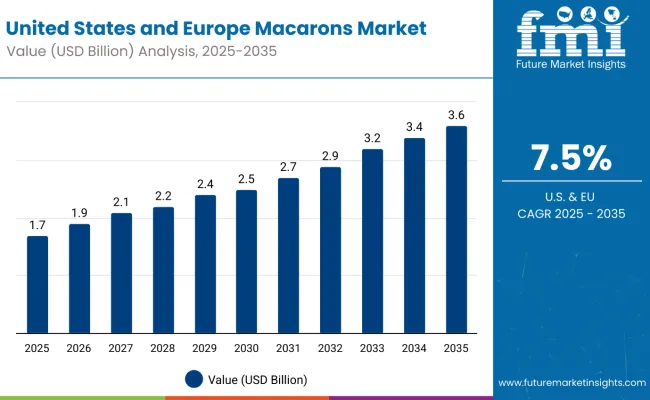

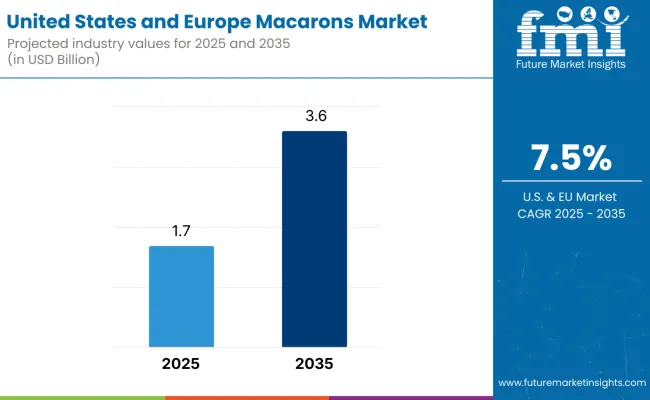

Sales of macarons in the USA and Europe are estimated at USD 1.7 billion in 2025, with projections indicating a rise to USD 3.6 billion by 2035, reflecting a CAGR of 7.5% over the forecast period. This growth reflects both increasing consumer preference for premium confectionery and expanding bakery retail networks across North America and Europe.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.7 billion |

| Projected Value (2035F) | USD 3.6 billion |

| CAGR (2025 to 2035) | 7.5% |

The rise in demand is linked to higher disposable incomes, evolving culinary trends, and the growing popularity of gourmet and artisanal desserts. By 2025, per capita consumption in leading countries such as Germany, the United Kingdom, France, Italy, and the United States averages between 0.5 and 0.8 kilograms, with projections reaching 1.2 kilograms by 2035. Germany leads among European countries, expected to generate the highest macaron sales by 2035, followed by the United Kingdom, France, the United States, and Italy.

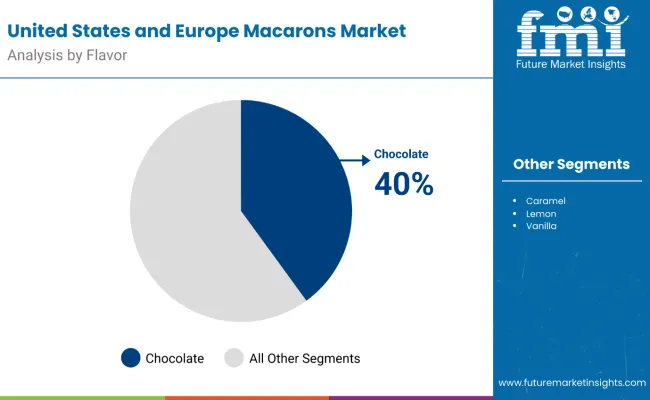

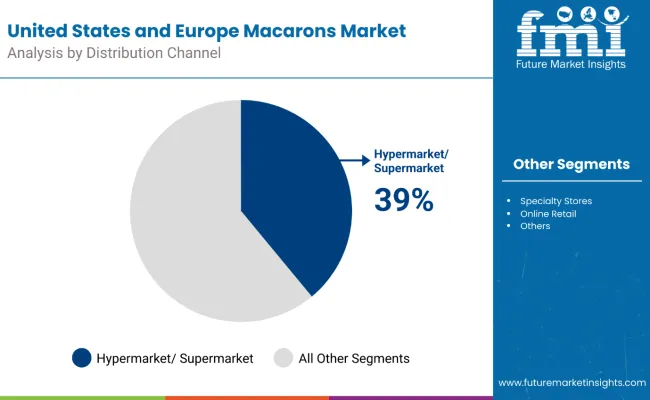

The largest contribution to demand continues to come from chocolate-flavored macarons, which are expected to account for 40% of total sales in 2025, owing to strong consumer preference for indulgent flavors and premium confectionery experiences. By distribution channel, supermarket and hypermarket sales represent the dominant segment with a 39% share, while specialty stores and online retail channels are expanding steadily as e-commerce adoption and gourmet food trends gain traction.

Consumer adoption is concentrated among retail buyers, premium bakeries, and specialty food outlets that seek high-quality, consistent products. Convenience and brand recognition emerge as significant drivers of demand. While premium positioning supports value growth, the expanding application scope across specialty dessert offerings and household consumption continues to drive volume expansion. Regional disparities persist, but per capita consumption in emerging confectionery markets is gradually aligning with established markets in Germany, the United Kingdom, and the United States.

The macarons in USA and European is classified into several segments such as flavor, distribution channel, and region. By flavor, sub-segments include fruit-flavored, chocolate, caramel, lemon, vanilla, pistachio, basic, and others. By distribution channel, sub-segments include supermarkets and hypermarkets, specialty stores, online retail, and others. By country, it includes the United States, Germany, the United Kingdom, France, and Italy.

Chocolate-flavored macarons are projected to dominate sales in 2025, driven by strong consumer preference for indulgent confectionery and premium dessert experiences. Other variants, such as fruit-flavored, pistachio, caramel, lemon, vanilla, and basic macarons, are steadily growing, supported by artisanal bakeries, specialty dessert shops, and premium retail outlets.

Supermarkets and hypermarkets account for the largest distribution share due to broad consumer reach, competitive pricing, and convenient access. Specialty stores, online retail platforms, and boutique bakeries are expanding as consumers increasingly seek premium and artisanal macaron options.

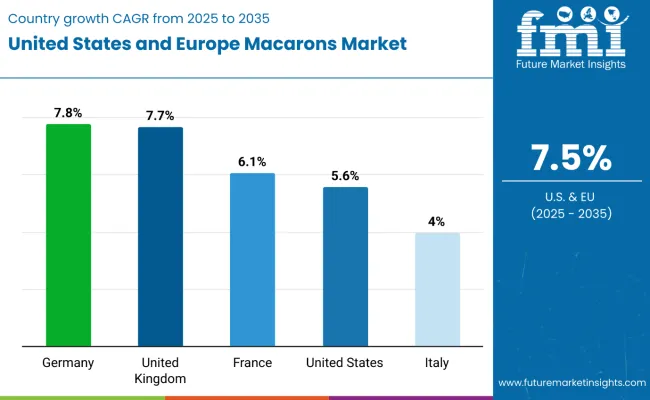

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.8% |

| UK | 7.7% |

| France | 6.1% |

| USA | 5.6% |

| Italy | 4.0% |

Macaron sales will not grow uniformly across all key countries in the United States and Europe. Expanding bakery retail networks, rising disposable incomes, and increasing preference for premium confectionery provide Germany and the United Kingdom with a measurable growth advantage. At the same time, other established markets such as France, the United States, and Italy are expected to expand more steadily from existing consumption levels. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for macarons is projected to expand across all major markets. Still, the pace of growth will vary based on retail penetration, consumer income levels, and adoption of premium dessert trends. Among the top five countries analyzed, Germany and the United Kingdom are expected to register the fastest compound annual growth rates of 7.8% and 7.7%, respectively, outpacing other established confectionery markets.

This acceleration is driven by strong consumer affinity for gourmet desserts, expanding supermarket and specialty bakery networks, and increasing adoption of online retail platforms for premium products. In both countries, per capita consumption is projected to rise from 0.7 kg in 2025 to 1.1 kg by 2035, reflecting growing consumer interest in indulgent and artisanal offerings.

France is forecast to grow at a CAGR of 6.1% over the same period, supported by sophisticated culinary culture, high demand for artisanal macarons, and continued expansion of specialty dessert outlets. Per capita consumption is expected to increase from 0.6 kg in 2025 to 1.0 kg by 2035, reflecting mainstream adoption of premium confectionery.

The United States and Italy, while representing mature markets with established consumption patterns, are expected to grow at more moderate CAGRs of 5.6% and 4.0%, respectively. Growth in these regions is driven by a steady rise in premium dessert adoption, boutique bakery expansion, and increasing demand for gourmet gifts and online delivery services. Per capita consumption is projected to rise from 0.5-0.6 kg in 2025 to 0.8-0.9 kg by 2035.

Collectively, these five countries represent the core of macaron demand in the United States and Europe, though their growth trajectories highlight the need for country-specific strategies in retail distribution, culinary innovation, and premium product positioning.

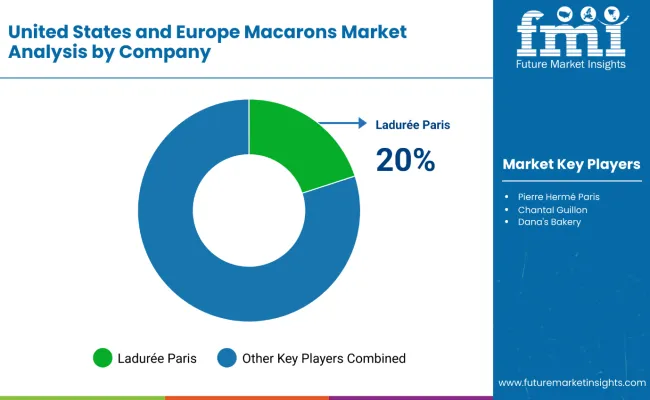

The competitive environment for macarons in the United States and Europe is characterized by a mix of established artisanal bakeries, premium confectionery brands, and specialty dessert manufacturers. Brand recognition, culinary expertise, and distribution networks, rather than product innovation alone, remain decisive success factors: leading suppliers collectively serve thousands of retail, specialty, and online outlets across North America and Europe, maintaining a strong presence in both physical and digital channels.

Ladurée Paris maintains a dominant position with an estimated 20% market share. The company emphasizes premium positioning, iconic brand recognition, and international bakery expansion, offering a broad range of signature and seasonal flavors while leveraging luxury marketing strategies to attract high-end consumers.

Pierre Hermé Paris focuses on artisanal craftsmanship and innovative flavor profiles, with a strong high-end retail presence. Its strategy revolves around limited-edition collections, gourmet collaborations, and curated seasonal offerings, appealing to consumers seeking unique and luxurious dessert experiences.

Chantal Guillon and Dana’s Bakery emphasize specialty retail and online distribution, with a focus on niche flavors, gift packaging, and direct-to-consumer channels. Both companies leverage e-commerce adoption and subscription models to reach discerning consumers seeking convenience and premium-quality macarons.

Dalloyau and Jean-Paul Hévin maintain strong artisanal positioning in European markets, combining heritage brand appeal with high-quality product offerings. Tipiak Group and La Maison du Chocolat expand through a combination of retail partnerships, online sales, and gourmet store placements, targeting both casual and premium confectionery buyers.

Olivia Macaron and RICHART focus on boutique operations, leveraging limited regional distribution, specialty flavors, and premium packaging to capture niche segments. Their strategies emphasize artisanal quality, seasonal innovation, and personalized customer experiences to differentiate from larger, mass-market players.

Across the market, private-label and retail bakery programs are expanding their assortment of macarons at competitive price points, increasing consumer access while creating margin pressure on smaller specialty players. Consolidation and strategic collaborations are likely to continue as brand reputation, culinary expertise, and distribution reach become critical success factors in this highly competitive premium dessert space.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.7 billion |

| Flavor | Chocolate, Fruit-flavored, Caramel, Lemon, Vanilla, Pistachio, Basic, Others |

| Distribution Channel | Supermarket/Hypermarket, Specialty Stores, Online Retail, Others |

| Key Countries Covered | United States, Germany, United Kingdom, France, Italy |

| Key Companies Profiled | Ladurée Paris, Chantal Guillon, Dana's Bakery, Dalloyau, Pierre Hermé Paris, Jean-Paul Hevin, Tipiak Group, La Maison du Chocolat, Olivia Macaron, RICHART |

| Additional Attributes | Dollar sales by product type and flavor, regional demand trends, premiumization in macarons, influence of clean-label trends, impact of sustainable packaging, growth of plant-based dessert formats, and competitive strategies focusing on flavor, texture, and artisanal positioning |

The global united states and europe macarons market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the united states and europe macarons market is projected to reach USD 3.5 billion by 2035.

The united states and europe macarons market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in united states and europe macarons market are fruit-flavored, chocolate, caramel, lemon, vanilla, pistachio, basic and others.

In terms of distribution channel, supermarket/hypermarket segment to command 42.3% share in the united states and europe macarons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA