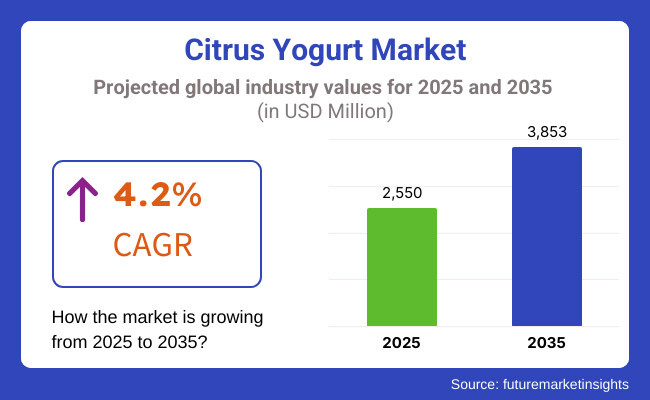

Citrus Yogurt Market will witness a phenomenal growth in 2025 to 2035 with the explosion in customer demand for health-conscious and functional milk.The market would be approximately USD 2,550 million in 2025 and will reach USD 3,853 million by 2035 with a compound annual growth rate (CAGR) of 4.2% over the forecast period.

Rising health consciousness among customers is one of the primary market growth drivers among them. Growing demand for naturally flavored probiotic-fortified dairy food is fueling widespread use of citrus yogurt. Digestion benefit and citrus-flavored refreshing taste are drawing consumers towards citrus-flavored yogurt, particularly in Greek yogurt and plant-based.

Yoplait and Chobani brands, for instance, launched citrus-flavored yogurt brands as part of rising demand for sour, vitamin C-sourced flavors like lemon, orange, and grapefruit. But lactose intolerance and veganism issues are complicating the process of companies developing innovative dairy-free and plant-based formulating for greater exposure to markets.

The market also segments on the type of product and application basis. Flavored yogurts, Greek yogurt, low-fat yogurts, and citrus plant-based yogurts are the most common segments. Citrus-flavored Greek yogurt is growing because it has good protein content and creaminess.

Coconut, almond, and soy milk-based citrus plant-based yogurts are also growing at humongous levels, particularly in North America and Europe based on the well-established plant-based nutrition. The food beverage segment is the second emerging one, and citrus yogurt smoothies and probiotic drinks are also gaining popularity increasingly.

North America is a high-end market for citrus yogurt because consumers have shown interest in functional foods and well-developed dairy marketplace.United States and Canada are two of the primary markets, and conventional dairy giants are launching new citrus-flavored yogurt because of diet trend.

Danone North America is one of them who launched low-sugar orange and lemon yogurt for health-focused consumers, for example. Greek yogurt and other dairy growth lies behind the trend of citrus flavors, and it's especially predominant in urban locations.

Increasingly vegan and lactose-intolerant consumers translate to North American companies introducing growth with citrus-flavored dairy-free yogurts. Companies are using honey and agave as natural sweeteners to create low-calorie, additive-free choices to appeal to clean-label buyers.

Europe leads the market for citrus yogurt in the region of broad market share due to the huge demand from France, Germany, and the United Kingdom. Growing demand for healthy snacking is one of the strongest drivers of the market. French breakfast is enriched with citrus yogurt, and La Fermière and Yeo Valley are just some of the luxury, artisan-grade citrus yogurts that can be found in the market.

The region's high sustainability and food security needs are driving green pack consumption and organic fruit and vegetable consumption. Low-fat, reduced-sugar offerings and probiotic offerings are being developed by European yogurt competitors due to increased focus on digestive health. Popularity of cultured dairy consumption among Eastern European nations is creating further market growth.

Asia-Pacific will develop the most for citrus yogurt market with increasing urbanization, altering dietary habits, and improved awareness towards digestion. India, China, Japan, and South Korea are turning out to be major consumers as well as producers of citrus yogurt.

China has a market that is dominated by increasing demand for probiotic beverages and dairy yogurts dessert with market leaders like Yili and Mengniu Dairy coming up with new citrus yogurts to meet local consumers' demands. Increasing demand for immune-boosting foods and gut health in India has fueled increasing demand for yogurt naturally flavored, particularly in the urban market. Premium dessert-like citrus yogurts with unique flavor profiles such as yuzu-honey yogurt are gaining ground in South Korea and Japan.

Cold chain logistics problems and limited dairy intake in the markets of some countries are challenges in the Asia-Pacific market, but long-term market growth will be driven by demand for lactose-free and vegan substitutes for yogurt.

Challenge

Rising Lactose Intolerance and Vegan Preferences

Lactose intolerance is also a major issue, particularly in Asian and African cultures, where individuals are unable to digest milk. This has generated an increasing demand for lactose-free and plant-based food. In addition, the increasing movement towards vegan diet and dairy-free is compelling traditional makers of citrus yogurt to respond. As increasingly more consumers ask for plant-based food, the traditional dairy yogurts are under threat.

To address this shift, the industry is concentrating on manufacturing substitute ingredients, i.e., fruit milks (soy, almond, coconut), and substitute formulation that tastes as much as has the same texture as conventional yogurt.This shift in direction towards fruit-based citrus yogurts not only is meeting the demand but also increasing the market for consumption by the customers based on dietary requirements.

Opportunity

Expansion of Plant-Based Citrus Yogurt

The boom in plant and non-dairy foods is providing tremendous scope to industry players to introduce even newer innovative products to reach even more hands. More and more citrus yogurts these days are being produced with plant milk such as coconut, almond, oat, and cashew and are being retailed mainly to lactose intolerance as well as vegan consumers.

It is also driven by consumers' needs for organic and non-GMO products, where sustainability and natural taste are being promoted by companies to appeal to green consumers. In addition to nutritional needs, functional yogurt brands are also needed.

Citrus yogurts that are fortified with probiotic, prebiotic, and vitamin C are also needed on the basis of perceived health benefit to the digestive and immune system. Additionally, growth opportunities are achieved with the creation of citrus yogurt smoothies and probiotics beverages offering consumers healthy and easy options. The trend is creating opportunity for innovation and market for manufacturers.

From 2020 to 2024, health and wellness trend created demand for the market for citrus yogurt in the functional dairy and plant-based trend. Companies launched organic, high-protein, and sugar-free citrus yogurts only for fitness athletes and clean-label consumers.

From 2025 to 2035, the citrus yogurt business will further evolve into sustainability, plant-based expansion, and nutrition customization.The sector will be concentrated on production of green packaging products to cut down the use of plastic and make the sector sustainable. Businesses will diversify plant-based citrus yogurt foods to cater to growing demands from vegan consumers as well.

There will be an attempt to develop functional attributes of such foods, i.e.,the addition of foods like probiotics and immune-stimulatory food components in foods for health-food buyers. Regional sources of citrus fruits, like Japan's yuzu and Philippines' calamansi, will bring a second trend of sourcing to develop distinctive, culturally unique flavors appealing to and reaching diverse consumers.

These forces will spur growth in the business, meeting the environmental need as well as the demands for customized, health-nourished food. With a growing need for healthy, sustainable food, the citrus yogurt market is poised for revolutionary development with unparalleled opportunities for traditional dairy giants and new plant-based challengers.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Consumer Preferences | Traditional flavor yogurts such as vanilla and berry were the consumers' preference, with little demand for citrus-infused variants. |

| Product Innovations | Citrus yogurts were restricted to a few popular brands offering traditional lemon and orange flavors. |

| Packaging Trends | Traditional plastic tubs were the hallmark of the market, with little use of sustainable packaging. |

| Dairy vs. Plant-Based Options | Dairy-based citrus yogurt was the norm, with little to no plant-based equivalents available. |

| Sugar Reduction Strategies | The majority of citrus yogurts had artificial sweeteners or added sugar for taste enhancement. |

| Distribution Channels | Supermarkets and chain stores made up most of the sales, with minimal online penetration. |

| Regulatory Compliance | Dairy regulation emphasized control of quality but saw no substantial changes impact citrus yogurt production. |

| Functional Benefits & Marketing | Functional yogurts were mainly sold for their role in digestion, but citrus yogurt had little to do with health benefits. |

| Market Shift | 2025 to 2035 |

|---|---|

| Consumer Preferences | Health-aware consumers fuel demand for citrus yogurt based on its perceived gut benefits and rich vitamin C levels. Exotic citrus combinations like yuzu-lime and blood orange pick up steam. |

| Product Innovations | Improvements in fermentation enhance citrus-yogurt texture and flavor. Companies innovate through probiotic-enhanced citrus yogurts infused with adaptogens for immunity and digestive health. |

| Packaging Trends | Sustainability fuels the uptake of biodegradable and recyclable packaging. Citrus zest-infused edible yogurt pods are introduced as a more sustainable option. |

| Dairy vs. Plant-Based Options | Increase in plant-based citrus yogurt alternatives made from almond, coconut, and oat bases. Cashew-yuzu yogurt gains more popularity among vegan consumers. |

| Sugar Reduction Strategies | Clean-label products rule, with honey and monk fruit natural sweeteners taking the place of refined sugars. Unsweetened, tart citrus yogurts meet low-sugar diet trends. |

| Distribution Channels | Direct-to-consumer models thrive, with subscription-based citrus yogurt deliveries. Specialty health stores and online platforms increase offerings. |

| Regulatory Compliance | Labeling laws focus on sugar declaration and probiotic strain identification. Governments encourage fortified dairy and plant yogurts as a means to alleviate nutritional deficiencies. |

| Functional Benefits & Marketing | Citrus yogurt becomes popular due to its immunity-enhancing attributes. Companies tout it as having antioxidant, probiotic, and vitamin C properties, supporting health trends. |

The USA market for citrus yogurt is expanding steadily, spearheaded by health-conscious consumers demanding probiotic and immunity-boosting dairy and dairy products. Natural-trend-led clean-label citrus yogurts with lower sugar content are gaining momentum. Greek yogurt and plant-based demand propel market expansion, with citrus flavors providing a refreshing twist.

There is an increasing number of consumers showing growing interest in functional foods, and therefore vitamin-enriched citrus yogurts are among the major movers in the marketplace.

The market is also subject to increasing demand in the United States for dairy-free, lactose-free, and vegan forms of citrus yogurts on bases of almond, coconut, and oat milks.E-commerce websites operated through the internet are becoming main channels of distribution, with subscription plans selling the goods directly to the consumer highly fashionable.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Citrus yogurt is gaining in the UK alongside growing demand for functional and added-value dairy. There is emerging trend towards healthy food, pressuring the demand for low-sugar, probiotic-fermented citrus yogurts. Plant-based is a growth area where oat- and almond-derived citrus yogurts have crossed over into mainstream.

Sustainability is the largest trend of the market with businesses putting investments in biodegradable and recyclable packs.

Additionally, expanding Mediterranean and Asian flavor trends are driving demand for distinctive citrus mixtures such as mandarin-cardamom and yuzu-ginger yogurt. Retailers' private-label citrus yogurts are becoming mainstream because it takes premium tastes to mass buyers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The European Union market for citrus yogurt is also growing healthily as there is rising demand for gut-friendly and immune system-boosting dairy. Germany, France, and Italy are the top contributors with an intense desire for high-protein, low-fat citrus yogurt. EFSA regulatory levels in Europe are shaping clean-labeling trends, and artificial additives are avoided by companies in favor of natural flavorings.

Plant-protein and probiotic-based functional citrus yogurts are premium, new-age products that aim at health-driven European consumers. Green manufacturing practices and green packaging characterize the market, as people favor green products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan's market for citrus yogurt is growing with consumer demand for fermented food and newer flavors driving this trend. Japanese indigenous citrus called yuzu is one of the features of quality yogurts, and that is making the market distinctly position itself. Japanese consumers find functional dairy foods immensely popular, so naturally there is strong demand for probiotics-full citrus yogurts that contribute to stronger gut function and better digestion.

Demand is also generated by high demand for liquid citrus yogurts, especially among busy city professional consumers.Improved technology in dairy fermentation technology improves the flavor and texture of citrus-flavored yogurts to make them acceptable to domestic consumers. Government efforts towards creating awareness of individuals regarding nutritional needs increase demand for fortified citrus yogurts containing vitamin and mineral content.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The South Korean citrus yogurt industry is changing increasingly with the rising pace of K-health trends and probiotic-enriched dairy product demand. Citrus yogurt made from Korean tangerine (Jeju Hallabong) is especially fashionable since it shows consumer interest in domestic origins of superior-quality ingredients.

The trend of functional food growth is towards collagen and antioxidant-enriched citrus yogurt, which attracts beauty-conscious consumers. The expansion of online channels of supermarkets for grocery shopping and doorstep delivery services also contributes to market growth. Government policies favoring the dairy industry and strict safety standards in foods are towards citrus yogurt production with superior quality.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

Dairy citrus yogurt is the most successful category in overall consumer acceptability and highest in nutrients. Consumers looking for protein food as a snack pick dairy citrus yogurt with the maximum amount of probiotics and key vitamins. Lemon Greek yogurt and orange creamy yogurt are specific favorite picks of health-conscious consumers looking for functional dairy foods.

Other than this, having an already established distribution channel and huge dairy brands provides high market penetration of dairy-based citrus yogurt with a possibility. Segments such as North America and Europe, where yogurt is consumed on a daily basis, are still under high demand. Demand for lactose-free and high-protein base is also increasing the size of such a segment of dairy-based citrus yogurt.

The market for non-dairy citrus yogurt is changing at a very fast pace with increased consumption of plant food and lactose intolerance issues. Thoughtful consumers looking for dairy alternatives are opting for almond, coconut, and oat citrus yogurt. Almond lemon-flavored yogurt and coconut tangerine-flavored yogurt are two trends in increasing demand among thoughtful consumers.

As the producers keep pushing the boundaries to achieve improved texture and flavor, citrus non-dairy yogurt is picking up firm momentum in online and offline stores. Increased introduction of additional plant-based product lines by large corporations and support from health bloggers are also fueling growth in this segment.

Spoonable citrus yogurt dominates the marketplace because people love its smooth and easy nature. It is mostly consumed as a breakfast item, snack, or dessert and is accompanied by products like orange zest Greek yogurt and lemon curd yogurt that are in increased demand. Low-fat and high-protein spoonable citrus yogurt retails most to health-conscious aficionados and dietetic consumers.

The segment is led by a strong retail base for several brands of on-the-go packs and different multipack sizes. Further, increasing usage of blending citrus yogurt in smoothie bowls, parfaits, and recipes is also underpinning high usages.

Citrus yogurt beverages are fast taking market share, tapping into active consumers who seek healthy and convenient drinks. Lemon-flavored probiotic yogurt beverages and orange-kefir beverages are selling off the shelves in urban markets where convenience is the primary driving reason for purchases.

Greater packaging innovation, including single-serve packets and resealable packs, has also driven the sales of drinkable citrus yogurt. Fortified versions with additional vitamins and gastrointestinal functions are also being developed by companies, and this category is becoming more and more appealing to health-conscious consumers.

Clean-label and sustainably sourced product momentum is driving growth in organic citrus yogurt. Category trend is driven by growing concern about milk production with added artificial ingredients, pesticides, and antibiotics. Organically certified tangerine Greek yogurt and probiotic blends, such as lemon-flavored ones, become popular with health-conscious consumers.

It is a rival premium price segment and organic citrus yogurt enjoys strong demand in highly disposal income and regulated food safety areas like Western Europe and North America. Organic expansion of dairy farms and certification also maintain growth and authenticity of the segment.

Traditional citrus yogurt remains the volume market leader, by virtue of its price and mass distribution. Mass production lots and distribution networks position traditional citrus yogurt in front of a massive consumer base through food stores, convenience stores, and food service units.

Even with growing demand for organic variants, traditional citrus yogurt is still the price-sensitive consumer's and institutional purchasing's top choice and institutional purchasing in high-demanding dairy markets. Continued product differentiation and offer strategies by market leaders continue to drive demand for the segment.

Supermarkets and hypermarkets are the largest distribution channels for citrus yogurt that provide the customer with rich flavor and brands. Convenience to compare and redeemable offers are some of the top reasons why such channels are the most sought ones. Multi-pack Greek citrus yogurt and orange probiotic drinkables are some of the good ones that sell like hotcakes in such channels.

Retail chains keep expanding private-label citrus yogurt lines, which is driving the degree of competition. Shoppers enjoy refrigerated storage space and top-shelf placement to guarantee ongoing consumer exposure for citrus yogurt in this category.

The growth in grocery delivery business and the business-to-consumer channel is driving the channel for citrus yogurt e-commerce in a robust manner. Online business channel provides convenience to purchasers to obtain easy access to large varieties of citrus yogurt types such as honey-lemon probiotic yogurt or mandarin oat yogurt.

Internet selling also is triggered by flash sale and yogurt delivery subscription. In addition, online marketing programs augmented by influencer promotion and endorsements facilitate brand awareness and consumer activity on the channel.

The HORECA food services market is driving demand for citrus yogurt. Citrus yogurt is becoming more popular as a generic ingredient for breakfast foods, smoothies, and desserts as gourmet cooking starts to develop specialty restaurant uses for citrus yogurt. Citrus-flavored parfaits and lemon-based yogurt dressings are among the most sought-after uses in this market.

Quick growth of quick-service restaurants (QSRs) and cafe chains worldwide is offering new opportunities to citrus yogurt suppliers. Opportunities to provide customizations and alliances with food service brands will continue to propel market penetration in this segment.

The global citrus yogurt industry is competitive with established global and regional dairy companies and global leaders leading market expansion. Large firms lead business with product innovation in flavor, health-positioned offerings, and alliances with foodservice and retail businesses.

The industry comprises brands with established market presence and new manufacturers that drive product diversification and broader market coverage. Firms emphasize clean-label ingredients, probiotic fortification, and sustainable dairy sources to counteract evolving consumer lifestyles.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Danone S.A. | 15-20% |

| Chobani LLC | 12-16% |

| General Mills Inc. | 10-14% |

| Nestlé S.A. | 8-12% |

| FAGE International S.A. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Danone S.A. | Produces citrus-infused yogurt under the Activia and Oikos brands. Focuses on probiotic benefits and clean-label formulations. |

| Chobani LLC | Specializes in Greek yogurt with citrus flavors, incorporating high-protein and lactose-free options. Invests in organic and non-GMO sourcing. |

| General Mills Inc. | Manufactures citrus-based Yoplait yogurt with added immune-boosting ingredients. Emphasizes sustainability in dairy farming. |

| Nestlé S.A. | Offers citrus-flavored yogurt in various formats, including drinkable and spoonable options. Develops plant-based citrus yogurt alternatives. |

| FAGE International S.A. | Produces citrus-infused strained yogurt with a focus on thick texture and protein-rich content. Markets premium dairy products to health-conscious consumers. |

Key Company Insights

Danone S.A. (15-20%)

Danone S.A. dominates the citrus yogurt market with its established brands Activia and Oikos.The company is a probiotic-enriched citrus yogurt specialist with gut wellness positioning, natural sweeteners, and organic fruit infusions. Danone has global distribution with investments in sustainability, lowering carbon footprints of dairy, and supply chain openness.

Chobani LLC (12-16%)

Chobani LLC is among the leading pioneers of innovation in Greek yogurt with a citrus taste among consumers interested in high-protein, lactose-free, and organic milk. Chobani boasts natural products and eco-friendly environmental sourcing. Chobani innovates non-dairy citrus yogurt substitutes to meet increasing plant-based needs.

General Mills Inc. (10-14%)

General Mills Inc., or Yoplait, offers citrus-flavored yogurts with vitamin and immune-boosting ingredient supplements. General Mills supports sustainable dairy farming through the adoption of animal welfare and environmental stewardship. Yoplait citrus flavor is mainstream as well as health-conscious consumers' options, thus further consolidating its market leadership.

Nestlé S.A. (8-12%)

Market leader is Nestlé S.A. with its launch of citrus-flavored yogurt in drink, spoonable, and plant-based categories. Nestlé emphasizes innovation with the launch of citrus yogurt that involves functional benefits such as protein and fiber content level. Nestlé emphasizes sustainable raw material and green packaging in its drive to lower its carbon footprint.

FAGE International S.A. (5-9%)

FAGE International S.A. is renowned for its full and rich citrus-flavored strained yogurts. FAGE sells premium dairy products with a focus on protein content and natural ingredients. FAGE's adherence to traditional Greek yogurt processes and high-quality dairy source enhances its competitive edge.

Other Key Players (40-50% Combined)

Apart from these leading companies, several regional and emerging brands collectively hold a significant market share, contributing to product innovation and regional expansion. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by Nature, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by Nature, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Form, 2023 to 2033

Figure 178: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for the citrus yogurt market was USD 2,550 million in 2025.

The citrus yogurt market is expected to reach USD 3,853 million by 2035.

The increasing consumer preference for healthy and natural food products, coupled with the rising demand for citrus-flavored dairy products, is expected to fuel the citrus yogurt market during the forecast period.

The top 5 countries contributing to the development of the citrus yogurt market are the United States, Canada, Germany, France, and China.

On the basis of product type, Greek yogurt is expected to command a significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.