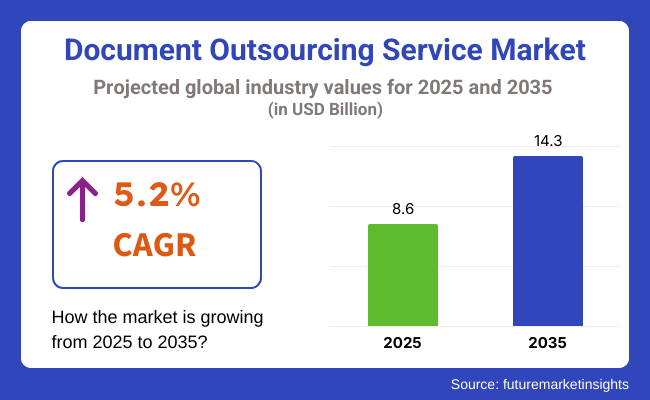

The global document outsourcing service market was valued at USD 8.6 billion in 2025 and is set to expand to USD 14.3 billion by 2035, reflecting a compound annual growth rate of 5.2%. This growth underscores a shift in enterprise priorities, with organizations seeking to streamline document-intensive operations and reduce in-house overhead. As digital transformation initiatives accelerate, businesses are relying more heavily on outsourcing partners to manage high-volume documentation across customer communications, compliance records, and marketing collateral.

Technological innovations in the market are transforming how organizations manage information, improve efficiency, and reduce operational costs. Advanced automation tools, including AI-driven document classification, OCR (Optical Character Recognition), and natural language processing (NLP), are streamlining data extraction and indexing processes. Cloud-based document management systems now enable real-time collaboration, secure access, and centralized storage, supporting remote work and global operations.

Integration with enterprise content management (ECM) and workflow automation platforms is also accelerating document lifecycle management, from capture to archiving. Moreover, the adoption of blockchain for document integrity and e-signature technologies is enhancing security, compliance, and traceability in document transactions. These innovations collectively enable service providers to offer scalable, compliant, and cost-effective solutions that align with digital transformation goals across industries.

Government regulations in the market are centered on data protection, confidentiality, and compliance with industry-specific standards. In regions like North America and Europe, service providers must adhere to laws such as the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), and the California Consumer Privacy Act (CCPA). These frameworks mandate strict handling of personal and sensitive data, including secure storage, limited access, and detailed audit trails.

In sectors such as banking and healthcare, outsourcing partners must also comply with additional regulatory protocols that govern data sovereignty and retention periods. These rules compel providers to invest in advanced cybersecurity infrastructure and maintain transparent policies to avoid legal liabilities. As a result, regulatory compliance has become a critical differentiator in vendor selection, pushing the market toward more standardized, certified, and tightly governed outsourcing models.

The market is segmented by service into document imaging & scanning services, archive & records management services, content management services, document processing services, and others (mailroom automation, print management, data entry, transcription, translation, and form processing services). By enterprise size, the market is categorized into small and medium enterprises and large enterprises. Based on industry, the segmentation includes banking, financial services, and insurance (BFSI), manufacturing, legal, media & entertainment, government, retail, healthcare, IT & telecom, and others (education, real estate, transportation, logistics, hospitality, and energy sectors). Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia, and Pacific, East Asia, the Middle East, and Africa.

Document processing services, the fastest-growing segment with a CAGR of 6.1% from 2025 to 2035, involve automated data extraction, validation, indexing, and distribution. The increasing reliance on AI and machine learning for intelligent document understanding is accelerating this segment’s growth. Document imaging and scanning services form the backbone of many outsourcing strategies, offering secure conversion of physical records into digital formats. These services are widely adopted across industries like banking, healthcare, and legal, where data accuracy and quick retrieval are essential. Archive and records management services focus on the systematic storage, categorization, and compliance-driven retention of business documents. This segment is crucial for companies dealing with legacy data and long-term document retention mandates.

Content management services provide centralized platforms for document creation, collaboration, and retrieval. These solutions are popular in industries with high documentation workflows, such as media, telecom, and government, where efficient content access and sharing improve operational productivity. Lastly, the other category includes specialized offerings such as mailroom automation, print management, and transcription services, which support end-to-end document lifecycle management and help businesses focus on core tasks.

| Service | CAGR (2025 to 2035) |

|---|---|

| Document processing services | 6.1% |

Small and medium enterprises are expected to register the highest growth, with a CAGR of 5.8% from 2025 to 2035. These enterprises are increasingly adopting outsourced document services to reduce capital investment in internal systems, relying on pay-as-you-go models and cloud-based solutions to manage records, invoices, and communications. Outsourcing enables SMEs to access advanced document technologies without the burden of hiring specialized staff or maintaining physical infrastructure.

Large enterprises, while growing at a slower rate, continue to contribute the majority of market revenue. Their adoption is driven by complex documentation needs spanning legal, compliance, and customer management functions. These organizations often form long-term partnerships with document service providers to securely and efficiently handle massive volumes of records. Large firms also lead in the use of AI-powered document processing and multi-layered access control systems to protect sensitive information. Both segments highlight how scalability, regulatory compliance, and digitization remain central to outsourcing strategies across enterprise sizes.

| Enterprise Size | CAGR (2025 to 2035) |

|---|---|

| Small and medium enterprises | 5.8% |

The healthcare segment is projected to be the fastest-growing segment in the market, with a CAGR of 6.4% from 2025 to 2035. This growth is driven by rising volumes of patient records, insurance claims, and regulatory compliance documentation, which require secure, efficient, and HIPAA-compliant handling. The BFSI sector currently holds the largest share due to its dependence on streamlined workflows for contracts, customer records, and financial reports. In manufacturing, outsourcing supports operational efficiency by managing technical manuals, quality documentation, and compliance records. The legal industry relies on document outsourcing for case files, transcription, and secure archiving, given its need for accuracy and confidentiality.

Media and entertainment companies outsource to manage high volumes of scripts, rights agreements, and licensing contracts. At the same time, government agencies utilize these services to digitize archives, manage citizen records, and reduce their reliance on paper. The retail sector benefits from outsourcing invoices, purchase orders, and marketing materials, improving back-end efficiency. IT and telecom firms utilize document outsourcing for product documentation, service-level agreements (SLAs), and customer communication. The other segments include education, real estate, and logistics, where administrative paperwork and record-keeping remain essential and are increasingly outsourced to improve turnaround time and reduce internal workload.

| Industry | CAGR (2025 to 2035) |

|---|---|

| Healthcare | 6.4% |

Growing Digital Workflows to Escalate Demand for Document Outsourcing Services

The increasing push for cost optimization and digital efficiency is driving organizations to adopt document outsourcing services. Enterprises are outsourcing non-core tasks, such as scanning, archiving, printing, and document storage, to streamline their operations. Advanced technologies, such as cloud document management, robotic process automation (RPA), and AI-driven document indexing, are helping to reduce manual errors and speed up workflows. With remote and hybrid work models becoming standard, digital accessibility and workflow automation have become critical.

Industries like healthcare, banking, and education are particularly focusing on digital document transformation to ensure continuity and compliance. Outsourcing enables firms to scale operations without investing heavily in physical infrastructure, creating strong market demand. As enterprises continue to prioritize lean operations and flexible document access, global adoption is expected to accelerate.

Data Privacy and Regulatory Complexities Restrict Growth Pace

Despite strong growth prospects, the market faces restraints from strict regulatory frameworks and data security concerns. Organizations are increasingly wary of outsourcing sensitive information due to compliance mandates such as GDPR, HIPAA, and CCPA. Mishandling of data, breaches, or third-party risks can lead to significant legal and reputational consequences.

For many firms, particularly in sectors such as government, defense, and banking, ensuring complete control over documents is a primary concern. Additionally, inconsistencies in service quality, lack of integration with legacy systems, and concerns over service provider reliability pose further challenges. These issues often delay decision-making around outsourcing and limit vendor penetration in highly sensitive segments. Market players are thus required to maintain high compliance standards and provide robust end-to-end security assurances to stay competitive.

Cloud Integration and SMEs Unlock Strong Growth Opportunities

Rising adoption of cloud-based platforms and SME digitalization trends are creating new market opportunities. Small and medium enterprises (SMEs) are increasingly adopting document outsourcing to improve productivity without expanding internal IT resources.

Cloud integration enables real-time collaboration, remote accessibility, and automatic backups, features highly valued by modern businesses. Service providers offering scalable subscription-based models tailored for SMEs are gaining traction. Furthermore, governments in emerging economies are promoting the digitization of public services and encouraging businesses to modernize document workflows. This trend is driving demand for outsourced solutions that offer compliance-ready, cost-efficient services.

Cybersecurity Threats Pose Risks

The growing cybersecurity threat landscape and market fragmentation present key threats to this market. Increasing sophistication in cyberattacks, phishing, and ransomware incidents makes document handling a high-risk area, especially when managed externally. Many businesses hesitate to outsource documents that include sensitive financial, legal, or customer information due to the fear of leaks and data breaches.

Additionally, the market remains fragmented with many local and regional players offering inconsistent quality and outdated infrastructure. This inconsistency undermines enterprise trust and slows market maturity. A lack of standardization in service delivery, coupled with limited accountability among vendors, further limits scalability.

The United States document outsourcing service market is poised to grow at a CAGR of 4.9% from 2025 to 2035. This growth is fueled by widespread digital transformation initiatives across industries, an established ecosystem of outsourcing vendors, and an increasing emphasis on data governance and operational efficiency.

The country’s mature market continues to evolve, with enterprises leveraging AI-driven automation and cloud-based document management to reduce reliance on physical documentation. Major players like Iron Mountain, Ricoh USA, and HP are expanding their service portfolios to meet growing demand for customized document solutions in sectors like BFSI, healthcare, and legal services.

The rise of remote and hybrid work models has further pushed USA firms to digitize records and streamline internal processes. Additionally, heightened regulatory scrutiny around data privacy has led companies to prioritize secure document handling through third-party vendors. Government regulations such as HIPAA, GLBA, and CCPA are making compliance a strategic imperative, positioning document outsourcing providers as essential partners.

Mid-sized businesses, in particular, are outsourcing high-volume tasks to improve speed, reduce errors, and control operational costs. As enterprises move toward leaner operations, the need for intelligent document workflows is expected to further elevate the role of outsourcing across American businesses.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The United Kingdom’s document outsourcing service market is expected to grow at a CAGR of 4.8% between 2025 and 2035. Following the acceleration of remote work and digital infrastructure investment post-Brexit, UK enterprises are increasingly turning to outsourcing providers for scalable document management. Key industries such as financial services, legal, healthcare, and retail are actively adopting document imaging, records management, and content automation services to reduce operational complexity and remain compliant with evolving regulations.

UK based vendors and multinational firms with operations in the region are prioritizing security, transparency, and integration with enterprise software ecosystems. Data protection regulations under the UK GDPR framework, as well as compliance with industry-specific standards, are compelling firms to partner with outsourcing providers that offer built-in audit trails, encryption, and cloud-based redundancy systems. Additionally, public sector modernization efforts and digital transformation funding have opened new opportunities for document outsourcing vendors in local government, education, and healthcare segments.

The demand is also being fueled by cost-conscious SMEs adopting managed document services to optimize resources and reduce labor costs. Overall, the UK market is progressing toward maturity with a clear focus on data integrity, agility, and digital compliance.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

Germany's document outsourcing service market is forecast to grow at a CAGR of 4.3% from 2025 to 2035. The country’s highly regulated business environment and strong industrial base make document management a critical operational area.

As German companies navigate complex compliance requirements under GDPR and sector-specific laws, outsourcing secure document handling and archiving has become a key strategy. Demand is especially strong in manufacturing, BFSI, legal, and healthcare sectors, where documentation volumes are high and accuracy is paramount.

German enterprises are emphasizing sustainability, and many document outsourcing vendors are responding by offering digital-first services that reduce paper usage and lower environmental impact. Automation tools for document capture, indexing, and retrieval are being rapidly adopted, particularly in small and mid-sized enterprises aiming to cut down on administrative overhead.

The rising number of startups and tech firms in cities like Berlin and Munich also contributes to the demand for scalable and flexible document solutions. As Germany continues to balance its traditional business conservatism with digital transformation, the market for reliable, regulation-compliant outsourcing services is expected to stay resilient and steadily expand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.3% |

France's document outsourcing service market is forecast to reacha CAGR of 4.2% during the forecast period. The country’s strong regulatory culture and focus on digital governance have created fertile ground for document outsourcing across industries.

French enterprises are increasingly outsourcing document digitization, archiving, and workflow automation to ensure compliance with local laws like CNIL regulations and broader EU mandates under GDPR. Sectors such as banking, public services, and utilities are particularly active in outsourcing documentation processes that require high accuracy and long-term traceability.

Many companies in France are opting for hybrid outsourcing models that combine on-premise digitization with cloud-based storage and content access. The French government’s push toward digital transformation in public services and healthcare has also contributed to a steady rise in document outsourcing demand. In addition, the rise of remote work has led organizations to prioritize centralized access to records and real-time collaboration across departments. Domestic and international service providers operating in France are focusing on secure data handling, multilingual support, and seamless system integration. As digitization deepens in both urban and regional markets, document outsourcing is becoming integral to France’s enterprise modernization agenda.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 4.2% |

Japan’s document outsourcing service market is projected to reach a CAGR of 4.7% during the forecast period. The market is shaped by the country’s aging workforce, high labor costs, and strong inclination toward operational efficiency. Organizations in Japan are outsourcing document services such as scanning, archiving, and digital content management to manage rising workloads with fewer human resources. The banking, insurance, and manufacturing sectors are key adopters, focusing on accuracy, compliance, and long-term digital storage.

Traditional corporate practices are gradually being replaced with cloud-based document solutions that integrate with legacy systems. Many Japanese firms prefer service providers that offer flexible deployment and strong data protection protocols, given Japan’s conservative approach to outsourcing and sensitive data.

Vendors that ensure localized support and seamless integration with existing workflows are especially successful in gaining traction. Regulatory mandates around data privacy and digital recordkeeping also influence adoption, particularly in sectors like healthcare and public administration. As Japan continues its digital evolution, driven by both government policy and corporate necessity, document outsourcing is becoming a cornerstone of sustainable enterprise efficiency in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The competitive landscape of the market is defined by a mix of global technology giants, regional specialists, and agile BPO providers offering tailored document solutions across verticals. The top five players by market share, Ricoh Co. Ltd., Iron Mountain Incorporated, Fuji Xerox Co. Ltd., Symcor, and Hewlett-Packard Co., collectively account for a significant portion of global revenue.

Ricoh Co. Ltd. leads the space with a dominant presence in both developed and emerging markets, supported by a comprehensive portfolio of digital workflow services. Iron Mountain follows closely, leveraging its global storage infrastructure and advanced information lifecycle solutions. Fuji Xerox maintains a strong position in Asia Pacific, especially in enterprise-grade imaging and document processing services. Symcor commands a solid share in the Canadian financial services sector, while HP remains influential due to its integration of managed print services with cloud-based document management.

These top players are executing strategies focused on vertical-specific customization, cloud migration, and AI-driven automation. For instance, Ricoh has expanded its managed document services through strategic acquisitions in Latin America and collaborative partnerships in Europe.

Iron Mountain has diversified into digital transformation and data center services, building synergies between physical records management and digital documentation. Meanwhile, HP continues to enhance its document outsourcing platforms by embedding cybersecurity features and expanding into AI-based analytics to support compliance-heavy industries like healthcare and finance.

Small and mid-tier players such as Max BPO, Invensis Technologies, Suma Soft, and Nimble Information Strategies are carving out niche segments within the broader market. These firms typically focus on cost-competitive solutions, offshore delivery models, and quick turnaround times.

Their agility allows them to serve clients in specific industries like real estate, education, or legal services, where tailored workflows and lower volumes make global providers less cost-effective. Many of these companies are also focusing on document digitization, multilingual support, and back-office processing for international clients looking to cut costs without compromising document quality or compliance.

To stay competitive, smaller vendors are embracing cloud-native platforms, low-code automation, and industry partnerships that allow them to scale services while maintaining operational flexibility. Some are also aligning with regional regulatory standards and offering integrated compliance tracking as a value-added feature.

This approach positions them as viable alternatives for SMEs and even select mid-size enterprises, especially in emerging markets. As larger enterprises seek end-to-end integration and data intelligence, and smaller firms prioritize affordability and agility, the competitive landscape remains both diverse and fluid, paving the way for innovation at all tiers of the market.

Recent Document Outsourcing Service Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.6 billion |

| Projected Market Size (2035) | USD 14.3 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Service | Document Imaging & Scanning Services, Archive & Records Management Services, Content Management Services, Document Processing Services, and Others ( Mailroom Automation, Print Management, Data Entry, Transcription, Translation, And Form Processing Services) |

| By Enterprise Size | Small and Medium Enterprises and Large Enterprises |

| By Industry | Banking, Financial Services, & Insurance (BFSI), Manufacturing, Legal, Media & Entertainment, Government, Retail, Healthcare, IT & Telecom, and Others (E ducation, Real Estate, Transportation, Logistics, Hospitality, And Energy Sectors) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa |

| Countries Covered | United States, China, Germany, India, Japan, Saudi Arabia, Brazil, Russia, South Korea, Canada. |

| Key Players | Ricoh Co. Ltd., Fuji Xerox Co. Ltd., Iron Mountain Incorporated, Max BPO, Symcor, Hewlett-Packard Co., Lexmark International Inc., Invensis Technologies Pvt. Ltd., Suma Soft Private Limited, and Nimble Information Strategies Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is expected to grow at a compound annual growth rate (CAGR) of 5.2% during the forecast period.

The BFSI, healthcare, legal, manufacturing, and government sectors are leading demand for document outsourcing services.

Leading companies include Ricoh Co. Ltd., Iron Mountain Incorporated, Fuji Xerox Co. Ltd., Symcor, and Hewlett-Packard Co.

Document processing services improve operational speed, reduce manual errors, and ensure compliance through automation.

SMEs are increasingly outsourcing document tasks to cut operational costs, access cloud solutions, and enhance flexibility.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Service, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Industry, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 17: Global Market Attractiveness by Service, 2024 to 2034

Figure 18: Global Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 19: Global Market Attractiveness by Industry, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Service, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 37: North America Market Attractiveness by Service, 2024 to 2034

Figure 38: North America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 39: North America Market Attractiveness by Industry, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Service, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Service, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Industry, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Service, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Industry, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Service, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Industry, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Service, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Industry, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Service, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Industry, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Service, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Industry, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Service, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Industry, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Service, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Industry, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Service, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Industry, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Document Control Software Market Size and Share Forecast Outlook 2025 to 2035

Document Cleaning Powder Market Size and Share Forecast Outlook 2025 to 2035

Document Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Document Imaging Market Size and Share Forecast Outlook 2025 to 2035

Document Management Software Market – Growth & Trends 2034

Global Clinical Documentation Improvement Market Insights – Trends & Forecast 2024-2034

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

Salesforce CRM Document Generation Software Market Size and Share Forecast Outlook 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Desktop Outsourcing Market

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Proteomics Outsourcing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Legal Process Outsourcing LPO Size Market Size and Share Forecast Outlook 2025 to 2035

Healthcare IT Outsourcing Market Growth - Analysis & Forecast 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Growth – Trends & Forecast 2024-2034

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA