The Australia Plant-based Pet Food market is estimated to be worth USD 89.7 million by 2025 and is projected to reach a value of USD 241.8 million by 2035, growing at a CAGR of 10.4% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 89.7 million |

| Projected Australia Value (2035) | USD 241.8 million |

| Value-based CAGR (2025 to 2035) | 10.4% |

The plant-based pet food market is an emerging market in Australia, which focuses on pet food products that are formulated using plant-derived ingredients, such as legumes, grains, vegetables, and plant-based proteins rather than being derived from animals. Such drivers include not only the trend for human consumption but also improved awareness about animal welfare and growing concerns over the environmental impact of animal agriculture.

In Australia, more and more pet owners are choosing ethical, sustainable, and healthy options for their pets. There is now potential in plant-based pet food as it aligns pet owners' diets with those of their pets and promotes health considerations that include allergies and sensitivities to animal proteins as well as gastrointestinal issues.

Much more, the environmental impact of plant-based foods is lower greenhouse gas emissions, among other things, in comparison with animal farming. Such issues align with the values of the eco-conscious consumer.

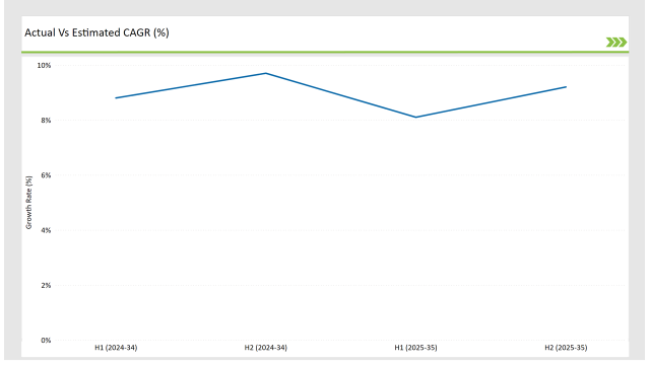

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Plant-based Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Plant-based Pet Food sector is predicted to grow at a CAGR of 10.1% during the first half of 2025, increasing to 11.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 8.8% in H1 but is expected to rise to 9.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Plant-based Pet Food market landscape is dynamic, in a continuous flux of shifting consumer preferences, innovative developments, and evolving dynamics of the market. Key factors for this market include changes in product formulation, diet-related shifts, and a desire for diverse flavors in creamers, all contributing to this market growth.

This periodic analysis is helpful for businesses in sharpening strategies, tapping into emerging opportunities, and identifying challenges to efficiently overcome them and gain a competitive advantage in the marketplace.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Mars Petcare announced the establishment of its first 100% renewable steam-based pet food production plant Wodonga facility in Victoria, Australia. |

| October 2023 | In October 2023, two of the most prominent plant-based meat companies in Australia, LOVE BUDS and vEEF, merged to create The Aussie Plant Based Co. In this strategic consolidation, the business sought to capture the increasing vegan, vegetarian, and flexitarian food market. Combining LOVE BUDS under All G Foods and vEEF, a signature product by Fenn Foods, helped it achieve this end. It seeks to expand the reach of this new entity throughout Australia and Asian and Middle Eastern markets with an assortment of plant-based products tailored to the most diverse consumer tastes. |

Increased Interest in Veterinary-Approved Plant-Based Pet Foods

Pet owners in Australia are becoming more particular about what they feed their pets, with many looking for items that have been authorized or suggested by veterinarians.

Veterinarians are closely following the emergence of plant-based meals for dogs, with a rising number of specialists offering advice on plant-based solutions that are good for pets, particularly those with food allergies or specific dietary requirements. As the demand for plant-based pet food is increasing, Australian pet food brands are expected to focus on developing credibility with veterinarians and animal nutritionists.

Such experts would play important roles in educating pet owners about the benefits of diet in regard to certain pets' allergies or digestive issues and how they can be nutritionally balanced to meet their requirements. This will result in not only size growth but also sophistication maturity of the market with greater consumer confidence in the nutritional sufficiency of plant-based diets for their pets.

Embracing Functional Ingredients for Holistic Pet Health

The Australian market of plant-based pet food is rapidly gaining attention by functional ingredients used beyond mere nutrient requirements. Beneficial compounds from probiotics, antioxidants, and omega-fatty acids are infused by manufacturers into their formulations to ensure proper health and wellbeing of pets in general.

The rising level of sophistication amongst Australian pet owners is being catered for with such pet food which not only helps meet the demands of pets in terms of diets but also health benefits. Hence, leveraging the functional ingredients might help the brands of plant-based pet food differentiate their products and win over the loyalty of pet owners who want the holistic solutions that make their pets more long-lived and livelier.

As the importance of comprehensive pet nutrition in Australia becomes increasingly recognized, demand for plant-based pet food products from leading players with functional ingredients is expected to grow, thereby further driving the evolution and diversification of the market.

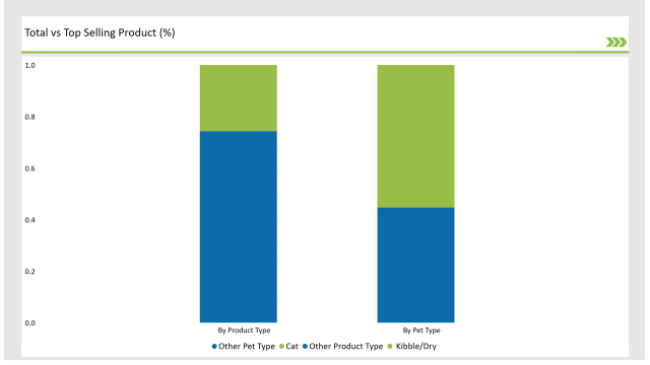

% share of Individual categories by Product Type and Pet Type in 2025

Convenience and Shelf-Stability: The Enduring Appeal of Plant-based Kibble in the Market

The kibble or dry food segment is the largest portion of the plant-based pet food market in Australia due to unmatched convenience, affordability, and practicality. Many pet owners prefer it. High-paced modern life in Australia, especially in urban areas, leads more to convenient, easy-to-store, long-lasting pet food options. Kibble products have longer shelf lives, which reduce waste and offer consumers a stable cost structure.

It is an attractive feature for Australian shoppers since most of them tend to purchase their pet food in bulk or keep it in stock for long periods of time. Kibble requires no refrigeration, making it perfect for hot climate-clad Australians or those with limited space.

In addition, kibble is much cheaper than wet food or raw options, which is a big part of the reason it leads the pack. Australian is an extremely competitive market for pet food, and kibble products will be bound to provide an attractive balance of good quality and value.

Feline Fascination: The Dominance of Cats in the Australian Plant-based Pet Food Market

In Australia, the cat pet type leads in the plant-based pet food market due to shifts in the dietary preferences of the Australian pet owners and the unique nutritional requirements of cats.

The more that Australians learn of the health and ethical benefits of plant-based diets for their pets, the more are opting for plant-based alternatives, as their cats are termed obligate carnivores. This shift has led to a rise in the number of plant-based options, particularly formulated to answer the complex demands of felines in terms of nutrition, which are also a much more ethical food option.

One of the primary factors that make people prefer plant-based cat food is the demand for health-related considerations. These formulas contain plant proteins that are usually of high quality from peas or lentils, among others, are designed to incorporate the essential amino acids and other nutrients in relation to a cat's needs but lack common allergens found in animal-based ingredients.

Note: The above chart is indicative in nature

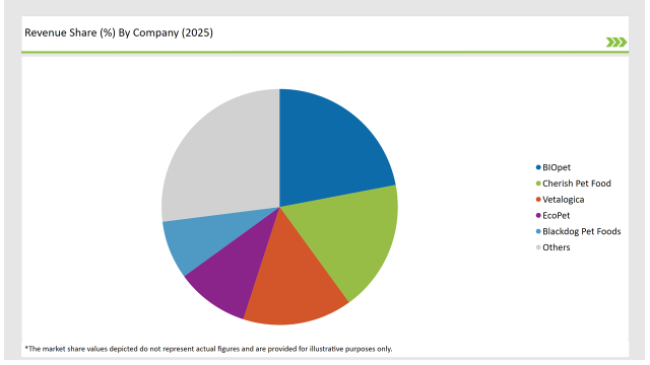

Tier 1 is that leading brands make up the most dominant part of the premium category, Australian plant-based pet food. This comprises companies emphasizing the quality and balanced nutrition provided through often very specific, high-grade formulation for pets. They service the health-conscious owner who has paid extra for these plant-based products of pet food.

Tier 2 for the plant-based pet food market in Australia involves rapidly growing firms providing competitive products that are higher in quality yet relatively cheaper to attract a larger client base of consumers. Most companies fall under this category and tend to attract consumers interested in feeding pets with plant-based diets but don't want to incur premium costs.

Tier 3 brands are up-and-coming, smaller companies which are not yet well established but offer great prospects for growth. Often, such businesses target niches in market segments, perhaps serving specific needs from pet owners such as vegan diets for pets, pet foods developed with local tastes and preferences, or health trends from around Australia.

The industry includes various product type of Plant-based Pet Food such as kibble/dry, dehydrated food, treats and chew, wet food, freeze-dried, raw, and frozen.

The industry includes various pet type such as cat, dogs, birds, and others.

The industry includes numerous sales channel such as store-based retailing, and online retailers.

By 2025, the Australia Plant-based Pet Food market is expected to grow at a CAGR of 10.4%.

By 2035, the sales value of the Australia Plant-based Pet Food industry is expected to reach USD 241.8 million.

Key factors propelling the Australian Plant-based Pet Food market include increasing veterinary endorsement of plant-based diets for pets, increased focus on digestive health and wellness for pets, and increasing demand for ethical and sustainable pet food options.

Prominent players in Australia Plant-based Pet Food manufacturing include BIOpet, Cherish Pet Food, Vetalogica, EcoPet, Fenn Foods, and Blackdog Pet Foods, Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition, Orijen, and V-dog, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Australia Fish Meal Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA