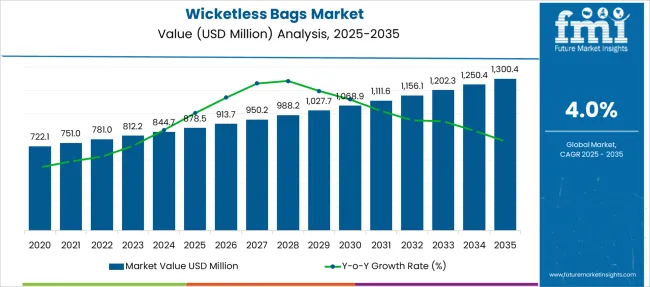

The Wicketless Bags Market is estimated to be valued at USD 878.5 million in 2025 and is projected to reach USD 1300.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Wicketless Bags Market Estimated Value in (2025 E) | USD 878.5 million |

| Wicketless Bags Market Forecast Value in (2035 F) | USD 1300.4 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The wicketless bags market is witnessing growing demand across various end-use industries due to a rising shift toward automation-friendly, contamination-reducing packaging formats. These bags are being increasingly adopted in high-speed filling operations where traditional wicketed formats face limitations in hygiene and operational efficiency.

Brands are leaning toward sustainable materials and design simplification to reduce waste and enhance production speed. The market has also benefited from the integration of wicketless formats into flexible packaging lines that support a broader range of food, retail, and industrial applications.

Regulatory pressure to minimize packaging touchpoints and improve food safety standards has further accelerated their use. Looking ahead, the market is expected to grow steadily with the support of advancements in pouch-forming machinery, increased investments in recyclable barrier films, and the need for packaging formats compatible with e-commerce and direct-to-retail supply chains.

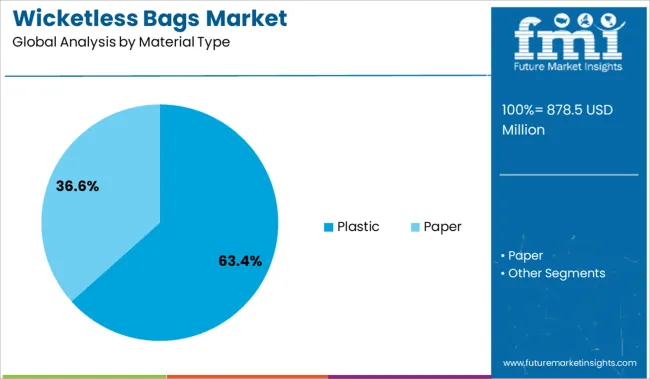

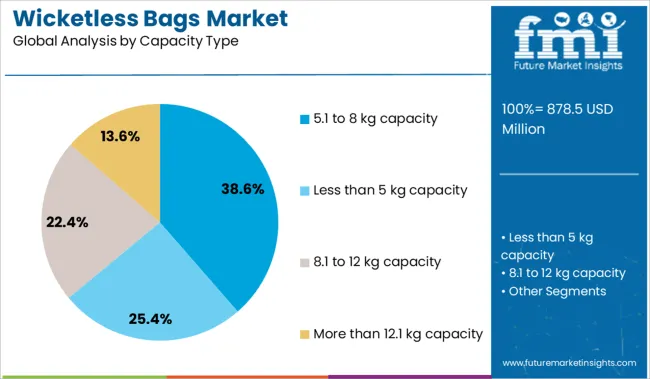

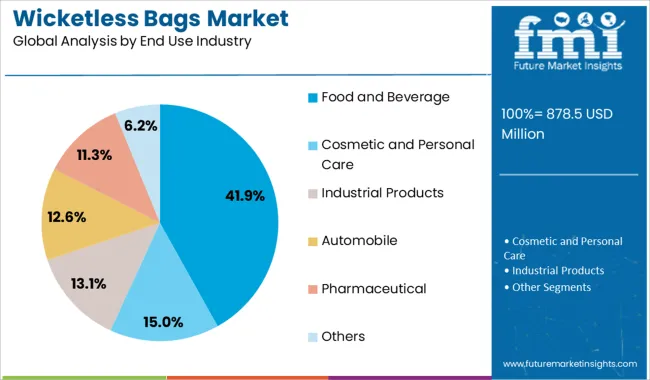

The market is segmented by Material Type, Capacity Type, and End Use Industry and region. By Material Type, the market is divided into Plastic and Paper. In terms of Capacity Type, the market is classified into 5.1 to 8 kg capacity, Less than 5 kg capacity, 8.1 to 12 kg capacity, and More than 12.1 kg capacity. Based on End Use Industry, the market is segmented into Food and Beverage, Cosmetic and Personal Care, Industrial Products, Automobile, Pharmaceutical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is projected to dominate the material landscape with 63.4% of total revenue share in 2025. This leadership is being reinforced by its superior flexibility, moisture barrier properties, and adaptability to automated filling systems.

Lightweight plastic films provide a cost-effective solution for manufacturers looking to optimize throughput without compromising on product protection. The segment’s strength is also linked to innovations in recyclable and bio-based plastic films, which are being increasingly adopted by converters seeking to align with sustainability mandates.

Plastic’s compatibility with high-speed sealing and cutting processes ensures lower downtime in production lines, making it the preferred choice for wicketless bag formats in both food and non-food sectors.

Bags in the 5.1 to 8 kg range are expected to lead in capacity format, accounting for 38.6% of revenue in 2025. This segment’s growth is being attributed to its utility across food staples, household goods, and bulk-purchase consumer products.

The format strikes a balance between volume efficiency and handling convenience, making it suitable for both retail and institutional packaging. Demand from food processors and distributors seeking flexible packaging for mid-sized product volumes has driven widespread adoption.

The growth has also been supported by supply chain shifts that emphasize packaging standardization for palletization and shelf-ready formats. The segment’s compatibility with wicketless automation systems enhances throughput in large-scale packing environments, contributing to its dominant market share.

The food and beverage sector is anticipated to hold the largest end-use share at 41.9% in 2025. This leadership is being driven by increased reliance on flexible, contamination-reducing packaging in both dry and semi-liquid food applications.

Wicketless bags are well-suited for automated production lines in snack foods, frozen goods, and powdered ingredients, where speed and hygiene are critical. Rising consumer demand for portioned, resealable, and extended shelf-life packaging has further propelled adoption within this segment.

The market has also seen increased investment in recyclable and mono-material barrier films within the food industry, making wicketless formats even more attractive. Ongoing regulatory scrutiny around food safety and packaging waste is expected to sustain momentum in this segment, particularly in highly regulated export-driven markets.

Innovation and technological development in packaging material and equipment has created game-changing opportunities and increasing application use of packaging across numerous industries.

Consumer’s choice of packaging product has seen a paradigm shift from paper to plastic materials as it offers increased flexibility and long-haul durability of the product. Also, increasing growth in organized retail store format have observed a shift toward poly bags market and in particular wicketless bags.

Traditionally, paper material was the primary choice of raw material in wicketless bags across countries of Germany, India, Indonesia, etc. But wicketless bags with the feature of the zipper closure, serrated lip, punched vent holes and hang holes is proven to be an alternative replacement of rigid boxes. Wicketless bags are designed with the intention of storing and transporting agricultural and food products.

Manufacturers of wicketless bags from countries of China, India are predominantly demanding poly bags to fit in their packaging requirement. Overall, the demand for wicketless bags is anticipated to boost during the forecast period, with the region of Europe expected to showcase a surging CAGR during the projected period.

Conventionally, wicket bags were dominantly used across the poly bags market, but with increasing use of bulk application products in the food industry it has translated into a high demand for wicketless bags. Also, easy availability of resins has fuelled a high demand for the manufacturers to produce plastic wicketless bags at a comparatively cheaper cost.

On the flip side, high regulatory pressure from European and North America legislative bodies on the use of the poly material is creating a backlash on the manufacturer of wicketless bags. Moreover, countries such as Rwanda have banned the use poly bags which is quite a lucrative market for wicketless bags.

Such factors are affecting the revenue margin of domestic distributor and manufacturers of wicketless bags. Overall the market of wicketless bags is expected to showcase a lucrative growth opportunity during the forecast period.

Global wicketless bags market is segmented into material type, capacity type, and end use industry. On the basis of material type, the global wicketless bags is segmented into plastic and paper. Further, plastic is segmented into polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), polystyrene (PS), and others.

On the basis of capacity type, the global wicketless bags market is segmented into less than 5 kg capacity, 5.1 to 8 kg capacity, 8.1 to 12 kg capacity, more than 12.1 kg capacity.

On the basis of end use industry, the global wicketless bags market is segmented into food and beverage, cosmetic and personal care, industrial products, automobile, pharmaceutical and others.

The global wicketless bags market is predominantly demanded in the regions of APEJ and MEA market. Countries such as China, India, South Africa are among the key markets who are demand wicketless bags.

The increasing demand for poly bags across APEJ market is correlating a high consumption pattern across the APEJ region. Regions of Europe and North America are showcasing an increasing growth of wicketless bags due to increasing consumption of grocery and food items.

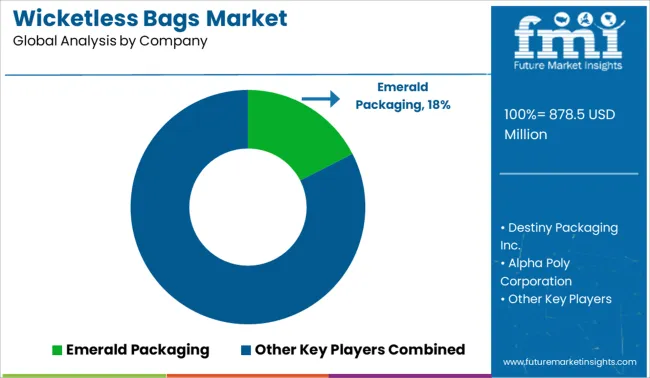

Some of the key players operating in the global wicketless bags market include Emerald Packaging, Destiny Packaging Inc., Alpha Poly Corporation.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The global wicketless bags market is estimated to be valued at USD 878.5 million in 2025.

The market size for the wicketless bags market is projected to reach USD 1,300.4 million by 2035.

The wicketless bags market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in wicketless bags market are plastic and paper.

In terms of capacity type, 5.1 to 8 kg capacity segment to command 38.6% share in the wicketless bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in Wicketless Bags

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Sugar Bags Market

Cotton Bags Market Size and Share Forecast Outlook 2025 to 2035

Refuse Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA