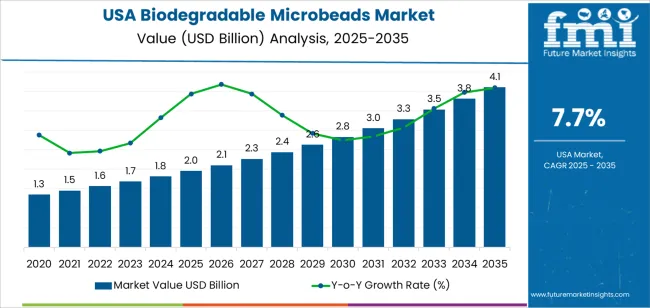

The USA biodegradable microbeads demand is valued at USD 2.0 billion in 2025 and is forecasted to reach USD 4.1 billion by 2035, reflecting a CAGR of 7.7%. Demand is driven by the transition from conventional plastic microbeads to environmentally compliant, bio-derived alternatives across personal care, household cleaning, and selected industrial formulations. Regulatory pressure to eliminate non-degradable microplastics, along with broader sustainability commitments among manufacturers, continues to influence procurement patterns. Increased R&D investment in biodegradable polymers and higher adoption of natural exfoliants also support segment expansion.

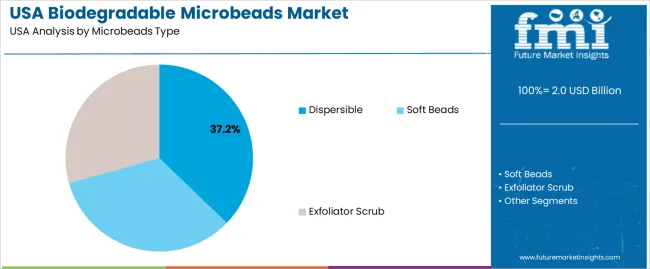

Dispersible microbeads lead the product landscape. These materials are selected for rapid breakdown in aqueous systems, compatibility with cosmetic formulations, and improved environmental performance. Their use in skincare, bath products, and dermatological applications reflects growing emphasis on eco-safe exfoliation and cleansing solutions. Manufacturers also incorporate dispersible microbeads in home-care and speciality formulations where biodegradability and mild sensory profiles are required.

West USA, South USA, and Northeast USA record the highest utilization rates, linked to the presence of major cosmetic manufacturers, R&D facilities, and regulatory-focused consumer-goods companies. These regions also maintain extensive distribution channels for personal care and home-care products, supporting consistent demand for biodegradable functional materials. Key suppliers include BASF SE, Merck KGaA, TerraVerdae Bioworks, and Evonik Industries AG. These companies develop bio-based and biodegradable microbead technologies used in personal care formulations, cleaning solutions, and selected speciality chemical applications.

Early-cycle momentum is driven by regulatory restrictions on conventional microplastics, rising compliance requirements, and accelerated reformulation efforts across personal care, home care, and specialty chemical applications. Companies increase procurement of certified biodegradable bead materials to meet federal and state-level environmental standards. This produces a consistent lift in annual spending as manufacturers transition product lines toward eco-compliant inputs, strengthening early-period growth intensity.

Mid-cycle momentum remains steady as biodegradable alternatives achieve wider commercial scale, reducing per-unit costs and supporting broader adoption by mass-market brands. Expanded production capacity and improved polymer-engineering technologies reinforce stable volume growth. Late-cycle momentum shows sustained but moderated lift as the transition away from traditional microbeads becomes largely complete. Growth reflects incremental gains linked to formulation diversification, premium segment expansion, and ongoing replacements in mature FMCG categories. Across the full horizon, the momentum curve indicates a strong and sustained upward trajectory anchored in regulatory drivers, consistent demand from high-volume manufacturers, and continuous material-innovation cycles that reinforce long-term adoption.

| Metric | Value |

|---|---|

| USA Biodegradable Microbeads Sales Value (2025) | USD 2.0 billion |

| USA Biodegradable Microbeads Forecast Value (2035) | USD 4.1 billion |

| USA Biodegradable Microbeads Forecast CAGR (2025-2035) | 7.7% |

Demand for biodegradable microbeads in the USA is increasing as manufacturers phase out traditional plastic microbeads in response to ecofriendly concerns, regulatory mandates and rising consumer preference for green beauty and housekeeping products. Many USA personal-care and household cleaning brands replace non-biodegradable beads with starch-, cellulose- or biopolymer-based alternatives in exfoliants, scrubs and rinse-off applications. Consumer attitudes toward plastic pollution and ocean health drive formulation changes, encouraging growth of biodegradable microbeads.

North America is a leading region in this industry because of early regulation and high awareness of microplastic issues. Constraints include higher cost of biodegradable microbead materials compared with legacy plastic versions, performance and feel differences in formulations that require R&D, and supply-chain limitations for plant-based feedstocks and consistent manufacturing quality. Some smaller brands may postpone switching until cost or performance parity is achieved.

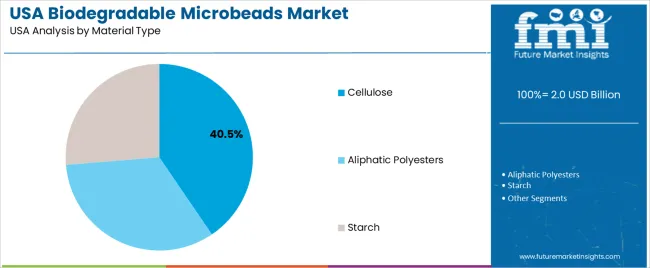

Demand for biodegradable microbeads in the United States reflects the shift toward environmentally compliant substitutes for synthetic microplastics used across personal care, coatings, and composite manufacturing. Microbead-type selection depends on desired texture, dispersibility, and mechanical behaviour within formulation systems. Application patterns show how manufacturers incorporate biodegradable microbeads to enhance flow characteristics, provide mild abrasiveness, or support reinforcement properties in structural materials. Material-type preferences illustrate how cellulose, aliphatic polyesters, and starch contribute varying biodegradation profiles, compatibility levels, and processing characteristics.

Dispersible microbeads hold 37.2% of national demand and represent the leading product category. These beads dissolve or disperse efficiently in aqueous formulations, supporting widespread use in personal care, cleaning agents, and water-based industrial blends. Soft beads account for 33.5%, offering compressibility and mild tactile behaviour suited to skin-contact formulations requiring gentle exfoliation or controlled release. Exfoliator scrub beads represent 29.3%, serving applications needing defined abrasion for surface cleansing or polishing. Microbead-type distribution reflects performance expectations, formulation viscosity, and end-product texture across USA manufacturers selecting biodegradable alternatives that balance functional integrity with environmental compatibility.

Key drivers and attributes:

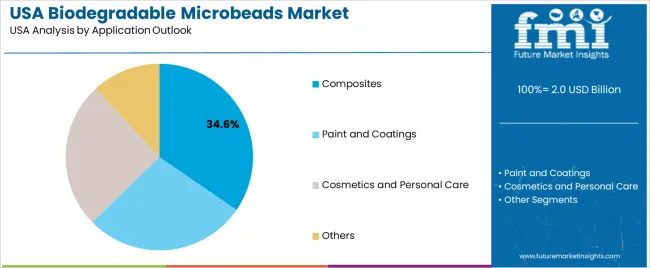

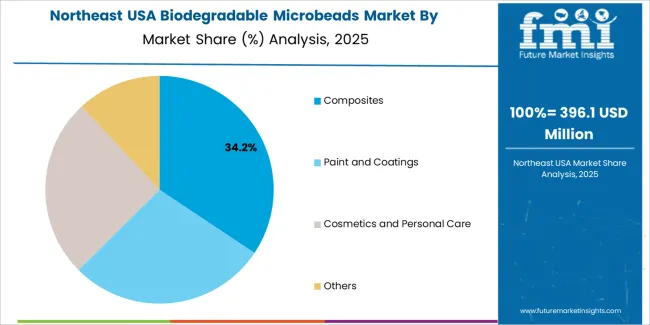

Composites hold 34.6% of national demand and represent the largest application category. Biodegradable microbeads support lightweight reinforcement, surface uniformity, and improved dispersion within polymer matrices. Paints and coatings account for 28.1%, where microbeads contribute to flow control, matte effects, and scratch resistance. Cosmetics and personal care represent 25.4%, relying on biodegradable beads for exfoliation, emulsion stability, and improved sensory performance. Other applications account for 11.9%, including cleaning agents and specialty formulations. Application distribution reflects mechanical, aesthetic, and environmental requirements across USA industries adopting biodegradable microbeads for improved functional outcomes and compliance with microplastic restrictions.

Key drivers and attributes:

Cellulose-based microbeads hold 40.5% of national demand and represent the leading material category. Cellulose supports biodegradability, chemical stability, and compatibility with aqueous and solvent-based systems. Aliphatic polyesters account for 33.2%, offering controlled degradation rates, structural strength, and processing flexibility in composite and coating applications. Starch-based materials represent 26.3%, supporting cost-effective, plant-derived options used in personal care and cleaning products. Material-type distribution reflects processing stability, environmental performance, and formulation requirements across USA industries implementing biodegradable microbeads in place of conventional microplastics.

Key drivers and attributes:

The federal ban on plastic microbeads in rinse-off cosmetics, rising consumer preference for eco-friendly personal-care products, and corporate ecofriendly commitments are boosting demand.

In the United States, the Microbead Free Waters Act of 2015 prohibited rinse-off products containing plastic microbeads, which forced many cosmetic and cleansing-product manufacturers to switch to biodegradable alternatives. This regulatory shift created a clear industry pull for biodegradable microbeads based on cellulose, starch or biopolymers. USA consumers increasingly factor sustainability into purchases of skincare, exfoliants and toiletries, leading brands and formulators to adopt biodegradable microbeads to maintain shelf-space and brand image. High visibility of plastic-pollution issues and active marketing of "plastic-free" personal care further strengthens demand for these materials in USA formulations.

High production cost of biobased microbeads, technical performance trade-offs and limited downstream adoption beyond personal care slow industry expansion.

Biodegradable microbeads typically cost more than conventional plastic microbeads due to more complex feedstock sourcing and processing. Some formulators in the USA remain concerned about performance attributes such as exfoliation feel, stability in formulations and compatibility with legacy manufacturing lines. Although personal-care uptake is strong, industrial applications such as industrial abrasives, coatings or composites are slower to switch, because cost savings or performance gains are less obvious. These factors restrict widespread substitution and lengthen the time required for full demand uptake across sectors.

Growth of algae- and plant-based microbeads, expansion into rinse-off and leave-on formats, and increasing use in non-cosmetic applications define the future direction.

Suppliers in the United States are developing microbeads derived from algae, agricultural waste or lignocellulosic biomass, which appeal to marketers emphasizing "up-cycled" and renewable content. The category is evolving beyond facial scrubs into body washes, oral-care and even leave-on lotions where biodegradable beads deliver sensory or functional benefits. Formulators in sectors such as coatings, paints, agro-chemicals and specialty cleaning agents in the USA are beginning to evaluate biodegradable microbeads for filler and delivery functions, broadening potential demand beyond cosmetics. These trends suggest steady growth albeit moderated by technical and cost considerations.

Demand for biodegradable microbeads in the USA is increasing through 2035 as manufacturers in personal care, household cleaning, and specialty chemical sectors replace synthetic microplastics with plant-based and mineral-derived exfoliating agents. The shift is reinforced by retailer ecofriendly commitments, state-level restrictions on microplastic ingredients, and broader consumer preference for eco-aligned formulations. Products such as facial scrubs, body washes, hand cleansers, and home-care powders integrate biodegradable microbeads to meet emerging compliance requirements.

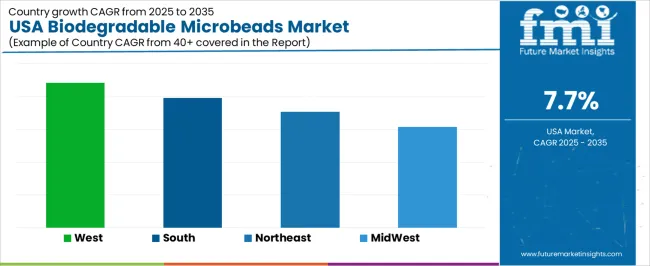

USA producers adopt cellulose, starch, lignin, polylactic acid, and naturally derived bead structures designed for controlled abrasion and full breakdown in wastewater systems. Regional differences reflect regulatory frameworks, manufacturing density, and concentration of personal-care brands. West USA leads at 8.8%, followed by South USA (7.9%), Northeast USA (7.1%), and Midwest USA (6.2%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 8.8% |

| South USA | 7.9% |

| Northeast USA | 7.1% |

| Midwest USA | 6.2% |

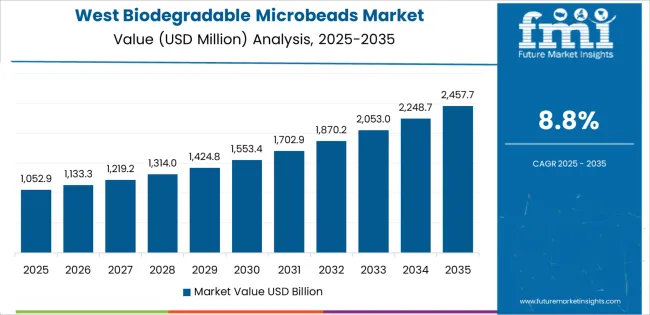

West USA grows at 8.8% CAGR, shaped by strong adoption of sustainable personal-care ingredients, extensive cosmetic product development, and regional regulatory pressure across California, Washington, Oregon, Colorado, and Arizona. Manufacturers in California reformulate cleansers and skincare products using biodegradable microbeads to comply with state restrictions on plastic microbeads and align with corporate ecofriendly standards.

Retailers expand shelf space for natural exfoliating products, supporting broader consumer transition toward bio-based ingredient profiles. Cleaning-product producers use biodegradable bead structures to provide mild abrasiveness in household powders and specialty cleaners. Research universities across the West collaborate with industry to scale plant-derived microbead technologies.

South USA grows at 7.9% CAGR, driven by an expanding personal-care manufacturing base and increasing demand for sustainable home-care formulations across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Regional producers of body washes, facial cleansers, and exfoliating scrubs adopt biodegradable microbeads to meet retailer expectations for environmentally compliant ingredient lists.

Household cleaning manufacturers use biodegradable bead structures for controlled abrasion in laundry additives and surface-prep solutions. Population growth across Southern metropolitan areas increases demand for personal-care products containing natural exfoliating agents. Universities and applied-research centers support pilot-scale testing of biodegradable microbead materials suitable for commercial production.

Northeast USA grows at 7.1% CAGR, supported by dense consumer industries, strong cosmetic-brand presence, and early adoption of environmentally compliant formulations across New York, Massachusetts, Pennsylvania, New Jersey, and Connecticut. Personal-care companies based in the region incorporate biodegradable microbeads into exfoliating products designed for natural ingredient preferences common in urban industries. Cleaning-product manufacturers adopt bio-based microbeads to meet procurement requirements from retailers prioritizing ecofriendly product lines. Healthcare and dermatology networks promote formulations containing biodegradable bead structures for gentle exfoliation. Research institutions advance material-science development related to cellulose and plant-polymer microbeads.

Midwest USA grows at 6.2% CAGR, reinforced by strong manufacturing capacity, established personal-care production plants, and regional focus on cost-efficient bio-based materials across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Personal-care factories upgrade formulations for facial scrubs and cleansing gels using biodegradable microbeads derived from starch, cellulose, and agricultural by-products. Cleaning-product manufacturers adopt biodegradable abrasives for scouring powders and specialty cleaners. Agricultural-material suppliers provide starch and cellulose inputs used in bio-based bead production. Local universities conduct material testing on controlled-abrasion properties and biodegradability performance.

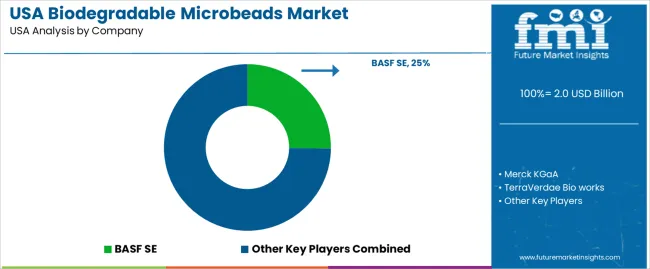

Demand for biodegradable microbeads in the USA is shaped by a group of material-technology suppliers serving personal care, household products, controlled-release systems, and specialty industrial applications. BASF SE holds the leading position with an estimated 25% share, supported by controlled bio-based polymer development, consistent particle-size uniformity, and long-standing supply relationships with USA personal-care and home-care formulators. Its position is reinforced by predictable biodegradation profiles and verified compliance with microbead-restriction legislation.

Merck KGaA follows as a significant participant through its life-science and functional-ingredient portfolio, supplying biodegradable microspheres with stable morphology, controlled encapsulation behaviour, and reliable performance in cosmetic and dermatological formulations. TerraVerdae Bioworks, operating in the USA through biopolymer production and distribution partnerships, contributes PHA-based biodegradable microbeads with documented environmental breakdown characteristics and consistent purity suited to exfoliating products and agricultural-delivery systems.

Evonik Industries AG maintains a strong presence with specialty biodegradable polymers used in controlled-release and cosmetic applications, providing materials with verified degradation rates, steady particle-size control, and stable performance under USA regulatory expectations. Competition across this segment centres on biodegradation reliability, particle-size precision, formulation compatibility, regulatory compliance, and supply-chain transparency. Demand continues to increase as USA manufacturers shift toward microplastic-free formulations, adopt bio-based polymers with verifiable environmental profiles, and require consistent microbead performance across personal-care, home-care, and specialised industrial end uses.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Microbeads Type | Dispersible, Soft Beads, Exfoliator Scrub |

| Application Outlook | Composites, Paint and Coatings, Cosmetics and Personal Care, Others |

| Material Type | Cellulose, Aliphatic Polyesters, Starch |

| Compounding | Powder-based, Granule-based |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | BASF SE, Merck KGaA, TerraVerdae Bioworks, Evonik Industries AG |

| Additional Attributes | Dollar sales by microbead type, application, material type, and compounding form; regional adoption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of biodegradable microbead manufacturers; developments in microplastic alternatives, cellulose-based exfoliants, and bio-polyester beads; integration with cosmetics, personal care formulations, eco-friendly coatings, composites, and green product manufacturing across the USA. |

The demand for biodegradable microbeads in usa is estimated to be valued at USD 2.0 billion in 2025.

The market size for the biodegradable microbeads in usa is projected to reach USD 4.1 billion by 2035.

The demand for biodegradable microbeads in usa is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in biodegradable microbeads in usa are dispersible, soft beads and exfoliator scrub.

In terms of application outlook, composites segment is expected to command 34.6% share in the biodegradable microbeads in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Demand for Biodegradable Microbeads in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA