The Nipah virus (NiV) infection testing market is valued at USD 2.18 billion in 2025. As per FMI's analysis, the Nipah virus (NiV) infection testing will grow at a CAGR of 5.2% and reach USD 2.63 billion by 2035. The global industry for Nipah Virus (NiV) infection testing is undergoing steady expansion powered by increasing concern over zoonotic disease outbreaks and growing investment in the development of diagnostic technologies. The segment is being fueled by the increasing demand for rapid diagnostic solutions, advancements in the molecular testing sector, and government actions to enhance infectious disease surveillance.

In 2024, the Nipah virus (NiV) infection testing sector saw continued growth due to enhanced surveillance, diagnostic technological advancements, and increased awareness after periodic outbreaks. Some nations, especially in South and Southeast Asia, increased their testing capabilities, with governments investing in early detection initiatives. The industry for polymerase chain reaction (PCR) tests remained strong due to their reliability, with rapid antigen tests gaining popularity for field diagnosis.

Furthermore, raising awareness regarding NiV infections especially in the high-risk areas like South and Southeast Asia is expected to grow the demand for early and accurate testing. The testing segment is divided into laboratory-based and point-of-care testing solutions, with the former sharing a large fraction of the sector. However, point-of-care diagnostics become advantageous due to their efficiency in outbreak settings.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.18 billion |

| Industry Size (2035F) | USD 2.63 billion |

| CAGR (2025 to 2035) | 5.2% |

The Nipah virus (NiV) infection testing industry is experiencing steady growth due to several factors. More outbreaks are being screened, new diagnostic technologies are being developed, and governments are emphasizing disease preparedness. Biotech companies benefit significantly because they are developing rapid and accurate testing solutions.

Healthcare organizations also gain from this growth because they can increase the number of tests they conduct, which helps in finding infections early. Governments aim to better control infectious disease outbreaks. However, regions with weak diagnostic systems might not keep up with these advancements. The industry is expected to undergo significant changes. The companies that innovate successfully will likely lead, especially if they can make testing more accessible, develop decentralized options, or use artificial intelligence effectively.

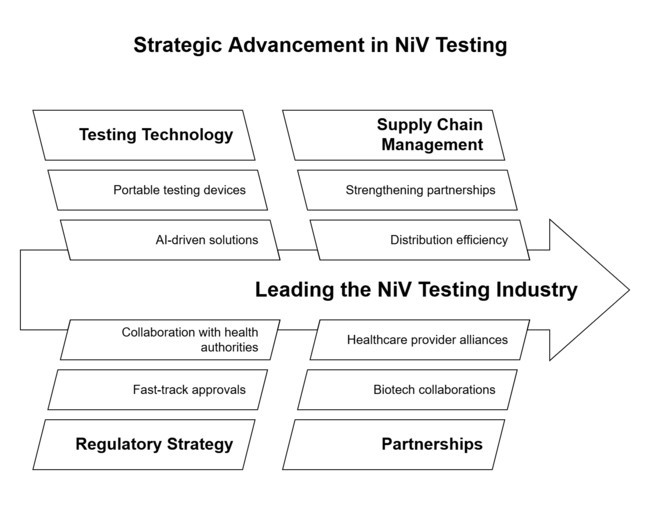

Accelerate Development of Rapid and Decentralized Testing Solutions

Make investments in point-of-care diagnostics and AI-based testing solutions to increase accessibility, especially in remote areas and high-risk zones, with an aim to speed up outbreak response and containment.

Strengthen Regulatory and Industry Alignment

Partner with global health authorities and regulatory organizations to expedite approvals for novel testing solutions while harmonizing with changing disease surveillance practices and new health policies.

Expand Strategic Partnerships and Supply Chain Resilience

Form partnerships with healthcare providers, governments, and biotech companies to improve distribution networks, maximize manufacturing capacity, and provide a steady supply of high-quality diagnostic kits during outbreaks.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Test Approvals | Medium Probability - High Impact |

| Supply Chain Disruptions | High Probability - High Impact |

| Low Testing Adoption in Resource-Limited Areas | Medium Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Expand Rapid and Decentralized Testing | Conduct feasibility studies on mobile and AI-driven diagnostic solutions for faster deployment. |

| Enhance Regulatory and Compliance Readiness | Engage with global health agencies to streamline approval processes for new testing technologies. |

| Strengthen Supply Chain and Distribution | Develop strategic partnerships with regional suppliers to ensure test availability during outbreaks. |

To remain at the forefront of the changing Nipah virus (NiV) testing industry, the next strategic step should be to expand rapid, decentralized testing, gain regulatory fast-tracks, and strengthen supply chains. AI-driven and portable testing investments will set the company apart in a more demand-driven world. Regulatory flexibility through forward-looking collaboration with global health authorities will speed time-to-sector for new tests.

Enhancing partnerships with biotech companies, governments, and healthcare providers will guarantee smooth distribution and manufacturing resilience. This knowledge pivots the roadmap to innovation-led growth, making the company not only keep up with increasing demand but also become a segment leader in global infectious disease diagnostics.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Healthcare Providers & Public Health Agencies):

Alignment:

Divergence:

USA:

Western Europe:

India/Southeast Asia:

High Consensus:

Key Variances:

Strategic Insight:

| Countries /Regions | Policies, Regulations & Certifications |

|---|---|

| United States | - FDA Emergency Use Authorization (EUA): Required for new diagnostic tests during outbreaks. - CLIA (Clinical Laboratory Improvement Amendments): Mandatory for labs conducting NiV testing. - CDC & NIH Guidelines: Set protocols for biosafety and disease surveillance. |

| Western Europe | - CE Marking ( Conformité Européenne ): Essential for test kits sold in the EU. - European Health Union Regulations: Strengthening disease preparedness and diagnostics oversight. - IVDR (In Vitro Diagnostic Regulation): Stricter compliance for accuracy and performance of NiV test kits. |

| India | - ICMR (Indian Council of Medical Research): Regulates diagnostic approval and quality standards. - CDSCO (Central Drugs Standard Control Organization): Approves commercial diagnostic kits for NiV . - National Centre for Disease Control (NCDC): Oversees surveillance and outbreak response. |

| Southeast Asia | - WHO Prequalification (for International Sales): Required for test kits to be used in WHO-led programs. - Country-Specific Regulations: Each country (e.g., Malaysia, Thailand) has local health ministry approvals for NiV diagnostics. - Biosafety Level 3+ Lab Certification: Needed for laboratories handling NiV samples. |

| Australia | - Therapeutic Goods Administration (TGA): Requires extensive clinical validation for new tests. - Biosecurity Act 2015: Governs the handling and transport of NiV samples. - National Notifiable Diseases Surveillance System (NNDSS): Ensures mandatory reporting of NiV cases. |

The USA NiV infection testing industry is expected to grow at a CAGR of 5.5% over the 2025 to 2035 period. Growth is aided by significant governmental allocation of research funds for infectious diseases, tough regulatory scrutiny, and a strong infrastructure for diagnostics. CDC and NIH fund the bulk of NiV research and support expansion of testing.

The EUA framework provided by the FDA facilitates the swift marketing of novel diagnostic tools during outbreaks, incentivizing biotech companies to direct resources into creating high-spec molecular assays. There are increasing instances of the uptake of both AI-powered diagnostics as well as multiplex PCR tests that can improve both speed and detection accuracy. The high healthcare expenditure and presence of global leaders in diagnostic companies including Abbott, Roche, Thermo Fisher, and others, have also contributed to the growth of the sector.

With a growing focus on disease preparedness in Europe, the UK NiV infection testing sector is set to expand at a CAGR of 5.0% during the 2025 to 2035 period. Modern programs for NiV surveillance are rolled out across the UK Health Security Agency (UKHSA) and National Health Service (NHS) providing early detection and response.

EU-wide and WHO-led disease monitoring programs in which the country may participate help align regulations and obtain funds for diagnostic research. Regulatory divergence from Brexit could endanger the supply chain, with new test kits needing to be approved for use in the UK. Eco-friendly diagnostic manufacturing is gaining momentum as sustainability becomes an ever-greater priority. The UK government is encouraging public-private partnerships to create affordable, quick NiV diagnostic tests for use at the community level.

The growth of France’s NiV infection testing landscape between 2025 and 2035 (CAGR 4.8%) is anticipated to be slightly below the global average. With the goal of this, the country is working to expand its diagnostic infrastructure within the frame of its National Plan for Health Security and improve its zoonotic disease surveillance networks.

The French National Institute for Health and Medical Research (INSERM) also funds NiV-related studies, which encourage the design of innovative diagnostic assays. Prolonged approval processes can delay segment entry for newer diagnostic tools. NiV testing has been in growing demand over recent years due to public awareness campaigns and hospital-based surveillance programs, notably in higher risk clinical settings.

Germany’s NiV infection testing sector will continue to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035, making it one of the fastest growing sectors in Europe. The strong public health infrastructure, advanced R&D capabilities, and stringent diagnostic regulations in the countries provide lucrative opportunities for the growth of the sector. NiV surveillance is driven by the Robert Koch Institute (RKI) in cooperation with the Paul Ehrlich Institute (PEI) responsible for developing and approving tests.

The smart PCR systems and digital biosensors sectors in Germany is one of the growing sectors with the presence of automated, AI diagnostics solutions. Its IVD (In Vitro Diagnostics) regulatory pathway is consistent with the European IVDR framework, delivering quality diagnostic tests. The government is directly funding zoonotic disease readiness efforts, including partnerships between biotech companies and academic researchers. Germany’s commitment to sustainable manufacturing also promotes the manufacturing of eco-friendly diagnostic kits.

Advent of government-orchestrated disease surveillance programs, and EU-mandated health security efforts, Italy's NiV infection testing industry is expected to expand at a CAGR of 4.7% over the forecast period (2025 to 2035). Multiplex diagnostic assay for the simultaneous detection of NiV and other zoonotic viruses are increasingly embraced by the Italian sector. The country needs to scale up lab infrastructure with few hospitals have advanced molecular testing capabilities.

NiV tests require CE-IVD certification, which creates an additional regulatory hurdle that prolongs approval for new diagnostics. Italy is, however, investing in regional laboratory networks and in cross border collaborations with EU health agencies. The government is also encouraging the use of inexpensive, rapid antigen tests to facilitate early detection in rural health systems. The NiV testing landscape in Italy is also set to witness gradual growth due to ongoing efforts for modernizing its disease surveillance systems.

The South Korea NiV infection testing industry is faster to grow, while the world average is expected to reach a CAGR of 5.6% from 2025 to 2035. Rapid innovation and development of diagnostic technologies are driven by the country’s robust biotechnology sector and R&D programs supported by the government. Among them, the Korea disease control and prevention agency (KDCA) is in charge of infectious disease preparedness and allocates funds for developing new NiV tests.

South Korea is at the forefront of miniaturized, portable PCR systems and AI-facilitated diagnostics, broadening the routine tests. Test approvals are governed here by the MFDS (Ministry of Food and Drug Safety) so the tests have to meet strict quality standards. Nonetheless, the cost of state-of-the-art molecular diagnostics may limit their widespread availability. However, with increasing investments in bio surveillance systems and AI-enabled testing solutions, South Korea shall leverage to act as a destination for next-generation NiV diagnostic tests.

Japan is likely to hold a CAGR of 4.9% during the 2025 to 2035 period, which is slightly less in comparison to the global growth rate. Although India has a well-developed healthcare infrastructure and advanced diagnostic tools, the perceived low probability of Nipah virus outbreak has restricted aggressive investment in testing infrastructure.

NiV research and diagnostic test approvals are managed by the National Institute of Infectious Diseases (NIID) in collaboration with the Ministry of Health, Labour and Welfare (MHLW). The GMP license overcomes the need for PMDA approval, which can be time-consuming and is often an impediment to the commercialization of new diagnostics, especially for diseases with lower domestic incidence. In contrast, Japan is in the egg of the needle (high-throughput molecular diagnostics, automation, and AI-driven laboratory workflows).

During the forecast period, the China NiV infection testing industry is expected to grow with the highest CAGR globally (5.8%) between 2025 and 2035. This rapid expansion of diagnostic capabilities is driven by the country’s growing focus on infectious disease preparedness and increased investment in biotechnology. NiV surveillance, research and funding, and regulatory approval efforts are being spearheaded by the National Health Commission (NHC) and the Chinese Center for Disease Control and Prevention (CCDC).

The National Medical Products Administration (NMPA) of China has simplified the application process for in-vitro diagnostics (IVD) to facilitate rapid entry of new NiVtest kits into the Chinese sector. China’s volume-production capabilities allow it to be a global supplier of PCR kits, ELISA assays and rapid antigen tests.

Leading companies such as BGI Genomics and Wondfo Biotech are working towards affordable, high-throughput testing solutions. Government initiatives (like the Healthy China 2030 Plan) are promoting network expansion of laboratory facilities and the use of AI in diagnostics to increase the prevalence of the disease detection.

From 2025 to 2035, the NiV infection testing sector in Australia and New Zealand is set to expand at a CAGR of 5.4%, owing to government-initiated zoonotic disease monitoring programs and robust R&D activity for infectious disease diagnostics. Australia’s Therapeutic Goods Administration (TGA) and New Zealand’s Medsafe grant approval for diagnostic test kits, subject to strict quality standards.

Researchers from the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and the Australian Centre for Disease Preparedness (ACDP) are investigating NiV through early detection and vaccines. Australia has a high awareness and funding for bio surveillance and diagnostic preparedness given its history with zoonotic outbreaks.

Recent progress in the adoption of point-of-care (PoC) testing, there has been a growing interest and need for PoC testing for remote and indigenous communities with minimal or no access to centralized laboratories. However, the high costs of advanced molecular testing coupled with limited private sector engagement might restrain the segment growth.

The NiV infection testing sector in India is an exception among all countries to register highest growth with a CAGR of 6.2% during the forecast period 2025 to 2035. Regular NiV outbreaks in southern India have also created robust demand for rapid diagnostics, government detection of disease surveillance, and biosafety lab expansion. The Indian Council of Medical Research (ICMR) and National Centre for Disease Control (NCDC) are spearheading the surveillance and response efforts.

India's diagnostic sector is price-sensitive and prioritizes low-cost, high-volume testing solutions. Mylab and Trivitron, domestic biotech companies, are working on cost-effective rapid antigen tests and RT-PCR kits. The government’s Ayushman Bharat health initiative is also seeking to expand availability of infectious disease diagnostic tests in rural regions. India is set to become a leading center for NiV diagnostics in Asia under increasing government investment, private sector collaborations, and international funding.

The CAGR for the NiV infection testing segment by test type is approximately 5.32% from 2025 to 2035. The Nipah Virus (NiV) infection testing industry is mainly divided into RT-PCR-based kits and ELISA kits, both playing different roles in diagnosis and surveillance. RT-PCR is the gold standard for early detection with high accuracy, ELISA tests offer a more scalable and affordable option for large-scale screening and epidemiological studies.

The selection of these testing measures is based on the infection stage, availability of laboratory infrastructure, and cost. The RT-PCR segment holds the largest sectors share as it can detect NiV during the early stage of an infection, making it quite useful for controlling an outbreak, as well as diagnosing patients at hospitals.

Portable and automated RT-PCR systems are in high demand due to their ease of deployment in risk-prone locations. However, cost, infrastructure requirements, and longer turnaround time are major concerns. In contrast, serological surveillance, which monitors and tests for infections and immunity over time, is often performed on samples using ELISA-based assays.

The CAGR for the NiV infection testing segment by end user from 2025 to 2035 is approximately 5.53%. By End Users (Hospitals, Research Laboratories, and Diagnostic Centers), each of which is essential for the disease surveillance, outbreak management, and long-term epidemiological studies, in The Nipah Virus (NiV) infection testing segment.

The main factors contributing to NiV testing demand include the rising number of outbreaks, introduction of government-mandated screening protocols, and technological advancement in diagnostic testing. The largest end-user segment is hospitals, as they are the first point of contact for suspected NiV cases.

The immediate need to identify and provisionally treat infected individuals has led to the adoption of RT-PCR kits for active infection detection and ELISA kits for the assessment of post-infection immunity in the laboratory and in public health settings.

Companies are employing pricing strategies, diagnostic innovations, strategic partnerships, and global expansion as key competitive components in the overall Nipah Virus (NiV) infection testing landscape. Industry leaders are focusing on differentiation through rapid and highly sensitive diagnostic solutions, including portable RT-PCR devices, AI-assisted molecular diagnostics, and multiplex testing kits.

From a growth strategy perspective, route expansions to Asia-Pacific and Africa, where NiV outbreaks are relatively higher, are aggressively pursued by companies. Companies are using mergers, acquisitions, and partnerships with research institutions, biotech firms, and hospitals to accelerate product development and obtain regulatory approvals.

Market Share Analysis

It is segmented into RT PCR based kits and ELISA Kits

It is segmented into Hospitals, Research Labs, Diagnostic Centres

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and MEA

Government detection of surveillance programs, the growing number of Nipah virus (NiV) infection testing outbreaks, improved diagnostic technologies, and the requirement for early identification are the key drivers of increasing testing demand.

RT-PCR is the gold standard for early detection because of its high sensitivity and specificity, while ELISA kits are commonly used for immunity monitoring and serological surveillance.

Top companies are emphasizing portable RT-PCR devices, economical ELISA kits, automation, and strategic collaborations with healthcare facilities to improve access, particularly in remote and resource-scarce areas.

High expenses, strict biosafety measures, dependency on centralized facilities, and lengthy regulatory approval processes are major challenges that prevent large-scale deployment of diagnostic solutions.

Technologies like AI-based molecular diagnosis, CRISPR-based tests, multiplex assays, and decentralized testing systems are likely to improve the speed, accuracy, and accessibility of NiV detection in the near future.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 13: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End-User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 28: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End-User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End-User, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Test Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End-User, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End-User, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 118: MEA Market Attractiveness by Test Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Universal Testing Machine Market Growth – Trends & Forecast 2025-2035

Norovirus Infection Treatment Market

Retrovirus Testing Market Size and Share Forecast Outlook 2025 to 2035

Zika Virus Testing Market Outlook – Growth, Demand & Forecast 2025-2035

Coxsackievirus Infections Treatment Market – Growth & Drug Innovations 2025 to 2035

West Nile Virus Testing Market

Pertussis Infection Testing Market

Hepatitis C Virus (HCV) Testing Market Size and Share Forecast Outlook 2025 to 2035

Self-urinary Infection Testing Market Size and Share Forecast Outlook 2025 to 2035

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Urinary Tract Infection Testing Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Mosquito-borne infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Hemotransmissive Infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Arthropod-borne Viral Infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Respiratory Syncytial Virus Infection Market Growth - Trends & Forecast 2025 to 2035

Infection Control Market Size and Share Forecast Outlook 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Universal Column Formwork Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA