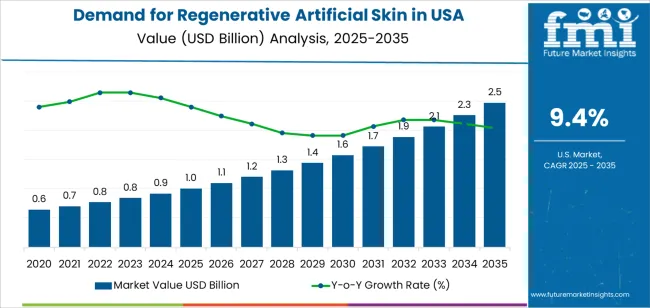

The demand for regenerative artificial skin in the USA is expected to grow from USD 1.0 billion in 2025 to USD 2.5 billion by 2035, reflecting a CAGR of 9.4%. Regenerative artificial skin, a key component in wound healing, burn treatment, and cosmetic applications, is gaining traction due to advancements in biotechnology and regenerative medicine. The market is driven by the increasing prevalence of burn injuries, diabetic ulcers, and other chronic skin conditions, as well as growing demand for cosmetic and reconstructive surgeries. Artificial skin products, designed to mimic the structure and function of natural skin, are particularly important for patients who require advanced wound care and tissue regeneration.

The growth of the regenerative artificial skin market is further supported by the development of biocompatible materials, stem cell-based therapies, and the expanding use of 3D bioprinting in medical applications. As healthcare providers focus on improving patient outcomes, minimizing recovery times, and enhancing skin repair, regenerative artificial skin plays a pivotal role in modern medical treatments. With continued innovation and expanding applications in burn care, surgery recovery, and cosmetic enhancements, this market is poised for steady growth over the next decade.

The rolling CAGR analysis for the regenerative artificial skin market in the USA indicates a consistent and sustained growth rate, with fluctuations reflecting the changing dynamics of demand and technological advancements.

Between 2025 and 2030, the market will grow from USD 1.0 billion to USD 1.6 billion, contributing USD 0.6 billion in growth. This phase will see an initial acceleration in demand as regenerative technologies for wound care and burn treatment gain traction. During these years, the adoption of artificial skin products in medical procedures, particularly for patients with severe burns and chronic wounds, will drive the early-stage growth. Innovations in biotechnology and skin regeneration therapies will play a key role in the market's growth during this period.

From 2030 to 2035, the market will grow from USD 1.6 billion to USD 2.5 billion, adding USD 0.9 billion in value. This period will experience a continued acceleration, driven by increasing acceptance of regenerative skin solutions in cosmetic surgeries, diabetic wound care, and chronic injury treatment. As clinical applications expand and biocompatible materials continue to improve, the CAGR will reflect the rising reliance on these advanced treatments. The later-phase acceleration is expected to be stronger as artificial skin technology becomes more widely adopted for both medical and cosmetic purposes, leading to faster market growth in the final years of the forecast period. The rolling CAGR during this phase will indicate increasing market maturity and widespread use across diverse applications.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1 billion |

| Industry Forecast Value (2035) | USD 2.5 billion |

| Industry Forecast CAGR (2025 to 2035) | 9.4% |

Demand for regenerative artificial skin in the USA is rising as the prevalence of severe burns, chronic wounds such as diabetic foot ulcers, and surgical skin defects continues to grow. Patients with limited donor tissue availability or non healing wounds require advanced alternatives that promote faster closure and reduce complications. The USA healthcare system’s investment in trauma, burn care and specialty wound care infrastructure supports uptake. In addition, hospitals and burn centres increasingly adopt artificial skin products that offer improved integration, lower infection risk and better functional outcomes compared with traditional grafting methods.

Technological innovations and wider clinical acceptance further support growth of the market. Improvements in biomaterials, cellular integration and manufacturing of pre vascularised skin substitutes make products more effective and scalable. The regulatory environment in the USA also enables faster adoption of next generation wound care solutions, and reimbursement frameworks have begun to recognise the long term benefits of advanced artificial skin. Challenges remain, such as high product cost, manufacturing complexity and the need for strong long term clinical evidence, but the convergence of clinical need and technological readiness suggests that demand for regenerative artificial skin in the USA will continue to expand steadily.

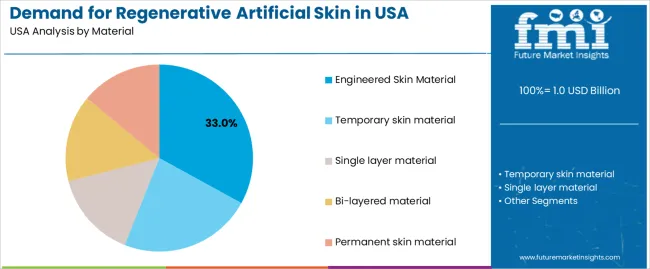

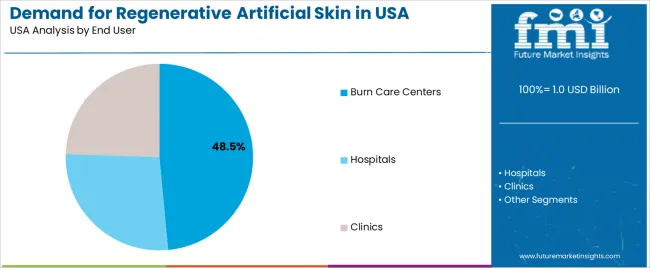

The demand for regenerative artificial skin in the USA is primarily driven by material type and end user. The leading material type is engineered skin material, which holds 33% of the market share, while burn care centers are the dominant end-user segment, accounting for 48.5% of the demand. Regenerative artificial skin is used to promote wound healing, particularly in cases of severe burns, skin grafts, and chronic wounds. With an increasing number of burn-related injuries and advancements in regenerative medicine, the demand for high-quality, specialized artificial skin continues to rise, particularly in specialized care settings.

Engineered skin material leads the regenerative artificial skin market, capturing 33% of the demand. Engineered skin material is designed to closely mimic the structure and function of human skin, making it highly effective for wound healing, burn treatment, and skin regeneration. This material is typically created through bioengineering processes, which use collagen, fibroblasts, and other biological components to construct a skin-like material that can support cell growth and tissue repair.

The demand for engineered skin material is driven by its ability to promote faster and more effective healing compared to traditional methods, such as grafting or bandaging. It is particularly beneficial for patients with large or deep burns, as it reduces the risk of infection, promotes tissue regeneration, and improves the overall aesthetic outcome of healing skin. As the healthcare sector continues to prioritize advancements in wound care and regenerative medicine, engineered skin materials are expected to remain a leading choice, bolstering their market dominance in the USA.

Burn care centers lead the demand for regenerative artificial skin in the USA, accounting for 48.5% of the market share. These specialized medical facilities treat patients with severe burns, where the use of advanced wound care products, including regenerative artificial skin, is critical for effective recovery. Burn care centers require high-quality skin substitutes to accelerate healing, reduce scarring, and minimize the risk of infection, making regenerative artificial skin an essential component of burn treatment protocols.

The growing prevalence of burn injuries, along with improvements in artificial skin technology, has driven the adoption of these products in burn care centers. Additionally, regenerative artificial skin helps in reducing the need for multiple surgical interventions, which is particularly important in severe cases. As burn care centers continue to provide specialized care for burn patients, their reliance on advanced skin regeneration technology, such as engineered and bi-layered materials, is expected to increase, ensuring that these centers remain a dominant force in the demand for regenerative artificial skin in the USA.

Demand for regenerative artificial skin in the USA is expanding due to the increasing incidence of severe burn injuries, chronic wounds such as diabetic ulcers, and surgical reconstruction needs. Healthcare providers are turning to bioengineered skin substitutes that enable faster wound closure, reduce donor site morbidity and support better functional recovery. Although innovation in biomaterials and tissue engineering drives market expansion, barriers such as high costs, reimbursement pressure and equipment intensive infrastructure persist. Meanwhile, trends like personalised skin grafts, 3D bioprinting and integration of smart sensors in wound care materials are reshaping the landscape.

One driver is the high prevalence of acute traumatic burns and chronic wounds across the USA, which increases the need for advanced wound care solutions that superior to traditional autografts. Another is rising adoption of tissue engineering technologies, including engineered skin scaffolds and cell based graft systems, enabling broader usage of artificial skin in burn centres and hospitals. A third driver is increasing investment in healthcare infrastructure, especially specialised wound care centres and burn units, where regenerative skin products are being adopted. Finally, rising focus on functional and aesthetic outcomes in reconstructive surgery prompts demand for skin substitutes that offer improved elasticity, pigmentation and reduced scarring.

A major restraint is the high cost of regenerative artificial skin solutions, including the materials, manufacturing and regulatory pathways, which can limit access in some hospitals or outpatient settings. Another restraint is reimbursement and policy uncertainty in outpatient and long term wound care settings, which may slow adoption of advanced skin substitutes. A third restraint involves technological risks: variability in clinical outcomes, integration challenges and concerns about long term durability of artificial skin grafts reduce hospital buyer confidence. Additionally, the relatively modest growth in the overall pool of eligible patients and competition from lower cost skin substitute options limit volume expansion.

Key trends include the rise of personalised and patient specific skin grafts through 3D bioprinting and cell seeded scaffolds, which improve fit and aesthetic outcomes. The integration of sensor technology and bioelectronics into skin substitutes enables real time monitoring of healing and wound status, and enhances product value. There is also increased collaboration between biomaterial companies, academic research centres and clinical burn care units to accelerate innovation and regulatory approval. Finally, the shift toward outpatient wound care settings and ambulatory surgery for less severe wounds is driving development of thinner, easier to apply artificial skin formats tailored for non hospital usage.

The demand for regenerative artificial skin in the USA is growing as advancements in biotechnology and medical treatments offer new solutions for burn victims, chronic wound care, and skin graft procedures. Regenerative artificial skin, which can help promote the natural healing process, is a crucial part of treating extensive burns, diabetic ulcers, and other skin-related conditions. Factors such as an aging population, the rise in chronic diseases like diabetes, and increased awareness of advanced wound care are contributing to the growing demand for regenerative artificial skin.

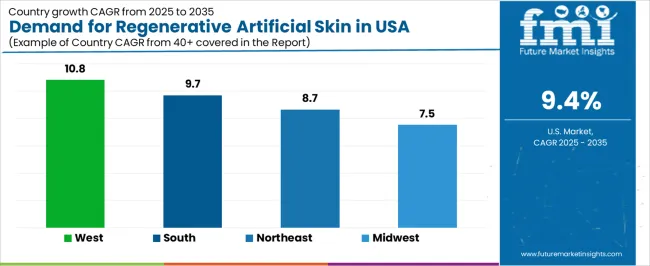

Additionally, the development of more effective and sustainable skin substitutes is further driving adoption in healthcare settings. Regional variations in demand are influenced by healthcare infrastructure, population demographics, and the prevalence of conditions that require advanced skin treatment. The West leads in demand due to its advanced healthcare facilities and technology adoption, while the South, Northeast, and Midwest follow with steady growth driven by healthcare access and the need for improved skin treatment solutions. This analysis explores the factors behind the regional demand for regenerative artificial skin across the USA.

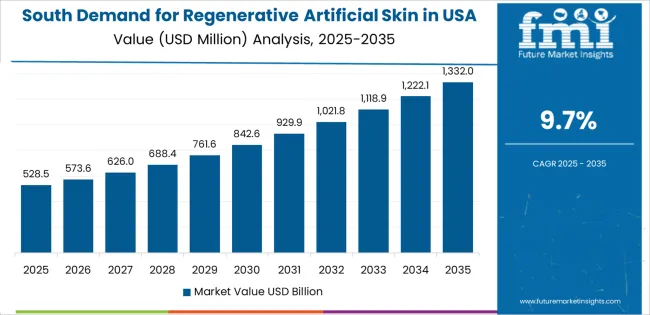

| Region | CAGR (2025-2035) |

|---|---|

| West | 10.8% |

| South | 9.7% |

| Northeast | 8.7% |

| Midwest | 7.5% |

The West region leads the USA in the demand for regenerative artificial skin with a CAGR of 10.8%. The region is home to some of the country’s most advanced medical research institutions, hospitals, and biotech companies, making it a hub for innovation in regenerative medicine and skin treatments. States like California, Oregon, and Washington have strong healthcare systems and leading-edge medical technology, which contribute to higher rates of adoption of regenerative artificial skin in treating burns, chronic wounds, and other skin conditions.

In addition, the West has a large population of elderly individuals and people with chronic conditions like diabetes, which increases the demand for skin substitutes and wound care treatments. As more hospitals and healthcare providers integrate advanced regenerative technologies into their practices, the demand for regenerative artificial skin continues to grow at a rapid pace in the West. The region’s emphasis on health, wellness, and technological advancements ensures its continued leadership in this market.

The South shows strong demand for regenerative artificial skin with a CAGR of 9.7%. The region’s large population, coupled with a significant number of burn cases and chronic conditions like diabetes, drives the need for advanced skin treatments. States such as Texas, Florida, and Georgia have large healthcare networks and specialized medical facilities where regenerative artificial skin is increasingly being adopted for treating burn victims, diabetic ulcers, and other skin wounds.

Additionally, the South has a growing aging population, which contributes to the rising demand for wound care and skin treatments. As the region continues to invest in advanced healthcare solutions and expand access to specialized care, the adoption of regenerative artificial skin will continue to grow. The region’s increasing healthcare infrastructure and focus on improving patient outcomes further support the demand for this advanced medical technology.

The Northeast demonstrates steady demand for regenerative artificial skin with a CAGR of 8.7%. The region has some of the country’s leading hospitals and medical research institutions, making it a key area for innovation in regenerative medicine. Cities like New York, Boston, and Philadelphia are home to top-tier medical centers where regenerative artificial skin is used in the treatment of burns, chronic wounds, and other skin conditions.

The demand in the Northeast is driven by the region’s high population density, advanced healthcare infrastructure, and a focus on providing cutting-edge medical treatments. The increasing prevalence of chronic conditions, combined with a growing awareness of the benefits of regenerative medicine, ensures steady adoption of regenerative artificial skin in the Northeast. The region’s aging population, which often requires advanced wound care, further contributes to the continued demand for this technology.

The Midwest shows moderate growth in the demand for regenerative artificial skin with a CAGR of 7.5%. While the region has a strong healthcare system, including major medical centers in cities like Chicago, Cleveland, and Detroit, the adoption of regenerative artificial skin is slightly slower compared to other regions like the West and South. However, the Midwest has a significant number of individuals with chronic conditions like diabetes and those in need of advanced wound care, which supports the steady demand for regenerative artificial skin.

As healthcare access improves and the understanding of regenerative medicine grows, demand for this technology is expected to rise. The region’s healthcare infrastructure, particularly in major urban centers, continues to expand, and as more hospitals integrate advanced wound care treatments into their services, the adoption of regenerative artificial skin will continue to increase at a moderate pace.

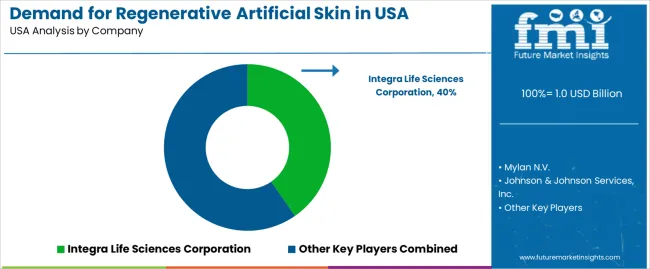

Demand for regenerative artificial skin in the United States is increasing as hospitals, burn centers, and surgical units adopt advanced wound-care solutions for trauma, burn injuries, chronic ulcers, and reconstructive procedures. Companies such as Integra Life Sciences Corporation with an estimated 40.4% share, Mylan N.V., Johnson & Johnson Services, Inc., Smith & Nephew, and Mallinckrodt Plc. are key participants in this industry. Growth is supported by rising patient volumes, improvements in bioengineered tissue technology, and the need for products that support faster healing and reduced infection risk. Clinicians in the United States place emphasis on biocompatibility, durability, and graft integration, which shapes product development and procurement decisions.

Competition in this industry develops around material innovation, clinical performance, and ease of surgical use. Companies refine collagen matrices, bilayer scaffolds, and synthetic composite structures to create artificial skin that promotes cell growth and vascularization. Another competitive path focuses on broadening clinical indications, with products designed for burns, diabetic ulcers, surgical defects, and cosmetic reconstruction. Firms also work to streamline application techniques, offering pre-shaped sheets, ready-to-use formats, and grafts that shorten operating time. Product brochures typically highlight structural composition, porosity, handling characteristics, infection-control properties, and evidence from clinical studies. By aligning these features with hospital priorities such as predictable healing, reduced complications, and efficient workflow, companies aim to strengthen their position in the evolving USA regenerative artificial skin industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Material | Engineered Skin Material, Temporary Skin Material, Single Layer Material, Bi-layered Material, Permanent Skin Material |

| End User | Burn Care Centers, Hospitals, Clinics |

| Key Companies Profiled | Integra Life Sciences Corporation, Mylan N.V., Johnson & Johnson Services, Inc., Smith & Nephew, Mallinckrodt Plc. |

| Additional Attributes | The market analysis includes dollar sales by material type and end-user categories. It also covers regional demand trends in the United States, particularly driven by the increasing use of regenerative artificial skin for burn care and wound healing. The competitive landscape highlights key manufacturers focusing on innovations in skin regeneration technologies and materials. Trends in the growing demand for advanced wound care products and the adoption of bi-layered and permanent skin materials are explored, along with advancements in bioengineered skin and treatment solutions. |

The global demand for regenerative artificial skin in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the demand for regenerative artificial skin in USA is projected to reach USD 2.5 billion by 2035.

The demand for regenerative artificial skin in USA is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in demand for regenerative artificial skin in USA are engineered skin material, temporary skin material, single layer material, bi-layered material and permanent skin material.

In terms of end user, burn care centers segment to command 48.5% share in the demand for regenerative artificial skin in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA