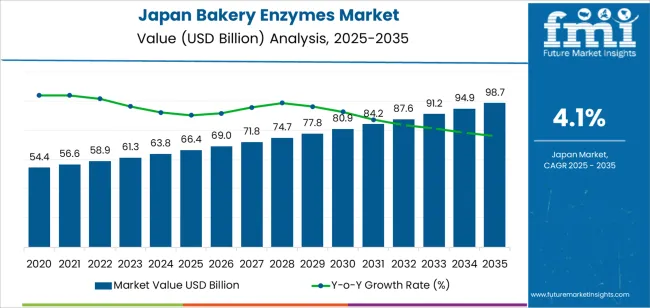

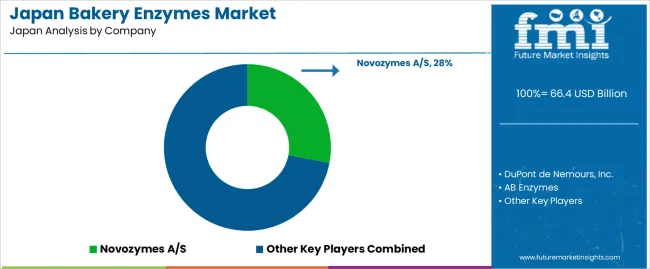

The demand for bakery enzymes in Japan is projected to grow from USD 66.4 billion in 2025 to USD 98.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.1%. Bakery enzymes are essential ingredients used to enhance the quality, texture, and shelf life of baked goods, such as bread, cakes, and pastries. As the demand for high-quality baked products continues to rise, particularly in the functional food and health-conscious food industrys, the demand for enzymes will increase, as they play a critical role in improving dough properties, flavor, and overall product consistency. Japan's established bakery sector, known for its innovation in creating high-quality and diverse bakery products, will continue to drive growth in this industry.

As consumer preferences shift towards nutritionally balanced and clean-label products, bakery enzymes are increasingly in demand for their ability to enhance product texture, flavor, and shelf life while aligning with the growing trend for natural ingredients. Consumers are becoming more health-conscious and are seeking foods that are not only tasty but also free from artificial additives. Bakery enzymes, such as amylases and lipases, help improve dough quality, control fermentation, and enhance flavor profiles, making them essential in meeting these evolving demands.

Between 2025 and 2030, the demand for bakery enzymes in Japan is expected to grow steadily, from USD 66.4 billion to USD 69.0 billion. This period reflects moderate growth, as the industry continues to integrate advanced enzyme solutions into baking operations to meet the rising consumer demand for quality, convenience, and healthier options. While the industry will experience steady growth, it will remain relatively stable, with incremental increases driven by an ongoing preference for functional and clean-label foods and more innovative baking technologies.

From 2030 to 2035, the demand for bakery enzymes is expected to approach a saturation point, rising from USD 69.0 billion to USD 98.7 billion. This period will see more accelerated growth as the industry reaches a stage of widespread adoption of enzyme-based baking solutions, particularly in industrial bakeries and mass food production. As the industry matures, the focus will shift to enhancing the efficiency of enzyme use, further improving shelf life and production costs. Regional regulations, environmental concerns, and rising consumer awareness of health-conscious ingredients will continue to drive demand for sustainable enzyme technologies.

| Metric | Value |

|---|---|

| Demand for Bakery Enzymes in Japan Value (2025) | USD 66.4 billion |

| Demand for Bakery Enzymes in Japan Forecast Value (2035) | USD 98.7 billion |

| Demand for Bakery Enzymes in Japan Forecast CAGR (2025-2035) | 4.1% |

The demand for bakery enzymes in Japan is growing as the food and beverage industry continues to focus on improving the quality, shelf life, and nutritional value of bakery products. Bakery enzymes are essential in optimizing dough processing, enhancing the texture and flavor of bread, cakes, and pastries, and improving overall product consistency. As Japanese consumers increasingly seek fresh, high-quality, and convenient baked goods, the demand for enzymes that streamline production while maintaining product excellence is rising.

A key driver of this demand is the shift towards healthier, cleaner-label baked goods. With more consumers becoming health-conscious, there is a growing preference for bakery products that are free from artificial additives and preservatives. Bakery enzymes, derived from natural sources, help improve the texture and quality of baked goods without the need for synthetic ingredients. As a result, manufacturers in Japan are incorporating enzymes into their processes to meet the rising demand for natural and functional foods.

The increasing popularity of gluten-free and specialty diet products is also fueling the growth of bakery enzymes. Enzymes play a critical role in improving the texture and quality of gluten-free baked goods, making them more appealing to a broader consumer base. As Japan’s bakery industry continues to evolve, the demand for bakery enzymes is expected to grow steadily through 2035, driven by the need for high-quality, clean-label, and innovative baked goods.

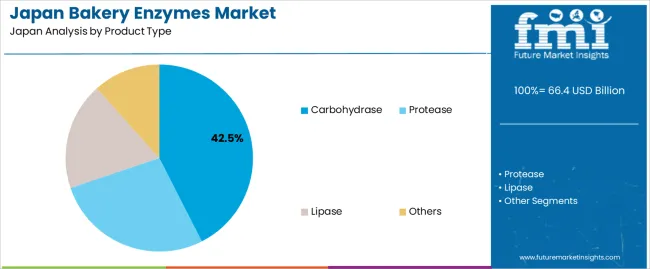

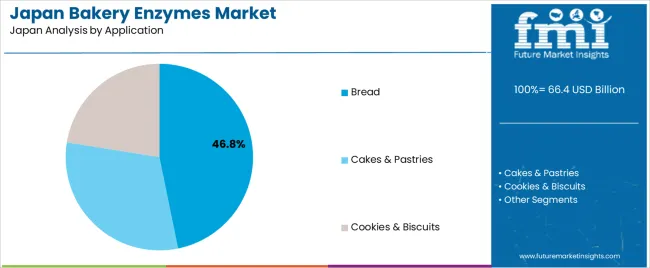

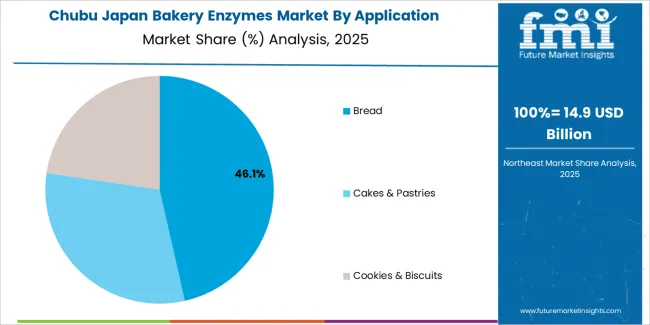

Demand for bakery enzymes in Japan is segmented by product type, application, form, and region. By product type, demand is divided into carbohydrase, protease, lipase, and others, with carbohydrase holding the largest share at 43%. The demand is also segmented by application, including bread, cakes & pastries, and cookies & biscuits, with bread leading the demand at 46.8%. In terms of form, demand is divided into powder and liquid, with powder being the more popular form. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan.

Carbohydrase accounts for 43% of the demand for bakery enzymes in Japan. This enzyme is essential in breaking down complex carbohydrates, such as starch, into simpler sugars, which are key to improving the texture, volume, and shelf life of baked goods like bread and cakes. Carbohydrase enzymes help enhance dough fermentation by promoting the production of carbon dioxide, which results in better leavening and a more desirable crumb structure. Carbohydrases are known for their ability to improve the consistency and softness of baked goods, making them a staple ingredient in the bakery industry. As the demand for high-quality, soft, and flavorful bakery products grows, the use of carbohydrases will continue to lead the industry, ensuring its ongoing dominance in bakery enzyme formulations.

Bread accounts for 46.8% of the demand for bakery enzymes in Japan. Enzymes like carbohydrase and protease are critical in bread production, as they help improve dough properties, fermentation, and the final texture of the bread. Bread dough requires specific enzymatic activity to achieve the desired volume, crumb structure, and shelf life. Carbohydrases are particularly important for breaking down starch into fermentable sugars, enhancing yeast activity and resulting in better leavening. Proteases help improve dough extensibility and handling, ensuring smooth and consistent texture. The growing demand for high-quality bread, particularly in artisanal and mass production, drives the need for specialized enzymes to maintain consistent and optimal product quality. As bread remains a staple food in Japan, bakery enzymes will continue to be an essential ingredient in the production of high-quality, soft, and fluffy bread.

In Japan, demand for bakery enzymes is driven by the growth of processed, ready‑to‑eat and packaged baked goods, especially as lifestyles become busier and artisan/industrial bakery operations expand. The need for better dough handling, improved texture, extended shelf‑life, and clean‑label ingredient claims creates strong uptake of enzyme solutions such as carbohydrases (for dough volume and softness), proteases (for gluten modification), and lipases (for fat replacement/texture). Restraints include relatively higher costs of enzyme formulations compared with conventional additives, variability in enzyme performance under specific Japanese bakery recipes, regulatory and labelling issues for functional enzyme usage, and competition from alternative processing aids.

Why is Demand for Bakery Enzymes Growing in Japan?

Demand for bakery enzymes in Japan is increasing as manufacturers are pressured to innovate and differentiate their products through texture, freshness, and label appeal. The rising popularity of premium and artisan breads, pastries, and convenience bakery products has driven the need for enzymes that help improve dough handling, speed up production cycles, and reduce the need for chemical improvers. Consumers in Japan are increasingly seeking clean‑label products with minimal additives, and are willing to pay more for high‑quality, natural ingredients, which further boosts enzyme adoption. Japan’s ageing population and growing demand for convenient, packaged bakery goods have created a strong industry for enzyme solutions that enhance freshness and extend shelf‑life, ultimately fueling the demand for bakery enzymes.

How are Technological Innovations Driving Growth of Bakery Enzymes in Japan?

Technological innovations in Japan are helping drive the demand for bakery enzymes by improving their performance, stability, and integration into bakery production. Advances include the development of enzyme blends tailored to Japanese flour types, as well as anti‑staling enzymes that maintain crumb softness over time. There have also been innovations in enzyme systems designed for gluten‑reduced or fibre‑fortified products, responding to growing consumer interest in healthier options. Advancements in dosing automation and more efficient enzyme delivery systems are helping bakers improve process efficiency and product consistency. These innovations, along with enhanced supply chain management and increased knowledge among bakers, make enzyme solutions more accessible, cost‑effective, and aligned with evolving consumer preferences, driving widespread adoption across Japan.

What are the Key Challenges Limiting Adoption of Bakery Enzymes in Japan?

Despite growing demand, the adoption of bakery enzymes in Japan faces several key challenges. One of the main hurdles is the cost: premium enzyme blends and high‑performance formulations can increase production costs, which may deter smaller bakery operators or those in price-sensitive segments. Regulatory and labelling requirements in Japan, especially regarding food safety and clean‑label claims, can delay the introduction of new enzyme-based products. There are also supply‑chain challenges, including batch consistency and sourcing high-quality enzymes, which can impact product reliability. Traditional baking methods deeply rooted in Japan’s baking culture may create resistance to change, while competition from alternative processing aids like modified starches and emulsifiers may slow the shift to enzyme-based solutions.

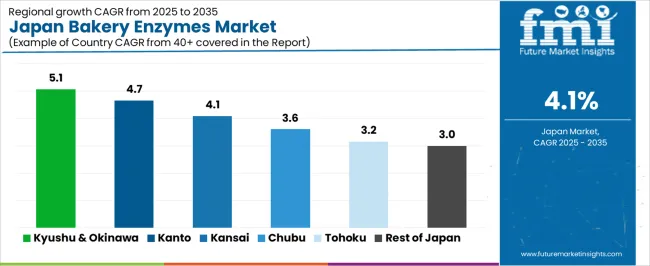

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.1% |

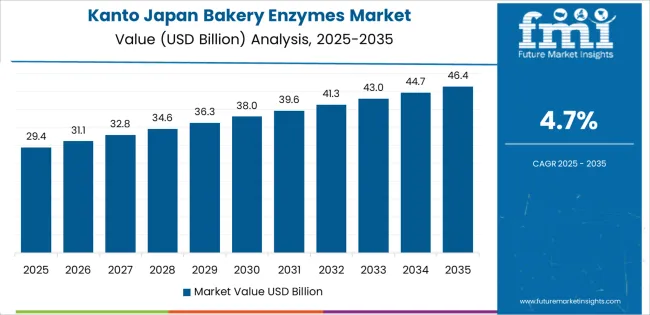

| Kanto | 4.7% |

| kansai | 4.1% |

| Chubu | 3.6% |

| Tohoku | 3.2% |

| Rest of Japan | 3.0% |

Demand for bakery enzymes in Japan is growing steadily, with Kyushu & Okinawa leading at a 5.1% CAGR, driven by local agriculture and a focus on healthier baked goods. Kanto follows with a 4.7% CAGR, supported by its large food production base and health-conscious consumers. Kansai shows a 4.1% CAGR, fueled by innovation in the food sector and premium product demand. Chubu experiences a 3.6% CAGR, with moderate growth driven by food production automation and healthier baked goods. Tohoku’s demand grows at 3.2%, supported by smaller bakeries adopting enzyme technologies. The Rest of Japan shows a 3.0% CAGR, driven by local food producers seeking to improve product quality.

Kyushu & Okinawa are leading in bakery enzyme demand, with a 5.1% CAGR. This growth is primarily driven by the region’s strong agricultural sector, particularly in Okinawa, where there is increasing interest in using local ingredients to enhance the nutritional value of bakery products. The rise of health-conscious consumers has pushed local bakeries to seek enzymes that can help produce healthier baked goods such as whole grain and gluten-free products. Kyushu’s focus on automation in food production is contributing to the adoption of enzymes that improve dough handling, texture, and shelf life. As traditional bakery products continue to be transformed to meet modern consumer preferences for healthier, natural options, demand for bakery enzymes will continue to rise in this region, supported by local agricultural practices and food innovation.

Kanto is experiencing strong demand for bakery enzymes, with a 4.7% CAGR, driven by its high concentration of large-scale commercial bakeries and food processors, particularly in Tokyo. As the region’s population becomes increasingly health-conscious, there is a growing preference for healthier, functional bakery products. Kanto’s bakery manufacturers are adopting enzymes to improve product quality, texture, and nutritional value. The demand for enzymes, such as amylase and lipase, is rising to improve dough properties and extend the shelf life of bread and pastries. As Japan’s industrial hub, Kanto’s push for premium, clean-label products is supporting this demand. With the region’s evolving consumer trends and the growing use of automation in bakeries, demand for bakery enzymes is expected to continue growing as manufacturers strive to meet consumer demands for high-quality, nutritious, and convenient products.

Kansai is experiencing steady growth in bakery enzyme demand, with a 4.1% CAGR. The region's strong food industry, particularly in Osaka and Kobe, is driving the adoption of bakery enzymes to improve the quality, texture, and freshness of baked goods. As consumer demand for healthy, functional, and premium bakery products increases, local food manufacturers are incorporating enzymes into their products to meet these expectations. The Kansai region’s automotive and machinery industries are also adopting food production automation, leading to the use of enzymes for better dough handling, efficiency, and waste reduction. Kansai focus on innovation in the food sector, coupled with its population's growing interest in clean-label and healthy bakery options, continues to drive steady demand for bakery enzymes. This demand is expected to grow as the region’s food producers focus on offering natural and high-quality bakery products.

Chubu is seeing moderate demand for bakery enzymes, with a 3.6% CAGR. The region's growth in bakery enzyme adoption is driven by the expanding food industry in Nagoya and other industrial centers, where large-scale commercial bakeries and food processors are looking to improve production efficiency. As more manufacturers in Chubu focus on automation, they are turning to bakery enzymes to optimize dough handling, enhance texture, and extend the shelf life of products. Chubu’s rising trend toward healthier and more functional baked goods, including whole grain and gluten-free options, is pushing demand for enzymes that can support these formulations. As Chubu continues to develop its food production capabilities, demand for bakery enzymes is expected to grow steadily, particularly in large-scale operations focused on improving the quality and nutritional value of baked goods.

Tohoku is experiencing steady growth in bakery enzyme demand, with a 3.2% CAGR. The demand is primarily driven by the region’s small to medium-sized bakeries modernizing to meet evolving consumer preferences for healthier, premium baked products. Tohoku’s focus on improving the quality and shelf life of locally made breads, pastries, and other baked goods is fueling the adoption of bakery enzymes. As the region’s manufacturers embrace automation and improve production efficiency, enzymes are being increasingly used to enhance dough properties and support product consistency. Tohoku’s growing interest in functional foods, particularly in the health-conscious consumer base, further contributes to the demand for enzymes. As the region’s food industry modernizes and aligns with health trends, demand for bakery enzymes is expected to grow, although at a more gradual pace compared to other regions.

The Rest of Japan is experiencing moderate growth in bakery enzyme demand, with a 3.0% CAGR. This demand is driven by the region’s small and medium-sized food producers who are increasingly adopting bakery enzymes to improve product quality, production efficiency, and the shelf life of baked goods. The demand for healthier, clean-label bakery products is also influencing the use of enzymes to enhance nutritional profiles. Although the Rest of Japan’s manufacturing industry is smaller compared to larger regions like Kanto and Kinki, the demand for functional bakery products in rural and suburban industrys is rising steadily. Local food manufacturers are adopting bakery enzymes to align with consumer preferences for natural ingredients in their products. As the food industry across Japan continues to modernize and focus on quality and health, the adoption of bakery enzymes is expected to increase in the Rest of Japan.

In Japan, demand for bakery enzymes is increasing as a result of changing consumer preferences, higher standards for food texture and freshness, and a growing emphasis on functional bakery products. These enzyme systems such as amylases, proteases, and lipases are used to improve dough handling, crumb structure, shelf life, and overall quality of bread and other baked goods. The bakery sector in Japan is mature, with significant innovation in both artisan and industrial baking that seeks productivity and consistent product performance.

Key players in this domain include Novozymes A/S with about a 28.0% share, along with DuPont de Nemours, Inc., AB Enzymes, Koninklijke DSM N.V., and Amano Enzyme Inc. Novozymes leads through its extensive enzyme portfolio, strong technical support for bakeries, and deep customer‑relationships in the Japanese food‐industry supply chain. The other suppliers differentiate via specialty enzyme grades, localisation of service, custom enzyme blends for Japanese bakery formats, and partnerships with food manufacturers.

Competitive dynamics are shaped by several crucial factors. One driver is the increasing demand for improved bakery product quality consumers expect better texture, longer freshness and premium attributes, which drive enzyme adoption. A second driver is the need for bakeries to improve efficiency including reduced ingredient costs, shorter process times and consistent output which enzyme technologies support. Third, challenges are present: bakery enzymes must meet rigorous food‑safety approvals, formulation changes can require validation, and bakeries may face cost‑pressure when implementing advanced enzyme systems. Suppliers able to provide regulatory‑compliant, high‑activity enzyme formulations, strong local technical service, and cost‑effective implementation are best positioned to lead in Japan’s bakery enzyme segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Carbohydrase, Protease, Lipase, Others |

| Application | Bread, Cakes & Pastries, Cookies & Biscuits |

| Form | Powder, Liquid |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Novozymes A/S, DuPont de Nemours, Inc., AB Enzymes, Koninklijke DSM N.V., Amano Enzyme Inc. |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in bakery enzymes; growth in bread, cake, and biscuit sectors; technology adoption for enzyme applications in baking; vendor offerings including enzyme formulations and solutions; regulatory influences and industry standards |

The demand for bakery enzymes in Japan is estimated to be valued at USD 66.4 billion in 2025.

The market size for the bakery enzymes in Japan is projected to reach USD 98.7 billion by 2035.

The demand for bakery enzymes in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in bakery enzymes in Japan are carbohydrase, protease, lipase and others.

In terms of application, bread segment is expected to command 46.8% share in the bakery enzymes in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA