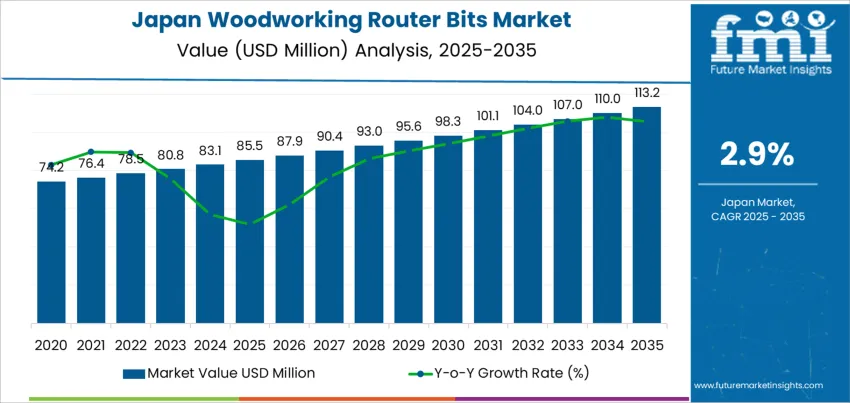

The demand for woodworking router bits in Japan is expected to grow from USD 85.5 million in 2025 to USD 113.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.9%. Woodworking router bits are essential tools for both professional woodworking and DIY applications, used to shape, trim, and cut wood. The steady demand for these tools is driven by the growth in construction, home improvement projects, and the increasing popularity of woodworking as a hobby in Japan. As the market matures, the demand for high-quality and durable router bits continues to support consistent growth.

The market will experience gradual, steady growth over the forecast period. Starting at USD 85.5 million in 2025, demand will increase slightly each year, reaching USD 87.9 million in 2026 and USD 90.4 million in 2027. By 2029, demand will rise to USD 95.6 million, with continued growth expected through the early 2030s. By 2035, the market for woodworking router bits is forecasted to reach USD 113.2 million, indicating a steady increase in demand driven by ongoing home improvement trends, industrial use, and the growing DIY market.

The woodworking router bits industry in Japan is expected to see moderate, consistent growth through 2035. Starting at USD 85.5 million in 2025, the market will gradually increase, reaching USD 87.9 million in 2026 and USD 90.4 million in 2027. The growth rate remains steady as the market continues to mature, with demand reaching USD 93.0 million in 2028 and USD 95.6 million in 2029. By 2035, the demand for woodworking router bits is expected to reach USD 113.2 million, driven by steady demand in both professional and DIY woodworking sectors.

The saturation point analysis suggests that while the woodworking router bits market continues to grow, the rate of growth will slow over time as the market reaches maturity. The early years of growth (2025–2029) reflect gradual increases, but as the market becomes saturated with established consumers and suppliers, growth will level off. The saturation point is anticipated to be reached in the later years of the forecast, with a more stable demand for products. Despite this, the market will remain steady, supported by ongoing demand for replacement tools and advancements in router bit technology.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 85.5 million |

| Industry Forecast Value (2035) | USD 113.2 million |

| Industry Forecast CAGR (2025-2035) | 2.9% |

The demand for woodworking router bits in Japan is increasing as the furniture manufacturing and interior design sectors expand. The domestic market for wooden furniture in Japan is rising, partly driven by growing interest in sustainable, space saving and multifunctional furniture, along with rising home renovation and interior design activity. As demand for high quality, well finished wood products increases, manufacturers and craftsmen require precise tools such as router bits for cutting, shaping, edging, and joinery. Use of engineered wood and prefabricated wood components adds to need for reliable router bits that deliver consistent performance. At the same time, growing use of automated and CNC woodworking systems in Japan supports demand for high precision router bits able to meet strict quality and finish standards.

Beyond industrial manufacturing, the rise in hobbyist woodworking and small workshop carpentry also supports growth. Interest in DIY, custom cabinetry, and home improvement projects encourages purchase of router bits by non professional users. Advances in tool material and design — including carbide tipped bits, improved coatings, and bits optimized for modern woodworking machines — make router bits more durable and effective on a range of wood types from softwoods to hardwoods and engineered board. These improvements lower maintenance and replacement costs and raise output quality. Combined with growth in furniture demand, rising renovation activity, and broader use of CNC or automated wood working technologies, these factors make demand for woodworking router bits in Japan likely to increase steadily over coming years.

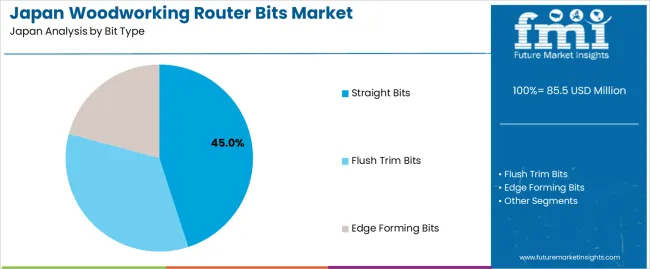

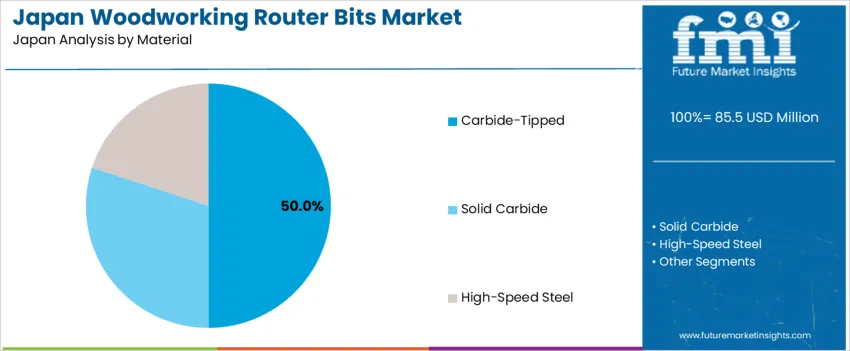

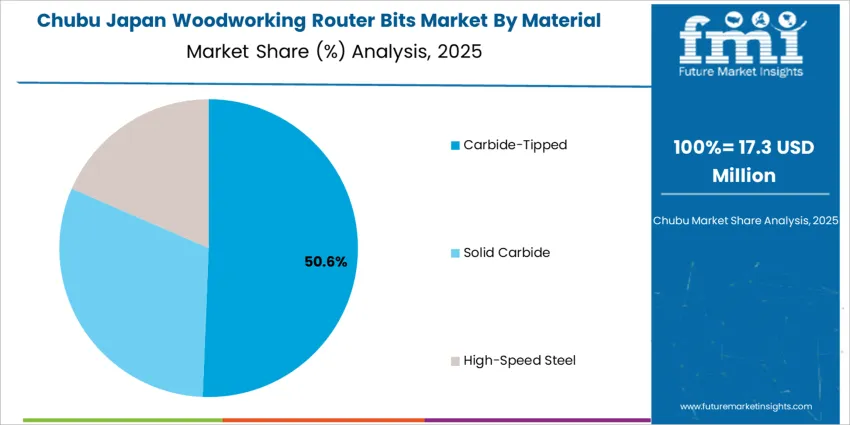

The demand for woodworking router bits in Japan is driven by bit type and material. The leading bit type is straight bits, capturing 45% of the market share, while carbide-tipped router bits dominate the material segment, accounting for 50% of the demand. Woodworking router bits are essential tools for precision cutting, shaping, and detailing, and they are widely used in both professional woodworking and DIY applications. As demand for high-quality, durable tools continues to rise, both straight bits and carbide-tipped materials remain top choices for woodworkers in Japan.

Straight bits lead the demand for woodworking router bits in Japan, holding 45% of the market share. Straight bits are the most commonly used router bits due to their simplicity and versatility. These bits are ideal for creating straight cuts, grooves, and dados, and they are widely used in various woodworking applications, including cabinetry, furniture making, and general carpentry. Their ability to cut clean, straight lines makes them essential for both novice and experienced woodworkers.

The demand for straight bits is driven by their widespread use and ability to perform basic yet essential tasks efficiently. Straight bits are relatively easy to use and provide precise cuts, making them a preferred choice for both professionals and hobbyists. As woodworking continues to be a popular craft in Japan, straight bits remain the dominant choice for general-purpose router tasks. Their effectiveness and cost-efficiency contribute to their continued leadership in the woodworking router bit market.

Carbide-tipped router bits lead the material demand in Japan, accounting for 50% of the market share. Carbide-tipped bits are preferred for their durability, sharpness, and resistance to wear, which make them ideal for high-precision woodworking. The carbide tips provide superior cutting performance and can withstand the high stresses of woodworking, especially when working with tough materials like hardwood, MDF, and plywood. Carbide-tipped bits are especially popular in professional settings, where consistent performance and longevity are essential.

The demand for carbide-tipped router bits is driven by their ability to offer longer tool life, precision, and efficiency in demanding tasks. While carbide-tipped bits tend to be more expensive than high-speed steel or other alternatives, their superior durability and ability to maintain sharpness for extended periods justify the investment. As the woodworking industry in Japan continues to prioritize high-performance tools for both residential and commercial applications, carbide-tipped router bits are expected to maintain their dominant position in the market. Their ability to deliver clean, accurate cuts and resist wear in tough materials makes them the preferred choice for serious woodworkers.

Demand for woodworking router bits in Japan has been rising in step with growth in furniture manufacturing, interior fit carpentry, and renovation activity. The domestic woodworking machinery market shows solid growth, driven by demand for bespoke wood products, interior fittings, and high-quality furniture. This environment supports steady demand for router bits, as woodworkers require tools for shaping, cutting, and finishing wood components. As more workshops adopt automated or semi-automated woodworking equipment, the need increases for bits compatible with modern routers. Overall, demand for router bits in Japan is expected to grow gradually and remain tied to the health of furniture, construction, and interior markets.

What are the Drivers of Demand for Woodworking Router Bits in Japan?

One driver is growth in the furniture and interior fitting sectors. As demand increases for custom furniture, cabinetry, and interior woodwork, woodworkers require precise cutting and shaping tools. The expansion of bespoke and high-quality wood products raises the need for router bits suited to varied tasks. Another driver is adoption of modern woodworking machines and CNC tools. The woodworking machinery market in Japan is growing, supported by firms seeking higher precision and productivity. That trend increases demand for router bits compatible with such machines. In addition, domestic appreciation for craftsmanship and fine woodworking supports demand for tools that enable clean cuts and detailed finishes. The market for engineered wood, renovation projects, and replacement or refurbishment of interior furniture or fixtures also sustains demand. These factors combine to support continued use and replacement of router bits among Japan’s woodworking industry.

What are the Restraints on Demand for Woodworking Router Bits in Japan?

One restraint arises from competition with alternative woodworking methods and tools. Traditional joinery techniques and hand tool-based workmanship remain culturally significant in Japan, which may reduce reliance on router-based methods for certain woodwork. Also, the high cost of premium router bits, particularly carbide-tipped or specialty bits, may limit adoption among smaller workshops or amateur woodworkers if budgets are constrained. Another restraint stems from fluctuations in demand for new furniture or renovation projects, which could slow overall tools demand when economic conditions change. In addition, if the availability of timber or suitable wood declines, that could reduce woodworking activity overall. Finally, high maintenance and investment costs associated with modern woodworking machinery, including routers, may restrain some smaller operators, affecting demand for associated bits.

What are the Key Trends Influencing Demand for Woodworking Router Bits in Japan?

A key trend is increasing use of advanced router bits made of carbide or other durable materials that deliver longer tool life and cleaner cuts. As woodworkers aim for precision and efficiency, such bits become more popular. Another trend is adoption of automated and CNC-based woodworking equipment, which requires bits suited to machine-based routing rather than manual routing. Demand is rising for bits designed for specialized tasks such as grooving, edge profiling, flush-trim, and custom shaping in response to demand for complex furniture and interior woodwork. Also, the shift toward custom, small-batch furniture, bespoke cabinetry, and interior renovation in urban housing supports demand for specialized router bits over generic ones. Finally, as the woodworking machinery market grows, replacement demand and maintenance of existing tools contribute to stable demand for router bits.

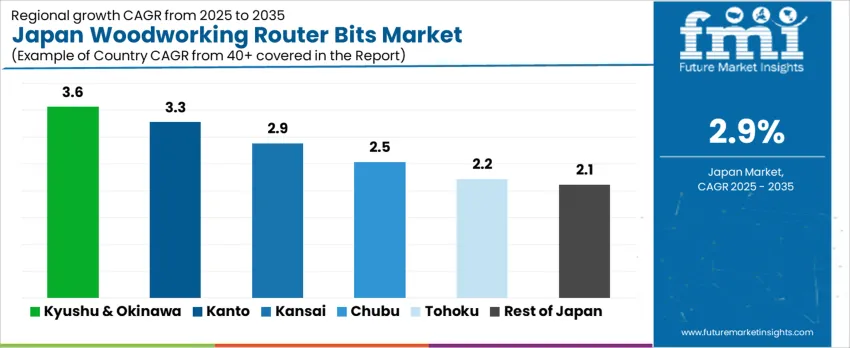

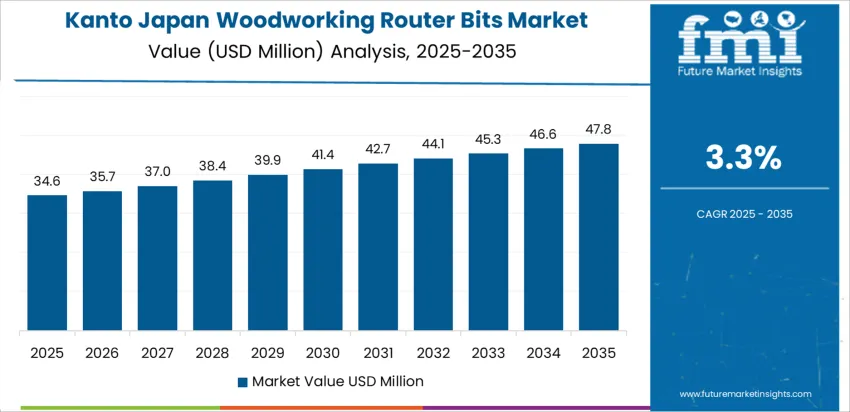

The demand for woodworking router bits in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 3.6%. Kanto follows with a CAGR of 3.3%, supported by the region's strong industrial base and woodworking activities. The Kinki region shows moderate growth at 2.9%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 2.5%, 2.2%, and 2.1%. These regional differences reflect varying levels of woodworking activity, consumer demand for high-quality tools, and the presence of industries that rely on precise woodwork for manufacturing and construction.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.6 |

| Kanto | 3.3 |

| Kinki | 2.9 |

| Chubu | 2.5 |

| Tohoku | 2.2 |

| Rest of Japan | 2.1 |

The demand for woodworking router bits in Kyushu & Okinawa is projected to grow at a CAGR of 3.6%, driven by the region's growing woodworking and construction sectors. Kyushu & Okinawa have a strong tradition of craftsmanship, and the demand for high-quality router bits is supported by both professional woodworkers and DIY enthusiasts. The increasing focus on home renovation and interior design, especially in Okinawa's growing tourism industry, is contributing to the rise in woodworking activities. Additionally, the region’s focus on local craftsmanship and custom-made wood products further fuels the demand for precision tools like router bits. As the popularity of woodworking as a hobby and profession increases, so does the need for high-performance router bits in the region.

In Kanto, the demand for woodworking router bits is expected to grow at a CAGR of 3.3%, driven by the region's strong industrial base and large population. Kanto, home to Tokyo and several major woodworking and furniture manufacturing industries, relies heavily on high-quality tools for both commercial and residential projects. The growing demand for custom furniture, cabinetry, and interior design is a key factor driving the need for precision woodworking tools such as router bits. The region’s focus on innovation and product quality in the construction and furniture sectors ensures continued growth in the demand for woodworking router bits. Additionally, the rise of DIY culture in urban areas has contributed to greater interest in woodworking, further supporting the need for these tools.

The demand for woodworking router bits in Kinki is projected to grow at a CAGR of 2.9%, reflecting moderate growth driven by the region’s industrial and manufacturing sectors. Kinki, including Osaka and Kyoto, has a significant woodworking industry, particularly in the furniture and interior design markets, where high-quality router bits are essential for precision work. As custom wood products and furniture gain popularity, the demand for specialized tools like router bits is expected to rise. Additionally, the region’s strong construction sector, with a focus on high-end residential and commercial projects, drives the need for fine woodwork. While the growth rate is slower compared to Kyushu & Okinawa and Kanto, the Kinki region's established woodworking infrastructure ensures steady demand for woodworking router bits.

The demand for woodworking router bits in Chubu is expected to grow at a CAGR of 2.5%, driven by the region’s industrial and agricultural activities. Chubu, home to Nagoya and other industrial centers, has a significant presence of woodworking operations in the furniture and cabinetry sectors. The demand for router bits in the region is primarily influenced by the need for precision tools in furniture production, wood-based panels, and interior construction. While the growth rate is slower compared to other regions, Chubu’s well-established woodworking industry continues to support steady demand for high-quality tools. As the region continues to modernize and adopt more advanced manufacturing techniques, the need for high-performance router bits will likely increase gradually.

In Tohoku, the demand for woodworking router bits is projected to grow at a CAGR of 2.2%, reflecting slower adoption compared to other regions. Tohoku has a less concentrated woodworking and manufacturing industry compared to regions like Kanto and Kinki, but demand for router bits is rising steadily as the region’s focus on craftsmanship and traditional wood products grows. The increasing interest in sustainable building materials and the rise of eco-friendly construction methods contribute to the region’s demand for woodworking tools. As Tohoku continues to invest in modern woodworking techniques and address the growing popularity of DIY woodworking projects, the demand for router bits will continue to increase, though at a slower pace.

In the Rest of Japan, the demand for woodworking router bits is expected to grow at a CAGR of 2.1%, reflecting more gradual growth in rural and less industrialized areas. This region has fewer large-scale woodworking operations, but the increasing interest in DIY woodworking, home improvement, and sustainable building practices is contributing to a steady rise in demand for high-quality woodworking tools. As consumers in smaller cities and rural areas seek more efficient and precise tools for their woodworking projects, the demand for router bits will continue to grow, albeit at a slower pace compared to more industrialized regions. The Rest of Japan's growing interest in craftsmanship and locally produced wood products will ensure a steady, if modest, increase in the demand for woodworking router bits.

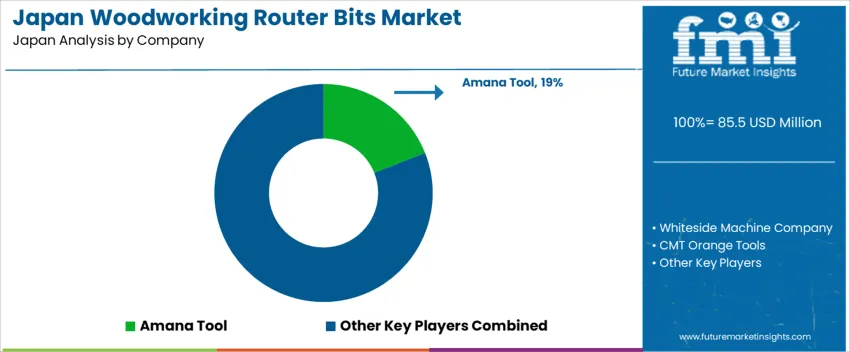

Demand for woodworking router bits in Japan remains steady, driven by a mix of professional woodworkers, carpenters, custom furniture makers, and enthusiastic hobbyists. Suppliers such as Amana Tool (with about 19% share of the market), Whiteside Machine Company, CMT Orange Tools, and Bosch Tools serve this demand. These firms provide a range of router bits used for trimming, edge profiling, joinery, decorative molding, and veneer cutting - covering both residential woodworking projects and industrial manufacturing needs.

Competition in this market revolves around tool quality, precision, versatility, and after sales support. Manufacturers highlight key features such as carbide tipped bits, precise grinding tolerances, long tool life, and clean, accurate cuts. Some suppliers offer sets tailored for specific uses — for example cabinet-making, decorative molding, or flooring installation — which appeals to both professionals and hobbyists. Ease of availability and parts replacement also matter; firms distributing through tool shops, specialized retailers, and online platforms often gain reach among small workshops and individual buyers. Technical literature typically emphasizes bit material, RPM range, lifespan, and suitability for different wood types. By focusing on durability, precision, and application versatility, these companies aim to maintain and grow their share in the Japanese woodworking router bits market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Bit Type | Straight Bits, Flush Trim Bits, Edge Forming Bits |

| Material | Carbide-Tipped, Solid Carbide, High-Speed Steel |

| End Use | Residential Sector, Commercial Sector, Industrial Segment |

| Key Companies Profiled | Amana Tool, Whiteside Machine Company, CMT Orange Tools, Bosch Tools |

| Additional Attributes | The market analysis includes dollar sales by bit type, material, end-use, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of woodworking router bits in residential, commercial, and industrial sectors. The competitive landscape highlights key manufacturers focusing on innovations in bit material and design for enhanced cutting precision and durability. Trends in the growing demand for high-performance, versatile router bits for various woodworking applications are explored, along with advancements in tool longevity and efficiency. |

The demand for woodworking router bits in Japan is estimated to be valued at USD 85.5 million in 2025.

The market size for the woodworking router bits in Japan is projected to reach USD 113.2 million by 2035.

The demand for woodworking router bits in Japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in woodworking router bits in Japan are straight bits, flush trim bits and edge forming bits.

In terms of material, carbide-tipped segment is expected to command 50.0% share in the woodworking router bits in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodworking Router Bits Market Growth - Trends & Forecast 2035

Demand for Woodworking Router Bits in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Router And Switch Size Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA