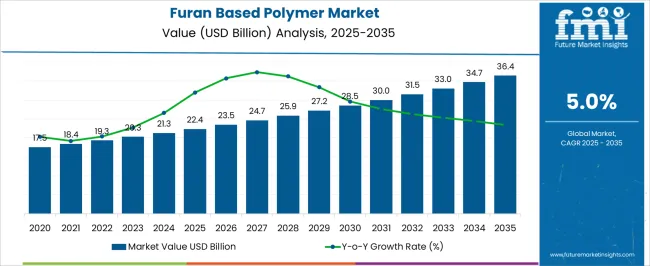

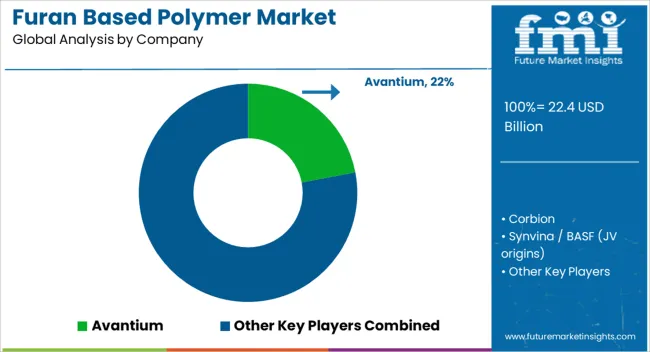

The furan based polymer market is estimated to be valued at USD 22.4 billion in 2025 and is projected to reach USD 36.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

Between 2025 and 2030, the value is projected to rise from USD 22.4 billion to USD 28.5 billion, supported by the increasing use of bio-derived polymers in packaging, coatings, and resins. The demand is being driven by industries that require lightweight, durable, and versatile alternatives to conventional petrochemical-based materials. Furan polymers are gaining traction due to their excellent thermal resistance, mechanical strength, and adaptability across multiple industrial applications. This trend is helping the market gain steady acceptance in automotive and construction sectors as well. From 2030 to 2035, the market is projected to expand further from USD 28.5 billion to USD 36.4 billion, maintaining its steady growth trajectory.

The rising use of furan based polymers in adhesives, composites, and specialty materials is expected to support this phase of expansion. Strong interest in bio-based and recyclable feedstock is giving manufacturers an edge in diversifying applications and meeting stricter regulatory frameworks in various regions. As industrial buyers continue to search for materials that provide both performance and cost efficiency, furan polymers are positioned to fill this demand gap. With ongoing research and commercialization efforts, the market will likely see wider adoption, creating consistent growth opportunities for suppliers and producers worldwide.

| Metric | Value |

|---|---|

| Furan Based Polymer Market Estimated Value in (2025 E) | USD 22.4 billion |

| Furan Based Polymer Market Forecast Value in (2035 F) | USD 36.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The furan based polymer market holds a relatively small but distinct position across its parent categories. Within the global polymer production landscape, it accounts for less than 1%, showing its role as a specialized material in a vast industry. In the bio based polymers market, the share stands near 3%, reflecting its growing acceptance among renewable materials. When compared with the biopolymers market, which encompasses both biodegradable and renewable segments, furan based polymers contribute around 2% of the total, emphasizing their emerging role in targeted applications.

Against the bioplastics market, the segment captures about 4%, supported by its use in high performance packaging and specialty applications. Within the furan resins market, which covers a narrower scope of related resins and derivatives, furan based polymers make up close to 7%, showing their more concentrated impact in this smaller domain. These shares illustrate how the furan based polymer market maintains modest penetration in very large parent industries but shows stronger visibility when evaluated within specialized resin categories, highlighting both its opportunities and limitations in broader adoption.

The market is witnessing notable growth, supported by rising demand for sustainable materials and the shift towards bio-based industrial solutions. The increasing focus on reducing reliance on petrochemical-based products has positioned furan polymers as a viable alternative in diverse applications such as coatings, adhesives, packaging, and automotive components. Advancements in biomass processing technologies and the availability of renewable raw materials are enabling cost-efficient and scalable production.

Government policies promoting the circular economy and the use of eco-friendly polymers are further accelerating adoption. The inherent properties of furan-based polymers, such as high thermal stability, chemical resistance, and mechanical strength, are enhancing their suitability across multiple industries.

With continuous research on improving processing techniques and expanding end-use applications, the market is expected to experience strong growth momentum Strategic collaborations between chemical producers, research institutions, and end-user industries are paving the way for broader commercialization, creating a favorable outlook for the coming years.

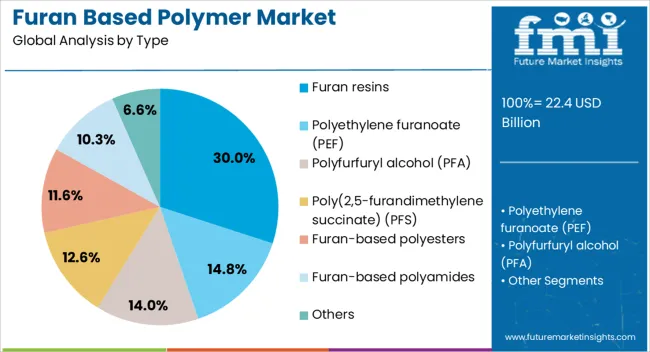

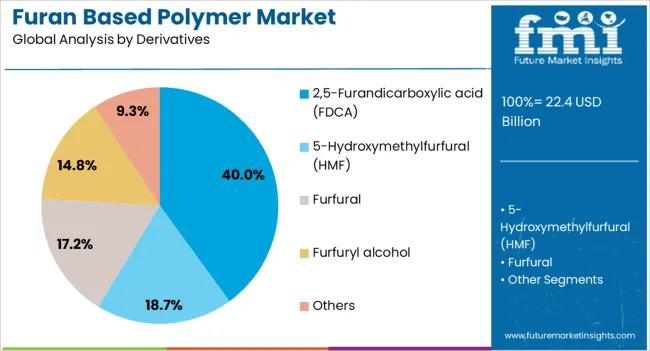

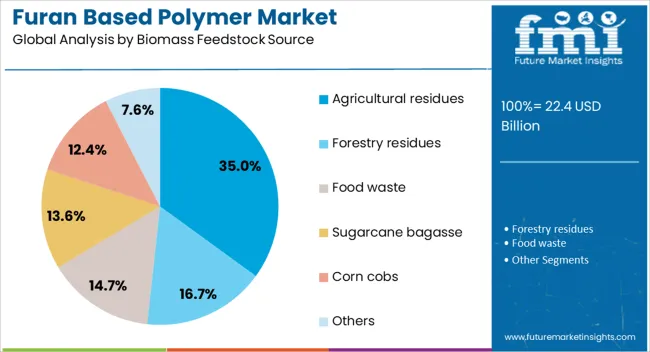

The furan based polymer market is segmented by type, derivatives, biomass feedstock source, application, and geographic regions. By type, furan based polymer market is divided into furan resins, polyethylene furanoate (PEF), polyfurfuryl alcohol (PFA), poly(2,5-furandimethylene succinate) (PFS), furan-based polyesters, furan-based polyamides, and others. In terms of derivatives, furan based polymer market is classified into 2,5-furandicarboxylic acid (FDCA), 5-hydroxymethylfurfural (HMF), furfural, furfuryl alcohol, and others. Based on biomass feedstock source, furan based polymer market is segmented into agricultural residues, forestry residues, food waste, sugarcane bagasse, sorn cobs, and others. By application, furan based polymer market is segmented into packaging, composites, coatings and adhesives, foundry, textiles and fibers, automotive, electronics, medical and healthcare, and others. Regionally, the furan based polymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The furan resins type segment is projected to hold 30% of the market revenue share in 2025, making it the leading type category. The growth of this segment has been supported by its superior thermal stability, chemical resistance, and mechanical strength, which are valued in applications such as foundry binders, adhesives, and corrosion-resistant coatings. The ability of furan resins to be produced from renewable feedstocks enhances their appeal in industries seeking sustainable solutions.

Industrial adoption has been further driven by their performance in high-temperature environments and their compatibility with diverse curing methods. These resins have been favored in heavy-duty industrial applications where durability and resistance to harsh chemicals are essential.

Additionally, the capability to tailor resin formulations for specific performance requirements has reinforced their market position The increasing regulatory push for greener materials has further accelerated their adoption, making furan resins a cornerstone product in the broader furan polymer landscape.

The 2,5-Furandicarboxylic acid derivatives segment is anticipated to account for 40% of the market revenue share in 2025, positioning it as the leading derivatives category. This segment’s expansion has been driven by FDCA’s critical role as a building block for bio-based polyethylene furanoate and other advanced polymers.

The use of FDCA in sustainable packaging materials has gained traction due to its high barrier properties against gases and its potential to replace traditional petrochemical-based plastics. Its compatibility with a wide range of bio-based monomers and its ability to enhance polymer performance have increased its demand in both consumer goods and industrial applications.

Ongoing research on efficient catalytic processes for FDCA production from renewable sources has further improved cost competitiveness Regulatory encouragement for sustainable materials, coupled with growing brand commitments to eco-friendly packaging, has reinforced the leadership of FDCA derivatives in the market’s value chain.

The agricultural residues biomass feedstock source segment is projected to command 35% of the market revenue share in 2025, making it the leading feedstock source. This growth has been supported by the abundant availability of agricultural by-products such as corn stover, wheat straw, and sugarcane bagasse, which serve as cost-effective and renewable raw materials. The use of agricultural residues minimizes waste and reduces the carbon footprint of polymer production, aligning with global sustainability goals.

Their high carbohydrate content facilitates efficient conversion into platform chemicals like furfural and hydroxymethylfurfural, which are precursors for furan-based polymers. Economic incentives and government-backed biomass utilization programs have further encouraged the adoption of agricultural residues in polymer manufacturing.

Technological advancements in biomass pretreatment and conversion processes have improved yields and scalability, strengthening their position as the preferred feedstock The growing demand for bio-based products across multiple industries continues to drive investment in agricultural residue-based production pathways.

The furan based polymer market has been propelled by growing adoption in packaging, automotive, and high-performance composites due to superior thermal stability, barrier properties, and biodegradability. Opportunities are opening in medical, electronics, and advanced industrial uses, while trends reveal strong momentum toward replacing petroleum-derived plastics with bio-derived alternatives. Persistent hurdles lie in high production costs, limited scaling, and feedstock dependence. In my opinion, competitive advantage will rest with producers investing in cost-efficient manufacturing and tailored applications, allowing them to capture premium opportunities while addressing industry-specific challenges in an evolving global landscape.

Demand for furan based polymers has been supported by their versatility in packaging, automotive, adhesives, and coatings. These polymers are derived from renewable feedstocks such as furfural and hydroxymethylfurfural, making them attractive to industries seeking eco-friendly substitutes for petroleum-derived plastics. Their superior barrier properties, thermal stability, and chemical resistance make them highly desirable for applications in flexible packaging and high-performance composites. In my opinion, end users in food, beverage, and automotive production will continue to rely heavily on furan polymers due to their unique balance of performance, cost-effectiveness, and environmental advantages, driving broader adoption across industries.

Opportunities have emerged for furan based polymers in advanced composites, medical devices, and electronics. Their biodegradability and resistance to solvents position them as competitive alternatives in industries facing pressure to shift toward more environmentally conscious solutions. Packaging companies are testing furan derivatives for high-barrier films that extend shelf life, while automotive players are exploring their use in lightweight structural components. It is my view that suppliers capable of tailoring polymer grades to specific industrial needs will unlock premium opportunities. Partnerships with downstream users in healthcare and electronics could further boost commercialization and revenue generation in this evolving field.

One of the most prominent trends is the substitution of petroleum-based polymers with bio-based furan derivatives across key industries. The push toward recyclable and biodegradable packaging materials has accelerated research and commercialization of polyfuranoates. Producers are investing in pilot plants to improve large-scale production and enhance cost competitiveness. Another trend is the interest of multinational chemical firms in forming collaborations with research institutions to accelerate product development. I believe this trend highlights a decisive shift, where emphasis will no longer be on bulk production but on specialized polymers designed for high-performance, value-added applications in global markets.

Challenges for furan based polymers revolve around cost competitiveness, scaling hurdles, and feedstock availability. Commercial-scale production is still limited due to high capital requirements for pilot and industrial plants, restricting broader usage. Price sensitivity in packaging and construction industries poses a barrier, as cheaper substitutes like PET and PE dominate. Feedstock sourcing from agricultural byproducts also presents uncertainty depending on regional harvest conditions. In my assessment, only companies that integrate upstream feedstock management and optimize process efficiency will manage to remain competitive. Without these steps, many players may find it difficult to withstand margin pressures in global markets.

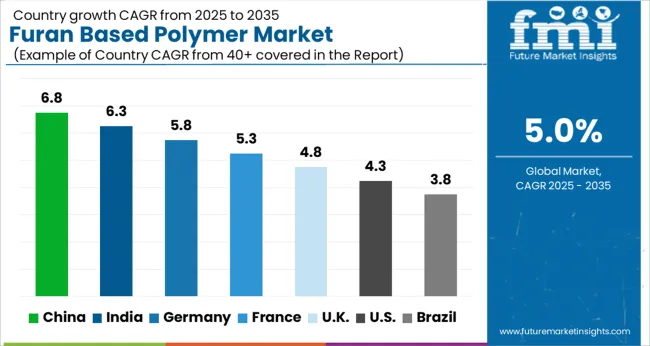

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global furan based polymer market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Rising adoption in emerging economies is driven by industrialization, expanding chemical and construction sectors, and increasing interest in bio-based polymer solutions. Mature markets, including the UK and USA, witness steady growth due to replacement demand, stricter regulations on chemical usage, and adoption of environmentally responsible polymer alternatives. This analysis incorporates insights from 40+ countries, highlighting top markets for reference.

The furan based polymer market in China is projected to grow at a CAGR of 6.8%. Rapid industrial expansion, especially in chemical manufacturing, construction, and automotive sectors, drives demand for furan-based polymers. Preference for bio-based and high-performance polymer alternatives is rising due to increasing environmental regulations and corporate sustainability initiatives. Infrastructure development, including roads and industrial plants, further accelerates the adoption of furan-based polymers for coatings, adhesives, and composite applications. Additionally, government policies encouraging bio-based material usage in manufacturing support growth and reinforce China’s leading position in the global market.

The furan based polymer market in India is expected to grow at a CAGR of 6.3%. Increasing industrialization and infrastructure projects are driving demand for high-performance polymers. Construction, automotive, and chemical sectors are adopting furan-based polymers in adhesives, coatings, and composites to improve durability and efficiency. Government initiatives promoting bio-based polymers and environmentally responsible manufacturing encourage wider adoption. The rising focus on reducing petrochemical dependency and improving product sustainability also supports growth. Expanding industrial hubs and rising investments in polymer manufacturing facilities continue to create opportunities for furan-based polymers in India.

The furan based polymer market in France is projected to grow at a CAGR of 5.3%. Demand is fueled by the chemical, automotive, and construction industries, where furan-based polymers are increasingly used in coatings, adhesives, and composites. Regulatory focus on reducing hazardous chemical use and promoting renewable materials encourages adoption. French manufacturers are investing in bio-based polymer technologies to meet environmental standards and consumer demand for greener solutions. The trend toward using high-performance polymers for industrial and commercial applications is also enhancing market growth.

The furan based polymer market in the United Kingdom is expected to grow at a CAGR of 4.8%. Adoption is largely driven by construction, chemical, and automotive industries seeking durable and efficient polymer solutions. Replacement demand for petrochemical-based polymers is creating opportunities for furan-based alternatives. Investments in advanced polymer processing facilities and stricter regulations on chemical usage support growth. The UK’s emphasis on green chemistry and environmentally responsible manufacturing practices encourages wider adoption of bio-based polymers, including furan-based solutions. Steady industrial activity ensures continued demand for these polymers in adhesives, coatings, and composites.

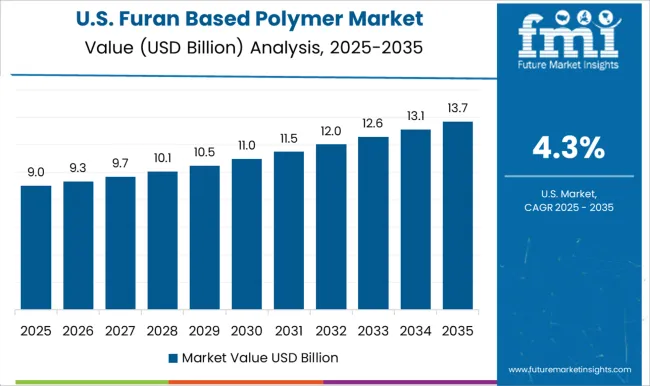

The furan based polymer market in the United States is projected to grow at a CAGR of 4.3%. Growth is supported by steady demand in chemical, automotive, and construction sectors. Increasing regulatory requirements on chemical safety and environmental compliance encourage the adoption of furan-based polymers as alternatives to conventional petrochemical polymers. Investments in polymer processing technologies and industrial modernization are further driving market expansion. While the growth rate is slower than emerging economies, ongoing demand for durable, high-performance, and environmentally responsible polymer solutions ensures stable expansion in the USA market.

Competition in the furan based polymer market has been characterized by distinct approaches from leading producers, with each company attempting to establish authority in specific applications. Avantium has been observed positioning itself as a technology leader by pushing forward the commercial scale of polyethylene furanoate production, highlighting superior performance and alignment with packaging industries that demand durability and clarity. Corbion has been strengthening its foothold by leveraging biochemical expertise and partnerships, extending capabilities into functional polymers for specialty applications. Synvina, born from joint venture origins involving BASF, has carried forward a legacy of research intensity and strategic partnerships, building credibility in advancing furan chemistry beyond pilot scale. Mitsubishi Chemical has maintained a reputation for broad chemical expertise, channeling its strength into integration of furan polymers within its extensive specialty materials portfolio. Eastman has been approaching the sector through a diversified lens, emphasizing resin performance and compatibility with existing processing infrastructure.

Bitrez has carved its own path by developing niche furan resin formulations for coatings and composites, demonstrating adaptability in specialized applications. Shengquan Group has emerged as a prominent producer in Asia, leveraging scale and process know-how to address adhesives, binders, and industrial applications where furan chemistry holds performance benefits. Competitive strategy across these firms has not been uniform, as some are relying on patents and proprietary processes, while others are emphasizing downstream partnerships and material certifications. Avantium, BASF-linked Synvina, and Corbion are perceived as more research-driven, investing in process innovation and demonstration plants. By contrast, Bitrez and Shengquan have been more product-driven, emphasizing functional performance and quicker deployment in targeted end-uses such as foundries, adhesives, and coatings. Mitsubishi Chemical and Eastman are seen as balancing scale with portfolio integration, embedding furan-based solutions alongside other high-performance polymers. This competition has been shaping the sector into a mix of specialized innovation and industrial pragmatism, where authority is granted to those companies capable of proving both commercial feasibility and technical performance across a wide set of applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.4 Billion |

| Type | Furan resins, Polyethylene furanoate (PEF), Polyfurfuryl alcohol (PFA), Poly(2,5-furandimethylene succinate) (PFS), Furan-based polyesters, Furan-based polyamides, and Others |

| Derivatives | 2,5-Furandicarboxylic acid (FDCA), 5-Hydroxymethylfurfural (HMF), Furfural, Furfuryl alcohol, and Others |

| Biomass Feedstock Source | Agricultural residues, Forestry residues, Food waste, Sugarcane bagasse, Corn cobs, and Others |

| Application | Packaging, Composites, Coatings and adhesives, Foundry, Textiles and Fibers, Automotive, Electronics, Medical and healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Avantium, Corbion, Synvina / BASF (JV origins), Mitsubishi Chemical, Eastman, Bitrez, Shengquan Group, and Others |

| Additional Attributes | Dollar sales by product type (PEF vs furfuryl alcohol resins), Dollar sales by application (packaging, coatings, composites), Trends in bio-based polymer adoption and petrochemical replacement, Use in beverage bottles and barrier films, Growth of automotive lightweight materials and construction composites, Regional production clusters in Europe, Asia-Pacific, and North America. |

The global furan based polymer market is estimated to be valued at USD 22.4 billion in 2025.

The market size for the furan based polymer market is projected to reach USD 36.4 billion by 2035.

The furan based polymer market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in furan based polymer market are furan resins, polyethylene furanoate (pef), polyfurfuryl alcohol (pfa), poly(2,5-furandimethylene succinate) (pfs), furan-based polyesters, furan-based polyamides and others.

In terms of derivatives, 2,5-furandicarboxylic acid (fdca) segment to command 40.0% share in the furan based polymer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furan Resin Market Size and Share Forecast Outlook 2025 to 2035

Furandicarboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

2-Methylfuran Market Size and Share Forecast Outlook 2025 to 2035

Tetrahydrofuran-2,4-Dione Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene furanoate Market

Polytetrahydrofuran (Poly THF) Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA