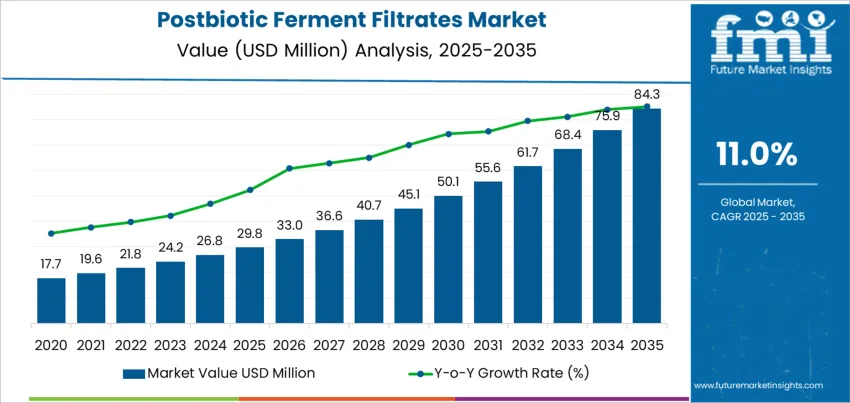

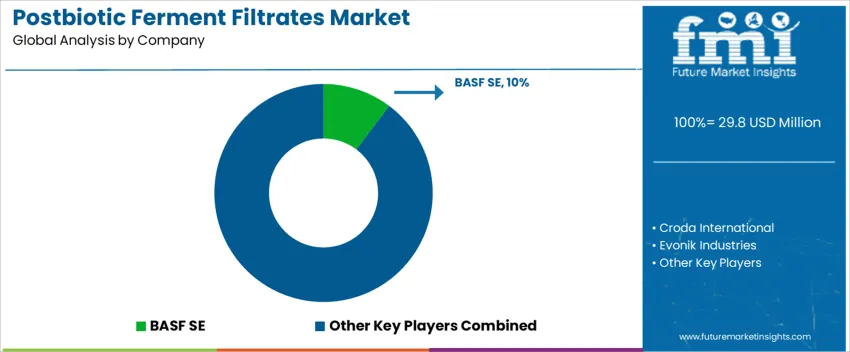

In 2025, the postbiotic ferment filtrates market is valued at USD 29.8 million and is projected to reach USD 84.3 million by 2035 at a CAGR of 11.0%. Early growth is driven by rising demand from skin care and dermocosmetic applications, where formulators use postbiotic actives for barrier repair, anti-irritation performance, and microbiome balance claims. Powder, liquid solutions, and concentrated high-active liquids dominate commercial production due to formulation flexibility across serums, creams, and cleansers. Body care, hair care, sun care, and baby care gradually expand adoption as safety profiles and efficacy documentation improve. BASF SE, Croda International, Evonik Industries, Symrise, Dow, Ashland, Clariant, and Seppic shape early supply through fermentation scale-up, downstream filtration control, and standardized bioactive consistency.

After 2030, demand accelerates as use broadens into color cosmetics, men's grooming, and professional care systems. Market value rises from about USD 50.1 million in 2030 toward USD 84.3 million by 2035 as postbiotic ingredients shift from niche actives into core formulation platforms. Emulsions, dispersions, gels, and oil-based systems gain a larger share as product formats diversify across leave-on and rinse-off categories. Competitive strategies focus on higher bioactive concentration, tighter batch-to-batch reproducibility, and integration with multifunctional cosmetic bases. Growth also reflects wider regulatory acceptance of postbiotics as non-living bioactives, which lowers formulation risk in mass market products. Contract fermenters and specialty ingredient suppliers expand toll production and co development programs to support brand specific bioactive positioning across global personal care portfolios.

Global demand for postbiotic ferment filtrates expands from USD 29.8 million in 2025 to USD 84.3 million by 2035, reflecting an 11.0 % growth trajectory and an absolute value creation of USD 54.5 million over the decade. This expansion builds on the early foundation laid between 2020 and 2024, when the market already climbed from USD 17.7 million to USD 26.8 million. The value increase is driven by the shift from live probiotic dependence toward shelf-stable bioactive alternatives with longer formulation life, lower cold-chain exposure, and broader regulatory acceptance in skin care, medical nutrition, and functional foods. Postbiotic filtrates gain traction because they deliver predictable bioactivity without viability risk.

The growth pattern shows a clear acceleration after 2030 rather than a front-loaded spike. From 2025 to 2030, the market rises from USD 29.8 million to USD 50.1 million, adding USD 20.3 million as adoption spreads across premium cosmetics, infant nutrition, and gut health supplements. From 2030 to 2035, value expands more sharply from USD 50.1 million to USD 84.3 million, adding USD 34.2 million as postbiotics shift from emerging ingredients to core formulation components. This back-weighted pattern reflects compounding demand across multi-channel consumer health platforms, growing clinical validation, and wider manufacturing standardization that supports higher-volume commercial deployment.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 29.8 million |

| Forecast Value (2035) | USD 84.3 million |

| Forecast CAGR (2025–2035) | 11.0% |

The global postbiotic ferment filtrates market began evolving when formulators recognized limits in traditional probiotic products. Live microbes required cold chains, careful handling, and still lost viability during processing and storage. By contrast, cell free filtrates captured metabolites, peptides, and cell wall fragments in a stable form. This allowed food, supplement, and skin care developers to claim microbiome linked functionality without managing live cultures. Historical growth has been strongest where mature probiotic categories already existed, because brands could extend portfolios with more shelf stable line extensions. Scientific work on immune function, skin barrier support, and gut comfort shifted attention from live counts to defined bioactive components, reinforcing adoption. Quality teams viewed non-viable ferments as easier to classify and distribute.

Future development of postbiotic ferment filtrates will depend on how clearly the industry links them to specific outcomes. Brands increasingly position these filtrates around immune resilience, skin appearance, digestive comfort, and healthy aging, which broadens potential categories. Growth will likely outpace older probiotic formats because formulators gain room to work with heat treated ingredients, ambient distribution, and complex blends. At the same time, several barriers constrain momentum. Regulators require precise description of origin, composition, and safety, slowing launch timelines. Clinicians demand more controlled trials before supporting strong benefit statements. Manufacturing groups must standardize fermentation, filtration, and analytics to guarantee batch consistency. Pricing, consumer confusion about postbiotics, and strong competition from probiotics and prebiotics will temper adoption over the coming years.

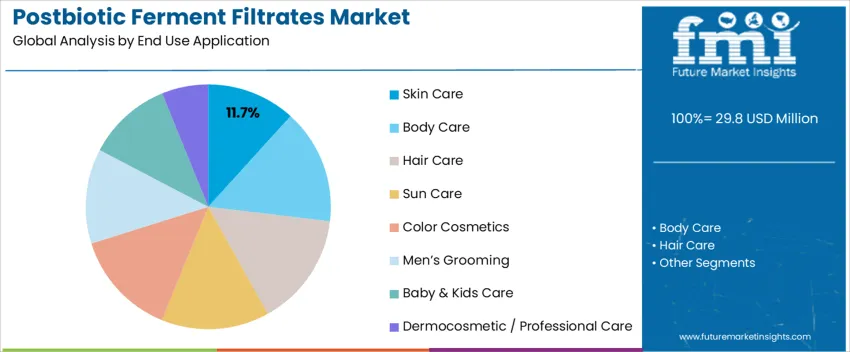

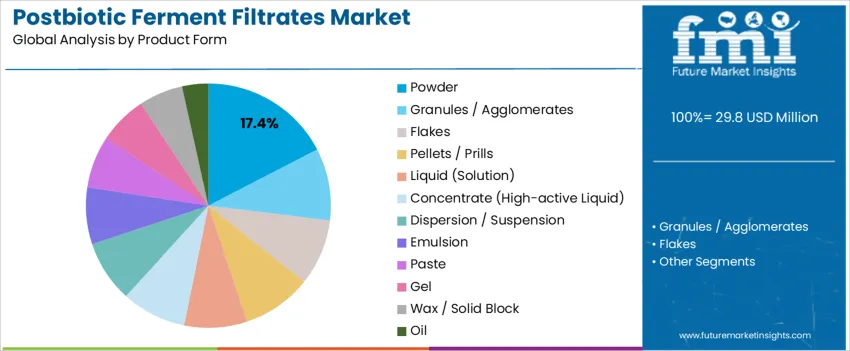

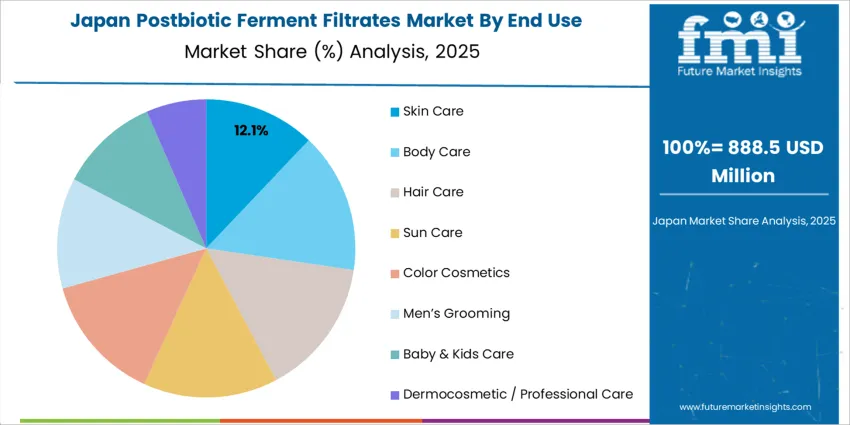

Global demand for postbiotic ferment filtrates is structured by end use application and product form, with consumption concentrated across East Asia, Western Europe, and North America. Skin care represents an 11.7% share, supported by formulation activity in South Korea, Japan, France, and the USA. Body care, hair care, sun care, color cosmetics, men grooming, baby and kids care, and dermocosmetic or professional care follow across both mass and professional channels. On the product form side, powders hold a 17.4% share alongside granules, flakes, pellets, liquid solutions, high active concentrates, dispersions, emulsions, pastes, gels, wax blocks, and oils. Selection patterns reflect stability needs, microbial metabolite preservation, and formulation compatibility across regional production hubs.

Skin care accounts for 11.7% of global postbiotic ferment filtrate usage. This position is supported by growing integration of postbiotic actives into facial creams, serums, masks, and cleansers aimed at barrier support, irritation control, and surface balance. Postbiotic filtrates offer functional benefits without the stability limitations of live cultures, which simplifies formulation and storage. Demand remains strongest across South Korea, Japan, Western Europe, and the USA, where microbiome aligned cosmetic positioning continues to expand in both clinical and retail categories.

Skin care also shows higher active concentration per unit compared with rinse off body and hair formats. Dermocosmetic brands increasingly rely on postbiotic ingredients to support use in sensitive and post treatment skin routines. Product development in France, Germany, and the USA emphasizes fermented metabolite systems for redness control and hydration maintenance. These formulation trends reinforce skin care as the leading global application for postbiotic ferment filtrates.

Powder form holds a 17.4% share of global postbiotic ferment filtrate demand. This dominance reflects superior shelf stability, reduced sensitivity to moisture, and consistent active concentration during storage and blending. Powders allow precise dosage control in emulsions, gels, masks, and dry cosmetic formats, which supports standardized quality across large batch manufacturing in Asia, Europe, and North America.

Powder formats also improve logistics efficiency across international supply chains by lowering leakage risk and reducing dependence on cold storage. Contract manufacturers favor powders for compatibility with automated dosing systems and predictable dispersion behavior. Regulatory documentation and export handling remain more standardized for dry biological inputs than for liquid alternatives. These processing, transport, and compliance advantages sustain powder as the dominant global product form for postbiotic ferment filtrates.

Global demand for postbiotic ferment filtrates is being driven by the need for microbiome-active ingredients that do not depend on live bacterial viability. Food, supplement, and cosmetic manufacturers favor postbiotics because they remain stable under heat, pressure, and extended shelf life. This makes them suitable for beverages, gummies, powders, creams, and serums without refrigeration. Consumer interest in gut–skin–immune linkage strengthens demand across wellness and personal care. Markets with weak cold-chain infrastructure adopt postbiotics faster than probiotics. These functional, logistical, and formulation advantages position postbiotic filtrates as scalable microbiome solutions.

Postbiotic ferment filtrates allow formulators to achieve consistent biological activity without the survival losses seen in live cultures. Their functional compounds such as organic acids, peptides, and signaling molecules work across a wider pH and temperature range. Beverage producers use them in clear drinks without sedimentation risk. Skin-care brands apply them for barrier repair and inflammation control without microbial contamination concerns. Nutraceutical firms integrate them into shelf-stable capsules and sachets. These formulation freedoms allow postbiotics to move across categories that were previously difficult for probiotics to enter.

Postbiotic ferment filtrates face regulatory ambiguity in several regions where definitions remain inconsistent between food, supplement, and cosmetic oversight bodies. This slows standardized claim development and labeling clarity. Manufacturing costs remain higher than conventional plant extracts due to controlled fermentation, filtration, and quality assurance requirements. Consumer awareness also lags behind probiotics and prebiotics, creating education barriers at retail level. In food and beverage applications, acidic sensory profiles limit dosage inclusion. These regulatory, cost, and communication constraints prevent postbiotics from moving as rapidly into mass-market penetration.

Postbiotic development is shifting toward strain-specific fermentation designed to generate defined metabolite profiles rather than broad mixed extracts. Skin-focused postbiotics targeting sensitivity, acne, and barrier recovery are expanding rapidly. In nutrition, hybrid synbiotic systems combining prebiotics with postbiotics are gaining traction. Clear functional shots and microbiome beverages using non-cloudy postbiotics are emerging as premium formats. Ingredient suppliers also emphasize traceability and process control to support brand trust. These trends show postbiotics transitioning from experimental adjuncts into engineered, application-specific functional ingredients.

| Country | CAGR (%) |

|---|---|

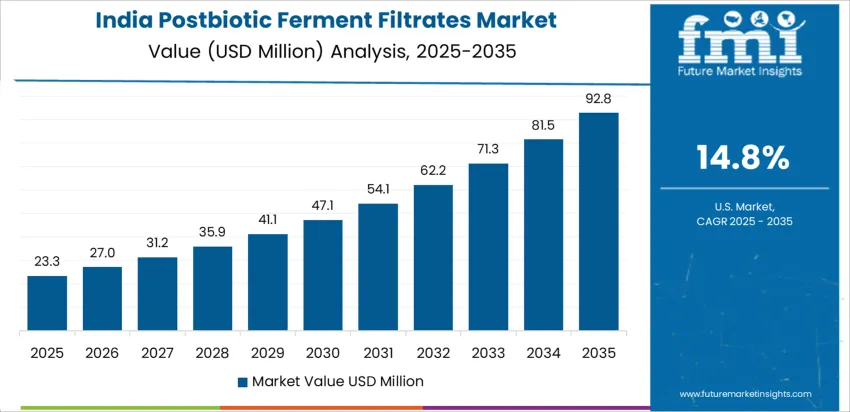

| India | 14.8% |

| China | 13.7% |

| Japan | 12.6% |

| UK | 11.5% |

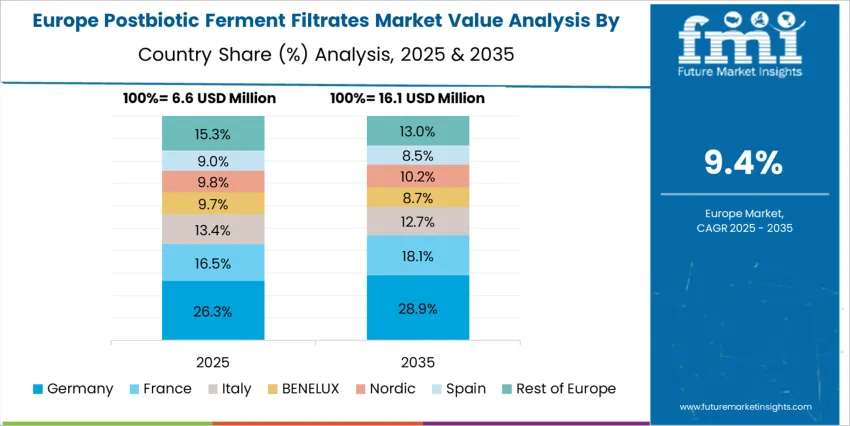

| Germany | 10.4% |

| USA | 9.3% |

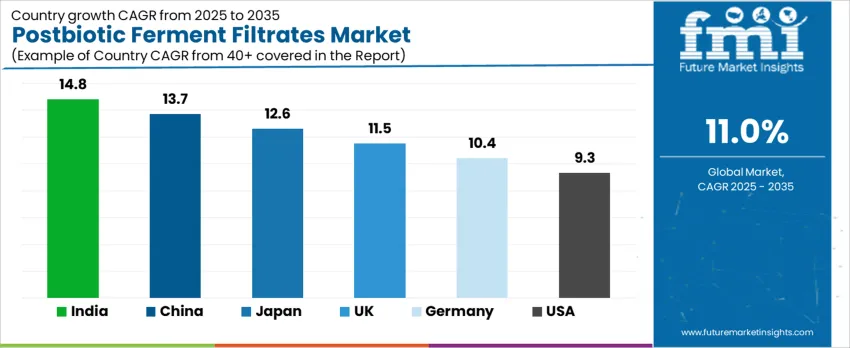

The global postbiotic ferment filtrates market is projected to grow robustly across several major countries, with India leading at a 14.8% CAGR, driven by rising health-conscious consumers and growing adoption of functional food and skincare products incorporating postbiotics. China follows at 13.7%, supported by expanding production capacities, increasing consumer interest in gut and skin health, and rising domestic demand for advanced bio-ingredient products. Japan at 12.6% shows stable growth as postbiotic-derived products gain traction in nutrition and cosmetics markets. The UK and Germany record 11.5% and 10.4% growth respectively, reflecting growing acceptance of postbiotic formulations in dietary supplements and personal care products. The USA shows a 9.3% CAGR, indicating a mature but gradually expanding market.

India records a CAGR of 14.8% through 2035 for postbiotic ferment filtrate growth, driven by rising interest in microbiome science, expanding dermatology use, and growing functional beverage development. Cosmetic and personal care manufacturers increasingly adopt postbiotic ingredients for skin barrier repair and anti inflammation positioning. Nutraceutical brands integrate filtrates into gut health and immunity focused formulations. Domestic fermentation capacity expansion improves supply reliability and cost efficiency. Growth is supported by strong online wellness retail traction and rapid adoption of science led skincare across urban consumer segments.

China posts a CAGR of 13.7% through 2035 for postbiotic ferment filtrate growth, supported by strong demand from premium skincare, infant nutrition, and immune health supplement segments. Cosmetic brands emphasize microbiome friendly formulations to address sensitivity and hydration concerns. Dairy alternative beverages and sachet based supplements expand consumer access. Domestic biotech firms scale up filtration and strain processing capability. Demand tracks rising health spending among urban populations and premium personal care adoption across tier one and tier two cities with growing middle income households.

Japan reflects a CAGR of 12.6% through 2035 for postbiotic ferment filtrate growth, shaped by advanced cosmetic science, fermented food integration, and clinical grade skincare positioning. Postbiotics are used in toners, serums, and functional drinks targeting skin sensitivity and aging concerns. High consumer trust in fermentation based actives supports long term use. Medical esthetic clinics and pharmacy retail guide structured adoption. Growth remains driven by formulation refinement and ingredient performance benchmarking rather than rapid expansion in base consumption.

The UK records a CAGR of 11.5% through 2035 for postbiotic ferment filtrate growth, supported by clean beauty adoption, gut skin axis awareness, and rising demand for functional cosmetics. Indie beauty brands and pharmacy chains expand postbiotic based product lines. Sports nutrition and hydration beverages integrate postbiotics for recovery and digestion support. Consumer interest in microbiome balance strengthens supplement uptake. Growth aligns with wellness driven discretionary spending rather than medicinal positioning, with lifestyle beauty applications driving the majority of new product launches.

Germany shows a CAGR of 10.4% through 2035 for postbiotic ferment filtrate growth, supported by pharmaceutical grade skincare, medical nutrition use, and strict formulation quality standards. Dermatology clinics and apothecary retail favor postbiotics for barrier repair and inflammation control. Functional food brands selectively integrate filtrates into digestive health products. Regulatory discipline reinforces cautious but consistent adoption. Growth remains led by clinical credibility and pharmacy distribution rather than rapid lifestyle beauty uptake, maintaining steady volume expansion aligned with therapeutic skin and gut care applications.

The USA records a CAGR of 9.3% through 2035 for postbiotic ferment filtrate growth, shaped by skincare innovation, sports nutrition expansion, and microbiome focused product development. Serums, creams, and ingestible powders represent leading formats. Direct to consumer beauty brands accelerate formulation trials. Sports recovery beverages integrate postbiotics for gut and performance support. Growth remains controlled due to ingredient cost sensitivity and high competition among active cosmetic ingredients. Demand focuses on targeted performance benefits rather than broad mass market penetration.

Global demand for postbiotic ferment filtrates is rising as interest in microbiome-based health, skin-microbiota care, and functional nutrition expands worldwide. Postbiotics, which are non-living microbial components or metabolites derived from fermentation, offer stability, safety, and consistency compared with live probiotics. They are increasingly incorporated into dietary supplements, functional foods and beverages, personal care and cosmetic products, and animal nutrition. Growing scientific validation of postbiotic benefits for gut health, immune support, skin barrier function, and overall wellness supports broader acceptance among manufacturers and consumers. The versatility of postbiotic filtrates across ingestible and topical applications drives global adoption and encourages innovation in product development.

Key players shaping the global market include BASF SE, Croda International, Evonik Industries, Symrise including IFF and Givaudan active ingredients, Dow Inc., Ashland, Clariant, and specialist ingredient providers such as Seppic, Lubrizol, Lonza, and Inolex. BASF SE and Croda International are prominent suppliers of postbiotic ferment filtrates and hold a significant global presence. Evonik and Symrise provide specialty formulations for diverse applications. Dow, Ashland, and Clariant focus on niche and regional product solutions, while smaller biotech and specialty firms supply custom or application-specific postbiotic ingredients. These companies collectively shape the market by providing high-quality, reliable products and supporting global adoption across multiple industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care, Functional Foods, Dietary Supplements, Medical Nutrition |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, plus 40+ additional countries globally |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow Inc., Ashland, Clariant, Seppic / other regional or niche ingredient suppliers |

| Additional Attributes | Dollar value breakdown by application and product form; regional and global CAGR projection; increasing adoption across cosmetics, personal care, functional foods, and nutraceuticals; emphasis on formulation flexibility (powder, liquid, emulsion, gel, etc.); growing regulatory acceptance for non viable bioactive filtrates; trend toward contract fermentation & toll manufacture; global distribution network covering developed and emerging markets; focus on batch consistency, stability, and global supply chain scalability. |

The global postbiotic ferment filtrates market is estimated to be valued at USD 29.8 million in 2025.

The market size for the postbiotic ferment filtrates market is projected to reach USD 84.3 million by 2035.

The postbiotic ferment filtrates market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in postbiotic ferment filtrates market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 17.4% share in the postbiotic ferment filtrates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Rice Filtrate Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Enhancers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermentation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA