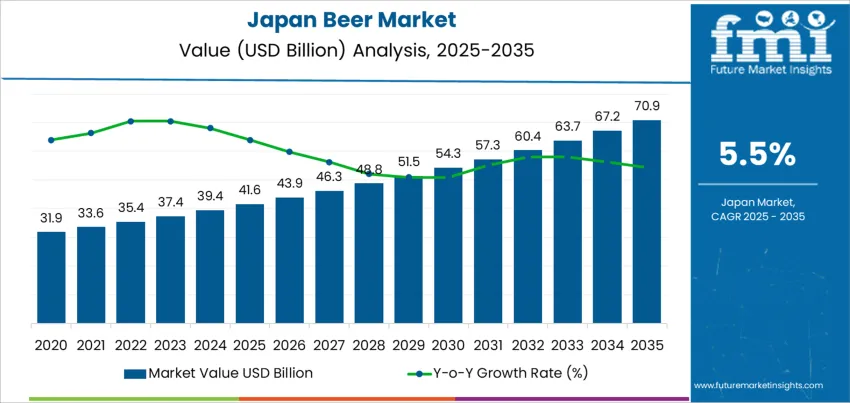

The Japan beer industry demand is valued at USD 41.6 billion in 2025 and is forecast to reach USD 70.9 billion by 2035, reflecting a CAGR of 5.5%. Demand is shaped by steady consumption among adult consumers, expanded premium-beer portfolios, and the adoption of innovative brewing processes that support flavour diversity. Continued tourism recovery, greater on-trade footfall, and rising interest in speciality beers contribute to consumption. Packaging redesigns, returnable container options, and supply-chain efficiencies also influence procurement decisions for bars, hospitality venues, and retail distributors.

Lager remains the leading product type due to its familiarity, clean profile, and strong alignment with Japanese dining culture. Light and refreshing formulations continue to dominate production volumes. Growth also benefits from alcohol-reduced lagers and clear brewing techniques that appeal to calorie-conscious consumers. Ongoing investment in yeast optimization, aroma hops, and fermentation management supports consistency and scalability in high-output breweries.

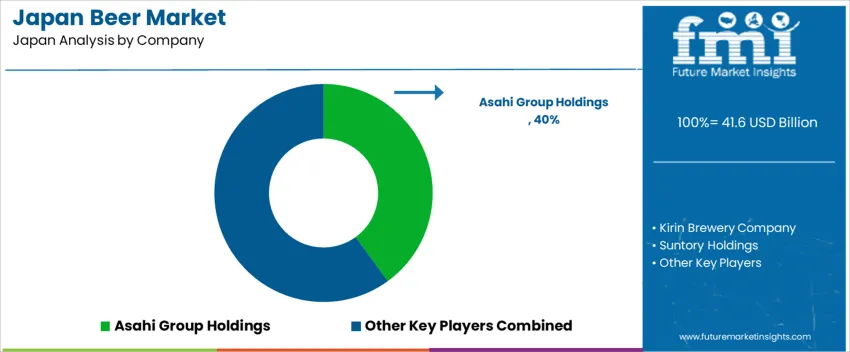

Kyushu & Okinawa, Kanto, and Kansai record the highest consumption levels. These regions maintain dense restaurant networks, convenience-store penetration, and logistics infrastructure that ensure cold-chain reliability. Urban business districts and leisure hubs support strong demand in both canned and draught formats. Key suppliers include Asahi Group Holdings, Kirin Brewery Company, Suntory Holdings, and Sapporo Breweries. Their portfolios span mainstream brands, seasonal releases, and craft-inspired variants, enabling coverage of multiple pricing tiers and distribution channels across Japan.

Demand for beer in Japan is positioned near a saturation stage due to high historical consumption levels and strong penetration of established brands across retail and foodservice channels. Core consumer segments already exhibit mature purchasing behavior, reflected in stable but limited volume changes year to year. Demographic trends, including an aging population and lower alcohol consumption among younger adults, contribute to slower expansion potential.

Despite maturity, selective growth opportunities remain. Premium craft offerings, low-alcohol and alcohol-free variants, and seasonal brews support incremental demand uplift. These segments introduce variety without substantially expanding total buyer numbers. Import brands also maintain niche momentum tied to tourism and diversified taste preferences. Volume gains often represent substitution within the category rather than industry expansion.

The saturation profile reveals a shift from broad consumption to value-led product stratification. Innovation sustains engagement and prevents deeper decline, yet the demand trajectory reflects a plateau shaped by demographic and cultural moderation. The segment is stable, with modest growth linked to differentiation rather than increased per capita intake.

| Metric | Value |

|---|---|

| Japan Beer Sales Value (2025) | USD 41.6 billion |

| Japan Beer Forecast Value (2035) | USD 70.9 billion |

| Japan Beer Forecast CAGR (2025-2035) | 5.5% |

Demand for beer in Japan shows selective growth in specific segments as drinking preferences shift across age groups. Craft breweries and premium brands gain traction because consumers seek distinctive flavors and limited seasonal offerings that appeal to smaller households and social occasions. Convenience stores and supermarkets highlight new varieties to support frequent trial purchases. Restaurants and entertainment venues continue to rely on beer as a core beverage for gatherings, especially in urban areas where after-work dining remains a common routine. Low malt and reduced calorie options maintain strong demand among health-conscious adults who still enjoy beer taste with lighter profiles.

Domestic producers invest in packaging innovations such as compact cans and recyclable materials that suit home consumption and online delivery. Tourism recovery also contributes to demand in hospitality channels, including regional brands that showcase local ingredients. Constraints include Japan’s aging population, which influences lower overall alcohol intake. Younger consumers increasingly favor cocktails, chuhai or nonalcoholic beverages, which limits volume growth for mainstream beer. Pricing pressure from raw material costs and alcohol tax structures also affects purchasing behavior.

Demand for beer in Japan is driven by established consumption culture, evolving craft preferences, and convenience-focused retail packaging. Japanese consumers balance traditional lager choices with rising interest in flavored, seasonal, and regionally sourced beer profiles. Pricing tiers vary across large brands and specialty brewers, while innovation in alcohol content and premium positioning supports product diversification. Consumption patterns remain linked to social dining, workplace leisure, and expanding home-drinking trends influenced by e-commerce availability.

Lager accounts for 45.0%, reflecting longstanding consumer familiarity, smooth taste profiles, and presence across restaurants, convenience stores, and vending channels. Strong lager positioning supports mass-volume distribution and continuous promotional cycles by major Japanese breweries. Ale represents 30.0%, driven by craft styles such as IPAs and wheat ales gaining popularity among younger consumers. Stouts contribute 15.0%, supported by niche seasonal releases and dessert-leaning profiles. Other styles hold 10.0%, including fruit beers and low-alcohol variants targeting diversification. Product type selection aligns with flavor preference stability and willingness to explore regional offerings.

Key Points:

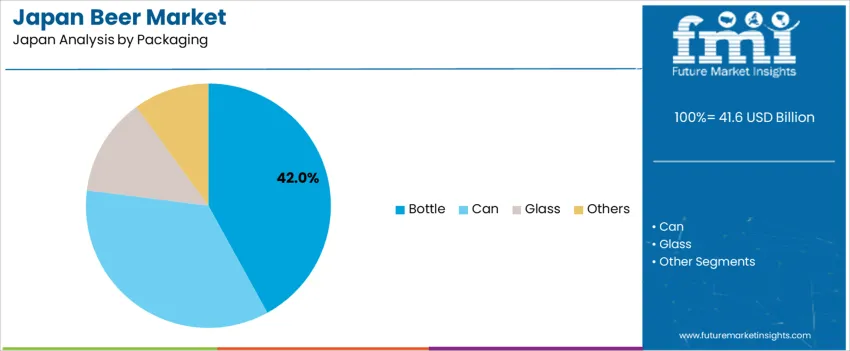

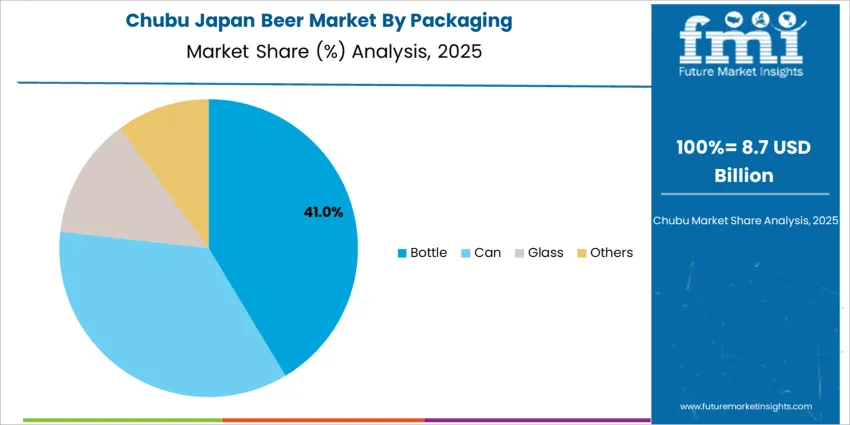

Bottled beer accounts for 42.0%, maintaining strong presence in bars, restaurants, and retail shelves where visual branding and glass packaging perception influence choice. Cans hold 35.0%, driven by outdoor consumption, portability, and lightweight distribution advantages across Japan’s dense logistics networks. Glass packaging types represent 13.0%, generally used for premium brews and limited releases. Other formats hold 10.0%, including kegs and growlers supporting dining and tap-room environments. Packaging trends reflect convenience, preservation stability, and variety in purchase occasions ranging from restaurants to at-home consumption.

Key Points:

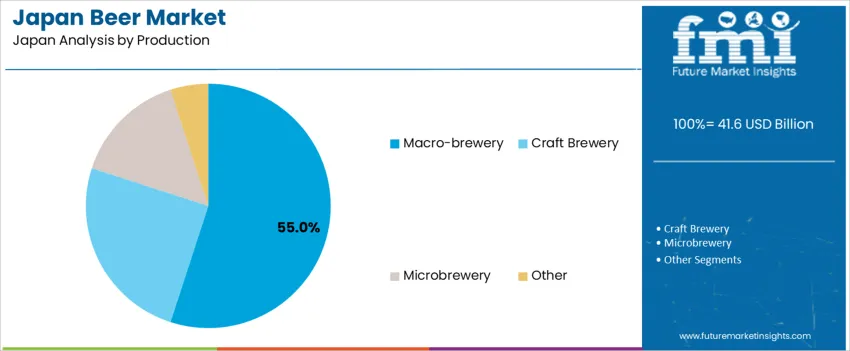

Macro-breweries hold 55.0%, supported by scale, distribution reach, and brand heritage from Japan’s established beer manufacturers. These breweries ensure pricing consistency and national product availability. Craft breweries represent 25.0%, expanding through local tourism, limited-edition launches, and specialty taprooms. Microbreweries hold 15.0%, supplying localized artisanal offerings within targeted city regions. Other production formats make up 5.0%, including contract brewing. Production mix reflects Japan’s preference for trustworthy mass brands alongside a gradually expanding craft ecosystem.

Key Points:

Expansion of convenience retail channels, growth of premium and craft beer segments and seasonal consumption tied to social gatherings are driving demand.

In Japan, beer remains a widely consumed beverage influenced by strong convenience-store sales near train stations and business districts. Major brewers develop premium lagers that target consumers willing to trade up for richer taste profiles, supporting higher-value demand even as overall alcohol consumption softens. Craft breweries in Tokyo, Kanagawa and Hokkaido expand local offerings that attract younger drinkers seeking variety and regional flavors. Seasonal occasions such as hanami, summer festivals and end-of-year gatherings sustain retail spikes and promote multipack purchases. Hospitality sectors including izakaya pubs continue to rely on beer as a core menu item, contributing to steady baseline consumption.

Aging population, increased health-conscious behavior and beer taxation structures restrain demand.

Japan’s declining youth population reduces the core demographic of frequent beer drinkers, shifting preferences toward lower-alcohol beverages or non-alcoholic alternatives. Health-minded consumers limit drinking frequency and explore beverages perceived as lighter, including chuhai and hard seltzers available widely in convenience stores. Japan’s alcohol tax framework historically differentiated between malt content categories, creating pricing sensitivity that influences brand and format choices. These demographic and regulatory influences contribute to slow long-term volume decline despite steady demand in specific drinking occasions.

Shift toward non-alcoholic and low-malt variants, increased popularity of canned craft formats and rising demand through home consumption define key trends.

Brewers are expanding non-alcoholic and low-malt beer lines that support moderation and comply with workplace drinking norms while maintaining traditional flavor cues. Craft beer packaged in cans improves freshness and distribution efficiency, enabling broader availability through nationwide online and specialty channels. Home consumption remains strong due to urban living patterns, with chilled single-serve cans dominating sales from convenience stores. Limited-edition seasonal releases and collaborations with regional producers help differentiate products in a competitive industry. These trends support diversified demand for beer aligned with Japan’s shifting consumption habits.

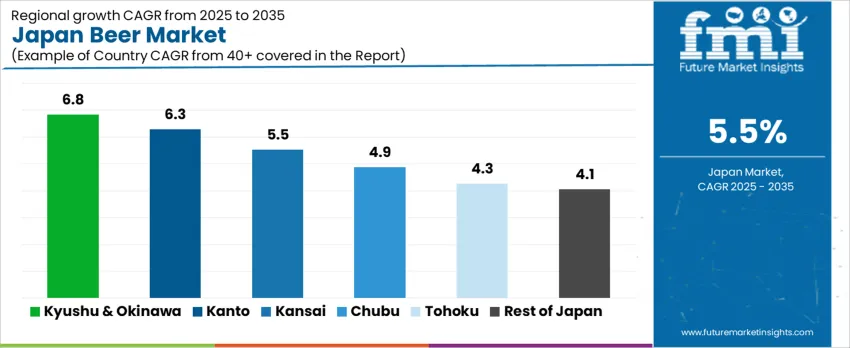

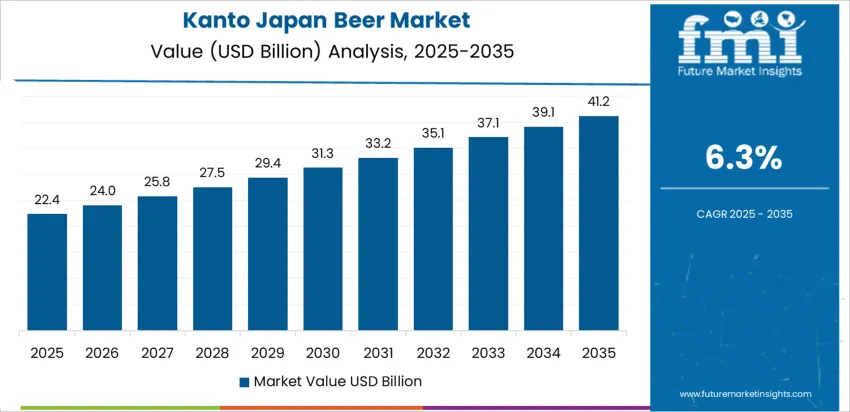

Beer demand in Japan is influenced by long-established consumption culture, retail distribution through convenience stores, and on premise sales in restaurants and izakaya venues. Growth varies by region, shaped by tourism, nightlife concentration, brewery footprints, and premium craft beer adoption. Kyushu & Okinawa leads at 6.8% CAGR, followed by Kanto (6.3%), Kansai (5.5%), Chubu (4.9%), Tohoku (4.3%), and the Rest of Japan (4.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.8% |

| Kanto | 6.3% |

| Kansai | 5.5% |

| Chubu | 4.9% |

| Tohoku | 4.3% |

| Rest of Japan | 4.1% |

Kyushu & Okinawa record 6.8% CAGR driven by tourism-supported consumption, local brewery expansion, and cultural alignment with social dining environments. Okinawa maintains strong packaged beer sales across hospitality corridors serving domestic and international visitors. Regional cities including Fukuoka and Kumamoto support draft beer demand in izakaya districts, with consistent evening footfall patterns enabling steady volume movement. Convenience stores play a major role in distribution, handling single-serve and multi-can formats sized for casual purchasing. Craft breweries operate tasting venues and seasonal releases that strengthen local brand loyalty. Hot and humid weather during peak travel months reinforces demand for chilled lagers and specialty variants tailored to warm-climate consumption habits. Buyers prioritize consistent carbonation and shelf stability for inventory planning.

Kanto grows at 6.3% CAGR due to large population concentration, metropolitan nightlife, and high turnover of packaged beverages through convenience and grocery outlets. Tokyo and Kanagawa support frequent after-work consumption at bars and food stalls, generating steady keg rotation among distributors. Retailers maintain broad portfolios covering mainstream lagers, limited-edition seasonal brews, and canned craft labels produced nationwide. E-commerce and home-delivery services expand access to specialty categories, complementing store purchases. Stadium, event, and theme-park venues contribute episodic volume increases. Production facilities in neighboring prefectures ensure short-haul transport to reduce temperature-control risk. Consumers show interest in lower-malt and calorie-adjusted beer aligned with regulatory labeling requirements.

Kansai posts 5.5% CAGR with Osaka, Kyoto, and Kobe supporting demand through culinary culture and tourism-heavy areas. Izakaya chains and local dining venues maintain predictable keg consumption tied to evening and weekend visits. Retailers promote mixed-pack sales targeting households purchasing for home gatherings and seasonal holidays. Craft producers strengthen product assortment with region-specific styles marketed to domestic travelers. Breweries manage supply aligned with temperature-controlled logistics to ensure profile consistency. University districts contribute casual consumption patterns influencing continuous small-pack movement across convenience stores. Local buyers monitor price stability and freshness dates to retain quality expectations.

Chubu reports 4.9% CAGR, linked to industrial workforce consumption, retail shopping behavior, and moderate tourism in Aichi, Shizuoka, and Nagano. Restaurants serving after-work customers maintain recurrent keg purchasing aligned with shift-based dining patterns. Convenience-driven retail supports standard cans and smaller multipacks preferred for home consumption. Regional breweries develop controlled-release craft batches distributed through select convenience stores and taprooms. Cold-chain logistics are important for maintaining product stability during transport across inland areas. Procurement focuses on cost-reliable offerings while reserving shelf space for seasonal SKUs during festivals and extended holidays.

Tohoku posts 4.3% CAGR, with regional consumption influenced by tourism in Sendai and coastal areas alongside hometown brand loyalty for established breweries. Packaged beer remains preferred for home gatherings and sporting events where community-based consumption patterns are common. Sales increase during summer festivals and travel seasons, reinforcing distributor planning. Retailers prioritize consistent carbonation and packaging strength suitable for transport in colder climates. Craft adoption continues gradually, with select brewpubs drawing attention from visitors.

The Rest of Japan records 4.1% CAGR with demand tied to local restaurants, suburban retail, and domestic tourism throughout smaller prefectures. Beer remains a common beverage for hospitality settings where casual dining drives regular turnover. Multi-can promotional offerings enable budget-aligned purchasing. Regional availability focuses on core brands with selective seasonal expansion. Distribution relies on planned deliveries maintaining suitable freshness windows across dispersed retail areas.

Demand for beer in Japan is shaped primarily by a small group of domestic brewers supplying mass-market lagers, premium brands, and seasonal/boutique variations through nationwide distribution, retail chains, bars, and izakaya. Asahi Group Holdings holds an estimated 40.0% share, supported by controlled brewing processes, consistent brand recognition, and broad retail and on-trade penetration. Its flagship lager and seasonal products maintain stable quality and strong consumption appeal across generations.

Kirin Brewery Company maintains significant participation through a diversified portfolio that includes its core lager brands as well as new alcoholic-beverage categories, offering reliable supply and widespread retail availability. Suntory Holdings contributes through its beer and “happoshu” portfolio, capturing demand from consumers seeking lighter taste profiles or alternative alcoholic beverages while leveraging its strong marketing and distribution network. Sapporo Breweries supports domestic demand through both mainstream and craft-style beers, offering consistent quality and leveraging legacy brand value among urban and regional drinkers.

Competition in Japan centers on brand identity, flavour consistency, seasonal product innovation, price positioning, retail distribution strength, and on-trade presence. Demand remains steady as Japanese consumers continue to prefer domestic beer products for everyday drinking, social occasions, and seasonal consumption, with loyalty reinforced by stable product availability and trusted brand heritage across generations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Lager, Ale, Stouts, Others |

| Packaging | Bottle, Can, Glass, Others |

| Production | Macro-brewery, Craft Brewery, Microbrewery, Other |

| Distribution Channel | Hypermarkets/Supermarkets, Convenience Stores, Online Retailers, Specialty Stores, Independent Retailers, Direct, Indirect |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Asahi Group Holdings, Kirin Brewery Company, Suntory Holdings, Sapporo Breweries |

| Additional Attributes | Demand segmented by packaging formats and brewery scales; variations in consumption across major urban regions including Kanto and Kansai; shift toward craft and microbrewery brands; online delivery integration in urban clusters; product diversification in ale and stout offerings; influence of evolving alcohol regulation, premiumization and ready-to-drink alternatives across Japan. |

The demand for beer in Japan is estimated to be valued at USD 41.6 billion in 2025.

The market size for the beer in Japan is projected to reach USD 70.9 billion by 2035.

The demand for beer in Japan is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in beer in Japan are lager, ale, stouts and others.

In terms of packaging, bottle segment is expected to command 42.0% share in the beer in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA