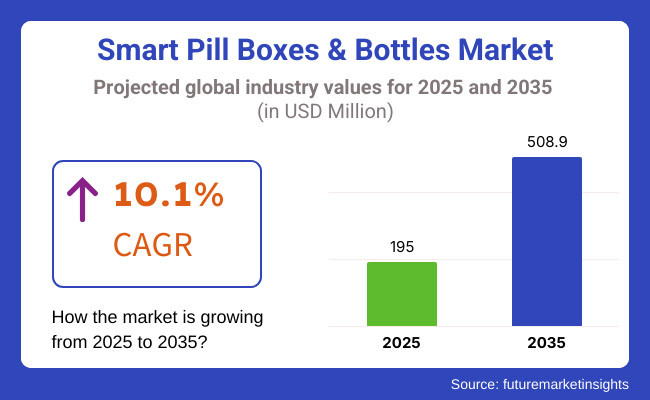

Smart pill boxes & bottles market is projected to expand from USD 195 million in 2025 to USD 508.9 million by 2035, registering a CAGR of 10.1% during the forecast period.

The United States is expected to remain the most lucrative country owing to its strong digital healthcare infrastructure and higher rates of chronic illness, while India is forecasted to be the fastest-growing market with a CAGR of 13.6%, driven by telemedicine growth and rising smartphone penetration.

The smart pill boxes & bottles market is undergoing a notable transformation fueled by the increasing global burden of chronic diseases such as diabetes, Alzheimer’s, and hypertension. With a growing geriatric population and the need for patient-centric medication management, demand for automated, connected, and user-friendly medication solutions is on the rise.

Smart pill boxes and bottles integrate Internet of Things (IoT) and Artificial Intelligence (AI) technologies, allowing for real-time dose tracking, missed medication alerts, and remote monitoring by healthcare providers. Integration with electronic health records (EHRs) and mobile platforms further boosts their relevance.

However, market penetration remains challenged in several developing economies due to limited digital infrastructure, connectivity issues, and concerns related to data security and compliance with privacy regulations.

Looking ahead to 2035, the smart pill boxes & bottles market is expected to form a vital element within digital health ecosystems. Ongoing innovations, such as compatibility with wearable devices, voice assistance, and AI-driven dose customization, will strengthen patient engagement and treatment adherence.

Increased focus on eco-friendly manufacturing, including biodegradable packaging and reusable dispensers, will align with global sustainability goals. Additionally, broader accessibility through low-cost smart devices tailored to regional healthcare needs is anticipated to expand market presence in Asia-Pacific, Latin America, and parts of Africa, positioning the market for substantial global adoption and integration across healthcare settings.

The smart pill boxes & bottles market isbe segmented into product type, indication, end user, and region. Under product type, smart pill boxes and smart pill bottles are the two primary segments. Indications covered include dementia, Parkinson's disease, cancer management, diabetes care, geriatric care, disability, and others.

End-user segments include seniors care & assisted living, long-term care centers, and home care settings. Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Smart pill boxes are lucrative among product type segment, accounting for approximately 58% of the market share in 2025. Their popularity is driven by the growing need for organized medication schedules among elderly and chronically ill patients.

These devices feature multi-compartment designs, built-in alarms, refill reminders, and digital compliance tracking, making them highly suitable for home care and assisted living scenarios. Their ease of use and cost-effectiveness contribute significantly to their widespread adoption in developed regions.

| Product Type | Market Share (2025) |

|---|---|

| Smart Pill Boxes | 58% |

Among indications, diabetes care is expected to witness the highest growth rate during the forecast period, supported by a rising global diabetic population and the need for consistent medication adherence. Devices that offer real-time alerts, glucose integration, and insulin timing reminders are gaining significant attention. Dementia and geriatric care remain strong segments due to aging populations requiring structured medication assistance.

| Indication | CAGR (2025 to 2035) |

|---|---|

| Diabetes Care | 11.2% |

Limited Digital Infrastructure and Connectivity Problems Affecting Adoption

The inability of the market for smart pill boxes and bottles to grow around the world one of the chief challenges is heterogeneity in the digital infrastructure globally. While those developed countries, such as the USA, Germany, and Japan, have mature IT healthcare systems for their respective domestic markets, producing regions of Africa, Latin America, and portions of Asia persistently lack internet connectivity and limited digital healthcare connectivity.

Smart drug management devices rely on robust internet connectivity, cloud storage, and interoperability with electronic health records (EHRs) to work. In areas where telecommunication infrastructure is weak, and healthcare IT infrastructure is outdated, integrating these intelligent solutions proves to be challenging.

Also, issues of cybersecurity and data privacy legislation further complicate the adoption of cloud-connected medical devices. Until a more standardized global development of digital health infrastructure occurs, the mass use of smart pill boxes and bottles will be restricted, especially in developing economies.

Rising Demand for Patient-Centric Imaging Creating Growth Opportunities

Integration of smart pill boxes and bottles with wearable devices provides a beautiful opportunity for the healthcare technology market to grow. Wearable devices like smartwatches and fitness trackers to monitor health have taken an extremely exciting path as far as popularity goes, including applications like heart rate, activity tracking, and sleep measurement.

Integration of this device, along with the smart medication management system, would offer all-rounded care in the case of chronically ill individuals.

Leading technology and healthcare companies are keenly interested in integrations that help to enhance user engagement and medication adherence. By linking wearable devices with smart medication systems, they will provide a seamless, personalized health management experience-such an innovation appeals greatly to tech-savvy younger demographics who appreciate the convenience of modern solutions.

In addition, the wearable and smart pill box convergence can have a multiplier effect in terms of furthering adoption by all age groups to achieve better health outcomes. Moving forward with this trend will keep the market increasingly on fire.

Expansion of Smart Medication Solutions in Home Healthcare

The smart pill box and bottle market is growing with the higher use of such products in-home care by caregivers and patients. With the population aging, the trend towards home care implies that there is greater demand for patients to utilize smart drug management devices to enhance compliance.

These devices remind patients to take medicine, monitor doses, and inform family members or other caregivers in case a patient forgets a dose. Home care minimizes hospital visits in high-cost healthcare areas and maximizes patient independence. Thus, with increasing demand for simple and low-cost options, this trend will extend in the market in the forecast period.

Integration with Mobile Health (mHealth) Applications

Manufacturers are pairing smart pill boxes and pill containers with mHealth applications to enhance convenience and accessibility for the management of drugs. Smart pill boxes and bottles are now synchronized with apps on smartphones, which send reminders to patients, enable tracking of medication history, and upload adherence data to the physician.

This has specifically helped technology-savvy patients or patients with several prescriptions. Additionally, with mHealth apps powered by AI, trends in medication intakes can be tracked, and personalized recommendations are given. As expansion persists in digital health ecosystems, so will the need for intelligent medication devices that integrate well with mobile platforms.

Market Outlook

The United States dominates the worldwide smart pill boxes and bottles market due to a high rate of chronic disease prevalence and a fast-developing aging population. As a result of the emphasis on rising medication adherence, healthcare practitioners and technology companies continue to enhance innovative solutions for enhanced patient compliance.

Moreover, substantial investments in digital health, along with the inclusion of AI-powered medication management systems, also enhance market growth. With an increase in the need for intelligent, efficient healthcare solutions, the American market continues to shape up, leading the way toward innovation in smart medication management.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 9.4% |

Market Outlook

India's smart pill bottles and boxes market is expanding, driven by a spate of rising chronic disease incidences and higher smartphone penetration. India has enormous challenges with medicine non-adherence, especially for diabetic and hypertensive patients.

Moreover, India's fast-growing telemedicine market encourages the deployment of smart medicine management devices in remote patient management. The cheap availability of domestic-made smart pill dispensers is also boosting the market's take-up, especially in urban areas where healthcare digitization is evolving.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 13.6% |

Market Outlook

China's market for smart pill boxes and bottles is growing fast, fueled by urbanization, increasing prevalence of chronic diseases, and growing self-medication behavior. The size of the population in China and the increasing middle class drive greater demand for personal health management products.

The growth of online pharmacies in China also drives the use of smart medication dispensers, as consumers turn to digital means for managing prescriptions. The government's drive towards electronic pharmacies and e-prescriptions also increases the adoption of smart medication devices.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 13.1% |

Market Outlook

Germany plays an important role in the global smart pill bottles and boxes industry because of its emphasis on personalized healthcare and precision medicine. In light of heightened interest in the safety of medicines, Germany lays emphasis on intelligent medication solutions for reducing prescription errors and improving outcomes for patients.

In addition, Germany's emphasis on green practice in healthcare fuels the adoption of eco-friendly smart pill dispensers. The nation's largest European pharmaceutical industry also supports market growth by integrating smart packaging and digital tracking technologies, further increasing the adoption of smart medication management solutions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 8.5% |

Market Outlook

The smart pill boxes and bottles market of Brazil is growing because of the rising burden of chronic diseases in the country and the expanding role of community pharmacies in managing medicines. With it being one of Latin America's largest drug markets, Brazil has increased demand for smart medicine-taking management technologies in cities.

On another front, the increased availability of private health facilities supports the adoption of advanced drug intake solutions. Further momentum in this drive is delivered from domestic preoccupations in stemming medication abuse and abuse potentials inherent to most potentially over-usage of vulnerable substances, namely analgesics, and antibiotics.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.4% |

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The smart pill boxes & bottles market is estimated to be valued at USD 195 million in 2025.

The market is projected to reach approximately USD 508.9 million by 2035, expanding at a CAGR of 10.1% from 2025 to 2035.

India is expected to be the fastest-growing market, registering a CAGR of 13.6% between 2025 and 2035.

Smart pill boxes hold the largest market share in 2025, accounting for approximately 58% of the global market

Rising chronic disease prevalence, aging populations, demand for medication adherence, and growth in digital health technologies are key drivers for market growth.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 7: Global Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2017 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 13: North America Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 15: North America Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2017 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2017 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 30: Europe Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 31: Europe Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by End User, 2017 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 34: East Asia Market Volume (Units) Forecast by Country, 2017 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 36: East Asia Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 40: East Asia Market Volume (Units) Forecast by End User, 2017 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 42: South Asia Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 44: South Asia Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 46: South Asia Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 48: South Asia Market Volume (Units) Forecast by End User, 2017 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 50: Oceania Market Volume (Units) Forecast by Country, 2017 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 52: Oceania Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 54: Oceania Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 56: Oceania Market Volume (Units) Forecast by End User, 2017 to 2033

Table 57: MEA Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 58: MEA Market Volume (Units) Forecast by Country, 2017 to 2033

Table 59: MEA Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 60: MEA Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 61: MEA Market Value (US$ million) Forecast by Indication, 2017 to 2033

Table 62: MEA Market Volume (Units) Forecast by Indication, 2017 to 2033

Table 63: MEA Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 64: MEA Market Volume (Units) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 14: Global Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Indication, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Indication, 2023 to 2033

Figure 27: North America Market Value (US$ million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 38: North America Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Indication, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Indication, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Indication, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Indication, 2023 to 2033

Figure 95: Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Indication, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by End User, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 106: East Asia Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 110: East Asia Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 114: East Asia Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Indication, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by End User, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 130: South Asia Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 134: South Asia Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 138: South Asia Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Indication, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Indication, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by End User, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 154: Oceania Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 158: Oceania Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 162: Oceania Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Indication, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ million) by Indication, 2023 to 2033

Figure 171: MEA Market Value (US$ million) by End User, 2023 to 2033

Figure 172: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 174: MEA Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 178: MEA Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 182: MEA Market Volume (Units) Analysis by Indication, 2017 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 185: MEA Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 186: MEA Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Indication, 2023 to 2033

Figure 191: MEA Market Attractiveness by End User, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA