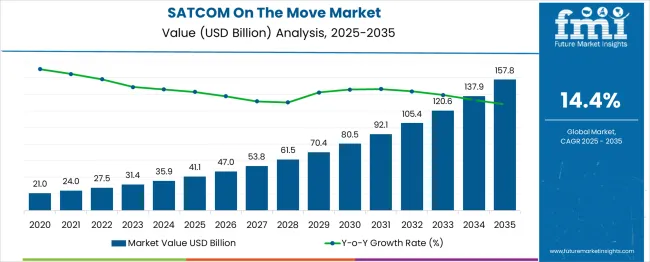

The SATCOM on the move market is set to rise from USD 41.1 billion in 2025 to USD 157.8 billion in 2035, at a compound annual growth rate (CAGR) of 14%. Market risks include geopolitical uncertainties, spectrum allocation constraints, and high capital expenditure for satellite launches and ground equipment. Supply chain disruptions for advanced electronics and antenna components could affect deployment timelines. Sensitivity is high to defense budgets, commercial adoption, and regulatory approvals. Delays in satellite launches or policy changes may slow incremental growth. Strategic partnerships, diversified geographies, and robust procurement planning are essential to mitigate risks and sustain rapid expansion.

Quick Stats for SATCOM On the Move Market

| Metric | Value |

| Estimated Value in (2025E) | USD 41.1 billion |

| Forecast Value in (2035F) | USD 157.8 billion |

| Forecast CAGR (2025 to 2035) | 14% |

The SATCOM on the move market is expected to grow from USD 41.1 billion in 2025 to USD 157.8 billion in 2035 at a compound annual growth rate (CAGR) of 14%, reflecting a substantial absolute increase of USD 116.7 billion over the decade. Proportional analysis indicates that early-decade growth (2025–2028) contributes approximately 23% of the total ten-year expansion, with values rising from USD 41.1 billion to USD 53.8 billion. Mid-decade expansion (2028–2032) accounts for roughly 35% of incremental growth, with the market increasing from USD 53.8 billion to USD 92.1 billion, driven by defense modernization programs, commercial vehicle connectivity, and maritime adoption. Late-decade growth (2032–2035) contributes the remaining 42%, with values surging from USD 92.1 billion to USD 157.8 billion, reflecting accelerated adoption in emerging markets, satellite capacity expansion, and integration of advanced multi-band antennas.

The ratio of early-, mid-, and late-decade contributions approximates 1:1.5:1.8, highlighting faster value accumulation in the latter half of the decade. Proportionally, defense SATCOM applications account for 40–45% of market growth, commercial mobility solutions contribute 30–35%, and maritime and aerospace segments represent 20–25%. These ratios demonstrate balanced market drivers across sectors, with strategic prioritization necessary to capture high-value opportunities and optimize long-term growth trajectories.

Market expansion is being supported by the increasing global defense spending and rising demand for secure communication systems in military operations. Modern military forces require reliable communication capabilities that can operate effectively in challenging environments and maintain connectivity during mobile operations. SATCOM on the move systems provide critical communication links for command and control operations, intelligence gathering, and coordination of military assets across various theaters of operation.

The growing emphasis on autonomous and connected vehicles is driving demand for mobile satellite communication solutions that can provide consistent connectivity regardless of terrestrial network coverage. Commercial sectors including transportation, logistics, and emergency services are increasingly adopting SATCOM on the move solutions to ensure operational efficiency and safety. The rising influence of next-generation satellite technologies and the development of high-throughput satellite networks are also contributing to increased adoption across different industries and applications.

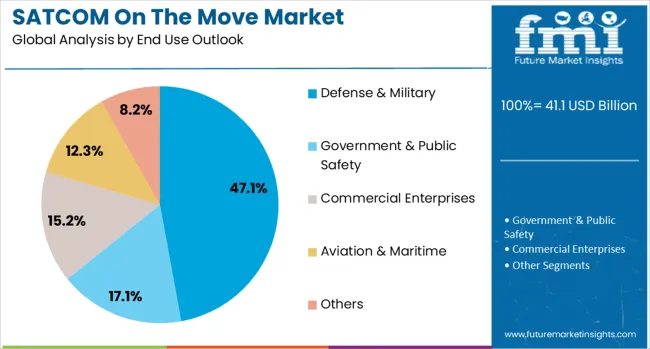

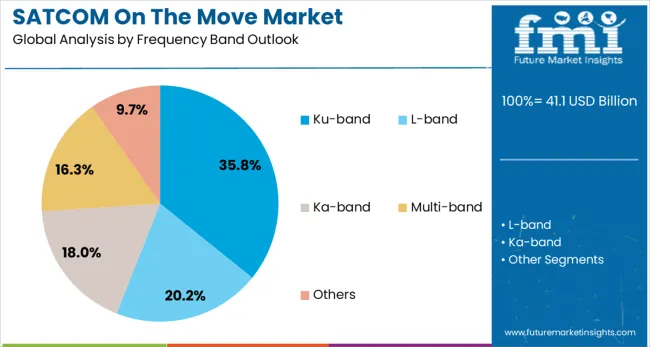

The market is segmented by platform, frequency band, end use, and region. By platform, the market is divided into land, airborne, maritime, and multi-band applications. Based on frequency band, the market is categorized into Ku-band, L-band, Ka-band, and others. In terms of end use, the market is segmented into defense & military, government & public safety, commercial enterprises, and aviation & maritime sectors. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The defense and military segment is projected to account for 47% of the SATCOM on the move market in 2025, maintaining its position as the primary application area. Armed forces globally are increasingly deploying mobile satellite communication systems to ensure secure, uninterrupted connectivity for personnel and equipment operating in remote, rugged, or hostile regions. SATCOM on the move enables real-time intelligence exchange, tactical coordination, and command oversight, which are critical for modern defense operations. Sustained government investment, modernization initiatives, and strategic requirements reinforce demand. Military applications form the backbone of the market, driving technological adoption and ensuring consistent growth for mobile satellite communication solutions.

Land platforms are expected to contribute 47% of SATCOM on the move demand in 2025, highlighting their prominence as the preferred operational environment for mobile satellite communication systems. Ground-based vehicles including military transport, armored vehicles, emergency response units, and commercial logistics fleets require reliable connectivity across diverse terrains and challenging conditions. Land platforms provide the stability and mobility necessary for uninterrupted data transmission, command communication, and situational monitoring. Adoption is fueled by increasing integration of connected vehicle technologies, autonomous vehicle testing, and mobile command centers. Land-based SATCOM solutions remain central to operational efficiency, supporting both defense and commercial requirements while ensuring market dominance.

The Ku-band frequency segment is forecasted to represent 36% of SATCOM on the move market in 2025, reflecting its widespread adoption and optimal performance characteristics. Ku-band systems balance coverage, data throughput, and equipment cost, making them suitable for mobile applications with moderate power requirements. Extensive satellite infrastructure and ground support networks ensure reliability, even under adverse weather conditions. The frequency band is well-suited for military, government, and commercial operations, enabling secure, continuous communication. Continued expansion of Ku-band capacity, technological upgrades, and standardization efforts reinforce its market position, making it a dependable choice for mobile satellite communication platforms.

The SATCOM on the move market is advancing rapidly due to increasing global defense spending and growing demand for mobile connectivity solutions across various sectors. However, the market faces challenges including high system costs, regulatory complexities, and technical limitations in harsh operating environments. Innovation in antenna technologies and satellite constellation development continue to influence product development and market expansion patterns.

The deployment of low earth orbit satellite constellations is enabling enhanced communication capabilities with reduced latency and improved data rates for mobile applications. These advanced satellite networks offer global coverage and support high-bandwidth communication requirements for various SATCOM on the move applications. The integration of software-defined satellite technologies allows for dynamic bandwidth allocation and improved system flexibility to meet diverse operational requirements.

Modern SATCOM on the move manufacturers are incorporating phased array antennas, electronically steered arrays, and advanced tracking systems to enhance communication reliability and performance. These technologies improve signal acquisition and maintenance capabilities while reducing system size and power requirements. Advanced antenna technologies also enable multi-band operation and seamless handover between different satellite networks for improved service continuity.

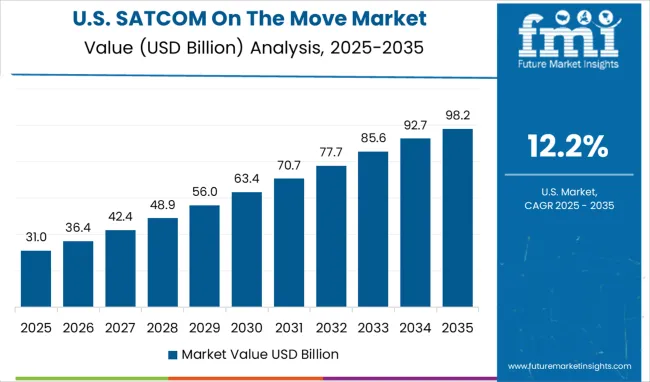

| Country | CAGR (2025-2035) |

| China | 19.4% |

| India | 18% |

| Germany | 16.6% |

| France | 15.1% |

| U.K. | 13.7% |

| U.S. | 12.2% |

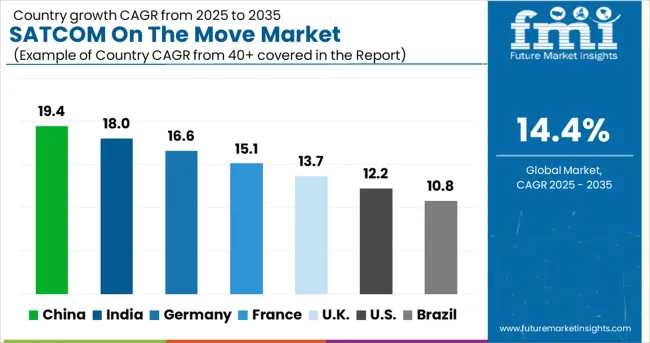

The SATCOM on the move market is experiencing robust growth globally, with China leading at a 19.4% CAGR through 2035, driven by substantial defense spending, military modernization programs, and growing commercial satellite communication adoption. India follows closely at 18.0%, supported by increasing defense investments, border security requirements, and expanding commercial aviation sector. Germany shows strong growth at 16.6%, emphasizing advanced aerospace technologies and defense system modernization. France records 15.1%, focusing on defense industry development and satellite communication innovation. The UK demonstrates 13.7% growth, prioritizing military communication capabilities and commercial transportation connectivity.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from SATCOM on the move systems in China is projected to exhibit strong growth with a CAGR of 19.4% through 2035, driven by significant military modernization programs and increasing investment in satellite communication infrastructure. The country's expanding defense budget and focus on advanced military technologies are creating substantial demand for mobile satellite communication systems across various military platforms and applications.

Revenue from SATCOM on the move systems in India is expanding at a CAGR of 18%, supported by increasing defense spending, border security requirements, and growing adoption of satellite communication technologies. The country's strategic focus on military modernization and indigenous defense production is driving demand for advanced mobile satellite communication solutions across various defense and commercial applications.

Demand for SATCOM on the move systems in the U.S. is projected to grow at a CAGR of 12.2%, supported by substantial defense spending, advanced military technology development, and established satellite communication infrastructure. American defense contractors and technology companies continue to lead innovation in mobile satellite communication systems with focus on performance enhancement and operational reliability.

Revenue from SATCOM on the move systems in Germany is projected to grow at a CAGR of 16.6% through 2035, driven by the country's strong aerospace industry, defense technology expertise, and emphasis on high-quality engineering solutions. German companies consistently focus on developing advanced mobile satellite communication systems that meet stringent performance and reliability requirements.

Revenue from SATCOM on the move systems in the UK is projected to grow at a CAGR of 13.7% through 2035, supported by strong defense industry capabilities, investment in military communication technologies, and focus on operational effectiveness enhancement. British companies emphasize developing sophisticated mobile satellite solutions that address evolving military and commercial communication requirements.

Revenue from SATCOM on the move systems in France is projected to grow at a CAGR of 15.1% through 2035, supported by the country's strong defense industry, aerospace expertise, and investment in satellite communication technologies. French companies prioritize developing advanced mobile satellite solutions that combine engineering excellence with operational effectiveness for military and commercial applications.

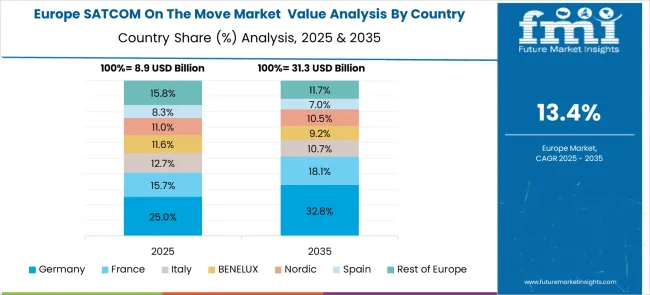

The SATCOM on the move market in Europe demonstrates strong development across major economies with Germany showing robust presence through its advanced defense industry and emphasis on military modernization programs, supported by companies leveraging aerospace expertise to develop sophisticated mobile satellite communication systems that meet stringent military and commercial requirements for reliable connectivity in challenging operational environments.

France represents a significant market driven by its strong defense spending and aerospace industry capabilities, with companies focusing on developing advanced SATCOM solutions that combine French engineering excellence with cutting-edge satellite communication technologies for enhanced mobile connectivity and operational effectiveness across military and commercial applications.

The UK exhibits considerable growth through its investment in defense technologies and emphasis on military communication capabilities, with companies developing innovative mobile satellite solutions that address evolving operational requirements for secure and reliable communication systems. Germany and other major European economies show expanding interest in advanced SATCOM technologies, particularly for defense modernization programs and commercial transportation applications.

The SATCOM on the move market is defined by competition among established defense contractors, satellite communication technology specialists, and innovative system integration companies. Substantial investments are being made in advanced antenna technologies, satellite constellation development, system integration capabilities, and collaborative partnerships to deliver reliable, high-performance mobile satellite communication solutions. Operational efficiency, technological innovation, and comprehensive customer support are emphasized to strengthen product portfolios, enhance market reach, and maintain competitive positioning across military and commercial applications.

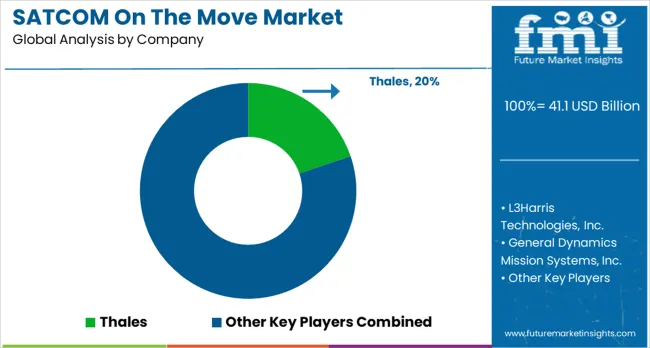

Thales, headquartered in France, maintains a leading position in the global market, capturing an estimated 20% of total value. Comprehensive SATCOM on the move solutions are offered with a focus on deployment across military vehicles, naval vessels, and commercial platforms, highlighting interoperability, reliability, and secure communications. L3Harris Technologies Inc., U.S.-based, delivers advanced satellite communication systems with emphasis on defense applications, integrated solutions, and mission-critical operational performance. General Dynamics Mission Systems Inc., U.S., provides specialized mobile satellite solutions tailored for military and government clients. RTX Corporation, U.S., focuses on advanced communication technologies and system integration for complex defense operations.

Additional market participants such as Viasat Inc., EchoStar Corporation, and Hughes Network Systems LLC, all headquartered in the U.S., offer comprehensive satellite communication equipment and services spanning multiple commercial and defense segments. Honeywell International Inc., U.S., applies integrated communication solutions for aerospace and defense platforms. Gilat Satellite Networks, Israel, delivers satellite communication technologies and solutions optimized for various mobile applications. Elbit Systems Ltd., Israel, provides mobile communication systems and defense electronics with particular focus on military operations. Technical brochures highlight antenna performance, system integration capabilities, secure communication protocols, and operational versatility, collectively reinforcing competitive positioning and illustrating market leadership in SATCOM on the move solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 41.1 billion |

| Platform | Land, Airborne, Maritime, Multi-band |

| Frequency Band | Ku-band, L-band, Ka-band, Others |

| End Use | Defense & Military, Government & Public Safety, Commercial Enterprises, Aviation & Maritime |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thales, L3Harris Technologies Inc., General Dynamics Mission Systems Inc., RTX Corporation, Viasat Inc., EchoStar Corporation, Honeywell International Inc., Gilat Satellite Networks, Hughes Network Systems LLC, and Elbit Systems Ltd. |

| Additional Attributes | Dollar sales by platform type and frequency band, regional demand trends, competitive landscape, customer preferences for different satellite communication technologies, integration with defense modernization programs, innovations in antenna technologies, next-generation satellite constellations, and advanced system integration capabilities |

Platform:

Frequency Band:

End Use:

Region:

The global satcom on the move market is estimated to be valued at USD 41.1 billion in 2025.

The market size for the satcom on the move market is projected to reach USD 157.8 billion by 2035.

The satcom on the move market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in satcom on the move market are land, airborne and maritime.

In terms of frequency band outlook, ku-band segment to command 35.8% share in the satcom on the move market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SatCom Terminal Market Analysis - Growth, Demand & Forecast 2025 to 2035

Airborne SATCOM Equipment Market

One-Box Electronic Hydraulic Brake (EHB)System Market Size and Share Forecast Outlook 2025 to 2035

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

On-orbit Satellite Servicing Market Forecast and Outlook 2025 to 2035

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Onsite Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

On-site Preventive Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

On-Board Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On-Demand Logistics Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA