina maintain active home-improvement industries that support frequent purchase of benchtop and mid-range planer units. Wood-processing facilities and carpentry operations use planers to achieve dimensional precision in softwood and hardwood applications. Big-box retailers and regional hardware chains increase product availability, supporting steady demand throughout suburban and semi-rural areas.

The Northeast grows at 3.8% CAGR, supported by established woodworking communities, stable home-renovation activity, and consistent demand for compact planers suitable for smaller workshop spaces. States such as New York, Pennsylvania, and Massachusetts show steady sales across specialty woodworking stores and e-commerce channels. Consumers prefer portable units that fit limited floor space while offering reliable surface-finishing capabilities for cabinetry, trim work, and furniture repair. The region’s concentration of older housing stock contributes to ongoing renovation activity, supporting demand for planers used in structural and interior-finish projects.

The Midwest grows at 3.3% CAGR, supported by long-standing woodworking traditions, a large DIY user base, and consistent production in small manufacturing and craft workshops. States including Michigan, Wisconsin, Illinois, and Minnesota maintain stable planer demand tied to furniture building, cabinetmaking, and traditional home-repair tasks. Regional buyers frequently choose durable mid-range planer models suited for hardwood species commonly used in local projects. Hardware-store networks and community woodworking centers provide consistent access to tooling, though growth remains moderate due to a mature and stable consumer base.

The thickness planer industry in the United States is moderately concentrated, with several established power tool manufacturers supplying equipment for woodworking shops, construction firms, and home workshops. DeWalt (Stanley Black & Decker, Inc.) leads the industry with an estimated 28.2% share, supported by consistent motor performance, durable cutterhead assemblies, and strong retail placement across national hardware chains. Its position is reinforced by reliable service networks and stable product availability for both professional and hobbyist users.

Makita Corporation and Bosch Power Tools (Robert Bosch GmbH) follow as major competitors, providing planers designed for precision, material stability, and reduced vibration during heavy cuts. Their competitive strengths include controlled depth adjustment systems, dependable build quality, and integration with dust extraction equipment suited to workshop safety and efficiency. JET Tools (JPW Industries, Inc.) maintains a solid presence through mid-range and professional-grade machines designed for continuous-duty shop environments that require uniform stock removal and long-term mechanical reliability.

Grizzly Industrial, Inc. supports industry diversity with cost-efficient planers targeted at small shops and serious hobbyists, emphasizing wide-cut capacities and accessible replacement parts. Competition in the USA thickness planer industry centers on cutting accuracy, motor durability, snipe control, and user safety features. Demand is supported by steady activity in residential construction, continued interest in home woodworking, and replacement requirements in commercial shops that rely on predictable surface finish quality and consistent machine performance.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Handheld, Bench-Top, Heavy Duty |

| Power Source | Electric Thickness Planers, Battery-Powered (Cordless) Thickness Planers, Pneumatic Thickness Planers |

| End-Use Industry | Furniture Manufacturing, Construction & Carpentry, DIY & Hobbyists, Industrial & Commercial Workshops |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | DeWalt (Stanley Black & Decker, Inc.), Makita Corporation, Bosch Power Tools (Robert Bosch GmbH), JET Tools (JPW Industries, Inc.), Grizzly Industrial, Inc. |

| Additional Attributes | Dollar sales by product type, power source, and end-use industry; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of power tool and woodworking machinery manufacturers; advancements in safety features, dust collection, and motor efficiency; integration with home workshops, construction sites, and professional furniture manufacturing operations. |

The global demand for thickness planers in USA is estimated to be valued at USD 0.8 billion in 2025.

The market size for the demand for thickness planers in USA is projected to reach USD 1.2 billion by 2035.

The demand for thickness planers in USA is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for thickness planers in USA are bench-top, handheld and heavy duty.

In terms of power source, electric thickness planers segment to command 58.0% share in the demand for thickness planers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA