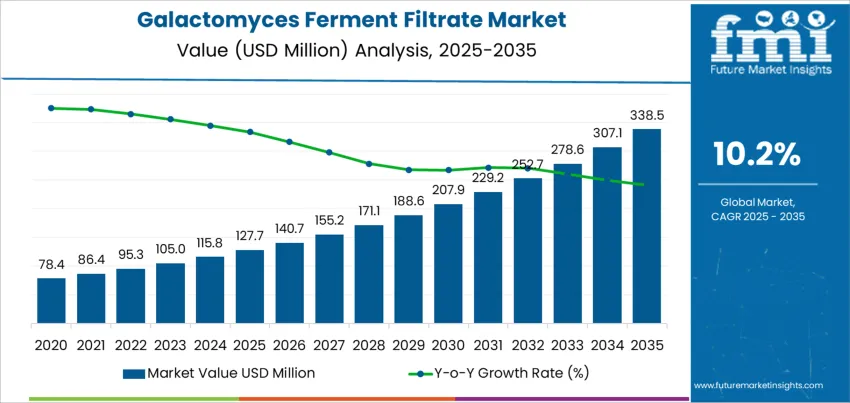

The global demand for galactomyces ferment filtrate (GFF) is expected to grow from USD 127.7 million in 2025 to USD 338.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 10.2%. GFF, a key ingredient in the cosmetics and skincare industries, is gaining popularity for its ability to improve skin hydration, texture, and overall health. Its popularity is driven by increasing consumer demand for natural, sustainable, and effective skincare products, especially those made from fermented ingredients. As the skincare market continues to expand globally, GFF is expected to see widespread adoption in both high-end and mass-market beauty products.

The market will experience steady growth, starting at USD 127.7 million in 2025 and increasing to USD 140.7 million in 2026, USD 155.2 million in 2027, and USD 171.1 million in 2028. By 2029, global demand for GFF will rise to USD 188.6 million, continuing its upward trajectory through the 2030s. By 2035, the demand for GFF is projected to reach USD 338.5 million, driven by advancements in skincare product formulations, the growing popularity of fermented ingredients, and rising consumer awareness of the benefits of natural skincare.

The global market for Galactomyces Ferment Filtrate is expected to witness strong and consistent growth through 2035. From USD 127.7 million in 2025, the market will rise to USD 140.7 million in 2026, USD 155.2 million in 2027, and USD 171.1 million by 2028. Demand for GFF will continue to expand, reaching USD 188.6 million in 2029, USD 207.9 million by 2030, and USD 229.2 million by 2031. By 2035, the market for GFF is projected to reach USD 338.5 million, supported by several factors, including the growing demand for anti-aging skincare, the increasing focus on natural and organic ingredients, and the expansion of fermented skincare products.

The global expansion of the beauty and wellness market will further fuel the demand for GFF. As more consumers become aware of the benefits of using fermented ingredients in their skincare routines, GFF is expected to become a key component in premium beauty products. This growth will be particularly noticeable in emerging markets where the adoption of Western beauty standards and practices is on the rise. Additionally, GFF’s use in products aimed at treating specific skin conditions, such as acne and aging, is expected to drive further market adoption, contributing to its increased use in a wider range of consumer skincare applications. The continued innovations in GFF-based formulations and the ongoing trend toward plant-based, sustainable beauty products will ensure that the global market for GFF remains strong and expanding over the next decade.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 127.7 million |

| Industry Forecast Value (2035) | USD 338.5 million |

| Industry Forecast CAGR (2025 to 2035) | 10.2% |

Demand for Galactomyces ferment filtrate (GFF) is increasing globally as the beauty and personal care industry shifts towards more natural, bioactive, and fermentation-derived ingredients. GFF is derived through the fermentation process, where beneficial microorganisms break down organic matter to produce ingredients that are considered gentler and more effective for the skin. This makes GFF particularly appealing to consumers seeking natural alternatives to synthetic additives. The ingredient is renowned for its moisturizing properties, antioxidant benefits, and its ability to help balance sebum production, improving skin texture and appearance. Its ability to enhance the skin’s natural radiance, promote hydration, and provide gentle exfoliation has made it a popular choice in skincare formulations such as serums, creams, and masks. As consumers become more ingredient-conscious, and as the demand for clean-label products rises, the popularity of biofermented ingredients like GFF continues to grow across the global skincare market.

At the same time, global market trends in the cosmetic ingredients sector are driving the increased adoption of GFF. Fermented ingredients, including GFF, are becoming mainstream as the demand for microbiome-friendly and sustainable beauty products continues to rise. The fermentation process, which involves minimal chemical intervention, appeals to both environmentally conscious consumers and those seeking products that support long-term skin health without the risk of harsh chemicals. This global shift toward natural, clean, and functional skincare is particularly strong in established markets like North America and Europe, where consumers are highly educated about skincare benefits. Emerging markets, particularly in Asia-Pacific, are also showing significant growth in demand for GFF as more consumers turn to high-performance skincare products. As GFF becomes more widely recognized for its skin benefits, it is expected that its adoption across various beauty and skincare formulations will continue to expand, propelling the global market for Galactomyces ferment filtrate to grow steadily.

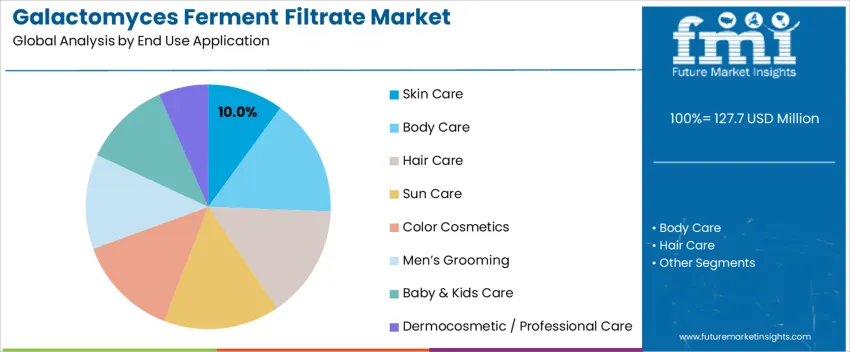

The global demand for galactomyces ferment filtrate is mainly influenced by application and product form. The largest demand is for skin care, which accounts for 10% of the market share, while powder is the leading product form, holding 17% of the demand. Galactomyces ferment filtrate is widely used for its hydrating, brightening, and anti-aging properties in various personal care products, contributing to its growing popularity worldwide.

Skin care is the leading application for galactomyces ferment filtrate globally, making up 10% of the market. The ingredient is valued in skin care for its ability to hydrate, brighten, and improve skin texture and elasticity. It is commonly included in products like moisturizers, serums, and facial masks, which are designed to address multiple skin concerns such as aging and uneven skin tone.

The increasing focus on clean, multifunctional beauty products drives the demand for galactomyces ferment filtrate in skin care. As consumers look for effective, natural ingredients, this ferment filtrate is gaining popularity in the market, particularly for anti-aging and skin repair applications. The growing demand for products with multiple skin benefits is expected to continue fueling the growth of galactomyces ferment filtrate in skin care globally.

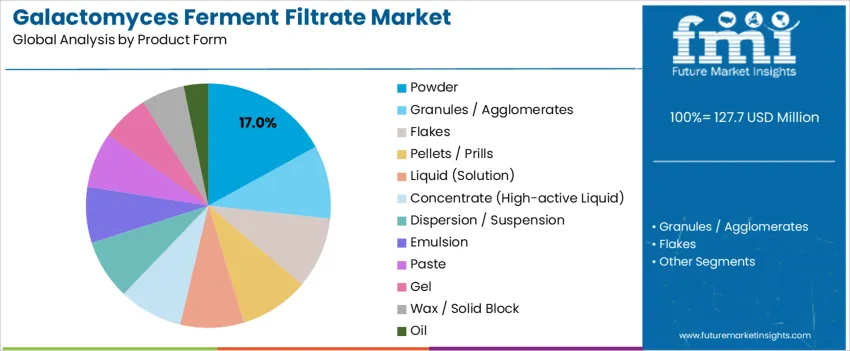

Powder is the most popular product form for galactomyces ferment filtrate globally, holding 17% of the market share. The powder form is preferred for its stability, ease of handling, and longer shelf life compared to liquid or gel forms. It is commonly used in products like masks, serums, and creams, where concentrated active ingredients are necessary.

The demand for powdered galactomyces ferment filtrate is driven by its versatility in formulation, particularly in professional and dermocosmetic applications. Powdered forms allow for customization and high potency, making them ideal for targeted skin treatments. As the demand for advanced, customizable beauty products grows, the powder form of galactomyces ferment filtrate is expected to continue its strong presence in the global market.

Demand for Galactomyces Ferment Filtrate (GFF) is increasing globally as consumers and skincare brands continue to seek out natural, fermentation-based ingredients. GFF, derived from yeast fermentation, is valued for its skin benefits, including moisture retention, skin barrier support, brightening, and pore reduction. Its popularity spans multiple regions, including East Asia, North America, and Europe, where there is a growing emphasis on natural skincare and functional ingredients. As the plant-based and clean beauty movement continues to expand, GFF is gaining recognition for its ability to provide effective skincare solutions without synthetic additives.

The demand for GFF is driven by several factors. First, the increasing adoption of plant-based, natural skincare products is pushing consumers towards fermentation-derived ingredients like GFF. These ingredients are known for their ability to improve skin health while offering a more sustainable and clean alternative to synthetic chemicals. Second, the rising global interest in multifunctional skincare that addresses multiple concerns, such as hydration, anti-aging, and skin brightening, makes GFF an appealing choice. Third, the growing presence of GFF in both retail and foodservice offerings, particularly in regions with established skincare traditions like East Asia, is expanding its reach. Additionally, the development of new and innovative formulations that incorporate GFF, including toners, serums, and masks, contributes to its increasing popularity across diverse consumer segments.

Despite the growth, there are several challenges to the widespread adoption of GFF. One of the main concerns is the potential for allergic reactions, especially for individuals with sensitivities to yeast or fungal ingredients. This can limit GFF’s appeal for certain consumers, particularly those with sensitive skin or conditions like fungal acne. Another limitation is the cost of production, as high-quality fermentation processes and strict quality control measures can increase the price of GFF products compared to synthetic alternatives. Additionally, some consumers may still prefer more familiar ingredients over newer, fermentation-based options. Finally, GFF’s availability in certain regions might be limited due to the complexity of sourcing and distributing yeast-derived products.

Several trends are driving the global demand for GFF. One prominent trend is the growing interest in microbiome-friendly skincare, which supports skin barrier function and overall health. GFF is increasingly recognized for its role in enhancing the skin’s natural moisture balance and strengthening the protective barrier. Additionally, the rise of clean beauty products, which prioritize safe and non-toxic ingredients, has accelerated the adoption of GFF in beauty formulations. The trend toward personalized skincare solutions, as well as the continued rise of e-commerce and direct-to-consumer beauty brands, is expanding the reach of GFF-based products. Furthermore, the increasing focus on sustainability, eco-friendly sourcing, and cruelty-free production in the beauty industry aligns with the values associated with fermentation-based ingredients like GFF.

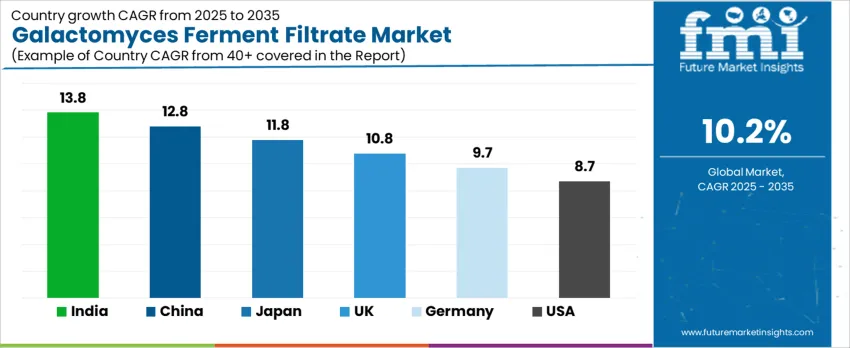

The demand for Galactomyces Ferment Filtrate (GFF) is rising globally, with varying growth trajectories across major markets. Demand in India leads at 13.8% CAGR, followed by China at 12.8%, Japan at 11.8%, UK at 10.8%, Germany at 9.7%, and USA at 8.7%. These differences reflect regional variation in consumer adoption of fermented-ingredient skincare, market maturity, and regulatory acceptance. As awareness of fermented cosmetics, natural actives, and skin-health oriented products grows, GFF is increasingly incorporated into skin care, anti-aging, and wellness formulations worldwide.

| Country | CAGR (%) |

|---|---|

| India | 13.8 |

| China | 12.8 |

| Japan | 11.8 |

| UK | 10.8 |

| Germany | 9.7 |

| USA | 8.7 |

In India, the projected 13.8% CAGR for GFF reflects a rising interest in premium skincare and natural cosmetic ingredients. Consumers increasingly seek products that offer benefits such as skin brightening, moisture barrier support, and anti-aging effects. GFF’s profile - rich in amino acids, antioxidants, and enzymes - makes it well suited to address skin concerns like uneven tone, dullness, and oxidative stress in urban Indian markets. Additionally, growing exposure to global skincare trends, rising disposable incomes, and increased penetration of international beauty brands contribute to adoption. Rapid expansion of e-commerce and beauty retail networks helps make GFF-based products more accessible to a broad consumer base. The combination of rising consumer awareness, demand for natural actives, and better access makes India a high-growth market for GFF.

In China, the 12.8% projected CAGR is driven by consumers’ growing appreciation for skincare products with functional ingredients. GFF is valued for its moisturizing, antioxidant, and potential brightening properties, aligning with Chinese consumers’ focus on complexion improvement, skin barrier health, and anti-aging. The popularity of fermented-ingredient cosmetics - partly influenced by K-beauty and J-beauty trends - supports rising incorporation of GFF in serums, essences, and face masks. Regulatory frameworks and growing manufacturing capacity for fermented actives further bolster supply. Beauty-focused social media, influencer marketing, and rising demand for premium skin treatments support growth in GFF adoption. As a result, China is among the fastest growing markets by demand for fermented cosmetic actives such as GFF.

In Japan, the 11.8% CAGR reflects long-standing acceptance of fermented cosmetics and advanced skincare routines. GFF, originally derived from sake-yeast fermentation, enjoys high recognition among Japanese consumers familiar with fermentation-based skin care. Research supports benefits of GFF such as anti-inflammaging, reduction in oxidative stress, improved skin barrier, and reduced hyperpigmentation. Japanese consumers’ preference for gentle but effective skin care, combined with the presence of established cosmetic manufacturers, ensures steady growth. Additionally, growing global demand boosts export opportunities from Japan, reinforcing domestic R&D and production. The familiarity and trust in GFF’s efficacy underlie its sustained demand growth in Japan.

In the UK, the 10.8% CAGR indicates increasing consumer interest in natural and fermented cosmetic ingredients. Rising awareness of skin health, demand for antioxidant and barrier-supportive formulations, and growing preference for “clean beauty” contribute to GFF’s appeal. GFF’s antioxidant, moisturizing and potential brightening properties make it suitable for European skin needs, where consumers often prioritise skin barrier and anti-aging care. The expanding range of skincare products incorporating fermented ingredients, supported by regulatory acceptance and growing e-commerce retail, further supports adoption. As more consumers seek gentle yet effective skincare, GFF is poised to gain prominence in the UK market.

Germany’s 9.7% projected CAGR reflects growing demand for scientifically supported, skin-friendly cosmetic actives and rising interest in sustainable and fermentation-derived ingredients. Consumers and dermatologists show increasing confidence in bio-fermented ingredients like GFF because of research showing antioxidative, barrier-protective, and anti-inflammaging effects. The regulatory environment in Europe values ingredient safety and transparency, which supports adoption of GFF in skincare. As consumers increasingly seek clean, efficacious, science-backed products rather than purely cosmetic finishes, GFF becomes a favorable ingredient in serums, essences, and anti-aging lines. Growth is moderate but steady as sustainability, ingredient transparency, and efficacy gain importance in German beauty market.

In the USA, the 8.7% CAGR reflects a growing but more conservative adoption of fermented cosmetic ingredients relative to Asia and parts of Europe. GFF appeals to consumers interested in functional skincare - especially antioxidant protection, barrier support, anti-aging and evening skin tone. Clinical and laboratory studies have demonstrated GFF’s ability to reduce oxidative stress, support skin barrier and improve signs of skin aging when applied over time. The “clean beauty” and natural ingredient movement supports incremental demand growth. However, relative to regions with stronger fermented-cosmetic traditions, the adoption curve is gentler. Growing interest in sustainability, ingredient transparency, and mild yet effective skin care suggests steady long-term growth for the US GFF market.

The global market for Galactomyces Ferment Filtrate (GFF) has been growing, driven by consumer demand for natural, sustainable, and effective skincare ingredients. GFF, derived from the fermentation of galactomyces yeast, is prized for its multifunctional benefits such as brightening the skin, enhancing the skin barrier, and providing antioxidant protection. As consumers become more conscious of skincare ingredients, there has been a shift toward natural actives that provide visible results with fewer chemicals. The increasing trend toward clean and green beauty products has further elevated the demand for fermented ingredients like GFF.

Rising global skincare consumption, boosted by an aging population and higher disposable incomes, also supports the growth of this market. Furthermore, the demand for anti-aging, brightening, and moisturizing properties, which GFF provides, aligns well with the beauty industry's focus on enhancing skin health. The increasing preference for plant-based and eco-friendly ingredients, along with a focus on sustainability, positions GFF as a leading ingredient in the cosmetics market. The key regions driving the demand include North America, Europe, and parts of Asia Pacific, where consumers are increasingly seeking out premium, naturally derived skincare solutions.

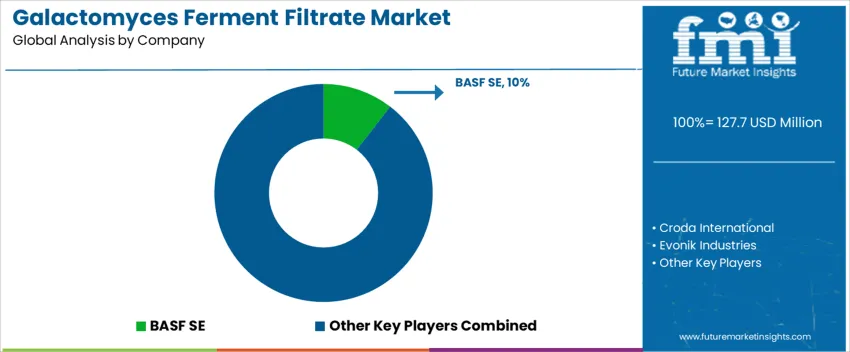

In this competitive market, several major players are vying for market share by providing high-quality, naturally derived products. BASF SE, which holds a notable share, is a leader in supplying GFF and other fermented actives. Other prominent players include Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant, and Seppic, along with additional suppliers like Lubrizol, Lonza, and Inolex.

These companies are differentiating themselves by their ability to offer consistent, high-quality GFF with a focus on advanced fermentation processes that ensure product purity and stability. Research and development are key factors driving innovation within the market, as firms seek to develop new benefits or applications for GFF in skincare.

As the market for fermented skincare ingredients continues to grow, companies with strong supply chains, eco-friendly production practices, and a diverse portfolio of active ingredients are best positioned to lead the market. Regulatory compliance, especially in the global cosmetic market, also remains a significant competitive factor.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America, Europe, Asia Pacific, The Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic / Others (Seppic, Lubrizol, Lonza, Inolex, etc.), Others |

| Additional Attributes | Dollar sales by end-use application and product form highlight strong demand for galactomyces ferment filtrate, particularly in skin care and body care products. Liquid solutions and emulsions are the most popular product forms, with concentrate forms also growing in demand. Major companies like BASF, Evonik, and Ashland dominate the market, providing a range of active ingredients for the cosmetic and dermocosmetic industries. The market is expected to grow with rising demand for innovative skincare solutions and natural ingredients. |

The global galactomyces ferment filtrate market is estimated to be valued at USD 127.7 million in 2025.

The market size for the galactomyces ferment filtrate market is projected to reach USD 338.5 million by 2035.

The galactomyces ferment filtrate market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in galactomyces ferment filtrate market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 17.0% share in the galactomyces ferment filtrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Rice Filtrate Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Ferment Filtrates Market Size and Share Forecast Outlook 2025 to 2035

Saccharomyces Ferment Filtrate Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Enhancers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Filtrate Sampler Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA