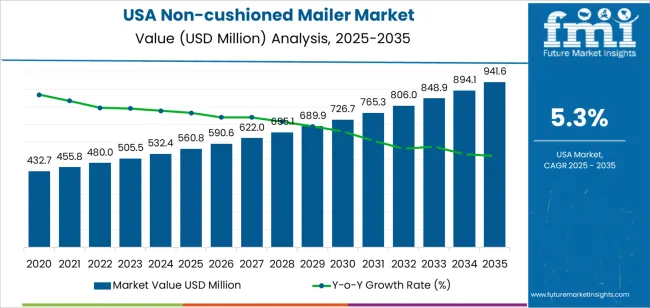

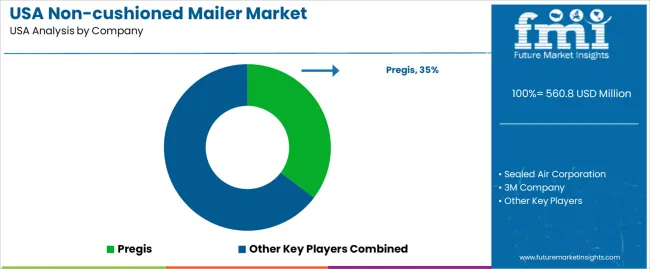

The demand for non-cushioned mailers in the USA is expected to grow from USD 560.8 million in 2025 to USD 941.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.3%. Non-cushioned mailers, commonly used for shipping a variety of products, are an economical and lightweight packaging option, widely adopted in e-commerce, retail, and logistics. As the demand for online shopping continues to rise, the market for non-cushioned mailers is expected to expand steadily, driven by the need for cost-effective, lightweight, and environmentally friendly packaging solutions.

The market will experience steady growth over the forecast period, starting at USD 560.8 million in 2025 and increasing to USD 590.6 million in 2026, USD 622.0 million in 2027, and USD 655.1 million in 2028. By 2029, demand for non-cushioned mailers will reach USD 689.9 million, continuing its upward trajectory through the 2030s. By 2035, the market is projected to reach USD 941.6 million, supported by continued growth in e-commerce and the ongoing trend toward reducing packaging costs while maintaining functional performance.

The saturation point analysis for non-cushioned mailers indicates that the market will likely continue to expand at a consistent pace without reaching a sharp decline in growth. In the early years of the forecast period (2025–2029), the market will see steady growth, driven by ongoing demand in e-commerce, retail shipping, and logistics sectors. During this period, non-cushioned mailers will maintain a strong foothold as an efficient and affordable packaging option.

By 2029, as the market matures, the growth rate may begin to decelerate slightly as the adoption of non-cushioned mailers stabilizes within certain industries. However, while growth rates may moderate, the overall demand for non-cushioned mailers is expected to continue increasing at a steady rate through 2035. The market is unlikely to reach saturation within the forecast period, as the growing e-commerce sector continues to fuel demand for packaging solutions.

Although there may be a shift toward alternative materials or packaging innovations in the long run, non-cushioned mailers will remain a staple in the packaging industry, particularly in lightweight shipping applications, due to their affordability, versatility, and alignment with sustainability trends. The saturation point is expected to be reached gradually, with steady growth still possible as the market adapts to evolving consumer preferences and the continued expansion of online shopping.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 560.8 million |

| Industry Forecast Value (2035) | USD 941.6 million |

| Industry Forecast CAGR (2025-2035) | 5.3% |

Demand for non cushioned mailers in the USA is rising as the growth of e commerce continues to expand parcel shipments for clothing, books, documents, soft goods, and other items that do not require heavy protection. Online retailers and direct to consumer brands increasingly prefer lightweight, low cost mailers for shipping because they reduce freight costs and simplify packaging operations. Non cushioned mailers are particularly suitable for items that are flexible, not fragile, and have minimal risk of damage during transit. As online shopping grows among USA consumers, especially for apparel, accessories, and small goods, demand for non cushioned mailers increases proportionally.

At the same time trends toward sustainability, efficiency and rapid fulfilment support further growth. Non cushioned mailers often use lighter materials and simpler packaging designs compared with padded or boxed solutions, which means less material waste and lower shipping weight. Many companies seeking to minimize environmental impact and shipping costs adopt these mailers for suitable products. Warehouses and fulfilment centers value their ease of handling, stackability, and space saving storage compared with bulky alternatives. As long as e commerce, home delivery, and cost-conscious logistics remain strong, demand for non cushioned mailers in the USA is likely to continue growing steadily.

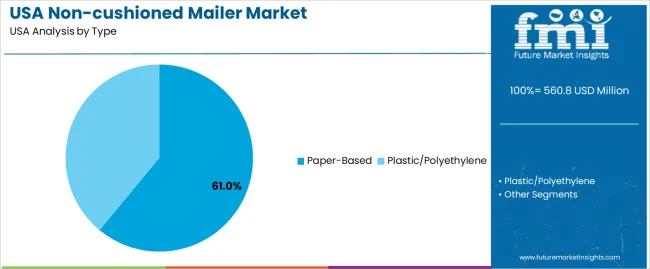

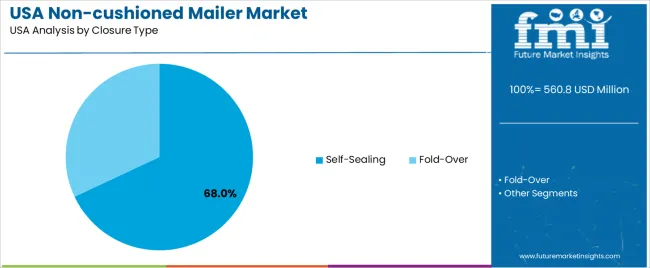

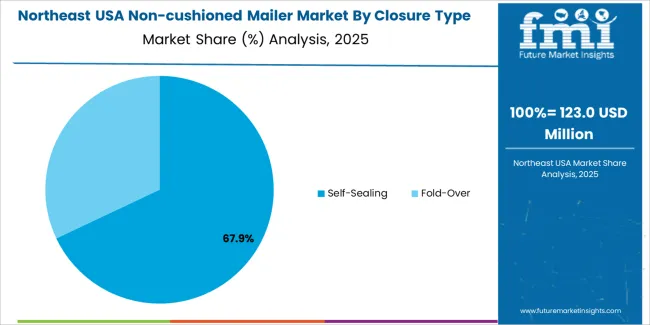

The demand for non-cushioned mailers in the USA is primarily driven by type and closure type. The leading type is paper-based, which accounts for 61% of the market share, while self-sealing closure types dominate, capturing 68% of the demand. Non-cushioned mailers are widely used in e-commerce, retail, and other industries where lightweight and cost-effective packaging solutions are required. The growing trend of online shopping and direct-to-consumer shipments continues to drive the demand for non-cushioned mailers, especially in paper-based materials with self-sealing closures.

Paper-based non-cushioned mailers lead the demand in the USA, holding 61% of the market share. Paper mailers are favored for their eco-friendly properties, providing a sustainable alternative to plastic mailers. They are typically made from recycled or biodegradable materials, which aligns with the growing consumer and business focus on environmental sustainability. Paper-based mailers offer durability and protection for lightweight items such as clothing, documents, and other non-fragile products.

The demand for paper-based mailers is driven by the increasing emphasis on sustainability and the need for packaging solutions that align with green business practices. As e-commerce businesses and consumers become more environmentally conscious, paper-based non-cushioned mailers are seen as a responsible choice for packaging. This trend is expected to continue as companies look to reduce their environmental footprint while still providing cost-effective, reliable packaging options. Paper-based mailers are not only eco-friendly but also provide an opportunity for branding and customization, further boosting their popularity in the market.

Self-sealing closure types lead the demand for non-cushioned mailers in the USA, capturing 68% of the market share. Self-sealing mailers are designed for convenience and efficiency, allowing for quick and easy closure without the need for additional adhesives, tape, or sealing equipment. This feature makes them particularly attractive to e-commerce businesses, shipping companies, and individuals who need a fast and secure way to seal packages.

The demand for self-sealing non-cushioned mailers is driven by their user-friendly design, which saves time and reduces labor costs for businesses. Self-sealing mailers also provide a secure, tamper-evident closure that ensures the contents are protected during transit. As e-commerce and online shopping continue to grow, the need for efficient and effective packaging solutions increases, making self-sealing mailers a preferred choice. Their combination of convenience, security, and cost-effectiveness ensures that self-sealing mailers will remain the dominant closure type for non-cushioned mailers in the USA.

Demand for non-cushioned mailers in the USA is growing steadily as e commerce and online retail continue to expand. Non-cushioned mailers serve as lightweight, cost effective packaging for shipping small to medium items such as clothing, documents, accessories and other non fragile goods. Because they use less material and volume compared with padded or boxed solutions, they help reduce shipping costs and waste. As online shopping and parcel volume rise, non-cushioned mailers are increasingly adopted by retailers and fulfilment centers for efficient packaging and delivery.

One main driver is the rapid growth of e-commerce and direct to consumer retail, which increases the number of parcels shipped and the need for simple, cost efficient packaging solutions. Non-cushioned mailers allow sellers to ship lighter or less fragile items without wasting space or paying for heavier packaging. Another driver is cost efficiency: these mailers are cheaper to produce, lighter to transport, and reduce shipping and material costs compared with bulky boxes or padded mailers. Packaging simplicity also speeds up packing operations in fulfilment centers. Additionally, demand for sustainable and minimal waste packaging encourages use of non-cushioned mailers because they consume fewer resources and generate less bulk, aligning with cost and environmental considerations.

Despite advantages, non-cushioned mailers face some limitations. They provide minimal protection, so they are not suitable for fragile or heavy products; this restricts their use to items that can withstand basic shipping. When more robust protection is needed, cushioned mailers or boxes remain necessary. Also, rising consumer and regulatory focus on packaging durability, product safety and return damage risk may discourage use of minimal mailers for items with higher value or fragility. Furthermore, for bulky or heavy items, non-cushioned mailers may lack structural strength or rigidity, reducing their utility. Finally, the growing trend toward protective and ‘premium’ packaging for certain segments such as electronics, fragile goods, or customer experience driven retail may limit growth of non-cushioned mailers in those segments.

A major trend is continued expansion of online shopping and small parcel e-commerce, which drives high volumes of shipments for items suitable for simple mailers. Retailers and fulfilment services increasingly optimize packaging to reduce shipping cost and waste, favouring lightweight, minimal mailers where possible. Another trend is growing interest in sustainable and low waste packaging materials, which supports non-cushioned, minimal material mailers for low risk items. Some businesses are also combining minimal mailers with efficient supply chain and order fulfillment practices to reduce overheads. However, for segments requiring higher protection or where customer perception matters, there remains demand for padded or premium packaging meaning non-cushioned mailers serve as a practical, but not universal, solution.

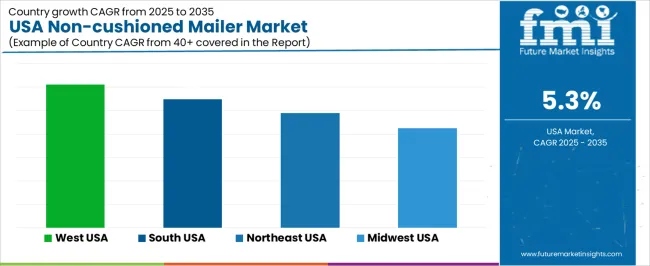

The demand for non-cushioned mailers in the USA is projected to grow across all regions, with the West USA leading at a CAGR of 6.1%. The South USA follows at 5.5%, the Northeast USA at 4.9%, and the Midwest USA at 4.3%. These regional differences are driven by factors such as the volume of e-commerce activity, retail shipping requirements, and packaging material preferences in industries like apparel, electronics, and consumer goods. The increasing trend of online shopping and the need for cost-effective, lightweight packaging solutions continue to boost the demand for non-cushioned mailers.

| Region | CAGR (%) |

|---|---|

| West USA | 6.1 |

| South USA | 5.5 |

| Northeast USA | 4.9 |

| Midwest USA | 4.3 |

In the West USA, the demand for non-cushioned mailers is expected to grow at a CAGR of 6.1%. This growth is driven by the region’s high volume of e-commerce activity, particularly in cities like Los Angeles and San Francisco, where there is a large concentration of online retailers. Non-cushioned mailers are cost-effective, lightweight, and versatile, making them an ideal packaging choice for the apparel, beauty products, and consumer electronics industries, all of which are thriving in the West. The growing trend of environmentally conscious packaging in the West also supports the increased use of non-cushioned mailers, which are often made from recyclable materials. As e-commerce continues to rise and the demand for efficient and sustainable packaging grows, the West USA remains a key driver of demand for non-cushioned mailers.

In the South USA, the demand for non-cushioned mailers is expected to grow at a CAGR of 5.5%. The region’s robust e-commerce market, along with the expansion of fulfillment centers and logistics infrastructure, contributes to the rising demand for cost-effective packaging solutions like non-cushioned mailers. As businesses in the South, particularly in states like Texas and Florida, increasingly move toward online retail and direct-to-consumer shipping models, the need for affordable and efficient mailers has risen. Non-cushioned mailers are particularly popular for lightweight items such as clothing, books, and non-fragile consumer goods. The increasing consumer preference for fast, affordable shipping options is further boosting the adoption of these packaging materials in the South USA.

In the Northeast USA, the demand for non-cushioned mailers is projected to grow at a CAGR of 4.9%. The Northeast, with its dense population and large number of retail businesses, has a consistently high demand for packaging materials, including non-cushioned mailers. The region’s strong presence in industries such as apparel, publishing, and consumer goods drives the need for lightweight and cost-efficient packaging solutions. The rise in e-commerce and the popularity of subscription boxes in the Northeast further contribute to demand, as non-cushioned mailers are commonly used for packaging these products. Additionally, the region's growing interest in sustainable packaging solutions aligns with the use of non-cushioned mailers made from recyclable and eco-friendly materials, supporting the region’s steady growth in demand.

In the Midwest USA, the demand for non-cushioned mailers is expected to grow at a CAGR of 4.3%. While growth in this region is somewhat slower compared to other areas, the demand remains steady due to the region's strong manufacturing and retail sectors. Non-cushioned mailers are widely used for shipping lightweight items such as clothing, electronics, and books, all of which are prevalent in Midwest retail markets. The rise of e-commerce in smaller cities and suburban areas is also contributing to the growing demand for efficient packaging solutions. As more businesses adopt direct-to-consumer shipping models and seek cost-effective packaging materials, non-cushioned mailers will continue to see steady demand in the Midwest USA. The focus on supply chain efficiency and sustainable packaging practices further supports this trend.

Demand for non-cushioned mailers in the USA is rising as e-commerce, retail shipping, and direct to consumer fulfilment grow. Non-cushioned mailers are often chosen for their lightweight structure, lower cost, and efficient storage and handling, especially for items that do not require padded protection. These features suit many shipments of clothing, documents, books, small consumer goods, and other non fragile items. The overall mailer packaging market in the USA was estimated at USD 6,823.4 million in 2024. Within that, non-cushioned mailers represented the largest product type segment by revenue in that year.

In this competitive landscape, several firms occupy leading positions. The firm listed as having roughly 35.3% share is Pregis Corporation. Other important players include Sealed Air Corporation, 3M Company, Berry Global Inc., and Smurfit Kappa Group. These companies supply non-cushioned mailers including poly mailers, paper mailers, and flexible envelopes aimed at high volume shipping users like online retailers and third party logistics providers. Competition among these firms centres on cost efficiency, material quality (durable yet lightweight films or papers), supply reliability, and ability to scale production to meet fluctuating demand. Some suppliers focus on offering eco friendly or recyclable mailers to address sustainability concerns. Others prioritise low unit cost and stable supply chains to support large volume e-commerce shipping operations. As online retail and direct shipments grow, demand for non-cushioned mailers is likely to remain strong while suppliers evolve packaging options to match customer cost, sustainability, and logistic needs.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Type | Paper-Based, Plastic/Polyethylene |

| Closure Type | Self-Sealing, Fold-Over |

| End-User | E-commerce and Retail, Logistics and Distribution, Personal Use |

| Key Companies Profiled | Pregis, Sealed Air Corporation, 3M Company, Berry Global Inc., Smurfit Kappa Group |

| Additional Attributes | Dollar sales by type, closure type, and end-user reveal strong demand for paper-based mailers, particularly in e-commerce and retail. Self-sealing closures are more commonly used for ease of packaging, though fold-over closures are still prevalent. The market is growing as e-commerce and logistics continue to expand, driving the demand for cost-effective and sustainable packaging solutions. Leading companies like Pregis, Sealed Air, and 3M provide high-quality mailers that cater to various packaging needs. |

The demand for non-cushioned mailer in USA is estimated to be valued at USD 560.8 million in 2025.

The market size for the non-cushioned mailer in USA is projected to reach USD 941.6 million by 2035.

The demand for non-cushioned mailer in USA is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in non-cushioned mailer in USA are paper-based and plastic/polyethylene.

In terms of closure type, self-sealing segment is expected to command 68.0% share in the non-cushioned mailer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Corrugated Mailers in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA