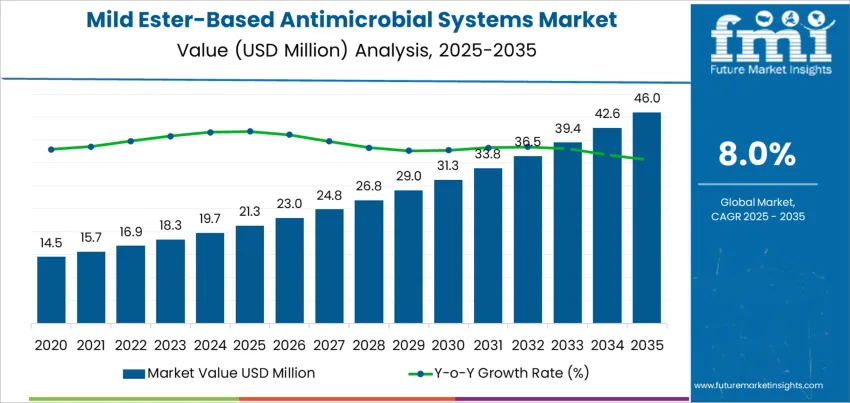

In 2025, the mild ester-based antimicrobial systems market is valued at USD 21.3 million and is projected to reach USD 46.0 million by 2035 at a CAGR of 8.0%. Early expansion is linked to rising use of low irritation antimicrobial agents in personal care, household hygiene, and surface disinfection products where conventional biocides face formulation constraints. Manufacturers favor ester-based systems for their compatibility with sensitive skin applications and lower sensory impact in leave-on formulations. Initial growth is concentrated in liquid and emulsion-based formats used in cleansers, wipes, and cosmetic preservation. Regulatory pressure on legacy preservatives also contributes to rising substitution with ester-based alternatives that meet updated safety and exposure standards.

From 2030 onward, market expansion accelerates as ester-based systems gain wider acceptance across institutional cleaning, healthcare hygiene, and professional personal care segments. Market value increases from about USD 31.3 million in 2030 toward USD 46.0 million by 2035 as demand shifts beyond preservation into broader antimicrobial performance roles. Product development emphasizes spectrum control, storage stability, and compatibility with surfactant systems. Growth is supported by higher use in baby care, facial care, and therapeutic skin products where microbial control must be balanced with barrier safety. Competitive activity centers on formulation blending, esterase resistance, and controlled release behavior to extend antimicrobial action without increasing user exposure.

Global demand for mild ester-based antimicrobial systems expands from USD 21.3 million in 2025 to USD 23.0 million in 2026 and USD 24.8 million in 2027, reflecting early-stage scale-up driven by clean-label reformulation across food, personal care, and topical pharmaceutical applications. By 2030, the market reaches USD 29.0 million, adding USD 7.7 million from the 2025 base. This phase is driven by rising restrictions on harsh synthetic preservatives, growing sensitivity to skin and mucosal irritation, and wider adoption in leave-on cosmetics, wet wipes, and oral-care adjunct products. Growth follows a controlled incline because ester-based systems require formulation stability validation, compatibility testing, and regional regulatory clearance before mass deployment.

From 2030 to 2035, the global market expands from USD 29.0 million to USD 46.0 million, generating a larger USD 17.0 million in absolute growth within five years. This back-weighted acceleration reflects the transition of mild ester systems from premium niche solutions to baseline antimicrobial platforms in mainstream personal care, baby products, and sensitive-food preservation. Value density increases as multi-ester blends replace single-agent systems and as usage spreads into high-volume daily-use formats. As consumer tolerance thresholds, regulatory pressure, and microbiome-safe positioning converge, ester-based antimicrobials shift from optional differentiators to structural formulation components across multiple end-use industries.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 21.3 million |

| Forecast Value (2035) | USD 46.0 million |

| Forecast CAGR (2025–2035) | 8.0% |

The global market for mild ester-based antimicrobial systems emerged from increasing demand for preservative agents that balance efficacy with consumer safety and regulatory constraints. Traditional antimicrobials and preservatives often faced scrutiny for toxicity, allergenicity, or harsh chemical profiles. Ester-based antimicrobials such as esterified fatty acids or mild ester derivatives offered antimicrobial activity with lower irritation potential and better biodegradability. Food, beverage, cosmetic, and personal-care manufacturers began adopting these systems to meet stricter regulatory standards and rising consumer preference for gentle, “clean” preservative solutions. Early growth was driven by niche applications that demanded mild action such as skin care products, oral care formulations, and sensitive-content food items where conventional preservatives were problematic.

Going forward the mild ester-based antimicrobial market is likely to expand through formulation versatility and increasing regulatory pressure on conventional antimicrobials. As regulations tighten globally on traditional preservatives, ester-based systems provide a viable alternative that balances microbial control, safety, and formulation stability. Market growth will be supported by rising adoption in cosmetic, personal-care, baby-care, and functional foods segments demanding safety and low-irritation profiles. Further innovation in controlled-release ester systems, synergistic blends, and compatibility with natural and organic ingredient trends will broaden application scope. Barriers remain in demonstrating long-term efficacy, preserving sensory attributes (odour, taste), and establishing spectrum coverage equivalent to traditional preservatives. Success will depend on advancing formulation science and achieving regulatory harmonisation across regions.

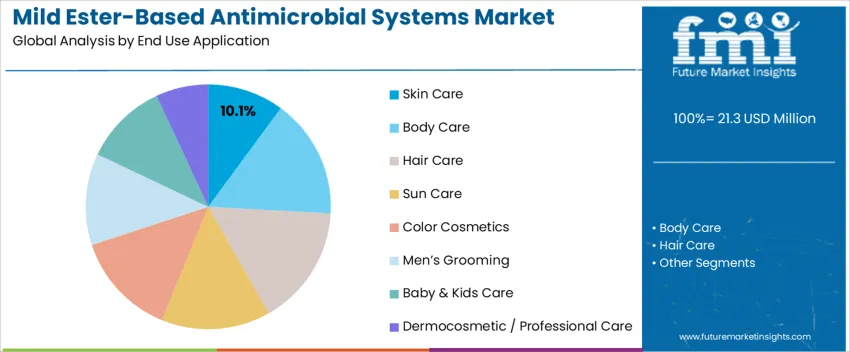

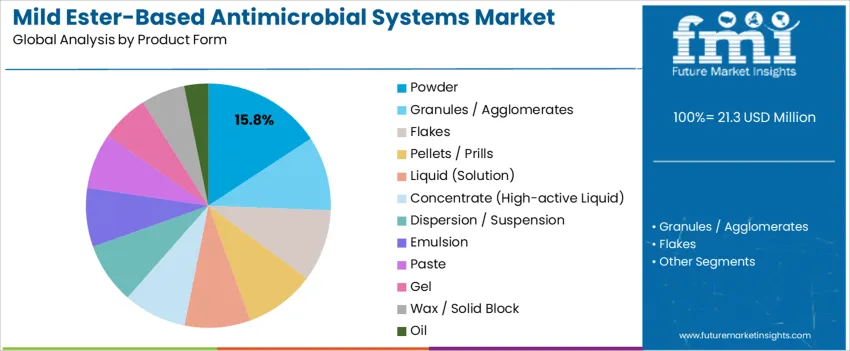

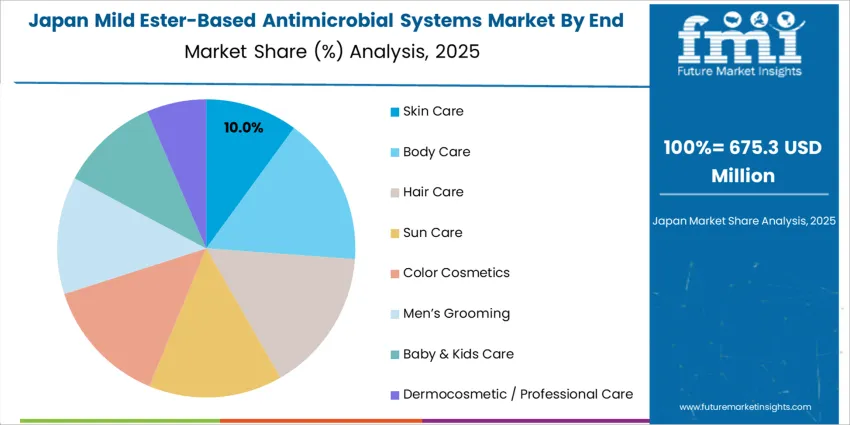

Global demand for mild ester based antimicrobial systems is structured by end use application and product form, with consumption centered in East Asia, Western Europe, and North America. Skin care accounts for a 10.1% share, supported by sustained formulation activity in South Korea, Japan, France, Germany, and the USA. Body care, hair care, sun care, color cosmetics, men grooming, baby and kids care, and dermocosmetic or professional care follow across mass and regulated product categories. On the product form side, powders hold a 15.8% share alongside liquids, concentrates, dispersions, emulsions, gels, pastes, wax blocks, and oils. Selection trends reflect antimicrobial efficacy, formulation mildness, and compatibility with sensitive skin applications across regional cosmetic hubs.

Skin care accounts for 10.1% of global mild ester based antimicrobial system usage due to rising integration of gentle preservation and antimicrobial protection in facial and leave on formulations. These systems are widely used to control microbial growth in creams, serums, cleansers, and post treatment recovery products without causing surface irritation. Demand is strongest in South Korea, Japan, Western Europe, and the USA, where microbiome safe and low irritation positioning has gained regulatory and commercial traction. Facial care products with extended shelf life and stabilized formulations continue to drive adoption at scale.

Skin care also shows higher antimicrobial loading per unit than rinse off categories. Dermocosmetic and professional brands rely on ester based systems to maintain microbial control in sensitive skin, acne care, and post procedure products. Stability testing standards in Europe and North America further reinforce use in regulated skin care categories. These formulation safety, testing, and performance driven factors sustain skin care as the leading global application for mild ester based antimicrobial systems.

Powder form accounts for 15.8% of global mild ester based antimicrobial system demand due to superior shelf stability, reduced hydrolytic degradation risk, and consistent antimicrobial potency during storage. Powders allow precise dosing into emulsions, gels, and serums while preserving antimicrobial efficiency under extended production and warehousing conditions. Contract manufacturers across Asia, Europe, and North America favor powdered systems for repeatable batch performance and predictable dispersion across large scale cosmetic production.

Powder formats also improve logistics efficiency by lowering transport weight, minimizing leakage risk, and reducing reliance on temperature controlled shipping. Regulatory documentation and export handling for dry antimicrobial actives remain more standardized across international trade routes. Powders integrate smoothly with automated feeding and mixing equipment used in cosmetic manufacturing. These storage, processing, and compliance advantages position powder as the preferred global product form for mild ester based antimicrobial systems.

Mild ester-based antimicrobials are redefining how microbial control is achieved in products that require both efficacy and biological tolerance. Unlike traditional aggressive biocides, ester systems act through membrane interaction and metabolic disruption without broad cellular destruction. This makes them suitable for applications where long-term exposure, skin contact, or microbiome stability matters. Their controlled hydrolysis behavior allows predictable activity windows rather than persistent residue. As regulatory and consumer pressure increases against harsh antimicrobial inputs, ester-based systems gain relevance as performance-balanced tools that emphasize compatibility over brute-force sterilization.

Multiple industries now seek antimicrobial solutions that accomplish protection without sensory damage or biological stress. Personal care uses ester systems to control spoilage while maintaining skin barrier integrity. Food contact surfaces and packaging leverage esters for low-odor, low-migration microbial control. Polymer and textile producers adopt ester-based agents to prevent surface biofouling without altering mechanical properties. This convergence reflects shifting performance criteria where antimicrobial action must coexist with tactile comfort, nutritional safety, and material stability. Ester systems operate within this narrow functional window more effectively than conventional high-impact preservatives.

Ester-based antimicrobial systems face performance ceiling constraints in high-burden microbial environments where aggressive kill rates are still demanded. Their activity spectrum is often narrower than oxidizing or halogen-based systems. Hydrolysis sensitivity introduces formulation challenges across wide pH and temperature ranges. Regulatory frameworks still evaluate antimicrobials through legacy toxicity and kill-rate benchmarks, which can disadvantage milder chemistries. Cost pressure also limits adoption in low-margin product categories. These factors slow full replacement of traditional antimicrobial systems even as ester-based alternatives gain acceptance in controlled-contact applications.

The market is shifting from single-molecule ester inputs toward blended antimicrobial architectures that combine esters with organic acids, chelating agents, or bio-derived boosters. Controlled-release carriers and polymer-bound esters extend surface protection without continuous dosing. Product developers increasingly treat antimicrobial systems as part of full preservation and material-stability platforms rather than isolated ingredients. Digital monitoring of microbial load, spoilage response, and surface contamination is guiding system tuning. This evolution reflects a move toward engineered antimicrobial environments rather than dependence on single high-intensity chemical agents.

| Country | CAGR (%) |

|---|---|

| India | 10.8% |

| China | 10.0% |

| Japan | 9.2% |

| UK | 8.4% |

| Germany | 7.6% |

| USA | 6.8% |

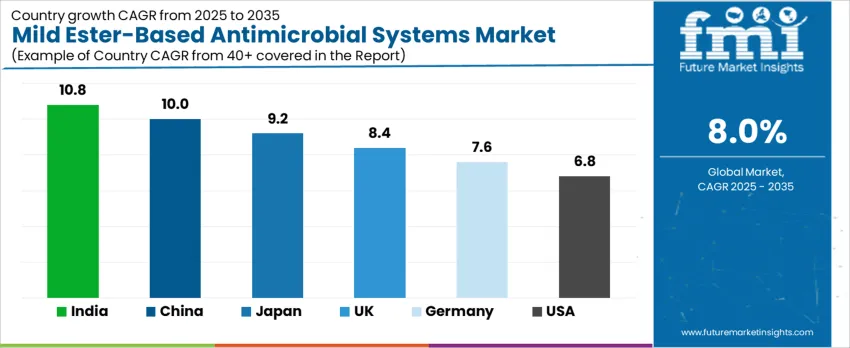

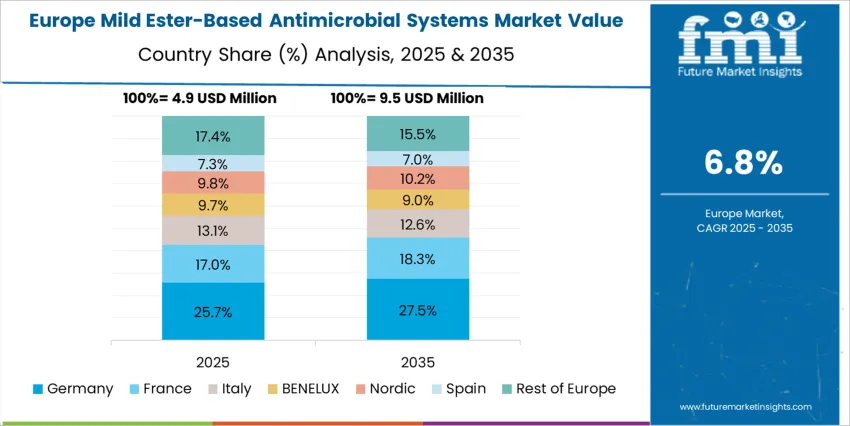

The global mild ester-based antimicrobial systems market is forecast to grow across all listed countries, with India leading at a 10.8% CAGR. Growth in India is driven by rising demand in food preservation, personal care, and hygiene products that require gentle but effective antimicrobial agents. China follows at 10.0%, supported by expanding industrial and consumer markets adopting antimicrobial systems for health, sanitation, and packaging uses. Japan at 9.2% reflects steady demand from cosmetics, food safety, and pharmaceutical segments. The UK (8.4%) and Germany (7.6%) show moderate growth, likely driven by regulatory emphasis on safer preservatives and growing clean-label product demand. The USA’s 6.8% CAGR suggests a mature but steadily expanding market for ester-based antimicrobial solutions.

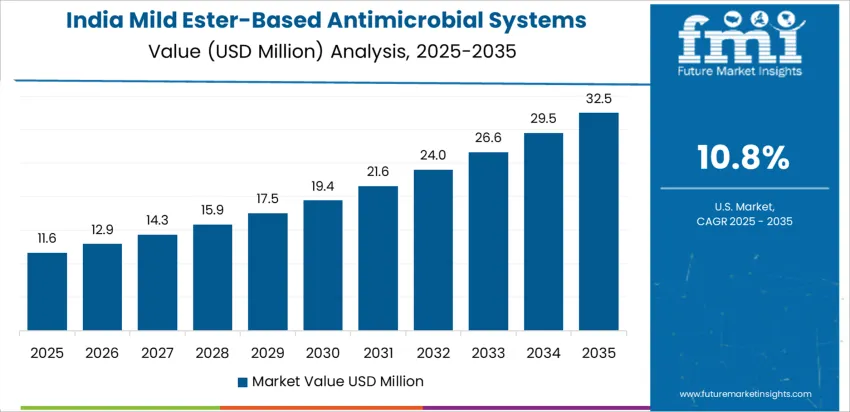

India records a CAGR of 10.8% through 2035 for mild ester based antimicrobial system growth, driven by rising hygiene awareness, packaged food expansion, and personal care manufacturing growth. Food processors adopt these systems for surface sanitation and shelf life control. Cosmetic and home care manufacturers integrate mild antimicrobials to meet skin safety and regulatory expectations. Pharmaceutical production also contributes steady demand for equipment and facility sanitation. Domestic chemical blending capability improves supply availability for mid sized manufacturers. Growth remains volume driven, aligned with mass market consumer product output and regulatory hygiene compliance.

China posts a CAGR of 10.0% through 2035 for mild ester based antimicrobial system growth, supported by large scale personal care manufacturing, food packaging, and institutional sanitation demand. Skincare, wipes, and home disinfectant production generate steady formulation consumption. Food safety regulations encourage use of low toxicity antimicrobial solutions. Hospital hygiene programs and public sanitation services add stable volume demand. Domestic chemical producers scale ester synthesis to meet industrial needs. Growth tracks rising urban population density, packaged product output, and structured hygiene enforcement across large municipal regions.

Japan reflects a CAGR of 9.2% through 2035 for mild ester based antimicrobial system growth, shaped by strict hygiene standards, advanced cosmetic manufacturing, and healthcare sanitation requirements. Skincare, baby care, and sensitive surface disinfectants favor mild antimicrobial chemistry. Pharmaceutical cleanroom sanitation and medical facility cleaning sustain institutional demand. Food processing plants maintain steady usage for equipment hygiene. Growth remains quality driven rather than volume driven, supported by formulation consistency and safety validation. Demand expansion relies on stable industrial output rather than rapid consumer market growth.

The UK records a CAGR of 8.4% through 2035 for mild ester based antimicrobial system growth, supported by rising clean label positioning, institutional hygiene programs, and home care product manufacturing. Household cleaners, surface sprays, and wipes represent major application segments. Regulatory focus on toxicity control shifts demand toward ester based actives. Public transportation sanitation and healthcare cleaning contribute steady consumption. Growth remains balanced between household and institutional usage. Demand expansion aligns with hygiene compliance rather than discretionary chemical consumption patterns across regional manufacturers and public service operators.

Germany shows a CAGR of 7.6% through 2035 for mild ester based antimicrobial system growth, supported by industrial hygiene, pharmaceutical manufacturing, and regulated cosmetic production. Cleanroom sanitation, surface disinfectants, and processing equipment hygiene remain core applications. Regulatory discipline encourages use of documented low risk antimicrobials. Institutional procurement dominates demand rather than retail driven consumption. Food processing plants maintain steady equipment sanitation cycles. Growth remains conservative and compliance oriented, guided by engineering standards, regulatory audits, and long term industrial production stability across health and manufacturing sectors.

The USA records a CAGR of 6.8% through 2035 for mild ester based antimicrobial system growth, shaped by mature disinfectant markets, institutional hygiene standards, and consumer safety expectations. Home care wipes, surface cleaners, and personal hygiene products represent major volume outlets. Hospitals, foodservice facilities, and public buildings require routine sanitation using low irritation formulations. Direct to consumer brands adopt ester systems for clean ingredient positioning. Growth remains measured due to established chemical alternatives and pricing sensitivity across mass market cleaning product categories.

Global demand for mild ester based antimicrobial systems is rising because manufacturers across food, personal care, cosmetics, and water treatment seek effective yet gentle antimicrobial agents for sensitive applications. These ester based systems offer microbial control with low irritation potential and better compatibility with delicate formulations. Rising consumer preference for milder preservatives and clean-label claims in skin care, hygiene products, and processed foods fuels broader adoption. Expansion of global hygiene standards, stricter regulation of stronger antimicrobials, and growing demand in emerging markets all contribute. Advances in formulation science and increased use of natural derivative esters also support growth across diversified applications worldwide.

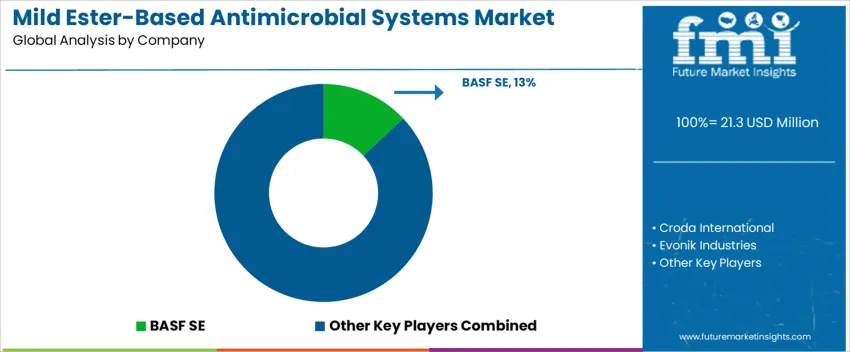

Major suppliers shaping this market include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant, and specialist ingredient firms such as Seppic, Lubrizol, Lonza, and Inolex. BASF and Evonik lead globally with broad portfolios and scalable production capacity suited to industrial and consumer applications. Croda and Symrise focus on personal care and cosmetic segments where mildness and regulatory compliance are critical. Dow, Ashland, and Clariant supply mid range antimicrobial systems suited to food, hygiene, and household products. Specialist firms deliver tailored or niche ester based solutions for sensitive applications. This mix of global giants and niche players ensures supply diversity and drives innovation across regions and end uses.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End-Use Applications | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Forms | Powder, Granules/Agglomerates, Flakes, Pellets/Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion/Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, Japan, South Korea, Taiwan, Germany, UK, France, Italy, USA, Canada, Mexico, India, Pakistan, Brazil, Argentina, Saudi Arabia, Russia, plus 40+ additional countries globally |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow Inc., Ashland, Clariant, Seppic, Lubrizol, Lonza, Inolex |

| Additional Attributes | Dollar-value breakdown by region, country, end-use, and product form, global growth projections, multi-sector adoption (personal care, hygiene, food, household cleaning), formulation mildness, antimicrobial efficacy, multi-ester and controlled-release systems, regulatory compliance, global supply chain coverage |

The global mild ester-based antimicrobial systems market is estimated to be valued at USD 21.3 million in 2025.

The market size for the mild ester-based antimicrobial systems market is projected to reach USD 46.0 million by 2035.

The mild ester-based antimicrobial systems market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in mild ester-based antimicrobial systems market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 15.8% share in the mild ester-based antimicrobial systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA