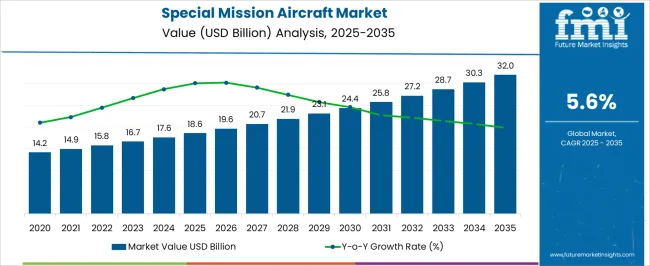

The special mission aircraft market is projected to expand from USD 18.6 billion in 2025 to USD 32.0 billion by 2035, reflecting a CAGR of 5.6%, indicating steady year-on-year growth. In 2025, the market value stands at USD 18.6 billion, rising from USD 17.6 billion in 2024, and increases to USD 19.6 billion in 2026. Each year records consistent growth of approximately 5–6%, driven by demand for intelligence, surveillance, reconnaissance, and specialized operational platforms. This predictable YoY growth enables manufacturers and defense stakeholders to plan production, optimize procurement, and secure long-term contracts efficiently.

By 2035, the market is expected to reach USD 32.0 billion, representing an absolute increase of USD 13.4 billion from 2025, supported by the 5.6% CAGR. Annual values progress steadily, from USD 20.7 billion in 2027 to USD 30.3 billion in 2034, demonstrating consistent expansion. These incremental yearly gains provide stakeholders with visibility for capacity planning, procurement, and investment strategies. The reliable YoY growth highlights long-term opportunities in specialized aircraft design, production, and deployment, ensuring that the market remains a key component of defense aviation planning over the decade.

| Metric | Value |

|---|---|

| Special Mission Aircraft Market Estimated Value in (2025 E) | USD 18.6 billion |

| Special Mission Aircraft Market Forecast Value in (2035 F) | USD 32.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The special mission aircraft segment is a critical part of the broader military and defense aviation market. In 2025, the segment accounts for USD 18.6 billion, representing approximately 12–13% of the total defense aircraft market. By 2035, it is projected to reach USD 32.0 billion, maintaining a similar share of around 12–13%. This stable percentage indicates that special mission aircraft will continue to be a key contributor to overall defense aviation revenues, driven by demand for platforms used in surveillance, reconnaissance, intelligence gathering, and other specialized operations. The consistent share highlights the segment’s strategic importance within the broader military aviation ecosystem.

Growing at a CAGR of 5.6% from 2025 to 2035, the special mission aircraft segment demonstrates steady expansion alongside the parent market. Maintaining roughly a 12–13% share over the decade provides aircraft manufacturers, defense contractors, and system integrators with predictable revenue streams while enabling strategic planning for production, procurement, and modernization programs. The segment’s consistent contribution underscores its long-term relevance, offering opportunities for investment, operational scaling, and integration within the larger defense aviation portfolio, ensuring sustained market growth over the forecast period.

The special mission aircraft market is witnessing robust growth due to increasing global geopolitical tensions, cross-border threats, and the demand for versatile airborne platforms capable of executing multiple defense and civilian missions. Nations are investing in fleet modernization, while defense OEMs are advancing aircraft customization with modular payloads for roles ranging from reconnaissance to humanitarian aid.

The market also benefits from the integration of AI-enabled sensors, electronic warfare systems, and long-endurance platforms, expanding operational capabilities. Government defense budgets, particularly in North America, Europe, and parts of Asia-Pacific, are consistently allocating funds for mission-specific aircraft procurement and lifecycle support.

As joint operations and strategic air superiority remain critical to national security, demand for specialized aerial platforms continues to rise.

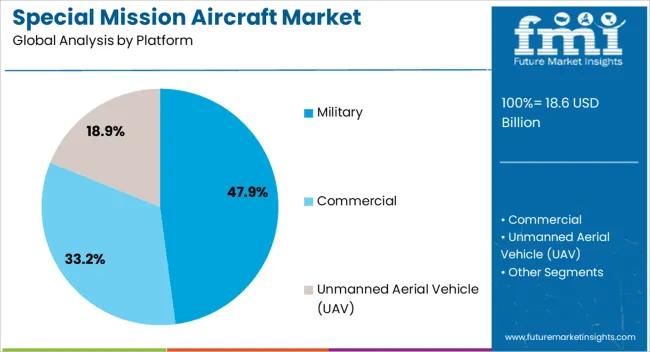

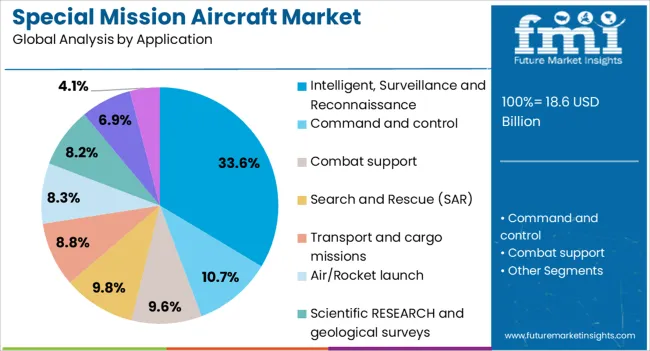

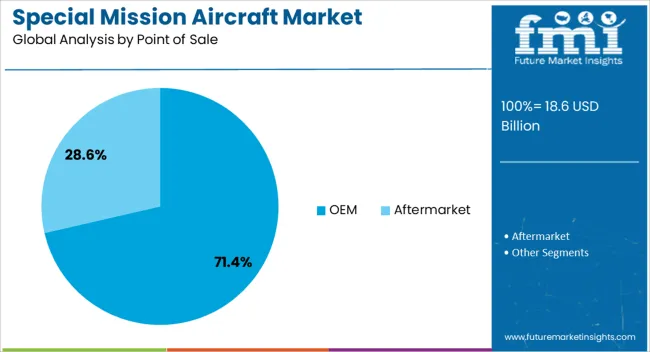

The special mission aircraft market is segmented by platform, application, point of sale, end-user, and geographic regions. By platform, special mission aircraft market is divided into Military, Commercial, and Unmanned Aerial Vehicle (UAV). In terms of application, special mission aircraft market is classified into Intelligent, Surveillance and Reconnaissance, Command and control, Combat support, Search and Rescue (SAR), Transport and cargo missions, Air/Rocket launch, Scientific RESEARCH and geological surveys, Electronic Warfare (EW), and Others. Based on point of sale, special mission aircraft market is segmented into OEM and Aftermarket. By end-user, special mission aircraft market is segmented into Defense, Civil & Commercial, and Space. Regionally, the special mission aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The military segment is expected to dominate with 47.90% share of the overall special mission aircraft market in 2025. The segment’s leadership is fueled by rising military budgets and the need for fleet augmentation amid ongoing modernization programs.

Military forces are relying on specialized aircraft for combat support, border patrol, counter-terrorism, and maritime surveillance operations. The adaptability of military platforms to integrate mission-specific avionics, EW systems, and armaments positions them as strategic assets.

Furthermore, the increasing deployment of military aircraft for dual-use combat readiness and disaster response bolsters their prominence. Continuous R&D in stealth, endurance, and sensor capabilities reinforces the segment’s growth trajectory.

Intelligent, Surveillance and Reconnaissance (ISR) is set to lead the market by application with a projected 33.60% share in 2025. This growth is underpinned by increasing security threats that demand real-time situational awareness and data-driven decision-making.

ISR aircraft support persistent monitoring, targeting, and border security missions, making them essential in both peacetime and conflict scenarios. Technological enhancements such as multi-sensor integration, hyperspectral imaging, and real-time data transmission have elevated ISR effectiveness.

Additionally, interoperability between manned and unmanned platforms has expanded the scope and reach of ISR operations, ensuring comprehensive coverage of strategic zones.

OEMs are anticipated to command 71.40% of the point of sale segment in 2025, leading the market by a significant margin. This dominance is driven by defense procurement policies favoring factory-new aircraft equipped with the latest mission packages and performance upgrades.

Governments and air forces prefer OEMs due to their ability to provide end-to-end solutions including platform integration, certification, and long-term support agreements. OEMs are also better positioned to incorporate evolving technologies—such as next-gen radar, AI-based analytics, and countermeasure systems—into baseline designs.

The push for indigenous manufacturing and strategic partnerships between local firms and global OEMs further reinforces the strength of this channel.

The special mission aircraft market is expanding as governments and defense organizations increasingly require platforms for surveillance, reconnaissance, electronic warfare, and search and rescue operations. These aircraft are modified or purpose-built to carry specialized sensors, communication equipment, and mission-specific payloads. Rising geopolitical tensions, border security needs, and modernization of defense fleets are driving demand. Technological advancements in radar systems, data link communication, and modular mission payloads are enhancing operational capabilities. Companies providing reliable, versatile, and customizable special mission aircraft solutions are well-positioned to capture opportunities in military, homeland security, and intelligence operations globally.

The market faces challenges due to the high costs of procurement, customization, and maintenance of special mission aircraft. Advanced avionics, sensor suites, and mission-specific modifications increase acquisition expenses. Operational costs, including fuel, specialized crew training, and maintenance of complex systems, can strain defense budgets. Ensuring availability and readiness for continuous missions requires robust support infrastructure and logistics, which may not be readily accessible in emerging markets. These factors can delay fleet expansion or reduce the number of aircraft acquired. Manufacturers must focus on cost-effective designs, modular systems, and lifecycle support solutions to help defense organizations manage budgets while maintaining operational readiness and mission efficiency.

Market trends are being shaped by the integration of advanced sensors, modular payloads, and digital communication systems. Special mission aircraft increasingly feature multi-sensor suites, including electro-optical, infrared, radar, and signals intelligence equipment, enabling versatile mission profiles. Modular payload designs allow rapid reconfiguration for different missions, improving operational flexibility. Digital systems and secure data links provide real-time communication, intelligence sharing, and remote control capabilities. Automation in monitoring, mission planning, and analysis enhances efficiency and reduces crew workload. These trends reflect a focus on adaptability, interoperability, and enhanced situational awareness, which are becoming key differentiators in special mission aircraft solutions.

The market offers significant opportunities driven by defense modernization programs, border security, and surveillance initiatives. Governments are investing in special mission aircraft to strengthen reconnaissance, intelligence gathering, and emergency response capabilities. Growing counter-terrorism and maritime security operations increase the need for multi-role and flexible platforms. Emerging markets with increasing defense budgets are seeking aircraft to enhance national security, while developed regions focus on upgrading aging fleets with modern avionics and sensor technology. Companies that provide versatile, cost-effective, and mission-ready platforms with strong after-sales support are positioned to benefit from this growing demand for specialized aerial capabilities.

Market growth is restrained by supply chain constraints, regulatory requirements, and operational complexity. Advanced sensors, avionics, and specialized components are sourced from limited suppliers, creating potential delays in production and delivery. Certification and compliance with military standards, aviation regulations, and export controls add complexity to manufacturing and sales. Operating special mission aircraft requires highly trained crews and robust maintenance infrastructure, increasing operational costs and limiting deployment flexibility. Until supply chains stabilize, compliance processes are streamlined, and cost-effective lifecycle management solutions are implemented, adoption may remain concentrated among well-funded defense organizations and specialized security agencies.

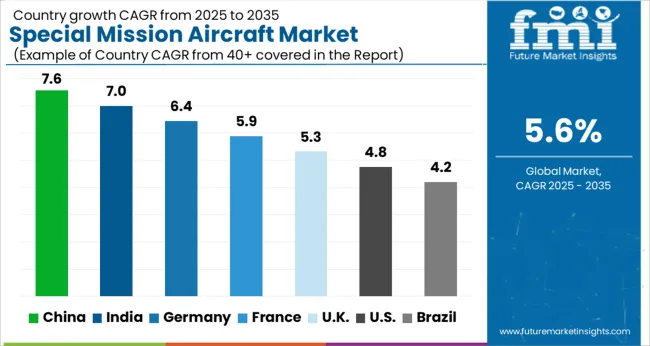

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global special mission aircraft market is projected to grow at a CAGR of 5.6% through 2035, supported by increasing demand across surveillance, reconnaissance, and defense operations. Among BRICS nations, China has been recorded with 7.6% growth, driven by large-scale production and deployment in intelligence, surveillance, and aerial reconnaissance missions, while India has been observed at 7.0%, supported by rising adoption for border security, maritime patrol, and tactical operations. In the OECD region, Germany has been measured at 6.4%, where production and utilization for reconnaissance, electronic warfare, and specialized logistics have been steadily maintained. The United Kingdom has been noted at 5.3%, reflecting consistent use in defense and intelligence operations, while the USA has been recorded at 4.8%, with production and utilization across defense, border security, and mission-specific aviation being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for special mission aircraft in China is expanding at a CAGR of 7.6%, driven by military aviation modernization, UAV programs, and domestic production of surveillance aircraft. Manufacturers are producing advanced platforms for reconnaissance, electronic warfare, and maritime patrol missions. Government initiatives supporting defense modernization, aerospace research, and indigenous aircraft production are accelerating adoption. Pilot deployments in military operations, border surveillance, and maritime missions show operational benefits including improved mission capability, real-time data collection, and extended operational range. Collaborations between aircraft manufacturers, research institutes, and defense contractors are enhancing avionics, mission systems, and airframe durability. Rising investments in defense infrastructure and advanced aircraft programs are key drivers for growth in the Chinese market.

The market for special mission aircraft in India is growing at a CAGR of 7.0%, supported by modernization of military aviation, UAV deployment, and domestic aerospace initiatives. Manufacturers are supplying aircraft configured for surveillance, reconnaissance, electronic warfare, and maritime operations. Government programs promoting Make in India, defense research, and aerospace technology development are encouraging adoption. Pilot deployments in border surveillance, naval operations, and intelligence missions show operational benefits such as enhanced situational awareness, extended operational range, and improved mission efficiency. Partnerships between domestic manufacturers, research institutions, and defense contractors enhance avionics, payload integration, and airframe reliability. The focus on strengthening domestic defense capabilities is a key driver of growth in India.

The market for special mission aircraft in Germany is recording a CAGR of 6.4%, supported by advanced aerospace manufacturing, defense modernization, and unmanned aircraft programs. Manufacturers focus on specialized aircraft for reconnaissance, electronic warfare, and maritime patrol. Government initiatives promoting defense readiness, aerospace research, and industrial innovation are driving adoption. Pilot projects in military operations, naval surveillance, and border security show operational benefits including enhanced mission capability, efficient data collection, and improved operational reliability. Collaborations between manufacturers, research institutes, and technology providers are enhancing avionics systems, mission payloads, and airframe durability. The emphasis on advanced aerospace technologies is supporting growth in the German market.

The market for special mission aircraft in the United Kingdom is growing at a CAGR of 5.3%, driven by modernization of military aviation, UAV deployment, and domestic aerospace capabilities. Manufacturers are producing aircraft for reconnaissance, maritime patrol, and electronic warfare missions. Government programs supporting defense research, industrial innovation, and aircraft procurement are encouraging adoption. Pilot deployments in border security, naval operations, and intelligence missions show operational benefits such as improved situational awareness, enhanced operational range, and better mission efficiency. Collaborations between manufacturers, research institutes, and defense contractors are improving avionics, payload integration, and airframe reliability. Continued investment in defense and aerospace programs is sustaining growth in the United Kingdom market.

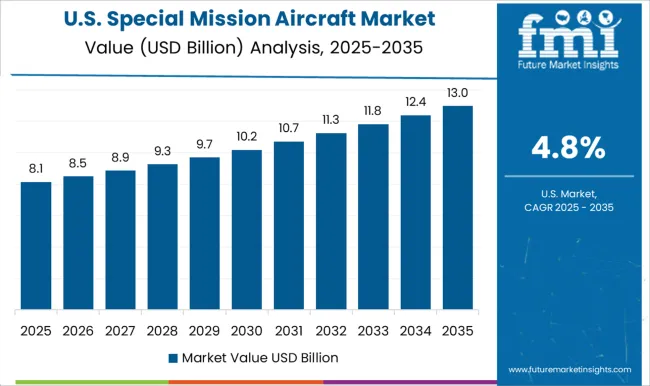

The market for special mission aircraft in the United States is expanding at a CAGR of 4.8%, fueled by defense modernization, UAV deployment, and advanced surveillance requirements. Manufacturers are producing aircraft equipped for electronic warfare, reconnaissance, maritime patrol, and intelligence missions. Government initiatives supporting aerospace research, defense procurement, and technology advancement are promoting adoption. Pilot projects in military operations, naval missions, and border surveillance show operational benefits including improved data collection, enhanced mission range, and increased operational reliability. Collaborations between manufacturers, research institutes, and defense contractors are enhancing avionics, payload systems, and airframe durability. The focus on advanced aerospace platforms and defense readiness continues to drive growth in the United States market.

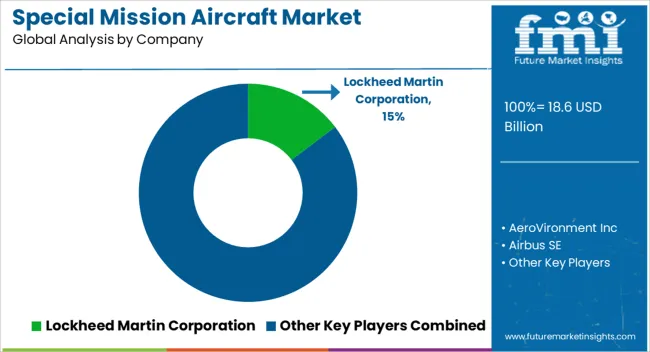

Operators of special mission aircraft increasingly rely on modular, mission-adaptable platforms, with manufacturers competing on payload capacity, endurance, and onboard systems integration. Lockheed Martin Corporation is positioned as a market leader, with brochures highlighting intelligence, surveillance, and reconnaissance (ISR) aircraft, sensor suites, and modular payload options. AeroVironment Inc. focuses on unmanned systems and small ISR platforms, with literature detailing payload limits, endurance specifications, and launch/recovery procedures. Airbus SE and BAE Systems provide manned and unmanned platforms, with brochures emphasizing avionics systems, modular mission bays, and environmental resilience. Bombardier Inc. and Dassault Aviation SA offer specialized executive and surveillance-configured jets, with technical documentation covering range, cabin modularity, and sensor integration. Elbit Systems Ltd., General Atomics Aeronautical Systems Inc., and Israel Aerospace Industries Ltd. deliver UAV and ISR solutions, with brochures presenting endurance data, payload compatibility, and communication interfaces. Kratos Defense & Security Solutions Inc., L3 Harris Technologies, and Leonardo SPA supply both tactical and strategic mission aircraft, with literature detailing onboard electronics, sensor stabilization, and flight envelope specifications.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.6 Billion |

| Platform | Military, Commercial, and Unmanned Aerial Vehicle (UAV) |

| Application | Intelligent, Surveillance and Reconnaissance, Command and control, Combat support, Search and Rescue (SAR), Transport and cargo missions, Air/Rocket launch, Scientific RESEARCH and geological surveys, Electronic Warfare (EW), and Others |

| Point of Sale | OEM and Aftermarket |

| End-User | Defense, Civil & Commercial, and Space |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, AeroVironment Inc, Airbus SE, BAE Systems, Bombardier Inc, Dassault Aviation SA, Elbit Systems Ltd., General Atomics Aeronautical Systems Inc., Israel Aerospace Industries Ltd., Kratos Defense & Security Solutions Inc., L3 Harris Technologies, Leonardo SPA, Northrop Grumman Corporation, Nova Systems, Raytheon Technologies Corporation, Saab AB, Textron Aviation Inc., Thales SA, The Boeing Company, and VOX Space |

| Additional Attributes | Dollar sales vary by aircraft type, including fixed-wing, rotary-wing, and UAVs; by mission, such as surveillance, reconnaissance, electronic warfare, and search & rescue; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising defense budgets, border security needs, and advanced avionics and mission systems. |

The global special mission aircraft market is estimated to be valued at USD 18.6 billion in 2025.

The market size for the special mission aircraft market is projected to reach USD 32.0 billion by 2035.

The special mission aircraft market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in special mission aircraft market are military, commercial and unmanned aerial vehicle (uav).

In terms of application, intelligent, surveillance and reconnaissance segment to command 33.6% share in the special mission aircraft market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Special Sealant for Photovoltaic Modules Market Forecast and Outlook 2025 to 2035

Special-Purpose Analog-to-Digital Converters (ADCs) Market Forecast and Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Special Coagulation Tests Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA