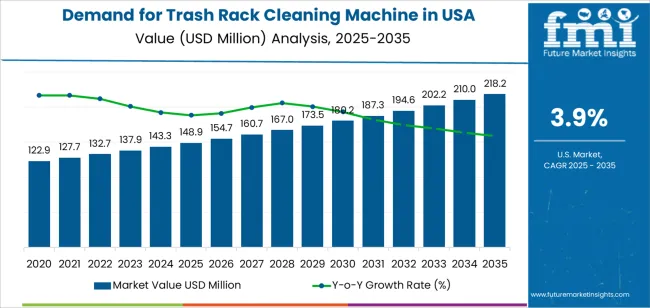

The absolute dollar opportunity for the demand for trash rack cleaning machines in the USA between 2025 and 2035 is projected to be USD 69.2 million, with a CAGR of 3.9%. Starting from USD 148.9 million in 2025, the industry is expected to reach USD 218.1 million by 2035, supported by growing requirements across water treatment facilities, hydroelectric power plants, and industrial operations that rely on efficient water intake systems. These machines play a critical role in preventing blockages, maintaining uninterrupted water flow, and ensuring smooth functioning of equipment, which makes them increasingly essential as facility capacities continue to expand. Advancements in cleaning mechanisms and automated systems are further strengthening adoption by improving operational reliability and reducing manual maintenance needs.

As infrastructure ages across the USA, more facilities are expected to upgrade or replace existing cleaning systems, creating additional opportunities for suppliers of trash rack cleaning technologies. Automation will be a major driving factor, as operators aim to reduce labor costs and minimize downtime through consistent, high-performance cleaning operations. The expansion of industrial activities, along with stricter requirements for maintaining efficient water intake passages, will also reinforce this growth trajectory. With technological innovation enhancing durability, efficiency, and adaptability to different environmental conditions, the demand for trash rack cleaning solutions is expected to grow steadily through 2035, creating a strong absolute dollar opportunity across the decade.

Between 2025 and 2030, the demand for trash rack cleaning machines in the USA is projected to grow from USD 148.9 million to approximately USD 160.7 million, adding USD 11.8 million, which accounts for about 25.4% of the total forecasted growth for the decade. This growth is driven by increasing infrastructure development, particularly in water treatment facilities, hydroelectric power plants, and industrial plants, where trash rack cleaning machines are essential for maintaining the efficiency of water intake systems and preventing clogging.

From 2030 to 2035, the demand is expected to expand from approximately USD 160.7 million to USD 218.1 million, adding USD 57.4 million, which constitutes about 74.6% of the overall growth. This period will see accelerated adoption as aging infrastructure demands more frequent maintenance, and the need for automated, reliable cleaning solutions increases in industries that depend on consistent water flow. Technological advancements, such as improved cleaning mechanisms and energy-efficient designs, will further boost the demand for these machines, ensuring their long-term USAge in critical applications.

| Metric | Value |

|---|---|

| Trash Rack Cleaning Machine Value (2025) | USD 148.9 million |

| Trash Rack Cleaning Machine Forecast Value (2035) | USD 218.1 million |

| Trash Rack Cleaning Machine Forecast CAGR (2025 to 2035) | 3.90% |

The demand for trash rack cleaning machines in the USA is growing due to the increasing focus on improving the efficiency and reliability of water intake systems in power plants, water treatment facilities, and other industrial applications. Trash racks, which are used to filter debris from water intakes, need regular cleaning to maintain the optimal functioning of these systems. Trash rack cleaning machines ensure that these operations run smoothly, reducing downtime and preventing costly maintenance issues.

The growing emphasis on maintaining environmental standards, particularly in industries reliant on water for cooling and processing, is a key driver for the adoption of trash rack cleaning machines. As regulations around water use and environmental impact become stricter, facilities are turning to automated solutions for cleaning trash racks to ensure compliance and minimize human labor costs.

The increasing industrialization, expansion of power plants, and modernization of existing water treatment facilities in the USA are contributing to the growing demand. As these industries continue to scale up their operations, the need for efficient, reliable, and automated cleaning systems to maintain water intake infrastructure becomes more critical. Despite challenges such as the high initial investment and maintenance requirements, the demand for trash rack cleaning machines is expected to grow steadily due to their crucial role in ensuring uninterrupted industrial operations.

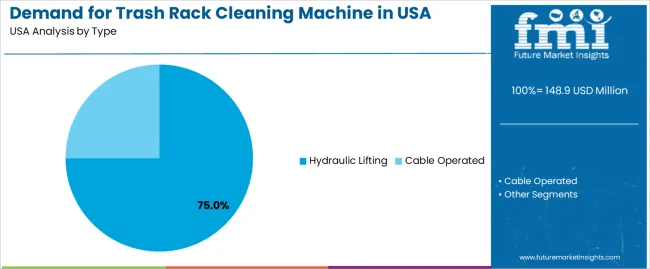

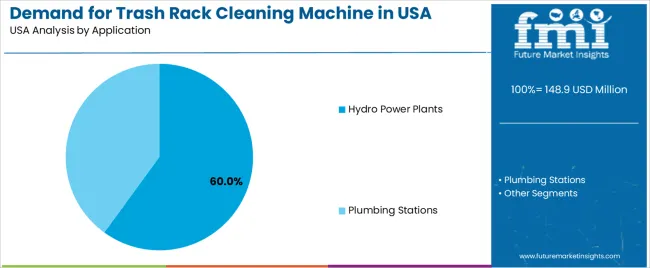

Demand is segmented by type, application, and region. By type, demand is divided into hydraulic lifting and cable operated, with hydraulic lifting leading the demand. Based on application, demand is categorized into hydro power plants, plumbing stations, and others, with hydro power plants representing the largest share in terms of demand. Regionally, demand is divided into North America, Europe, Asia Pacific, and other key regions.

The hydraulic lifting segment accounts for 75% of the demand for trash rack cleaning machines in the USA, making it the most preferred type. Hydraulic lifting systems are favored in industrial applications due to their high lifting capacity, robustness, and ability to function efficiently in challenging environments, such as water treatment facilities and hydroelectric power plants. These systems use hydraulic pressure to lift and remove debris from trash racks, ensuring smooth water flow and preventing clogging, which can negatively impact equipment performance.

The strength of hydraulic systems lies in their ability to handle heavy loads and provide consistent performance under high-pressure conditions, making them ideal for large-scale operations. Hydraulic lifting machines are known for their durability and relatively low maintenance requirements, which makes them cost-effective over time. They are also versatile and can be adapted for use in various facilities, including those with high-volume debris and fluctuating operational conditions. This combination of power, reliability, and adaptability explains why hydraulic lifting is the leading type in demand across the USA.

The hydro power plants application accounts for 60% of the demand for trash rack cleaning machines in the USA. This is driven by the critical role these machines play in ensuring the efficient operation of hydroelectric power generation systems. Trash racks are installed at the intake of water turbines, and any debris or organic material can significantly hinder the water flow, reducing the efficiency of power generation and potentially damaging the turbine equipment. Trash rack cleaning machines are essential for maintaining consistent water flow and preventing equipment damage by regularly removing debris.

As the USA increasingly focuses on renewable energy sources, the efficiency of hydro power plants is paramount. Trash rack cleaning machines ensure that these plants continue to operate at peak performance by preventing debris buildup that could otherwise cause costly downtime or decreased energy output. The hydro power plant sector’s continued expansion, fueled by a shift towards green energy, reinforces the demand for reliable, efficient cleaning systems. This ensures that hydro power plants remain the largest application segment for trash rack cleaning solutions in the USA.

The USA demand is expanding as water‑intake infrastructures-such as hydroelectric plants, municipal pumping stations and industrial cooling systems-look to automate debris removal for improved reliability and safety. These machines offer features like hydraulic lifting, remote‑monitoring, and automated raking of intake screens. Key drivers include ageing hydropower and water‑utility assets, increasing regulatory pressure on water‑infrastructure maintenance, and the shift toward unmanned and digital‑monitoring operations. Restraints stem from high upfront equipment and installation costs, budget constraints at smaller utilities, and limited new build‑out in hydropower advancing slowly.

Demand is growing in USA because operators seek to minimise manual cleaning risks, reduce unplanned downtime and maintain continuous water‑intake efficiency. In hydroelectric facilities and large pumping stations, debris build‑up at trash racks can reduce flow, damage turbines or pumps, and increase maintenance costs. Automated cleaning machines allow for predictable operations and lower labour overheads. Also, as many USA utilities face infrastructure‑refurbishment cycles, investment in reliable cleaning equipment becomes part of long‑term asset‑management strategies, driving machine adoption.

Technological innovations are driving USA growth by reducing labour needs and improving machine performance in difficult environments. Advances include hydraulic‑driven cleaning arms designed for deep intake channels, sensors that detect debris build‑up and trigger cleaning automatically, and modular mobile cleaning units for retrofit projects. Improved corrosion‑resistant materials and rugged designs suit harsh intake sites, while more efficient automation lowers lifetime cost‑of‑ownership. These developments make the business case for USA operators stronger especially where manual methods were previously costly or unreliable.

Despite the clear benefits, adoption in the USA is limited by several challenges. One major barrier is the high capital cost of automated machines, which can exceed budgets at smaller utilities or older plants. Complex retrofits in older intake structures (fitting the cleaning machine into existing geometries) can drive up installation time and cost. Some utilities face procurement and budget‑cycle delays, making project scheduling uncertain. Lower growth in new hydropower construction compared to emerging industry means much of the USA demand is replacement or upgrade of existing systems rather than new installations slowing overall industry expansion.

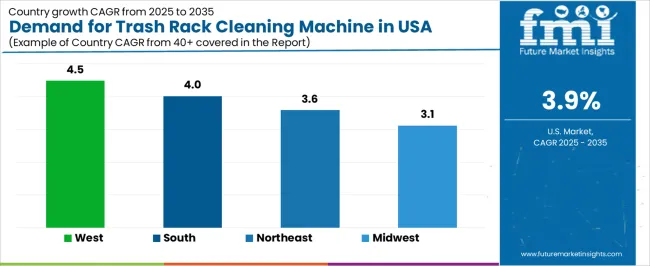

| Region | CAGR (%) |

|---|---|

| West | 4.7% |

| South | 4.2% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The demand for trash rack cleaning machines in USA is growing across various regions, with the West leading at a 4.7% CAGR. This growth is driven by the increasing need for water treatment facilities, power plants, and industrial applications to maintain clean and efficient operations. The South follows with a 4.2% CAGR, supported by industrial activities and the expansion of infrastructure in the region. The Northeast shows a 3.8% CAGR, fueled by the demand for environmental maintenance solutions in water treatment and energy sectors. The Midwest, while experiencing steady growth at 3.3%, continues to adopt advanced machinery for waste management in utility and water filtration industries.

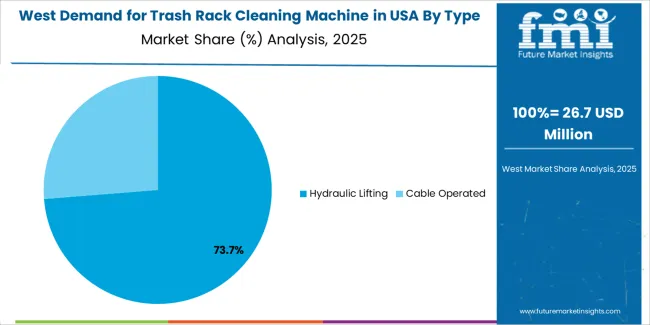

The West is experiencing the highest demand growth for trash rack cleaning machines in USA, with a 4.7% CAGR. The region's growing water treatment and power generation sectors, especially in states like California and Nevada, are driving the adoption of these cleaning machines. As the West continues to face water scarcity and stringent environmental regulations, utilities are investing in efficient solutions to maintain the functionality of water intake systems, which increases the demand for trash rack cleaning machines.

The West’s expanding industrial base, including manufacturing and energy production, is contributing to the need for these machines. The focus on maintaining efficient operations and preventing blockages in water intakes and cooling systems is further fueling the demand for trash rack cleaning solutions. With environmental sustainability becoming a priority, the need for automation and improved water intake maintenance in the region is expected to drive continued growth in this industry.

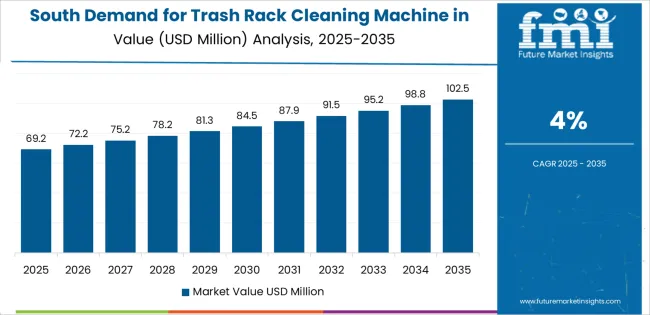

The South is experiencing steady growth in the demand for trash rack cleaning machines, with a 4.2% CAGR. The region’s strong industrial base, including power plants, chemical processing, and water treatment facilities, is driving the need for effective trash removal solutions in water intake systems. Major industrial hubs in states like Texas, Florida, and Louisiana rely on these machines to keep their water intake systems operational, especially in facilities that require constant access to clean water for cooling and processing.

The increasing focus on improving the efficiency and sustainability of water USAge in industrial operations is contributing to the rising adoption of trash rack cleaning machines. As the South continues to expand its infrastructure, especially in industrial and power generation sectors, the demand for maintenance solutions like these cleaning machines is expected to grow. Investments in environmental management and the need to comply with stringent regulatory standards further support the continued rise in demand for trash rack cleaning machines in the South.

The Northeast is seeing moderate growth in the demand for trash rack cleaning machines, with a 3.8% CAGR. The region’s strong presence of water treatment plants, energy production facilities, and industrial sectors is driving the need for efficient trash removal solutions. Cities like New York and Boston, with their dense industrial activity and aging infrastructure, require reliable cleaning solutions to ensure water intake systems remain clear and operational, which boosts demand for trash rack cleaning machines.

As environmental concerns continue to grow and the need for efficient water management becomes more critical, the adoption of automation and advanced cleaning systems in the Northeast is increasing. The region's focus on renewable energy sources and reducing environmental impact has also led to increased demand for efficient systems that maintain clean water intakes, particularly in energy production and waste treatment facilities. The growth of urban areas and industrial expansion ensures a steady rise in demand for trash rack cleaning machines in the Northeast.

The Midwest is experiencing steady growth in the demand for trash rack cleaning machines, with a 3.3% CAGR. The region’s industrial infrastructure, particularly in cities like Chicago and Detroit, and the large number of water treatment and power generation facilities, are contributing to the increased need for efficient trash removal systems in water intake structures. As industries such as manufacturing, chemical processing, and energy production continue to grow, the need to maintain clean and effective water intake systems is driving the demand for these machines.

The Midwest’s continued investment in water infrastructure and the importance of maintaining reliable water intake systems for industrial operations are key factors influencing growth. With the increasing focus on reducing downtime, improving operational efficiency, and adhering to environmental standards, demand for trash rack cleaning machines in the region is expected to rise steadily. The region’s focus on modernizing infrastructure and adopting advanced maintenance solutions for water and wastewater management ensures continued demand for these cleaning systems.

The demand for trash rack cleaning machines in the United States is on the rise, driven by the need to maintain efficient water intake systems in industries such as hydropower, municipal water utilities, and industrial pumping stations. These machines are essential for removing debris from water intake racks to ensure uninterrupted water flow and prevent damage to equipment. As aging infrastructure needs modernization and the focus on efficient water management increases, the demand for such cleaning systems is growing steadily.

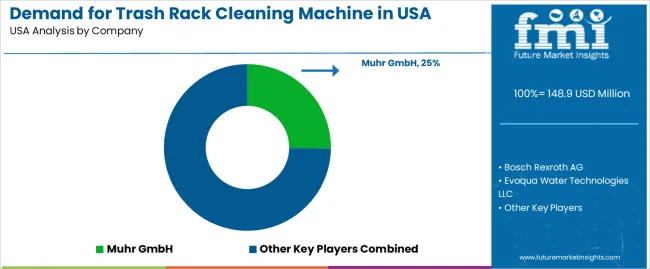

Muhr GmbH is a leader in USA industry with a 25.2% share, providing reliable and automated trash rack cleaning machines designed for large-scale operations. The company’s presence reflects its success in delivering advanced debris-removal solutions for critical water management systems. Other key competitors in the industry include Bosch Rexroth AG, Evoqua Water Technologies LLC, FRIULAIR S.R.L., and Jash Engineering Ltd. These companies contribute to the industry with advanced cleaning technologies that ensure the long-term functionality of water intake systems.

Several factors are fueling the demand for trash rack cleaning machines in the USA, including rising investments in renewable energy and hydropower infrastructure, regulatory requirements for efficient water intake, and the need to modernize aging water intake systems. Automation and remote monitoring features are becoming increasingly popular in new systems, reducing the need for manual labor and increasing operational efficiency. The high initial investment cost and integration challenges in older facilities remain obstacles to widespread adoption. Nonetheless, the growing focus on sustainable water management ensures continued demand for these critical cleaning systems.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Type | Hydraulic Lifting, Cable Operated |

| Application | Hydro Power Plants, Plumbing Stations |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Muhr GmbH, Bosch Rexroth AG, Evoqua Water Technologies LLC, FRIULAIR S.R.L., Jash Engineering Ltd. |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends, competitive landscape, advancements in trash rack cleaning machine technologies, integration with hydro power and plumbing industries. |

The global demand for trash rack cleaning machine in USA is estimated to be valued at USD 148.9 million in 2025.

The market size for the demand for trash rack cleaning machine in USA is projected to reach USD 218.2 million by 2035.

The demand for trash rack cleaning machine in USA is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in demand for trash rack cleaning machine in USA are hydraulic lifting and cable operated.

In terms of application, hydro power plants segment to command 60.0% share in the demand for trash rack cleaning machine in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA