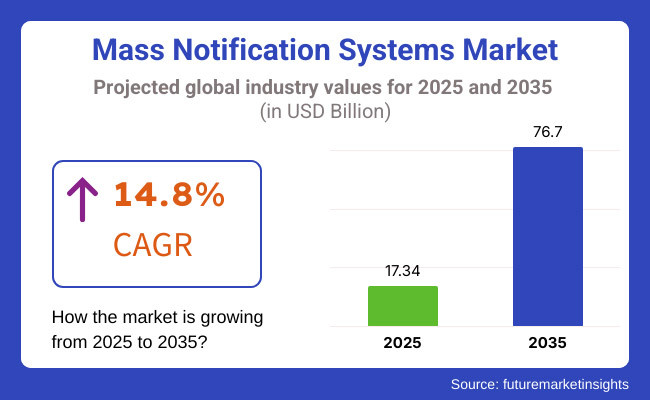

The global mass notification systems market is set to observe USD 17.34 billion in 2025. The industry is poised to depict 14.8% CAGR from 2025 to 2035, reaching USD 76.7 billion by 2035.

Industry drivers include increasing demand for multi-channel communications, automated alerts, and geolocation-based notifications. Organizations are now engaging with this system, which come with threat detection powered by AI and live monitoring tech, to drive better emergency response capability. With rising natural disasters, cybersecurity risks, and employee safety being some of the concerns of many industries, scalable technology investments are being made that aim to ensure fast, reliable information transmission during time-of-crisis events.

The industry is involved in advanced communication technologies designed to relay information quickly and effectively during emergencies, with notifications broadcast over varied channels. These systems are crucial in delivering public safety, disaster preparedness, and response coordination.

Mass notification solutions are being embraced increasingly by government agencies, schools, and businesses to communicate better during an emergency, mitigate risks, and improve situational awareness. With the development of cloud-based systems, AI-based analytics and IoT-based messaging, the industry is poised for a significant expansion in the coming years.

With emerging technologies of cloud computing, mobile alerts, and satellite-based messaging, the industry is also witnessing a transformation that promises to enhance the effectiveness of communication systems. AI-powered crisis management solutions are augmenting threat analysis efforts leading to better foresight of upcoming emergencies to enable targeted alerts.

The growing importance of delivering timely information and instructions to the masses has also resulted in systems having to comply with the regulatory requirements of public safety networks, smart city elements, and enterprise communication systems.

Increasing use of smart city programs and IoT-enabled public safety systems are driving demand for converged mass notification solutions. Companies are investing in inexpensive, cloud-based platforms that seamlessly integrate with enterprise resource planning (ERP) software, public safety networks and mobile apps. Training on data until October 2023

As AI continues to develop, real-time analytics imperial, and IoT-enabled alert systems ingenuity, the industry will see continued expansion. Growing need for effective communication measures for emergencies and growing complexity of security threats are driving adoption across government, education, healthcare, and business segments. As industries advance prevention efforts and the enhancement of citizen safety, mass notification solutions will remain a vital component of modern communication and crisis management platform.

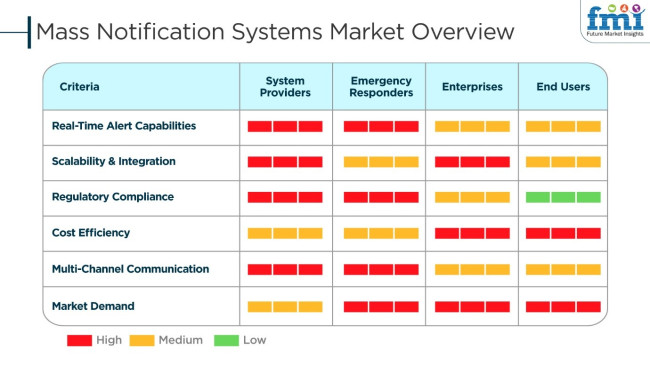

The industry has run into a whopping growth pivot step, distinctly characterized by the skyrocketing demand for public safety, emergency communication, and organizational crisis management. The priority of the system providers remains on enhancing the efficiency of the rapid response mainly through real-time alert capabilities and multi-channel communication.

Scale operator emergency people look for greatly modular and the best suited ones among the ones that adhere to regulations and provide the option of seamless agency collaboration. Companies particularly focus on safe and integrated systems at the same time being cost-efficient when it comes to the management of the workforce and the clients in the midst of natural disasters, cyber-attacks, and other perilous workplace situations.

Typical end users comprising learning institutions, medical treatment plants, and the authority establishment rate a good sense, user-friendliness, and low-cost as the main priorities in choosing solutions that send alerts in real time.

Cloud MNS, which is based on the-so-called AI, through the threat detection, and mobile app emergency alerts, are trade shaping technologies in which industries invest their capital thus making them the primary purchasing criteria. The demand for the modular, location-specific, and smart notification systems that are integrated with IoT technology is what is primarily charging the industry by expanding in myriad areas.

| Company | Thoma Bravo and Everbridge |

|---|---|

| Contract/Development Details | Thoma Bravo, a private equity firm, acquired Everbridge, a global critical event management and mass notification solutions provider, to enhance its portfolio in safety and communication technologies. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 1,750 - USD 1,850 |

| Estimated Renewal Period | 5 - 7 years |

| Company | New York State Office of Information Technology Services (NYS ITS) |

|---|---|

| Contract/Development Details | NYS ITS issued a Request for Proposals (RFP) to replace the current New York State Alert Mass Notification System with a vendor-hosted solution, aiming to improve emergency communication capabilities. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 80 - USD 100 |

| Estimated Renewal Period | 4 - 6 years |

In 2024, the industry experienced a significant activity, notably Thoma Bravo's acquisition of Everbridge for approximately USD 1.7 - USD 1.85 billion in July. This strategic move aims to bolster Thoma Bravo's portfolio in safety and communication technologies.

Additionally, in November 2024, the New York State Office of Information Technology Services issued an RFP, valued at approximately USD 80 - USD 100 million, to upgrade its mass notification system, reflecting a broader trend of governmental investment in advanced emergency communication solutions. These developments underscore the growing importance of efficient products in both public and private sectors to enhance safety and responsiveness during critical events.

Between 2020 and 2024, the industry grew rapidly due to rising concerns over public safety, emergency communication, and disaster management. The COVID-19 pandemic underscored the need for real-time, multi-channel communication systems in healthcare, education, and government sectors. Organizations deployed cloud-based systems for business continuity, remote worker communication, and emergency notifications. Support for digital signage, social media, and mobile apps increased reach and engagement with messages.

Between 2025 and 2035, the industry will move towards intelligent, context-based notification systems, taking advantage of AI-powered automation, 5G connectivity, and immersive communication experiences. Mass notification systems will be integrated with wearable devices to provide location-based, personalized alerts. The emphasis will be on predictive crisis management, real-time threat intelligence, and quantum-secure communication networks to provide public safety and business resilience.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| MNS was merged with SMS, email, voice, social media, and digital signage for multi-channel alert notification. | Contextual communication driven by AI will provide personalized notifications through AR, VR, holographic screens, and wearable devices for immersive experiences. |

| AI-facilitated automation improved message sending, escalation, and follow-up processes. | Predictive crisis management real-time threat detection will be enabled by autonomous decision-making in emergency responses cognitive AI models. |

| The PPC-based emergency management MNS gave real-time alerts and two-way communications to people experiencing emergencies. | 5G-enabled MNS will provide ultra-low latency communications which will allow real-time tracking and alerting of critical incidents without time delay. |

| Alerts were triggered according to predefined rule sets and conditions of events. | Context-aware notification systems using AI-enabled geofencing and behavior analysis provide personalized, location-based alerts. |

| MNS, which was integrated with various social media, digital signage, and mobile applications, provided a public reach. | Intelligent communication ecosystems will seamlessly integrate with smart city infrastructure, IoT devices, and digital twins for dynamic alert dissemination. |

| MNS ensured business continuity, emergency alerts, and disaster recovery communication. | Predictive crisis management systems with AI-driven risk assessment, digital twins, and quantum-resilient communication will enhance disaster preparedness and response. |

| End-to-end encryption and multi-factor authentication were utilized to keep the communications safe. | Blockchain-based identity verification of networks will ensure data integrity, confidentiality, and cybersecurity resilience. |

| Voice alerts, text-to-speech, and rich media messages made the communication and information delivery even more engaging. | Immersive multimedia alerts with holographic projections, AI-generated voice assistants, and real-time language translations will revolutionize emergency communication. |

| MNS enhanced public safety by delivering emergency alerts, evacuation instructions, and community updates. | AI-driven community engagement platforms with sentiment analysis and feedback loops will ensure effective communication and public trust. |

| Compliance with safety regulations (e.g., FEMA, FCC, and GDPR) influenced alert management and data privacy. | AI-driven compliance monitoring, decentralized identity management, and quantum-safe protocols will simplify regulatory adherence and cross-border communication. |

The sector is undergoing a tough time as it has encountered multiple major threats such as the regulatory compliance, cybersecurity threats, integration challenges, and reliability concerns. The key problem among them is regulatory compliance, as mass notification systems are required to follow the rules such as emergency communication laws, data privacy regulations, and industry-specific standards. In places like the USA (FEMA, FCC, NFPA 72), EU (GDPR), and APAC, breaking these rules can lead to legal liabilities, fines, and customer trust issues.

Cybersecurity threats are an inherent risk as MNS platforms are used to manage critical failed communication for emergencies, public safety, and enterprise risk management. The weaknesses you encounter in cloud and IoT-integrated MNS solutions can result in data holes, hacking, and system manipulation which in turn lead to the degradation of the emergency response action.

The integration is yet another major risk we are talking about. The companies that have experience with the old ones having communication systems, obsolete software, and a variety of messaging platforms will find it quite difficult to implement MNS solutions. Poor integration can be the cause of latency issues, missed alerts, or system malfunctions, hence the emergency notifications will not be as effective.

Besides that, you should not overlook system reliability and the risks of downtime. Mass notification systems should always be in full operation when they are most needed such as in times of natural disasters, cyberattacks, active shooter incidents, and industrial accidents. Whenever there is downtime, software glitches, or network disruptions, the operation might go out of control and also have a life-threatening outcome and a legal charge.

Moreover, the initial talks of the high implementation costs and vendor dependency prevent small companies, education institutes, and government agencies with tight budgets from adopting the practice as they should. The high costs incurred are mainly for the training of staff, technical support, and the introduction of new or upgraded systems which often result in financial risks to customers.

2025 will see in-building mass notification systems capturing an industry share of 43.8%, continuing to be the most favoured solution within the industry. Such systems are crucial for emergency communication in enclosed places like hospitals, corporate offices, educational institutions, and government buildings.

Integrated mass notification solutions from companies such as Honeywell International and Siemens AG interface with public address systems, LED signage, and fire alarm controls to aid in situational awareness. Regulated sectors like manufacturing and healthcare are also driving the adoption as they're mandated to comply with NFPA 72 (National Fire Alarm and Signalling Code) and OSHA safety regulations.

Wide-area mass notification systems are used for large-scale communication in times of emergencies, ranging from cities to military bases to transportation hubs. These solutions communicate with people in real time through sirens, radio alerts, SMS notifications, satellite-based messaging, etc. Federal Signal Corporation and Motorola Solutions make the high-decibel sirens and digital warning systems that are used in things like hurricane advisories, active shooter systems, and industrial disaster notifications.

Due to their scalability & capability for multi-location emergency communication, they use cloud-located platforms along with your mobile-based application & IoT-based alerting. AI-fuelled mass notification companies like Everbridge and AlertMedia connect with weather surveillance, cyberattack alerts, and building lockdown systems to aid disaster response.

The system is designed to send information to limited sectors or agencies and serves as an early warning tool to protect the lives and risk assets of citizens and agencies.

Emergency and crisis notification continue to be key drivers for mass notification system(MNS) market solutions, accounting for bulk cost share. Governments, educational institutions, and healthcare facilities use real-time alert systems to legitimately address natural disasters, security threats, and health emergencies.

Motorola Solutions, for example, along with Everbridge, offer AI-driven alerting platforms that work with cellular networks, sirens, and digital signage to ensure swift communication in times of crisis. The USA Integrated Public Alert & Warning System (IPAWS), for instance, relies on mass notification solutions to send weather alerts, AMBER alerts, and civil emergency warnings.

Based on services, the business continuity and disaster recovery segment is expected to witness the fastest growth, with a CAGR of 22.8%, and capture 25.8% of the industry share by 2033. MNS is increasingly a part of organizations focusing on operational resilience by connecting with cloud-based incident management, automated alerts linked to internal and external risks, and cybersecurity breach notifications.

Entrust and Alert Media provide enterprise-grade MNS solutions to ensure real-time employee, supply chain, and stakeholder communication during IT failures, power outages, or cyberattacks. For example, businesses used MNS during Hurricane Ida (2021) to coordinate emergency response, notify remote teams, and ensure service continuity.

MNS is utilized by organizations for operational running, space management, and workforce synchronization. Integration solutions are provided by Siemens and Honeywell International, which provide notification systems that bring IoT capability to corporate messaging, shift scheduling, and safety drills to improve workplace productivity.

With the increasing pace of digital transformation, MNS adoption will also only increase across industries, primarily due to regulatory requirements, AI-driven automation use cases, and the growing organizational gambit on risk management.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 9.5% |

| European Union | 9.6% |

| Japan | 9.7% |

| South Korea | 9.9% |

The USA industry is growing as organizations adopt advanced emergency communication solutions to improve public safety, enterprise security, and disaster relief. Notification systems based on artificial intelligence are revolutionizing real-time alerting, automation of emergency messages, and optimizing crisis coordination. Cloud-based, multi-channel, and geo-targeted notification systems are becoming increasingly popular as institutions seek efficiency and reliability in emergency communications.

Government entities, business communities, and training institutions in the USA are establishing mass notification systems to communicate well in times of emergency. Federal legislation promotes the investment in safe, scalable technology for emergency alerting, fostering adoption across several industries.

The National Weather Service (NWS) and the Federal Emergency Management Agency (FEMA) are still advising the implementation of national alert systems for the secure and timely sharing of critical information. FMI believes the USA Industry will expand at 9.8% CAGR throughout the forecast period.

| Key Drivers | Details |

|---|---|

| Increased use of AI-based alerting systems | Companies use artificial intelligence to identify threats in advance, send automated notifications, and control crises. |

| Regulatory mandates and public safety initiatives | Government mandates require safe, scalable, and efficient solutions for crisis notification. |

| Growing adoption in education and corporate sectors | Schools, universities, and organizations utilize real-time notice systems to facilitate communication. |

The UK industry has developed steadily since government ministries and institutions implemented AI-driven notification systems to build emergency communications infrastructure. Organizations are building real-time threat alerts, auto-alerts, and cloud infrastructure to support crisis management activities. Increasing requirements of mass notification systems in public spaces, law enforcement departments, and workplace security are fuelling industry growth.

The government of the UK is highly interested in national security and disaster readiness, and the government encourages the application of mass notification technologies across various industries. Investment in smart city projects and public alert systems leads to increased application of location-based alerting and utilization of artificial intelligence (AI)-driven emergency communications systems. Companies keep developing solutions to meet the requirements of the General Data Protection Regulation (GDPR) and other data protection regulations.

| Key Drivers in the UK | Detail |

|---|---|

| Rise in deployment to infrastructure and public safety | Government agencies create communication networks to improve national security and disaster readiness. |

| Cloud and intelligent messaging solutions | Companies adopt prudent alerting solutions to automate crisis handling. |

| Compliance with robust data security regulations | Organizations build GDPR-compliant notice systems to maintain security and privacy. |

The European Union industry is growing with municipalities, businesses, and public safety organizations implementing AI-driven emergency communication systems. Industry growth is driven by nations like Germany, France, and Italy, which implement mass notification systems with smart city solutions. Increasing demand for timely alerts, disaster management, and adherence to public safety directives continues to drive adoption in industries.

The European Union is defined by stringent data privacy and security regulations, which are forcing organizations to create GDPR-compatible and encrypted messaging applications. Cloud-based alert systems, IoT-based alert systems, and real-time analytics are picking up pace as key applications for public and private organizations. Expenditure on smart city initiatives and emergency readiness programs is also driving the industry.

| Key Drivers in the European Union | Detail |

|---|---|

| Mass alert with integration of smart city infrastructure | Cities enhance urban safety measures through IoT-based emergency alerting. |

| GDPR-compliant encrypted communications solutions. | Companies use secure platforms to ensure continued compliance with European data protection regulations. |

| Public safety and disaster preparedness investments | Governments invest to create AI-powered alert systems. |

Japan's industry is expanding as organizations and companies deploy AI-based emergency message platforms to boost disaster response, corporate security, and public warning systems. Japan's extreme emphasis on disaster resilience and technological innovation pushes investments in mass notification technologies.

Industries such as transportation, manufacturing, and healthcare are adopting smart alert technologies in their processes to improve crisis management and risk reduction. Japan's earthquake and tsunami readiness has been aimed at using sophisticated early warning systems to offer timely notification and efficient emergency coordination. FMI is of the opinion that the industry in Japan will grow at 9.7% CAGR during the study period.

| Key Drivers in Japan | Detail |

|---|---|

| Strong government support for natural disaster readiness | Governments invest in advanced natural disaster warning systems. |

| Scalation of smart alerting solutions across industries | Corporations use AI-backed products to enhance corporate security. |

| Increased takeup in public sector and healthcare organizations | Hospitals and government agencies use mass notification systems to help respond during crises. |

The industry in South Korea is growing with the advent of AI-enabled real-time alerting, crisis management systems, and IoT-based communication systems. Digital safety measures are highly supported by the South Korean government, which is further pushing for adopting sophisticated emergency notification systems.

Organizations are adopting mobile alerts, automated evacuation messages, and location-based alerts for improved public safety.

The nation's advanced 5G network and cloud technology also improve the reliability and efficiency of mass notification systems. As the tech infrastructure in South Korea develops, AI-driven notification technology is becoming a first-priority answer for business organizations and government departments in managing crises. FMI believes the South Korean Industry will reach 9.9% CAGR during the forecast period.

| Key Drivers in South Korea | Detail |

|---|---|

| Government investment in digital security efforts | Governments encourage the utilization of smart emergency alert systems. |

| Technological changes in 5G and cloud infrastructure | Rapid connectivity increases real-time alerting capacity. |

| Rising uses of AI-based emergency response solutions | Companies deploy smart notification systems to optimize crisis management. |

The industry for global mass notification systems (MNS) is fiercely competitive, primed by the increasing demand for urgent communication during emergency situations and disaster preparation, as well as compliance with public safety. The growth of the industry is fueled by threats such as natural calamities, security threats, and cyberattacks that force organizations to invest in advanced alerting solutions powered by AI, as well as cloud-based messaging platforms for immediate communications.

Top players like Everbridge, Motorola Solutions, Honeywell, BlackBerry AtHoc, and Siemens AG lead the pack with scalable multi-channel notification systems, automated alerts, and geolocation-based warnings.

The focus is now on AI-driven analytics, IoT integration, and seamless interoperability with government and enterprise networks for situational awareness and crisis management, further intensified by niche providers focusing on MNS solutions specific to industry segments like healthcare, education, transportation, as well as energy.

Cloud adoption and mobile-first communication strategies are transforming this industry, spawning a stream of startups offering innovative SaaS-based notification platforms that feature real-time tracking, two-way communication, and multilingual support.

Strategic partnerships with emergency services, smart city initiatives, and providers of security infrastructure are vital to increasing access to the industry. These companies are engaged in an arms race for an ever-tightening industry with, notably, systems included in public alert systems, as those emphasizing cybersecurity, data privacy, and compliance with standards such as IPAWS and GDPR will find a suitable competitive advantage in this milieu.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Everbridge | 20-25% |

| Motorola Solutions | 15-20% |

| Honeywell International | 12-17% |

| Siemens AG | 8-12% |

| BlackBerry AtHoc | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Everbridge | Provides cloud-based mass notification systems, AI-driven emergency alerting as well as real-time crisis management. |

| Motorola Solutions | Develops public safety communication solutions, AI-powered dispatch systems, and secure emergency messaging. |

| Honeywell International | Specializes in enterprise-wide alerting, fire and safety notification systems, and industrial communication solutions. |

| Siemens AG | Focuses on integrated emergency notification platforms, smart city alert systems, and IoT-enabled messaging. |

| BlackBerry AtHoc | Offers encrypted crisis communication, real-time location tracking as well as multi-channel alerting for enterprises. |

Key Company Insights

Everbridge (20-25%)

Everbridge is the industry leader in mass notification systems, offering cloud-based alerting platforms, AI-driven crisis response, and real-time emergency communication.

Motorola Solutions (15-20%)

Motorola Solutions uses AI in dispatching systems to render safer public assistance, communicate for emergency response, and provide complex incident management solutions.

Honeywell International (12-17%)

Honeywell International is primarily engaged in enterprise-wide emergency notification solutions, integrating fire, safety, and industrial communications systems.

Siemens AG (8-12%)

Siemens AG builds smart city notification systems, IoT-enabled alerting, and integrated emergency messaging platforms across industries.

BlackBerry AtHoc (5-9%)

BlackBerry AtHoc is providing encrypted crisis communications, multi-channel alerting, and real-time location tracking for enterprises as well as government agencies.

Other Key Players (20-30% Combined)

The industry covers mass notification systems hardware, emergency notification platform, and mass notification systems services.

By solution, the industry includes in-building, wide-area, and distributed.

In terms of application, the industry covers emergency & crisis notification, business continuity and disaster recovery, business communication & operations, and others.

By industry, the market includes military & defense, government & public sector, industrial, commercial, event & sports venues, critical infrastructures, and others.

Regionally, the industry is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is slated to reach USD 17.34 billion in 2025.

The industry is predicted to reach USD 76.7 billion by 2035.

The leading companies in the industry include Everbridge, Motorola Solutions, Honeywell International, Siemens AG, BlackBerry AtHoc, OnSolve, Singlewire Software, AlertMedia, and Rave Mobile Safety.

South Korea, slated to grow at 9.9% CAGR during the forecast period, is poised for the fastest growth.

They are majorly used for emergency & crisis notification.

Table 01: Global Market Volume (Units), by Component, 2017 to 2033

Table 02: Global Market Value (US$ Billion), by Component, 2017 to 2033

Table 03: Global Market Volume (Units), by Component, 2017 to 2033

Table 04: Global Market Value (US$ Billion), by Component, 2017 to 2033

Table 05: Global Market Volume (Units), by Industry, 2017 to 2033

Table 06: Global Market Value (US$ Billion), by Industry, 2017 to 2033

Table 07: Global Market Volume (Units), by Industry, 2017 to 2033

Table 08: Global Market Value (US$ Billion), by Industry, 2017 to 2033

Table 09: Global Market Volume (Units), by Region, 2017 to 2033

Table 10: Global Market Value (US$ Billion), by Region, 2017 to 2033

Table 11: North America Market Volume (Units), by Component, 2017 to 2033

Table 12: North America Market Value (US$ Billion), by Component, 2017 to 2033

Table 13: North America Market Volume (Units), by Component, 2017 to 2033

Table 14: North America Market Value (US$ Billion), by Component, 2017 to 2033

Table 15: North America Market Volume (Units), by Industry, 2017 to 2033

Table 16: North America Market Value (US$ Billion), by Industry, 2017 to 2033

Table 17: North America Market Volume (Units), by Industry, 2017 to 2033

Table 18: North America Market Value (US$ Billion), by Industry, 2017 to 2033

Table 19: North America Market Volume (Units), by Country, 2017 to 2033

Table 20: North America Market Value (US$ Billion), by Country, 2017 to 2033

Table 21: Europe Market Volume (Units), by Component, 2017 to 2033

Table 22: Europe Market Value (US$ Billion), by Component, 2017 to 2033

Table 23: Europe Market Volume (Units), by Component, 2017 to 2033

Table 24: Europe Market Value (US$ Billion), by Component, 2017 to 2033

Table 25: Europe Market Volume (Units), by Industry, 2017 to 2033

Table 26: Europe Market Value (US$ Billion), by Industry, 2017 to 2033

Table 27: Europe Market Volume (Units), by Industry, 2017 to 2033

Table 28: Europe Market Value (US$ Billion), by Industry, 2017 to 2033

Table 29: Europe Market Volume (Units), by Country, 2017 to 2033

Table 30: Europe Market Value (US$ Billion), by Country, 2017 to 2033

Table 31: East Asia Market Volume (Units), by Component, 2017 to 2033

Table 32: East Asia Market Value (US$ Billion), by Component, 2017 to 2033

Table 33: East Asia Market Volume (Units), by Component, 2017 to 2033

Table 34: East Asia Market Value (US$ Billion), by Component, 2017 to 2033

Table 35: East Asia Market Volume (Units), by Industry, 2017 to 2033

Table 36: East Asia Market Value (US$ Billion), by Industry, 2017 to 2033

Table 37: East Asia Market Volume (Units), by Industry, 2017 to 2033

Table 38: East Asia Market Value (US$ Billion), by Industry, 2017 to 2033

Table 39: East Asia Market Volume (Units), by Country, 2017 to 2033

Table 40: East Asia Market Value (US$ Billion), by Country, 2017 to 2033

Table 41: South Asia & Pacific Market Volume (Units), by Component, 2017 to 2033

Table 42: South Asia & Pacific Market Value (US$ Billion), by Component, 2017 to 2033

Table 43: South Asia & Pacific Market Volume (Units), by Component, 2017 to 2033

Table 44: South Asia & Pacific Market Value (US$ Billion), by Component, 2017 to 2033

Table 45: South Asia & Pacific Market Volume (Units), by Industry, 2017 to 2033

Table 46: South Asia & Pacific Market Value (US$ Billion), by Industry, 2017 to 2033

Table 47: South Asia & Pacific Market Volume (Units), by Industry, 2017 to 2033

Table 48: South Asia & Pacific Market Value (US$ Billion), by Industry, 2017 to 2033

Table 49: South Asia & Pacific Market Volume (Units), by Country, 2017 to 2033

Table 50: South Asia & Pacific Market Value (US$ Billion), by Country, 2017 to 2033

Table 51: Latin America Market Volume (Units), by Component, 2017 to 2033

Table 52: Latin America Market Value (US$ Billion), by Component, 2017 to 2033

Table 53: Latin America Market Volume (Units), by Component, 2017 to 2033

Table 54: Latin America Market Value (US$ Billion), by Component, 2017 to 2033

Table 55: Latin America Market Volume (Units), by Industry, 2017 to 2033

Table 56: Latin America Market Value (US$ Billion), by Industry, 2017 to 2033

Table 57: Latin America Market Volume (Units), by Industry, 2017 to 2033

Table 58: Latin America Market Value (US$ Billion), by Industry, 2017 to 2033

Table 59: Latin America Market Volume (Units), by Country, 2017 to 2033

Table 60: Latin America Market Value (US$ Billion), by Country, 2017 to 2033

Table 61: Middle East and Africa Market Volume (Units), by Component, 2017 to 2033

Table 62: Middle East and Africa Market Value (US$ Billion), by Component, 2017 to 2033

Table 63: Middle East and Africa Market Volume (Units), by Component, 2017 to 2033

Table 64: Middle East and Africa Market Value (US$ Billion), by Component, 2017 to 2033

Table 65: Middle East and Africa Market Volume (Units), by Industry, 2017 to 2033

Table 66: Middle East and Africa Market Value (US$ Billion), by Industry, 2017 to 2033

Table 67: Middle East and Africa Market Volume (Units), by Industry, 2017 to 2033

Table 68: Middle East and Africa Market Value (US$ Billion), by Industry, 2017 to 2033

Table 69: Middle East and Africa Market Volume (Units), by Country, 2017 to 2033

Table 70: Middle East and Africa Market Value (US$ Billion), by Country, 2017 to 2033

Table 71: Oceania Market Volume (Units), by Component, 2017 to 2033

Table 72: Oceania Market Value (US$ Billion), by Component, 2017 to 2033

Table 73: Oceania Market Volume (Units), by Component, 2017 to 2033

Table 74: Oceania Market Value (US$ Billion), by Component, 2017 to 2033

Table 75: Oceania Market Volume (Units), by Industry, 2017 to 2033

Table 76: Oceania Market Value (US$ Billion), by Industry, 2017 to 2033

Table 77: Oceania Market Volume (Units), by Industry, 2017 to 2033

Table 78: Oceania Market Value (US$ Billion), by Industry, 2017 to 2033

Table 79: Oceania Market Volume (Units), by Country, 2017 to 2033

Table 80: Oceania Market Value (US$ Billion), by Country, 2017 to 2033

Figure 01: Global Market Volume (Units), Value (US$ Thousand), and Y-o-Y Growth, 2017 to 2033

Figure 02: Global Absolute $ Historical Market (2018 to 2022) and Absolute $ Opportunity (2023 to 2033), US$ Billion

Figure 03: Global Absolute Historical Volume Market (2018 to 2022) and Absolute Volume Opportunity (2023 to 2033), Units

Figure 04: Global Market Value Y-o-Y Growth and Forecast, 2017 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Thousand), 2023 to 2033

Figure 06: Global Market Share, By Component - 2023 to 2033

Figure 07: Global Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 08: Global Market Attractiveness Index, By Component - 2023 to 2033

Figure 09: Global Market Share, By Solution- 2023 to 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Solution- 2023 to 2033

Figure 12: Global Market Share, By Industry - 2023 to 2033

Figure 13: Global Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 14: Global Market Attractiveness Index, By Industry - 2023 to 2033

Figure 15: Global Market Share, By Industry - 2023 to 2033

Figure 16: Global Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 17: Global Market Attractiveness Index, By Industry - 2023 to 2033

Figure 18: Global Market Share, by Region - 2023 to 2033

Figure 19: Global Market Y-o-Y Growth Projections, by Region - 2023 to 2033

Figure 20: Global Market Attractiveness Index, by Region - 2023 to 2033

Figure 21: North America Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 22: Y-o-Y Growth Comparison of Market: North America Vs North America Countries Vs North America Average

Figure 23: North America Market Share, By Component - 2023 to 2033

Figure 24: North America Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 25: North America Market Attractiveness Index, By Component - 2023 to 2033

Figure 26: North America Market Share, By Solution- 2023 to 2033

Figure 27: North America Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 28: North America Market Attractiveness Index, By Solution- 2023 to 2033

Figure 29: North America Market Share, By Industry - 2023 to 2033

Figure 30: North America Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 31: North America Market Attractiveness Index, By Industry - 2023 to 2033

Figure 32: North America Market Share, By Industry - 2023 to 2033

Figure 33: North America Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 34: North America Market Attractiveness Index, By Industry - 2023 to 2033

Figure 35: North America Market Share, By Country - 2023 to 2033

Figure 36: North America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 37: North America Market Attractiveness Index, By Country - 2023 to 2033

Figure 38: Europe Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 39: Y-o-Y Growth Comparison of Market: Europe Vs Europe Countries Vs Europe Average

Figure 40: Europe Market Share, By Component - 2023 to 2033

Figure 41: Europe Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 42: Europe Market Attractiveness Index, By Component - 2023 to 2033

Figure 43: Europe Market Share, By Solution- 2023 to 2033

Figure 44: Europe Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 45: Europe Market Attractiveness Index, By Solution- 2023 to 2033

Figure 46: Europe Market Share, By Industry - 2023 to 2033

Figure 47: Europe Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 48: Europe Market Attractiveness Index, By Industry - 2023 to 2033

Figure 49: Europe Market Share, By Industry - 2023 to 2033

Figure 50: Europe Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 51: Europe Market Attractiveness Index, By Industry - 2023 to 2033

Figure 52: Europe Market Share, By Country - 2023 to 2033

Figure 53: Europe Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 54: Europe Market Attractiveness Index, By Country - 2023 to 2033

Figure 55: East Asia Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 56: Y-o-Y Growth Comparison of Market: East Asia Vs East Asia Countries Vs East Asia Average

Figure 57: East Asia Market Share, By Component - 2023 to 2033

Figure 58: East Asia Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 59: East Asia Market Attractiveness Index, By Component - 2023 to 2033

Figure 60: East Asia Market Share, By Solution- 2023 to 2033

Figure 61: East Asia Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 62: East Asia Market Attractiveness Index, By Solution- 2023 to 2033

Figure 63: East Asia Market Share, By Industry - 2023 to 2033

Figure 64: East Asia Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 65: East Asia Market Attractiveness Index, By Industry - 2023 to 2033

Figure 66: East Asia Market Share, By Industry - 2023 to 2033

Figure 67: East Asia Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 68: East Asia Market Attractiveness Index, By Industry - 2023 to 2033

Figure 69: East Asia Market Share, By Country - 2023 to 2033

Figure 70: East Asia Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 71: East Asia Market Attractiveness Index, By Country - 2023 to 2033

Figure 72: South Asia & Pacific Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 73: Y-o-Y Growth Comparison of Market: South Asia & Pacific Vs South Asia & Pacific Countries Vs South Asia & Pacific Average

Figure 74: South Asia & Pacific Market Share, By Component - 2023 to 2033

Figure 75: South Asia & Pacific Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 76: South Asia & Pacific Market Attractiveness Index, By Component - 2023 to 2033

Figure 77: South Asia & Pacific Market Share, By Solution- 2023 to 2033

Figure 78: South Asia & Pacific Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 79: South Asia & Pacific Market Attractiveness Index, By Solution- 2023 to 2033

Figure 80: South Asia & Pacific Market Share, By Industry - 2023 to 2033

Figure 81: South Asia & Pacific Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 82: South Asia & Pacific Market Attractiveness Index, By Industry - 2023 to 2033

Figure 83: South Asia & Pacific Market Share, By Industry - 2023 to 2033

Figure 84: South Asia & Pacific Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 85: South Asia & Pacific Market Attractiveness Index, By Industry - 2023 to 2033

Figure 86: South Asia & Pacific Market Share, By Country - 2023 to 2033

Figure 87: South Asia & Pacific Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 88: South Asia & Pacific Market Attractiveness Index, By Country - 2023 to 2033

Figure 89: Latin America Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 90: Y-o-Y Growth Comparison of Market: Latin America Vs Latin America Countries Vs Latin America Average

Figure 91: Latin America Market Share, By Component - 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 93: Latin America Market Attractiveness Index, By Component - 2023 to 2033

Figure 94: Latin America Market Share, By Solution- 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 96: Latin America Market Attractiveness Index, By Solution- 2023 to 2033

Figure 97: Latin America Market Share, By Industry - 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 99: Latin America Market Attractiveness Index, By Industry - 2023 to 2033

Figure 100: Latin America Market Share, By Industry - 2023 to 2033

Figure 101: Latin America Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 102: Latin America Market Attractiveness Index, By Industry - 2023 to 2033

Figure 103: Latin America Market Share, By Country - 2023 to 2033

Figure 104: Latin America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 105: Latin America Market Attractiveness Index, By Country - 2023 to 2033

Figure 106: MEA Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 107: Y-o-Y Growth Comparison of Market: MEA Vs MEA Countries Vs MEA Average

Figure 108: MEA Market Share, By Component - 2023 to 2033

Figure 109: MEA Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 110: MEA Market Attractiveness Index, By Component - 2023 to 2033

Figure 111: MEA Market Share, By Solution- 2023 to 2033

Figure 112: MEA Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 113: MEA Market Attractiveness Index, By Solution- 2023 to 2033

Figure 114: MEA Market Share, By Industry - 2023 to 2033

Figure 115: MEA Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 116: MEA Market Attractiveness Index, By Industry - 2023 to 2033

Figure 117: MEA Market Share, By Industry - 2023 to 2033

Figure 118: MEA Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 119: MEA Market Attractiveness Index, By Industry - 2023 to 2033

Figure 120: MEA Market Share, By Country - 2023 to 2033

Figure 121: MEA Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 122: MEA Market Attractiveness Index, By Country - 2023 to 2033

Figure 123: Oceania Market Value (US$ Thousand), Volume (Units) Forecast and Analysis, 2017 to 2033

Figure 124: Y-o-Y Growth Comparison of Market: Oceania Vs Oceania Countries Vs Oceania Average

Figure 125: Oceania Market Share, By Component - 2023 to 2033

Figure 126: Oceania Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 127: Oceania Market Attractiveness Index, By Component - 2023 to 2033

Figure 128: Oceania Market Share, By Solution- 2023 to 2033

Figure 129: Oceania Market Y-o-Y Growth Projections, By Solution- 2023 to 2033

Figure 130: Oceania Market Attractiveness Index, By Solution- 2023 to 2033

Figure 131: Oceania Market Share, By Industry - 2023 to 2033

Figure 132: Oceania Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 133: Oceania Market Attractiveness Index, By Industry - 2023 to 2033

Figure 134: Oceania Market Share, By Industry - 2023 to 2033

Figure 135: Oceania Market Y-o-Y Growth Projections, By Industry - 2023 to 2033

Figure 136: Oceania Market Attractiveness Index, By Industry - 2023 to 2033

Figure 137: Oceania Market Share, By Country - 2023 to 2033

Figure 138: Oceania Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 139: Oceania Market Attractiveness Index, By Country - 2023 to 2033

Figure 140: United States Market Share by Component, 2022

Figure 141: United States Market Share by Component, 2022

Figure 142: United States Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 143: United States Market Share by Industry, 2022

Figure 144: Canada Market Share by Component, 2022

Figure 145: Canada Market Share by Component, 2022

Figure 146: Canada Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 147: Canada Market Share by Industry, 2022

Figure 148: Germany Market Share by Component, 2022

Figure 149: Germany Market Share by Component, 2022

Figure 150: Germany Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 151: Germany Market Share by Industry, 2022

Figure 152: United Kingdom Market Share by Component, 2022

Figure 153: United Kingdom Market Share by Component, 2022

Figure 154: United Kingdom Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 155: United Kingdom Market Share by Industry, 2022

Figure 156: France Market Share by Component, 2022

Figure 157: France Market Share by Component, 2022

Figure 158: France Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 159: France Market Share by Industry, 2022

Figure 160: Russia Market Share by Component, 2022

Figure 161: Russia Market Share by Component, 2022

Figure 162: Russia Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 163: Russia Market Share by Industry, 2022

Figure 164: Spain Market Share by Component, 2022

Figure 165: Spain Market Share by Component, 2022

Figure 166: Spain Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 167: Spain Market Share by Industry, 2022

Figure 168: Italy Market Share by Component, 2022

Figure 169: Italy Market Share by Component, 2022

Figure 170: Italy Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 171: Italy Market Share by Industry, 2022

Figure 172: China Market Share by Component, 2022

Figure 173: China Market Share by Component, 2022

Figure 174: China Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 175: China Market Share by Industry, 2022

Figure 176: Japan Market Share by Component, 2022

Figure 177: Japan Market Share by Component, 2022

Figure 178: Japan Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 179: Japan Market Share by Industry, 2022

Figure 180: South Korea Market Share by Component, 2022

Figure 181: South Korea Market Share by Component, 2022

Figure 182: South Korea Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 183: South Korea Market Share by Industry, 2022

Figure 184: India Market Share by Component, 2022

Figure 185: India Market Share by Component, 2022

Figure 186: India Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 187: India Market Share by Industry, 2022

Figure 188: Singapore Market Share by Component, 2022

Figure 189: Singapore Market Share by Component, 2022

Figure 190: Singapore Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 191: Singapore Market Share by Industry, 2022

Figure 192: Indonesia Market Share by Component, 2022

Figure 193: Indonesia Market Share by Component, 2022

Figure 194: Indonesia Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 195: Indonesia Market Share by Industry, 2022

Figure 196: Thailand Market Share by Component, 2022

Figure 197: Thailand Market Share by Component, 2022

Figure 198: Thailand Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 199: Thailand Market Share by Industry, 2022

Figure 200: Brazil Market Share by Component, 2022

Figure 201: Brazil Market Share by Component, 2022

Figure 202: Brazil Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 203: Brazil Market Share by Industry, 2022

Figure 204: Mexico Market Share by Component, 2022

Figure 205: Mexico Market Share by Component, 2022

Figure 206: Mexico Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 207: Mexico Market Share by Industry, 2022

Figure 208: Israel Market Share by Component, 2022

Figure 209: Israel Market Share by Component, 2022

Figure 210: Israel Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 211: Israel Market Share by Industry, 2022

Figure 212: GCC Countries Market Share by Component, 2022

Figure 213: GCC Countries Market Share by Component, 2022

Figure 214: GCC Countries Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 215: GCC Countries Market Share by Industry, 2022

Figure 216: South Africa Market Share by Component, 2022

Figure 217: South Africa Market Share by Component, 2022

Figure 218: South Africa Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 219: South Africa Market Share by Industry, 2022

Figure 220: Australia Market Share by Component, 2022

Figure 221: Australia Market Share by Component, 2022

Figure 222: Australia Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 223: Australia Market Share by Industry, 2022

Figure 224: New Zealand Market Share by Component, 2022

Figure 225: New Zealand Market Share by Component, 2022

Figure 226: New Zealand Market Value (US$ Billion) and Forecast 2023 to 2033

Figure 227: New Zealand Market Share by Industry, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Massoia Bark Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Mass Loaded Vinyl (MLV) Market Size and Share Forecast Outlook 2025 to 2035

Mass Finishing Consumables Market Size and Share Forecast Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Industry Share Analysis for Massage Therapy Service Providers

Massive MIMO Market

Massage Equipment Market

Mass Notification System in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Spatial Mass Spectrometry Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Massagers Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA