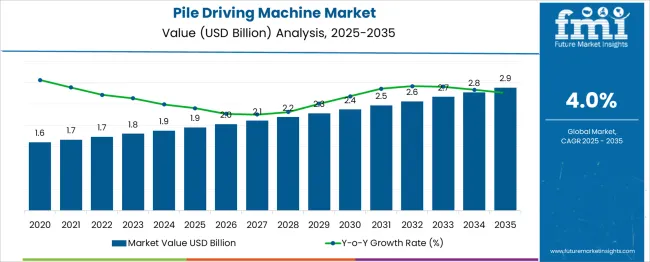

The Pile Driving Machine Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. From 2025 to 2030, the market expands steadily, reaching USD 2.4 billion. Yearly values show modest but consistent growth: USD 2.0 billion in 2026, USD 2.1 billion in 2027, USD 2.2 billion in 2028, USD 2.3 billion in 2029, and USD 2.4 billion in 2030. This period of gradual expansion favors manufacturers with a strong presence in public infrastructure, energy, and commercial construction segments.

Market share gains are likely for companies offering fuel-efficient machines, reduced vibration systems, and adaptability across soil types. Products that support operational safety and require minimal downtime are especially valued in time-sensitive projects. Market share erosion may affect vendors relying on legacy equipment lines or offering limited technical support. Buyers are increasingly evaluating equipment on long-term operating costs, resale value, and parts availability, rather than just upfront pricing. From 2025 to 2030, growth will be largely driven by large-scale utility and transport projects, making regional partnerships and after-sales networks crucial. Brand loyalty, service responsiveness, and machine reliability will shape competitive positioning in this period.

| Metric | Value |

|---|---|

| Pile Driving Machine Market Estimated Value in (2025 E) | USD 1.9 billion |

| Pile Driving Machine Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The long-term value accumulation curve for the Pile Driving Machine Market reflects a steady, moderate incline over a 10-year horizon, consistent with the sector's dependence on long-cycle infrastructure projects and capital equipment procurement. Beginning from a base value of 1.9 USD billion in 2025 and reaching 2.9 USD billion by 2035, the market demonstrates gradual but compounding value accumulation, underpinned by a CAGR of 4.0 %. The curve initially rises at a measured pace between 2025 and 2028, driven by planned infrastructure developments and new project initiations. In this early phase, government-backed construction efforts in emerging economies and sustained road and bridge expansion projects in developed regions contribute to incremental growth.

Between 2028 and 2032, the curve steepens modestly, marking an inflection point where cumulative deployments, fleet replacements, and technological upgrades (particularly toward hydraulic systems) lead to higher procurement volumes and after-sales service revenues. Post-2032, the slope begins to plateau slightly, indicating market saturation in high-adoption regions and longer machinery lifecycles. However, ongoing infrastructure resilience initiatives and emerging offshore and port construction keep the curve positively sloped, albeit at a slower rate. Overall, the curve suggests stable value accumulation, anchored in equipment longevity, recurring service contracts, and cyclical but resilient construction demand.

Urbanization in developing countries and the need for deep foundation work in coastal and seismic regions have intensified the demand for efficient pile driving solutions. Equipment manufacturers are increasingly integrating automation and digital control features into pile driving machines, improving operational efficiency, precision, and safety across construction environments. Additionally, the rising demand for eco-friendly and noise-controlled operations has encouraged the use of technologically advanced machines that comply with modern environmental standards.

Government-backed infrastructure initiatives and the resurgence of large-scale transport, commercial, and residential projects are contributing significantly to market expansion. With the ongoing shift towards sustainable construction practices, the market outlook remains positive, underpinned by innovation, regulatory compliance, and continuous enhancements in machine performance and productivity..

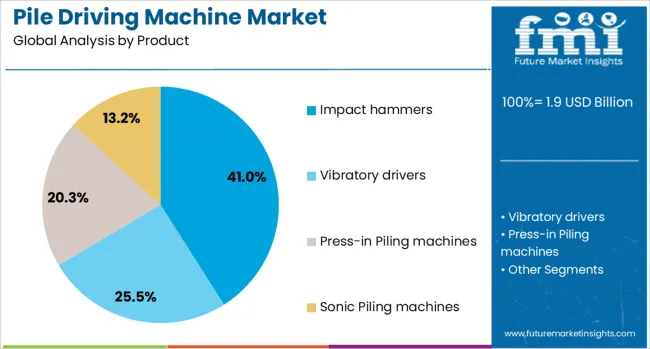

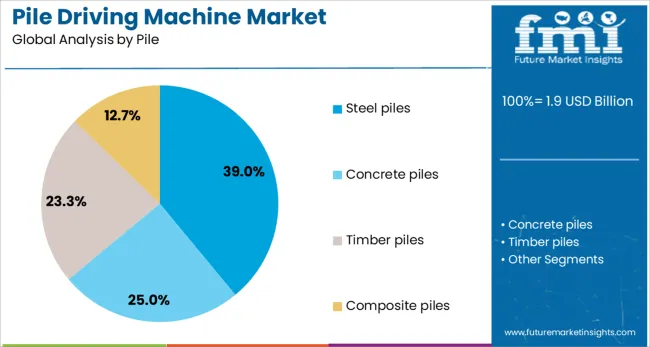

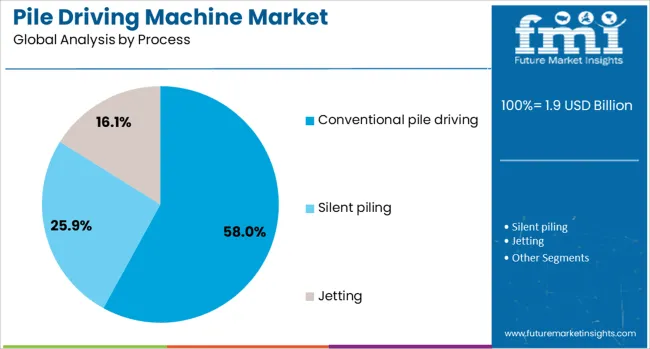

The pile driving machine market is segmented by product, pile, process, application, and geographic regions. The pile driving machine market is divided into Impact hammers, Vibratory drivers, Press-in Piling machines, and Sonic Piling machines. In terms of the pile driving machine market, it is classified into Steel piles, Concrete piles, Timber piles, and Composite piles. Based on the process of the pile driving machine market, it is segmented into Conventional pile driving, Silent piling, and Jetting. The pile driving machine market is segmented into Infrastructure, Residential construction, Commercial construction, and Industrial construction. Regionally, the pile driving machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The impact hammers product segment is projected to account for 41% of the Pile Driving Machine market revenue share in 2025, making it the dominant product category. This leadership has been driven by the high energy efficiency and adaptability of impact hammers across various soil conditions.

The ability of these machines to deliver rapid, repetitive force allows for deeper and faster penetration of piles, which is essential in both onshore and offshore construction. Their compatibility with different types of pile materials and project scales has supported their continued use in infrastructure projects, particularly where speed and reliability are critical.

The design of impact hammers has evolved to include advanced control systems that optimize impact force and ensure greater driving accuracy, reducing structural damage and improving project timelines. As construction firms prioritize cost-effective and proven methods, the use of impact hammers has remained prominent due to their durability, simplicity of operation, and effectiveness in challenging environments..

The steel piles product segment is anticipated to capture 39% of the Pile Driving Machine market revenue share in 2025, reflecting strong demand within the material category. This growth has been attributed to the structural strength, load-bearing capacity, and corrosion resistance offered by steel piles. These attributes make steel piles particularly suited for heavy infrastructure and marine applications where soil variability and environmental factors present challenges.

Their precision in fabrication and ease of handling have allowed engineers to deploy them in complex foundation projects with reduced installation times. Furthermore, steel piles are often favored for projects requiring extended service life and minimal maintenance, providing long-term value in infrastructure development.

As regulatory and performance standards become more rigorous, the inherent advantages of steel as a foundation material have positioned it as a strategic choice in both public and private construction sectors. The recyclability and environmental compliance of steel piles have also supported their increased adoption across global markets..

The conventional pile driving process segment is expected to hold 58% of the Pile Driving Machine market revenue share in 2025, indicating its continued dominance among process types. This segment has maintained its lead due to its long-standing reliability and familiarity among contractors and construction firms. The process involves driving piles into the ground using repetitive force, providing a time-tested and cost-efficient method of foundation support.

The widespread availability of conventional pile driving equipment and the straightforward operation of the method have made it the preferred choice for a range of projects, including roads, bridges, buildings, and port facilities. Moreover, improvements in equipment durability and fuel efficiency have enhanced the viability of conventional processes for modern construction demands.

Despite the emergence of newer technologies, many companies continue to rely on conventional pile driving due to its proven success rate and adaptability in varying site conditions. Its resilience under diverse environmental and geotechnical scenarios has reinforced its dominance within the market.

The pile driving machine market is expanding globally as construction firms pursue deep foundation work for infrastructure, marine, and high-rise structures. These machines are relied on to install large-diameter and deep piles in soils that require high axial and lateral capacity. Demand is strong in regions with rapid urban development, port expansion, and bridge construction. Manufacturers focus on hydraulic hammers, vibration-reducing systems, and machine automation to support multiple soil types. Innovations in quieter rigs and precision positioning enhance appeal in urban environments. Growth is further supported by infrastructure stimulus programs, advances in modular crane compatibility, and the need for safe, efficient installation equipment in dense construction zones.

Diverse soil types and geological conditions significantly affect pile driving machine performance and project planning. Machines must deliver sufficient energy to penetrate clay, silt, sand, or rock layers reliably. Mismatches among machine power, hammer type, pile material, and soil resistance can result in incomplete penetration or pile damage. Managing vibration and noise in urban sites also remains difficult, especially when piling occurs near sensitive structures or utilities. Manufacturers and contractors must customize rig specifications to local ground conditions. Site-specific geotechnical surveys and test driving phases add time and cost. These complexities raise barriers to deploying generic equipment. Suppliers who provide adaptable rigs, variable hammer options, and geotech-informed machine matching better serve project needs in varied terrains and regulatory contexts, improving installation accuracy and reducing risks.

A surge in global infrastructure investment is creating substantial demand for pile driving machinery. New bridges, elevated metro lines, waterfront developments, offshore foundations, and high-rise buildings require deep foundation installations. Government-led stimulus and public-private partnerships are accelerating construction across urban and coastal regions. Marine and offshore projects, including ports and wind turbine bases, are increasing demand for coastal pile drivers with corrosion-resistant designs. Contractors select heavy-duty rigs capable of delivering high-impact energy and working across diverse pile types from steel H‑piles to concrete or timber. Multi-purpose mounting platforms and quick conversion capabilities improve machine utilization. Cities expanding metro and road networks lean on piling equipment to expedite foundation timelines. As infrastructure planning expands worldwide, market opportunity aligns with contractors seeking reliable and scalable pile installation solutions.

Despite their operational advantages, pile driving machines involve substantial upfront costs and ongoing maintenance expenses. High-power rigs and hammers entail complex hydraulics, heavy structural components, and specialty manufacturing. Maintenance and spare parts costs, especially for high-frequency operations, elevate lifecycle expenditure. Fuel consumption during hammer cycling further increases operating budgets. Entry-level contractors or small firms may struggle with capital investment or lack service support in remote regions. Downtime due to component wear, such as hammer seals or hydraulic cylinders, interrupts project timelines. In retrofit or rental scenarios, machine relocation and reconditioning add cost. Until financing models, rental frameworks, or service ecosystems improve, many smaller contractors may favor shared equipment or conventional methods. Cost sensitivity and the burden of maintenance logistics remain key restraints on broader adoption of advanced pile driving machinery.

Modern pile driving machines increasingly incorporate automation, noise reduction, and precision control systems. Automated depth and blow counting systems help optimize pile installation and prevent over‑driving or under‑driving. Hydraulic hammers with energy-efficient designs reduce fuel consumption and emissions. Noise-absorption features, including sound shields and anti-vibration foundations, make machines suitable for urban and noise-sensitive zones. GPS‑based positioning and machine monitoring improve operator efficiency and control. Remote diagnostics enable predictive maintenance and minimize downtime. These features reduce the environmental footprint and permit operations in tight urban noise regulations. Contractors adopting advanced rigs gain an advantage in tender bids for projects that restrict noise or demand fast, repeatable piling cycles. In sum, automation and quieter operation trends enhance safety, speed, and machine reliability in modern construction contexts.

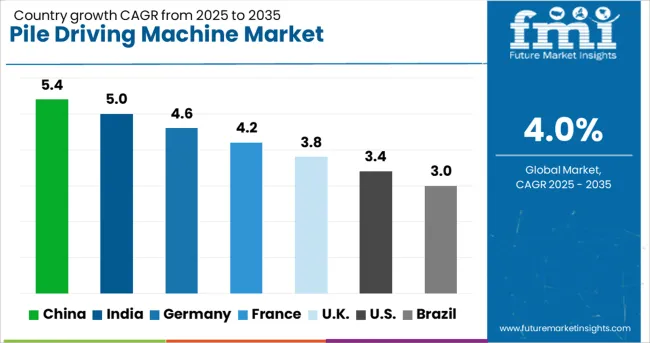

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The pile driving machine market is projected to expand at a CAGR of 4% through 2035, driven by rising infrastructure development, urbanization, and large-scale construction projects globally. China leads the market with a 5.4% growth rate, underpinned by rapid expansion of transportation networks and urban infrastructure. India, following at 5.0%, benefits from ongoing smart city initiatives and increased demand for deep foundation systems. Germany, at 4.6%, is investing in sustainable construction and high-rise developments, pushing demand for advanced piling equipment. The UK, growing at 3.8%, sees steady growth due to urban regeneration efforts and modular construction trends. The USA, with a 3.4% growth rate, is driven by aging infrastructure replacement and ongoing civil engineering projects. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is recording a CAGR of 5.4% in the pile driving machine market, driven by extensive infrastructure development across transportation, energy, and urban sectors. The government’s continuous investment in mega infrastructure projects like high-speed rail, smart cities, and coastal developments has sharply increased demand for efficient foundation equipment. Domestic manufacturers are enhancing machine durability, automation, and fuel efficiency, leading to faster project completion rates. Hydraulic systems, GPS-enabled control panels, and reduced noise designs are becoming standard to meet both regulatory and operational needs. Additionally, rising coastal reclamation and offshore wind power projects are pushing demand for specialized pile drivers capable of handling deep marine foundations. Joint ventures between local and foreign firms are enhancing technology adoption and streamlining supply chains. Construction firms are opting for equipment with integrated telematics and predictive maintenance to reduce downtime and improve safety on-site.

Pile driving machine market is growing at a CAGR of 5%, fueled by smart city initiatives, and highway expansions. Major projects under the National Infrastructure Pipeline and Bharatmala Pariyojana require reliable deep foundation solutions, thus increasing the demand for advanced pile drivers. Indian construction companies are investing in semi-automatic and hydraulic systems that offer better accuracy and reduced labor dependency. Rental models are also gaining traction, especially among medium-scale contractors, encouraging wider adoption. Noise and emission regulations have prompted a shift toward electric and hybrid pile driving equipment in metro areas. Additionally, capacity-building programs and government incentives are accelerating technology adoption, especially in tier-2 and tier-3 cities. Integration of GPS-guided systems, real-time monitoring, and load data tracking is enhancing site productivity. Manufacturers are localizing component supply to reduce lead times and improve after-sales support.

Pile driving machine market in Germany is witnessing a CAGR of 4.6%, supported by strict building codes, green infrastructure standards, and the modernization of transportation networks. Projects like rail corridor upgrades, flood protection, and offshore wind farms have made high-performance pile driving machines a necessity. The demand is shifting toward vibration-free and low-noise equipment that complies with EU environmental standards. German manufacturers are leading in innovation, offering pile drivers with digital diagnostics, automation, and energy recovery systems. The integration of BIM (Building Information Modeling) and sensor technology allows for real-time load testing and installation depth precision. Government subsidies for sustainable construction projects are encouraging adoption of fuel-efficient and electrically powered equipment. Furthermore, collaboration between engineering firms and OEMs is improving machine versatility across different soil and terrain conditions. Germany’s focus on sustainability and precision is reshaping the market landscape.

The United Kingdom is experiencing a CAGR of 3.8%in the pile driving machine market, driven by the redevelopment of aging infrastructure and the expansion of urban transport networks. Projects like HS2, Thames Tideway, and new housing developments are increasing the requirement for dependable and compliant foundation solutions. The UK market emphasizes noise mitigation and compact machine design to meet the challenges of urban construction. Demand is growing for rigs equipped with real-time monitoring systems, load sensors, and energy-efficient powertrains. Manufacturers and contractors are also responding to sustainability goals by trialing electric and hybrid-powered pile driving equipment in city centers. Post-Brexit logistics and labor shortages have increased reliance on highly automated and remote-operated systems. Regulations on noise and ground vibrations have made hydraulic and press-in pile drivers more prevalent, particularly in residential zones.

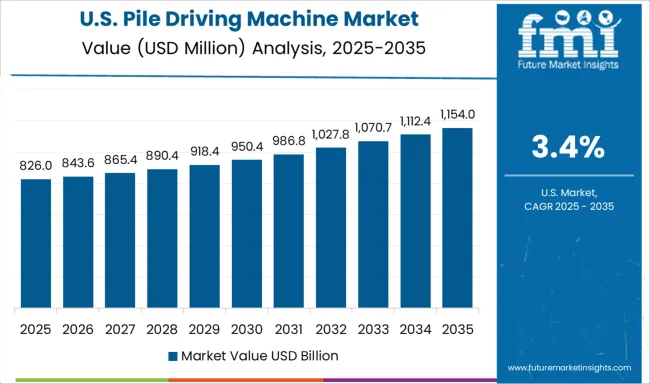

The United States is recording a CAGR of 3.4% in the pile driving machine market, led by bridge construction, port upgrades, and renewable energy installations. The Bipartisan Infrastructure Law is unlocking funding for major civil works, increasing demand for durable and high-capacity foundation equipment. Contractors are investing in GPS-assisted, high-speed pile drivers for quicker execution of piling operations, particularly in flood-prone and seismic regions. Demand is also rising for quieter, emissions-compliant models as environmental restrictions become stricter in states like California and New York. USA-based and international manufacturers are introducing telematics and AI-assisted diagnostics to reduce maintenance costs and operator error. Coastal projects, including offshore wind developments, require large, specialized rigs with extended reach and real-time data logging. The rental market remains strong, particularly for heavy-duty machines required for time-sensitive federal contracts.

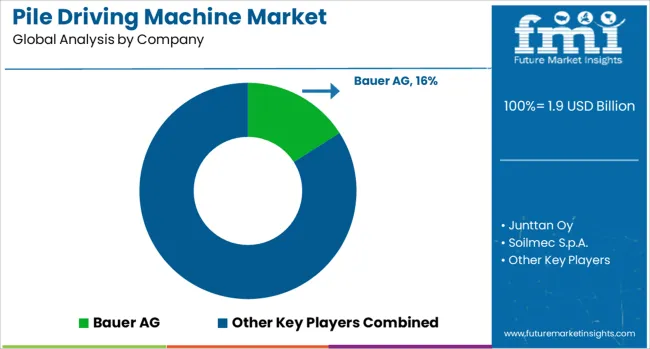

The pile driving machine market is a critical segment of the construction equipment industry, supporting foundation work for infrastructure such as bridges, highways, buildings, and marine structures. These machines are used to drive prefabricated piles into the ground, ensuring structural stability in a wide range of soil and load conditions. The market is driven by rapid urbanization, increased investment in civil infrastructure, and the expansion of offshore and transport projects worldwide. Bauer AG is a global leader offering a full range of pile driving rigs and foundation engineering equipment known for precision, versatility, and efficiency in complex ground conditions. The company integrates advanced hydraulic systems and digital monitoring tools for optimized performance.

Junttan Oy, a Finland-based specialist, focuses exclusively on hydraulic pile driving rigs, known for their robust build, mobility, and user-friendly control systems, making them a preferred choice in urban and offshore piling operations. Soilmec S.p.A. and Casagrande S.p.A., both Italian manufacturers, provide advanced piling rigs and multifunction machines capable of handling deep foundation work and ground improvement tasks. Their modular designs and adaptability to various pile types and driving techniques make them versatile players in the global market. Liebherr Group brings its strong engineering expertise to the segment, offering heavy-duty piling and drilling rigs that combine lifting capabilities, stability, and smart operation systems. As sustainability and automation grow in importance, manufacturers investing in low-emission engines, telematics, and energy-efficient hydraulics are poised to lead the next generation of piling equipment.

As mentioned in the official Enphase Energy press release dated June 4, 2025, IQ8P‑3P™ Commercial Microinverters made with domestic content were selected for commercial solar projects in Florida, Rhode Island, and California, totaling nearly 3 MW. These installations qualify for the Inflation Reduction Act’s domestic content bonus tax credit, enhancing project economics and supporting USA manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product | Impact hammers, Vibratory drivers, Press-in Piling machines, and Sonic Piling machines |

| Pile | Steel piles, Concrete piles, Timber piles, and Composite piles |

| Process | Conventional pile driving, Silent piling, and Jetting |

| Application | Infrastructure, Residential construction, Commercial construction, and Industrial construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bauer AG, Junttan Oy, Soilmec S.p.A., Liebherr Group, and Casagrande S.p.A. |

| Additional Attributes | Dollar sales by pile driving machine type including impact hammer, vibratory driver, sonic piling rig, and auger boring equipment; by application in infrastructure construction, residential/commercial development, and energy projects; and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by urbanization, infrastructure investment, and renewable energy foundations; innovation in eco‑friendly electric and hydraulic hammers, GPS‑guided pile placement systems, and low‑vibration rigs; costs influenced by steel alloy prices, precision engineering requirements, and certification standards; emerging use cases in solar and wind foundation installation, port reconstruction, and metro transit piling. |

The global pile driving machine market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the pile driving machine market is projected to reach USD 2.9 billion by 2035.

The pile driving machine market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in pile driving machine market are impact hammers, vibratory drivers, press-in piling machines and sonic piling machines.

In terms of pile, steel piles segment to command 39.0% share in the pile driving machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Driving Test Simulator Market Size and Share Forecast Outlook 2025 to 2035

Pile Turner Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Driving Protection Gear Market Analysis by Product, Material, Vehicle, Consumer Group, Distribution Channel and Region 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA