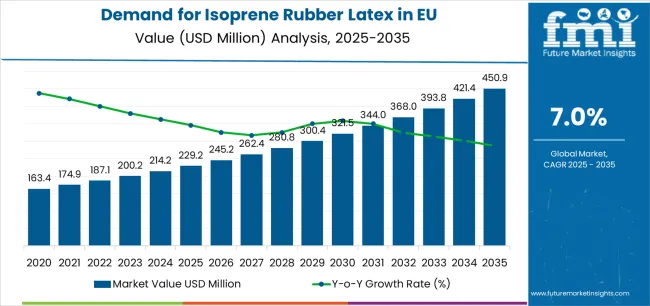

European Union isoprene rubber latex sales are projected to grow from USD 229.2 million in 2025 to approximately USD 450.9 million by 2035, recording an absolute increase of USD 16.6 million over the forecast period. This translates into total growth of 7.2%, with demand forecast to expand at a CAGR of 7% between 2025 and 2035. Production across the EU remains concentrated in industrial hubs such as Germany, France, and Belgium, where chemical clusters and advanced polymer facilities allow stable manufacturing of medical-grade and industrial-grade latex. The reliance on imported feedstocks from Asia and the Middle East, however, keeps supply costs vulnerable to raw material price swings. Recycling and feedstock substitution are limited in isoprene rubber latex production, which makes Europe’s production base dependent on external supply stability.

Demand is strongly driven by medical disposables, surgical gloves, adhesives, and dipping products, with Germany, France, and Italy leading consumption due to well-established healthcare and industrial sectors. Growth in Eastern Europe, particularly Poland and Romania, is supported by the expansion of medical device assembly and increasing consumption of industrial dipping products in automotive and packaging. Southern Europe, including Spain and Italy, reflects moderate demand growth tied to both healthcare usage and niche industrial applications. The rising focus on biocompatible materials and high-tensile strength latex in catheter and glove manufacturing continues to anchor medical demand, while industrial uses in adhesives, sealants, and coated fabrics support broader uptake.

Supply trends are uneven across the region. Western Europe maintains steady availability due to integrated supply chains and strong logistics, while Central and Eastern Europe remain more import-dependent. German producers and distributors dominate intra-EU trade, with France and Belgium acting as critical re-export nodes. Supply is also influenced by fluctuating feedstock imports and regulatory controls on chemical processing, which increase compliance costs but ensure consistent quality standards. The Nordic region demonstrates smaller consumption volumes but emphasizes premium-grade latex products, especially in medical applications, which keeps supply focused on specialized imports. As demand for isoprene rubber latex continues to grow, regional supply dynamics highlight the importance of balanced imports, optimized logistics, and integration of regional distribution hubs.

Between 2025 and 2030, EU isoprene rubber latex demand is projected to expand from USD 229.2 million to USD 237.3 million, resulting in a value increase of USD 8.1 million, which represents 48.8% of the total forecast growth for the decade.

This phase of development will be shaped by steady healthcare demand for latex-free alternatives, increasing latex allergy awareness across European healthcare facilities, and growing regulatory requirements for hypoallergenic medical products. Manufacturers are maintaining their product portfolios to address the evolving preferences for improved protein-free formulations, enhanced manufacturing consistency, and quality standards comparable to natural rubber latex while delivering superior allergy-prevention characteristics.

From 2030 to 2035, sales are forecast to grow from USD 237.3 million to USD 450.9 million, adding another USD 8.5 million, which constitutes 51.2% of the ten-year expansion. This period is expected to be characterized by further consolidation of powder-free formulations, integration of advanced synthetic polymerization technologies for improved product quality, and development of specialized medical-grade isoprene rubber latex targeting surgical and examination glove applications.

The growing emphasis on healthcare worker safety and increasing hospital procurement focus on latex-alternative products will drive demand for premium isoprene rubber latex products that deliver natural rubber latex-equivalent performance without allergenic protein content.

Between 2020 and 2025, EU isoprene rubber latex sales experienced modest expansion at a CAGR of 5.0%, growing from USD 223.6 million to USD 229.2 million. This period was driven by steady healthcare sector adoption across European countries, rising latex allergy awareness following increased sensitivity reporting, and growing recognition of synthetic isoprene rubber latex advantages in medical applications.

The industry developed as major medical glove manufacturers and specialized synthetic latex producers recognized the commercial opportunity of protein-free latex alternatives. Product innovations, processing improvements, and powder-free manufacturing enhancements began establishing clinical acceptance and safety profiles of synthetic isoprene rubber latex products.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 229.2 million |

| Forecast Value in (2035F) | USD 450.9 million |

| Forecast CAGR (2025 to 2035) | 7% |

Industry expansion is being supported by the steady growth in latex allergy awareness across European healthcare systems and the corresponding demand for safe, high-performance, and clinically validated disposable medical products with hypoallergenic properties in clinical applications.

Modern healthcare facilities rely on isoprene rubber latex as the preferred synthetic alternative for surgical gloves, examination gloves, and medical devices requiring natural rubber latex-equivalent tactile sensitivity, driving demand for products that match or exceed natural rubber latex barrier properties, including viral penetration resistance, puncture resistance, and flexibility characteristics, without allergenic protein content.

Even minor clinical requirements, such as surgical precision, patient examination sensitivity, or latex allergy accommodation, can drive comprehensive adoption of isoprene rubber latex to maintain optimal clinical outcomes and support healthcare worker safety protocols.

The growing awareness of Type I latex hypersensitivity and increasing recognition of proper latex allergy management protocols are driving demand for isoprene rubber latex products from certified manufacturers with appropriate medical device certifications and quality management systems.

Regulatory authorities are increasingly establishing clear guidelines for synthetic latex medical device specifications, biocompatibility requirements, and powder-free standards to maintain patient and healthcare worker safety and ensure product consistency.

Scientific research studies and clinical analyses are providing evidence supporting isoprene rubber latex's equivalent tactile sensitivity and barrier performance compared to natural rubber latex, requiring specialized polymerization methods and standardized manufacturing protocols for consistent molecular weight distribution, appropriate crosslinking density, and quality validation, including cytotoxicity testing and medical device certification compliance.

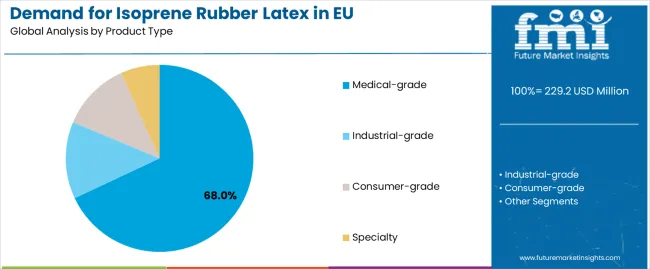

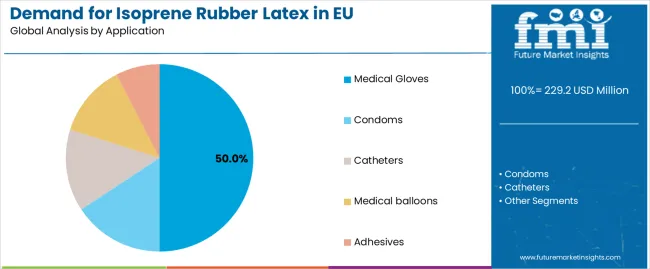

Sales are segmented by product type (grade), application (format), distribution channel, nature, and country. By product type, demand is divided into medical-grade, industrial-grade, consumer-grade, and specialty. Based on the application, sales are categorized into medical gloves, condoms, catheters, medical balloons, and adhesives.

In terms of distribution channel, demand is segmented into direct to OEM, distributors, and online. By nature, sales are classified into powder-free surgical, examination (powder-free), powdered/other, and sterile specialty. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The medical-grade segment is projected to account for 68% of EU isoprene rubber latex sales in 2025, establishing itself as the dominant product category across European markets. This commanding position is fundamentally supported by medical-grade isoprene rubber latex's compliance with stringent European medical device regulations, comprehensive quality specifications featuring protein-free formulations, and superior performance properties enabling surgical precision, barrier protection, and tactile sensitivity equivalent to natural rubber latex.

The medical-grade format delivers exceptional reliability, providing manufacturers with certified synthetic latex that facilitates medical device manufacturing, quality assurance, and regulatory compliance properties essential for healthcare applications requiring latex allergy mitigation.

This segment benefits from established medical device supply chains, well-developed quality management systems, and extensive regulatory compliance frameworks from European Medicines Agency and notified bodies who maintain rigorous safety standards and manufacturing certifications. Medical-grade isoprene rubber latex offers versatility across various formats, including surgical gloves, examination gloves, catheters, and medical balloons, supported by proven polymerization technologies that address traditional challenges in achieving natural rubber latex-equivalent performance without allergenic proteins.

The medical-grade segment is expected to decline slightly to 66.0% share by 2035, demonstrating gradual positioning adjustment as nitrile and other synthetic alternatives gain incremental market share in certain applications, though medical-grade maintains dominant positioning throughout the forecast period.

Medical gloves format is positioned to represent 50% of total isoprene rubber latex demand across European markets in 2025, declining slightly to 48.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem.

This substantial share directly demonstrates that medical gloves represent the largest single application, with healthcare facilities purchasing synthetic isoprene rubber latex gloves for surgical procedures, patient examination, laboratory work, and infection control applications, providing latex-free alternatives for healthcare workers with natural rubber latex sensitivity and patients requiring latex-free medical environments.

Modern healthcare facilities increasingly adopt isoprene rubber latex gloves as premium synthetic alternatives to natural rubber latex, driving demand for powder-free formulations optimized for hypoallergenic properties with natural rubber latex-equivalent tactile sensitivity, superior barrier protection that meets clinical standards, and competitive pricing relative to natural rubber latex addressing healthcare budget considerations.

The segment benefits from growing latex allergy awareness among healthcare workers, proven barrier performance against bloodborne pathogens equivalent to natural rubber latex, and superior tactile sensitivity enabling precision surgical techniques and diagnostic examination procedures without protein allergen exposure.

The segment's slight share decline reflects gradual nitrile glove penetration in examination applications due to cost considerations, with isoprene rubber latex gloves maintaining dominant positioning among synthetic alternatives for surgical applications requiring superior tactile sensitivity throughout the forecast period.

EU isoprene rubber latex sales are advancing modestly due to steady latex allergy awareness growth, increasing healthcare facility adoption of latex-free products, and expanding regulatory focus on healthcare worker safety. The industry faces challenges, including significant cost premiums compared to natural rubber latex limiting mass-market penetration, competition from lower-cost nitrile alternatives in examination glove applications, and mature market dynamics restricting growth rates. Continued innovation in polymerization technologies and cost reduction initiatives remains central to industry development.

The steadily increasing awareness of Type I latex hypersensitivity among healthcare workers and patients is fundamentally driving institutional adoption of latex-free medical product protocols, creating continued demand for synthetic isoprene rubber latex as the premium alternative offering natural rubber latex-equivalent performance. Comprehensive latex allergy management programs featuring latex-free surgical suites, patient screening protocols, and healthcare worker accommodation policies systematically increase synthetic isoprene rubber latex adoption as hospitals implement evidence-based allergen elimination strategies.

These institutional protocol changes prove particularly important for surgical applications, including cardiovascular surgery, obstetrics, and neurosurgery, where tactile sensitivity requirements prove essential and synthetic isoprene rubber latex provides superior performance compared to nitrile alternatives.

Modern synthetic isoprene rubber latex producers systematically incorporate advanced emulsion polymerization technologies, including controlled molecular weight distribution, optimized particle size management, and enhanced crosslinking systems that deliver natural rubber latex-equivalent mechanical properties, superior manufacturing consistency, and improved barrier performance supporting medical device applications.

Strategic integration of polymerization innovations optimized for clinical performance enables manufacturers to position synthetic isoprene rubber latex as premium latex-free alternatives where tactile sensitivity and barrier protection directly determine clinical acceptance and market penetration. These technical improvements prove essential for surgical glove adoption, as surgeons demand natural rubber latex-equivalent finger sensitivity, reliable barrier protection, and consistent quality supporting surgical precision.

European synthetic latex producers increasingly prioritize production efficiency improvements featuring energy optimization, monomer recovery systems, and manufacturing process innovations that reduce per-unit costs supporting competitive positioning against natural rubber latex and nitrile alternatives.

This cost reduction focus enables manufacturers to narrow price differentials versus natural rubber latex through economies of scale, process optimization, and technical innovations that improve manufacturing efficiency while maintaining product quality and performance characteristics. Cost competitiveness proves particularly important for examination glove applications where procurement decisions emphasize value optimization rather than premium performance differentiation.

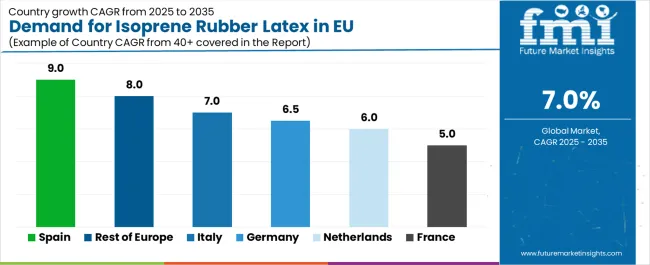

| Country | CAGR % |

|---|---|

| Spain | 9.0% |

| Rest of Europe | 8.0% |

| Italy | 7.0% |

| Germany | 6.5% |

| Netherlands | 6.0% |

| France | 5.0% |

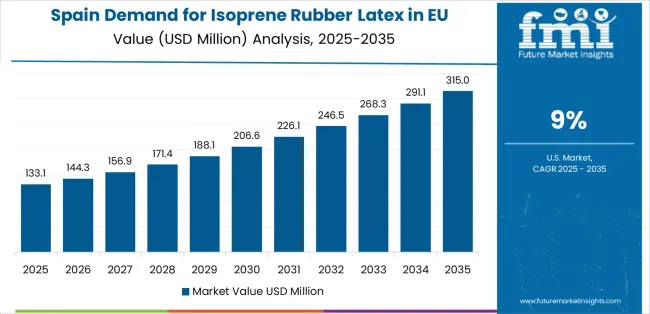

EU isoprene rubber latex sales demonstrate modest growth across major European economies, with Spain leading expansion at 9.0% CAGR through 2035, driven by healthcare infrastructure development and increasing latex-free product adoption. Germany maintains leadership through established healthcare systems and mature latex allergy awareness.

France benefits from comprehensive occupational health programs and systematic latex-free protocol implementation. Italy leverages expanding healthcare budgets and growing medical device manufacturing. Spain shows strongest growth supported by healthcare modernization and increasing latex allergy recognition.

Netherlands emphasizes advanced occupational health management and comprehensive latex-free procurement policies. Sales show stable regional development reflecting EU-wide latex allergy awareness and steady latex-free medical product adoption.

Revenue from isoprene rubber latex in Germany is projected to exhibit modest growth with a CAGR of 6.5% through 2035, driven by exceptionally well-developed healthcare infrastructure, comprehensive occupational health programs, and mature latex allergy awareness throughout the country. Germany's sophisticated healthcare system and internationally recognized leadership in medical device quality standards are maintaining substantial demand for premium synthetic isoprene rubber latex across surgical and examination glove applications.

Major healthcare systems, including university hospitals, specialized surgical centers, and large hospital networks, systematically implement latex-free protocols, often dedicating procurement specifications to synthetic isoprene rubber latex for surgical applications requiring natural rubber latex-equivalent tactile sensitivity. German demand benefits from strong occupational health emphasis, substantial healthcare worker protection standards supporting latex-free alternatives, and clinical acceptance of synthetic isoprene rubber latex among surgical specialties requiring superior tactile sensitivity.

Revenue from isoprene rubber latex in France is expanding at a CAGR of 5.0%, substantially supported by comprehensive occupational health regulations emphasizing healthcare worker protection, established latex allergy surveillance programs, and systematic latex-free protocol implementation across French healthcare facilities. France's rigorous occupational health framework and clinical quality emphasis are maintaining demand for premium synthetic isoprene rubber latex in surgical applications.

Major healthcare facilities, including teaching hospitals, public hospital systems, and specialized surgical centers, strategically implement latex-free surgical suites and healthcare worker accommodation programs requiring synthetic isoprene rubber latex procurement. French sales particularly benefit from occupational medicine emphasis that mandates latex allergy screening and accommodation, driving institutional adoption of latex-free alternatives supporting healthcare worker safety and patient protection protocols.

Revenue from isoprene rubber latex in Italy is growing at a modest CAGR of 7.0%, fundamentally driven by healthcare infrastructure modernization, increasing latex allergy awareness among healthcare workers, and gradual latex-free protocol adoption across Italian healthcare facilities. Italy's expanding healthcare budgets and growing medical device quality focus are supporting steady demand for synthetic isoprene rubber latex in clinical applications.

Major healthcare systems, including regional hospitals, university medical centers, and specialized surgical facilities, strategically invest in latex-free medical products and healthcare worker safety programs addressing latex sensitization concerns. Italian sales particularly benefit from growing occupational health awareness, driving latex allergy screening programs and latex-free alternative procurement supporting healthcare worker protection and institutional liability management.

Demand for isoprene rubber latex in Spain is projected to grow at a CAGR of 9.0%, substantially supported by healthcare infrastructure expansion, increasing latex allergy recognition among healthcare professionals, and growing adoption of latex-free protocols in modernized healthcare facilities. Spanish healthcare system's ongoing investment in quality improvement and safety programs positions synthetic isoprene rubber latex as valuable latex-free alternatives supporting healthcare worker protection.

Major healthcare systems, including regional health services, teaching hospitals, and private hospital groups, systematically expand latex-free product procurement, with growing recognition of latex allergy management importance driving synthetic isoprene rubber latex adoption. Spain's healthcare expansion particularly supports increased surgical volumes requiring premium glove products, creating natural demand for synthetic isoprene rubber latex in tactile-sensitive surgical specialties.

Demand for isoprene rubber latex in Netherlands is expanding at a CAGR of 6.0%, fundamentally driven by exceptional occupational health management, leadership in healthcare worker safety programs, and comprehensive latex allergy protocols across Dutch healthcare facilities. Dutch healthcare systems demonstrate particularly strong commitment to evidence-based occupational health practices supporting systematic latex-free alternative adoption.

Netherlands sales significantly benefit from advanced occupational health infrastructure, including comprehensive healthcare worker surveillance programs, latex sensitization prevention initiatives, and systematic latex-free procurement policies ensuring healthcare worker protection. The country's healthcare quality leadership paradoxically coexists with cost-conscious procurement; as healthcare systems balance premium synthetic isoprene rubber latex adoption for surgical applications with cost-effective alternatives for examination glove applications.

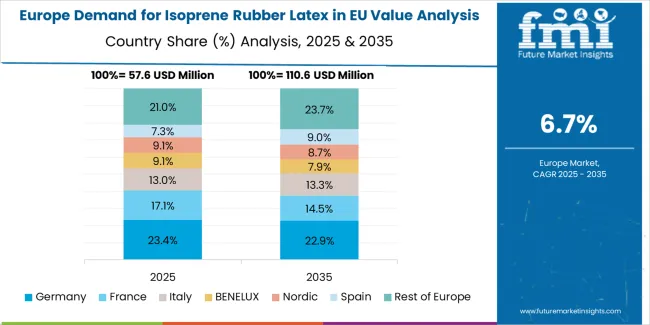

EU isoprene rubber latex sales are projected to grow from USD 229.2 million in 2025 to USD 245.8 million by 2035, registering a CAGR of 7.0% over the forecast period. The Spain region is expected to demonstrate the strongest growth trajectory with a 9.0% CAGR, supported by expanding healthcare infrastructure, increasing latex allergy awareness, and growing medical glove manufacturing. Rest of Europe and Italy follow with 8.0% and 7.0% CAGR each, attributed to steady healthcare demand and latex-free product adoption, respectively.

Germany, while maintaining the largest share at 21.0% in 2025, is expected to grow at a 6.5% CAGR, reflecting market maturity and established latex-free product penetration. Netherlands and France also demonstrate 6.0% and 5.0% CAGR, respectively, supported by stable healthcare demand and comprehensive latex allergy management programs.

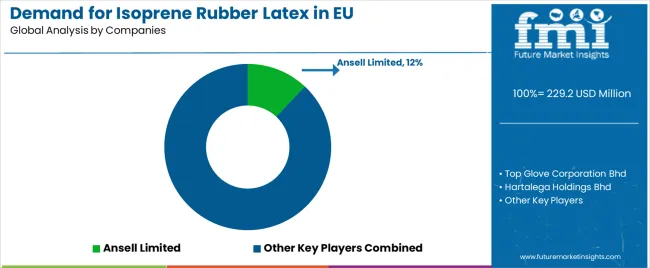

EU isoprene rubber latex sales are defined by competition among specialized synthetic latex producers, major chemical companies, and medical device manufacturers with vertical integration. Companies are investing in polymerization technology optimization, cost reduction initiatives, clinical validation programs, and technical support services to deliver high-quality, competitively priced, and clinically proven synthetic isoprene rubber latex solutions. Strategic partnerships with medical glove manufacturers, surgical specialty endorsements, and marketing campaigns emphasizing latex-free performance equivalency are central to strengthening competitive position.

Major participants include Ansell Limited with an estimated 12.0% share, leveraging its vertically integrated manufacturing capabilities, established hospital distribution channels, and comprehensive EU medical device certifications, supporting consistent supply to healthcare facilities across Europe. Ansell benefits from direct medical glove manufacturing integration, technical support capabilities, and the ability to provide complete latex-free surgical glove solutions, including synthetic isoprene rubber latex sourcing, glove manufacturing, and clinical validation, supporting hospital latex allergy management programs.

Top Glove Corporation Bhd holds approximately 10.0% share, emphasizing strong EU distribution networks, medical-grade product focus, and competitive pricing supporting market penetration across examination and surgical glove applications. Top Glove's success in developing cost-competitive synthetic isoprene rubber latex gloves while maintaining medical device certification creates strong competitive positioning in price-sensitive examination glove segments, supported by manufacturing scale and established European distributor relationships.

Hartalega Holdings Bhd accounts for roughly 7.5% share through its position as premium synthetic latex glove manufacturer, providing high-quality surgical glove portfolios featuring synthetic isoprene rubber latex formulations optimized for tactile sensitivity and barrier performance. The company benefits from advanced manufacturing technology, proprietary polymerization capabilities, and premium product positioning supporting surgical specialty preference and healthcare system adoption.

Other companies and regional manufacturers collectively hold 75.0% share, reflecting the fragmented nature of European synthetic isoprene rubber latex sales, where numerous medical glove manufacturers, chemical companies, specialty latex producers, and vertically integrated medical device companies serve regional markets, specific hospital systems, and niche applications. This fragmentation provides opportunities for differentiation through specialized formulations (ultra-thin surgical, extended-cuff examination), proprietary polymerization technologies, clinical validation programs, and premium positioning resonating with healthcare facilities seeking reliable latex-free alternatives delivering natural rubber latex-equivalent clinical performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 450.9 million |

| Product Type (Grade) | Medical-grade, Industrial-grade, Consumer-grade, Specialty |

| Application (Format) | Medical gloves, Condoms, Catheters, Medical balloons, Adhesives |

| Distribution Channel | Direct to OEM, Distributors, Online |

| Nature | Powder-free surgical, Examination (powder-free), Powdered/Other, Sterile specialty |

| Forecast Period | 2025 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 to 2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Ansell Limited, Top Glove Corporation Bhd, Hartalega Holdings Bhd, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (grade), application (format), distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established medical glove manufacturers and specialized synthetic latex producers; healthcare facility preferences for various synthetic latex specifications and applications; integration with latex allergy management programs and latex-free protocol development; innovations in polymerization technology and cost reduction initiatives; adoption across surgical and examination glove applications; regulatory framework analysis for medical device certification and latex-free product positioning; supply chain strategies; and penetration analysis for healthcare systems and medical device manufacturers implementing latex allergy accommodation across European markets. |

The global demand for isoprene rubber latex in eu is estimated to be valued at USD 229.2 million in 2025.

The market size for the demand for isoprene rubber latex in eu is projected to reach USD 450.9 million by 2035.

The demand for isoprene rubber latex in eu is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in demand for isoprene rubber latex in eu are medical-grade, industrial-grade, consumer-grade and specialty.

In terms of application, medical gloves segment to command 50.0% share in the demand for isoprene rubber latex in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isoprene Rubber Latex Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Nitrile Butadiene Rubber (NBR) Latex Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber Molding Market Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA