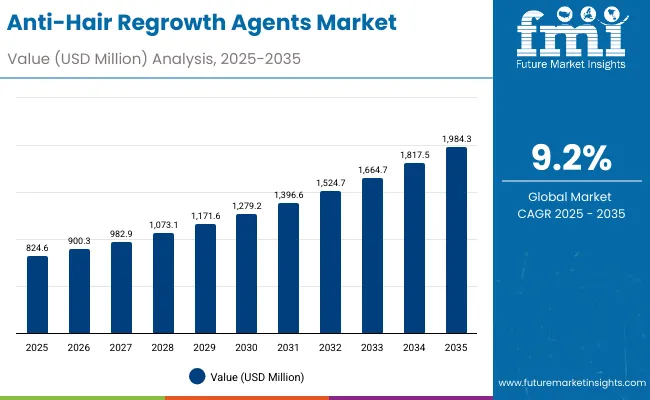

The global Anti-Hair Regrowth Agents Market is expected to record a valuation of USD 824.6 million in 2025 and USD 1,984.3 million in 2035, with an increase of USD 1,159.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 9.2% and more thsan a 2X increase in market size.

Global Anti-Hair Regrowth Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Anti-Hair Regrowth Agents Market Estimated Value in (2025E) | USD 824.6 million |

| Global Anti-Hair Regrowth Agents Market Forecast Value in (2035F) | USD 1,984.3 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 824.6 million to USD 1,279.2 million, adding USD 454.6 million, which accounts for 39% of the total decade growth. This phase records steady adoption in post-depilation care, professional depilatory solutions, and skincare regimes, driven by rising consumer interest in longer-lasting smoothness and botanical formulations. Follicular cycle modulators dominate this period as they cater to over 40% of applications, effectively targeting hair cycle phases for delayed regrowth and reduced density.

The second half from 2030 to 2035 contributes USD 705.1 million, equal to 61% of total growth, as the market jumps from USD 1,279.2 million to USD 1,984.3 million. This acceleration is powered by widespread deployment of encapsulated and sustained-release systems, biotechnology-derived actives, and premium salon-based aftercare in urban markets. East Asia and India are projected to drive explosive growth, with India’s CAGR of 26.2% and Japan’s CAGR of 23.4% reflecting a dramatic uptake of biotech-driven formulations. Encapsulated delivery systems combined with biotechnology-derived actives capture a larger share above 50% by the end of the decade. Skincare and at-home aftercare continue to expand, but professional depilatory care and spa-driven demand contribute significantly to premium revenues.

From 2020 to 2024, the global Anti-Hair Regrowth Agents Market grew from a niche base to nearly USD 800 million, driven largely by botanical innovation and early clinical positioning of follicular modulators. During this period, the competitive landscape was dominated by ingredient manufacturers controlling nearly 90% of revenue, with leaders such as Lipotec, Symrise, and Givaudan focusing on bioactive compounds derived from plants, peptides, and biotech platforms. Competitive differentiation relied on efficacy, irritation-free performance, and safety compliance with cosmetic regulations, while delivery systems were often simple free-form solutions or creams. Service-based applications, such as salon aftercare protocols, had strong traction in Europe but remained underdeveloped in Asia.

Demand for anti-hair regrowth solutions will expand to USD 824.6 million in 2025, and the revenue mix will shift as encapsulated and sustained-release systems grow to over 48% share. Traditional botanical leaders face rising competition from biotechnology-derived actives and hybrid delivery technologies offering controlled release and enhanced skin compatibility. Major suppliers are pivoting to integrated approaches, combining botanical actives with advanced encapsulation to extend duration of effect and minimize irritation. Emerging entrants specializing in AR/VR diagnostic tools for hair density tracking, microbiome-balancing formulations, and AI-personalized depilatory aftercare solutions are gaining share. The competitive advantage is moving away from botanical sourcing alone to ecosystem strength, formulation stability, and long-term consumer adherence.

Advances in delivery technologies have transformed the efficacy of anti-hair regrowth formulations. Encapsulation and sustained-release matrices allow prolonged bioavailability of actives such as enzyme inhibitors, peptides, and plant-derived extracts. This has improved consumer satisfaction by extending smoothness duration after depilation, minimizing irritation, and enhancing skin hydration. The growing consumer preference for multifunctional productswhere hair regrowth inhibition is combined with moisturizing, anti-inflammatory, or brightening functionsis driving innovation and premium pricing across skincare and spa channels.

The expansion of professional depilatory treatments and the rising popularity of at-home aftercare routines are fueling growth. Portable roll-on and gel-based formats are becoming mainstream in North America and Europe, while concentrated serums and creams dominate in Asia-Pacific. Botanicals hold a strong consumer appeal, reflected in their 45% global share in 2025, particularly in India and China where natural formulations align with traditional beauty practices. Biotechnology-derived actives are expected to record double-digit growth, especially in Japan and South Korea, as premium dermocosmetic consumers demand clinically validated, microbiome-safe, and irritation-free formulations. Segment growth is expected to be led by follicular cycle modulators, encapsulated delivery formats, and botanical-biotech hybrids due to their proven ability to delay regrowth while offering additional skincare benefits.

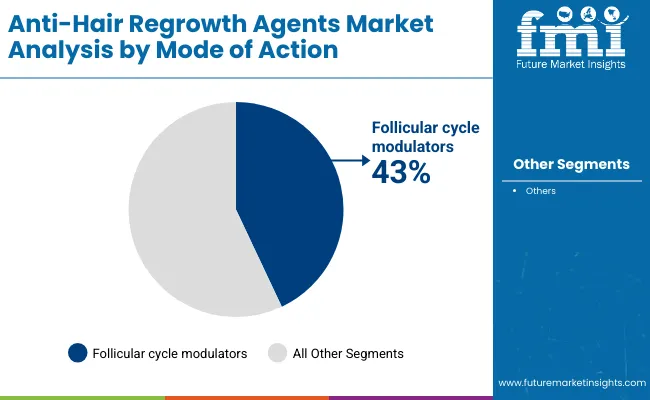

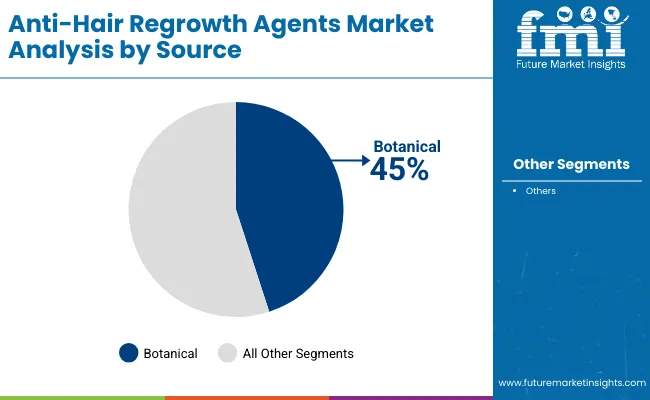

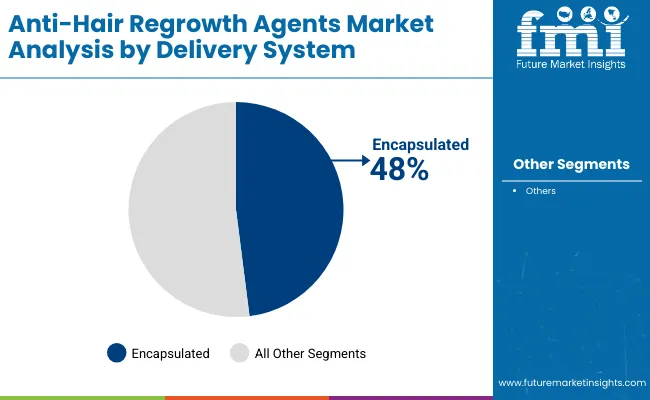

The market is segmented by mode of action, source, delivery system, physical form, application, end use, and geography. Mode of action categories include follicular cycle modulators, keratin synthesis modulators, and surface growth minimizers, reflecting distinct biological intervention strategies. Sources cover botanical, synthetic, and biotechnology-derived actives, with botanicals driving early adoption while biotech gains premium share. Delivery systems encompass free form, encapsulated, and sustained-release matrix, showcasing the transition from basic formulations to advanced systems with controlled-release efficacy. Physical forms range from solutions and concentrates to cream bases and roll-on or gel bases, meeting consumer convenience and salon application requirements. Applications span post-depilation body care, facial hair minimizers, and salon & spa aftercare, reflecting both personal and professional use. End-use industries include skincare, professional depilatory care, and at-home aftercare, each contributing differently to global growth trajectories. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, capturing diverse consumer behaviors, cultural beauty norms, and adoption trends across developed and emerging markets.

| Mode of Action | Value Share % 2025 |

|---|---|

| Follicular cycle modulators | 43% |

| Others | 57.0% |

The follicular cycle modulators segment is projected to contribute 43% of the global Anti-Hair Regrowth Agents Market revenue in 2025, maintaining its lead as the dominant category by mode of action. This leadership stems from their targeted ability to influence the hair follicle cycle directly, effectively delaying regrowth and reducing hair density after depilation. Consumers and professionals prefer these agents because of their proven efficacy, rapid visible results, and compatibility with both at-home and salon-based aftercare routines.

Growth in this segment is further supported by innovation in combining follicular cycle modulators with skin-calming actives, ensuring minimal irritation while maintaining efficacy. The development of multi-functional solutions, such as modulators infused with antioxidants and moisturizers, is expanding their appeal in skincare-focused depilatory treatments. By the end of the decade, follicular cycle modulators are expected to remain the foundation of anti-regrowth formulations, securing strong uptake in both premium and mass-market offerings.

| Source | Value Share % 2025 |

|---|---|

| Botanical | 45% |

| Others | 55.0% |

The botanical source segment is forecasted to hold 45% of the market share in 2025, led by rising consumer demand for natural, plant-based, and herbal formulations in depilatory aftercare. Botanicals are favored for their perceived safety, cultural acceptance, and alignment with clean-label beauty trends. This trend is particularly strong in Asia-Pacific markets such as India and China, where herbal beauty traditions are deeply entrenched, and in Europe, where regulatory frameworks favor natural actives.

Formulation advancements are enhancing the efficacy of botanicals by combining them with encapsulation and bioavailability enhancers, allowing longer-lasting regrowth inhibition while reducing irritation. As consumers increasingly seek multi-benefit productsthose that inhibit regrowth, soothe skin, and provide hydrationbotanicals are positioned as the preferred solution. The segment’s growth is also fueled by premium salon and spa brands promoting botanical actives as a core differentiator in aftercare solutions.

| Delivery System | Value Share % 2025 |

|---|---|

| Encapsulated | 48% |

| Others | 52.0% |

The encapsulated delivery system segment is projected to account for 48% of the global Anti-Hair Regrowth Agents Market revenue in 2025, establishing it as the leading category by delivery technology. Encapsulation is preferred for its ability to provide controlled release of active ingredients, enhancing product performance by extending efficacy over time and reducing skin irritation.

Its suitability for sensitive applications such as facial hair minimizers, combined with its adaptability to body care creams and roll-on formulations, has made encapsulation the technology of choice for premium brands. Continuous improvements in micro- and nano-encapsulation systems have further boosted absorption, stability, and consumer comfort. This approach not only increases the effectiveness of botanical and biotech-derived actives but also supports innovation in multifunctional skincare products. Given its balance of efficacy, safety, and consumer appeal, encapsulation is expected to maintain its dominance throughout the forecast period.

Rising Demand for Long-Lasting Hair-Free Results Beyond Traditional Depilation

One of the strongest growth drivers is consumer dissatisfaction with the short-lived results of shaving, waxing, and epilation alone. Anti-hair regrowth agents extend smoothness duration post-depilation, creating a significant value-add to routine grooming. This is particularly relevant in urban populations where time-pressed consumers prefer fewer grooming sessions. In markets like the USA and Europe, these products are marketed as premium add-ons in salon packages, while in Asia, affordability-focused formulations are entering the at-home aftercare space. The willingness of consumers to pay more for results that minimize hair density and slow regrowth cycles underpins the sustained 9.2% CAGR globally.

Expansion of Botanical-Biotech Hybrid Formulations

With botanicals already holding 45% of the global share in 2025, growth is accelerated by the fusion of natural extracts with biotech-derived delivery systems. Consumers in Asia-Pacific and Europe show strong preferences for "natural but clinically proven" claims, and encapsulation technologies are enabling precisely this combination. Hybrid formulations appeal to premium dermocosmetic buyers in Japan and South Korea, where biotech innovation drives efficacy, while still resonating with the herbal legacy in India and China. This dual acceptance across culturally diverse markets creates scalability for global players and allows ingredient suppliers to command higher margins.

Regulatory Ambiguity Around Functional Cosmetic Claims

Unlike pharmaceutical depilatory agents, anti-regrowth solutions straddle the line between cosmetics and quasi-drug categories. In regions like the EU and Japan, stringent rules require scientific substantiation for claims such as "delays regrowth" or "reduces follicular density." This adds compliance costs, delays product launches, and forces conservative marketing strategies. For smaller players, the burden of conducting in vivo and clinical studies creates entry barriers, slowing innovation cycles compared to established incumbents.

Consumer Concerns Over Skin Sensitivity and Irritation

While demand is strong, irritation remains a restraint. Post-depilation skin is already sensitized, and certain active agents (e.g., keratin synthesis inhibitors) may trigger redness or itching if not formulated properly. This risk has led to hesitancy among consumers with sensitive skin, particularly in Western markets where dermatological safety standards are high. Brands must invest in dermatology-tested claims and integrate soothing excipients such as aloe vera or ceramides, adding cost and complexity to formulation pipelines.

Encapsulated Delivery Systems Becoming a Differentiator in Premium Segments

Encapsulation already accounts for 48% of delivery systems in 2025, and its trajectory shows clear dominance by 2035. Beyond simple performance improvement, encapsulated systems are being marketed as "skin intelligent" technologiesoffering controlled release, hydration, and reduced irritation. High-growth markets like Japan and Europe are using encapsulation as a premium marker, enabling differentiation in crowded post-depilation skincare aisles. Over time, encapsulation will be less of a technology choice and more of a baseline expectation in mid-to-high-end product ranges.

Surge of Facial Hair Minimizers and Gender-Neutral Aftercare Products

Facial hair minimizers are emerging as a fast-growing niche within the application segment, particularly in female consumers seeking alternatives to costly laser treatments and in men exploring grooming solutions beyond shaving. This is tied to urban lifestyles, rising visibility of personal grooming on social media, and growing gender-neutral positioning of beauty products. North America and Europe are seeing launches of roll-on and cream-based formats marketed as safe for facial use, while Asia-Pacific brands are emphasizing herbal anti-irritant blends for sensitive skin. This trend not only expands the user base but also creates pathways for high-margin innovation in at-home aftercare routines.

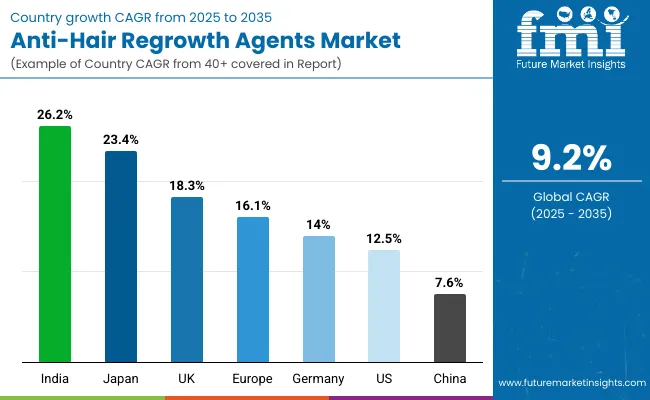

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

| USA | 12.5% |

| India | 26.2% |

| UK | 18.3% |

| Germany | 14.0% |

| Japan | 23.4% |

| Europe | 16.1% |

The global Anti-Hair Regrowth Agents Market is showing highly uneven growth trajectories across key countries, reflecting differences in cultural grooming practices, regulatory frameworks, and adoption of premium skincare solutions. India stands out with the fastest CAGR of 26.2%, driven by its large young population, affordability-focused herbal demand, and a strong cultural acceptance of post-depilation body care. Japan follows with a CAGR of 23.4%, where biotech-driven dermocosmetic innovations and encapsulated delivery systems are propelling uptake in both facial hair minimizers and premium skincare routines. The USA market, while more mature, is forecasted at 12.5% CAGR, supported by the increasing professionalization of depilatory aftercare in salons and growing acceptance of gender-neutral grooming products. Together, India, Japan, and the USA account for the fastest-expanding opportunities, indicating a dual path of growthaffordability-led volume expansion in emerging markets and innovation-led premiumization in developed ones.

In Europe, the picture is more balanced, with the region as a whole projected to expand at 16.1% CAGR. Within this, the UK (18.3%) and Germany (14.0%) are particularly important, benefiting from strong consumer interest in botanical and clinically proven formulations. Regulatory rigor in the EU also ensures credibility, driving demand for premium products that comply with dermatological testing standards. China, at 7.6% CAGR, is slower by comparison due to stiff competition from traditional herbal remedies and cautious consumer adoption, but it still represents a large-volume market with steady incremental growth. Overall, the data underscores a bifurcated landscape: rapid acceleration in Asian markets like India and Japan, solid premium-driven expansion in the USA and Europe, and moderate but steady demand growth in China.

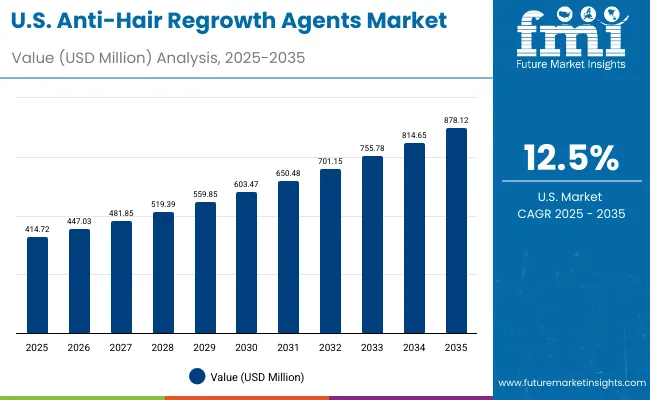

| Year | USA Anti-Hair Regrowth Agents Market (USD Million) |

|---|---|

| 2025 | 414.72 |

| 2026 | 447.03 |

| 2027 | 481.85 |

| 2028 | 519.39 |

| 2029 | 559.85 |

| 2030 | 603.47 |

| 2031 | 650.48 |

| 2032 | 701.15 |

| 2033 | 755.78 |

| 2034 | 814.65 |

| 2035 | 878.12 |

The Anti-Hair Regrowth Agents Market in the United States is projected to grow at a CAGR of 12.5%, led by strong consumer awareness, premium dermocosmetic launches, and rising salon-based aftercare programs. The market has seen a steady rise in follicular cycle modulators, which hold 42% share in 2025, reflecting demand for advanced actives that deliver noticeable results. Dermatology clinics and skincare specialists are integrating these solutions into post-laser and waxing care packages. Meanwhile, gender-neutral marketing campaigns and inclusivity-focused grooming trends are broadening the customer base. The USA market is also benefiting from biotech-led innovation, where encapsulated delivery and hybrid botanical formulations are marketed as clinically validated and irritation-free.

The Anti-Hair Regrowth Agents Market in the United Kingdom is expected to grow at a CAGR of 18.3%, supported by applications in premium skincare, salon-driven aftercare, and clinical beauty solutions. High adoption is seen in facial hair minimizers, where consumer preference aligns with irritation-free botanical-biotech hybrids. The UK has also seen strong uptake among professional depilatory care providers, with spas and beauty clinics adding anti-regrowth products as value-added treatments. Sustainability and natural sourcing claims have played a central role in consumer choices, particularly in urban markets such as London and Manchester. Government-supported innovation in cosmetic R&D and close collaboration between ingredient suppliers and salon chains continue to strengthen adoption.

India is witnessing rapid growth in the Anti-Hair Regrowth Agents Market, which is forecast to expand at a CAGR of 26.2% through 2035, the highest among global peers. A sharp increase in installations across tier-2 and tier-3 cities has been fueled by the affordability of botanical-based solutions and growing awareness through mass-market retail and e-commerce platforms. Herbal formulations hold strong dominance due to cultural acceptance, but biotechnology-derived actives are beginning to capture premium segments in metro areas. Local MSMEs are partnering with ingredient suppliers to co-develop low-cost, irritation-free formulations tailored to Indian skin types. Public campaigns around personal grooming and rising disposable incomes in younger demographics are accelerating adoption.

The Anti-Hair Regrowth Agents Market in China is expected to grow at a CAGR of 7.6%, slower compared to peers but still significant given the market’s scale. Growth is driven by strong urban demand in tier-1 cities, where skincare-conscious consumers are investing in post-depilation body care and salon-based aftercare solutions. However, competition from traditional herbal remedies has moderated adoption speed. Domestic brands are increasingly launching affordable roll-on and cream formats, targeting the middle-class consumer segment, while premium international players are introducing biotech-driven actives aimed at younger, urban professionals. Regulatory oversight remains strict, requiring evidence-based claims, which has encouraged global companies to invest in clinical testing for Chinese launches.

| Country | 2025 Share (%) |

|---|---|

| USA | 18.0% |

| China | 9.6% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.9% |

| India | 4.3% |

| Europe | 17.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 8.0% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

| Europe | 15.8% |

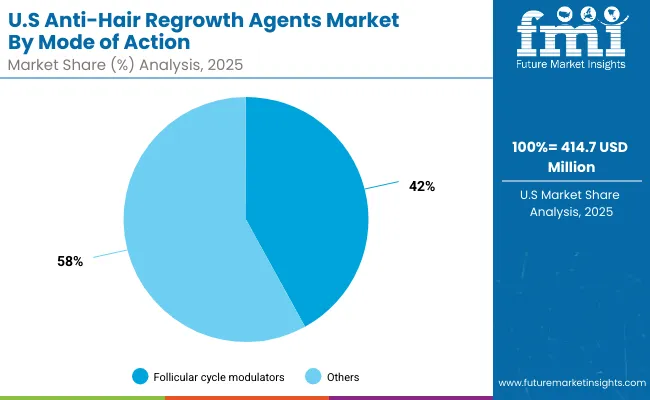

| USA by Mode of Action | Value Share % 2025 |

|---|---|

| Follicular cycle modulators | 42% |

| Others | 58.0% |

The Anti-Hair Regrowth Agents Market in the United States is valued at USD 414.7 million in 2025, with follicular cycle modulators contributing 42% of revenue. These agents are favored for their proven ability to extend smoothness duration post-depilation, aligning with rising demand for professional salon aftercare and at-home premium formulations. USA consumers show strong preference for clinically validated products, which has boosted encapsulated and biotech-driven innovations marketed as safe and irritation-free.

Growth in this market is closely tied to the expansion of professional depilatory care services, where salons and dermatology clinics integrate anti-regrowth agents into bundled waxing and laser packages. Gender-neutral grooming campaigns and social media-led consumer education are broadening adoption across men and women. As biotech-derived actives gain traction and premium facial hair minimizers emerge as a niche, the USA market will continue to play a pivotal role in shaping the innovation curve globally.

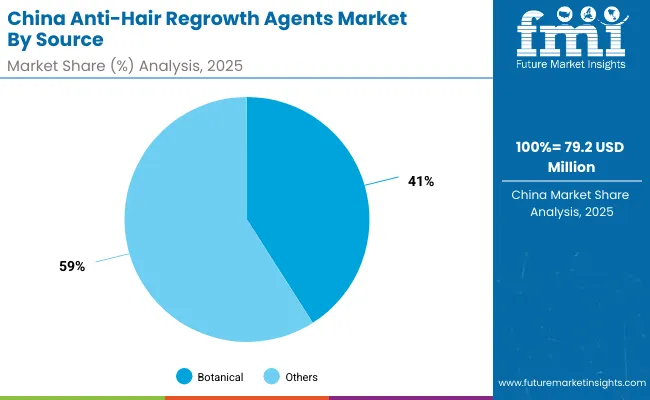

| China by source | Value Share % 2025 |

|---|---|

| Botanical | 41% |

| Others | 59.0% |

The Anti-Hair Regrowth Agents Market in China is valued at USD 79.2 million in 2025, with botanical sources contributing 41% of revenue. This reflects strong cultural alignment with herbal-based solutions and consumer confidence in natural formulations. Domestic brands have capitalized on this preference, launching affordable roll-on and cream-based products positioned as herbal aftercare for everyday grooming.

Despite this, biotechnology-derived actives are gradually gaining recognition in urban centers, particularly among younger professionals who seek clinically proven, irritation-free solutions. Regulatory oversight in China is stringent, requiring scientific substantiation for claims, which has pushed both domestic and international players to invest in clinical validation. With government-led initiatives encouraging digital beauty platforms and e-commerce expansion, botanical-biotech hybrids are expected to scale, albeit at a slower CAGR of 7.6% compared to high-growth peers like India and Japan.

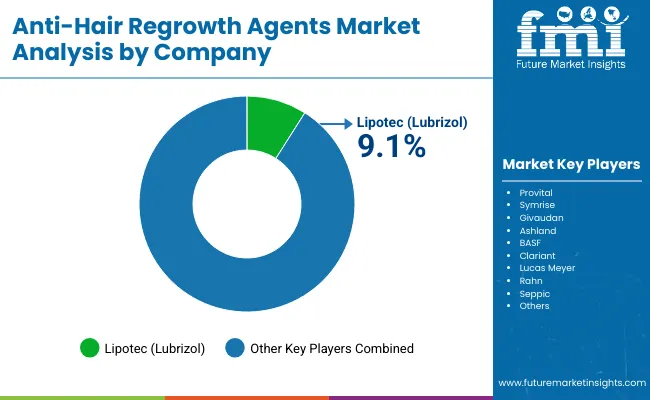

| Company | Global Value Share 2025 |

|---|---|

| Lipotec (Lubrizol) | 9.1% |

| Others | 90.9% |

The global Anti-Hair Regrowth Agents Market is moderately fragmented, with a blend of multinational ingredient suppliers, regional specialists, and niche innovators competing across delivery systems and formulations. Global leaders such as Lipotec (Lubrizol), Symrise, Givaudan, and BASF maintain significant influence through advanced peptide technologies, encapsulated delivery systems, and clinical validation platforms. Their strategies emphasize efficacy-backed botanical-biotech hybrids and partnerships with premium skincare and salon brands to secure global reach.

Mid-sized players including Provital, Lucas Meyer, and Rahn are carving out strong positions by focusing on natural actives, botanical sourcing, and hybrid delivery solutions. They are particularly active in Europe and Asia, where consumer preference for botanicals and sustainability is high. Specialized firms such as Seppic and Clariant leverage innovation in functional excipients and delivery matrices, enabling superior stability and absorption of actives. Competitive differentiation is shifting away from raw active sourcing toward integrated ecosystems that combine encapsulation, skin-calming co-actives, and multifunctional benefits such as moisturization and microbiome balance. Subscription-based aftercare lines, spa-integrated solutions, and AI-driven personalization platforms are emerging as competitive frontiers, ensuring that innovation in delivery and consumer experience defines market leadership rather than actives alone.

Key Developments in Global Anti-Hair Regrowth Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mode of Action | Follicular cycle modulators, Keratin synthesis modulators, Surface growth minimizers |

| Source | Botanical, Synthetic, Biotechnology-derived |

| Delivery System | Free form, Encapsulated, Sustained-release matrix |

| Physical Form | Solution/concentrate, Cream base, Roll-on/gel base |

| Application | Post-depilation body care, Facial hair minimizers, Salon & spa aftercare |

| End-use Industry | Skincare, Professional depilatory care, At-home aftercare |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lipotec (Lubrizol), Provital, Symrise, Givaudan, Ashland, BASF, Clariant, Lucas Meyer, Rahn, Seppic |

| Additional Attributes | Dollar sales by mode of action, source, and delivery system; adoption trends in salon & spa aftercare; rising demand for encapsulated and sustained-release formulations; sector-specific growth in skincare, professional care, and at-home aftercare; software-inspired personalization tools for consumer routines; integration with AI-driven skin diagnostics and digital twin platforms; regional trends shaped by herbal traditions and premium biotech adoption; and innovations in follicular modulators, botanical-biotech hybrids, and encapsulation methods. |

The global Anti-Hair Regrowth Agents Market is estimated to be valued at USD 824.6 million in 2025.

The market size for the global Anti-Hair Regrowth Agents Market is projected to reach USD 1,984.3 million by 2035.

The global Anti-Hair Regrowth Agents Market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in the global Anti-Hair Regrowth Agents Market are follicular cycle modulators, keratin synthesis modulators, and surface growth minimizers.

In terms of delivery system, the encapsulated segment is forecasted to command 48% share in the global Anti-Hair Regrowth Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA