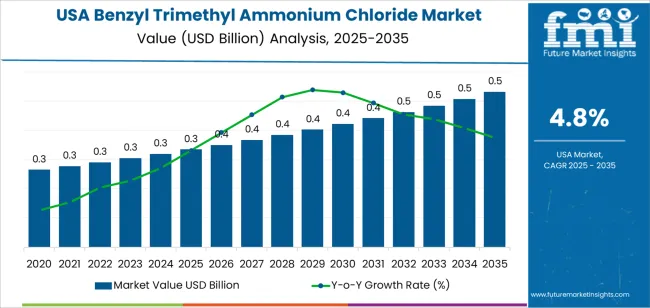

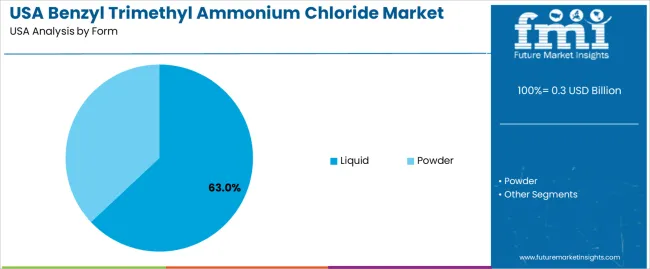

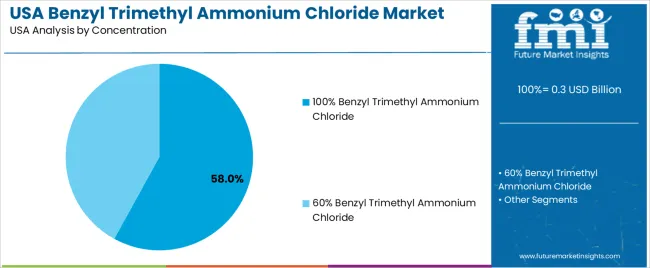

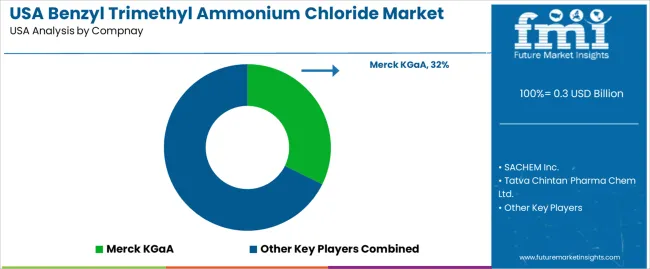

In 2025, the demand for benzyl trimethyl ammonium chloride in the USA is valued at USD 0.3 billion and is projected to reach USD 0.5 billion by 2035 at a CAGR of 4.8%. Market stability in the first half of the forecast reflects consistent industrial consumption rather than rapid capacity expansion. Liquid formulations account for 63% of total demand as they align with bulk handling needs in oilfield services and chemical processing. Products with 100% concentration hold 58% share due to their higher efficiency in drilling fluids, biocidal applications, and specialty synthesis. Oilfields represent the largest application at 31%, followed by agrochemicals at 26%, supported by steady drilling activity and crop protection demand across key producing states.

From 2030 onward, value growth becomes more diversified across downstream sectors. Polymers account for 18% of demand as the compound is used in antistatic agents and phase transfer catalysis for specialty materials. Pharmaceuticals contribute 15% through controlled synthesis processes, while personal care and cosmetics hold 10% through conditioning and antimicrobial formulations. Powder forms retain a 37% share where dry handling and blended formulations are required. The supplier base in the USA includes Merck KGaA, SACHEM Inc., Tatva Chintan Pharma Chem Ltd., Novo Nordisk Pharmatech A/S, and Stepan Company. Competitive strategies focus on purity control, batch consistency, regulated supply for pharma uses, and long term procurement agreements with oilfield and chemical processors.

The overall demand for benzyl trimethyl ammonium chloride in USA remains structurally stable between 2025 and 2030, increasing from USD 0.3 billion to USD 0.4 billion. This USD 0.1 billion expansion over five years reflects a controlled growth phase shaped by steady use in industrial disinfectants, water treatment formulations, textile processing, and specialty chemical applications. Demand during this phase is primarily volume anchored rather than price driven, with consumption tied to baseline sanitation, antimicrobial treatments, and process chemical requirements. The flat structure observed across multiple early years indicates that penetration is mature in core applications, with new demand arising mainly from incremental capacity additions rather than new end use verticals.

From 2030 to 2035, the market expands from USD 0.4 billion to USD 0.5 billion, again adding USD 0.1 billion but on a higher base. This second phase reflects compounding rather than acceleration, driven by sustained regulatory compliance needs, steady industrial hygiene demand, and continued reliance on quaternary ammonium compounds in controlled environments. The growth pattern remains smooth and back weighted, confirming that long term expansion is driven by repeat industrial consumption cycles rather than episodic demand spikes. Value per unit remains largely stable, and total demand increases through gradual scale-up in manufacturing, utilities, and institutional applications rather than product substitution dynamics.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.3 billion |

| Forecast Value (2035) | USD 0.5 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Demand for benzyl trimethyl ammonium chloride in the USA has historically been driven by its role as a quaternary ammonium compound used in disinfection, surfactant systems, and phase transfer catalysis. Early growth came from institutional cleaning, food processing sanitation, and water treatment, where consistent antimicrobial performance became a baseline requirement. Expansion of commercial facilities, healthcare infrastructure, and large-scale food production increased routine consumption. Industrial users also adopted this compound in textile processing, coatings, and material preservation. During periods of heightened hygiene awareness, procurement cycles accelerated as buyers shifted toward proven disinfectant chemistries with broad applicability. Household and personal care formulations using quats also contributed to steady baseline demand through detergents, fabric treatments, and specialty cleaners.

Future demand in the USA will be shaped by industrial sanitation requirements, formulation trends, and regulatory scrutiny. Growth will continue in institutional hygiene, water treatment, and controlled industrial environments where chemical efficacy outweighs substitution risk. At the same time, barriers will become more visible. Environmental persistence, aquatic toxicity concerns, and regulatory pressure on quaternary ammonium compounds will influence future USAge limits. Some end users are testing alternative biocides and non-quat surfactants to reduce long-term exposure risk. Cost sensitivity in consumer products and resistance to chemical harshness may slow household adoption. Market evolution will therefore depend on balancing performance reliability with tightening environmental and safety expectations across industrial and consumer sectors.

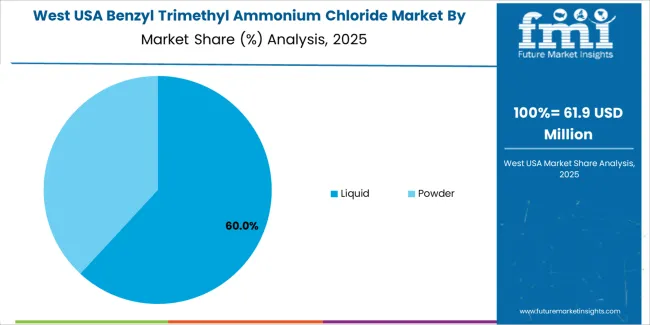

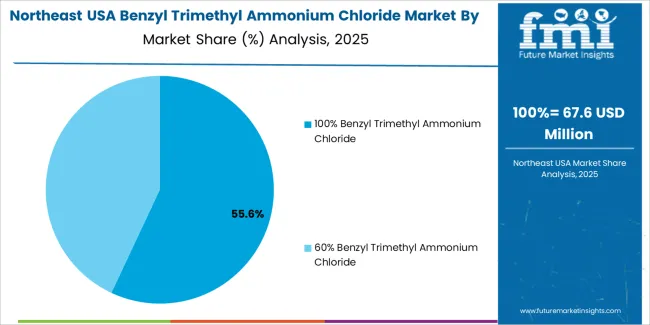

The demand for benzyl trimethyl ammonium chloride in the USA is structured by form and concentration. Liquid form accounts for 63% of total demand, while powder serves a smaller share focused on dry blending applications. By concentration, products based on 100% benzyl trimethyl ammonium chloride represent 58.0% of total consumption, followed by 60% concentration grades used in formulated blends. Demand patterns are shaped by handling efficiency, dilution practices, storage safety, and downstream formulation requirements. These segments reflect how application intensity, transport logistics, and end user processing preferences define purchasing behavior across industrial cleaning, water treatment, and chemical manufacturing sectors in the USA.

Liquid form accounts for 63% of total benzyl trimethyl ammonium chloride demand in the USA. This dominance reflects ease of handling, rapid solubility, and suitability for direct dosing in continuous processing systems. Liquid grades integrate efficiently into water treatment chemicals, disinfectant formulations, and industrial sanitation products where controlled metering is required. The ability to pump and automate liquid transfer reduces labor dependency and minimizes handling errors in high volume production environments.

Liquid form also offers advantages in transport and storage across centralized distribution networks. Bulk tank logistics support consistent supply to chemical formulators and treatment facilities. Compatibility with standard polymer containers and intermediate bulk containers simplifies warehousing infrastructure. Replacement purchasing patterns in municipal and industrial sanitation operations further support steady liquid volume demand. These operational and logistical efficiencies sustain liquid form as the dominant format for benzyl trimethyl ammonium chloride USAge across the USA.

Products based on 100% benzyl trimethyl ammonium chloride account for 58.0% of total demand in the USA. This concentration is favored for formulation flexibility, as it allows precise dilution control based on application strength requirements. Chemical manufacturers and water treatment formulators use full strength grades to customize end use concentrations for disinfectants, algaecides, textile auxiliaries, and industrial biocides. This approach improves inventory efficiency by reducing the number of stock keeping units required for different applications.

Higher concentration also lowers transport cost per unit of active ingredient by reducing excess water content. This improves freight efficiency in long distance chemical distribution across regional supply hubs. Regulatory documentation and concentration verification remain more standardized for neat grades in institutional procurement. These economic, formulation control, and logistics advantages position 100% concentration as the leading specification for benzyl trimethyl ammonium chloride consumption across the USA chemical processing ecosystem.

Demand for benzyl trimethyl ammonium chloride in the USA is driven by its broad use as a phase-transfer catalyst, surfactant, and antimicrobial agent across pharmaceuticals, chemicals, water treatment, and specialty manufacturing. U.S. chemical producers rely on this compound for reaction efficiency in organic synthesis and for improving yield control in fine chemicals. Growth in domestic pharmaceutical production and contract manufacturing supports stable consumption. Institutional and industrial cleaning sectors also contribute steady offtake due to its antimicrobial functionality. These diversified industrial uses anchor consistent baseline demand across multiple U.S. manufacturing verticals.

In the USA, benzyl trimethyl ammonium chloride is widely used in pharmaceutical synthesis as a catalyst and stabilizing agent during intermediate production. Growth in domestic drug manufacturing, sterile injectables, and specialty APIs sustains high-purity demand. The compound is also used in polymerization reactions, agrochemical intermediates, and specialty coatings where controlled phase transfer improves reaction consistency. Research laboratories and pilot-scale plants further contribute to repeated low-volume, high-margin consumption. These pharmaceutical and specialty chemical applications require strict purity control, reinforcing demand for refined grades rather than bulk industrial material.

Market expansion in the USA is constrained by regulatory oversight of quaternary ammonium compounds due to toxicity, handling, and wastewater discharge considerations. Compliance with environmental and occupational safety standards increases storage, transport, and labeling costs. Volatility in upstream raw materials affects production economics. End users also face rising scrutiny around surfactant residues in water treatment and cleaning applications. These regulatory and compliance burdens raise operational cost and slow penetration into lower-margin mass-use categories, keeping demand concentrated in regulated industrial and pharmaceutical segments.

Demand is shifting toward controlled-dosage, high-efficiency formulations to reduce waste and improve performance in reaction systems and antimicrobial applications. In U.S. water treatment, operators increasingly favor compounds that deliver predictable microbial control without excessive foaming or sludge formation. Specialty formulators use benzyl trimethyl ammonium chloride in niche coatings, biocide blends, and emulsifier systems where performance consistency is critical. Automation in chemical dosing and digital monitoring systems also influence procurement toward stable, high-quality supply. These trends reflect a move from volume-driven consumption to precision-driven industrial USAge.

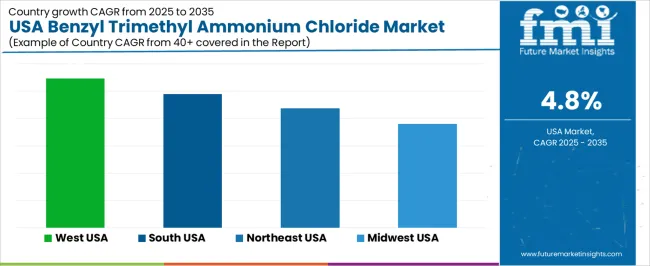

| Region | CAGR (%) |

|---|---|

| West | 5.5% |

| South | 4.9% |

| Northeast | 4.4% |

| Midwest | 3.8% |

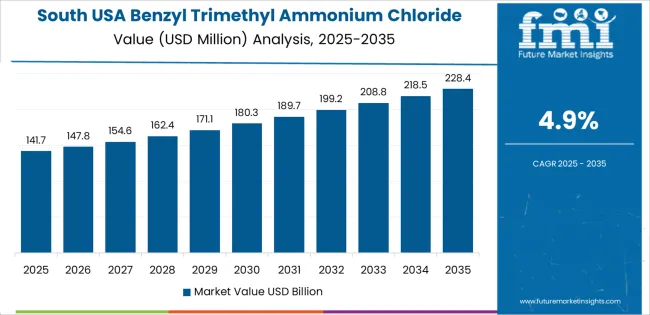

The demand for benzyl trimethyl ammonium chloride in the USA shows a clear regional ranking. The West leads with a 5.5 % CAGR, likely due to higher industrial, agricultural and disinfectant chemical consumption in states with large urban and coastal populations. The South follows at 4.9 %, reflecting demand from agriculture, water-treatment and cleaning-product industries across warm climates. The Northeast’s 4.4 % growth reflects demand from institutional cleaning, sanitation and industrial chemical users in urbanized areas. The Midwest at 3.8 % shows more modest growth, possibly due to a smaller industrial base and lower overall demand for quaternary ammonium compounds.

Expansion in the West reflects a CAGR of 5.5% through 2035 for benzyl trimethyl ammonium chloride demand, supported by strong consumption from water treatment, industrial sanitization, and specialty chemical formulation activities. Municipal utilities rely on quaternary ammonium compounds for surface disinfection and microbial control. Food processing and beverage plants maintain steady USAge for equipment sanitation. Pharmaceutical and laboratory cleaning applications contribute additional volume. Demand remains process driven rather than discretionary, with stable procurement schedules across public utilities and regulated industrial users supporting predictable chemical offtake across western states.

The South advances at a CAGR of 4.9% through 2035 for benzyl trimethyl ammonium chloride demand, driven by high agricultural processing activity, expanding food manufacturing, and regional water utility investments. Poultry, meat, and produce processing facilities require routine disinfectant USAge for hygiene compliance. Warm climate conditions support year round sanitation cycles. Regional chemical distributors serve a wide base of industrial users across rural and semi urban areas. Demand remains volume oriented, with consistent bulk chemical movement aligned with continuous production and cleaning requirements across southern processing corridors.

The Northeast records a CAGR of 4.4% through 2035 for benzyl trimethyl ammonium chloride demand, shaped by dense municipal sanitation programs, pharmaceutical manufacturing, and healthcare facility maintenance. Hospitals and laboratories depend on quaternary disinfectants for surface and equipment hygiene. Urban water treatment infrastructure sustains routine chemical dosing requirements. Cold climate conditions support seasonal cleaning and mold control applications. Demand emphasizes regulatory compliance and pathogen control rather than high volume industrial output, maintaining steady chemical throughput across institutional and municipal end users.

The Midwest expands at a CAGR of 3.8% through 2035 for benzyl trimethyl ammonium chloride demand, supported by meat processing, dairy sanitation, and municipal wastewater treatment operations. Large scale food processing plants require consistent disinfectant USAge to meet hygiene standards. Agricultural runoff management contributes to routine water treatment chemical use. Regional chemical blending and distribution centers support local supply chains. Demand remains operational and maintenance driven, with purchasing linked to plant operating schedules rather than market volatility across industrial and municipal sanitation applications.

Demand for benzyl trimethyl ammonium chloride in the USA is rising as industries increase use of disinfectants, sanitizers, water treatment agents, and surfactants. The compound’s effectiveness as a biocide and surfactant makes it useful across sanitation, personal care, and chemical processing segments. Hospitals, commercial cleaning services, and public facilities drive demand for disinfectant formulations. Growth in textile processing, agrochemical production, and industrial water treatment also requires surfactants and antimicrobial agents. Increased regulatory emphasis on hygiene and water safety supports broader adoption of this chemical compound across multiple sectors.

Key suppliers in the US market include Merck KGaA, SACHEM Inc., Tatva Chintan Pharma Chem Ltd., Novo Nordisk Pharmatech A/S, and Stepan Company. These firms supply benzyl trimethyl ammonium chloride and similar quaternary ammonium compounds to disinfectant, chemical, and industrial formulation customers. Large chemical companies maintain global supply chains and regulatory compliance, facilitating consistent availability for diverse applications. Specialty chemical firms contribute by offering custom concentrations and tailored formulations for water treatment, personal care, and industrial uses. The combined presence of global and regional suppliers helps sustain a competitive and resilient market structure.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Form | Liquid, Powder |

| Concentration | 100% Benzyl Trimethyl Ammonium Chloride, 60% Benzyl Trimethyl Ammonium Chloride |

| Applications | Oilfields, Agrochemicals, Polymers, Pharmaceuticals, Personal Care and Cosmetics |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Merck KGaA, SACHEM Inc., Tatva Chintan Pharma Chem Ltd., Novo Nordisk Pharmatech A/S, Stepan Company |

| Additional Attributes | Dollar-value breakdown by form, concentration, and application; regional CAGR projections; consumption driven by industrial hygiene, water treatment, and specialty chemical processing; regulatory compliance and operational safety requirements influence adoption; liquid dominates for bulk handling and automated dosing; powder used in dry blending and formulation customization; supplier strategy focuses on purity control, batch consistency, and long-term procurement contracts. |

The demand for benzyl trimethyl ammonium chloride in USA is estimated to be valued at USD 0.3 billion in 2025.

The market size for the benzyl trimethyl ammonium chloride in USA is projected to reach USD 0.5 billion by 2035.

The demand for benzyl trimethyl ammonium chloride in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in benzyl trimethyl ammonium chloride in USA are liquid and powder.

In terms of concentration, 100% benzyl trimethyl ammonium chloride segment is expected to command 58.0% share in the benzyl trimethyl ammonium chloride in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Benzyl Trimethyl Ammonium Chloride Market Growth – Trends & Forecast 2025 to 2035

Cetyl Trimethyl Ammonium Chloride Market

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Ammonium Humate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Dichromate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Benzylamine Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Metavanadate Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA