The lactation feed market is projected to reach USD 4,595.6 million by 2035, recording an absolute increase of USD 2,095.6 million over the forecast period. The market is valued at USD 2,500 million in 2025 and is set to rise at a CAGR of 6.3% during the assessment period. Growth is driven by increasing demand for high-quality animal nutrition, rising adoption of specialized feed formulations, and growing focus on milk production optimization across the global dairy and livestock management sectors. Lactation feeds offer balanced protein sources, enhanced milk yield capabilities, and improved reproductive performance, making them suitable for commercial dairy operations, livestock farming enterprises, and agricultural cooperatives.

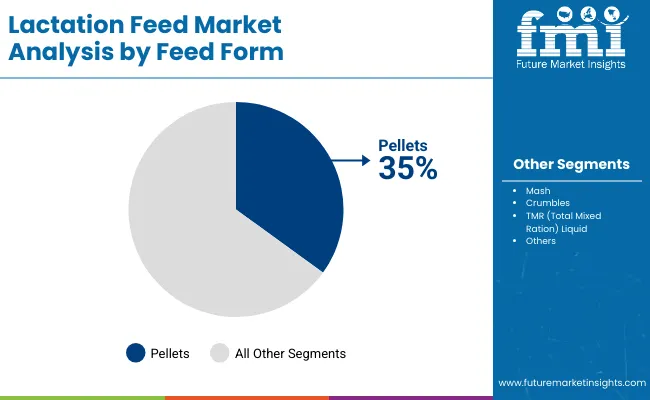

Pellet feeds account for the largest share at 35% due to convenient handling, consistent nutrient delivery, and compatibility with automated feeding infrastructure, while mash and TMR systems support traditional and precision feeding approaches. Dairy cattle applications represent the dominant share of demand at 60%, followed by sow feeding programs as producers expand lactation management offerings.

Lactation Feed Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,500.0 million |

| Market Forecast Value (2035) | USD 4,595.6 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

Europe, particularly France and Germany, leads growth due to dairy sector modernization and livestock technology advancement, while Asia Pacific shows steady demand supported by expanding dairy operations in India and China. Competition in the lactation feed market remains moderately consolidated, with key companies such as Cargill, De Heus Animal Nutrition, and Alltech focusing on advanced nutritional formulations, feed processing technologies, and technical support capabilities to strengthen market positioning.

Lactation feed represents a specialized nutritional formulation designed to support optimal milk production in dairy animals during the critical lactation period. These feeds combine carefully balanced protein sources, energy-dense grains, essential vitamins, minerals, and specialized additives to enhance milk yield while maintaining animal health and reproductive performance. The formulations address specific metabolic demands of lactating animals through precise nutrient timing and delivery mechanisms that support mammary gland function and overall physiological requirements.

Modern lactation feed production utilizes advanced feed processing technologies including pelleting, mash preparation, and total mixed ration systems to optimize nutrient availability and palatability. Manufacturing processes incorporate quality control protocols that ensure consistent nutrient profiles, minimal contamination risks, and extended shelf stability. Processing facilities employ sophisticated mixing systems, grinding equipment, and conditioning technologies to achieve uniform particle distribution and enhanced digestibility characteristics.

Nutritional formulations focus on high-quality protein sources including soybean meal, rapeseed meal, and specialized amino acid supplements to support milk protein synthesis. Energy components utilize corn, barley, wheat, and bypass fats to provide readily available energy sources while maintaining rumen health through balanced fiber content. Vitamin and mineral premixes address specific lactation requirements including calcium, phosphorus, magnesium, and trace elements essential for milk production and bone metabolism.

Feed additives encompass probiotics, prebiotics, and enzyme systems that enhance digestive efficiency and nutrient utilization rates. Specialized ingredients including organic acids, plant extracts, and immune modulators support animal health during the metabolically demanding lactation period. These components work synergistically to optimize feed conversion efficiency, reduce metabolic stress, and maintain consistent milk production levels throughout the lactation cycle.

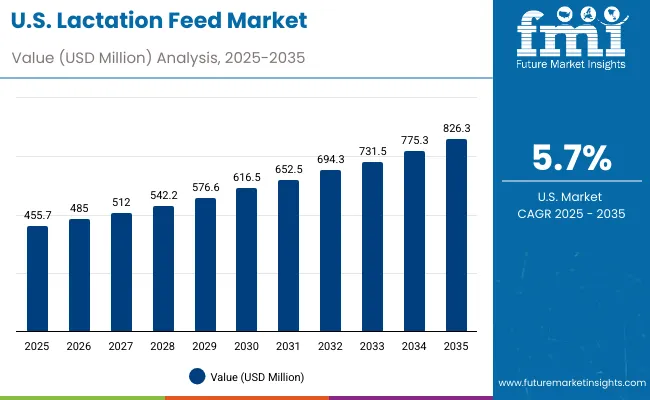

Between 2025 and 2030, the lactation feed market is projected to expand from USD 2,500.0 million to USD 3,366.7 million, resulting in a value increase of USD 866.7 million, which represents 41.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for dairy cattle nutrition and specialized feed formulations, product innovation in feed processing technologies and nutritional systems, as well as expanding integration with commercial farming operations and livestock management applications. Companies are establishing competitive positions through investment in feed manufacturing capabilities, advanced nutritional technologies, and strategic market expansion across dairy, swine, and small ruminant applications.

From 2030 to 2035, the market is forecast to grow from USD 3,366.7 million to USD 4,595.6 million, adding another USD 1,228.9 million, which constitutes 58.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized nutritional applications, including advanced feed formulations and precision feeding systems tailored for specific animal requirements, strategic collaborations between feed producers and livestock operations, and an enhanced focus on feed efficiency standards and automated feeding protocols. The growing emphasis on animal welfare and production optimization will drive demand for comprehensive lactation feed solutions across diverse livestock applications.

The lactation feed market grows by enabling livestock producers and dairy operations to optimize animal performance while accessing specialized nutritional solutions without substantial in-house feed formulation investment. Livestock operators and dairy farmers face mounting pressure to develop advanced nutrition programs and specialized feeding protocols while managing complex production requirements, with high-quality lactation feed typically providing 40-60% performance enhancement compared to conventional feed alternatives, making advanced nutritional formulations essential for competitive market positioning.

The livestock industry's need for specialized nutrition and application-specific feeding capabilities creates demand for comprehensive lactation feed solutions that can provide superior milk production, maintain consistent animal health, and ensure reliable operation without compromising production efficiency or regulatory compliance.

Government initiatives promoting livestock development and dairy sector modernization drive adoption in commercial farming, smallholder operations, and institutional applications, where feed quality has a direct impact on production performance and long-term operational outcomes. Complex nutritional requirements during lactation periods and the expertise requirements for feed formulation may limit accessibility among smaller livestock operations and developing regions with limited technical infrastructure for advanced animal nutrition systems.

The market is segmented by animal type, feed form, ingredient type, purpose/functionality, sales channel, end-use, and region. By animal type, the market is divided into dairy cattle, sows, goats & sheep, and others (buffalo, camel). Based on feed form, the market is categorized into pellets, mash, crumbles, TMR (total mixed ration), and liquid. By ingredient type, the market includes grains, oilseed meals, animal protein meals, molasses, bypass fats, amino acids, vitamins & minerals, probiotics/yeast, and others.

By purpose/functionality, the market covers milk yield enhancer, energy dense feed, protein rich feed, gut health promoting, reproductive efficiency, and transition period nutrition. By sales channel, the market is divided into direct (B2B, farms), distributors/dealers, cooperatives, and online. By end-use, the market includes commercial farms, household/smallholder farmers, and veterinary/institutional use. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The dairy cattle segment represents the dominant force in the lactation feed market, capturing approximately 60.0% of total market share in 2025. This established animal category encompasses solutions featuring advanced nutritional formulations and specialized feeding applications, including high-performance milk production characteristics and enhanced reproductive efficiency that enable superior dairy outcomes and operational results across all farming applications. The dairy cattle segment's market leadership stems from its proven production capabilities, with solutions capable of addressing diverse nutritional requirements while maintaining consistent feed performance and operational effectiveness across all livestock environments.

The sows segment maintains a substantial 20.0% market share, serving specialized requirements for swine lactation with enhanced productivity characteristics for piglet development and sow health optimization. The goats & sheep segment captures 15.0% market share, offering specialized formulations for small ruminant lactation requirements, while the others segment accounts for 5.0% market share through buffalo and camel feeding applications.

Key animal type advantages driving the dairy cattle segment include:

Pellets applications dominate the lactation feed market with approximately 35.0% market share in 2025, reflecting the critical role of processed feed forms in supporting specialized nutrition delivery and feeding efficiency worldwide. The pellets segment's market leadership is reinforced by increasing mechanization trends, feeding system automation requirements, and rising needs for convenient handling capabilities in livestock operations across developed and emerging markets.

The mash segment represents the second-largest form category, capturing 25.0% market share through specialized requirements for traditional feeding systems, farm-level mixing applications, and custom nutritional formulations. This segment benefits from growing on-farm processing demand that requires specific preparation methods, cost optimization protocols, and operational flexibility in feeding markets.

The TMR segment accounts for 20.0% market share, serving commercial dairy operations with complete nutritional systems and precision feeding protocols. The crumbles segment captures 15.0% market share through specialized applications for young animals and transitional feeding requirements, while the liquid segment maintains 5.0% market share through specialized liquid feeding systems.

Key market dynamics supporting form growth include:

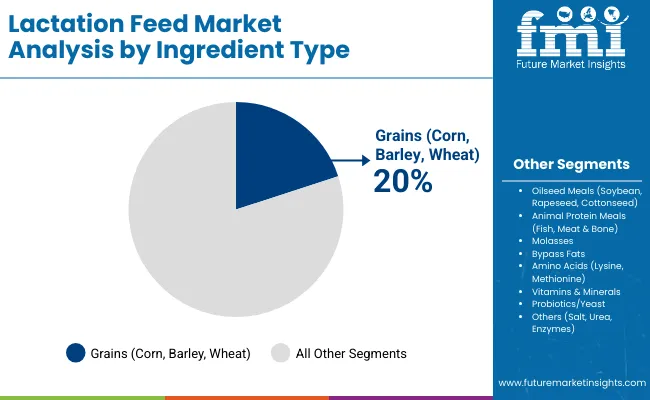

Grains applications dominate the lactation feed ingredient market with approximately 20.0% market share in 2025, reflecting the fundamental role of energy sources in supporting lactation metabolism and feed formulation requirements worldwide. The grains segment's market leadership encompasses corn, barley, and wheat components that provide essential carbohydrate energy for milk production and animal maintenance across diverse livestock systems.

The oilseed meals segment represents the second-largest ingredient category, capturing 18.0% market share through soybean meal, rapeseed meal, and cottonseed meal applications providing high-quality protein sources for milk protein synthesis. The bypass fats segment accounts for 12.0% market share, serving energy-dense nutrition requirements for high-producing animals, while vitamins & minerals and probiotics/yeast segments each capture 10.0% market share through essential micronutrients and digestive health applications.

Other significant ingredients include amino acids at 7.0% market share, animal protein meals at 8.0%, molasses at 5.0%, and others at 10.0% market share through salt, urea, and enzyme applications.

The market is driven by three concrete demand factors tied to livestock production outcomes. First, dairy industry expansion and milk production intensification create increasing demand for specialized lactation feed systems, with production enhancement of 15-25% annually in major dairy regions worldwide, requiring comprehensive nutritional infrastructure.

Second, government initiatives promoting livestock development and food security drive increased adoption of advanced feeding systems, with many countries implementing dairy development programs and regulatory frameworks for livestock nutrition advancement by 2030. Third, technological advancements in feed processing and nutritional science enable more efficient and effective feeding solutions that improve animal performance while reducing production costs and operational complexity.

Market restraints include complex nutritional requirements and formulation costs for specialized lactation feed platforms that can challenge market participants in developing compliant feeding capabilities, particularly in regions where technical expertise for advanced animal nutrition remains limited and uncertain. Feed ingredient price volatility and supply chain constraints pose another challenge, as lactation feeds demand high-quality raw materials and consistent availability, potentially affecting production costs and operational efficiency. Quality control requirements across different regions create additional operational challenges for manufacturers, demanding ongoing investment in testing infrastructure and quality assurance programs.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly India and China, where dairy sector expansion and livestock modernization drive comprehensive lactation feed adoption. Technology integration trends toward specialized pellet systems with enhanced nutritional characteristics, advanced TMR applications, and integrated feeding solutions enable effective nutrition approaches that optimize production efficiency and minimize feeding risks. The market thesis could face disruption if advances in alternative protein sources or changes in livestock production systems reduce reliance on traditional lactation feeding applications.

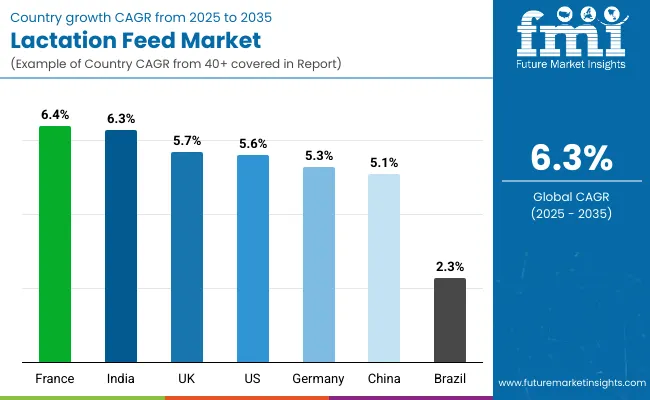

| Countries | CAGR (%) |

|---|---|

| France | 6.4 |

| India | 6.3 |

| UK | 5.7 |

| USA | 5. 6 |

| Germany | 5.3 |

| China | 5.1 |

| Brazil | 2.3 |

The global lactation feed market is expanding steadily, with France leading at a 6.4% CAGR through 2035, driven by dairy sector modernization, advanced livestock technologies, and comprehensive nutritional platforms. India follows closely at 6.3%, supported by expanding dairy production, government livestock programs, and rural development initiatives. UK record 5.7%, reflecting established dairy industries with growing emphasis on feed efficiency and animal welfare. Germany advances at 5.3%, leveraging precision farming technologies and quality-focused dairy operations. China grows at 5.1%, anchored by large-scale dairy expansion and feed industry modernization. Brazil grows at 2.3%, reflecting mature market conditions.

France demonstrates the strongest growth potential in the lactation feed market with a CAGR of 6.4% through 2035. The country's leadership position stems from advanced dairy sector modernization, precision livestock technologies, and comprehensive agricultural regulations driving the adoption of specialized lactation feeding solutions. Growth is concentrated in major dairy regions, including Normandy, Brittany, and Pays de la Loire, where dairy cooperatives and livestock operations are implementing advanced nutritional systems for enhanced milk production capabilities and animal welfare standards.

Distribution channels through agricultural cooperatives and feed retailers expand deployment across dairy farming projects and livestock development initiatives. The country's Ministry of Agriculture provides policy support for livestock nutrition modernization, including comprehensive feed technology capability development. French dairy operations demonstrate exceptional adoption rates of TMR feeding systems and specialized lactation formulations, with documented improvements in milk quality and production efficiency across major cooperative networks throughout traditional dairy producing regions.

India demonstrates exceptional growth potential in the lactation feed market with a CAGR of 6.3% through 2035, driven by expanding dairy production, government livestock development programs, and rural modernization initiatives. Growth is concentrated in major dairy producing states including Uttar Pradesh, Gujarat, Rajasthan, and Punjab, where commercial dairy operations and cooperative societies are implementing advanced lactation feeding systems to enhance productivity and animal health outcomes.

The market benefits from increasing commercialization of dairy farming, growing awareness of animal nutrition, and government support through programs like the National Programme for Dairy Development and Rashtriya Gokul Mission that promote improved feeding practices and livestock productivity enhancement. Distribution networks through village cooperatives and agricultural input suppliers facilitate market penetration across rural farming communities. Indian dairy sector demonstrates strong adoption of pelleted feeds and specialized nutritional supplements, with documented case studies showing significant improvements in milk yield and animal reproduction rates through targeted feeding programs implemented across cooperative dairy networks and commercial livestock operations.

The UK market expansion is driven by established dairy industry demand, including precision farming development in major dairy regions and comprehensive animal welfare projects across multiple counties. The country demonstrates strong growth potential with a CAGR of 5.7% through 2035, supported by government agricultural policies and industry-level dairy development initiatives. British dairy operations face implementation challenges related to feed cost management and regulatory compliance requirements, requiring strategic nutrition approaches and support from specialized feed partners.

Growing consumer demand for high-quality dairy products and advanced animal welfare requirements create compelling business cases for lactation feed adoption, particularly in commercial dairy areas where nutritional systems have a direct impact on production outcomes and market positioning. Distribution channels through agricultural merchants and feed cooperatives expand coverage across dairy farming operations in England, Scotland, Wales, and Northern Ireland. Technology adoption focuses on automated feeding systems and precision nutrition protocols that align with environmental regulations while maintaining production efficiency standards demanded by processing companies and retail partners.

USA's market expansion is driven by diverse dairy industry demand, including commercial dairy development in major producing states and comprehensive livestock nutrition projects across multiple regions. The country shows strong growth potential with a CAGR of 5.6% through 2035, supported by federal agricultural programs and industry-level dairy modernization initiatives. American dairy operations implement advanced lactation feeding systems to optimize production efficiency while meeting consumer demands for high-quality milk products. Technology deployment through established feed dealers and nutrition consultants expands coverage across dairy farms and livestock facilities, with documented case studies showing significant improvements in milk production and feed efficiency through specialized nutrition programs.

Market dynamics favor large-scale commercial operations implementing TMR systems and precision feeding technologies, while smaller dairy farms increasingly adopt specialized pelleted feeds and nutritional supplements. Distribution networks through agricultural cooperatives and feed companies facilitate market penetration across traditional dairy regions including California, Wisconsin, New York, and Pennsylvania, where technological innovation drives competitive positioning in global dairy markets.

The Germany market leads in advanced feed processing innovation based on integration with precision farming systems and quality-focused dairy technologies for enhanced production performance. The country shows strong potential with a CAGR of 5.3% through 2035, driven by the modernization of existing dairy infrastructure and the expansion of advanced livestock facilities in major agricultural regions, including Bavaria, Lower Saxony, North Rhine-Westphalia, and Schleswig-Holstein. German dairy operations are adopting intelligent feeding systems for production optimization and quality enhancement, particularly in regions with advanced dairy requirements and applications demanding comprehensive technology upgrades.

Technology deployment channels through established agricultural institutions and cooperative networks expand coverage across dairy facilities and precision farming applications. Market characteristics demonstrate strong emphasis on feed efficiency optimization and environmental compliance protocols that align with European Union regulations while maintaining competitive production standards. German dairy sector showcases advanced implementation of automated feeding systems and nutritional monitoring technologies, with documented improvements in milk quality parameters and production consistency through integrated feed management programs deployed across cooperative networks and commercial dairy operations throughout major agricultural regions.

In major dairy development centers including Inner Mongolia, Heilongjiang, Xinjiang, and Hebei, the adoption of comprehensive lactation feeding solutions is accelerating across commercial dairy projects and livestock modernization initiatives, driven by government dairy development programs and food security requirements. The market demonstrates steady growth momentum with a CAGR of 5.1% through 2035, linked to comprehensive dairy industry expansion and increasing focus on feed quality solutions. Chinese dairy companies are implementing advanced lactation feeding systems and processing platforms to enhance production performance while meeting growing domestic demand in expanding dairy consumption markets.

The country's agricultural modernization initiatives create continued demand for feed systems, while increasing emphasis on food safety drives adoption of quality-assured feeding solutions. Distribution channels through state-owned agricultural enterprises and private feed companies expand deployment across large-scale dairy operations and emerging commercial farming projects. Technology integration focuses on mechanized feeding systems and standardized nutritional protocols that support rapid scaling of dairy production capacity while maintaining quality control requirements demanded by processing companies and regulatory authorities.

Brazil demonstrates moderate growth potential in the lactation feed market with a CAGR of 2.3% through 2035, reflecting mature market conditions in established dairy regions and steady expansion in developing agricultural areas. Growth is concentrated in major dairy producing states including Minas Gerais, Rio Grande do Sul, and São Paulo, where commercial dairy operations and agricultural cooperatives maintain consistent adoption of specialized feeding systems for milk production optimization. The market benefits from established feed manufacturing infrastructure and distribution networks that serve diverse livestock operations across varied climatic and production conditions.

Brazilian dairy sector demonstrates preference for locally sourced feed ingredients and cost-effective nutritional formulations that address specific regional requirements while maintaining production efficiency standards. Market dynamics reflect balance between commercial dairy expansion and traditional farming practices, with documented adoption of pelleted feeds and mineral supplements showing steady growth across cooperative networks and independent dairy operations throughout major agricultural regions.

The lactation feed market in Europe is projected to grow from USD 822.2 million in 2025 to USD 1,498.0 million by 2035, registering a CAGR of 6.2% over the forecast period. Germany is expected to maintain its leadership position with a 20.0% market share in 2025, projected to reach 19.0% by 2035, supported by its extensive dairy infrastructure, advanced feed processing facilities, and comprehensive distribution networks serving major European markets.

United Kingdom follows with a 16.0% share in 2025, projected to reach 15% by 2035, driven by comprehensive dairy programs in major agricultural regions implementing advanced lactation feeding systems. France holds a 14% share in 2025, expected to reach 13% by 2035 through the ongoing development of dairy facilities and cooperative networks. Italy commands a 1% share, while Spain accounts for 8% in 2025, expected to reach 9% by 2035. BENELUX region captures 6.0% in 2025, projected to reach 7% by 2035. Nordic countries account for 5% share, expected to reach 6% by 2035. The Rest of Europe region maintains a stable 21% share throughout the forecast period, attributed to consistent lactation feed adoption across various European dairy markets and emerging agricultural development programs.

The lactation feed market features approximately 10-15 meaningful players with moderate concentration, where the top five companies control roughly 40-50% of global market share through established feed portfolios and extensive agricultural relationships. Competition centers on nutritional quality, feed efficiency, and technical expertise rather than price competition alone.

Market leaders include Cargill with 11.0% market share, De Heus Animal Nutrition, Alltech, Land O'Lakes (Purina Animal Nutrition), and ADM (Archer Daniels Midland), which maintain competitive advantages through comprehensive lactation feed portfolios, advanced processing capabilities, and deep expertise in the dairy and livestock sectors, creating high switching costs for customers. These companies leverage established agricultural relationships and ongoing research partnerships to defend market positions while expanding into adjacent animal nutrition and feed technology applications.

Regional players and emerging lactation feed companies create competitive pressure through innovative formulation approaches and rapid development capabilities, particularly in high-growth markets including India and China, where local presence provides advantages in cost optimization and regulatory compliance. Market dynamics favor companies that combine advanced nutritional technologies with comprehensive agricultural services that address the complete feeding lifecycle from formulation through ongoing performance monitoring and technical support.

Lactation feed solutions represent a critical nutritional component that enables dairy producers, livestock operators, and agricultural enterprises to enhance production efficiency and animal welfare without substantial ongoing nutrition investment. With the market projected to grow from USD 2,500 million in 2025 to USD 4,595.6 million by 2035 at a 6.3% CAGR, these solutions offer compelling advantages - superior nutrition, enhanced efficiency, and production capabilities - making them essential for dairy cattle applications. Scaling market penetration and feeding capabilities requires coordinated action across agricultural policy, feed standards, lactation feed providers, livestock producers, and dairy institutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,500.0 Million |

| Animal Type | Dairy Cattle, Sows, Goats & Sheep, Others (Buffalo, Camel) |

| Feed Form | Pellets, Mash, Crumbles, TMR (Total Mixed Ration), Liquid |

| Ingredient Type | Grains (Corn, Barley, Wheat), Oilseed Meals (Soybean Meal, Rapeseed Meal, Cottonseed Meal), Animal Protein Meals (Fish Meal, Meat & Bone Meal), Molasses, Bypass Fats, Amino Acids (Lysine, Methionine), Vitamins & Minerals, Probiotics/Yeast, Others (Salt, Urea, Enzymes) |

| Purpose/Functionality | Milk Yield Enhancer, Energy Dense Feed, Protein Rich Feed, Gut Health Promoting, Reproductive Efficiency, Transition Period Nutrition |

| Sales Channel | Direct (B2B, Farms), Distributors/Dealers, Cooperatives, Online |

| End-Use | Commercial Farms, Household/Smallholder Farmers, Veterinary/Institutional Use |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, France, UK, USA, Brazil, and 40+ countries |

| Key Companies Profiled | Cargill, De Heus Animal Nutrition, Alltech, Land O'Lakes (Purina Animal Nutrition), ADM (Archer Daniels Midland) |

| Additional Attributes | Dollar sales by animal type and feed form categories, regional adoption trends across North America, Europe, and Asia Pacific, competitive landscape with lactation feed providers and agricultural companies, processing facility requirements and specifications, integration with dairy initiatives and livestock platforms. |

Lactation feed is a specialized animal feed formulated for lactating dairy animals (such as cows, buffalo, goats, and sows). It combines balanced protein, energy, vitamins, minerals, and additives to support higher milk yield, maintain body condition, and protect reproductive health during the lactation period.

In 2025, the global lactation feed market is valued at USD 2,500.0 million. Demand is primarily driven by commercial dairy farms and organized livestock operations that are shifting from generic rations to specialized lactation nutrition.

By 2035, the lactation feed market is forecast to reach USD 4,595.6 million. This reflects an absolute increase of USD 2,095.6 million over 2025–2035 as more dairy and livestock producers adopt precision feeding and performance-linked nutrition programs.

The market is projected to grow at a CAGR of 6.3% between 2025 and 2035, supported by dairy sector modernization, rising milk yield targets, and the replacement of generic home-mixed feeds with formulated lactation rations.

Dairy cattle account for the dominant share at around 60% of the lactation feed market in 2025. Sows hold about 20%, goats and sheep around 15%, while buffalo and camel-based systems make up the remaining share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactation Support Supplements Market - Size, Share, and Forecast Outlook 2025-2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA