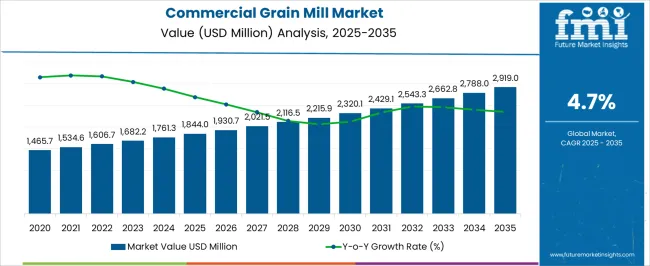

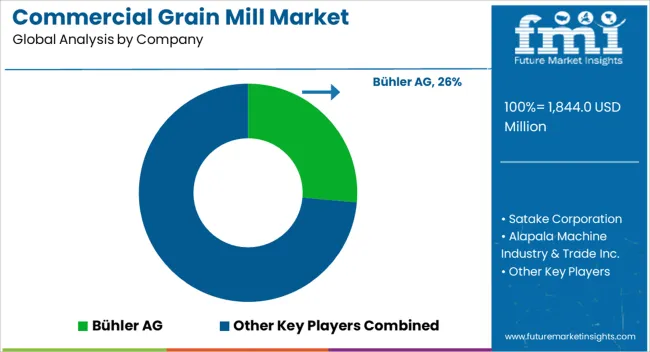

The commercial grain mill market is estimated to be valued at USD 1844.0 million in 2025 and is projected to reach USD 2919.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The market demonstrates steady expansion driven by increasing demand for flour production, feed processing, and specialty grain products that require precise particle size control and contamination-free processing environments. Food manufacturing facilities invest in advanced milling systems that accommodate diverse grain types while maintaining consistent product quality standards essential for commercial bakery operations, snack food production, and industrial food ingredient manufacturing. The industry's evolution toward organic and specialty flour products creates demand for dedicated milling equipment that prevents cross-contamination between different grain varieties and processing standards.

Feed manufacturing operations represent a dominant market segment where commercial grain mills process corn, wheat, barley, and specialized feed grains into precise particle sizes that optimize animal nutrition and digestive efficiency. Livestock feed producers require milling systems capable of handling varying moisture content and foreign material contamination while maintaining throughput rates necessary for large-scale production operations. Quality control protocols demand consistent particle size distribution that directly impacts feed conversion ratios and animal performance metrics tracked by commercial farming operations.

Technology integration trends emphasize automation systems that monitor grain flow rates, moisture content, and particle size distribution throughout milling operations while providing real-time adjustments that maintain product consistency. Pneumatic conveying systems eliminate manual grain handling while preventing contamination and reducing labor requirements in commercial milling facilities. Dust collection and air filtration equipment become essential components as environmental regulations require emission control systems that capture particulate matter generated during milling operations.

Supply chain considerations impact equipment procurement as grain mill manufacturers balance initial capital costs against long-term operational expenses including energy consumption, maintenance requirements, and replacement part availability. Service networks provide technical support for mill optimization, preventive maintenance programs, and emergency repair services that minimize production downtime during critical harvest seasons when milling capacity directly affects grain processor revenues. Equipment financing options enable grain processors to access advanced milling technology through lease arrangements that align equipment costs with seasonal cash flow patterns.

Manufacturing process considerations highlight material flow design and contamination prevention protocols that ensure food safety compliance throughout milling operations. Facility layouts incorporate grain cleaning systems, magnetic separation equipment, and foreign material removal mechanisms that eliminate contamination sources before milling processes begin. Temperature control systems prevent overheating during grinding operations that could damage grain proteins and affect final product quality in commercial applications requiring specific functional characteristics.

| Metric | Value |

|---|---|

| Commercial Grain Mill Market Estimated Value in (2025 E) | USD 1844.0 million |

| Commercial Grain Mill Market Forecast Value in (2035 F) | USD 2919.0 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The commercial grain mill market is expanding due to rising demand for freshly milled flour, growing health consciousness, and the increasing preference for whole grain products across global consumer markets. The surge in artisanal and specialty baking trends, coupled with the emphasis on nutritional value retention in flour, has boosted adoption of advanced milling technologies.

Manufacturers are investing in energy efficient designs, digital control systems, and hygienic milling solutions to align with food safety regulations and sustainable production practices. The bakery sector and food service industries are playing a pivotal role in shaping market demand by integrating freshly milled grain into premium offerings.

With rising urbanization and evolving consumer preferences, the outlook remains positive as investments continue in scalable, innovative grain milling solutions that support both large scale operations and mid sized commercial enterprises.

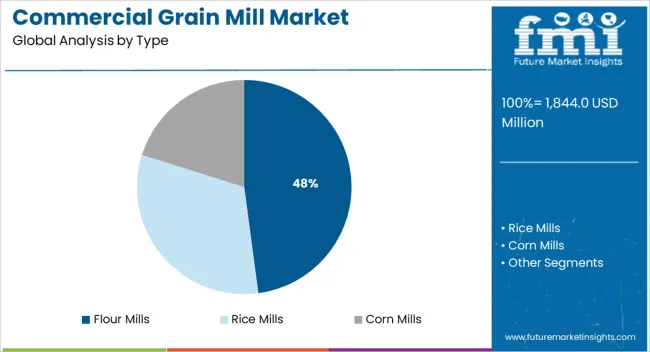

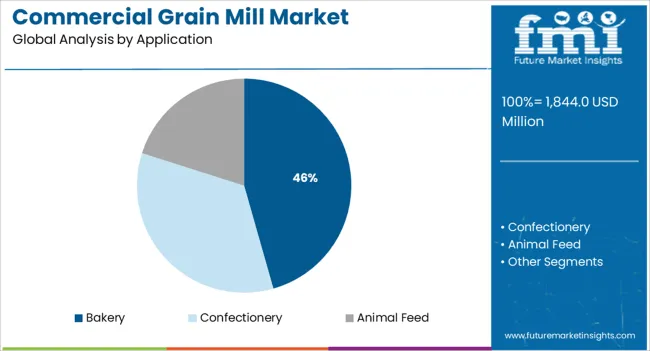

The market is segmented by Type and Application and region. By Type, the market is divided into Flour Mills, Rice Mills, and Corn Mills. In terms of Application, the market is classified into Bakery, Confectionery, and Animal Feed. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flour mills segment is projected to represent 47.90% of total revenue by 2025 within the type category, making it the dominant segment. This growth is being driven by rising demand for high quality flour that preserves essential nutrients and delivers consistent texture required by commercial bakers and food manufacturers.

The ability of flour mills to support bulk processing with efficiency and cost effectiveness has further reinforced their adoption. Continuous improvements in milling machinery including precision control and reduced energy consumption have enhanced operational efficiency for users.

With greater focus on food safety compliance and premium flour production, the flour mills segment continues to lead the type category within the commercial grain mill market.

The bakery application segment is expected to account for 45.60% of market revenue by 2025, positioning it as the leading application area. This dominance is being influenced by the expanding bakery industry, driven by demand for artisanal breads, pastries, and specialty baked goods.

Commercial bakeries require consistent flour quality with controlled granularity, which has made investment in grain mills essential. Rising consumer preference for healthier and fresher baked products has further supported the integration of on site milling solutions.

Additionally, bakery chains and food service providers are using freshly milled flour as a value proposition to differentiate products and attract health conscious consumers. These factors have established bakery as the foremost application segment, underpinning its continued leadership in driving demand within the commercial grain mill market.

The global market for commercial grain mills observed a CAGR of 3.9% during the historical period from 2020 to 2025 and reached a valuation of USD 1,606.7 Million at the end of 2025. However, for the forecast period of 2025 to 2035, a CAGR of 4.7% has been predicted by FMI for the worldwide commercial grain mill industry.

Rising demand for bakery and confectionery products across the world is a key factor fostering the development of the global commercial grain mill industry.

In recent years, there has been a dramatic surge in the production and consumption of various types of flours worldwide due to the rapid growth of the bakery, confectionery, and food processing industries, changing lifestyles, and urbanization. This in turn has generated high demand for commercial grain mills that are being increasingly used to produce flour on a commercial scale.

Similarly, increasing demand for healthy and nutritious food is emerging as a crucial factor propelling commercial grain mill demand globally.

Leading manufacturers of commercial grain mills are introducing new solutions with enhanced features in the market to help end users significantly improve productivity and save costs. They are also investing in research and development activities to expand their product portfolio. This will bode well for the global commercial grain mill industry during the assessment period.

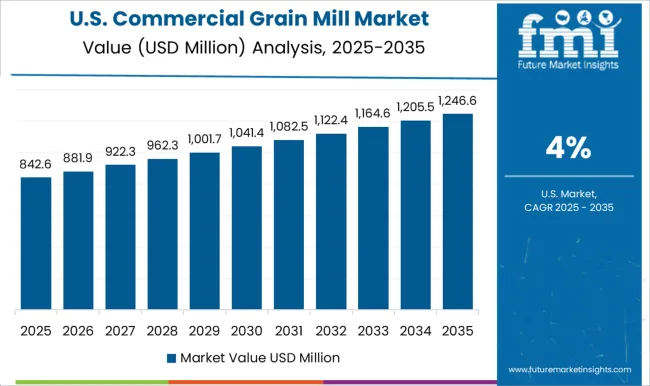

Growing Consumption of Wheat Flour Boosting Commercial Mill Machine Sales in the USA

The USA currently holds around 32.2% share of the global commercial grain mill industry and it is likely to retain its dominance during the next ten years as well. Growth in the USA market is driven by increasing demand for healthy and nutritious foods, the heavy presence of leading commercial grain mill manufacturers, and increasing consumer spending on bakery and confectionery products.

Similarly, growing awareness about the health benefits of functional flours, rapid urbanization, and availability of advanced grain milling equipment are expected to boost the USA market during the assessment period.

In recent years, there has been a significant increase in the consumption of wheat flour across the USA, and the trend is expected to continue during the forecast period. According to the United States Department of Agriculture’s Economic Research Service, per capita, wheat flour usage reached around 131.1 pounds in 2020. This in turn is positively influencing the commercial grain mill sales in the country.

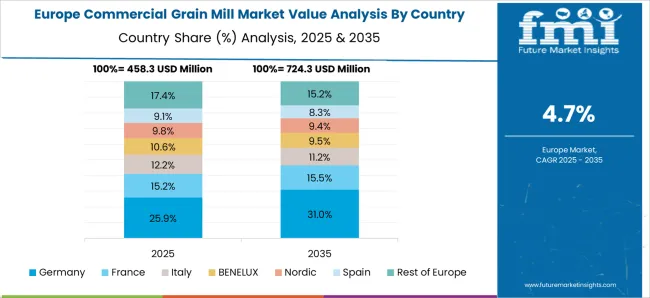

Germany and the United Kingdom to Spearhead the Growth in Europe Commercial Grain Mills Market

There are a few factors that are driving the growth of the commercial grain mill market in Europe. One of the main factors is the increasing health consciousness among consumers. Europeans are becoming more aware of the importance of eating healthy and organic food. This has led to an increase in demand for products made with whole grains.

Another factor that is driving the growth of the market in Europe is the increasing presence of bakeries and cafes. These businesses are increasingly utilizing flour to make bread, pastries, and other baked goods. Growing production and consumption of bakery items across countries like the United Kingdom and Germany will bolster commercial grain mill sales during the projection period.

Currently, Germany accounts for 23.4% of the global market for commercial grain mills, while the United Kingdom market is set to expand at 6.6% CAGR over the projection period.

High Demand for Flour and Processed Grain Fueling Commercial Grain Mill Sales in India and China

The Asia Pacific commercial grain mill market is expanding rapidly due to the growing demand for flour and other processed grains. The region is home to a few of the world’s largest flour-producing countries, such as China, India, and Japan. In addition, the growing popularity of Western-style bread and pastries in Asia is driving up demand for flour.

As the demand for flour increases, so does the demand for commercial grain mills. These machines are used to grind wheat, rice, and other grains into flour. Asia Pacific region is expected to see a significant increase in commercial grain mills over the next few years.

India and China are the market leaders in the Asia Pacific. FMI has predicted the India and China markets to grow at 6.5% and 6.6% CAGRs respectively.

Flour Mills Remain the Most Sought-After Type in the Market

Based on type, the global commercial grain mill industry is segmented into flour mills, rice mills, and corn mills. Among these, the flour mills segment holds the largest share of the global market, and the trend is expected to continue during the forecast period. This is attributed to the rising demand for flour for making bread, bakery items, confectionery, and several other food products.

Similarly, the growing popularity of functional flours due to their numerous potential health benefits and increasing usage of various types of flours for making fast food items will fuel flour mill sales over the assessment period.

Flour mills are being increasingly installed across various end-use sectors for milling/grinding grains into flour. This growing demand for flour like wheat flour will impact flour mill demand globally.

Bakery Sector to Generate Highest Revenues Throughout the Forecast Period

According to Future Market Insights, the bakery segment will continue to dominate the global commercial grain mill industry during the forecast period owing to the rising consumption of bakery products globally.

A commercial grain mill is a very useful tool for any bakery. Not only does it grind wheat and other grains into flour, but it also separates the bran and germ from the endosperm. This process results in a much finer flour that is more suited for baking bread, cakes, and pastries. The germ and bran are separated so that they can be used for other purposes or sold separately.

The rapid growth of the bakery industry coupled with increasing consumer spending on bakery products is expected to bolster demand for commercial grain mills during the assessment period.

The commercial grain mill market is led by global machinery manufacturers and food industry players focusing on efficiency, automation, and consistent output quality. Bühler AG dominates the market with advanced milling systems that combine precision engineering, digital control, and energy efficiency, serving both industrial grain processors and commercial bakeries. Satake Corporation provides high-capacity milling equipment with innovative grain cleaning, polishing, and grading technologies, ensuring superior product yield and quality across rice, wheat, and corn segments. Alapala Machine Industry & Trade Inc. strengthens its position through turnkey grain milling solutions, offering customized plant designs that cater to regional processing requirements and export markets.

Peterson Pacific Corporation, Caterpillar Inc., and Komatsu Ltd. support the market through industrial-grade milling, grinding, and material handling equipment used in large-scale agricultural and feed processing facilities. Their heavy-duty systems contribute to pre-processing and logistics efficiency within grain handling chains.

General Mills Inc. and Groupe Danone drive downstream demand as major grain-based product manufacturers, investing in advanced milling technologies to improve texture, nutritional quality, and production efficiency in cereals, flours, and bakery ingredients. Wärtsilä Corporation contributes specialized industrial energy solutions and mechanical systems that support milling operations with reliable power and process optimization.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1844.0 million |

| Projected Market Size (2035) | USD 2919.0 million |

| Anticipated Growth Rate (2025 to 2035) | 4.7% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa; RoW |

| Key Countries Covered | United States of America, Canada, Mexico, Germany, United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India, Indonesia, South Korea |

| Key Segments Covered | Type, Application, Sales Channel, Region |

| Key Companies Profiled | Bühler AG, Satake Corporation, Alapala Machine Industry & Trade Inc., Peterson Pacific Corporation, Caterpillar Inc., Komatsu Ltd., General Mills Inc., Groupe Danone, and Wartsila Corporation. |

| Report Coverage | Strategic Growth Initiatives, Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, and Competitive Landscape. |

The global commercial grain mill market is estimated to be valued at USD 1,844.0 million in 2025.

The market size for the commercial grain mill market is projected to reach USD 2,919.0 million by 2035.

The commercial grain mill market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in commercial grain mill market are flour mills, rice mills and corn mills.

In terms of application, bakery segment to command 45.6% share in the commercial grain mill market in 2025.

The global commercial grain mill market is estimated to be valued at USD 1,844.0 million in 2025.

The market size for the commercial grain mill market is projected to reach USD 2,919.0 million by 2035.

The commercial grain mill market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in commercial grain mill market are flour mills, rice mills and corn mills.

In terms of application, bakery segment to command 45.6% share in the commercial grain mill market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA