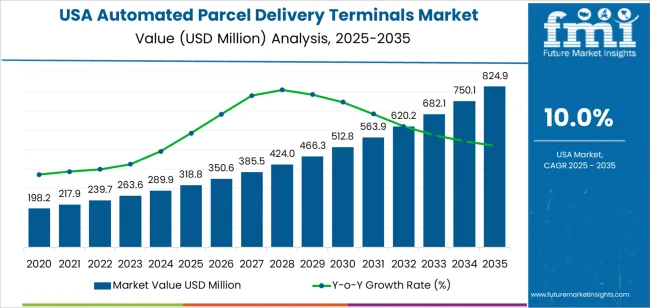

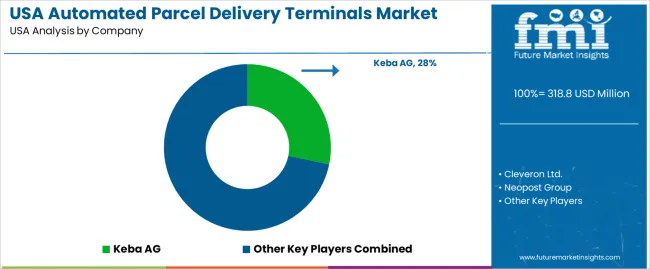

In 2025, demand for automated parcel delivery terminals in the USA is valued at USD 318.8 million and is projected to reach USD 824.9 million by 2035 at a CAGR of 10.0%. Growth in the first half of the forecast reflects the scale of e commerce penetration, last mile congestion, and rising labor costs across metropolitan delivery networks. National parcel operators, grocery chains, and multifamily property owners expand locker installations to reduce failed deliveries and streamline returns. Urban hubs and transit oriented developments account for the highest installation density. Early demand is driven less by technology novelty and more by throughput efficiency, contactless access, and round the clock parcel retrieval in high traffic residential and retail environments.

After 2030, demand expansion becomes more network driven than exploratory. Market value rises from roughly USD 512.8 million in 2030 to USD 824.9 million by 2035 as locker grids extend into suburban logistics corridors, university campuses, healthcare complexes, and employer based distribution points. Hardware unit growth continues, though a growing share of value comes from software layers, remote monitoring, and access management systems.

National retailers integrate lockers into omnichannel order fulfillment to control reverse logistics cost. Key suppliers include global automation firms and domestic smart locker integrators with USA manufacturing and installation networks. Competitive positioning centers on deployment speed, weather resistance, cybersecurity of access systems, and service uptime across large distributed fleets.

The Growth Volatility Index for automated parcel delivery terminals in the USA between 2020 and 2025 reflects an early acceleration phase with widening year on year absolute additions. Demand rises from USD 198.2 million to USD 318.8 million across this window, with annual increments expanding from USD 19.7 million to nearly USD 28.9 million by 2025. This widening step size signals increasing volatility relative to the early base as infrastructure deployment shifts from pilot density to network scale across urban logistics hubs. The volatility during this phase is constructive rather than disruptive, reflecting rising installation pace across retail chains, residential complexes, and carrier-operated locker networks. The variability is driven by site acquisition timing and network clustering rather than cyclical demand shocks.

From 2025 to 2035, the volatility profile remains elevated but structurally controlled as demand expands from USD 318.8 million to USD 824.9 million. Annual value additions rise progressively from about USD 31.8 million to more than USD 74.8 million by the final years, marking a clear increase in volatility amplitude. This higher volatility band reflects aggressive network density expansion, suburban penetration, and platform-driven deployment contracts rather than instability. The Growth Volatility Index indicates accelerating deployment momentum after 2030 as infrastructure scale compounds. Despite rising fluctuations in yearly additions, downside volatility remains limited because demand is anchored to structural e commerce flow growth rather than discretionary investment cycles.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 318.8 million |

| Forecast Value (2035) | USD 824.9 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

Demand for automated parcel delivery terminals in the USA has risen as e-commerce and online retail have grown rapidly. As consumers increasingly order goods online, parcel volumes have surged and delivery networks are strained by first-delivery failures, package theft, and missed delivery windows. Automated parcel lockers give delivery firms a way to reduce failed deliveries and returns, while offering customers secure 24/7 access to packages. Retailers and logistics providers see lockers and terminals as efficient ways to manage high parcel volumes, especially in dense urban and suburban areas. The convenience for end customers and savings on failed-delivery costs have made these systems more attractive.

Urbanisation patterns, rise in apartment living, and the growth of multi-family housing have also contributed. In many urban or condominium environments, delivering a parcel to an individual door is inefficient. Lockers placed in lobbies, parking lots, or near public transit hubs offer a centralised, secure pick-up point. For logistics companies, this consolidates last-mile deliveries and reduces driver time per parcel. For recipients, it removes the need to wait at home or coordinate with couriers.

Another driver is logistics and operational challenges in the US labour and delivery ecosystem. Labour shortages and cost pressures for drivers, plus inefficient door-to-door delivery models, push firms to look for scalable, lower-cost infrastructure. Automated terminals reduce reliance on manual handling and support high-volume throughput. They align with rising demand for rapid fulfilment and ability to handle spikes for example during holiday seasons or flash sale peaks.

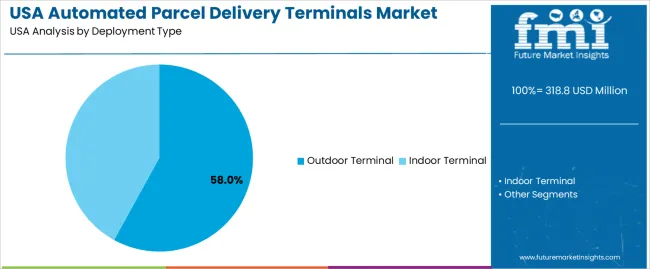

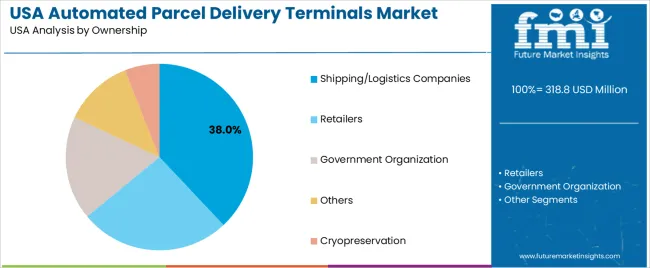

The demand for automated parcel delivery terminals in the USA is defined by deployment type and ownership structure. Outdoor terminals account for 58% of total installations, while indoor terminals are deployed within retail buildings, offices, and controlled facilities. By ownership, shipping and logistics companies hold a 38% share, followed by retailers, government organizations, and other operators. Deployment is influenced by delivery density, real estate access, security requirements, and consumer pickup behavior. Ownership patterns reflect capital expenditure capacity and direct alignment with delivery operations. These segments show how infrastructure placement and operational control determine terminal adoption across urban, suburban, and mixed use environments nationwide.

Outdoor automated parcel delivery terminals represent 58% of total demand in the USA. Their dominance reflects the need for unrestricted, round the clock access to parcel pickup in high traffic locations. Outdoor terminals are commonly placed near apartment complexes, transit hubs, roadside service zones, and commercial centers. These locations allow carriers to serve large user groups from a single delivery point. Weather resistant enclosures and reinforced structures support consistent operation under variable climate conditions.

Outdoor deployment reduces failed delivery attempts by allowing unattended drop off without reliance on building access schedules. Installation timelines remain shorter since indoor construction modification is not required. Maintenance access is also simplified without disrupting indoor foot traffic. High daily utilization improves return on investment for operators managing dense route coverage. These logistical and operational advantages sustain outdoor terminals as the dominant deployment type across the USA parcel delivery infrastructure.

Shipping and logistics companies account for 38% of total ownership of automated parcel delivery terminals in the USA. This ownership leadership reflects the direct operating benefits terminals provide for network efficiency. Logistics firms use terminals to consolidate delivery volume, reduce door to door drop offs, and lower repeat delivery costs. Centralized terminal drops shorten route times and improve driver productivity. Ownership allows carriers to optimize terminal placement based on parcel flow density and routing data.

Terminal networks also support service reliability through time flexible pickup. Customers receive automated access notifications which improves collection success without driver re engagement. Integration with tracking systems strengthens delivery transparency. Long term cost control across labor, fuel, and vehicle utilization supports continued capital investment by logistics firms. These operational efficiencies reinforce shipping and logistics companies as the primary owners of automated parcel delivery terminals across the USA.

Demand for automated parcel delivery terminals in the USA is driven by sustained growth in e-commerce, rising last-mile delivery costs, and consumer demand for flexible pickup options. Failed home deliveries, porch theft, and apartment access issues increase pressure on carriers to shift away from door-to-door drop models. Retailers seek to reduce reverse logistics cost from returns by using shared locker networks. Expansion of multi-family housing, college campuses, office parks, and mixed-use developments creates natural deployment sites for automated terminals. These operational and urban factors collectively support steady infrastructure-level demand.

High parcel density in metropolitan zones such as New York, Los Angeles, Chicago, Dallas, and Atlanta creates congestion-driven inefficiencies in traditional delivery models. Automated terminals allow carriers to consolidate multiple deliveries at a single point, reducing route time and fuel consumption per package. Gig-based delivery models benefit from faster drop-off cycles with fewer access failures. Retailers also use lockers as omnichannel fulfillment nodes for buy-online-pickup and fast-return services. These logistics patterns push parcel terminals from auxiliary devices into permanent components of urban delivery networks.

Automated parcel terminal growth in the USA faces restraints tied to hardware cost, real-estate approval, and uneven user acceptance. Installation requires agreements with property owners, municipalities, or retail operators, which slows rollout. Upfront capital costs and maintenance contracts delay deployment outside dense urban zones. Some users still prefer direct doorstep delivery for convenience. Rural and low-density suburban areas lack the parcel volume required to justify installation economics. These physical, financial, and behavioral constraints keep automated terminal deployment concentrated in high-throughput commercial and residential environments.

Parcel terminal demand in the USA is shifting toward open-access, multi-carrier networks rather than single-courier systems. Terminals now integrate with mobile authentication, remote access control, and real-time delivery confirmation. Enhanced surveillance, anti-tampering design, and temperature-controlled compartments support higher-value and grocery shipments. Retail-linked locker hubs enable returns, repairs, and exchange services alongside deliveries. Data integration with route optimization software improves delivery density planning. These trends indicate automated parcel terminals evolving into smart, secure logistics nodes embedded within neighborhood infrastructure.

| Region | CAGR (%) |

|---|---|

| West USA | 11.5% |

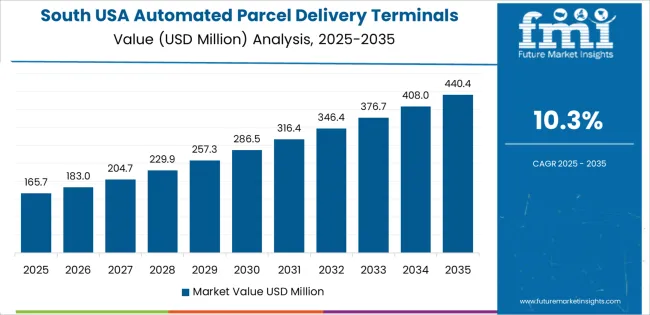

| South USA | 10.3% |

| Northeast USA | 9.2% |

| Midwest USA | 8.0% |

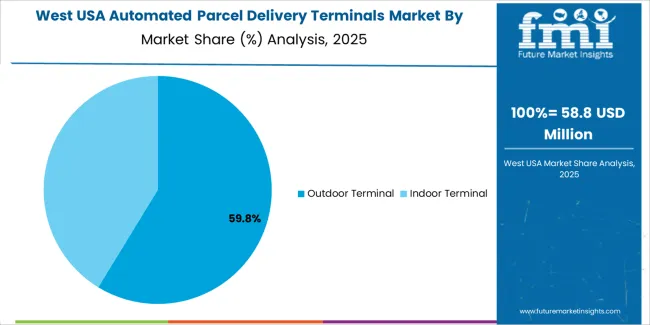

The demand for automated parcel delivery terminals in the USA is rising rapidly across all regions. The West leads with an 11.5% CAGR, reflecting strong growth in e-commerce, rising urban population density, and increasing demand for efficient, contactless last-mile delivery and secure, 24/7 parcel pickup solutions. The South region follows at 10.3%, supported by expanding logistics infrastructure, rising online retail penetration, and increased adoption of smart-locker networks by carriers and retailers.

The Northeast at 9.2% shows steady growth driven by urban centres, high population density, and demand for convenient parcel retrieval. The Midwest’s 8.0% growth reflects growing e-commerce penetration even in less densely populated areas and gradual expansion of parcel-terminal installations. Overall growth is underpinned by e-commerce expansion, need for efficient last-mile delivery, and rising consumer preference for convenience and contactless deliveries.

Growth in the West reflects a CAGR of 11.5% through 2035 for automated parcel delivery terminal demand, driven by high ecommerce penetration, dense urban housing, and strong consumer preference for unattended delivery solutions. Large metropolitan zones generate sustained parcel volume from retail, grocery, and meal delivery platforms. Apartment complexes and mixed use developments continue integrating shared locker systems to reduce delivery congestion. Technology oriented logistics operators prioritize locker networks to support same day fulfillment models. Demand is reinforced by labor cost control measures and last mile efficiency goals across urban delivery corridors.

The South advances at a CAGR of 10.3% through 2035 for automated parcel delivery terminal demand, supported by rapid suburban expansion, rising online retail consumption, and growing third party logistics activity. Residential communities with gated access increase the need for secure unattended parcel solutions. Food, apparel, and household goods ecommerce sustain consistent locker turnover. Courier operators deploy terminals near retail centers and fuel stations to improve route efficiency. Demand remains balanced between last mile residential coverage and regional distribution node placement aligned with expanding suburban population patterns.

The Northeast records a CAGR of 9.2% through 2035 for automated parcel delivery terminal demand, shaped by dense urban settlement, high vertical housing concentration, and strong retail fulfillment activity. Limited building access windows increase failed doorstep delivery attempts, encouraging locker deployment. Office districts and transit hubs emerge as preferred terminal locations. Cold weather logistics favor protected unattended delivery infrastructure. Demand is driven more by congestion management and service reliability than by housing expansion. Growth remains steady through continuous network infill across mature metropolitan logistics zones.

The Midwest expands at a CAGR of 8.0% through 2035 for automated parcel delivery terminal demand, supported by steady ecommerce adoption, regional distribution hubs, and increasing small city parcel volumes. Lower population density favors targeted installations near supermarkets, colleges, and municipal centers. Manufacturing parts deliveries and rural ecommerce contribute secondary volume flow. Courier investment focuses on reducing redelivery distances rather than high frequency urban turnover. Demand growth remains gradual, following incremental digital retail adoption rather than rapid urban densification across regional logistics networks.

Demand for automated parcel delivery terminals in the USA is increasing as e commerce volumes rise and consumers seek convenience, flexibility, and reliability for last mile delivery. Parcel lockers and automated terminals help reduce failed deliveries, cut labour costs for couriers, and allow customers to retrieve parcels anytime. Urban congestion, busy lifestyles, and growth of multi unit housing make locker based delivery appealing. Retailers and logistics firms favour terminals that support high throughput, contactless access, and integration with delivery tracking systems. As overall parcel volume grows, terminals offer a scalable solution to manage delivery spikes and reduce delivery delays.

Among suppliers active in the USA and global terminal equipment market, Keba AG, Cleveron Ltd., Neopost Group, Smartbox Ecommerce Solutions Pvt. Ltd., and Winsen Industry Co., Ltd. shape supply dynamics. Keba AG holds approximately 18-22% of global market share and leads in smart locker deployment. Cleveron contributes a significant share (around 12-16%) through robotics based parcel terminals. Neopost Group also ranks among the main providers offering modular locker systems. Smartbox and Winsen, though less dominant globally, contribute with scalable terminal solutions suited for high volume and specialty deployments. The collective footprint of these firms supports expanding locker infrastructure across the US logistics and retail sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Deployment Type | Outdoor Terminal, Indoor Terminal |

| Ownership | Shipping/Logistics Companies, Retailers, Government Organization, Others |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Keba AG, Cleveron Ltd., Neopost Group, Smartbox Ecommerce Solutions Pvt. Ltd., Winsen Industry Co., Ltd. |

| Additional Attributes | Dollar by sales by deployment type and ownership; regional CAGR and adoption trends; outdoor vs indoor terminal share; ownership distribution across logistics, retailers, and government; unit density in urban vs suburban installations; network integration, software layers, and remote monitoring adoption; contactless access and cybersecurity performance; integration with omnichannel fulfillment and reverse logistics; installation and maintenance timelines; climate and weather resistance of terminals; e-commerce parcel flow impact on deployment; niche vs high-throughput usage; regional urbanization influence on terminal placement; supplier strategies including long-term contracts and scalable deployments. |

The demand for automated parcel delivery terminals in USA is estimated to be valued at USD 318.8 million in 2025.

The market size for the automated parcel delivery terminals in USA is projected to reach USD 824.9 million by 2035.

The demand for automated parcel delivery terminals in USA is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in automated parcel delivery terminals in USA are outdoor terminal and indoor terminal.

In terms of ownership, shipping/logistics companies segment is expected to command 38.0% share in the automated parcel delivery terminals in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automated Test Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA