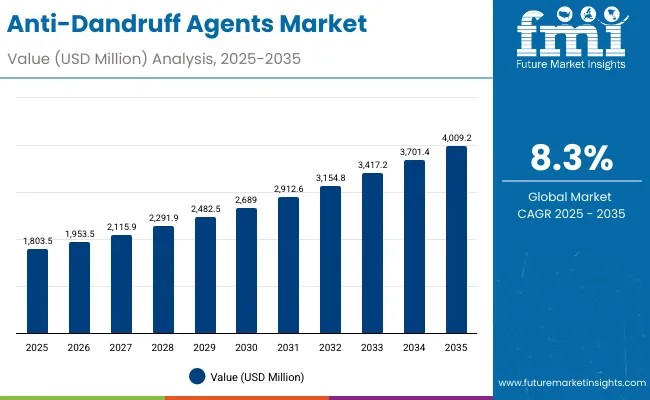

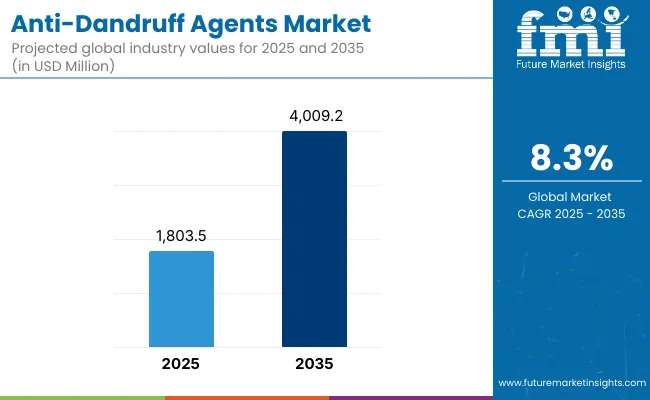

The global Anti-Dandruff Agents Market is expected to record a valuation of USD 1,803.5 million in 2025 and USD 4,009.2 million in 2035, with an increase of USD 2,205.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.3% and more than a 2X increase in market size.

Global Anti-Dandruff Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Anti-Dandruff Agents Market Estimated Value in (2025E) | USD 1,803.5 million |

| Global Anti-Dandruff Agents Market Forecast Value in (2035F) | USD 4,009.2 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,803.5 million to USD 2,689.0 million, adding USD 885.5 million, which accounts for 40% of the total decade growth. This phase records steady adoption of advanced haircare actives in mass shampoos, dermocosmetic products, and OTC scalp therapeutics, driven by the rising prevalence of seborrheic dermatitis and consumer demand for clinically proven efficacy. Antifungal actives dominate this period as they cater to over 43% of scalp-care needs in the USA and nearly half of global requirements, reflecting their role in directly targeting Malassezia fungi, the leading cause of dandruff.

The second half from 2030 to 2035 contributes USD 1,320.2 million, equal to 60% of total growth, as the market jumps from USD 2,689.0 million to USD 4,009.2 million. This acceleration is powered by the premiumization of scalp-care routines, the rise of biotechnology-derived agents offering novel mechanisms of action, and rapid uptake of encapsulated delivery systems in leave-on formats.

Botanical and clean-label ingredients capture rising consumer preference, while East Asia and India lead expansion with CAGRs of 22.9% and 25.6% respectively. By the end of the decade, innovation-driven formats such as scalp masks and professional salon solutions achieve mainstream traction, supported by strong dermocosmetic positioning in Europe and high OTC adoption in North America.

From 2020 to 2024, the global Anti-Dandruff Agents Market expanded steadily from USD ~1,500 million to nearly USD 1,750 million, driven largely by synthetic antifungal actives dominating OTC formulations and mass shampoos. During this period, the competitive landscape was dominated by chemical majors controlling nearly 70% of revenue, with leaders such as BASF, Clariant, and Kumar Organic focusing on proven synthetic ingredients like climbazole, zinc pyrithione, and ketoconazole.

Competitive differentiation relied on efficacy, regulatory approvals, and cost competitiveness, while natural ingredients contributed less than 25% of the total market value, primarily positioned in niche herbal formulations. Encapsulated or biotechnology-based actives were still at an early stage with limited commercialization.

Demand for anti-dandruff agents will expand to USD 1,803.5 million in 2025, and the revenue mix will shift significantly as botanical and biotechnology-derived actives gain traction, contributing to over 56% share by source. Traditional chemical leaders face rising competition from specialty ingredient suppliers offering microbiome-friendly scalp solutions, novel encapsulation technologies, and multifunctional actives that combine antifungal efficacy with soothing or sebum-regulating benefits.

Major companies are pivoting towards sustainable sourcing and clean-label claims, integrating encapsulation and controlled-release mechanisms to enhance long-term scalp relief. Emerging players specializing in biotech fermentation, natural actives, and scalp barrier repair are gaining share, reflecting how the competitive advantage is moving away from synthetic antifungal strength alone to a broader ecosystem of innovation, regulatory compliance, and consumer-trusted sustainability.

The global Anti-Dandruff Agents Market is expanding due to the rising prevalence of dandruff and seborrheic dermatitis across both developed and emerging markets. Advances in antifungal agents have reinforced their efficacy and affordability, driving their widespread inclusion in shampoos and rinse-off products.

At the same time, the demand for scalp-soothing actives and keratolytic exfoliators is growing as consumers recognize the importance of holistic scalp health rather than only symptom suppression. In addition, rinse-off stable dispersions dominate because of their proven stability in mass-market shampoos, while encapsulated actives are gaining acceptance in dermocosmetic and premium ranges for targeted delivery.

Another major growth factor is the shift towards natural and biotechnology-derived actives. With consumers seeking transparency, sustainability, and gentler solutions, botanical ingredients and biotech fermentation-based agents are accelerating adoption in both OTC and salon-grade formulations. Markets like India and Japan are propelling double-digit CAGR growth due to their cultural emphasis on scalp health and adoption of herbal and natural-based agents.

Globally, the industry is also benefiting from strong R&D investments into controlled-release formulations, scalp microbiome balance technologies, and regulatory-compliant alternatives to restricted actives. Segment growth is expected to be led by antifungal actives, synthetic and botanical sources, rinse-off dispersions, and application in shampoos, with professional salon and dermocosmetic segments gaining momentum towards 2035.

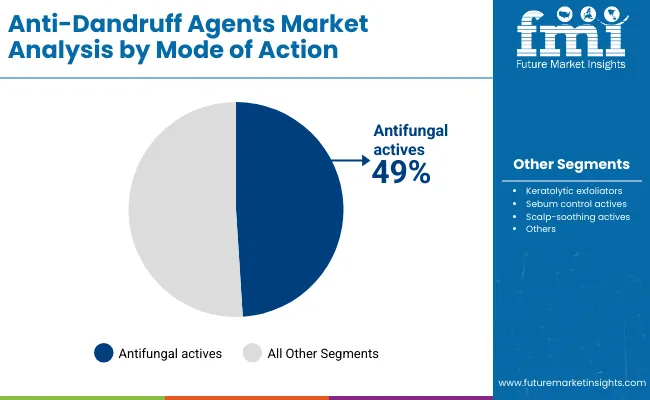

The global Anti-Dandruff Agents Market is segmented by mode of action, source, delivery system, physical form, application, end use, and geography. By mode of action, categories include antifungal actives, keratolytic exfoliators, sebum control actives, and scalp-soothing actives, with antifungal agents leading due to their strong clinical efficacy.

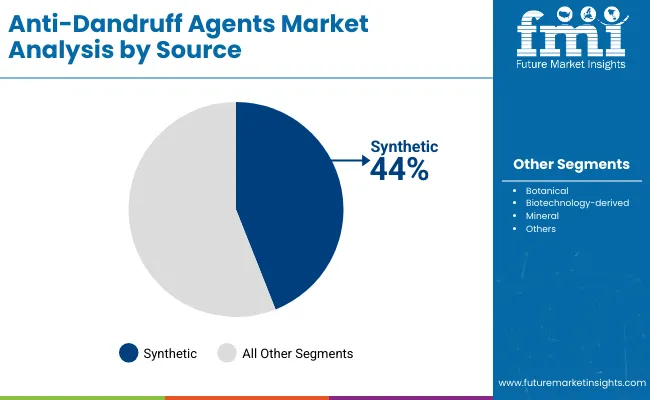

By source, the market is divided into synthetic, botanical, biotechnology-derived, and mineral actives, capturing the growing demand for clean-label and sustainable options. By delivery system, the segmentation includes free form, encapsulated, and rinse-off stable dispersions, reflecting how formulations are optimized for product stability and consumer convenience.

Physical forms include solution/concentrate, powder, and suspension, catering to different formulation requirements. By application, the market spans shampoos, leave-on tonics, conditioners, and scalp masks, with shampoos dominating but scalp masks growing rapidly in premium ranges.

End uses include mass haircare, dermocosmetic haircare, professional salon, and OTC hair therapeutics, highlighting the breadth of consumption from everyday products to advanced clinical scalp treatments. Regionally, the scope covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with high growth in Asia and mature but premium-driven demand in Europe and North America.

| Mode of Action | Value Share % 2025 |

|---|---|

| Antifungal actives | 49% |

| Others | 51.0% |

The antifungal actives segment is projected to contribute 49% of the global Anti-Dandruff Agents Market revenue in 2025, maintaining its lead as the dominant mode of action. This growth is driven by the proven efficacy of antifungal ingredients in targeting Malassezia fungi, the primary cause of dandruff and seborrheic dermatitis. Global adoption has been accelerated by strong clinical validation, affordability, and compatibility with mass-market shampoos and OTC therapeutics.

The segment’s dominance is further supported by ongoing innovation in synthetic antifungal molecules and biotechnology-derived variants that offer enhanced safety and long-lasting scalp relief. With increasing restrictions on certain traditional actives in Europe, manufacturers are investing heavily in R&D to develop next-generation antifungal agents that remain effective while meeting stringent regulatory standards. Antifungal actives are expected to retain their position as the backbone of anti-dandruff formulations, continuing to serve both mass haircare products and dermocosmetic scalp treatments worldwide.

| Source | Value Share % 2025 |

|---|---|

| Synthetic | 44% |

| Others | 56.0% |

The synthetic source segment is forecasted to hold 44% of the market share in 2025, reflecting its enduring role in providing reliable and cost-effective anti-dandruff actives. These ingredients, including zinc pyrithione, climbazole, and ketoconazole, remain widely used in both OTC and professional salon formulations due to their proven efficacy and stability in rinse-off applications.

Their continued relevance is reinforced by consumer trust in clinically validated solutions that deliver quick and visible results. At the same time, the rise of botanical, biotechnology-derived, and mineral-based actives, which collectively account for the remaining 56%, signals a growing transition toward sustainable and clean-label options. However, synthetic agents are expected to retain a significant role in mass haircare and therapeutic OTC ranges, particularly in regions where regulatory approval and consumer acceptance favor established actives.

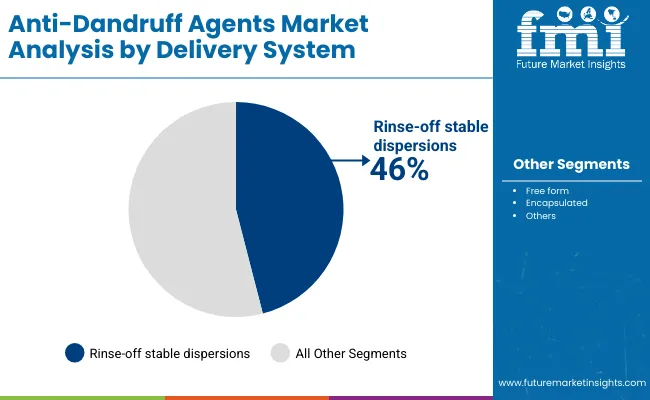

| Delivery System | Value Share % 2025 |

|---|---|

| Rinse-off stable dispersions | 46% |

| Others | 54.0% |

The rinse-off stable dispersions segment is projected to contribute 46% of the global Anti-Dandruff Agents Market revenue in 2025, establishing itself as the leading delivery format. Its dominance is supported by the fact that shampoos remain the most common and accessible anti-dandruff product worldwide, and rinse-off formulations offer both convenience and proven efficacy.

Manufacturers have optimized dispersion stability to ensure uniform release of antifungal and soothing agents, making these products highly effective in controlling dandruff over repeated use. The segment’s growth is also driven by its adaptability across both mass-market haircare brands and dermocosmetic ranges, with strong distribution through retail and pharmacy chains.

Meanwhile, encapsulated actives and free-form delivery systems are gaining traction in premium and leave-on applications, reflecting demand for controlled release and enhanced bioavailability. However, rinse-off dispersions are expected to remain the backbone of global anti-dandruff solutions, sustaining their lead through 2035.

Rising Transition from Zinc Pyrithione to Next-Generation Antifungal Agents

A major driver in the global Anti-Dandruff Agents Market is the regulatory-driven transition away from zinc pyrithione (ZnPT) in Europe and other regions. The ban and restrictions on ZnPT due to environmental and safety concerns have forced formulators to pivot toward alternative antifungal actives such as climbazole, ketoconazole, piroctoneolamine, and novel biotechnology-derived antifungal molecules.

This shift has created an innovation race, where ingredient suppliers like BASF, Clariant, and Kumar Organic are accelerating R&D pipelines to fill the efficacy gap left by ZnPT. The result is higher investment in new delivery systems (e.g., encapsulation for controlled release) and biocompatible actives that meet both regulatory and consumer clean-label demands. This regulatory push is not slowing the market but rather expanding its value potential by opening premium dermocosmetic segments.

Expansion of Dermocosmetic and Professional Salon Haircare Channels

While mass shampoos dominate revenue, the fastest growth is occurring in dermocosmetic ranges and salon-grade scalp treatments, particularly in Europe, Japan, and India. Dermatologists increasingly prescribe anti-dandruff solutions as part of broader scalp health regimens, integrating soothing, keratolytic, and antifungal actives in combination.

Professional salons are adopting anti-dandruff treatments packaged as scalp masks, leave-on tonics, and in-salon therapies, creating new opportunities for high-value ingredient suppliers. This driver is amplified by rising consumer awareness of scalp microbiome balance and the shift toward multi-functional products (anti-dandruff + anti-hair fall + soothing). The professionalization of scalp care is effectively expanding the end-use mix and fueling premium adoption, beyond traditional OTC shampoo markets.

Formulation Complexity with Multifunctional Claims

A restraint for the global Anti-Dandruff Agents Market is the increasing formulation complexity as brands push to combine anti-dandruff efficacy with multi-claim positioning (soothing, volumizing, anti-hair fall, and color protection). Delivering stability in formulations with multiple actives, such as antifungals with keratolytic exfoliators or sebum regulators, requires advanced delivery systems and compatibility testing.

This raises both time-to-market and production costs, limiting the ability of smaller brands to scale globally. Ingredient suppliers must invest in co-development with FMCG companies, which slows down adoption and creates entry barriers for niche players.

Regional Variability in Consumer Acceptance and Regulatory Standards

Another restraint is the high variability in consumer preferences and regulatory frameworks across regions. For instance, while Europe demands clean-label and sulfate-free anti-dandruff solutions, Asian markets such as India still prioritize high-strength antifungal efficacy at affordable price points.

Regulatory restrictions on key actives (like ZnPT in Europe or ketoconazole in certain OTC channels) further fragment global supply chains. This creates added costs for manufacturers, who must customize formulations per region and manage parallel regulatory pathways, making global standardization of anti-dandruff agents highly challenging.

Biotechnology-Derived and Microbiome-Friendly Actives

A key trend is the rise of biotechnology-derived ingredients and microbiome-focused scalp solutions. Consumers are increasingly aware that dandruff is linked not only to fungal overgrowth but also to scalp barrier integrity and microbiome balance. Ingredient suppliers are responding with biotech actives derived from fermentation, bioengineered peptides, and microbiome modulators.

For example, next-generation ingredients aim to reduce Malassezia load while supporting beneficial scalp flora, shifting the focus from eradication to balance. This trend is gaining momentum in Japan, South Korea, and Western Europe, where consumers are willing to pay a premium for scalp health aligned with skin-care principles.

Encapsulation and Controlled-Release Delivery Systems

Another important trend is the adoption of encapsulation technologies for anti-dandruff actives, particularly in premium and dermocosmetic ranges. Encapsulation allows controlled release of antifungal or soothing agents, enhancing efficacy, reducing irritation potential, and prolonging activity on the scalp.

This is critical in leave-on tonics and scalp masks, where rinse-off stability is not sufficient. Ingredient suppliers are innovating with liposomal carriers, polymeric beads, and microcapsules that integrate seamlessly into shampoos, conditioners, and professional salon treatments. This trend not only improves product differentiation but also aligns with consumer demand for long-lasting relief and scientifically advanced formulations.

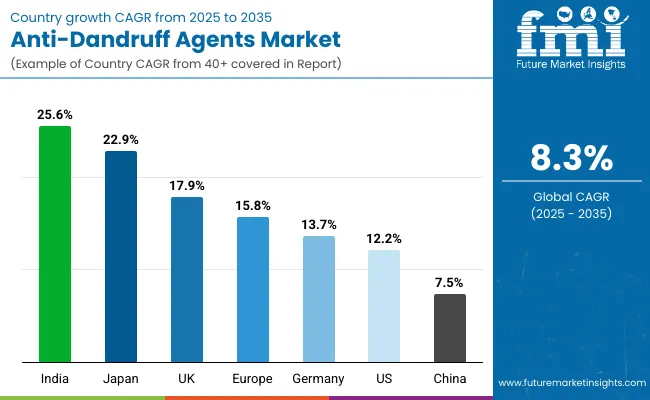

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

| USA | 12.2% |

| India | 25.6% |

| UK | 17.9% |

| Germany | 13.7% |

| Japan | 22.9% |

| Europe | 15.8% |

The growth outlook of the global Anti-Dandruff Agents Market across major countries highlights sharp contrasts in demand patterns and innovation-led adoption. India and Japan are the fastest-growing markets, with CAGRs of 25.6% and 22.9%, respectively. India’s rapid rise is attributed to the high prevalence of dandruff among urban and semi-urban populations, combined with increasing penetration of affordable OTC shampoos that rely on synthetic antifungal actives for quick relief.

At the same time, India’s cultural preference for herbal solutions is fueling demand for botanical and mineral-based agents, enabling global ingredient suppliers to diversify portfolios. Japan, on the other hand, is driving growth through premium dermocosmetic scalp-care solutions, with consumers embracing biotech-derived actives, encapsulated delivery systems, and scalp microbiome-balancing ingredients.

These two markets demonstrate how both affordability-driven demand and innovation-led premiumization can deliver double-digit growth in different contexts. Europe, growing at a solid 15.8% CAGR, is emerging as a premium hub where dermocosmetic innovation, regulatory-compliant actives, and encapsulated botanical solutions are becoming central to scalp care across Germany, France, and the UK

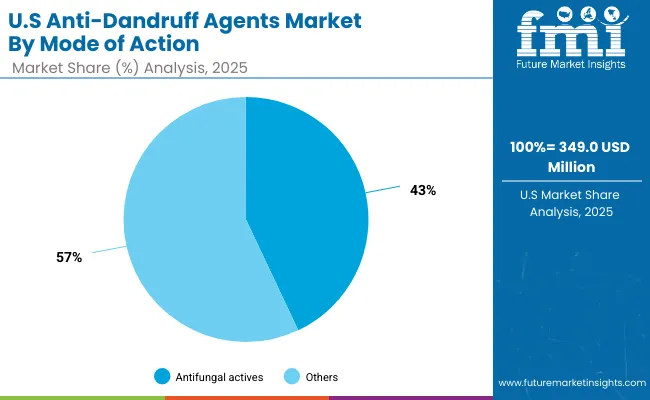

Mature markets such as the USA, UK, and Germany are expanding at 12.2%, 17.9%, and 13.7% CAGR, respectively, reflecting evolving consumer expectations and regulatory-driven change. The USA is experiencing rising traction in OTC hair therapeutics and dermocosmetic brands endorsed by dermatologists, with antifungal actives accounting for nearly 43% of national revenue in 2025.

The UK is benefiting from professional salon adoption and growing demand for scalp masks and leave-on tonics in premium haircare ranges. Germany continues to be a stronghold for dermocosmetic innovation, with leading ingredient suppliers advancing encapsulation technologies and microbiome-friendly formulations to replace restricted agents like zinc pyrithione.

China, growing steadily at 7.5% CAGR, remains largely driven by mass-market shampoos, but a gradual shift toward premium scalp solutions and biotech actives is expected beyond 2030. Collectively, these dynamics emphasize how the market is being reshaped by regulatory transitions, dermocosmetic innovation in Europe, and consumer-driven demand for multifunctional, clean-label scalp health products worldwide.

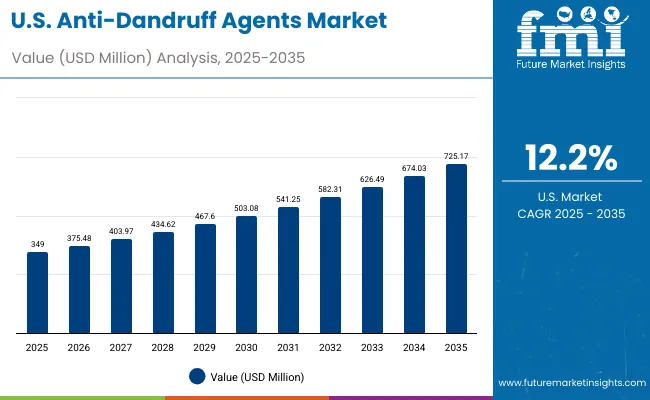

| Year | USA Anti-Dandruff Agents Market (USD Million) |

|---|---|

| 2025 | 349.00 |

| 2026 | 375.48 |

| 2027 | 403.97 |

| 2028 | 434.62 |

| 2029 | 467.60 |

| 2030 | 503.08 |

| 2031 | 541.25 |

| 2032 | 582.31 |

| 2033 | 626.49 |

| 2034 | 674.03 |

| 2035 | 725.17 |

The global Anti-Dandruff Agents Market in the United States is projected to grow at a CAGR of 12.2%, led by increasing adoption of OTC hair therapeutics and dermocosmetic scalp care products. Antifungal actives remain the backbone of the USA market, accounting for 43% of segment revenues in 2025, as they continue to deliver proven results against Malassezia-driven dandruff.

Dermatologist-recommended leave-on tonics and shampoos are gaining popularity in both retail and pharmacy channels, while premium brands are integrating soothing and keratolytic ingredients for multi-functional scalp health. The growth is also supported by consumer shift toward clinically validated scalp solutions and the rise of professional-grade salon products.

The global Anti-Dandruff Agents Market in the United Kingdom is expected to grow at a CAGR of 17.9%, supported by rapid expansion of salon-grade and dermocosmetic haircare products. Professional salon brands are increasingly introducing scalp treatments, masks, and soothing formulations, targeting high-income consumer groups.

The UK is also a hub for regulatory-compliant innovations, where companies are moving away from restricted antifungals such as zinc pyrithione and adopting encapsulated botanicals, biotech actives, and microbiome-balancing solutions. This creates a premium-driven landscape where retailers and pharmacies are collaborating with salons to expand distribution of multi-functional scalp products.

India is witnessing the fastest expansion in the global Anti-Dandruff Agents Market, forecast to grow at a CAGR of 25.6% through 2035. Rising dandruff prevalence among young adults, combined with high demand for affordable OTC shampoos, is driving mass adoption. At the same time, India’s deep cultural preference for herbal and botanical remedies is fueling demand for plant-based anti-dandruff actives, leading to significant opportunities for both domestic and global suppliers.

Increasing adoption in tier-2 and tier-3 cities, where awareness is rising and price-sensitive consumers are exploring both herbal and synthetic solutions, is widening the growth base. Professional salons are also beginning to offer scalp treatments, creating a premium niche alongside mass-market expansion.

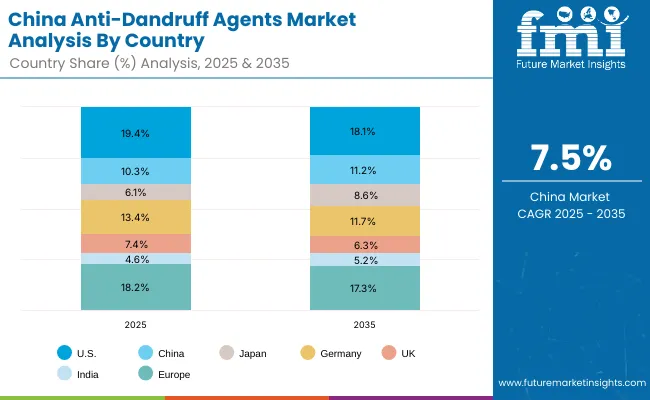

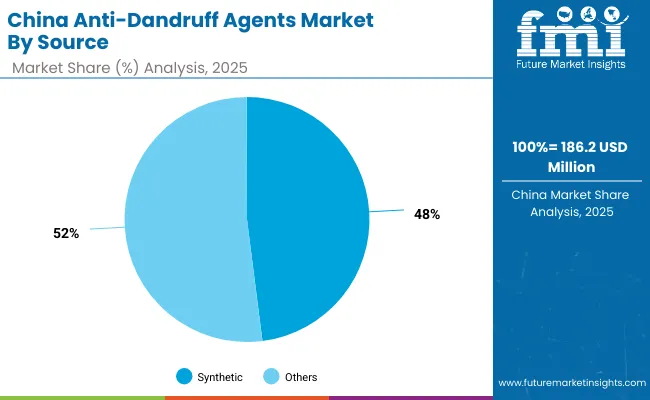

The global Anti-Dandruff Agents Market in China is projected to grow at a CAGR of 7.5%, reflecting steady expansion with increasing adoption of mass-market shampoos. Synthetic ingredients dominate with 48% share of revenue in 2025, as they provide reliable efficacy at scale. However, premiumization is gradually gaining traction, with biotech-derived and microbiome-friendly actives being adopted in urban retail channels.

Local brands are competing strongly with multinational suppliers, particularly through affordable product lines distributed via e-commerce platforms. Over time, growth is expected to accelerate as younger consumers show willingness to pay for botanical and encapsulated anti-dandruff actives in scalp-focused cosmetic ranges.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.4% |

| China | 10.3% |

| Japan | 6.1% |

| Germany | 13.4% |

| UK | 7.4% |

| India | 4.6% |

| Europe | 18.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.1% |

| China | 11.2% |

| Japan | 8.6% |

| Germany | 11.7% |

| UK | 6.3% |

| India | 5.2% |

| Europe | 17.3% |

| USA by Mode of Action | Value Share % 2025 |

| Antifungal actives | 43% |

| Others | 57.0% |

The Anti-Dandruff Agents Market in the United States is projected at USD 349.0 million in 2025, growing steadily at a CAGR of 12.2% through 2035. Antifungal actives dominate with 43% share (USD 150.1 million), supported by strong OTC and dermocosmetic penetration. The market shows a clear value transition toward multi-functional formulations, where antifungals are increasingly paired with keratolytic exfoliators, sebum regulators, and soothing actives. This reflects the demand for holistic scalp health rather than just symptomatic relief.

Growth in the USA is further catalyzed by dermatologist-endorsed therapies and pharmacy-led distribution, which amplify consumer trust in clinically proven ingredients. OTC hair therapeutics and leave-on scalp treatments are gaining visibility, supported by regulatory approval and rising consumer willingness to invest in premium solutions. Professional salon adoption of scalp masks and tonics is also expanding, establishing a dual growth pathway that strengthens both mass-market shampoos and premium dermocosmetic categories.

| China by Source | Value Share % 2025 |

|---|---|

| Synthetic | 48% |

| Others | 52.0% |

The Anti-Dandruff Agents Market in China is estimated at USD 186.2 million in 2025, expanding at a CAGR of 7.5% through 2035. Synthetic ingredients hold the lead with 48% share (USD 89.4 million), while botanical, biotech-derived, and mineral-based actives collectively account for 52% (USD 96.8 million). The slight dominance of synthetic agents stems from their affordability, strong efficacy profile, and broad application in mass-market shampoos, which remain the backbone of China’s scalp-care industry.

However, the market is undergoing a gradual transition toward clean-label and premium botanical actives, driven by rising consumer awareness in urban centers. E-commerce platforms play a critical role in expanding access, allowing smaller domestic players to compete with global giants. Innovation is increasingly focused on biotech-derived antifungal agents and encapsulated delivery systems, aligning with the country’s move toward smart manufacturing and premium personal care positioning.

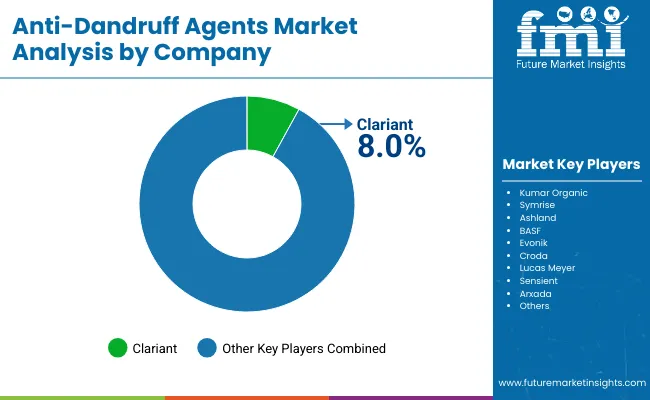

| Company | Global Value Share 2025 |

|---|---|

| Clariant | 8.0% |

| Others | 92.0% |

The global Anti-Dandruff Agents Market is moderately fragmented, with multinational ingredient suppliers, regional specialists, and biotech innovators competing across end-use applications. Global leaders such as Clariant, BASF, and Symrise hold notable shares, driven by advanced antifungal actives, clean-label innovations, and extensive regulatory compliance expertise.

Their strategies emphasize biotech-derived solutions, encapsulated delivery technologies, and microbiome-friendly formulations, making them highly competitive in premium dermocosmetic and professional segments.Established players like Kumar Organic, Ashland, Evonik, and Croda maintain strong footholds through synthetic antifungal agents and multifunctional scalp actives.

They cater to mass-market and OTC demand while pivoting toward sustainable sourcing and botanical innovation. These companies also benefit from global distribution networks, enabling broad market penetration.

Niche-focused suppliers such as Lucas Meyer, Sensient, and Arxada concentrate on specialty actives and custom scalp solutions, including soothing agents and keratolytic exfoliators. Their strengths lie in targeted formulations, application-specific customization, and partnerships with cosmetic brands in emerging markets.

Competitive differentiation is shifting away from traditional synthetic antifungal dominance toward ecosystem-driven portfolios, where integration of natural actives, encapsulated delivery systems, and regulatory-driven compliance solutions are defining long-term market leadership.

Key Developments in Global Anti-Dandruff Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mode of Action | Antifungal actives, Keratolytic exfoliators, Sebum control actives, Scalp-soothing actives |

| Source | Synthetic, Botanical, Biotechnology-derived, Mineral |

| Delivery System | Free form, Encapsulated, Rinse-off stable dispersions |

| Physical Form | Solution/concentrate, Powder, Suspension |

| Application | Shampoos, Leave-on tonics, Conditioners, Scalp masks |

| End Use | Mass haircare, Dermocosmetic haircare, Professional salon, OTC hair therapeutics |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kumar Organic, Clariant , Symrise , Ashland, BASF, Evonik , Croda , Lucas Meyer, Sensient , Arxada |

| Additional Attributes | Dollar sales by mode of action, source, delivery system, and end use; adoption trends in OTC, dermocosmetic , and salon haircare; growing preference for rinse-off stable dispersions and encapsulated actives; rising demand for microbiome-friendly and biotech-derived ingredients; regulatory transition from restricted antifungals; regional variation in scalp health preferences; innovation in antifungal efficacy, soothing/ keratolytic combinations, and controlled-release delivery formats. |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA