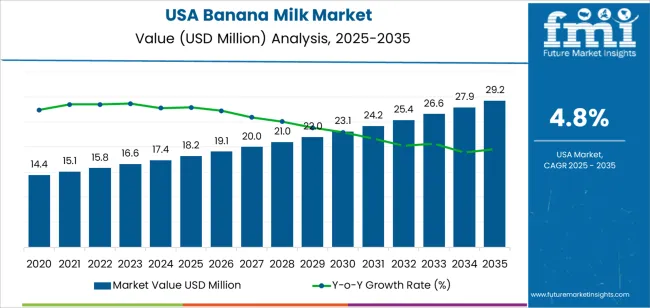

The demand for banana milk in the USA is expected to grow from USD 18.2 million in 2025 to USD 29.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. Banana milk, known for its unique flavor and nutritional benefits, is gaining traction as an alternative milk product, driven by the increasing demand for plant-based and dairy-free beverages. The market for banana milk is also supported by rising consumer interest in innovative dairy alternatives, particularly as more people seek lactose-free, dairy-free, and vegan-friendly products. The steady increase in health-conscious consumers and the growing trend toward plant-based diets will continue to drive the demand for banana milk.

The market will experience gradual growth over the forecast period, with demand rising from USD 18.2 million in 2025 to USD 19.1 million in 2026, and USD 20.0 million in 2027. By 2028, the market will increase to USD 21.0 million, with further growth expected in the following years. By 2035, the demand for banana milk is expected to reach USD 29.2 million, reflecting sustained consumer interest and the ongoing expansion of the plant-based beverage market.

The banana milk market in the USA is expected to continue growing steadily over the next decade. Starting at USD 18.2 million in 2025, the market will rise to USD 19.1 million in 2026 and USD 20.0 million in 2027. By 2029, demand will reach USD 22.0 million, with continued growth expected throughout the 2030s. By 2035, the market for banana milk is projected to reach USD 29.2 million, driven by increasing consumer demand for dairy alternatives, the popularity of flavored plant-based beverages, and the ongoing growth of the health-conscious and vegan consumer base.

The long-term value accumulation curve for banana milk shows a consistent and steady increase over the forecast period. From 2025 to 2035, the market will experience an accumulation of approximately USD 11 million in value, reflecting sustained growth driven by the increasing adoption of plant-based products and the expanding range of options for consumers. The curve demonstrates a smooth upward trend, indicating steady market demand without significant volatility. As banana milk continues to gain popularity as a dairy alternative, its market value will accumulate gradually, reaching the projected USD 29.2 million by 2035. This growth pattern reflects the steady accumulation of market share within the broader plant-based beverage category, with the potential for continued expansion as consumer preferences evolve.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 18.2 million |

| Industry Forecast Value (2035) | USD 29.2 million |

| Industry Forecast CAGR (2025 to 2035) | 4.8% |

Demand for banana milk in the USA is rising alongside increasing consumer interest in plant based beverages and dairy alternatives. Many consumers are shifting away from traditional dairy because of lactose intolerance, dietary preferences, or eco conscious choices. In this context, banana milk stands out as a flavored, often dairy free alternative that delivers sweetness and a creamy texture without reliance on cow’s milk. As part of the broader growth of plant based and flavored milk alternatives, banana milk benefits from this shift in consumption habits.

At the same time, beverage trends toward convenience, nutrition, and taste are fueling adoption of ready to drink banana milk products. Consumers increasingly seek on the go beverage options that offer pleasant flavor along with perceived nutritional or functional benefits. Banana milk fits this demand as a palatable, easy to consume product. Producers frequently enhance banana milk formulations with added nutrients, vitamins, or minerals to appeal to health conscious buyers.

Given the growing acceptance of plant based milks, rising consumer interest in flavored and functional beverages, and the appeal of banana milk’s taste and convenience, demand for banana milk in the USA is likely to continue growing steadily over the coming years.

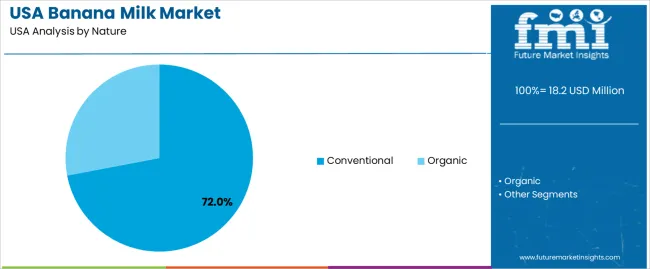

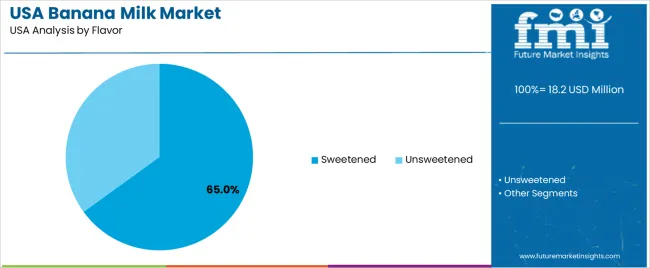

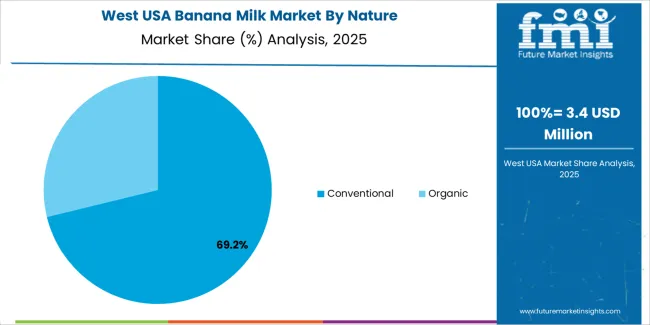

The demand for banana milk in the USA is primarily driven by nature and flavor. The leading nature is conventional, accounting for 72% of the market share, while sweetened is the dominant flavor, capturing 65% of the demand. Banana milk, known for its creamy texture and naturally sweet banana flavor, is increasingly popular among consumers seeking plant-based milk alternatives. The growing focus on flavor customization and dietary preferences continues to drive demand for both conventional and sweetened versions of banana milk in the USA.

Conventional banana milk leads the demand in the USA, holding 72% of the market share. Conventional banana milk is typically made from a combination of water, bananas, and added sweeteners or flavorings, offering a rich and smooth taste that appeals to a broad range of consumers. This version is widely available in supermarkets and grocery stores and is generally less expensive than its organic counterparts, making it more accessible to a larger consumer base.

The demand for conventional banana milk is driven by its affordability, availability, and familiarity. As more consumers look for plant-based alternatives to dairy, conventional banana milk provides a flavorful and cost-effective option. It is also a popular choice for consumers who enjoy sweetened beverages but prefer a non-dairy alternative. With the growing interest in plant-based and lactose-free products in the USA, conventional banana milk is expected to maintain its dominant position in the market.

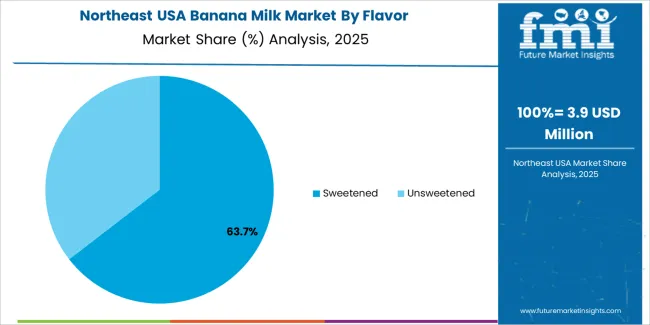

Sweetened banana milk leads the flavor demand in the USA, capturing 65% of the market share. Sweetened banana milk typically contains added sugar or sweeteners to enhance the natural sweetness of the banana flavor, making it more appealing to consumers who enjoy a sweeter taste in their beverages. This version is often favored by individuals who are looking for a dessert-like drink or a sweet alternative to traditional dairy milk.

The demand for sweetened banana milk is driven by consumer preferences for sweeter flavors, particularly in the growing plant-based beverage market. Sweetened banana milk is popular in smoothies, cereals, and as a standalone drink, offering a satisfying and indulgent option for those seeking comfort and flavor in their beverages. As consumers continue to explore plant-based alternatives to traditional dairy products, sweetened banana milk is expected to remain a strong choice, particularly in the snack and beverage categories.

Demand for banana milk in the USA is growing as consumers increasingly seek plant based and flavored milk alternatives. Banana milk is gaining popularity due to its unique taste profile and appeal to consumers looking for lactose free, allergen friendly beverages. The rise in the demand for convenient, ready to drink beverages, coupled with health trends favoring dairy alternatives, has supported the growth of banana milk. As lifestyles become busier, consumers are looking for easy-to-consume beverages that provide both taste and nutritional value, which makes banana milk an attractive option.

What are the Drivers of Demand for Banana Milk in the USA?

Several factors are driving the growing demand for banana milk in the USA. The increasing interest in plant based alternatives to dairy products is a significant driver, as more consumers opt for lactose free and vegan-friendly options. The appeal of banana milk as a flavored and novel beverage also attracts consumers, especially younger demographics who seek variety beyond traditional milk options. Additionally, the convenience of ready to drink packaging caters to on the go consumers, making banana milk a popular choice in busy lifestyles. As health awareness grows, banana milk’s nutrient profile, including potassium and fiber, makes it an appealing option for consumers looking for nutritious and functional beverages.

What are the Restraints on Demand for Banana Milk in the USA?

Despite the growing interest, there are factors that may restrain the demand for banana milk in the USA. Competition from other plant based milks, such as almond, oat, and soy, can limit banana milk's market share, as these alternatives have established consumer bases. Additionally, some consumers may be concerned about the nutritional content of banana milk, particularly its lower protein content compared to dairy milk, which could limit its appeal for those seeking more complete nutritional profiles. Price sensitivity may also be a restraint, as the cost of banana milk could be higher compared to traditional dairy or other plant based alternatives, making it less attractive to cost conscious buyers. Finally, consumer trends toward less processed or unflavored beverages may reduce interest in flavored milk options like banana milk.

What are the Key Trends Influencing Demand for Banana Milk in the USA?

Key trends influencing the demand for banana milk in the USA include the growing shift toward plant based and dairy alternative beverages. As more consumers reduce their dairy intake due to health or ethical reasons, plant based milks like banana milk are benefiting from this broader trend. There is also increasing interest in flavored milk alternatives, as consumers look for unique and exotic options beyond traditional flavors. The convenience of ready to drink beverages, particularly in shelf stable formats, is another trend driving the demand for banana milk, as busy consumers seek convenient and nutritious options. Additionally, as more consumers prioritize health and wellness, banana milk's natural sweetness, potential vitamins, and dairy-free profile align with the growing demand for functional beverages.

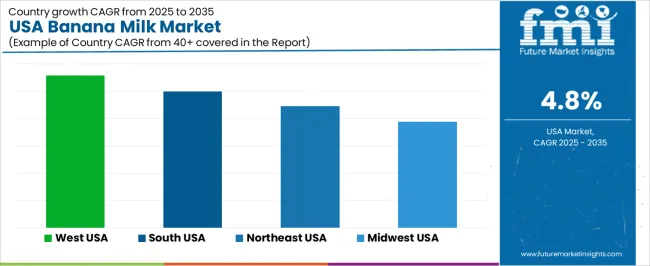

The demand for banana milk in the USA is projected to grow steadily across regions, with the West USA leading at a CAGR of 5.6%. The South USA follows with a CAGR of 5.0%, driven by increasing interest in plant-based and flavored milk products. The Northeast USA is expected to grow at 4.5%, while the Midwest USA shows a slightly lower growth rate of 3.9%. These regional variations are influenced by factors such as consumer preferences, regional dietary trends, availability of plant-based alternatives, and regional market maturity.

| Region | CAGR (%) |

|---|---|

| West USA | 5.6 |

| South USA | 5.0 |

| Northeast USA | 4.5 |

| Midwest USA | 3.9 |

In the West USA, the demand for banana milk is expected to grow at a CAGR of 5.6%. This growth is supported by the region’s strong trend toward plant-based products and innovative food options. The West, particularly states like California and Oregon, has a large market for alternative dairy products, with consumers increasingly seeking new, nutritious, and eco-friendly beverages. The demand for banana milk is also driven by health-conscious consumers who are drawn to its dairy-free, high-protein content and naturally sweet flavor. Additionally, the West USA has a large, diverse population with a high level of awareness about the benefits of plant-based diets, further fueling the growth of banana milk in the region.

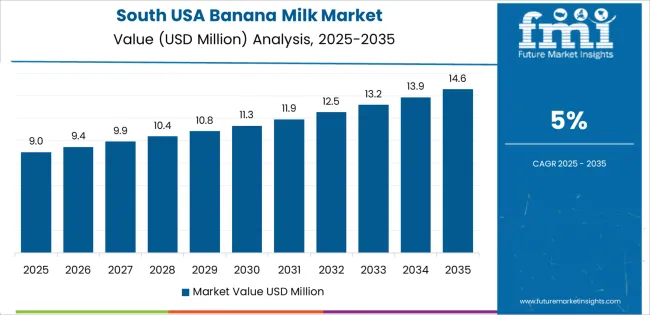

In the South USA, the demand for banana milk is projected to grow at a CAGR of 5.0%, reflecting an increasing shift toward plant-based beverages and unique flavored milk options. The South has witnessed growing interest in non-dairy milk alternatives, driven by concerns about lactose intolerance, vegan diets, and the desire for healthier food choices. Banana milk, with its naturally sweet flavor and nutritional benefits, appeals to health-conscious consumers in the region. Additionally, Southern states are known for embracing innovative food and beverage trends, which contributes to the growing popularity of banana milk in the South. As retail availability increases, this trend is expected to expand further.

In the Northeast USA, the demand for banana milk is expected to grow at a CAGR of 4.5%. The Northeast, with its large metropolitan areas like New York and Boston, has a diverse and health-conscious consumer base that is increasingly adopting plant-based diets. Banana milk fits well with this trend, offering a dairy-free, nutritious alternative to traditional milk. As more consumers seek variety in their beverage choices, the appeal of flavored and plant-based milks, including banana milk, continues to rise. The region’s strong retail infrastructure and increasing awareness of dietary preferences further support the growth of banana milk in the Northeast.

In the Midwest USA, the demand for banana milk is projected to grow at a CAGR of 3.9%. The Midwest, traditionally known for its strong dairy consumption, is gradually embracing plant-based alternatives as consumer preferences evolve. While dairy remains a staple in the region, there is growing awareness of lactose intolerance and plant-based diets, particularly among younger consumers. As demand for alternative milk options like oat, almond, and coconut milk rises, banana milk is becoming a popular addition to the range of available plant-based beverages. Despite slower growth compared to other regions, the Midwest’s growing interest in health and wellness, coupled with the increasing availability of plant-based products, will contribute to steady demand growth for banana milk in the region.

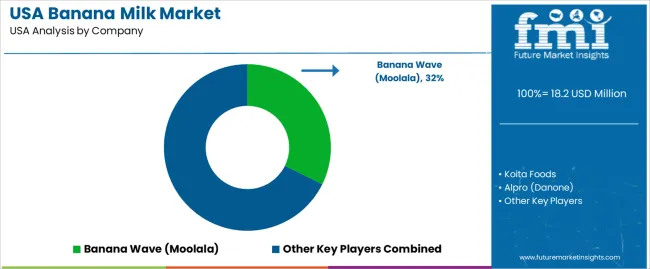

Demand for banana milk style beverages in the USA is rising as consumers increasingly prefer plant based, lactose free and allergen friendly alternatives to traditional dairy. Firms offering banana milk focus on non dairy, gluten free and nut free formulations to appeal to health conscious, vegan and allergy sensitive consumers. Among these firms, Banana Wave (also known as Moolala) holds about 32.3% of the U.S. banana milk market. Other important players in this space include Koita Foods, Alpro (owned by Danone), Good Karma Foods and Mooala. These companies supply banana based milks for direct consumption, smoothies, breakfast cereals, and as dairy substitutes in recipes.

Competition among these providers generally centres on product formulation, ingredient sourcing, packaging formats, and distribution reach. Some emphasise clean label ingredients and allergen free recipes to meet demand from health oriented consumers. Others invest in shelf stable packaging and fortified nutrition to improve convenience and appeal. Firms also differentiate via flavor variations, protein or nutrient fortification, and strategic retail placement in mainstream supermarkets and online grocery channels. The resulting market remains dynamic. Suppliers continually refine banana milk products to respond to evolving consumer tastes, dietary preferences, and non dairy beverage trends.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Nature | Conventional, Organic |

| Flavor | Sweetened, Unsweetened |

| Sales Channel | Indirect, Direct |

| Key Companies Profiled | Banana Wave (Moolala), Koita Foods, Alpro (Danone), Good Karma Foods, Mooala |

| Additional Attributes | The demand for banana milk in the USA is driven by the growing trend towards plant-based beverages and lactose-free alternatives to traditional dairy milk. Both conventional and organic options are available, catering to the rising consumer interest in healthier, natural products. Banana milk is offered in both sweetened and unsweetened flavors, with sweetened varieties being more popular among consumers seeking a dessert-like drink. Sales channels include both indirect retail sales and direct-to-consumer options, with an increasing presence in online platforms. Key players like Mooala, Koita Foods, and Alpro (Danone) are at the forefront of the market, offering a variety of flavors and formulations designed to meet consumer preferences. The market is expected to continue expanding as demand for plant-based and dairy alternatives grows in the health-conscious consumer segment. |

The demand for banana milk in USA is estimated to be valued at USD 18.2 million in 2025.

The market size for the banana milk in USA is projected to reach USD 29.2 million by 2035.

The demand for banana milk in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in banana milk in USA are conventional and organic.

In terms of flavor, sweetened segment is expected to command 65.0% share in the banana milk in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Milk Market Trends - Demand & Growth 2025 to 2035

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

Demand for Organic Milk in USA Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA