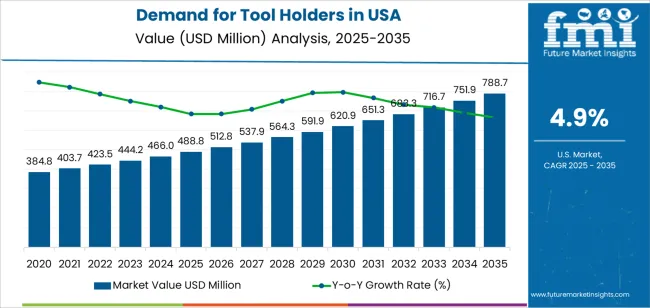

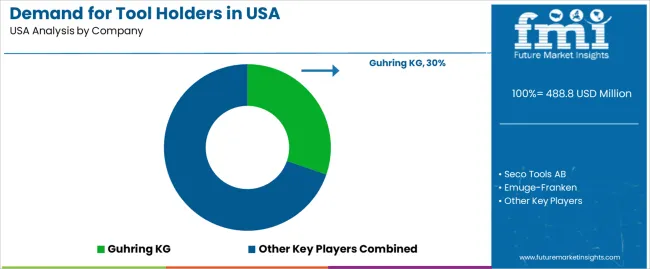

Demand for tool holders in USA is projected to reach USD 788.7 million by 2035, reflecting an absolute increase of USD 302.9 million over the forecast period. The industry, valued at USD 488.8 million in 2025, is expected to grow at a CAGR of 4.90%. This growth is primarily driven by the increasing demand for high-precision tools and machinery in industries like manufacturing, automotive, and aerospace, where tool holders play a critical role in ensuring the efficiency of machining operations.

Tool holders are crucial components that securely hold cutting tools during machining processes, guaranteeing precision, accuracy, and safety. As manufacturing processes become more advanced and automated, the need for durable, efficient, and high-performance tool holders is growing.

The automotive and aerospace sectors are seeing a significant rise in the demand for tool holders, driven by the production of more complex, high-precision components. Advancements in materials and design such as the development of lightweight alloys and improved tool retention mechanisms are helping meet the growing need for better-performing tool holders.

The growing trend of automation in manufacturing is also contributing to the industry’s growth. Tool holders that offer improved consistency, reduce downtime, and enhance operational efficiency are becoming increasingly essential as industries shift toward more automated production processes. This, in turn, is helping drive the adoption of tool holders in various industries, fueling the demand throughout the forecast period.

Between 2025 and 2030, the demand for tool holders in USA is projected to grow from USD 488.8 million to approximately USD 564.9 million, adding USD 76.1 million, which accounts for about 25.1% of the total forecasted growth for the decade.

This period will see an increase in demand driven by the expansion of manufacturing and automation in industries like automotive, aerospace, and machinery manufacturing. As production processes become more sophisticated, manufacturers will invest in high-precision and durable tool holders to enhance productivity and maintain accuracy in complex machining tasks.

Technological advancements will also play a significant role, as innovations in tool holder materials and designs improve performance, extending tool life and increasing machining efficiency. The growing adoption of automated and robotic manufacturing systems will drive the need for more advanced tool holders that are compatible with these systems.

Furthermore, the rise in demand for customized tool holders in various industries will contribute to industry expansion. As manufacturers seek to improve production efficiency, reduce waste, and optimize machining processes, the industry for tool holders is expected to grow steadily during this five-year period.

| Metric | Value |

|---|---|

| Tool Holders Value (2025) | USD 488.8 million |

| Tool Holders Forecast Value (2035) | USD 788.7 million |

| Tool Holders Forecast CAGR (2025 to 2035) | 4.90% |

The demand for tool holders in the USA is growing due to the expanding need for precision, efficiency, and productivity in manufacturing and machining industries. Tool holders are essential components in machining operations, securing tools in place to ensure accurate and stable cutting, shaping, and finishing of materials. As industries such as automotive, aerospace, and metalworking continue to modernize and automate their manufacturing processes, the demand for high-quality, reliable tool holders is increasing.

The rise in demand for advanced manufacturing techniques, such as CNC (Computer Numerical Control) machining and 3D printing, is driving the growth of tool holder systems. These technologies require highly precise tool holding solutions to ensure the accuracy and efficiency of production processes. As more manufacturers embrace automation and pursue higher levels of operational efficiency, tool holders have become crucial to maintaining the stability and precision of machinery.

The increasing focus on reducing downtime and improving machine tool lifespan is pushing manufacturers to invest in more durable and adaptable tool holders. The growing trend of customizations in manufacturing processes, as well as the need for tools that can handle a wider range of materials and applications, is also fueling demand for advanced tool holder designs. Despite challenges such as fluctuating raw material costs, the industry is expected to continue growing due to the increasing focus on optimizing production and improving manufacturing quality.

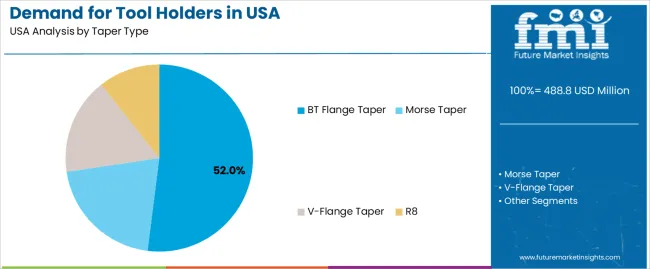

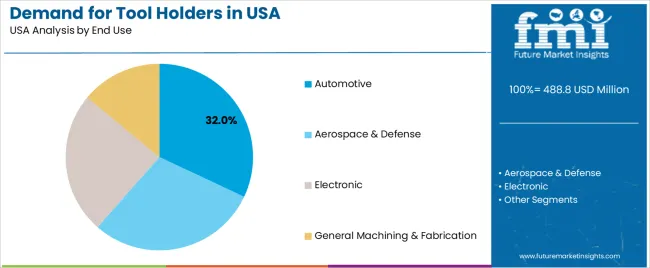

Demand is segmented by taper type, end use, and region. By taper type, demand is divided into BT flange taper, Morse taper, V-flange taper, and R8, with BT flange taper leading the demand. Based on end use, demand is categorized into automotive, aerospace & defense, electronic, and general machining & fabrication, with automotive representing the largest share. Regionally, demand is divided into North America, Europe, Asia Pacific, and other key regions.

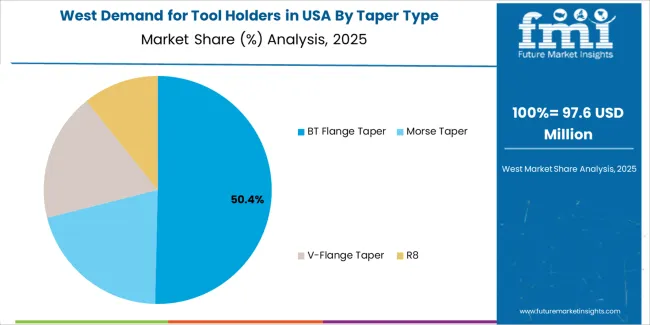

The BT flange taper segment leads the demand for tool holders in the USA, accounting for 52% of the total demand. This dominance is driven by its use in CNC (computer numerical control) machining, especially in industries requiring high precision, reliability, and rigidity. The BT flange taper system is designed for heavy-duty operations and is known for offering superior tool holding power, which reduces vibration during machining and enhances accuracy.

Industries such as automotive, aerospace, and general machining prefer this system because of its versatility, high performance, and compatibility with various machines and tools. It ensures high efficiency in precision machining tasks and has become the standard in CNC setups across numerous manufacturing processes. The ability to deliver exceptional rigidity and secure tool mounting while reducing operational downtime strengthens its position as the leading taper type used in the USA, making BT flange taper the most widely adopted solution.

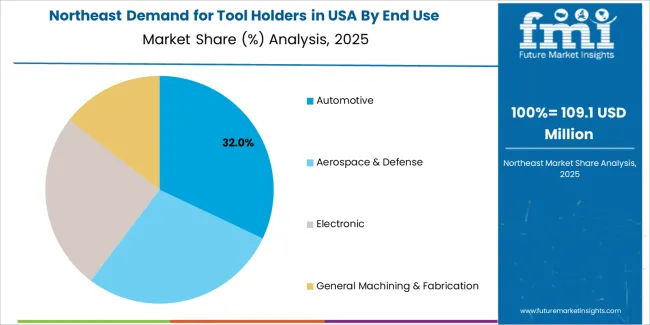

The automotive sector holds the largest demand for tool holders in the USA, accounting for 32% of the total demand. This high demand is primarily due to the automotive industry’s need for precision in manufacturing a wide range of components, including engine parts, transmission systems, and chassis. Tool holders, particularly for CNC machines, are crucial in ensuring the accuracy of machining processes, which is vital in producing high-quality, durable parts.

The complexity of modern vehicles and the constant push for higher precision and efficiency in automotive manufacturing has led to a steady rise in the adoption of advanced tool holders. The automotive industry’s focus on automation, high-speed manufacturing, and lean production methods continues to drive the demand for tool holders that can deliver consistent, reliable performance in mass production environments. As the industry evolves, particularly with the rise of electric vehicles and complex component designs, the demand for precision tool holders is expected to remain robust.

In USA, demand for tool holders is growing as manufacturers push toward higher machining precision, automation, and faster changeovers in sectors like automotive, aerospace, and general manufacturing. Enhanced tool‑holder systems help reduce vibration, improve tool life, and support advanced CNC and Industry 4.0 setups. Demand is tempered by high costs for premium holders, the need to retrofit older machine‑tools, and competition from lower‑cost global suppliers.

Demand in USA is rising because manufacturers are increasingly investing in high‑precision machining to meet stringent tolerances, reduce waste, and increase throughput. With automotive and aerospace segments having strong U.S. footprints, there is a steady requirement for advanced tool‑holder solutions that can support high‑speed spindles and heavy cutting operations. In addition, as domestic manufacturing shifts back and reshoring continues, tool‑holder demand grows alongside machine‑tool installations, factory upgrades and increased automation within U.S. production lines.

Technological innovations are boosting USA tool‑holder demand through the development of holders with superior run‑out accuracy, vibration‑damping, and quick‑change capabilities. Features like smart tool‑holder systems embedded with sensors for predictive maintenance, integration with digital tool‑management platforms, and advanced coatings/materials that extend tool life are gaining traction. These innovations make holders more valuable in automated machining environments common in USA advanced manufacturing, thereby driving suppliers and users to invest in newer systems rather than legacy holders.

Despite the strong backdrop, several challenges limit tool‑holder demand in USA industry. One major issue is the capital cost of upgrading to premium holders’ smaller job shops may find it difficult to justify the investment when legacy holders are still serviceable. Retrofit complexity is another barrier, as older machines often require customization or new tooling spindles to accept modern holders. Fluctuations in raw‐material prices (especially steel/alloy costs) and global supply‑chain disruptions affect availability and pricing. Lastly, widespread adoption of smart holders is slowed by workforce training needs and the necessity to integrate with legacy machine‑tool systems.

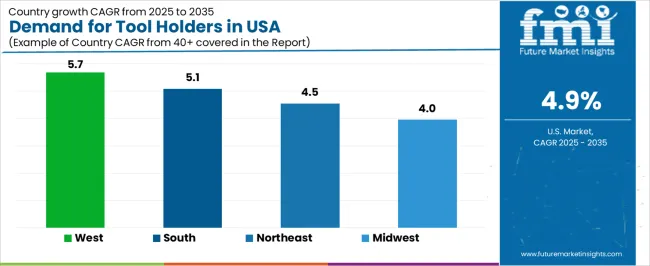

| Region | CAGR (%) |

|---|---|

| West | 5.7% |

| South | 5.1% |

| Northeast | 4.5% |

| Midwest | 4.0% |

The demand for tool holders in the USA is increasing across regions, with the West leading at a 5.7% CAGR. The growth is driven by expanding industrial and manufacturing sectors, particularly in states like California and Nevada. The South follows with a 5.1% CAGR, supported by a strong base in manufacturing, automotive, and energy industries. The Northeast shows a 4.5% CAGR, fueled by ongoing industrial modernization and the adoption of advanced tools in manufacturing. The Midwest, while growing at a more moderate 4.0%, remains a critical hub for production and machining operations, driving demand for tool holders.

The West is experiencing the highest growth in demand for tool holders in the USA, with a 5.7% CAGR. The region’s booming manufacturing, aerospace, and technology sectors contribute to the demand for high-quality tool holders. Cities like Los Angeles, San Francisco, and Seattle are hubs for industries such as automotive, aerospace, and electronics, all of which require precise and reliable tooling solutions. As manufacturing processes become more advanced and automated, the need for efficient tool holders is increasing.

The West’s growing emphasis on innovation and technology adoption in production processes is further boosting the demand for tool holders. With industries shifting towards more automated, efficient production lines, tool holders play a critical role in ensuring precision and reducing downtime in manufacturing. The region’s strong industrial base and focus on technological advancements ensure that the demand for tool holders will continue to grow.

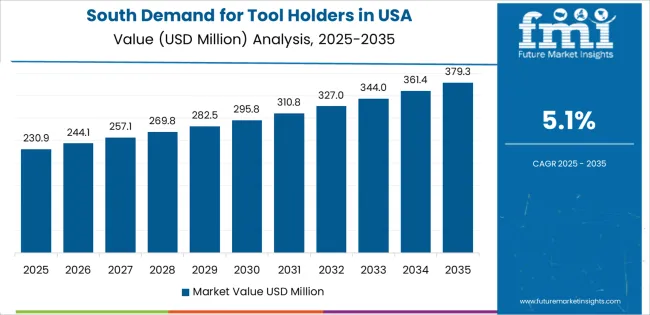

The South is witnessing steady growth in the demand for tool holders, with a 5.1% CAGR. The region’s rapidly expanding manufacturing sector, particularly in states like Texas, Georgia, and Florida, is contributing to the rising demand for these products. The automotive, oil and gas, and energy industries in the South rely heavily on high-performance tool holders to maintain efficiency and precision in production processes. As these industries grow, the need for advanced tooling solutions continues to rise.

The South’s increasing focus on infrastructure development and the modernization of manufacturing facilities are driving the demand for tool holders. With more companies investing in automated production lines and advanced machining techniques, the need for high-quality, durable tool holders to ensure consistent performance in industrial applications is growing. As the region’s manufacturing sector continues to thrive, demand for tool holders is expected to maintain its upward trajectory.

The Northeast is experiencing moderate growth in the demand for tool holders, with a 4.5% CAGR. The region’s focus on industrial modernization and its high concentration of manufacturing, particularly in states like New York, Pennsylvania, and New Jersey, is fueling the demand for precision tools and accessories like tool holders. With industries ranging from pharmaceuticals and electronics to heavy machinery and automotive manufacturing, the Northeast remains a key player in the demand for high-quality tooling solutions.

The need for efficient, reliable, and precise manufacturing processes is driving the adoption of advanced tool holders, especially as production lines become more automated. The Northeast’s emphasis on technological innovation and improving manufacturing efficiency is further contributing to the growing demand for tool holders. As industries continue to upgrade their equipment and tooling systems, the demand for tool holders is expected to rise steadily.

The Midwest is witnessing steady growth in the demand for tool holders, with a 4.0% CAGR. The region’s strong industrial base, particularly in manufacturing, automotive, and heavy machinery sectors, continues to drive the need for efficient and durable tooling solutions. Cities like Detroit, Chicago, and Cleveland, known for their manufacturing industries, require reliable tool holders for precision machining and assembly operations. The Midwest’s focus on improving manufacturing efficiency and reducing downtime is contributing to the rising demand for tool holders.

As the region continues to focus on automating production processes and upgrading manufacturing facilities, the need for high-performance tool holders that ensure smooth and accurate operations is increasing. The Midwest’s position as a hub for industrial production and its ongoing investments in advanced manufacturing technologies ensure that the demand for tool holders will continue to grow at a steady pace.

The demand for tool holders in the United States is strong and continues to rise as manufacturers seek to improve precision, efficiency, and throughput in machining operations. With advanced manufacturing and automation sectors expanding, particularly in automotive, aerospace, and industrial machinery production, the need for high-performance tool holders has become increasingly critical. These components which securely hold cutting tools in CNC machines are vital for achieving tight tolerances, minimizing vibration, and reducing downtime through rapid tool changes.

In the USA, Guhring KG leads this segment with a commanding share of 30.3%, reflecting its reputation for quality, innovative designs, and strong presence across OEM and aftermarket channels. Other prominent companies include Seco Tools AB, Emuge‑Franken, NT Tool Corporation, and Mapal Group, which together serve a wide range of industries needing robust tool‑holding solutions.

Key drivers of demand include the rising adoption of high‑speed machining and multi‑axis CNC systems, where rigid and accurate tool holders are essential for maintaining productivity and part quality. Investment in retrofit and upgrade programmes for aging machine fleets is fuelling replacement purchases. Adoption is tempered by factors such as high capital costs for advanced tool‑holder systems and supply‑chain challenges for precision manufacturing. The USA demand outlook for tool holders remains positive, supported by ongoing industrial investment and technological advancement in machining infrastructure.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Taper Type | BT Flange Taper, Morse Taper, V-Flange Taper, R8 |

| End Use | Automotive, Aerospace & Defense, Electronic |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Guhring KG, Seco Tools AB, Emuge-Franken, NT Tool Corporation, Mapal Group |

| Additional Attributes | Dollar sales by taper type and end-use categories, regional adoption trends, competitive landscape, advancements in tool holder technologies, integration with automotive, aerospace, and electronic industries. |

The global demand for tool holders in USA is estimated to be valued at USD 488.8 million in 2025.

The market size for the demand for tool holders in USA is projected to reach USD 788.7 million by 2035.

The demand for tool holders in USA is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in demand for tool holders in USA are bt flange taper, morse taper, v-flange taper and r8.

In terms of end use, automotive segment to command 32.0% share in the demand for tool holders in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA