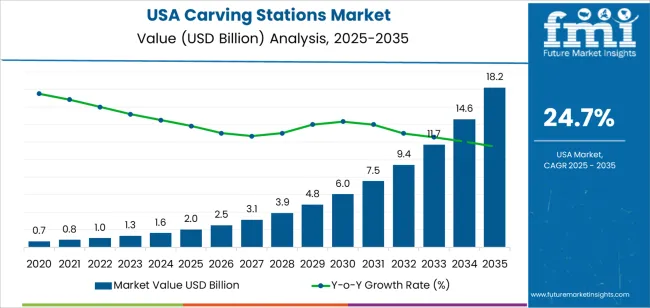

The demand for carving stations in the USA is expected to grow from USD 2.0 billion in 2025 to USD 18.2 billion by 2035, with a compound annual growth rate (CAGR) of 24.7%. Carving stations are becoming an integral part of the foodservice and catering industries, providing an interactive dining experience that appeals to consumers seeking quality and presentation. They are particularly popular in buffet-style restaurants, hotels, and event catering, where freshly carved meats and other specialties are served to enhance the dining experience.

The rising demand for customized dining experiences, specialized menus, and event catering solutions has contributed to the growing adoption of carving stations. These stations are preferred for their ability to elevate buffet-style dining, where guests can enjoy food that is freshly carved on-site, creating a more personal and engaging experience. As consumers increasingly prioritize unique dining experiences, carving stations have become a sought-after feature at weddings, corporate events, and conferences.

The event and hospitality industries are key drivers of carving station adoption, as these sectors continue to look for ways to enhance the guest experience. Buffet-style catering is also becoming more popular, especially in large gatherings, as carving stations offer a memorable, interactive dining experience. The ability to serve high-quality, freshly prepared foods in an engaging manner makes carving stations a valuable addition to large-scale events and high-end dining establishments, further fueling demand for these solutions in the coming years.

Between 2025 and 2030, the demand for carving stations in the USA is expected to grow from USD 2.0 billion to USD 2.5 billion. This steady growth will be driven by the increasing popularity of interactive dining experiences and the expansion of foodservice businesses that focus on elevating their offerings. As more consumers seek personalized dining, carving stations will become a key component of buffet-style dining and catering services.

From 2030 to 2035, the demand for carving stations is expected to increase significantly, rising from USD 2.5 billion to USD 18.2 billion. This sharp rise will be fueled by the growing popularity of wedding events, corporate functions, and other large-scale gatherings where carving stations offer an interactive and personalized food service. As buffet dining continues to grow in popularity, especially in banquet catering and hospitality venues, carving stations will become a prominent feature. Innovations in carving station technology, including automated systems and self-service models, will further drive industry growth, making it easier and more efficient for businesses to integrate these stations into their operations.

| Metric | Value |

|---|---|

| Demand for Carving Stations in USA Value (2025) | USD 2.0 billion |

| Demand for Carving Stations in USA Forecast Value (2035) | USD 18.2 billion |

| Demand for Carving Stations in USA Forecast CAGR (2025-2035) | 24.7% |

The demand for carving stations in the USA is rapidly increasing as the hospitality and catering industries continue to evolve and adapt to changing consumer preferences. Carving stations, often featured at buffets, weddings, and large events, offer a personalized and interactive dining experience, which is becoming more popular among consumers. The trend towards unique, high-quality food experiences, particularly in upscale venues and events, is driving the growth of carving stations. Consumers are seeking more interactive and engaging meal options, and carving stations provide a way to serve freshly carved, high-quality meats in a visually appealing manner.

The increasing demand for high-end catering services, buffets, and event-driven hospitality is another key factor behind the rise of carving stations. As the foodservice industry becomes more competitive, businesses are adopting carving stations as a way to differentiate their offerings and provide guests with a memorable dining experience. The growing trend of experiential dining, where the focus is on the experience as much as the meal, is encouraging the integration of carving stations into more events and restaurants.

Technological advancements in carving station design, such as portable and more efficient units, are also contributing to this growth. These innovations allow caterers and restaurants to offer high-quality, hot food at scale, with improved ease of use and greater food safety. As the trend for personalized and memorable dining experiences continues, the demand for carving stations in the USA is expected to grow steadily through 2035.

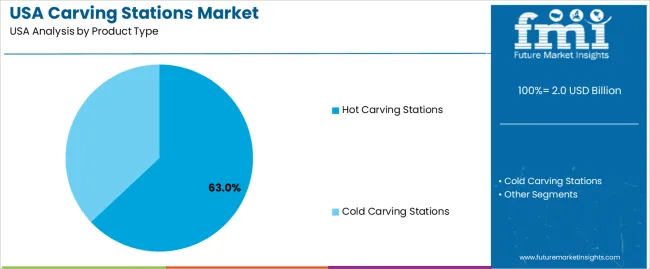

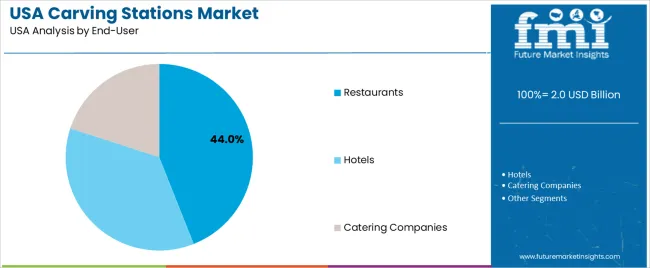

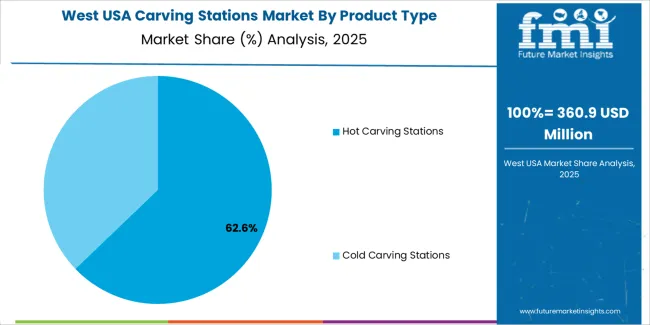

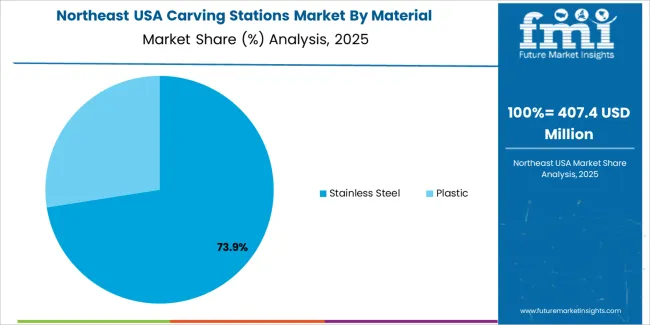

Demand for carving stations in the USA is segmented by product type, end-user, material, and region. By product type, demand is divided into hot carving stations and cold carving stations, with hot carving stations holding the largest share at 63%. The demand is also segmented by end-user, including restaurants, hotels, and catering companies, with restaurants leading the demand at 44%. In terms of material, demand is divided into stainless steel and plastic, with stainless steel leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Hot carving stations account for 63% of the demand for carving stations in the USA. These stations are preferred in foodservice settings due to their ability to maintain the temperature of meat and other food items, ensuring they are warm and ready for carving. This is particularly important in restaurants, catering events, and buffets, where food quality and customer satisfaction depend on maintaining optimal serving temperatures. Hot carving stations are equipped with heating elements that ensure food stays at the right temperature throughout service. They also offer a unique, interactive dining experience by allowing chefs to carve in front of guests. As more consumers seek premium dining experiences that offer fresh, high-quality food in an engaging setting, hot carving stations will continue to dominate the industry, providing both functionality and an enhanced customer experience.

Restaurants account for 44% of the demand for carving stations in the USA. These establishments are key drivers of demand, especially for buffet-style dining, special events, and banquets where customers enjoy freshly carved meats and dishes. Hot carving stations are ideal for creating an interactive dining experience, allowing chefs to carve in front of guests, which enhances the atmosphere and customer satisfaction. Restaurants increasingly use carving stations to provide high-quality, premium dining options that align with consumer preferences for fresh, made-to-order dishes. This focus on elevating the dining experience ensures that carving stations remain popular in restaurant settings. As restaurants continue to prioritize customer engagement and high-end offerings, the demand for carving stations will remain strong, solidifying their role in enhancing foodservice experiences.

Demand for carving stations in the USA is increasing as restaurants, hotels, caterers, and event venues increasingly offer buffet-style and live-cooking experiences. The growing popularity of interactive dining, elaborate banquet meals, weddings, and corporate events is driving the need for specialized carving station equipment that allows chefs to present freshly carved meats or dishes directly to guests. At the same time, hospitality operators are investing in carving stations to improve service quality and enhance the customer experience, combining visual appeal, convenience, and operational efficiency. Widespread adoption is constrained by the relatively high upfront cost of carving-station equipment, maintenance requirements (especially for heated stations), and the need for proper hygiene and food-safety controls, such as temperature maintenance, staff training, and sanitary design, to meet regulatory standards.

Why is Demand for Carving Stations Growing in USA?

In the USA, demand for carving stations is growing because foodservice and hospitality businesses seek to offer premium, memorable dining experiences. Carving stations provide flexibility and elegance, making them ideal for buffets, banquet dinners, weddings, corporate gatherings, and high-volume catering functions where guests expect fresh, customizable portions and live food presentation. As consumer preferences shift toward experiential dining, where ambience, presentation, and interactivity matter, carving stations become valuable differentiators for hotels, restaurants, and event planners. The ability to serve large volumes while maintaining food quality and presentation has led many operators to adopt these specialized stations.

How are Technological and Design Innovations Driving Growth of Carving Stations in USA?

Technological and design innovations are significantly contributing to the growth of carving stations in the USA. Newer units feature integrated heating solutions, such as infrared lamps, induction-based warmers, and efficient heat-retention surfaces, which help maintain optimal serving temperatures for meats and hot dishes, preserving moisture, food quality, and safety during service. Material choices such as stainless steel with hygienic finishes, and modular or portable designs, allow for easier cleaning, mobility, and adaptation across different venues. Portable carving stations are particularly useful for outdoor events, pop-up restaurants, or mobile catering services, which further expand the industry for these devices.

What are the Key Challenges Limiting Wider Adoption of Carving Stations in USA?

Despite strong demand, several challenges hinder broader adoption of carving stations in the USA. One major barrier is the capital investment required for high-quality or heated carving-station equipment, which includes heating elements, hygienic materials, and durable construction. These costs can be substantial, particularly for smaller or mid-size restaurants. Maintaining food safety and hygiene standards in buffet or high-traffic settings requires careful temperature control, regular maintenance, and trained staff, which increases operational complexity and costs. Shifting consumer trends toward lighter meals, plant-based diets, or fast-casual dining may reduce demand for traditional meat-carving stations. Alternatives to buffet-style or carving-station setups, such as pre-plated service, à la carte menus, and more flexible catering formats, could limit the growth of this equipment, especially in cost-sensitive segments.

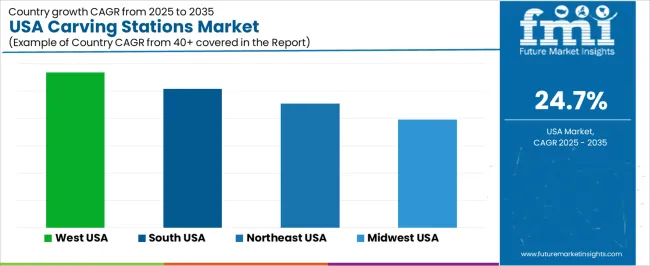

| Region | CAGR (%) |

|---|---|

| West USA | 28.4% |

| South USA | 25.4% |

| Northeast USA | 22.7% |

| Midwest USA | 19.8% |

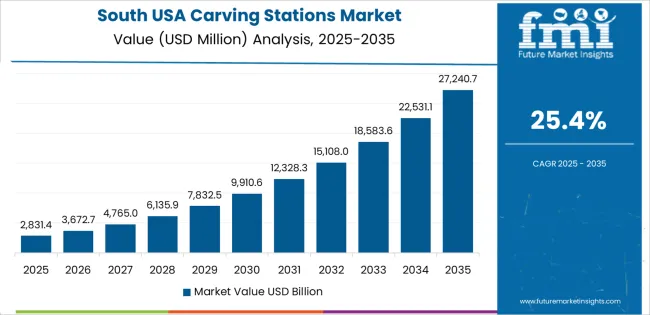

Demand for carving stations in the USA is growing across all regions, with the West leading at a 28.4% CAGR, driven by the region’s thriving food service and hospitality industries. The South follows with a 25.4% CAGR, supported by the demand for large-scale events and interactive dining experiences. The Northeast shows a 22.7% CAGR, fueled by the region’s focus on high-end dining and catered events. The Midwest experiences a 19.8% CAGR, with demand driven by the growing hospitality sector and event-driven dining. As the trend toward unique, personalized dining experiences continues, the adoption of carving stations is expected to continue rising across the USA.

The West USA leads in carving station demand, with a 28.4% CAGR. This growth is driven by the region’s thriving food service and hospitality industries, particularly in cities like Los Angeles, San Francisco, and Seattle, where large-scale events, conventions, and high-end catering services are in high demand. Carving stations are commonly used in buffets, weddings, corporate events, and hotels to enhance the dining experience. The West’s diverse cultural events, festivals, and increasing popularity of live cooking stations contribute to the rising use of carving stations for creating interactive and engaging dining experiences. The region’s booming tourism sector and its focus on experiential dining further boost demand. As more venues and caterers in the West seek to offer customized, premium food experiences, the demand for carving stations is expected to continue to grow.

The South USA is experiencing strong demand for carving stations, with a 25.4% CAGR. This growth is driven by the region’s strong focus on hospitality and large social gatherings, which are common in states like Texas, Florida, and Georgia. Events such as weddings, festivals, and corporate functions are driving the need for carving stations, which offer a unique and engaging dining experience. In addition, the South’s diverse food culture, with an emphasis on hearty, comfort foods, has led to the widespread use of carving stations in buffets and catering events. The rise of event-based dining and the popularity of interactive food stations are also contributing to the increasing adoption of carving stations across the region. As the demand for large-scale events and unique culinary experiences continues to grow, the use of carving stations in the South is expected to continue expanding.

The Northeast USA is experiencing steady growth in carving station demand, with a 22.7% CAGR. This demand is driven by the region’s strong food service and event industries, particularly in major metropolitan areas like New York City, Boston, and Philadelphia. Carving stations are increasingly being used in weddings, corporate events, hotels, and high-end restaurants to offer a more personalized and luxurious dining experience. The Northeast’s emphasis on fine dining and its growing focus on providing interactive food experiences have contributed to the adoption of carving stations in both casual and upscale venues. As the demand for buffet-style meals and catered events rises, carving stations are becoming a staple for creating memorable and engaging dining moments. As event-driven dining and catering services continue to thrive in the Northeast, the demand for carving stations is expected to grow steadily.

The Midwest USA is seeing moderate demand for carving stations, with a 19.8% CAGR. This demand is largely driven by the growing hospitality industry, particularly in cities like Chicago, Detroit, and St. Louis, where large-scale events, banquets, and conventions are common. As the region continues to focus on improving dining experiences at hotels, conferences, and corporate events, carving stations are becoming increasingly popular for buffets and catering services. The Midwest’s strong agricultural base and focus on local, fresh ingredients have also influenced the adoption of carving stations, which provide an opportunity to showcase high-quality meats and prepared foods in an interactive, engaging way. As consumer interest in experiential dining continues to rise, demand for carving stations in the Midwest is expected to grow steadily, particularly in venues focused on offering memorable and customized food experiences.

Demand for carving stations in the USA has been increasing as the hospitality industry embraces interactive and buffet-style dining experiences. These stations are becoming essential for businesses like hotels, restaurants, and catering services, offering fresh, customized food preparation in front of customers. The trend is fueled by the growing demand for visually engaging dining setups, where guests can enjoy the experience of watching food being carved or served hot in real-time. As consumer preferences shift toward live-food stations and personalized dining, the need for carving stations continues to grow.

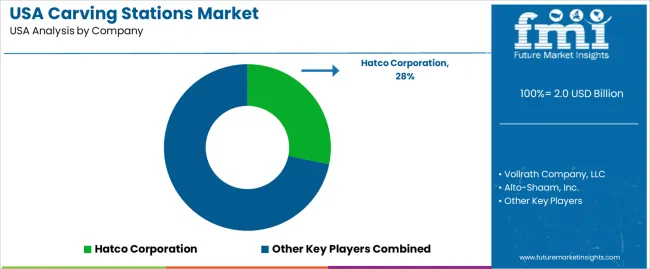

Hatco Corporation holds the largest share of the industry, commanding 28.2% with its innovative and energy-efficient carving stations. These solutions are designed for durability and optimal food temperature maintenance, making them ideal for restaurants and buffets. Other key players in the carving station sector include Vollrath Company, LLC, Alto-Shaam, Inc., Duke Manufacturing Co., Inc., and Tomlinson Industries. Each of these companies provides high-quality equipment, focusing on features such as easy cleaning, heavy-duty construction, and portability to meet the needs of different businesses in the foodservice industry.

The competition in the carving station industry centers around offering reliable, durable, and energy-efficient equipment. Vollrath focuses on build quality and user-friendly designs, while Alto-Shaam emphasizes radiant-heat technology for portability. Duke and Tomlinson target larger-scale buffets and hotels with robust, easy-to-maintain carving stations. Providers differentiate by balancing performance, sanitation features, aesthetic appeal, and cost-effectiveness. As demand for upscale buffet and catering services rises, these companies continue to evolve their offerings to cater to a wide variety of customer needs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Hot Carving Stations, Cold Carving Stations |

| Material | Stainless Steel, Plastic |

| End-User | Restaurants, Hotels, Catering Companies |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Hatco Corporation, Vollrath Company, LLC, Alto-Shaam, Inc., Duke Manufacturing Co., Inc., Tomlinson Industries |

| Additional Attributes | Dollar sales by product type and material; regional CAGR and adoption trends; demand trends in carving stations; growth in restaurant, hotel, and catering industries; technology adoption for food service equipment; vendor offerings including carving stations, accessories, and installation services; regulatory influences and industry standards |

The demand for carving stations in USA is estimated to be valued at USD 2.0 billion in 2025.

The market size for the carving stations in USA is projected to reach USD 18.2 billion by 2035.

The demand for carving stations in USA is expected to grow at a 24.7% CAGR between 2025 and 2035.

The key product types in carving stations in USA are hot carving stations and cold carving stations.

In terms of material, stainless steel segment is expected to command 72.0% share in the carving stations in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carving Stations Market – Premium Buffet & Catering Display 2025-2035

Demand for Carving Stations in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA