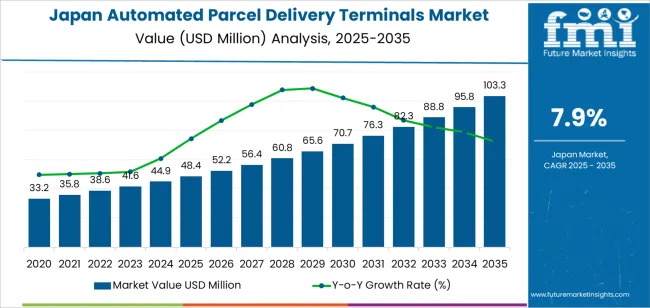

In 2025, demand for automated parcel delivery terminals in Japan is valued at USD 48.4 million and is projected to reach USD 103.3 million by 2035, reflecting a CAGR of 7.9%. The early part of the curve, from 2025 to around 2030, shows demand rising from USD 48.4 million to roughly USD 70.7 million, driven by e commerce expansion, high urban population density, and pressure on last mile delivery costs. Peak usage growth appears around the phase when large logistics groups, convenience store chains, and real estate operators roll out dense locker networks in major metropolitan areas. During this period, utilization rates increase and network coverage becomes a key competitive factor across parcel operators.

After this early peak growth phase, the curve begins to flatten as installation density in core cities approaches practical saturation. Between 2030 and 2035, demand rises from about USD 70.7 million to USD 103.3 million, with growth shifting from new greenfield deployments toward upgrades, software enhancements, and expansion into secondary cities and suburban zones. The trough periods in growth appear where macroeconomic pressures and cautious capital spending slow new terminal projects. Suppliers and logistics operators respond with modular systems, retrofit friendly designs, and data driven placement strategies, aiming to raise throughput per terminal rather than relying solely on new unit additions.

From 2020 to 2025 demand for automated parcel delivery terminals in Japan rises from USD 33.2 million to 48.4 million, giving early movers room to consolidate share while the market is still forming. Network operators linked to postal groups and large parcel carriers tend to hold the highest installation density, capturing most urban and transit hub locations. Between 2025 and 2030, as demand climbs from 48.4 million to 70.7 million, second tier logistics providers, real estate owners, and convenience store chains begin deploying branded lockers, slowly eroding the dominance of the initial three or four networks. Market share shifts at this stage are gradual because hardware standards, integration requirements, and location contracts limit rapid switching for incumbent networks in transition.

From 2030 to 2035 market value grows from USD 70.7 million to 103.3 million, and the Market Share Erosion or Gain profile becomes more pronounced. Fast growing e commerce platforms, parcel aggregators, and software centric locker managers add capacity faster than legacy players focused on owned hardware. Their emphasis on open APIs, white label cabinets, and data driven route allocation enables penetration into secondary cities and residential clusters that were previously under served. Established networks still grow in absolute revenue terms but surrender relative share where contract terms are rigid or upgrade cycles are slow. The winners in this phase are operators that convert hardware scale into flexible access models for retailers and carriers across dense urban and suburban corridors.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 48.4 million |

| Forecast Value (2035) | USD 103.3 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

The rise of online shopping in Japan has increased demand for efficient parcel delivery options and helped drive interest in automated parcel delivery terminals. Growth of e-commerce has resulted in higher volumes of parcels needing delivery and pickup. This has created pressure on logistics providers to offer more flexible, secure, and time-efficient delivery solutions. Automated parcel delivery terminals offer a pickup option that avoids missed deliveries, reduces delivery times, and provides 24/7 access for customers.

Looking ahead, demand for automated parcel delivery terminals in Japan will likely increase as urbanisation continues and last-mile delivery becomes more critical. Expansion of high-density residential buildings and mixed-use complexes will favor installation of parcel lockers and smart delivery terminals. Pressure on logistics companies to reduce costs and maintain high service reliability will support deployment of indoor and outdoor automated terminals. Adoption of smart locker networks and IoT-based tracking systems will encourage investment in parcel terminal infrastructure. As e-commerce and delivery volumes grow, automated delivery terminals offer a scalable solution for parcel handling and retrieval.

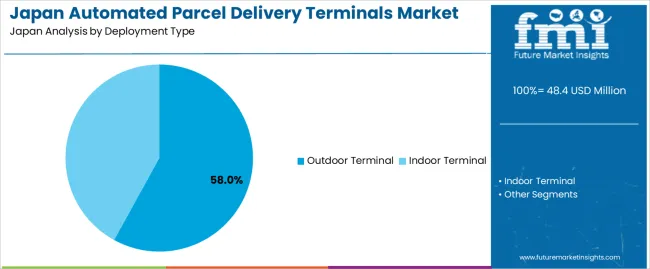

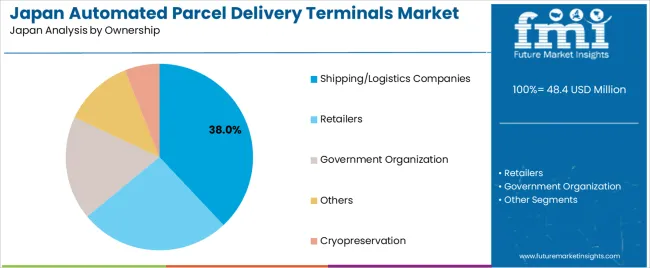

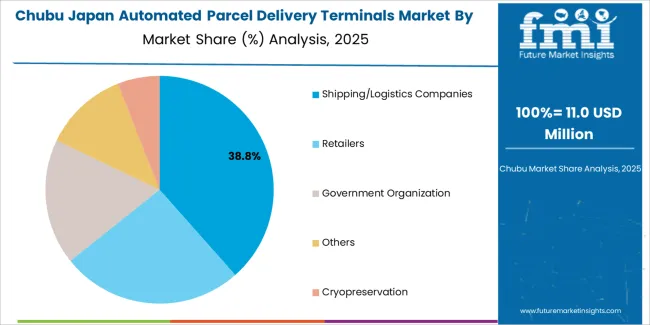

The demand for automated parcel delivery terminals in Japan is determined by deployment type and ownership structure. Outdoor terminals account for 58% of total installations, reflecting their suitability for high traffic residential and transit locations. Indoor terminals serve retail buildings, offices, and controlled access facilities. By ownership, shipping and logistics companies lead with a 38% share, followed by retailers, government organizations, and other operators. Demand patterns reflect delivery volume concentration, real estate availability, security needs, and service accessibility. These segments illustrate how operator scale and placement strategy shape terminal deployment across urban, suburban, and mixed use logistics environments.

Outdoor automated parcel delivery terminals account for 58% of total demand in Japan. Their dominance is linked to their ability to operate continuously in open access environments such as residential complexes, train stations, and roadside hubs. Outdoor terminals support unattended parcel pickup, which aligns with high frequency delivery cycles in dense urban neighborhoods. Weather resistant enclosures and vandal resistant structures allow reliable operation under varied climate and traffic conditions. These installations reduce failed delivery attempts and lower repeat handling costs for carriers managing time constrained urban routes.

Municipal zoning and property access policies also support outdoor terminal placement near public transit and large housing blocks. Installation does not require integration with existing indoor floor plans, which reduces setup timelines. Maintenance activities can be scheduled without disrupting building operations. High usage rates in 24 hour public settings improve return on investment for operators. These operating advantages reinforce outdoor terminals as the primary deployment format across cities where last mile parcel volumes remain structurally elevated.

Shipping and logistics companies represent 38% of total ownership of automated parcel delivery terminals in Japan. This leadership reflects direct alignment between terminal networks and core delivery operations. Carriers use terminals to consolidate drop density, lower redelivery rates, and improve route efficiency. Terminals enable batch delivery to single locations serving hundreds of recipients. This reduces vehicle dwell time and improves utilization across urban and suburban service zones. Ownership allows logistics firms to control placement strategy based on route engineering and parcel flow analytics.

Terminal ownership also supports service differentiation through time flexible pickup options. Carriers integrate terminal access with shipment tracking systems to provide end recipients with real time collection notifications. This improves service reliability without increasing driver labor hours. Capital investment in terminals is justified by long term cost reduction across fuel, labor, and missed delivery handling. These cross functional efficiencies continue to reinforce shipping and logistics companies as the primary terminal owners within the national deployment structure.

Demand for automated parcel delivery terminals in Japan is driven mainly by the sharp rise in home deliveries linked to e-commerce, grocery ordering, and subscription-based retail. High rates of failed first-time deliveries in dense urban housing clusters make unattended delivery a persistent operational problem for logistics firms. Labour shortages in the courier workforce increase pressure to cut repetitive door-to-door attempts. Consumer preference for 24-hour pickup flexibility matches the lifestyle of long working hours. Railway stations, apartments, and convenience stores already function as logistics nodes, which supports steady expansion of parcel terminal installations.

Japanese cities combine extreme population density with limited parking, narrow streets, and strict delivery timing windows. These conditions increase per-parcel delivery cost and reduce vehicle productivity. Automated parcel terminals allow multiple deliveries in one stop rather than sequential door drops, lowering time and fuel usage per package. Property developers also install lockers as a standard amenity to increase rental appeal in urban housing. For logistics providers, parcel terminals act as fixed consolidation points that stabilize delivery planning under congestion and time constraints. These urban cost pressures make lockers structurally attractive across Japan’s metropolitan regions.

Despite strong fundamentals, rollout of automated parcel terminals in Japan faces location and acceptance limits. Installation requires landlord approval in dense apartment buildings and public space agreements near stations. High equipment cost and long payback periods restrict rapid deployment outside prime urban zones. Older residents and users without smartphones may find digital locker systems less accessible. Rural areas with low parcel density do not justify hardware investment on commercial terms. These physical, demographic, and cost constraints slow uniform national penetration and keep deployment concentrated in high-traffic residential and transit corridors.

Parcel terminals in Japan are transitioning from single-carrier lockers to shared multi-operator networks that handle deliveries from multiple couriers. System design now prioritises compact footprints, high turnover capacity, and secure digital access through QR codes and mobile authentication. Temperature-controlled compartments for groceries and pharmaceuticals are gaining importance as cold-chain delivery expands. Retail-linked pickup points and station-adjacent lockers are increasing network reach without heavy real-estate cost. These technology and placement trends show parcel terminals becoming standardized logistics infrastructure rather than optional last-mile add-ons.

| Region | CAGR (%) |

|---|---|

| West | 9.8% |

| South | 9.1% |

| Northeast | 8.0% |

| Midwest | 7.0% |

| Others | 5.8% |

The demand for automated parcel delivery terminals in the USA is expected to rise significantly across all regions with the West leading at a 9.8% CAGR. This strong growth reflects expanding e-commerce volumes, rising consumer preference for convenient 24/7 parcel pickup, and increasing adoption of locker-based last-mile delivery infrastructure. The South at 9.1% and Northeast at 8.0% follow, driven by growing urban populations and logistics investments. The Midwest shows a 7.0% CAGR, reflecting more moderate but steady uptake of parcel locker networks as delivery services modernize. The “Others” segment at 5.8% signals emerging demand in less dense or rural areas as infrastructure expands nationwide. The overall growth underscores the shift toward contactless, efficient parcel distribution systems across the country.

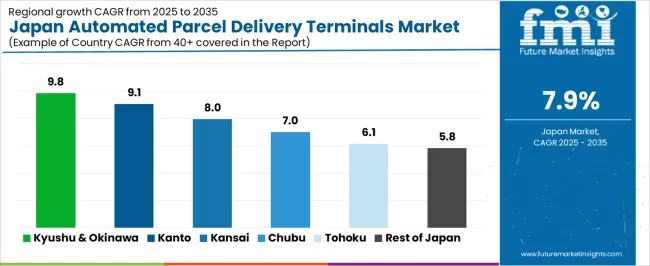

Expansion in Kyushu and Okinawa reflects a CAGR of 9.8% through 2035 for automated parcel delivery terminal demand, driven by rising e commerce penetration and growing interisland logistics activity. Urban centers such as Fukuoka generate high parcel volumes from retail and food delivery platforms. Tourism led consumption further increases last mile delivery pressure. Limited storage access in residential zones supports terminal installation near transit hubs and apartment complexes. Courier operators prioritize unattended delivery infrastructure to reduce redelivery costs and improve service reliability across island and mainland routes with consistent residential turnover.

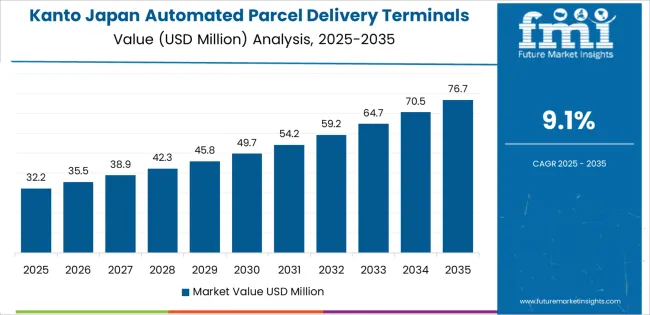

Kanto advances at a CAGR of 9.1% through 2035 for automated parcel delivery terminal demand, supported by Japans highest parcel traffic density and extensive multi channel retail networks. Tokyo metropolitan logistics generates continuous pressure on doorstep delivery capacity. High rise residential development increases dependency on shared delivery infrastructure. Retailers integrate locker based fulfillment to reduce failed delivery attempts. Courier companies prioritize networked terminal deployment near rail stations, mixed use developments, and office corridors. Demand aligns closely with same day delivery growth and urban congestion management strategies across greater Kanto.

Kinki records a CAGR of 8.0% through 2035 for automated parcel delivery terminal demand, supported by dense commercial zones and strong retail distribution activity in Osaka and surrounding cities. Warehouse automation growth links directly with last mile infrastructure investment. Residential parcel volumes rise due to food delivery and apparel ecommerce demand. Space limitations in older urban housing increase use of shared terminal systems. Courier networks expand installations across transit corridors and shopping districts. Demand remains tied to consistent urban consumer purchasing behavior rather than industrial freight movement.

Chubu expands at a CAGR of 7.0% through 2035 for automated parcel delivery terminal demand, driven by balanced residential parcel volume and industrial ecommerce fulfillment. Manufacturing related spare parts logistics contribute to business to consumer shipments. Suburban housing demand supports steady terminal installation near local commercial centers. Automotive workforce communities rely on unattended delivery for shift based work patterns. Regional fulfillment centers integrate lockers to manage peak seasonal surges. Deployment remains moderately paced due to lower population density compared with Kanto and Kinki but benefits from stable logistics planning.

Tohoku shows a CAGR of 6.1% through 2035 for automated parcel delivery terminal demand, shaped by gradual ecommerce adoption and dispersed settlement patterns. Residential parcel volume grows steadily but remains below urban intensities. Installation centers on municipal hubs, hospital districts, and university zones. Courier operators favor cluster based placement to optimize service routes. Harsh winter conditions reinforce the need for protected unattended delivery solutions. Growth remains stable rather than rapid due to moderate population densities and longer intercity transport distances affecting same day delivery penetration rates.

The rest of Japan reflects a CAGR of 5.8% through 2035 for automated parcel delivery terminal demand, supported by steady growth in rural ecommerce adoption and municipal logistics services. Low population density limits large scale rollout but supports targeted installations near supermarkets, fuel stations, and town centers. Aging households increase demand for secure unattended parcel reception. Courier investment focuses on reducing redelivery travel distances rather than volume maximization. Demand stability depends on local government partnerships and community retail platforms integrating parcel services into daily rural consumption patterns.

Demand for automated parcel delivery terminals in Japan is rising as e commerce expands and consumers expect flexible, contactless delivery options. Urban density and limited residential space make locker based delivery attractive because it reduces failed deliveries and simplifies pickup. Parcel lockers placed in apartment buildings, retail hubs, and transit oriented complexes offer convenience for busy customers. Logistics and courier companies favour these terminals to streamline last mile delivery operations, reduce repeated delivery attempts, and manage rising parcel volumes efficiently. The shift toward parcel locker networks supports higher throughput, lowers distribution costs, and improves reliability in a market where prompt delivery and user convenience are important.

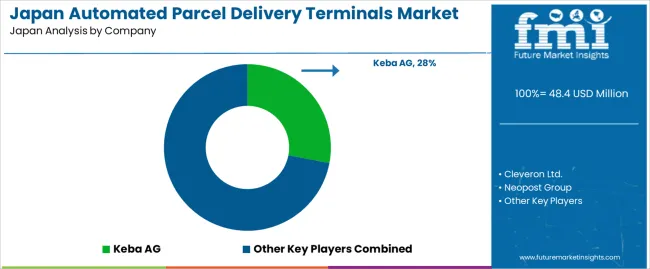

Among global terminal providers, a small number of firms lead the market. Keba AG is notable for advanced automation and locker systems; Cleveron Ltd. and Neopost Group supply modular smart locker solutions and have been cited among key global vendors. Smartbox Ecommerce Solutions Pvt. Ltd. and Winsen Industry Co., Ltd. also contribute with scalable systems suited to high volume delivery flows. In global comparison, Keba AG together with another major vendor control roughly 28% of the overall automated parcel delivery terminal market. This share indicates a moderate concentration but leaves room for regional players to capture meaningful segments in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Deployment Type | Outdoor Terminal, Indoor Terminal |

| Ownership | Shipping/Logistics Companies, Retailers, Government Organization, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Keba AG, Cleveron Ltd., Neopost Group, Smartbox Ecommerce Solutions Pvt. Ltd., Winsen Industry Co., Ltd. |

| Additional Attributes | Dollar by sales by deployment type and ownership; regional CAGR and volume growth projections; outdoor vs indoor terminal share; shipping/logistics company vs retailer vs government ownership proportion; urban vs suburban deployment trends; density saturation in core cities; software and modular upgrade adoption; integration with e-commerce platforms; multi-operator and white label locker networks; IoT tracking and cold-chain enabled compartments; influence of population density and urbanization; optimization for last-mile efficiency; cost and capital expenditure considerations; replacement vs new installations. |

The demand for automated parcel delivery terminals in Japan is estimated to be valued at USD 48.4 million in 2025.

The market size for the automated parcel delivery terminals in Japan is projected to reach USD 103.3 million by 2035.

The demand for automated parcel delivery terminals in Japan is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in automated parcel delivery terminals in Japan are outdoor terminal and indoor terminal.

In terms of ownership, shipping/logistics companies segment is expected to command 38.0% share in the automated parcel delivery terminals in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Demand for Automated Parcel Delivery Terminals in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA