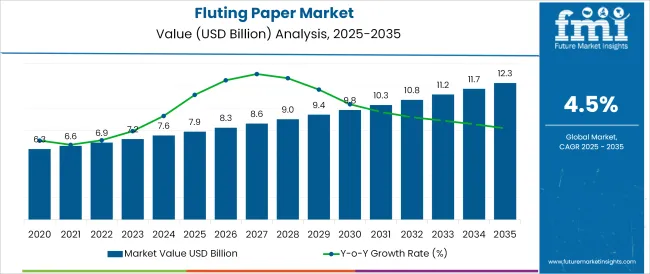

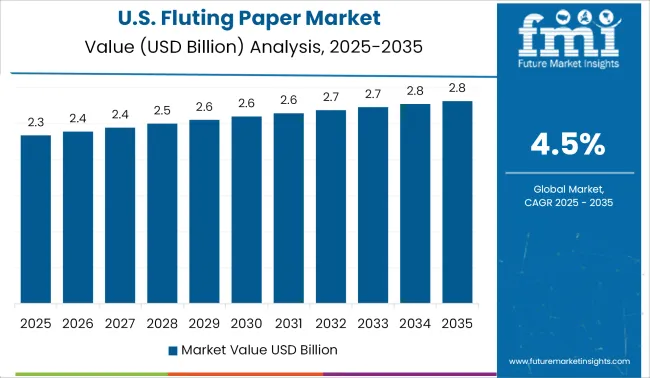

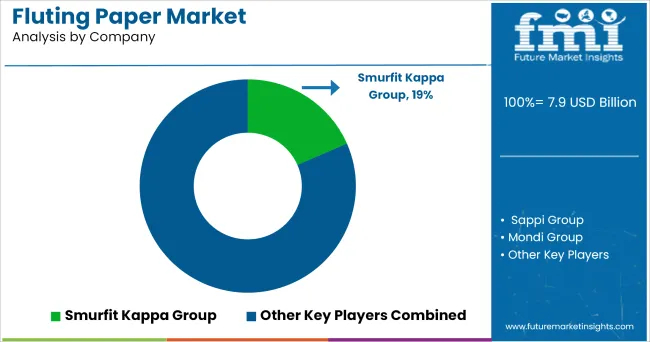

The Fluting Paper Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 12.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The fluting paper market is experiencing consistent growth, underpinned by the surge in e-commerce, food packaging, and industrial shipping needs. Demand is being fueled by the rising preference for sustainable packaging formats, as corrugated board manufacturers adopt recyclable and biodegradable paper inputs.

Regulatory emphasis on reducing plastic usage and promoting fiber-based materials has further positioned fluting paper as a viable alternative for both primary and secondary packaging layers. Enhancements in paper strength, moisture resistance, and printability have elevated the utility of fluting paper across various end-use sectors.

Manufacturers are optimizing grammage, fiber quality, and machine-line efficiency to meet performance and cost benchmarks in volume-driven applications. As supply chains become more sustainability-focused and automation in box production expands, fluting paper especially in rigid, C-flute, and roll formats is expected to witness heightened demand due to its compatibility with automated die-cutting, stacking, and filling systems.

The market is segmented by Product Type, Form, Availability, and End User and region. By Product Type, the market is divided into C-Flute Paper, A-Flute Paper, B-Flute Paper, E-Flute Paper, and F-Flute Paper. In terms of Form, the market is classified into Rigid and Flexible. Based on Availability, the market is segmented into Rolls and Sheets.

By End User, the market is divided into Food Industry, Pharmaceutical companies, Biopharmaceutical companies, Disinfectant company, and Consumer healthcare company. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

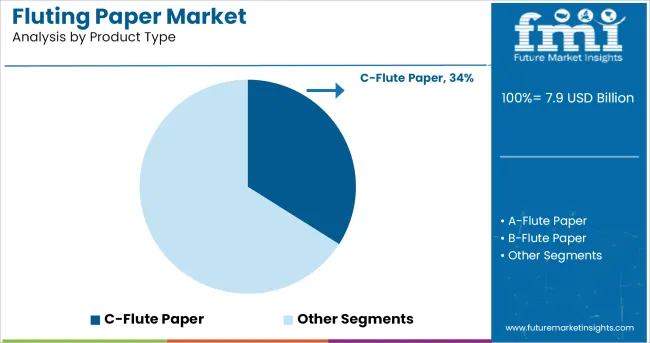

C-Flute paper is projected to hold 34.0% of the total revenue share in the fluting paper market in 2025, making it the leading product type segment. The segment's dominance is being driven by its balanced performance characteristics offering a strong combination of stacking strength, cushioning capability, and material efficiency.

C-Flute paper provides optimal rigidity for mid-weight goods while maintaining compatibility with high-speed converting equipment. It has been widely adopted due to its effective vertical compression strength and adaptability to various corrugated packaging layers, particularly in single-wall and double-wall constructions.

The format's integration into automated packing lines, along with its cost-effectiveness, has reinforced its adoption among packaging suppliers serving food, consumer goods, and industrial segments. As durability, sustainability, and printing clarity become central to procurement decisions, the C-Flute paper segment continues to outperform alternatives in both protective function and process efficiency.

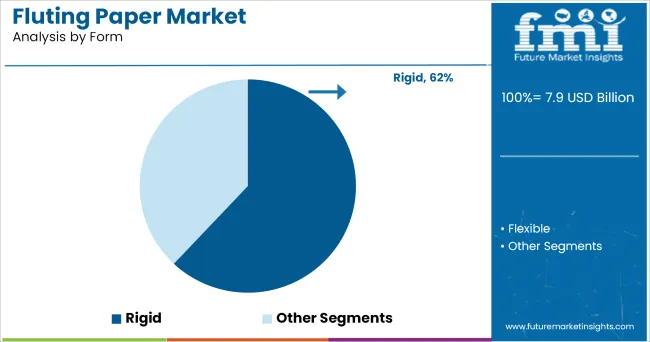

Rigid fluting paper is anticipated to account for 62.0% of the market revenue in 2025, maintaining its position as the leading form segment. The segment’s growth is being driven by the increasing need for structurally sound packaging solutions that can withstand long-distance transportation and warehouse stacking.

Rigid formats deliver higher compression resistance and dimensional stability, reducing the need for secondary protective packaging materials. Their usage aligns with automated box-forming processes, where uniformity and foldability are essential to operational efficiency.

Additionally, rigid fluting paper enhances protection for fragile or high-value contents, making it a preferred choice in sectors such as industrial machinery, electronics, and perishables logistics. The growing shift toward environmentally conscious packaging that does not compromise on strength and performance is further boosting the adoption of rigid fluting paper across global markets.

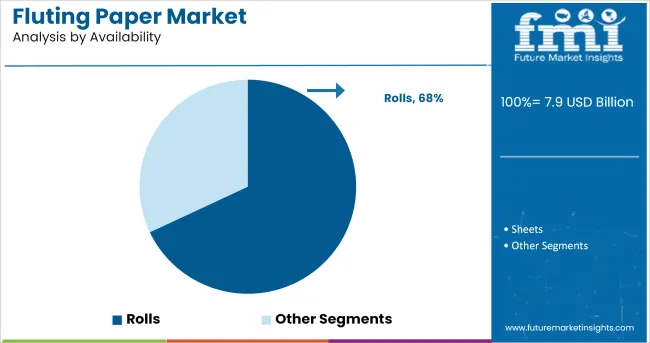

Rolls are projected to lead the fluting paper market by availability, accounting for 68.0% of the total revenue share in 2025. The segment’s dominance is attributed to its operational efficiency, material handling ease, and compatibility with large-scale corrugation and converting lines. Rolls offer high throughput in automated environments, enabling uninterrupted feeding and reduced waste compared to pre-cut sheets.

They support just-in-time production strategies and allow for flexible sheet length customization at the point of conversion. The compact and stackable nature of rolls also lowers warehousing and transportation costs. Moreover, the roll format reduces manual intervention and improves hygiene in food-contact packaging operations.

With the ongoing modernization of packaging facilities and integration of digital monitoring systems, rolls continue to serve as the preferred supply format for corrugator plants and folding carton manufacturers seeking to streamline operations while meeting sustainability and cost-control targets.

Fluted paper provides cushioning effect to product that provide protection to the products from wearing-tearing or leakage. From this paper secondary packaging is done to product. Growing demand of fluting paper in packaging industry. Primary packaging of any product is protected by secondary packaging and in that fluting paper is very effective to prevent internal products.

Secondary packaging mainly deal with the protective packaging, box-in box, bag-in box, nutrition packaging, pharma-packaging, cosmetic- packaging e-commerce packaging and other. The global fluted paper market is expected to show significant growth during the forecasted period.

Fluting Paper has gaining attention over past few years due to high adoption of lightweight box. Lightweight box material have good acceptance rate by packaging industry. It is easy to deliver products to consumer due to its lightweight. Lightweight box by fluting paper results in less plastic usage and also meet the recent need of environmental friendly products. This act as driving force for market.

Demand for fluting Paper increases around the globe due biodegradable packaging material trend. Over the past few years, a significant transformation has been observed in the overall packaging industry.

Rising awareness about reducing land-pollution in recent years so fluting paper is best solution. Fluting paper are of nature origin so it can be biodegrade easily and pollution is prevented. This create demand for fluting paper.

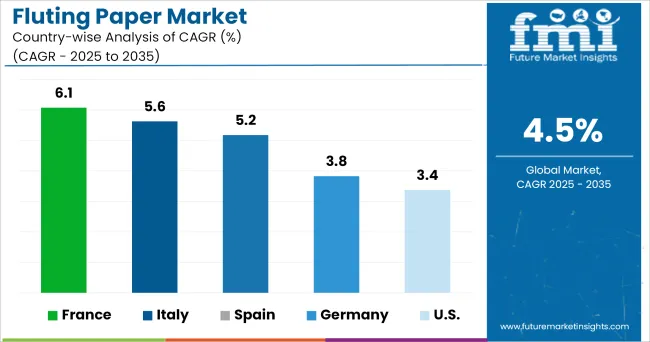

USA remains one of the largest markets for fluting paper globally. USA will hold significant markets share of fluting paper market throughout the course of the forecast period. Due to increasing focus in this area forces innovator to develop new designs that satisfy and convince the consumers’ demands and needs.

Opportunities are created for a wide range of package types - shapes, sizes, technologies, and many other parameters that define the user-friendly application for consumers as well as manufacturers. So this drive demand of eco-friendly foam container in USA and Canada.

Advance technology keep the nature of packaging stability of product during storage, shipment, and delivery. On these note, improvement in field of packaging and adoption of such product can propel this market.

Fluting Paper has gained traction in European countries in recent years due to adaption of e-commerce. Due to e-commerce sales external appearance of any product matters a lot.

That attractive designs are easily achieved on fluting paper. Social media is fastest growing network to connect with costumers these days with highly-flooded sales strategy by online market is Europe.

Product availability and accessibility by online platform opens up new avenues for vendors to expand their business in Europe. This is leads more innovative designs on packaging material for customer attraction. So, Europe create a good opportunities.

Some of the leading manufacturers and suppliers of Fluting Paper include

Many leading manufacturer have strategic e-commerce to for strengthen their position in market. In June 2024, Hugo Beck has launched two new machines specifically designed to meet the demands of e-commerce for packaging.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global fluting paper market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the fluting paper market is projected to reach USD 12.3 billion by 2035.

The fluting paper market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in fluting paper market are c-flute paper, a-flute paper, b-flute paper, e-flute paper and f-flute paper.

In terms of form, rigid segment to command 62.0% share in the fluting paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in Fluting Paper Industry

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA