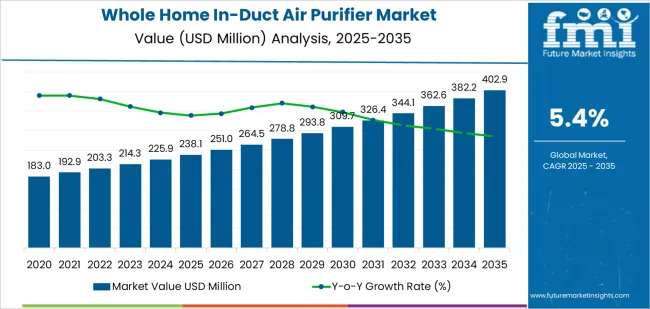

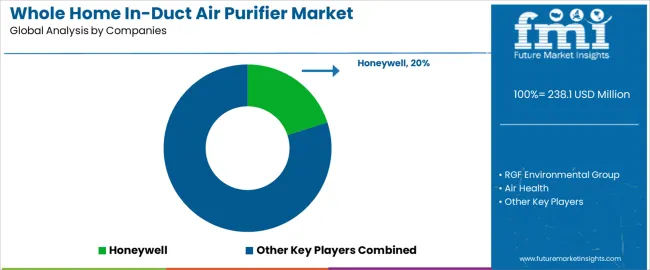

The global whole home in-duct air purifier market, valued at USD 238.1 million in 2025, is projected to reach USD 402.8 million by 2035, growing at a CAGR of 5.4%. Growth is fueled by rising concerns about indoor air quality, increasing health awareness, and the expanding integration of air purification into HVAC systems across residential and commercial spaces. The filtration adsorption segment leads the market due to its proven efficiency and maintenance simplicity. The home use segment dominates demand as homeowners prioritize whole-house purification for health protection.

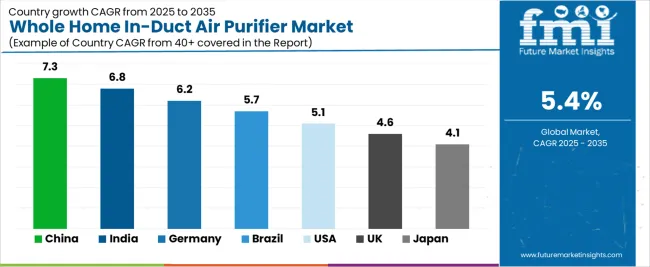

China and India are the fastest-growing regions, with CAGRs of 7.3% and 6.8%, driven by concerns about air pollution and urban residential expansion. Germany and Brazil exhibit solid growth driven by energy-efficient HVAC standards and expanding middle-class housing, while the United States and the United Kingdom maintain steady demand driven by allergen sensitivities and air quality regulations. Key players such as RGF Environmental Group, Air Health, Lennox, Mars Motors, Aerus, Honeywell, Aprilaire, GreenTech, and LakeAir focus on developing energy-efficient, smart-integrated systems with pathogen-inactivation capabilities and advanced air-quality monitoring. Innovation centers on intelligent sensors, IoT connectivity, and advanced purification technologies to enhance system performance and user confidence.

From 2030 to 2035, the market is forecast to grow from USD 326.4 million to USD 402.8 million, adding another USD 76.4 million, which constitutes 46.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart building integration and IoT connectivity features, the development of advanced purification technologies with enhanced pathogen removal capabilities, and the growth of energy-efficient systems addressing operational cost concerns. The growing adoption of building health certifications and wellness-focused construction standards will drive demand for in-duct air purifiers with verified performance and comprehensive air quality monitoring features.

Between 2020 and 2025, the whole home in-duct air purifier market experienced steady growth, driven by increasing indoor air quality concerns and growing recognition of whole-house air purification as an effective solution for removing airborne contaminants, allergens, and pathogens throughout residential and commercial spaces. The market developed as homeowners and facility managers recognized the potential for in-duct purification technology to enhance indoor air quality, reduce airborne disease transmission, and support health objectives while integrating seamlessly with existing HVAC infrastructure. Technological advancement in purification methods and sensor integration began emphasizing the critical importance of maintaining consistent air treatment and system efficiency in occupied building environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 238.1 million |

| Forecast Value in (2035F) | USD 402.8 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

Market expansion is being supported by the increasing global demand for indoor air quality improvement driven by health awareness and airborne disease concerns, alongside the corresponding need for comprehensive air treatment systems that can remove particulates, neutralize pathogens, and maintain air quality across residential properties, commercial buildings, and institutional facilities. Modern homeowners and facility managers are increasingly focused on implementing in-duct purification solutions that can improve respiratory health, reduce allergen exposure, and provide consistent performance throughout HVAC distribution systems.

The growing emphasis on building health and wellness standards is driving demand for in-duct air purifiers that can support certification requirements, enable comprehensive air treatment, and ensure verified performance documentation. Building owners' preference for air quality solutions that combine whole-house coverage with HVAC integration and energy efficiency is creating opportunities for innovative purification implementations. The rising influence of pandemic preparedness and airborne pathogen concerns is also contributing to increased adoption of purifiers that can provide superior contaminant removal without compromising system airflow or operational costs.

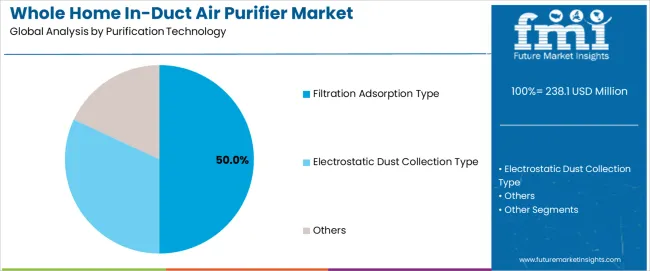

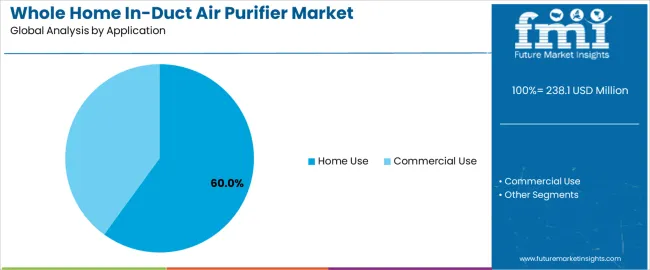

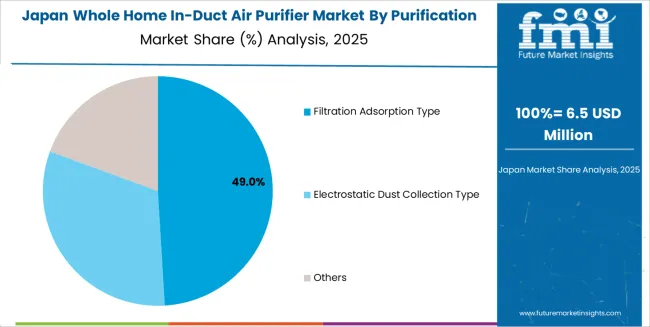

The market is segmented by purification technology, application, and region. By purification technology, the market is divided into filtration adsorption type, electrostatic dust collection type, and others. Based on application, the market is categorized into home use and commercial use. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The filtration adsorption type segment is projected to maintain its leading position in the whole home in-duct air purifier market in 2025 with a substantial market share, reaffirming its role as the preferred technology for comprehensive particle removal and contaminant adsorption applications. Homeowners and HVAC contractors increasingly utilize filtration adsorption systems for their effective particulate capture characteristics, straightforward maintenance features, and proven effectiveness in removing allergens, dust, and odors while maintaining system compatibility. Filtration adsorption technology's proven effectiveness and application versatility directly address market requirements for reliable air treatment and established performance record across diverse building types and HVAC configurations.

This purification technology forms the foundation of modern whole-house air quality systems, as it represents the approach with the greatest compatibility with existing HVAC infrastructure and established reliability record across multiple residential and commercial applications. HVAC industry investments in air quality enhancement continue to strengthen adoption among contractors and equipment manufacturers. With health pressures requiring improved indoor air quality and allergen reduction, filtration adsorption systems align with both performance objectives and maintenance requirements, making them the central component of comprehensive whole-house air treatment strategies.

The home use application segment is projected to represent the largest share of whole home in-duct air purifier demand in 2025, underscoring its critical role as the primary driver for purifier adoption across single-family residences, townhomes, and residential properties serving homeowner markets. Residential property owners prefer in-duct air purifiers for home applications due to their exceptional whole-house coverage capabilities, seamless HVAC integration, and ability to improve indoor air quality while supporting family health objectives and maintaining property value. Positioned as essential upgrades for modern residential HVAC systems, in-duct air purifiers offer both health advantages and operational benefits.

The segment is supported by continuous expansion in residential construction and the growing availability of affordable purification systems that enable superior air quality with comprehensive coverage and reduced maintenance requirements. Additionally, homeowners are investing in air quality improvement programs to support increasingly demanding health concerns and allergen sensitivity considerations among family members. As residential air quality awareness accelerates and health consciousness increases, the home use application will continue to dominate the market while supporting advanced purification integration and indoor environmental quality optimization strategies.

The whole home in-duct air purifier market is advancing steadily due to increasing demand for indoor air quality solutions driven by health awareness and growing adoption of whole-house air treatment systems that require integrated purification technologies providing comprehensive contaminant removal and pathogen reduction benefits across residential properties, commercial buildings, and institutional facilities. However, the market faces challenges, including installation costs and HVAC system compatibility requirements, competition from portable air purifiers and individual room solutions, and maintenance concerns related to filter replacement and system servicing. Innovation in smart monitoring capabilities and energy-efficient designs continues to influence product development and market expansion patterns.

The growing awareness of indoor air pollution impacts is driving demand for specialized air treatment solutions that address health requirements including allergen reduction, pathogen removal, and volatile organic compound neutralization for residential and commercial occupants. Whole-house applications require effective in-duct purification systems that deliver superior air quality across all building spaces while maintaining energy efficiency and cost-effectiveness. Building owners are increasingly recognizing the competitive advantages of in-duct purification integration for occupant health enhancement and property value protection, creating opportunities for innovative air treatment solutions specifically designed for comprehensive building-wide air quality management.

Modern in-duct air purifiers are incorporating intelligent sensors and connectivity features to enhance performance monitoring, enable predictive maintenance, and support comprehensive air quality management through real-time feedback and remote system control capabilities. Leading manufacturers are developing integrated monitoring platforms, implementing air quality sensor arrays, and advancing technologies that provide occupant alerts and automated system adjustments. These technologies improve system effectiveness while enabling new operational capabilities, including demand-based purification, energy optimization, and comprehensive performance documentation. Advanced technology integration also allows system owners to support comprehensive health objectives and operational transparency beyond traditional purification attributes.

The expansion of airborne disease concerns, pandemic preparedness requirements, and health-focused building standards is driving demand for advanced purification technologies with verified pathogen inactivation capabilities and comprehensive microbial control performance. These demanding applications require specialized purification systems with proven antimicrobial effectiveness that exceed conventional filtration capabilities, creating premium market segments with differentiated value propositions. Manufacturers are investing in technology validation and performance certification to serve health-conscious building segments while supporting innovation in residential wellness, healthcare facilities, and commercial building air quality management.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| United States | 5.1% |

| United Kingdom | 4.6% |

| Japan | 4.1% |

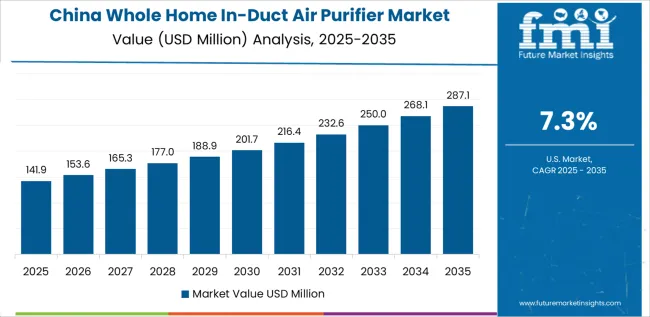

The whole home in-duct air purifier market is experiencing solid growth globally, with China leading at a 7.3% CAGR through 2035, driven by rapid urbanization creating indoor air quality concerns, expanding middle-class housing with central HVAC systems, and growing health awareness among urban consumers. India follows at 6.8%, supported by increasing air pollution concerns, expanding residential construction with HVAC adoption, and growing awareness of indoor air quality health impacts. Germany shows growth at 6.2%, emphasizing building health standards, energy-efficient HVAC integration, and environmental health consciousness.

Brazil demonstrates 5.7% growth, supported by residential construction expansion, growing middle-class HVAC adoption, and increasing awareness of air quality benefits. The United States records 5.1%, focusing on residential air quality concerns, allergen sensitivity awareness, and HVAC system upgrade cycles. The United Kingdom exhibits 4.6% growth, emphasizing building health standards and residential air quality improvement. Japan shows 4.1% growth, supported by health consciousness and precision air quality management systems.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from whole home in-duct air purifiers in China is projected to exhibit exceptional growth with a CAGR of 7.3% through 2035, driven by rapid urbanization creating indoor air quality concerns and expanding middle-class housing with central HVAC systems supported by growing health awareness and environmental consciousness among urban consumers. The country's massive residential construction activity and increasing emphasis on air quality are creating substantial demand for in-duct purification solutions. Major HVAC manufacturers and air quality companies are establishing comprehensive product offerings to serve both new construction and retrofit markets.

Revenue from whole home in-duct air purifiers in India is expanding at a CAGR of 6.8%, supported by increasing air pollution concerns, expanding residential construction with HVAC system adoption, and growing awareness of indoor air quality health impacts driven by urbanization and middle-class expansion. The country's comprehensive residential development and increasing health consciousness are driving sophisticated air purification capabilities throughout urban housing. Leading HVAC companies and air quality specialists are establishing market presence to address growing residential demand.

Revenue from whole home in-duct air purifiers in Germany is expanding at a CAGR of 6.2%, supported by the country's building health standards, energy-efficient HVAC integration requirements, and strong emphasis on environmental health and indoor air quality management. The nation's building excellence and health consciousness are driving sophisticated air purification capabilities throughout residential sectors. Leading HVAC manufacturers and building technology companies are investing extensively in integrated air quality solutions and system optimization.

Revenue from whole home in-duct air purifiers in Brazil is expanding at a CAGR of 5.7%, supported by the country's residential construction expansion, growing middle-class HVAC system adoption, and increasing awareness of air quality health benefits driven by urbanization patterns. The nation's housing development and consumer awareness growth are driving demand for air quality solutions. Homeowners and HVAC contractors are investing in purification capabilities to support market preferences.

Revenue from whole home in-duct air purifiers in the United States is expanding at a CAGR of 5.1%, supported by the country's residential air quality concerns, allergen sensitivity awareness, and growing emphasis on whole-house air treatment through HVAC system upgrades and enhancements. The nation's comprehensive HVAC infrastructure and health awareness are driving demand for integrated air purification solutions. Homeowners and HVAC contractors are investing in air quality improvement to serve health objectives.

Revenue from whole home in-duct air purifiers in the United Kingdom is expanding at a CAGR of 4.6%, driven by the country's building health standards, residential air quality improvement initiatives, and emphasis on indoor environmental quality and ventilation system enhancement. The UK's building regulations and health focus are driving demand for air purification solutions. Homeowners and contractors are establishing air quality improvement capabilities for building compliance.

Revenue from whole home in-duct air purifiers in Japan is expanding at a CAGR of 4.1%, supported by the country's health consciousness, precision air quality management preferences, and strong emphasis on indoor environmental control and residential comfort systems. Japan's quality focus and health awareness are driving demand for advanced air purification products. Homeowners are investing in comprehensive air quality solutions for health-conscious applications.

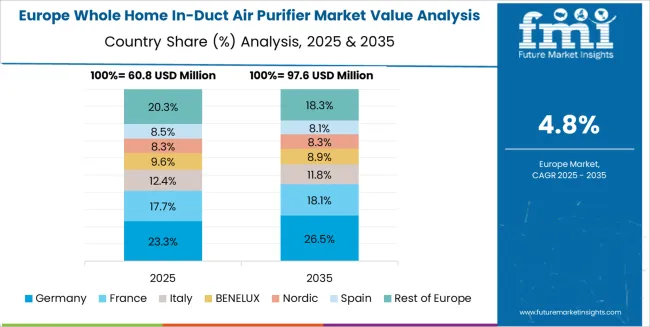

The whole home in-duct air purifier market in Europe is projected to grow from USD 81.3 million in 2025 to USD 132.4 million by 2035, registering a CAGR of 5% over the forecast period. Germany is expected to maintain leadership with a 30.8% market share in 2025, moderating to 30.3% by 2035, supported by building health standards leadership, energy-efficient HVAC integration, and environmental health consciousness.

The United Kingdom follows with 20.1% in 2025, projected at 19.8% by 2035, driven by building regulations, air quality standards, and residential ventilation requirements. France holds 17.4% in 2025, reaching 17.8% by 2035 on the back of building health initiatives and residential air quality programs. Italy commands 13.2% in 2025, rising slightly to 13.5% by 2035, while Spain accounts for 9.6% in 2025, reaching 9.9% by 2035 aided by residential construction growth and HVAC market expansion. The Netherlands maintains 4.3% in 2025, up to 4.5% by 2035 due to building health standards and advanced HVAC adoption. The Rest of Europe region, including Nordic countries, Central & Eastern Europe, and other markets, is anticipated to hold 4.6% in 2025 and 4.2% by 2035, reflecting steady development in residential air quality awareness and HVAC integration programs.

The whole home in-duct air purifier market is characterized by competition among established HVAC equipment manufacturers, specialized air quality companies, and diversified environmental technology providers. Companies are investing in purification technology enhancement, smart monitoring integration, energy efficiency optimization, and installation simplification to deliver high-performance, reliable, and cost-effective in-duct air purification solutions. Innovation in sensor technologies, pathogen inactivation methods, and IoT connectivity features is central to strengthening market position and competitive advantage.

RGF Environmental Group leads with comprehensive in-duct air purification solutions focused on advanced oxidation technology, pathogen reduction capabilities, and extensive product range across residential and commercial applications. Air Health provides integrated HVAC air quality systems with emphasis on whole-house coverage and allergen removal. Lennox offers premium HVAC equipment with integrated air purification options and system optimization. Mars - Motors delivers HVAC components and air quality products with focus on contractor markets.

Aerus specializes in air purification technologies with emphasis on active air treatment systems. Honeywell provides comprehensive building automation and air quality solutions with HVAC integration. Aprilaire focuses on residential indoor air quality products including humidification and air purification. GreenTech delivers environmental air treatment technologies for residential and commercial applications. LakeAir offers in-duct air purification systems serving diverse installation requirements.

Whole home in-duct air purifiers represent a specialized indoor air quality segment within HVAC and building systems applications, projected to grow from USD 238.1 million in 2025 to USD 402.8 million by 2035 at a 5.4% CAGR. These integrated air treatment systems—primarily filtration adsorption and electrostatic configurations for multiple applications—serve as critical air quality enhancement equipment in residential homes, commercial buildings, and institutional facilities where comprehensive air purification, pathogen reduction, and allergen removal are essential. Market expansion is driven by increasing indoor air quality awareness, growing health consciousness, expanding HVAC system integration, and rising demand for whole-house air treatment across diverse residential and commercial building operations.

How Building Standards Organizations Could Strengthen Air Quality Requirements and Performance Specifications?

How Industry Associations Could Advance Technology Standards and Air Quality Knowledge?

How In-Duct Air Purifier Manufacturers Could Drive Innovation and Market Leadership?

How Building Owners and Homeowners Could Optimize Air Quality Performance?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 238.1 million |

| Purification Technology | Filtration Adsorption Type, Electrostatic Dust Collection Type, Others |

| Application | Home Use, Commercial Use |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | RGF Environmental Group, Air Health, Lennox, Mars - Motors, Aerus |

| Additional Attributes | Dollar sales by purification technology and application category, regional demand trends, competitive landscape, technological advancements in air purification methods, smart monitoring integration, energy efficiency development, and indoor air quality optimization |

The global whole home in-duct air purifier market is estimated to be valued at USD 238.1 million in 2025.

The market size for the whole home in-duct air purifier market is projected to reach USD 402.9 million by 2035.

The whole home in-duct air purifier market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in whole home in-duct air purifier market are filtration adsorption type, electrostatic dust collection type and others.

In terms of application, home use segment to command 60.0% share in the whole home in-duct air purifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Whole Genome Amplification Market Size and Share Forecast Outlook 2025 to 2035

Whole-Body Imaging Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Whole Grain & High Fiber Foods Market Growth – Demand, Trends & Forecast 2025–2035

Whole Grain Salty Snacks Market Analysis by Product Type, Product Claim, Source, Distribution Channel and Region Through 2035

Whole Plasmid Sequencing Market Growth – Innovations, Trends & Forecast 2025-2035

Whole Milk Powder Market

Wholesale Roaming Market Insights – Growth & Forecast 2023-2033

Whole Home UV Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

United States Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Japan Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Korea Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Europe Whole Grain and High Fiber Foods Market Insights – Size & Forecast 2025–2035

Demand for Whole-Wheat Flour in EU Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

International Wholesale Voice Carrier Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Whole Wheat Flour Market Analysis – Trends, Demand & Forecast 2025–2035

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA