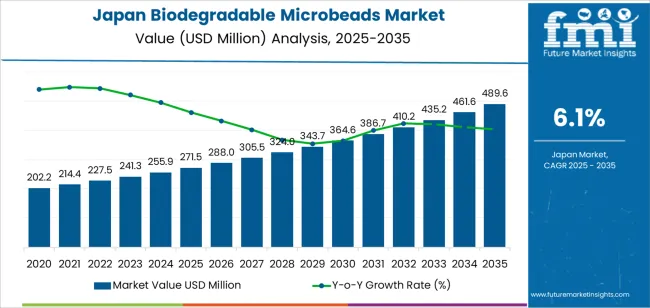

The demand for biodegradable microbeads in Japan is projected to grow from USD 271.5 million in 2025 to USD 489.6 million by 2035, reflecting a CAGR of 6.1%. Biodegradable microbeads are used in a variety of industries, including cosmetics, personal care, pharmaceuticals, and cleaning products, as alternatives to plastic microbeads. The growing awareness about the environmental impact of non-biodegradable plastics has significantly driven the shift toward biodegradable solutions, making microbeads a preferred choice in the formulation of scrubs, exfoliants, and cleansing products.

Stricter regulations regarding plastic waste and the sustainability movement within the consumer goods sector are contributing to this market’s growth. The increasing popularity of eco-friendly personal care products and the push for green alternatives in the market will drive further adoption of biodegradable microbeads in various product lines. As Japan continues to focus on sustainable production and environmentally friendly innovations, the demand for biodegradable microbeads will likely remain strong throughout the forecast period.

From 2025 to 2030, the demand for biodegradable microbeads in Japan will grow from USD 271.5 million to USD 364.6 million, contributing USD 93.1 million in value. During this period, the market will experience accelerated growth driven by rising environmental consciousness and the increased adoption of sustainable product ingredients. The introduction of more eco-friendly alternatives in cosmetics and personal care products, combined with government regulations pushing for plastic-free solutions, will drive the demand for biodegradable microbeads. The shift from non-biodegradable plastic microbeads to biodegradable options will lead to increased sales, especially in Japan's cosmetic and skincare industry, where natural, sustainable ingredients are gaining popularity.

From 2030 to 2035, the market will grow from USD 364.6 million to USD 489.6 million, adding USD 125 million in value. During this phase, growth will continue but at a moderate pace, as the market stabilizes after an initial surge. By this time, biodegradable microbeads will become more standardized in product formulations, and the market will see saturation in the personal care sector. However, growth will be sustained by expanding adoption across other industries, such as pharmaceuticals and cleaning products, which will continue to seek environmentally friendly alternatives. The overall demand will be influenced by regulatory frameworks and increased preference for green products, maintaining steady growth despite the market approaching maturity.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 271.5 million |

| Industry Forecast Value (2035) | USD 489.6 million |

| Industry Forecast CAGR (2025-2035) | 6.1% |

Demand for biodegradable microbeads in Japan is growing as manufacturers in cosmetics, personal care and household cleaning seek alternatives to synthetic microplastics. The market in Japan is estimated at USD 271.5 million and is projected to reach USD 489.6 million, indicating a compound annual growth rate (CAGR) of approximately 6.1 %. Key drivers include regulatory pressure to phase out non biodegradable microbeads, growing consumer awareness of plastic pollution, and increasing adoption of formulations with cellulose or starch derived particles.

Another factor supporting demand is the rise of plant based and bio based formulation trends in Japan’s beauty and hygiene industries. Brands are reformulating exfoliating scrubs, face washes and cleansers to include biodegradable microbeads that align with clean label and eco friendly positioning. At the same time, challenges remain, such as higher production costs for bio based beads compared with traditional plastic beads, variable performance in certain applications, and the need for supporting infrastructure for biodegradation. Despite these obstacles, the structural shift in public policy, consumer demand for sustainability and industry reformulation plans suggest steady growth in Japan’s market for biodegradable microbeads.

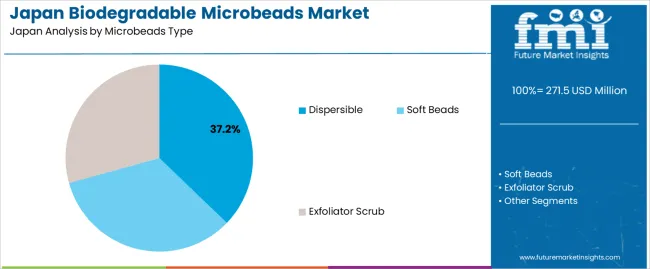

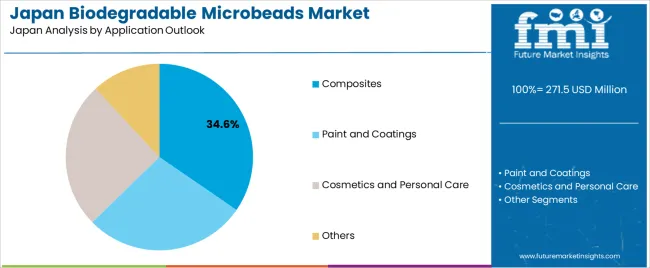

The demand for biodegradable microbeads in Japan is driven by microbeads type and application outlook. The leading microbeads type is dispersible, accounting for 37% of the market share, while composites is the dominant application outlook, capturing 34.6% of the demand. Biodegradable microbeads are used as an eco-friendly alternative to traditional plastic microbeads in various industries, providing an environmentally responsible solution without compromising performance. As concerns about plastic pollution grow, the demand for biodegradable microbeads continues to increase, particularly in industries that focus on sustainability and regulatory compliance.

Dispersible microbeads lead the demand for biodegradable microbeads in Japan, holding 37% of the market share. These microbeads are designed to break down easily in water, making them a more environmentally friendly alternative to traditional plastic microbeads. Dispersible microbeads are widely used in applications such as personal care products, where they serve as exfoliating agents, and in other industries where easy dispersion in liquids is required.

The demand for dispersible biodegradable microbeads is driven by their ability to meet environmental standards while providing the necessary performance for applications like exfoliation and cleaning. As awareness about the environmental impact of microplastics increases, dispersible biodegradable microbeads offer a sustainable solution for industries seeking to reduce their ecological footprint. Their widespread use in cosmetics, personal care products, and other industries looking for eco-friendly alternatives ensures that dispersible microbeads will remain the dominant type in the market in Japan.

Composites is the leading application outlook for biodegradable microbeads in Japan, capturing 34.6% of the demand. Biodegradable microbeads are increasingly being used in composite materials to enhance performance, especially in the production of environmentally friendly products. In composites, these microbeads are used to improve material properties such as texture, rigidity, and durability, making them valuable in the automotive, construction, and other industrial sectors.

The demand for biodegradable microbeads in composites is driven by the growing need for sustainable materials that offer both performance and environmental benefits. As manufacturers in Japan prioritize reducing their carbon footprint and adhering to environmental regulations, the adoption of biodegradable microbeads in composite materials is expected to grow. Additionally, the rising demand for lightweight, high-performance materials in industries like automotive and construction supports the continued use of biodegradable microbeads in composites, making this application segment a key driver of market growth.

Demand for biodegradable microbeads in Japan is being shaped by increasing regulatory scrutiny on conventional plastic microbeads, rising consumer awareness of micro plastic pollution, and expanding eco friendly personal care and household product portfolios. The well developed Japanese cosmetics industry is shifting toward bio based alternatives, and manufacturers are adopting biodegradable microbeads derived from cellulose, starch or aliphatic polyesters. At the same time, higher cost of bio based beads, complexity of supply chains and limited large scale availability moderate the rate of uptake. These dynamics define how the biodegradable microbeads market in Japan is evolving.

What Are the Primary Growth Drivers for Biodegradable Microbead Demand in Japan?

Several drivers support market growth. First, regulatory and voluntary measures to replace synthetic plastic microbeads in rinse off cosmetics and household cleaning products are accelerating, pushing adoption of biodegradable alternatives. Second, Japanese consumers are increasingly concerned about environmental impact, marine pollution and micro plastics, which motivates brands to introduce sustainable formulations. Third, the strong presence of skincare, cosmetics and household care manufacturers in Japan creates a large base of potential users of biodegradable microbeads. Fourth, advances in biopolymer technology, green chemistry and plant derived raw materials enable development of functional biodegradable microbeads compatible with Japanese formulation standards.

What Are the Key Restraints Affecting Biodegradable Microbead Demand in Japan?

Despite supportive conditions, several constraints apply. The cost of developing and manufacturing high performance biodegradable microbeads remains higher than conventional microbeads, which can reduce competitiveness in cost sensitive applications. Some biodegradable microbeads may not yet match the performance of traditional plastic beads in terms of abrasiveness, solubility or stability, which may hamper adoption in premium formulations. Supply chain limitations for bio based feed stocks or specialised production also delay wide rollout. Finally, the transition process for reformulating existing products and achieving regulatory clearance may slow implementation by formulators.

What Are the Key Trends Shaping Biodegradable Microbead Demand in Japan?

Important trends include increased use of cellulose based or starch derived microbeads in exfoliating scrubs, facial washes and personal care products as part of clean label and eco friendly positioning. Suppliers are also offering microbeads engineered for controlled dissolution in water, minimal residue and improved biodegradability in marine conditions, aligning with Japanese environmental priorities. There is growing interest in integrating microbeads within multifunctional formulations, combining exfoliation with skincare benefits and biodegradability. Finally, collaboration between material scientists, cosmetic formulators and Japanese regulatory bodies is accelerating innovation and standard setting for next generation biodegradable microbeads.

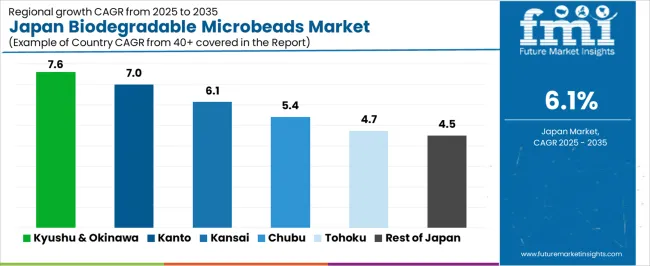

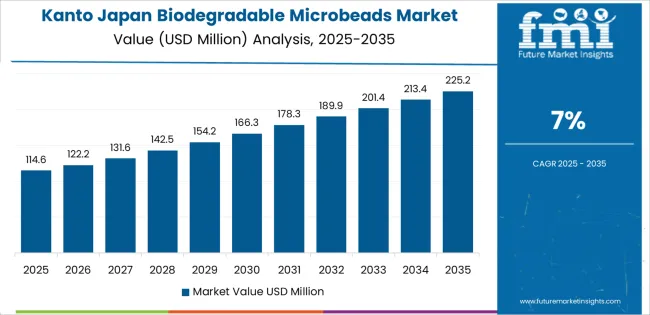

The demand for biodegradable microbeads in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 7.6%. Kanto follows closely with a CAGR of 7.0%, driven by the region's strong emphasis on environmental sustainability and technological innovation. The Kinki region exhibits moderate growth at 6.1%, while Chubu, Tohoku, and the Rest of Japan show slower growth, with respective CAGRs of 5.4%, 4.7%, and 4.5%. These regional differences reflect varying levels of environmental awareness, industrial activity, and consumer demand for eco-friendly alternatives across Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.6% |

| Kanto | 7% |

| Kinki | 6.1% |

| Chubu | 5.4% |

| Tohoku | 4.7% |

| Rest of Japan | 4.5% |

The demand for biodegradable microbeads in Kyushu & Okinawa is projected to grow at a CAGR of 7.6%, driven by the region's increasing focus on sustainability and environmental protection. Kyushu & Okinawa are known for their natural beauty and biodiversity, which has led to a growing awareness of the environmental impact of plastic waste and the need for eco-friendly alternatives. The region's adoption of biodegradable products, particularly in industries such as cosmetics, personal care, and cleaning, is fostering a positive market for biodegradable microbeads. Furthermore, the region's strong tourism sector is placing increased emphasis on sustainability, driving both local consumers and businesses to adopt greener products. As regulations around plastic usage become stricter, the demand for biodegradable solutions, including microbeads, is expected to continue growing in this region.

In Kanto, the demand for biodegradable microbeads is expected to grow at a CAGR of 7.0%, fueled by the region's high level of environmental awareness and the presence of major industries and research institutions. Kanto, particularly Tokyo, is at the forefront of Japan’s push for sustainability, with both consumers and businesses prioritizing eco-friendly solutions. The region's regulatory environment, which includes policies aimed at reducing plastic waste, is also contributing to the demand for biodegradable alternatives. Additionally, the cosmetics and personal care industries in Kanto are large and growing, with many companies actively seeking sustainable ingredients, including biodegradable microbeads, to replace harmful plastics in their products. As consumer preferences shift towards green, cruelty-free, and sustainable options, demand for biodegradable microbeads in Kanto is expected to remain strong.

The demand for biodegradable microbeads in the Kinki region is projected to grow at a CAGR of 6.1%, reflecting a moderate but steady increase. Kinki, which includes Osaka and Kyoto, has a strong manufacturing base and a growing consumer market focused on sustainability. As the region continues to evolve toward greener practices, particularly in industries like cosmetics, agriculture, and manufacturing, the demand for biodegradable products, including microbeads, is rising. The region's consumers, particularly in urban centers, are becoming increasingly environmentally conscious and are seeking products that align with their values, such as eco-friendly personal care items and cleaning products. The Kinki region’s growing interest in reducing plastic waste, coupled with increased regulatory pressure on industries to adopt sustainable practices, ensures that the demand for biodegradable microbeads will continue to grow, though at a slower pace compared to regions like Kyushu & Okinawa and Kanto.

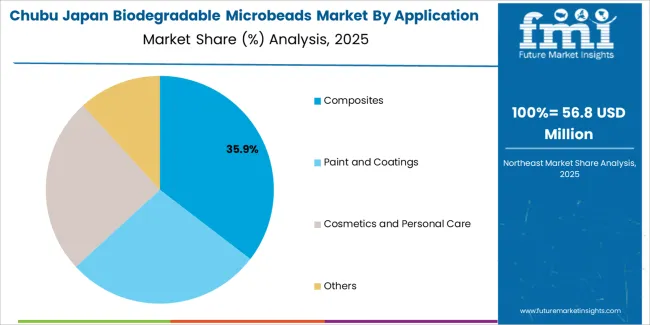

The demand for biodegradable microbeads in Chubu is expected to grow at a CAGR of 5.4%, driven by the region's manufacturing sector and increasing environmental awareness. Chubu, home to major industrial cities like Nagoya, has a large consumer base in industries such as automotive, manufacturing, and personal care. As sustainability becomes a more pressing concern in both consumer products and industrial applications, the demand for biodegradable alternatives, including microbeads, is rising. The region's growing interest in green products is partly driven by stricter environmental regulations and an increasing focus on reducing plastic waste. However, the growth rate in Chubu is slower compared to regions like Kyushu & Okinawa and Kanto, likely due to the more traditional industries present in the region. Despite this, the demand for biodegradable microbeads is expected to continue expanding as industries in Chubu adjust to the increasing emphasis on eco-friendly practices.

In Tohoku, the demand for biodegradable microbeads is projected to grow at a CAGR of 4.7%, reflecting slower adoption compared to more urbanized regions. Tohoku, with its more rural and less industrialized nature, has fewer large-scale manufacturers, which may result in slower uptake of biodegradable products. However, as environmental awareness grows and sustainability becomes a key focus for both consumers and businesses, the demand for biodegradable alternatives like microbeads is gradually increasing. The region's aging population and the increasing awareness of the environmental impact of traditional plastic-based products are contributing to the demand for eco-friendly options. Although the growth rate is slower than in major urban centers, Tohoku's rising commitment to sustainability ensures steady growth in the demand for biodegradable microbeads.

In the Rest of Japan, the demand for biodegradable microbeads is expected to grow at a CAGR of 4.5%, reflecting gradual growth driven by the shift towards more sustainable consumer products. This region, which includes rural areas and smaller cities, tends to be slower to adopt new environmental practices, but growing awareness of global environmental issues and the harmful effects of plastic waste is driving change. As more consumers in the Rest of Japan seek eco-friendly alternatives, including biodegradable microbeads, industries such as cosmetics and personal care are responding by incorporating greener ingredients into their products. Although the pace of growth in the Rest of Japan is slower compared to more urbanized regions, the ongoing shift towards sustainability is expected to result in steady, if modest, demand for biodegradable microbeads in the coming years.

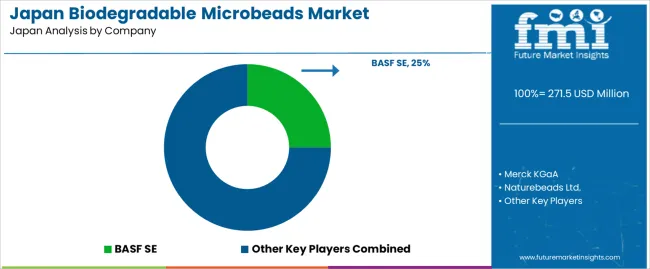

Demand for biodegradable microbeads in Japan is growing as consumer goods manufacturers and regulators move away from traditional plastic microbeads and toward materials that degrade naturally in wastewater or compost. Companies such as BASF SE (holding approximately 25% market share), Merck KGaA, Naturebeads Ltd., TerraVerdae Bio Works, and Evonik Industries AG are active in this sector. Japanese personal care brands increasingly deploy biodegradable microbeads in exfoliants, cleansing gels and cosmetics to meet both consumer expectations and regulatory pressures around microplastics.

Competition in the biodegradable microbeads industry is shaped by material performance, environmental credentials and formulation compatibility. Suppliers focus on ensuring that microbeads provide similar exfoliation or suspension properties to conventional products while offering biodegradation under specified conditions. Another competitive dimension is compatibility with existing formulations and manufacturing processes in Japan, particularly within cosmetics production lines that favour minimal reformulation. Firms also emphasise compliance with Japanese and international standards for biodegradability and microplastics reduction. Marketing materials commonly highlight particle size distribution, effective biodegradation time, and application versatility in skincare systems. By aligning their offerings with the industry trend toward sustainable consumer care ingredients, these companies aim to strengthen their position in Japan’s biodegradable microbeads market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Microbeads Type | Dispersible, Soft Beads, Exfoliator Scrub |

| Application Outlook | Composites, Paint and Coatings, Cosmetics and Personal Care, Others |

| Material Type | Cellulose, Aliphatic Polyesters, Starch |

| Compounding | Powder-based, Granule-based |

| Key Companies Profiled | BASF SE, Merck KGaA, Naturebeads Ltd., TerraVerdae Bio works, Evonik Industries AG |

| Additional Attributes | The market analysis includes dollar sales by microbeads type, application, material type, and compounding method. It also covers regional demand trends in Japan, driven by the increasing adoption of biodegradable microbeads in cosmetics and personal care products, as well as their use in coatings and composites. The competitive landscape highlights key manufacturers focusing on sustainable materials and innovations in biodegradable formulations. Trends in the growing demand for environmentally friendly alternatives to plastic microbeads are explored, along with advancements in material development and eco-conscious production practices. |

The demand for biodegradable microbeads in japan is estimated to be valued at USD 271.5 million in 2025.

The market size for the biodegradable microbeads in japan is projected to reach USD 489.6 million by 2035.

The demand for biodegradable microbeads in japan is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in biodegradable microbeads in japan are dispersible, soft beads and exfoliator scrub.

In terms of application outlook, composites segment is expected to command 34.6% share in the biodegradable microbeads in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA