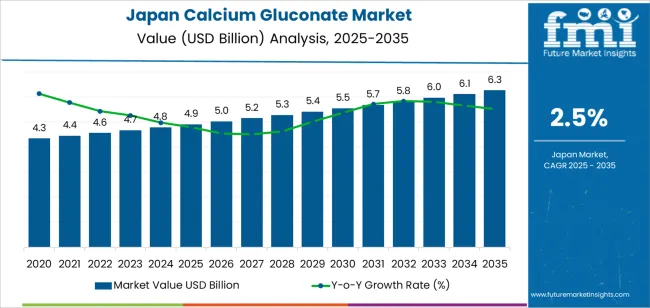

The demand for calcium gluconate in Japan is expected to grow from USD 4.9 billion in 2025 to USD 6.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 2.5%. Calcium gluconate, a calcium salt, is used primarily in the pharmaceutical and food industries. It plays a vital role in treating calcium deficiencies and is commonly used intravenously to treat conditions such as hyperkalemia. In the food sector, calcium gluconate is used for food fortification and as a stabilizing agent. As the demand for nutraceuticals, functional foods, and dietary supplements continues to rise in Japan, calcium gluconate is expected to see increased adoption, particularly as awareness of the benefits of calcium supplementation grows.

The growing interest in preventive healthcare, combined with an aging population, is fueling the demand for calcium supplements. In the healthcare industry, calcium gluconate remains a key treatment for various medical conditions involving calcium imbalances, further contributing to its industry growth. As the global trend towards healthier lifestyles continues to gain momentum, there is a significant push for more fortified foods and supplements to support overall health, which will drive the demand for calcium gluconate in the functional food sector.

Between 2025 and 2030, the demand for calcium gluconate in Japan is expected to grow from USD 4.9 billion to USD 5.2 billion. This period will experience steady, consistent growth as the demand for calcium gluconate remains stable across existing industrys. The early years will reflect incremental increases, driven by consistent use in healthcare applications and ongoing adoption in the food sector. The slight increase in demand during this phase will primarily be attributed to the continuation of existing trends in the nutraceutical and pharmaceutical industrys, with calcium gluconate remaining a trusted ingredient in dietary supplements and medical treatments.

From 2030 to 2035, the demand for calcium gluconate is expected to experience a more pronounced rise, growing from USD 5.2 billion to USD 6.3 billion. The later phase will reflect an acceleration in demand, driven by the expanding awareness of the benefits of calcium supplementation, especially among aging populations who are more prone to calcium deficiencies. The increased emphasis on preventive healthcare, functional foods, and personalized nutrition will drive this growth. The rising trend of fortifying foods with essential nutrients, including calcium, will lead to greater adoption of calcium gluconate as a preferred source of calcium in food and beverage formulations.

| Metric | Value |

|---|---|

| Demand for Calcium Gluconate in Japan Value (2025) | USD 4.9 billion |

| Demand for Calcium Gluconate in Japan Forecast Value (2035) | USD 6.3 billion |

| Demand for Calcium Gluconate in Japan Forecast CAGR (2025-2035) | 2.5% |

The demand for calcium gluconate in Japan is increasing due to its vital applications in the pharmaceutical, food, and healthcare industries. Calcium gluconate is commonly used in the treatment of calcium deficiencies, particularly in medical settings for conditions like hypocalcemia, and as a stabilizer in various food products. The increasing prevalence of conditions related to calcium deficiency, along with Japan’s aging population, is driving the demand for calcium gluconate as a key supplement for bone health and overall wellness.

A major driver of growth is the rising focus on health and nutrition, especially in aging adults who are more prone to calcium loss due to reduced absorption. Calcium gluconate is frequently used as a calcium supplement in both the pharmaceutical sector and in fortified foods. As awareness of the importance of bone health grows in Japan, calcium gluconate is becoming a preferred option for maintaining proper calcium levels, particularly for older populations and those at risk for osteoporosis.

The demand for calcium gluconate is supported by its use in the food and beverage industry, where it is utilized as a food additive and preservative. As food manufacturers seek ways to improve the nutritional value of products, calcium gluconate's role as a dietary supplement and fortifier is contributing to its increasing demand. As Japan continues to prioritize health and wellness, the demand for calcium gluconate is expected to grow steadily through 2035.

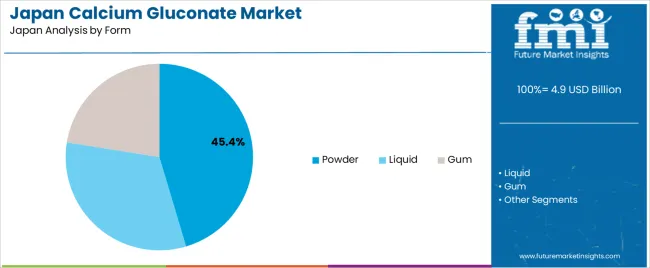

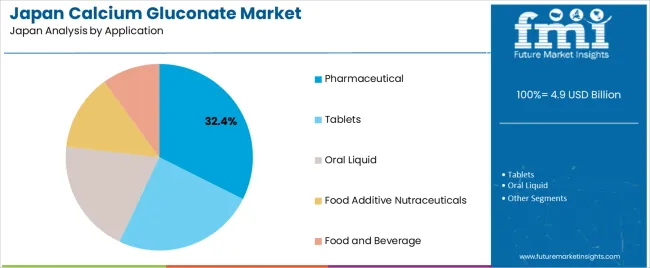

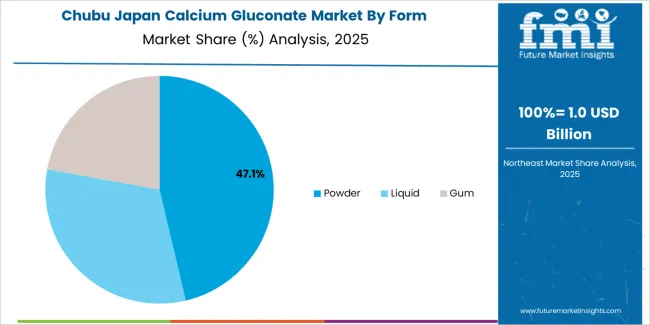

Demand for calcium gluconate in Japan is segmented by form, application, end use, and region. By form, demand is divided into powder, liquid, and gum, with powder holding the largest share at 45.4%. The demand is also segmented by application, including pharmaceuticals, tablets, oral liquids, nutraceuticals, and food & beverage, with pharmaceutical applications leading the demand at 32.4%. By end use, demand is split into bulking agents, emulsifiers, and thickening agents, with bulking agents leading the way. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

Powdered calcium gluconate accounts for 45.4% of the demand in Japan. Powder form is highly favored due to its versatility, ease of handling, and cost-effectiveness. It is commonly used in pharmaceuticals and food products as a source of calcium supplementation. The powder form allows for precise dosing, making it ideal for inclusion in tablet and capsule formulations, which are widely used for calcium supplementation in the healthcare sector. Powdered calcium gluconate can be easily incorporated into food and beverage products, providing a stable and easily absorbable form of calcium. The preference for powdered forms is also driven by their longer shelf life and ease of storage, as they are less prone to degradation compared to liquid or gum forms. With continued demand for calcium supplements in the pharmaceutical and food industries, powdered calcium gluconate will remain a dominant choice in the industry.

Pharmaceutical applications account for 32.4% of the demand for calcium gluconate in Japan. Calcium gluconate is widely used in the pharmaceutical industry for its essential role in treating calcium deficiencies, as well as in various medical conditions such as hypocalcemia. It is often included in intravenous (IV) solutions for patients who require quick calcium replenishment. It is used as a key ingredient in calcium supplements available in tablet or oral liquid forms. The pharmaceutical sector drives the demand for calcium gluconate due to its vital health benefits, particularly in bone health, muscle function, and heart health. As the aging population in Japan increasingly seeks treatments for calcium deficiency and bone-related diseases like osteoporosis, the demand for calcium gluconate in pharmaceutical applications is expected to grow, making it a central component in calcium supplements and medical formulations.

In Japan, the demand for calcium gluconate is increasingly influenced by several industry dynamics. On the driver side, Japan’s ageing population and rising prevalence of bone‑health issues such as osteoporosis create a stronger need for clinically‑relevant calcium salts, including calcium gluconate. T growth of nutraceuticals, fortified foods and functional beverages supports uptake of food‑grade calcium salts. On the restraint side, the fairly high cost of pharmaceutical‑grade calcium gluconate, regulatory requirements for both medicinal and food‑supplement applications, and competition from other cheaper calcium salts (for example calcium carbonate or calcium citrate) limit faster expansion.

Why is Demand for Calcium Gluconate Growing in Japan?

Demand for calcium gluconate in Japan is growing as healthcare providers, supplement manufacturers, and food‑fortification industries seek effective calcium salts that offer high bioavailability and safety, especially for older adults and people with dietary restrictions. Calcium gluconate is used in hospital settings to treat hypocalcemia through injectable forms, as well as in dietary supplements and fortified foods. Japan’s demand for premium, high‑quality ingredients that meet strict safety standards supports its growing use. The country’s increasing focus on preventive healthcare and the rising popularity of bone‑health products further drive the demand for calcium gluconate, which is considered a trusted source of calcium for both therapeutic and nutritional applications.

How are Technological Innovations Driving Growth of Calcium Gluconate in Japan?

Technological innovations are helping to drive the growth of calcium gluconate in Japan by improving production processes, formulation techniques, and applications. Advancements in pharmaceutical manufacturing have made injectable and oral preparations of calcium gluconate safer and more stable, increasing their efficacy. In the nutraceutical and food‑fortification sectors, producers are developing more soluble, bioavailable forms of calcium gluconate that can be used in beverages or functional foods. Innovations in encapsulation and delivery systems have further enhanced its usability, making it easier to incorporate calcium gluconate into various consumer‑friendly formats. These innovations are essential in meeting the growing demand for calcium supplementation and fortification in Japan’s evolving health industry.

What are the Key Challenges Limiting Adoption of Calcium Gluconate in Japan?

Despite strong demand, adoption of calcium gluconate in Japan faces several challenges. One of the major hurdles is cost, as pharmaceutical‑grade calcium gluconate and high‑purity forms suitable for supplements or fortified foods are more expensive than basic calcium salts like calcium carbonate. Regulatory challenges also pose obstacles, as both pharmaceutical uses and food/fortification applications require compliance with strict Japanese standards for safety, labeling, and ingredient approval. Supply‑chain issues such as sourcing high‑quality raw materials and maintaining consistent manufacturing can impact the availability and pricing of calcium gluconate. The preference for cheaper calcium salts in some applications can limit the broader adoption of calcium gluconate in the industry.

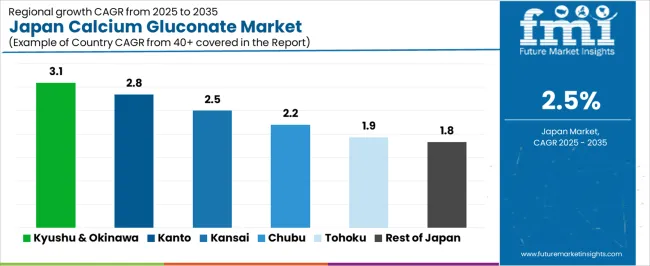

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.1% |

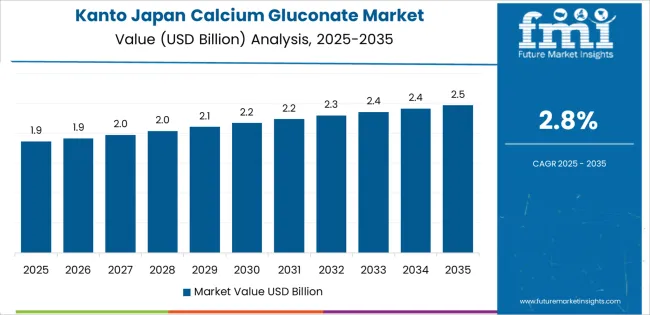

| Kanto | 2.8% |

| Kansai | 2.5% |

| Chubu | 2.2% |

| Tohoku | 1.9% |

| Rest of Japan | 1.8% |

Demand for calcium gluconate in Japan is growing across all regions, with Kyushu & Okinawa leading at a 3.1% CAGR due to the strong presence of healthcare facilities and rising awareness of calcium's medical uses. Kanto follows at 2.8% CAGR, driven by its large population and concentration of hospitals and clinics. Kansai experiences a 2.5% CAGR, fueled by the pharmaceutical and food industries. Chubu grows at 2.2%, supported by a health-conscious population and demand from food and healthcare sectors. Tohoku and the Rest of Japan see moderate growth at 1.9% and 1.8%, with demand driven by pharmaceutical applications and regional healthcare awareness.

Kyushu & Okinawa lead Japan in the demand for calcium gluconate, with a 3.1% CAGR. The demand in this region is largely driven by the increasing need for calcium supplements in medical treatments, particularly in Okinawa, where calcium deficiency is a concern due to dietary habits. Calcium gluconate is widely used in intravenous treatments for patients with hypocalcemia in healthcare facilities across Kyushu. The region’s strong healthcare infrastructure, combined with an aging population, is contributing to the rising use of calcium gluconate in both clinical and hospital settings. The demand for calcium gluconate in the food and supplement industry is rising, as more consumers are turning to calcium-based products to support bone health and prevent deficiencies. Kyushu’s growing healthcare awareness and the continued focus on improving public health contribute to the steady increase in demand for calcium gluconate across the region.

Kanto is experiencing steady demand for calcium gluconate, with a 2.8% CAGR. The region’s demand is largely driven by its dense population and high concentration of healthcare facilities, including hospitals, clinics, and pharmacies. Kanto is Japan’s medical hub, with many patients requiring calcium gluconate for intravenous infusions due to its role in correcting calcium imbalances. The region’s well-established pharmaceutical industry also contributes to the demand for calcium gluconate as a key ingredient in various supplements and treatment solutions. In addition, Kanto’s growing focus on preventive healthcare and its aging population, which faces an increased risk of calcium deficiency, further supports the demand for calcium gluconate. As Kanto continues to lead in healthcare innovation and population health management, the need for calcium gluconate will remain strong across medical and consumer applications.

Kansai is seeing moderate demand for calcium gluconate, with a 2.5% CAGR. The demand is largely driven by the region’s robust pharmaceutical and food industries, where calcium gluconate is used in a variety of applications. In Osaka and Kobe, leading pharmaceutical companies are incorporating calcium gluconate into their intravenous and supplement products, especially as part of treatments for calcium deficiency and bone health management. The region’s large food processing sector also drives demand, with calcium gluconate used as a supplement in fortified foods and beverages. Kansai's strong presence in the healthcare sector, combined with an aging population, contributes to the region's growing need for medical-grade calcium gluconate in hospitals and clinics. As the healthcare industry continues to expand and consumer awareness about bone health increases, the demand for calcium gluconate is expected to grow steadily in Kansai.

Chubu is experiencing steady demand for calcium gluconate, with a 2.2% CAGR. The demand in this region is largely driven by the healthcare sector’s increasing focus on calcium-based treatments, particularly for patients with calcium deficiencies. As the healthcare facilities in cities like Nagoya continue to expand, the demand for calcium gluconate in intravenous treatments is rising. The region’s food industry, which is involved in both production and distribution of health-focused products, is also a significant driver. Calcium gluconate is increasingly being incorporated into food supplements aimed at supporting bone and heart health. Chubu's aging population and growing interest in preventive healthcare contribute to the demand for calcium-based products. As Chubu continues to focus on improving healthcare access and public health, the demand for calcium gluconate in medical treatments and supplements is expected to increase steadily.

Tohoku is experiencing moderate demand for calcium gluconate, with a 1.9% CAGR. The demand in this region is primarily driven by healthcare applications, as local hospitals and clinics utilize calcium gluconate in treating patients with calcium deficiencies. Tohoku’s aging population and the region’s focus on improving healthcare services are increasing the need for calcium gluconate in both medical treatments and preventative health solutions. While the growth rate is slower compared to more industrialized regions, there is a steady rise in consumer awareness regarding the importance of calcium for bone health. Tohoku's growing focus on improving the healthcare infrastructure and providing better treatment options for elderly residents supports the demand for calcium gluconate, particularly in hospitals and healthcare centers.

The Rest of Japan is seeing moderate demand for calcium gluconate, with a 1.8% CAGR. The demand is driven by smaller-scale healthcare facilities and regional pharmaceutical manufacturers that use calcium gluconate for medical treatments and nutritional supplements. In rural and suburban areas, there is a growing awareness of calcium supplementation, especially among the elderly population, contributing to steady demand for calcium gluconate. As local hospitals and clinics continue to expand and improve their healthcare offerings, the demand for calcium gluconate in intravenous treatments is expected to grow. The food industry in smaller regions is increasingly using calcium gluconate in health-focused products, particularly in bone health supplements and fortified foods. The Rest of Japan’s moderate growth in demand for calcium gluconate reflects a steady rise in regional healthcare awareness and a growing focus on improving health outcomes.

In Japan, demand for calcium gluconate is driven by its extensive use in both pharmaceutical and nutraceutical applications. The compound, a calcium salt of gluconic acid, finds usage in intravenous treatments for hypocalcemia, as well as in dietary supplement and fortified food applications targeting bone health and mineral deficiency. The dense ageing population in Japan alongside well developed healthcare and nutrition sectors supports steady uptake of calcium gluconate formulations.

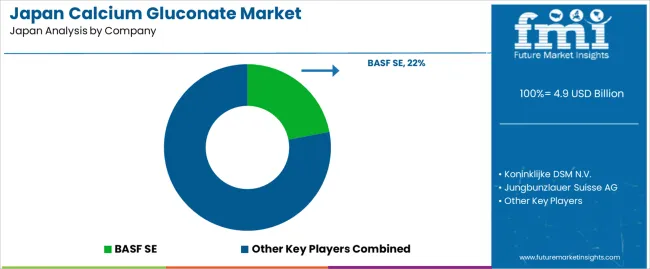

Leading suppliers with a significant presence in the Japanese industry include BASF SE (holding approximately 22.0 % share), Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc and Global Calcium Pvt Ltd. These firms differentiate through their high purity manufacturing, regulatory compliant production for pharmaceuticals, broad distribution networks, and technical support tailored for the Japanese industry. BASF SE’s share reflects its leadership in supplying both food grade and pharmaceutical grade calcium gluconate to Japanese formulators and healthcare providers.

The competitive dynamics in Japan’s calcium gluconate landscape are shaped by several factors. Key growth drivers include increasing dietary supplement penetration, fortification of functional foods, and growing incidence of calcium deficiency-linked conditions in older demographics. Advancements in bioavailability formulations and the rising health awareness among Japanese consumers strengthen demand. On the other hand, challenges persist raw material cost fluctuations, stringent Japanese regulatory requirements for pharmaceutical and food grade ingredients, and competitive pressure from alternative calcium salts are notable restraints. Suppliers who can provide consistent high quality calcium gluconate, efficient supply chain logistics, strong local technical service and regulatory expertise are best positioned to capture the opportunity in Japan’s calcium gluconate demand environment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Form | Powder, Liquid, Gum |

| Application | Pharmaceutical, Tablets, Oral Liquid, Food Additive Nutraceuticals, Food and Beverage |

| End Use | Bulking Agent, Emulsifier, Thickening Agent |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, Global Calcium Pvt Ltd |

| Additional Attributes | Dollar sales by form and application; regional CAGR and adoption trends; demand trends in calcium gluconate; growth in pharmaceuticals, food & beverage, and nutraceutical sectors; technology adoption for food additives and pharmaceutical applications; vendor offerings including raw materials and solutions; regulatory influences and industry standards |

The demand for calcium gluconate in Japan is estimated to be valued at USD 4.9 billion in 2025.

The market size for the calcium gluconate in Japan is projected to reach USD 6.3 billion by 2035.

The demand for calcium gluconate in Japan is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in calcium gluconate in Japan are pharmaceutical and food.

In terms of form, powder segment is expected to command 45.4% share in the calcium gluconate in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Calcium Supplement Market Trends – Growth, Demand & Forecast 2025-2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Demand for Calcium Oxide in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA