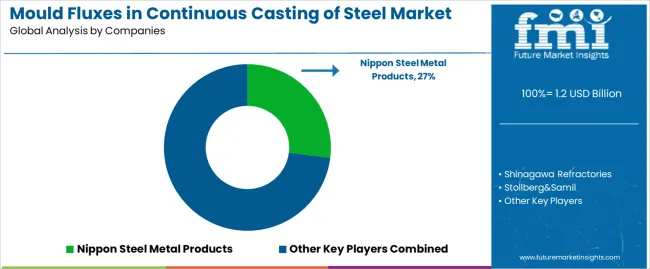

The mould fluxes in continuous casting of steel market is valued at USD 1.2 billion in 2025 and is projected to reach USD 1.9 billion by 2035, expanding at a CAGR of 5.3%. Market growth is driven by increasing global steel production, growing adoption of continuous casting technology, and the need for consistent slab quality in high-speed casting operations. The rising focus on energy efficiency and reduction of surface defects in steel manufacturing continues to strengthen demand for advanced mould flux formulations optimized for thermal control and lubrication.

Granule form mould fluxes represent the leading product segment due to their uniform melting behavior, ease of handling, and suitability for high-throughput casting processes. These materials facilitate stable heat transfer between the mould and solidifying steel, reducing cracking, inclusions, and shell deformation. Ongoing development of low-fluorine and environment-friendly flux compositions supports compliance with industrial safety and environmental standards while maintaining casting performance.

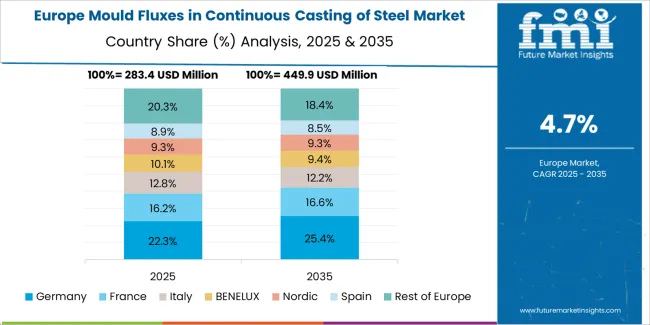

Asia Pacific remains the dominant growth region, supported by large-scale steel production in China, India, and Japan. Europe and North America maintain steady demand through modernization of steel plants and technological upgrades in casting facilities. Major industry participants include Nippon Steel Metal Products, Shinagawa Refractories, Stollberg & Samil, Grind-Chem, and XIXIA Longcheng Metallurgical Materials Co., Ltd., focusing on process optimization, material consistency, and reduced environmental impact.

The growth rate volatility index for this market is expected to remain moderate, indicating stable long-term expansion with limited short-term fluctuations. Between 2025 and 2028, mild volatility may occur due to variations in global steel output and raw material pricing, particularly for fluorite and alumina-based flux components. Demand during this period will correlate closely with the performance of the construction and automotive industries, which influence steel production volumes.

From 2029 onward, the volatility index is expected to decline as technological upgrades in continuous casting and improved process automation create predictable consumption patterns. The adoption of customized flux formulations for enhanced lubrication, heat transfer, and surface quality will stabilize demand. Regional fluctuations in steel capacity utilization will persist but remain within controlled margins. The market demonstrates a low-to-moderate volatility profile characterized by consistent industrial demand, efficiency-oriented product innovation, and limited exposure to cyclical disruptions within the global steel manufacturing ecosystem.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast Value (2035) | USD 1.9 billion |

| Forecast CAGR (2025-2035) | 5.3% |

The mould fluxes market for continuous casting in the steel industry is expanding due to growing demand for high-quality and high-volume steel production. Mould fluxes perform crucial functions such as thermal insulation of molten steel and lubrication between the solidifying steel shell and the mould, enabling defect control and stable operation in continuous casting machines. Technical innovations in flux composition and performance tuning have enhanced their ability to prevent reoxidation, absorb inclusions, optimise heat extraction and maintain viscosity and melting behaviour tailored to various steel grades.

Rising global investments in steel infrastructure, increasing demand for speciality and high-carbon steels requiring advanced flux solutions, and expansion of casting capacity in emerging markets contribute to market growth. Market demand also aligns with efforts to reduce production waste and improve yield through better casting consistency. Constraints include sensitivity of flux performance to molten steel composition and operating conditions, requirement for precise material matching, and competition from alternative technologies and materials.

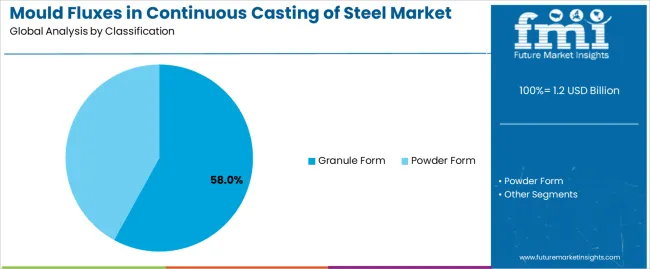

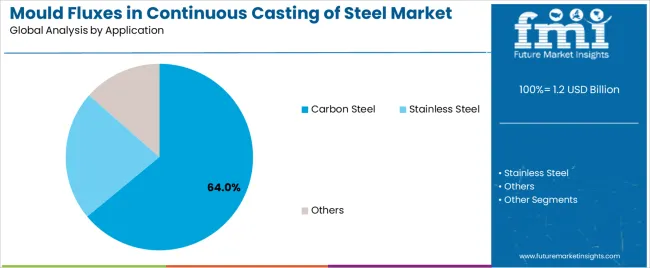

The mould fluxes in continuous casting of steel market is segmented by classification and application. By classification, the market is divided into granule form and powder form. Based on application, it is categorized into carbon steel, stainless steel, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The granule form segment holds the leading position in the mould fluxes market for continuous casting of steel, representing an estimated 58.0% of total market share in 2025. Granular mould fluxes are preferred for their superior flowability, consistent melting characteristics, and ease of handling during casting operations. Their uniform particle size enables controlled heat transfer, effective lubrication between the mould and solidifying steel shell, and stable slag formation, which collectively enhance casting performance and surface quality.

This form is extensively used in modern high-speed continuous casting systems for both slab and billet production, particularly in large steel plants seeking operational consistency and reduced inclusion rates. The powder form segment remains significant but is gradually declining in use due to higher dust emissions, irregular melting behavior, and lower thermal stability compared to granular fluxes. Nevertheless, powder fluxes continue to serve in smaller-scale operations and specific steel grades requiring customized melting properties.

Key factors supporting the granule form segment include:

The carbon steel segment accounts for approximately 64.0% of the mould fluxes in continuous casting of steel market in 2025. Carbon steel production constitutes the majority of global steel output, and mould fluxes are integral in ensuring smooth casting, minimizing surface defects, and achieving controlled heat extraction during solidification. The segment’s dominance is reinforced by widespread use in automotive, construction, and machinery manufacturing industries that rely heavily on continuous casting operations.

The stainless steel segment follows, representing an estimated 27.0% of the market, supported by flux formulations specifically designed for high-chromium steels requiring optimized viscosity and melting points. The others category, comprising special alloy steels and tool steels, holds the remaining 9.0%, primarily in applications with stringent surface finish and inclusion control requirements.

Primary dynamics driving demand from the carbon steel segment include:

Increasing global steel demand, stricter quality requirements for advanced steel grades, and casting process innovations drive flux usage.

Growth in worldwide steel production expands demand for continuous-casting fluxes. As steelmakers adopt higher-grade and more complex alloyed steels, the need for precision in thermal insulation, lubrication, and inclusion management in mould fluxes intensifies. Advances in casting speeds and high-carbon/high-alloy steel billets require fluxes tailored for optimized melting behaviour, crystallization control, and heat-flux regulation to ensure surface quality and minimize defects.

Cost pressures, material compatibility challenges, and environmental and regulatory concerns limit market growth.

Flux manufacture involves precise chemical composition control, making raw-material costs and formulation parameters critical. Alloy interactions (especially with high-alloy steels) can destabilize traditional flux behaviour, requiring customized development and increasing production complexity. Environmental pressures encourage reductions in harmful elements (like fluorides), pushing research into alternatives, but this transition can increase cost and risk.

Advancements in flux formulation, regional growth in Asia-Pacific and demand for specialized flux solutions shape market trends.

The industry is shifting toward engineered fluxes with optimized viscosity, melt rate, and controlled crystallization for high-speed and high-alloy casting applications. Emerging steel production capacity in Asia-Pacific drives substantial adoption, especially in markets combining volume and evolving quality standards. There is rising focus on fluxes compatible with modern casting technologies and environmentally compliant compositions to address both performance and ecofriendly demands.

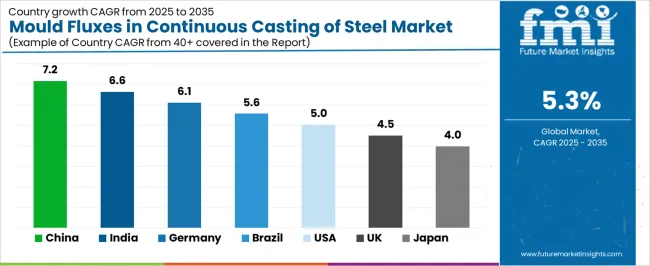

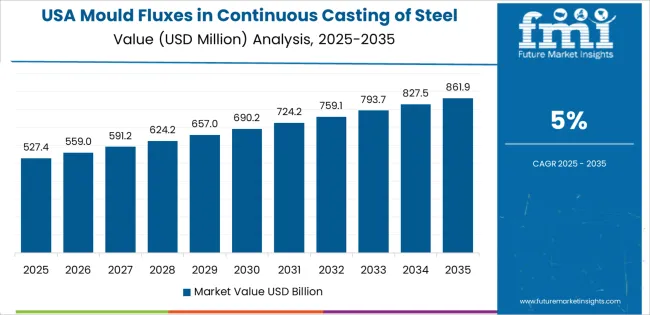

The global mould fluxes market for continuous casting of steel is expanding steadily through 2035, driven by technological advancements in steelmaking, increasing production of high-quality grades, and improved process automation in casting operations. China leads with a 7.2% CAGR, followed by India at 6.6%, supported by growing steel output and domestic manufacturing modernization. Germany grows at 6.1%, emphasizing metallurgical innovation and casting efficiency. Brazil records 5.6%, backed by industrial steel expansion and infrastructure investment. The United States grows at 5.0%, driven by high-strength steel production and automation integration, while the United Kingdom (4.5%) and Japan (4.0%) maintain steady progress through advanced materials R&D and precision casting practices.

| Country | CAGR (%) |

|---|---|

| China | 7.2 |

| India | 6.6 |

| Germany | 6.1 |

| Brazil | 5.6 |

| USA | 5.0 |

| UK | 4.5 |

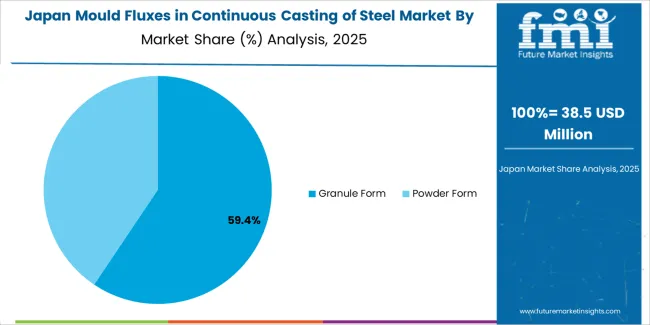

| Japan | 4.0 |

China’s market grows at 7.2% CAGR, supported by large-scale steel production, industrial upgrading, and continuous casting technology innovation. Domestic manufacturers are developing high-performance mould fluxes with optimized viscosity, thermal conductivity, and crystallization characteristics for improved lubrication and heat transfer control. The government’s Made in China 2025 initiative promotes high-efficiency metallurgical equipment and localized flux material manufacturing. Collaboration between steel producers and research institutes enhances formulation precision for specialized steel grades such as automotive and electrical steels. Expansion of integrated steel plants further strengthens product demand.

Key Market Factors:

India’s market grows at 6.6% CAGR, driven by steel industry expansion, technological adoption, and energy-efficient casting modernization. Domestic manufacturers are producing mould fluxes optimized for low-carbon and high-strength steel grades. The National Steel Policy 2017 and infrastructure investment initiatives promote capacity growth in integrated and mini-mills. Collaboration with international metallurgical firms enhances product standardization and process stability. Increasing use of continuous casting in secondary steelmaking supports demand for consistent-quality fluxes. Focus on reduced slag entrapment and surface defect control is improving product yield and metallurgical efficiency.

Market Development Factors:

Germany’s market grows at 6.1% CAGR, supported by high-end steel production, advanced metallurgy, and material optimization. German steel producers are adopting precision-controlled mould flux compositions to enhance heat transfer stability and surface quality in automotive-grade and stainless steel casting. Research institutions are innovating in fluoride-free and environmentally compliant flux systems. Integration of data-driven process analytics in casting operations supports predictive control and thermal uniformity. The focus on energy efficiency and quality control within Industrie 4.0 frameworks promotes technological innovation in steel casting.

Key Market Characteristics:

Brazil’s market grows at 5.6% CAGR, driven by modernization in steel manufacturing, increasing exports, and infrastructure projects. Domestic suppliers are producing mould fluxes for carbon, stainless, and specialty steels used in automotive and construction industries. The National Steel Plan supports operational efficiency improvements in casting and refining stages. Collaboration with international metallurgical firms provides access to advanced raw materials and formulation expertise. Rising production in flat and long steel products enhances demand for stable, high-lubricity flux compositions suited for continuous casting.

Market Development Factors:

The United States grows at 5.0% CAGR, supported by modernization of steel plants, increased production of advanced high-strength steels (AHSS), and automation integration. Manufacturers are adopting mould fluxes with improved crystallization behavior to reduce surface cracking and slag entrapment. Research under the Advanced Manufacturing Office promotes cleaner steel production and waste reduction through material efficiency improvements. Growth in electric arc furnace (EAF) operations boosts demand for high-performance fluxes designed for temperature uniformity and smooth lubrication. The market benefits from technical collaborations between steel mills and academic research centers focused on high-quality casting outcomes.

Key Market Factors:

The United Kingdom’s market grows at 4.5% CAGR, supported by precision casting development, quality optimization, and metallurgical innovation. Steel manufacturers are adopting mould fluxes formulated for consistent viscosity control and surface smoothness in high-value alloy production. Research funded through Innovate UK supports environmentally green material development and defect minimization in casting operations. Partnerships with European metallurgy institutes are improving process diagnostics and microstructural control. The growing focus on decarbonization and efficient material use reinforces the demand for optimized flux compositions.

Market Development Factors:

Japan’s market grows at 4.0% CAGR, reflecting steady steel production and technological refinement. Domestic manufacturers are focusing on fluxes with high crystallization control and heat transfer stability to improve casting reliability. Research under the Green Innovation Fund supports cleaner steelmaking technologies and efficient resource utilization. Leading steel companies are developing advanced simulation models to predict flux solidification and interfacial phenomena. The growing focus on environmental compliance and energy conservation supports innovation in low-fluoride, low-viscosity flux materials. Japan’s consistent steel output and export-driven manufacturing maintain long-term market stability.

Key Market Characteristics:

The mould fluxes in continuous casting of steel market is moderately concentrated, consisting of a limited number of specialized manufacturers supplying high-performance fluxes to integrated steel producers worldwide. Nippon Steel Metal Products leads the market with an estimated 27.0% global share, supported by its strong metallurgical expertise, advanced process integration, and long-standing relationships with major steel plants in Asia and Europe. The company’s competitive advantage lies in its ability to engineer flux compositions that ensure optimal heat transfer, lubrication, and impurity absorption under varying casting conditions.

Shinagawa Refractories and Stollberg & Samil follow as significant competitors, offering a range of synthetic and natural mould fluxes formulated for both slab and bloom casting. Their competitiveness is based on consistent product performance, adaptation to different steel grades, and technical collaboration with foundries and steel mills. Grind-Chem serves niche industrial clients through customized low-carbon flux formulations, emphasizing cost efficiency and stable crystallization control. XIXIA Longcheng Metallurgical Materials Co., Ltd. represents an emerging producer in China, leveraging proximity to major steel manufacturing clusters and flexible production capacity to meet regional demand.

Competition in this market centers on thermal stability, slag viscosity, and crystallization behavior, with growing focus on environmental compliance and energy-efficient formulations. Market growth is supported by ongoing upgrades in continuous casting technology and the increasing adoption of optimized flux systems to enhance casting quality, reduce surface defects, and improve operational consistency in steel production.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Granule Form, Powder Form |

| Application | Carbon Steel, Stainless Steel, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Nippon Steel Metal Products, Shinagawa Refractories, Stollberg & Samil, Grind-Chem, XIXIA LONGCHENG Metallurgical Materials Co., Ltd. |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of metallurgical material and flux manufacturers; advancements in mould flux formulation for improved lubrication and heat transfer; integration with continuous casting processes in modern steel production. |

The global mould fluxes in continuous casting of steel market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the mould fluxes in continuous casting of steel market is projected to reach USD 2.0 billion by 2035.

The mould fluxes in continuous casting of steel market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in mould fluxes in continuous casting of steel market are granule form and powder form.

In terms of application, carbon steel segment to command 64.0% share in the mould fluxes in continuous casting of steel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mould Remover Kit Market Size and Share Forecast Outlook 2025 to 2035

Mould Inhibitors Market

In-Mould Label Film Market Size and Share Forecast Outlook 2025 to 2035

Rotomoulding Powder Market Size and Share Forecast Outlook 2025 to 2035

Pulp Moulding Tooling Market

Blow Moulded Plastic Packaging Market

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Thin Wall Mould Market

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Multi Component Injection Moulding Technology Market Size and Share Forecast Outlook 2025 to 2035

Non-Corrosive Fluxes - Market Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA