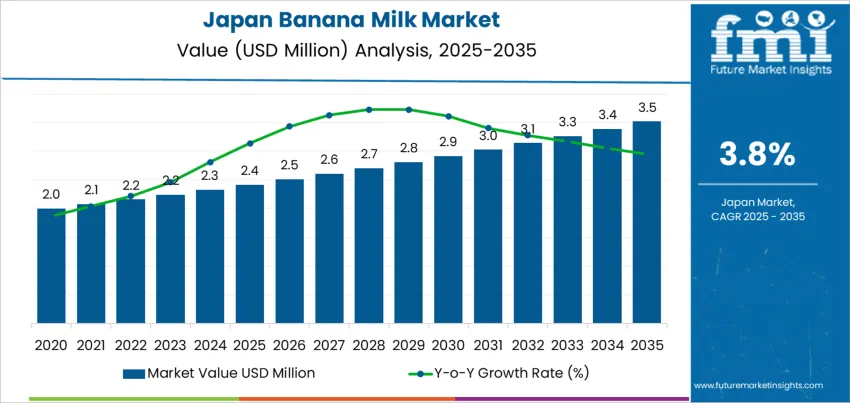

The Japan banana milk demand is valued at USD 2.4 million in 2025 and is forecasted to reach USD 3.5 million by 2035, reflecting a CAGR of 3.8%. Demand is shaped by steady consumption of flavoured dairy beverages, broader availability of single-serve drink formats, and interest in fruit-based flavours within daily snacking and breakfast routines. Banana milk continues to appeal to younger consumers and households seeking familiar tastes combined with perceived nutritional benefits.

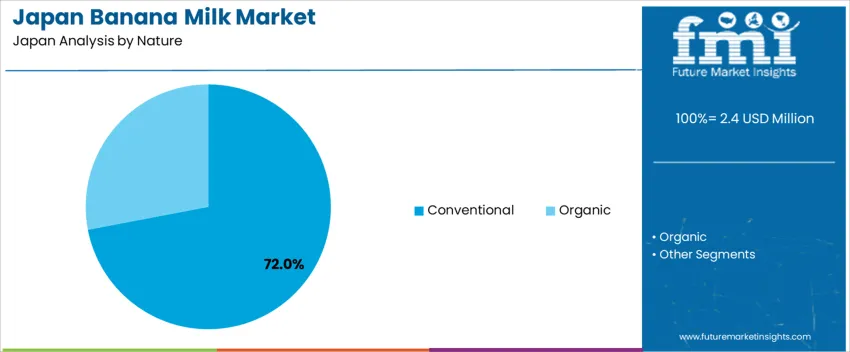

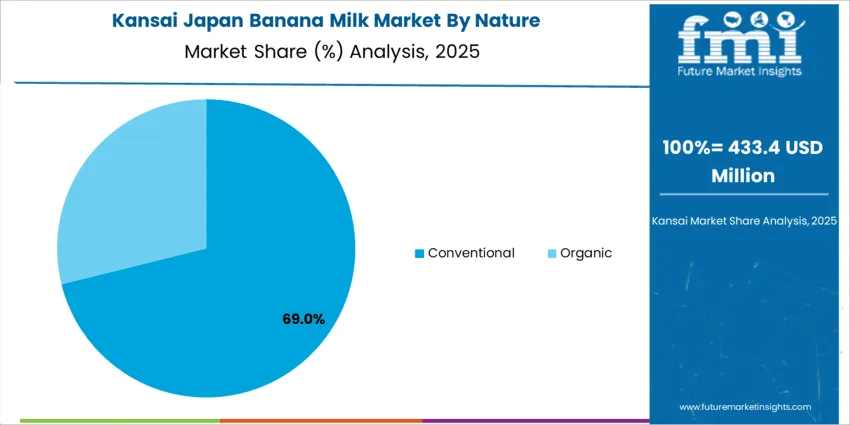

Conventional banana milk dominates the product landscape. Consistent pricing, wide distribution, and established dairy-processing capacity support its leading position over organic alternatives. Product innovation focuses on shelf-stable formulations, reduced-sugar recipes, and blends incorporating added vitamins or functional ingredients to strengthen positioning in the health-oriented beverage category.

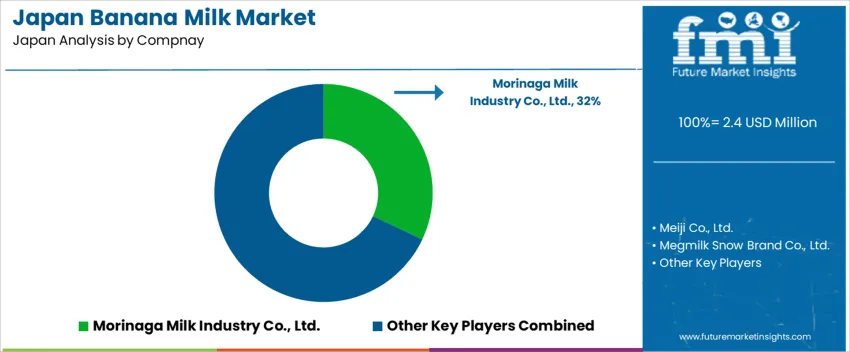

Kyushu & Okinawa, Kanto, and Kansai register the highest uptake due to larger retail footprints, higher beverage consumption frequency, and well-developed cold-chain networks. These regions host major dairy processors and deliver broad access through supermarkets, convenience stores, and vending channels. Key suppliers include Morinaga Milk Industry Co., Ltd., Meiji Co., Ltd., Megmilk Snow Brand Co., Ltd., Koiwai Dairy Products Co., Ltd., and Ito En, Ltd. Their strategies involve expanding regional penetration, upgrading flavour profiles, and strengthening brand differentiation in a segment characterized by moderate but consistent demand growth.

Demand for banana milk in Japan shows a two-phase growth pattern shaped by novelty appeal and category maturation. In the early phase, growth is driven by limited-edition launches, convenience-store placement, and social visibility. Trial consumption and curiosity lead to short bursts of higher demand, especially among younger consumers. Product variety, including functional or low-sugar versions, supports additional early momentum.

In the later phase, growth shifts toward repeat purchasing and brand loyalty. The curve moderates as novelty diminishes, and the category competes more directly with flavored dairy drinks and plant-based alternatives. Sustained demand depends on nutritional positioning, pack-size optimization, and consistent availability in mainstream retail. Innovation cycles still contribute to uplift, but the frequency of spikes reduces as the product finds a stable role in beverage portfolios.

The comparison indicates that early growth relies on promotional excitement and new-product exposure, while late growth reflects balanced, recurring consumption. Expansion continues, but with a moderate curve as banana milk transitions from trend-led adoption toward routine, differentiated dairy beverage usage within Japan.

| Metric | Value |

|---|---|

| Japan Banana Milk Sales Value (2025) | USD 2.4 million |

| Japan Banana Milk Forecast Value (2035) | USD 3.5 million |

| Japan Banana Milk Forecast CAGR (2025-2035) | 3.8% |

Demand for banana milk in Japan is increasing because consumers show strong interest in flavored dairy beverages that offer a familiar and mildly sweet taste suited to both children and adults. Convenience stores and supermarkets promote single serve banana milk varieties that support on the go drinking during commutes and school activities. The product fits well within Japan’s preference for limited edition beverages, encouraging brands to introduce seasonal packaging and collaborations that drive trial purchases.

Growth in home consumption of snacks and beverages reinforces demand for drinks that combine flavor enjoyment with the nutritional familiarity of milk. Banana milk is also used as a dessert style drink, which appeals to younger consumers seeking novelty without strong or unfamiliar flavors. Product placement near coffee drinks and flavored milk supports frequent visibility at retail.

Constraints include competition from plant based milk alternatives and other flavored dairy beverages that offer lower sugar options. Health conscious shoppers may limit consumption when sugar content is high, and some buyers prefer fresh fruit smoothies instead of processed beverages. Shelf space competition in convenience channels may restrict the number of variants offered at one time.

Demand for banana milk in Japan is supported by its popularity as a convenient, flavored dairy beverage appealing to children, students, and on-the-go consumers. Growth is linked to product placement in convenience retail, vending machines, and ready-to-drink categories. Functional positioning with calcium and vitamin enrichment sustains household uptake. Demand also aligns with limited-edition flavors and brand collaborations that enhance consumer curiosity and repeat purchases.

Conventional banana milk holds 72.0%, supported by affordable mass-market offerings widely distributed across convenience stores, supermarkets, and foodservice outlets. Manufacturers focus on long shelf-life UHT variants and cost-efficient dairy sourcing to maintain competitive pricing. Organic variants represent 28.0%, gaining traction among health-aware shoppers prioritizing clean-label ingredients and reduced pesticide exposure. Adoption remains moderate due to premium pricing and limited SKU availability outside metropolitan areas. Conventional products continue to lead due to broad consumption among younger demographics and high brand familiarity. Production and distribution efficiencies support steady preference for everyday consumption formats across multipacks and single-serve options.

Key Points:

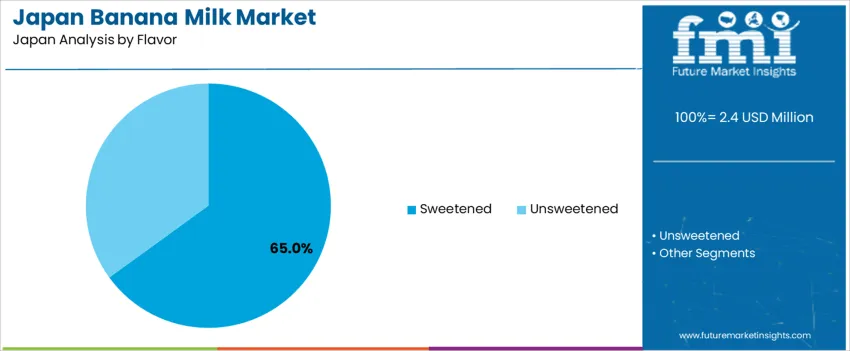

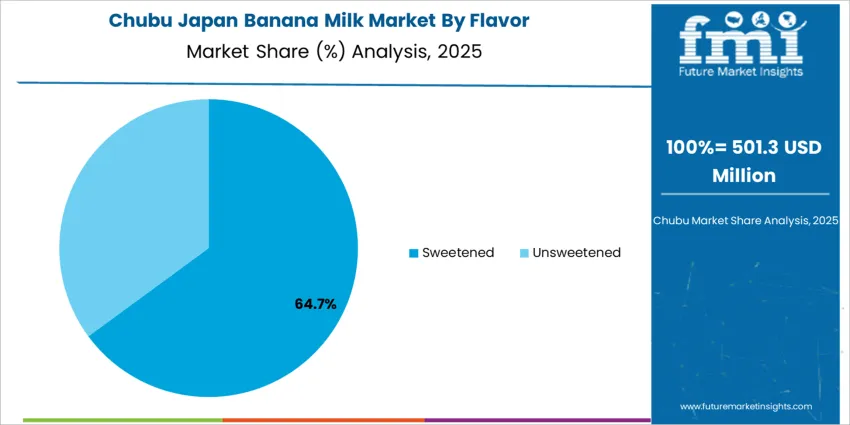

Sweetened banana milk accounts for 65.0%, driven by Japan’s strong preference for indulgent dairy tastes and flavored RTD beverages. These products target school-age consumers and teens drawn to creamy, dessert-like finishes. Unsweetened variants represent 35.0%, positioned for calorie-conscious adults and households managing sugar intake. Their growth is supported by improved formulations that retain fruit flavor without artificial sweeteners. Sweetened varieties remain dominant due to habitual consumption patterns and greater representation in vending channels. Flavor innovation focuses on balanced sweetness, texture enhancement, and reduced additives to meet evolving nutrition labeling requirements.

Key Points:

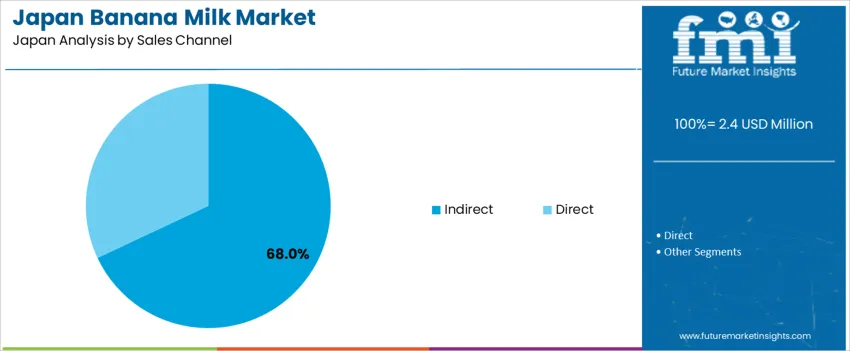

Indirect channels account for 68.0%, including supermarkets, convenience stores, and wholesalers that enable extensive national reach. Convenience stores play a significant role due to impulse buying and chilled drink accessibility near schools and transit hubs. Direct channels represent 32.0%, covering brand-owned delivery, cafés, and e-commerce platforms. Online growth is steady, supported by multipack ordering and subscription deliveries. Indirect retail dominance persists due to high foot traffic and rapid replenishment cycles. Channel strategies emphasize cold chain reliability and prominent shelf positioning within flavored dairy and breakfast drink segments.

Key Points:

Expansion of flavored dairy beverages, nostalgia-driven consumer interest and increased visibility in convenience retail channels are driving demand.

In Japan, banana milk adoption grows as flavored dairy products remain popular among students, young adults and office workers seeking sweet, portable beverages. Convenience stores located near train stations and residential zones promote single-serve banana milk as a refreshing snack drink available throughout the day. Retro-themed flavors and packaging tap into nostalgia, which resonates with consumers familiar with banana-flavored products historically marketed in Japan. Cafes and dessert shops incorporate banana milk into specialty beverages, supporting brand collaboration and seasonal promotions. These factors contribute to steady demand within the chilled beverage category.

Competition from plant-based milks, sugar-reduction concerns and limited household storage space restrain demand.

Plant-based alternatives such as oat and almond beverages attract consumers seeking lower-calorie or lactose-free options, potentially displacing flavored dairy choices. Public health guidance encouraging reduced sugar intake influences purchasing decisions, especially for parents selecting drinks for children. Refrigeration storage in compact urban kitchens can limit multipack purchases, reducing volume growth for large-format sales. These dietary and lifestyle trends create measured demand growth despite strong impulse buying in convenience stores.

Shift toward low-sugar formulations, increased use of limited-edition packaging and rising demand in dessert-inspired variants define key trends.

Producers are reducing sugar content and introducing fiber-enriched options to align with wellness preferences while maintaining familiar sweetness. Limited-edition graphics tied to characters, regional events or seasonal fruit promotions help maintain consumer interest in a category driven by novelty appeal. Dessert-inspired variants such as banana pudding and chocolate-banana blends are gaining visibility on convenience-store shelves. Online grocery platforms and chilled vending placements are expanding access beyond traditional retail sites. These trends suggest that banana milk maintains niche but durable demand within Japan’s flavored dairy landscape.

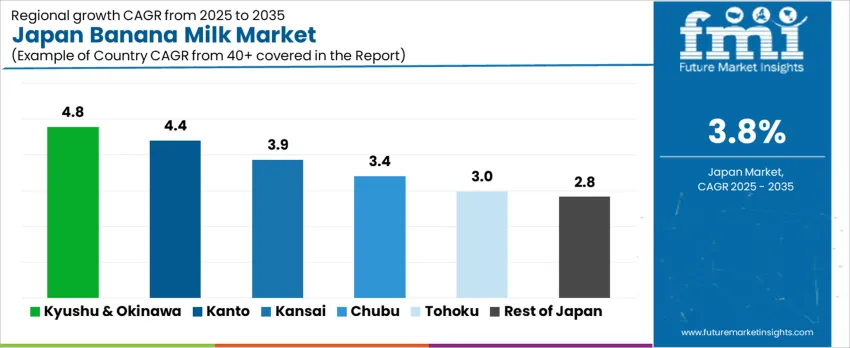

Demand for banana milk in Japan reflects interest in flavored dairy beverages suited to chilled convenience retail and home consumption. Product rotation aligns with breakfast convenience, snack occasions, and limited-edition flavor experimentation. Growth shows regional variation based on retail density, student populations, tourism activity, and distribution coverage. Kyushu & Okinawa lead at 4.8% CAGR, followed by Kanto (4.4%), Kansai (3.9%), Chubu (3.4%), Tohoku (3.0%), and the Rest of Japan (2.8%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.8% |

| Kanto | 4.4% |

| Kansai | 3.9% |

| Chubu | 3.4% |

| Tohoku | 3.0% |

| Rest of Japan | 2.8% |

Kyushu & Okinawa record 4.8% CAGR due to a strong convenience-store presence, high tourism interaction, and wide refrigerated distribution across warm-weather coastal locations. Local consumption patterns support sweet dairy beverages as portable refreshment for transit and leisure routines. Student populations in cities like Fukuoka drive frequent single-serve purchases linked to snack times, reinforcing repeat volume.

Hospitality venues and hotels maintain beverage availability as part of breakfast offerings for visiting travelers. Banana milk marketed with regional fruit branding finds acceptance due to familiarity with sweet flavor preferences. Packaged formats with mild texture and portion-controlled sizing appeal to buyers seeking quick energy intake during daily activities. Retailers maintain broad coverage of seasonal SKUs that change based on school holidays and tourism peaks. Shelf stability expectations emphasize packaging that withstands temperature variation during high-turnover restocking cycles.

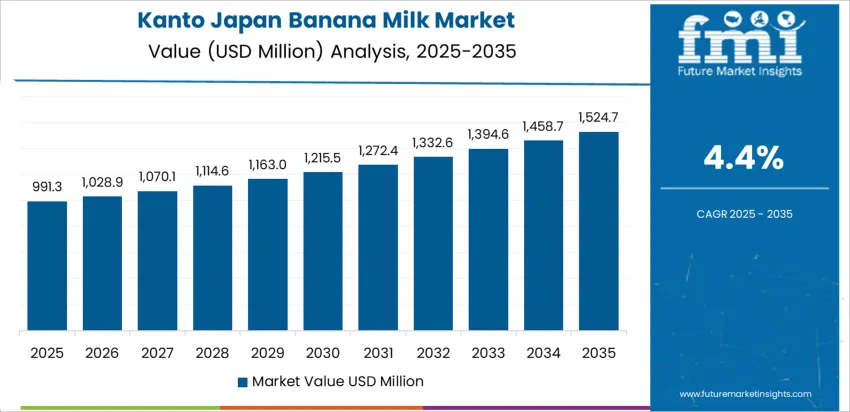

Kanto posts 4.4% CAGR with Tokyo, Kanagawa, and Chiba driving strong retail throughput through convenience, supermarket, and station-area vending channels. High commuter activity supports grab-and-go beverage selection where banana milk fits short-duration consumption behavior. Product availability covers national dairy brands and distributed license variants that match established flavor preferences. Nutrition-positioned messaging focusing on energy intake and fruit association maintains shelf presence in youth-focused retail zones.

Food-service channels include banana milk in student cafeterias and smaller eateries. Packaging formats that accommodate small backpack space perform well. Promotions emphasize limited seasonal launches aligned with large events such as school entry months and summer breaks. Distribution centers in Greater Tokyo ensure consistent inventory flow across high-traffic stores to maintain cold-chain reliability.

Kansai grows at 3.9% CAGR with Osaka, Kyoto, and Kobe contributing through dense retail zones and culinary-culture influence. Banana milk complements snack purchasing tied to convenience retailers located near schools, residential areas, and sightseeing routes. Regional beverage suppliers evaluate packaging ease for vending-machine compatibility, ensuring accessibility in public spaces. University districts contribute regular small-pack sales linked to daily study breaks. Retailers emphasize competitive price positioning to encourage steady impulse purchasing. Distribution planning aligns with weekend consumer flows and holiday tourism spikes. Packaged banana milk appeals as a sweet refreshment option balancing flavor and mild nutrition familiarity.

Chubu advances at 3.4% CAGR, influenced by commuter routes surrounding Nagoya and surrounding prefectures. Beverage selection in convenience and supermarket channels supports quick access for workers seeking refreshing options during breaks or after transit. Local dairy producers partner with retailers for rotating flavor variants aligned to regional marketing. Logistics teams emphasize temperature stability through inland transport. Retail assortments center on core SKUs offering recognizable flavor consistency.

Tohoku records 3.0% CAGR with demand emerging from convenience-oriented purchasing in smaller cities where chilled beverage sections remain core to local retail. Household shopping trips include selected flavored dairy options that accompany breakfast or snack use. Seasonal climate shifts require packaging that maintains quality under colder conditions. Price sensitivity influences inventory decisions for smaller stores managing limited chilled-shelf capacity.

The Rest of Japan posts 2.8% CAGR, supported by gradual acceptance in suburban and rural retail settings where demand rises through familiarity with mainstream dairy beverages. Multi-pack promotions support household stocking. Distribution ensures steady availability dependent on weekly supply cycles. Retailers retain staple flavors that align with predictable consumption patterns observed in family-shopping behavior.

Demand for banana milk in Japan is supported by dairy companies supplying flavoured milk beverages through convenience stores, supermarkets, and vending platforms. Morinaga Milk Industry Co., Ltd. holds an estimated 32.0% share, supported by controlled flavour-stability performance, consistent pasteurization standards, and strong nationwide refrigeration logistics. Its banana-milk products maintain predictable texture and reliable shelf handling in Japan’s high-turnover retail environment.

Meiji Co., Ltd. maintains strong participation with banana-flavoured milk lines designed for stable sweetness balance and uniform sensory experience across packaging formats. Megmilk Snow Brand Co., Ltd. contributes through chilled beverages aimed at children and office-worker consumption routines, with dependable protein composition and distribution into suburban outlets.

Koiwai Dairy Products Co., Ltd. supports niche demand using premium dairy bases that emphasize mouthfeel consistency. Ito En, Ltd. provides selective plant-based alternatives where lactose-free formulations and lighter flavour profiles support dietary-preference segments. Competition focuses on flavour uniformity, cold-chain reliability, packaging convenience, and retail shelf efficiency. Demand remains steady as banana milk continues to serve daily refreshment and snack-time consumption in Japan’s established dairy-beverage ecosystem.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Nature | Conventional, Organic |

| Flavor | Sweetened, Unsweetened |

| Sales Channel | Indirect, Direct |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Morinaga Milk Industry Co., Ltd., Meiji Co., Ltd., Megmilk Snow Brand Co., Ltd., Koiwai Dairy Products Co., Ltd., Ito En, Ltd. |

| Additional Attributes | Sales by nature, flavor type, and distribution model; product availability across convenience stores and vending ecosystems; expansion in flavored dairy beverages; growth driven by youth beverage trends and limited-edition offerings; competition with plant-based banana milk variants; adoption concentration in Kanto and urban retail environments. |

The demand for banana milk in Japan is estimated to be valued at USD 2.4 million in 2025.

The market size for the banana milk in Japan is projected to reach USD 3.5 million by 2035.

The demand for banana milk in Japan is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in banana milk in Japan are conventional and organic.

In terms of flavor, sweetened segment is expected to command 65.0% share in the banana milk in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Banana Milk in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Organic Milk in Japan Size and Share Forecast Outlook 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA