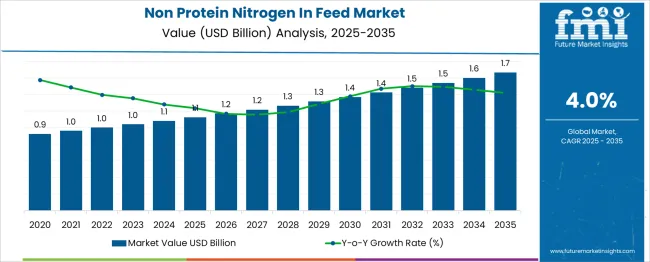

The Non Protein Nitrogen In Feed Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

A breakpoint analysis of the provided dataset indicates distinct phases of growth with a gradual shift in momentum over the decade. From 2025 to 2028, the market increases steadily from USD 1.1 billion to USD 1.3 billion. This period represents an early-stage build-up where adoption is supported by its cost-effectiveness in ruminant feed formulations, enabling optimized protein synthesis and improved feed conversion efficiency. A notable breakpoint appears around 2029, when the market value reaches USD 1.4 billion. From this stage through 2032, the upward trend becomes more consistent, driven by greater awareness among livestock producers, higher demand from intensive farming operations, and gradual advancements in nitrogen compound delivery methods that enhance digestibility. Between 2033 and 2035, the market advances to USD 1.7 billion, although the growth pace begins to moderate. This plateau effect indicates movement toward maturity in key developed regions, where penetration rates are already high. Future growth beyond this point is expected to rely on innovative formulations, entry into underdeveloped livestock markets, and supportive regulatory frameworks in emerging economies.

| Metric | Value |

|---|---|

| Non Protein Nitrogen In Feed Market Estimated Value in (2025 E) | USD 1.1 billion |

| Non Protein Nitrogen In Feed Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The non-protein nitrogen in feed market is regarded as a specialized yet steadily expanding category within its broader parent industries. It is estimated to represent about 1.9% of the global animal feed additives market reflecting growing use in livestock nutrition optimization. Within the specialty feed ingredients sector a share of approximately 3.1% is assessed based on use of urea, ammonia and related compounds. In the dairy and beef production segment an estimated 3.6% contribution is observed given targeted nitrogen supplementation needs. In the aquaculture feed market about 2.4% is evaluated due to rising protein cost pressures.

Within the sustainable livestock nutrition solutions industry, a share of roughly 2.7% is calculated supported by interest in cost-effective feed formulation. Trends in this market have been shaped by increasing adoption of nitrogen supplementation strategies in ruminant diets where protein feed prices are volatile. Innovations have been focused on coated and slow-release urea products designed to improve nitrogen utilization efficiency and reduce environmental nitrogen losses. Interest has increased in specialty blends that combine non protein nitrogen with amino acids to support balanced nutrition. The Asia Pacific region has been observed to exhibit the fastest growth while Europe has maintained significant demand driven by feed regulation and optimization targets. Strategic initiatives have included collaborations between feed additive companies and agritech firms to deliver integrated feed systems featuring controlled-release formulations, improved rumen stability, and digital diagnostics for feed performance optimization.

The non-protein nitrogen in feed market is regarded as a specialized yet steadily expanding category within its broader parent industries. It is estimated to represent about 1.9% of the global animal feed additives market reflecting growing use in livestock nutrition optimization. Within the specialty feed ingredients sector a share of approximately 3.1% is assessed based on use of urea, ammonia and related compounds. In the dairy and beef production segment an estimated 3.6% contribution is observed given targeted nitrogen supplementation needs. In the aquaculture feed market about 2.4% is evaluated due to rising protein cost pressures. Within the sustainable livestock nutrition solutions industry, a share of roughly 2.7% is calculated supported by interest in cost-effective feed formulation. Trends in this market have been shaped by increasing adoption of nitrogen supplementation strategies in ruminant diets where protein feed prices are volatile. Innovations have been focused on coated and slow-release urea products designed to improve nitrogen utilization efficiency and reduce environmental nitrogen losses. Interest has increased in specialty blends that combine non protein nitrogen with amino acids to support balanced nutrition. The Asia Pacific region has been observed to exhibit the fastest growth while Europe has maintained significant demand driven by feed regulation and optimization targets. Strategic initiatives have included collaborations between feed additive companies and agritech firms to deliver integrated feed systems featuring controlled-release formulations, improved rumen stability, and digital diagnostics for feed performance optimization.

| Metric | Value |

|---|---|

| Non Protein Nitrogen In Feed Market Estimated Value in (2025 E) | USD 1.1 billion |

| Non Protein Nitrogen In Feed Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

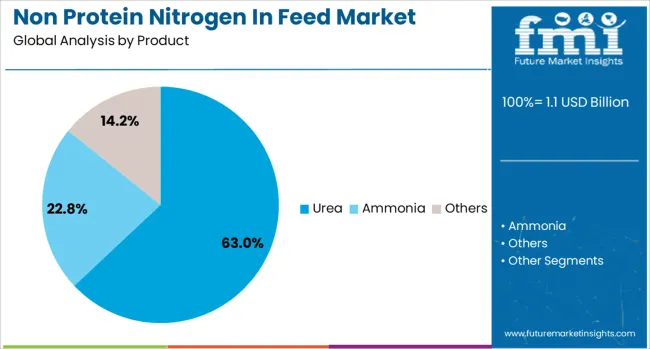

Urea is expected to dominate the non-protein nitrogen in feed market with a projected 63.0% share in 2025, making it the leading product type. This leadership stems from urea’s high nitrogen content, affordability, and widespread availability.

It serves as a highly concentrated source of nitrogen that ruminants can efficiently convert into microbial protein, enhancing overall feed performance. Urea's compatibility with common feedstocks and its ease of mixing have contributed to its widespread use in both developed and emerging livestock markets.

Additionally, growing awareness of proper urea feeding techniques and safety protocols is supporting its responsible integration into commercial feed systems. As producers seek to reduce dependency on conventional protein sources like soybean meal, urea is expected to remain the backbone of the NPN feed segment.

Non-protein nitrogen (NPN) sources have been widely incorporated in livestock feed to provide ruminants with an economical nitrogen supply for microbial protein synthesis in the rumen. Urea, biuret, and ammonium salts have been the most commonly used NPN compounds in cattle and sheep diets. Demand has been influenced by the need to improve feed efficiency, reduce feeding costs, and support protein requirements in large-scale livestock operations. Manufacturers have been offering NPN products in coated or slow-release forms to enhance safety and utilization rates in ruminant nutrition.

NPN compounds such as feed-grade urea have been extensively used to replace part of the natural protein in ruminant diets, offering a cost-effective alternative for protein supplementation. In cattle and sheep feeding programs, NPN has been metabolized by rumen microbes into amino acids, supporting growth and milk production. This practice has been particularly valuable in regions where natural protein sources like soybean meal and alfalfa are expensive or seasonally limited. Large feedlots and dairy farms in the United States, Brazil, and Australia have reported improved feed conversion ratios with balanced NPN inclusion. Coated or slow-release formulations have minimized the risk of ammonia toxicity, enabling more consistent nitrogen availability for microbial utilization. The economic advantage of NPN supplementation has made it a key component in cost-optimized feed strategies.

The inclusion of NPN in ruminant diets has been recognized for its role in enhancing feed efficiency, particularly when combined with adequate energy sources. Properly formulated diets have allowed rumen microbes to convert NPN into microbial protein, which has then been digested in the animal’s small intestine. This process has improved weight gain, milk yield, and reproductive performance in beef and dairy cattle. Feed mills and premix manufacturers have been producing NPN-containing blends tailored to specific livestock requirements. In developing countries, where protein feed resources are scarce, NPN has been an important tool in improving productivity without significantly increasing feed costs. The ability to improve performance metrics while maintaining economic feasibility has reinforced NPN’s role in modern ruminant nutrition programs.

Advancements in NPN technology have focused on improving safety, handling, and nutrient release rates. Encapsulation, coating, and granulation techniques have been applied to control the dissolution of urea and other NPN compounds in the rumen, preventing rapid ammonia release. Some formulations have been combined with trace minerals, vitamins, or energy sources to improve microbial efficiency. Manufacturers in North America, Europe, and Asia have developed NPN-based products that integrate with total mixed rations (TMR) and pelleted feeds. Quality control measures and standardized inclusion guidelines have helped reduce risks associated with overfeeding. These innovations have encouraged broader adoption by reducing concerns among feed producers and livestock managers, particularly in intensive dairy and beef production systems.

While NPN offers significant benefits, misuse and overfeeding have posed risks of ammonia toxicity, leading to animal health issues and productivity losses. Regulatory frameworks in various countries have established strict inclusion limits and labeling requirements to ensure safe use in livestock diets. In some markets, limited awareness among small-scale farmers about proper mixing and feeding practices has restricted adoption. Fluctuations in urea prices, often linked to fertilizer demand, have influenced NPN cost stability. Additionally, NPN cannot be effectively utilized in non-ruminant livestock such as pigs and poultry, limiting its market scope. Without continued farmer education, regulatory clarity, and stable raw material supply, the expansion of NPN use may remain concentrated in established cattle and sheep feeding sectors.

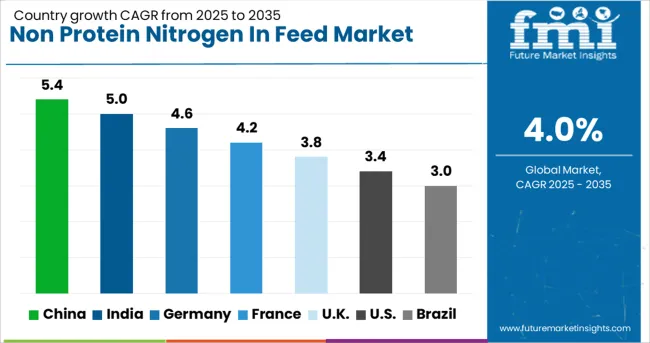

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

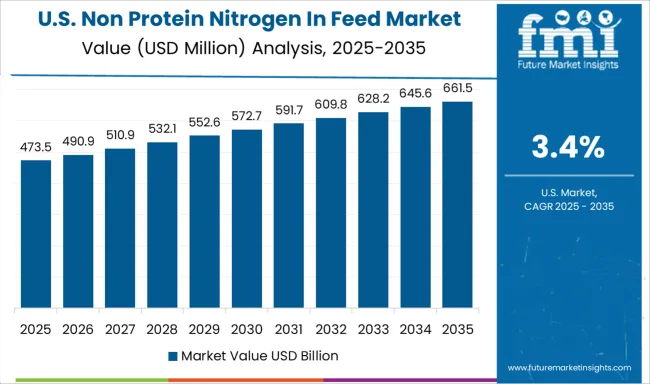

| USA | 3.4% |

| Brazil | 3.0% |

The non-protein nitrogen in feed market is expected to grow at a global CAGR of 4.0% between 2025 and 2035, driven by rising demand for cost-effective protein alternatives in livestock nutrition and increasing meat and dairy production. China leads with a 5.4% CAGR, supported by large-scale cattle farming and expanding feed manufacturing capacity. India follows at 5.0%, fueled by growth in dairy production and adoption of urea-based feed supplements. Germany, at 4.6%, benefits from advanced feed formulation technologies and strong livestock farming practices. The UK, projected at 3.8%, sees steady adoption in ruminant nutrition programs. The USA, at 3.4%, reflects stable but mature demand in commercial livestock operations. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 5.4% from 2025 to 2035 in the NPN in feed market, supported by its large livestock industry and increasing demand for cost-effective protein alternatives. Domestic feed producers such as New Hope Group, Tongwei Co., and Beijing Dabeinong Technology are incorporating urea and other NPN sources to optimize ruminant diets. Growth is being driven by the dairy and beef cattle sectors, where improved feed conversion efficiency directly impacts profitability. Government-backed programs to modernize livestock farming are encouraging the adoption of scientifically formulated NPN-based feeds. Partnerships between feed mills and research institutions are also promoting awareness of correct inclusion rates to prevent overuse.

India is forecasted to achieve a CAGR of 5.0% from 2025 to 2035, driven by the need to boost milk production and meat yield through affordable nutrition solutions. Local manufacturers such as Godrej Agrovet, Amrit Feeds, and Suguna Foods are increasing the use of NPN additives like urea, ammonium salts, and biuret in ruminant feed. The dairy cooperative network is playing a key role in educating farmers about safe inclusion rates to improve productivity without health risks. Rising livestock population and higher demand for protein-rich animal products are further contributing to market growth.

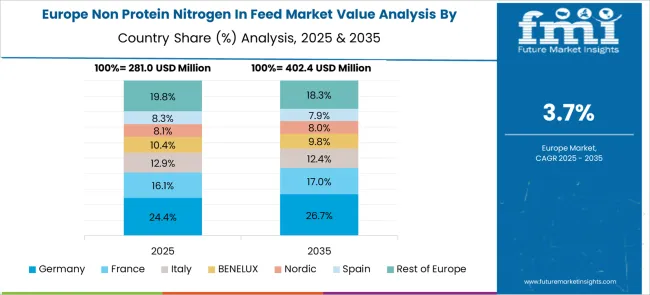

Germany is projected to post a CAGR of 4.6% from 2025 to 2035, supported by a focus on efficient livestock nutrition and advanced feed formulation technology. Companies such as BASF, Deutsche Tiernahrung Cremer, and AGRAVIS Raiffeisen AG are developing precision feeding solutions incorporating NPN to balance protein levels in dairy and beef cattle diets. Stringent EU regulations on feed safety are driving innovation in controlled-release NPN products that improve digestibility and minimize ammonia toxicity risks. Germany’s strong research base is enabling the development of blends that integrate NPN with natural protein sources for better animal health outcomes.

The United Kingdom is expected to record a CAGR of 3.8% from 2025 to 2035, driven by livestock feed cost optimization and the adoption of scientifically balanced diets. Suppliers such as AB Agri, Carr’s Group, and Harbro Ltd are introducing pelleted and liquid NPN products for dairy and beef cattle. Farmers are increasingly adopting NPN to supplement low-protein forage during winter feeding. Research programs funded by agricultural boards are focusing on improving NPN utilization efficiency to enhance profitability without compromising animal welfare.

The United States is forecasted to grow at a CAGR of 3.4% from 2025 to 2035, supported by the expansion of the cattle industry and advancements in feed technology. Key players such as ADM, Cargill, and Land O’Lakes are offering NPN-based supplements designed for feedlot cattle and high-yield dairy cows. Controlled-release formulations are gaining traction to reduce risks associated with improper dosing. The feed industry is also integrating NPN with bypass protein sources to optimize nutrient availability and improve feed conversion ratios. Increasing adoption in large-scale dairy farms is driving steady market growth.

The non-protein nitrogen (NPN) in feed market is driven by global agribusiness giants, fertilizer producers, and specialized animal nutrition companies supplying ruminant livestock sectors. Nutrien Limited and Yara International ASA lead with large-scale urea and ammonia-based NPN products formulated to improve rumen microbial protein synthesis. Incitec Pivot Limited and Borealis Ag utilize integrated fertilizer production to supply feed-grade NPN with consistent nitrogen content.

Archer Daniels Midland Company and Alltech Inc. focus on incorporating NPN into complete feed solutions, often combining it with balanced mineral and vitamin premixes to optimize cattle performance. Fertiberia, S.A and Antonio Tarazona serve European markets with customized formulations for dairy and beef operations, ensuring controlled nitrogen release for better feed efficiency.

PetroLeo Brasileiro S.A leverages its chemical production capacity to produce feed-grade urea for South American markets, while Nutri Feeds, Kay Dee Feed Company, Meadow Feeds, Anipro Feeds, and Quality Liquid Feeds cater to regional livestock industries with tailored liquid and dry NPN supplements. Key strategies include farmer education programs on safe NPN usage, integration into total mixed rations (TMR), and development of slow-release formulations to minimize nitrogen losses. Entry into the market is limited by regulatory compliance for feed safety, secure access to industrial nitrogen sources, and established distribution relationships within the livestock feed sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product | Urea, Ammonia, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nutrien Limited, Antonio Tarazona, Alltech Inc., Fertiberia, S.A, PetroLeo Brasileiro S.A, Incitec Pivot Limited, Borealis Ag, Nutri Feeds, Kay Dee Feed Company, Meadow Feeds, Anipro Feeds, Quality Liquid Feeds, Yara International ASA, and Archer Daniels Midland Company |

The global non protein nitrogen in feed market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the non protein nitrogen in feed market is projected to reach USD 1.7 billion by 2035.

The non protein nitrogen in feed market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in non protein nitrogen in feed market are urea, _by form, _livestock, ammonia, _form, _livestock, others, _form and _livestock.

In terms of , segment to command 0.0% share in the non protein nitrogen in feed market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonprotein Nitrogen Market Insights - Livestock Nutrition & Industry Demand 2025 to 2035

High-Protein Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Microbial Protein Used in Feed Market Analysis by Application, Source, and Region Through 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Australia Animal Feed Alternative Protein Market Report – Size, Share & Innovations 2025-2035

Non-Invasive Jaundice Detector Market Size and Share Forecast Outlook 2025 to 2035

Non-Insulin Peptide Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Respiratory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Brain Stimulation System Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Pulse Wave Tonometer Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Surgical Wound Closure Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA