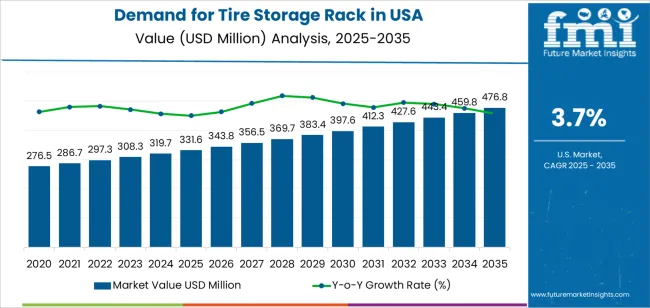

The demand for tire storage racks in USA is valued at USD 331.6 million in 2025 and is projected to reach USD 477.0 million by 2035, reflecting a CAGR of 3.7%. Early growth is supported by the expansion of retail tire outlets, automotive service centers, and growing awareness of tire storage best practices to optimize space, protect tire quality, and improve safety. Tire storage racks are essential for organizing and maintaining tire inventory in auto repair shops, distribution centers, and warehouses. As more businesses adopt standardized, durable, and space-efficient storage systems, the demand for tire racks steadily increases. Additionally, tire racks' ability to reduce tire damage during storage and handling also drives consistent demand across the USA.

As the sector progresses toward 2035, demand for tire storage racks continues to rise steadily, influenced by the growing number of vehicles on the road and the continuous need for tire replacements. In the later years of the forecast, demand is also supported by an increase in tire retail and repair services, especially with the ongoing rise in online tire sales and servicing. Manufacturers are expected to continue innovating by introducing more customizable, heavy-duty racks with advanced safety features and efficient designs to accommodate a wide range of tire sizes and quantities. By 2035, growth remains steady as tire storage systems become a standard feature in automotive retail and service businesses across the country.

Demand in USA for tire storage racks is expected to grow from USD 331.6 million in 2025 to USD 477.0 million by 2035, marking an increase of USD 145.4 million over the decade, with a CAGR of approximately 3.7%. From 2020 through 2025, demand rises from USD 276.4 million to USD 331.6 million, an increase of USD 55.2 million. Thereafter, from 2025 to 2030, demand grows from USD 331.6 million to USD 383.5 million, adding USD 51.9 million. The final five years (2030 to 2035) see demand climb from USD 383.5 million to USD 477.0 million, adding USD 93.5 million.

Drivers behind this growth include rising vehicle ownership, larger tire inventories for service centres and warehouses, higher utilization of storage systems to optimise real estate footprint, and specialised racks to handle heavier loads and larger EV vehicle tires. Additionally, demand for storage solutions incorporating automation, higher load capacity racks, and mobile systems is boosting uptake. As such, the projected increase to USD 477.0 million by 2035 signals a mature growth phase, driven less by explosive expansion and more by incremental upgrades and efficiency driven investments.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 331.6 million |

| Forecast Value (2035) | USD 477.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The demand for tire storage racks in USA is increasing as automotive service shops, tire retailers, and vehicle fleet depots seek efficient, organized solutions for storing seasonal and off vehicle tires. These racks help maximize floor space, maintain tire condition, and support quick rotation between winter, summer, and performance models. Manufacturers design racks with reinforced frames, adjustable shelf heights, and secure shelving systems to accommodate multiple sizes of tires and alloy wheels. Chain stores and service centers increasingly adopt standardized rack systems to improve inventory management and reduce handling time, contributing to adoption across the country.

Growth in demand is also driven by seasonal tire regulations, higher ownership of multiple vehicle households, and subscription based tire services that require rapid access to stored inventory. As consumer expectations shift toward convenience and turnaround speed, service providers rely on dedicated storage infrastructure to guarantee availability and quality. Growing vehicle fleet sizes such as rideshare and delivery services expand demand for storage solutions that help manage large volumes of spare tires efficiently. These trends reinforce continued growth of tire storage rack demand within the USA.

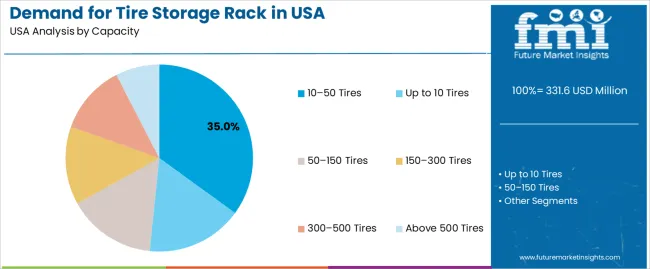

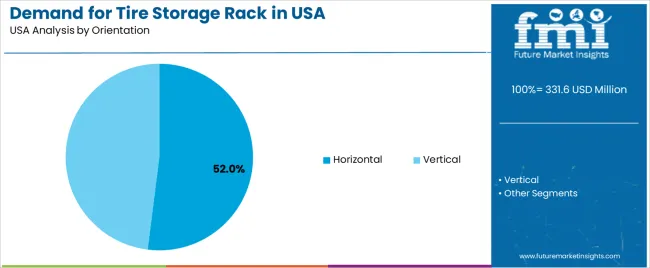

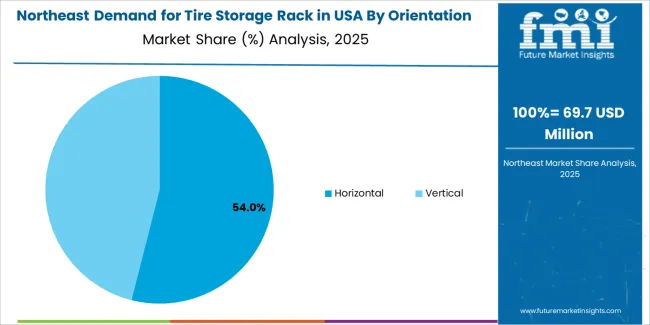

The demand for tire storage racks in the USA is segmented by capacity, orientation, and region. By capacity, the demand is divided into 10- 50 tires, up to 10 tires, 50- 150 tires, 150- 300 tires, 300- 500 tires, and above 500 tires. Based on orientation, it is categorized into horizontal and vertical. These segments reflect differing storage needs based on the number of tires, available space, and the preferences of various industries and users in the USA.

The 10- 50 tires capacity segment accounts for approximately 35% of the total demand for tire storage racks in the USA in 2025, making it the leading capacity category. This position is supported by the widespread demand from small to medium-sized businesses, such as tire retailers, repair shops, and smaller automotive service centers that typically manage a moderate inventory of tires. These businesses require space-efficient, practical solutions for tire organization and easy accessibility.

The demand for racks in this capacity range is particularly strong in urban areas, where space is limited, and efficient storage solutions are necessary to keep operations streamlined. The growth of the automotive aftermarket industry and increased vehicle ownership further contribute to this segment’s demand. Both horizontal and vertical orientations are popular in this range, as they offer flexibility for different types of tire storage spaces. The 10- 50 tires capacity segment maintains its lead because it serves a broad range of businesses that require cost-effective and space-efficient storage solutions.

The horizontal orientation segment represents about 52.0% of the total demand for tire storage racks in the USA in 2025, making it the dominant orientation category. This position is driven by the preference for horizontal racks in environments where accessibility, space efficiency, and quick tire retrieval are crucial. Horizontal racks allow tires to be easily stacked and accessed, which is ideal for tire shops, garages, and commercial storage areas.

Horizontal racks are particularly beneficial in settings where space optimization is key, as they maximize floor space and simplify the process of selecting and moving tires. Adoption is strong in tire retail and service centers, where large volumes of tires need to be stored in an organized manner. Horizontal racks also provide flexibility in terms of tire size and ease of organization, making them the go-to solution for many tire-related businesses. The segment maintains its leading share because horizontal storage aligns with the operational needs of businesses seeking to store tires efficiently and access them with minimal effort.

The demand for tire storage racks in USA is expanding as automotive service centres, fleet maintenance operations and retail tyre outlets seek efficient and safe storage solutions. Growth is driven by rising tyre replacement volumes, increasing regulatory scrutiny over inventory management and the need to optimise workshop space. Adoption is tempered by cost pressures, building code constraints and variability in rack durability requirements across locations. Rack manufacturers are introducing modular, high load capacity systems, mobile cart configurations and corrosion resistant finishes to meet storage demands in diverse service environments.

Demand rises as vehicle parc size and annual miles driven remain high in the USA, leading to consistent tyre replacement cycles and higher inventory storage needs at tyre retail shops and automotive service centres. As consumers delay servicing or concentrate purchases into peak seasons, businesses require flexible storage systems to handle spikes in inventory. Larger fleet operators also seek systematic rack solutions for efficient storage of seasonal or spare tyres. This dynamic supports steady demand growth for specialised storage infrastructure across the automotive aftermarket sector.

Adoption is constrained by several factors. Installation of heavy duty storage racks may require structural reinforcement, floor space allocation and compliance with fire safety and building codes, raising setup cost and complexity for smaller service operations. Some businesses may prefer simpler shelving or off site storage to avoid upfront investment. Variability in rack specifications such as load rating, tire size compatibility and accessibility adds procurement complexity. Additionally, unscheduled shifts in tyre replacement demand or inventory turnover may reduce perceived benefit of specialised racks.

Key trends include modular rack systems that allow flexible expansion as storage needs evolve, multi tier mobile racks that maximise floor space and integrated inventory tracking (barcodes, RFID) for tyre stock management. Manufacturers are also offering corrosion resistant coatings suited to service environments and designs compatible with forklifts or tyre handling carts. Growth in retail chains and fleet maintenance networks is driving standardisation of rack configurations. As service businesses prioritise productivity and space efficiency, storage rack solutions continue evolving toward durable, scalable and workflow aligned designs.

| Region | CAGR (%) |

|---|---|

| West | 4.3% |

| South | 3.8% |

| Northeast | 3.4% |

| Midwest | 3.0% |

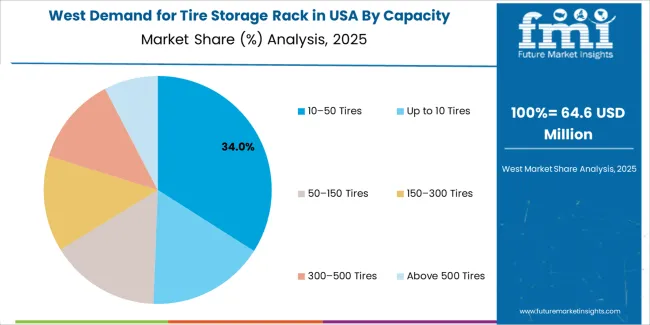

The demand for tire storage racks in USA is growing steadily, with the West leading at a 4.3% CAGR through 2035. This growth is driven by an increase in the automotive industry, strong demand for organized tire storage in auto dealerships, and expanding e-commerce for automotive parts. The South follows at 3.8%, supported by the region's expanding automotive service and repair industry. The Northeast records a 3.4% CAGR, with steady demand from both retail and automotive repair businesses. The Midwest, at 3.0%, shows slower growth, driven by consistent demand from tire dealers, vehicle maintenance shops, and automotive service centers.

The West region of the USA is projected to grow at a CAGR of 4.3% through 2035 in demand for tire storage racks. The rapid growth in the automotive industry and increasing number of tire retailers, repair shops, and warehouses drive the demand for effective tire storage solutions. The region's high volume of automotive sales and services further increases the need for space-efficient and durable tire storage racks. Additionally, with rising consumer demand for multiple tire options, businesses seek to optimise storage capacities. The growing presence of e-commerce and retail outlets also contributes to this demand.

The South region of the USA is projected to grow at a CAGR of 3.8% through 2035 in demand for tire storage racks. The region’s expanding automotive services, tire dealers, and logistics operations fuel demand for space-efficient tire storage solutions. With a rise in automotive servicing and maintenance businesses, the need for racks to store large quantities of tires in a compact manner increases. Businesses in the South are increasingly seeking solutions to streamline storage and optimise space. The region’s growing distribution networks and automotive sales also contribute to the demand for reliable storage solutions.

The Northeast region of the USA is projected to grow at a CAGR of 3.4% through 2035 in demand for tire storage racks. As automotive servicing, repair, and tire retail businesses continue to expand, the need for organised tire storage solutions increases. The region’s higher population density and strong presence of automotive dealerships create consistent demand for efficient tire storage racks. With growing concerns over storage space and inventory management, businesses are adopting racks that help maximise available space and improve operational efficiency.

The Midwest region of the USA is projected to grow at a CAGR of 3% through 2035 in demand for tire storage racks. With a stable automotive industry and steady growth in tire retailers and service shops, there is a consistent need for durable and space-efficient tire storage solutions. Midwest businesses in the automotive and logistics sectors increasingly turn to organised storage racks to maximise their available floor space and ensure inventory is easily accessible. As the demand for automotive services and tire replacement continues to rise, so does the need for proper tire storage solutions.

The demand for tire storage racks in the USA is steadily growing, driven by the increasing need for efficient and organized tire storage solutions in both the retail and industrial sectors. FEMCO Holdings, LLC leads the market with high-quality, durable tire racks that are designed to optimize storage space and ensure easy accessibility for businesses in the automotive industry. Steel King Industries, Inc. follows closely, offering a broad range of heavy-duty storage solutions built to accommodate large volumes of tires while maintaining safety and structural integrity. Martins Industries and Meiser GmbH strengthen the competitive landscape with customizable tire rack systems that cater to specific business needs, from retail tire shops to warehouse operations. Tier-Rack Corporation rounds out the market by providing versatile, space-saving tire storage solutions that help businesses improve efficiency and organization.

The key factors driving the growth of tire storage racks include the expansion of the automotive and tire retail sectors, as well as the need for organized, space-efficient solutions in tire distribution and storage. As the demand for quick and efficient tire retrieval increases, businesses are investing in modular and flexible storage systems to streamline operations and maximize space. Competition in this market is defined by the ability to offer durable, scalable, and customizable tire racks that can meet the diverse needs of businesses in the automotive industry. With the growing demand for space-efficient storage solutions, brands that prioritize innovation, durability, and functionality are well-positioned to lead the tire storage rack market in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Tire Storage Racks |

| Application | Automotive Service Centers, Tire Retailers, Distribution Centers |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | FEMCO Holdings, LLC, Steel King Industries, Inc., Martins Industries, Meiser GmbH, Tier-Rack Corporation |

| Additional Attributes | Dollar sales by capacity and orientation, regulations affecting storage practices, growth in vehicle ownership and tire replacement cycles, tire storage system innovations, impact of e-commerce on tire retail distribution, specialized racks for heavier loads, modular rack solutions, and automation integration trends. |

The global demand for tire storage rack in USA is estimated to be valued at USD 331.6 million in 2025.

The market size for the demand for tire storage rack in USA is projected to reach USD 476.8 million by 2035.

The demand for tire storage rack in USA is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in demand for tire storage rack in USA are 10–50 tires, up to 10 tires, 50–150 tires, 150–300 tires, 300–500 tires and above 500 tires.

In terms of orientation, horizontal segment to command 52.0% share in the demand for tire storage rack in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA