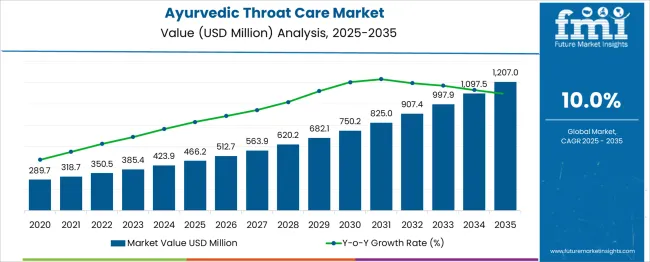

The global ayurvedic throat care market is projected to grow from USD 466.2 million in 2025 to approximately USD 1,207 million by 2035, recording an absolute increase of USD 740.8 million over the forecast period. This translates into a total growth of 159%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10% between 2025 and 2035. The overall market size is expected to grow by nearly 2.6X during the same period, supported by increasing consumer preference for natural remedies, rising awareness about the benefits of traditional medicine, and growing concerns about the side effects of conventional throat care products.

Between 2025 and 2030, the ayurvedic throat care market is projected to expand from USD 466.2 million to USD 748.3 million, resulting in a value increase of USD 282.1 million, which represents 38.1% of the total forecast growth for the decade. This phase of growth will be shaped by increasing acceptance of herbal medicines in mainstream healthcare, growing consumer awareness about immunity-boosting natural ingredients, and expanding distribution networks for ayurvedic products. Healthcare practitioners are increasingly recommending ayurvedic throat care solutions as complementary treatments, particularly for recurring throat infections and seasonal ailments.

| Metric | Value |

| Estimated Value in (2025E) | USD 466.2 million |

| Forecast Value in (2035F) | USD 1,207 million |

| Forecast CAGR (2025 to 2035) | 10% |

From 2030 to 2035, the market is forecast to grow from USD 748.3 million to USD 1,207.0 million, adding another USD 458.7 million, which constitutes 61.9% of the overall ten-year expansion. This period is expected to be characterized by integration of modern processing technologies with traditional formulations, development of innovative delivery formats for enhanced efficacy, and expansion of e-commerce platforms specializing in ayurvedic products. The growing global interest in preventive healthcare and holistic wellness approaches will drive demand for premium ayurvedic throat care products with standardized formulations and quality certifications.

Between 2020 and 2025, the ayurvedic throat care market experienced substantial expansion, driven by the global pandemic's impact on consumer health consciousness and preference for immunity-boosting natural products. The market developed as consumers increasingly sought alternatives to conventional throat medications, particularly those with fewer side effects and long-term health benefits. Traditional medicine practitioners and modern healthcare providers began recognizing the therapeutic value of ayurvedic formulations in managing throat discomfort and respiratory wellness.

Market expansion is being supported by the increasing consumer shift towards natural and herbal healthcare solutions, driven by concerns about antibiotic resistance and the side effects of conventional medications. Modern consumers are increasingly aware of the holistic benefits of ayurvedic medicine, which addresses not just symptoms but overall throat and respiratory health. The proven efficacy of traditional herbs like tulsi, ginger, licorice, and turmeric in managing throat infections, inflammation, and immunity makes ayurvedic products a preferred choice for preventive and therapeutic care.

The growing emphasis on preventive healthcare and wellness-oriented lifestyles is driving demand for ayurvedic throat care products that offer long-term health benefits without dependency concerns. Consumer preference for products with natural ingredients, minimal processing, and traditional wisdom backing is creating opportunities for authentic ayurvedic formulations. The rising influence of yoga and holistic wellness practices globally is contributing to increased acceptance and adoption of ayurvedic throat care solutions across different demographics and geographies.

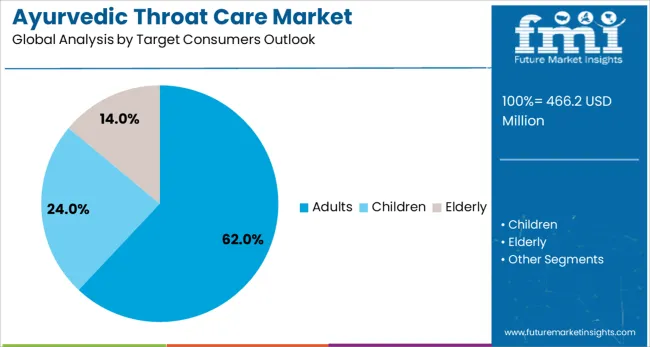

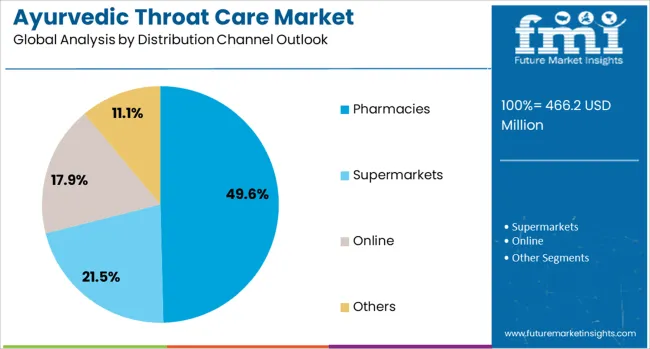

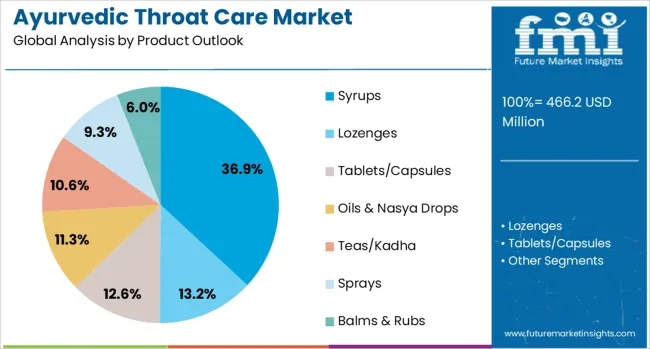

The market is segmented by product outlook, target consumers outlook, distribution channel outlook, and region. By product outlook, the market is divided into syrups, lozenges, tablets/capsules, oils & nasya drops, teas/kadha, sprays, and balms & rubs. Based on target consumers outlook, the market is categorized into adults, children, elderly, and others. In terms of distribution channel outlook, the market is segmented into pharmacies, supermarkets, and online channels. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adults segment is projected to account for 62% of the ayurvedic throat care market in 2025, establishing its position as the primary consumer demographic. Adults represent the most health-conscious consumer group, actively seeking natural alternatives to manage throat discomfort, seasonal infections, and voice-related issues arising from professional demands. This demographic's purchasing power and awareness about preventive healthcare make them ideal consumers for premium ayurvedic throat care products.

Working professionals, teachers, singers, and individuals in vocations requiring extensive verbal communication particularly value ayurvedic solutions for maintaining throat health without the drowsiness or dependency associated with conventional medications. The segment benefits from adults' ability to appreciate the long-term wellness benefits of ayurvedic medicine beyond immediate symptom relief. Their preference for natural immunity boosters and preventive care aligns perfectly with ayurvedic principles of holistic health management. With increasing stress levels and environmental pollution affecting throat health, adults continue to drive demand for effective, natural throat care solutions.

Pharmacies are projected to represent 49.6% of ayurvedic throat care distribution in 2025, underscoring their role as trusted healthcare retail points. Consumers value the professional guidance available at pharmacies, where trained pharmacists can recommend appropriate ayurvedic products based on specific symptoms and health conditions. The presence of both modern and ayurvedic pharmacies creates a comprehensive distribution network that caters to diverse consumer preferences and accessibility needs.

Pharmacies provide the credibility and quality assurance that consumers seek when purchasing healthcare products, particularly important for ayurvedic medicines where authenticity and standardization are critical. The segment benefits from the growing trend of integrative medicine, where pharmacies stock both conventional and traditional remedies, allowing consumers to make informed choices. Many pharmacies are expanding their ayurvedic sections and training staff in traditional medicine to better serve the increasing demand. As regulatory frameworks for ayurvedic products strengthen globally, pharmacies' role in ensuring product quality and consumer safety becomes even more significant in driving market growth.

The syrups segment is forecasted to contribute 36.9% of the ayurvedic throat care market in 2025, reflecting consumer preference for this traditional and effective delivery format. Ayurvedic syrups offer the advantage of combining multiple herbs in a palatable form that provides immediate soothing relief to throat irritation while delivering therapeutic benefits. The liquid format ensures better absorption of active ingredients and allows for precise dosing, making it suitable for all age groups.

Traditional formulations like Chyawanprash-based syrups, honey-infused herbal preparations, and specialized cough syrups with ingredients like tulsi, adulsa, and mulethi have established strong consumer trust over generations. The segment benefits from the versatility of syrup formulations that can address various throat conditions from dry cough to phlegm, sore throat to voice hoarseness. Modern manufacturing techniques have improved the taste, stability, and shelf-life of ayurvedic syrups without compromising their traditional efficacy. As consumers increasingly seek natural alternatives to codeine-based cough syrups, ayurvedic formulations provide safe, non-addictive options for regular use.

The ayurvedic throat care market is advancing rapidly due to growing consumer preference for natural remedies and increasing awareness about the side effects of conventional medications. However, the market faces challenges including standardization issues, limited clinical validation for some formulations, and regulatory complexities across different markets. Innovation in product formulations and modernization of traditional recipes continue to influence product development and market expansion patterns.

The convergence of traditional ayurvedic wisdom with modern scientific research is enhancing product credibility and efficacy. Manufacturers are conducting clinical trials to validate traditional claims, using advanced extraction techniques to standardize active compounds, and employing quality control measures that meet international standards. This scientific approach is helping ayurvedic throat care products gain acceptance among conventional healthcare practitioners and skeptical consumers who demand evidence-based solutions.

The growing adoption of e-commerce platforms is revolutionizing the distribution of ayurvedic throat care products, making them accessible to global consumers. Online channels provide detailed product information, ingredient transparency, and customer reviews that build trust and inform purchasing decisions. Digital marketing strategies, including educational content about ayurvedic principles and ingredient benefits, are helping brands connect with health-conscious consumers. Social media influencers and wellness bloggers are playing crucial roles in spreading awareness about the benefits of ayurvedic throat care solutions.

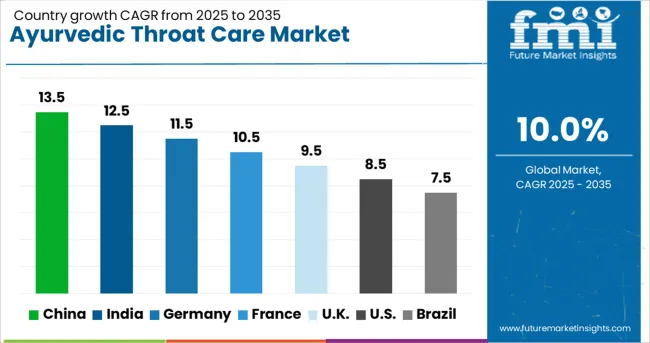

| Country | CAGR (2025-2035) |

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The ayurvedic throat care market is experiencing diverse growth patterns globally, with China leading at a 13.5% CAGR through 2035, driven by increasing integration of traditional medicine systems and growing consumer interest in natural healthcare solutions. India follows at 12.5%, supported by deep-rooted ayurvedic traditions, extensive manufacturing capabilities, and government promotion of traditional medicine. Germany shows robust growth at 11.5%, emphasizing quality standardization and scientific validation. France records 10.5%, focusing on natural wellness trends and preventive healthcare. The UK demonstrates 9.5% growth, driven by multicultural acceptance and alternative medicine adoption. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from ayurvedic throat care in China is projected to exhibit strong growth with a CAGR of 13.5% through 2035, driven by the country's openness to traditional medicine systems and increasing interest in natural healthcare alternatives. Chinese consumers' familiarity with traditional Chinese medicine creates receptivity to ayurvedic concepts, particularly for preventive care and chronic condition management. The growing middle class and rising healthcare awareness are driving demand for premium natural throat care products that offer holistic benefits.

Revenue from ayurvedic throat care in India is expanding at a CAGR of 12.5%, supported by the country's position as the birthplace of ayurveda and its extensive traditional medicine infrastructure. The deep cultural understanding and acceptance of ayurvedic principles create a strong domestic market while positioning India as a global supplier of authentic ayurvedic throat care products. Government initiatives promoting AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) systems are strengthening the sector's growth and international credibility.

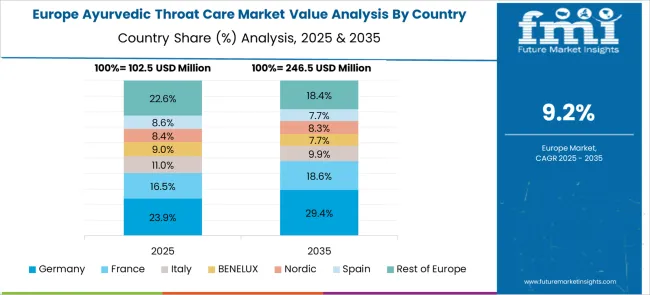

The ayurvedic throat care market in Europe demonstrates emerging growth across major economies with Germany showing strong presence through its established natural medicine tradition and consumer openness to complementary healthcare approaches, supported by the country's well-developed network of natural health stores and practitioners who integrate ayurvedic solutions into holistic treatment protocols. France represents a growing market driven by increasing interest in traditional medicine systems and natural wellness solutions, with consumers particularly appreciating the preventive healthcare philosophy of ayurveda and seeking alternatives to conventional throat medications.

The UK exhibits significant potential through its multicultural population familiar with ayurvedic traditions and growing mainstream acceptance of traditional medicine, with established ayurvedic clinics and specialized retailers expanding product accessibility across urban centers. Italy and Spain show developing interest in ayurvedic throat care, particularly among consumers seeking natural remedies for seasonal throat ailments and voice care. Nordic countries contribute through their focus on preventive healthcare and natural wellness, while Eastern European markets display emerging potential driven by increasing awareness of ayurvedic medicine and growing availability of authentic products through specialized importers and online channels.

Revenue from ayurvedic throat care in Germany is projected to grow at a CAGR of 11.5% through 2035, supported by the country's strong tradition of natural medicine and regulatory framework for herbal products. German consumers' preference for evidence-based natural remedies and willingness to invest in preventive healthcare create favorable conditions for premium ayurvedic throat care products. The presence of specialized natural health stores and trained practitioners facilitates proper product education and distribution.

Revenue from ayurvedic throat care in France is projected to grow at a CAGR of 10.5% through 2035, driven by increasing consumer interest in holistic wellness and natural prevention strategies. French consumers' appreciation for traditional medicine systems and emphasis on quality of life support adoption of ayurvedic throat care solutions. The country's developed spa and wellness industry provides additional channels for introducing ayurvedic concepts and products.

Revenue from ayurvedic throat care in the UK is projected to grow at a CAGR of 9.5% through 2035, supported by the country's diverse population familiar with ayurvedic traditions and increasing mainstream acceptance of complementary medicine. British consumers' growing preference for natural alternatives to conventional medications and interest in preventive healthcare drive demand for ayurvedic throat care products.

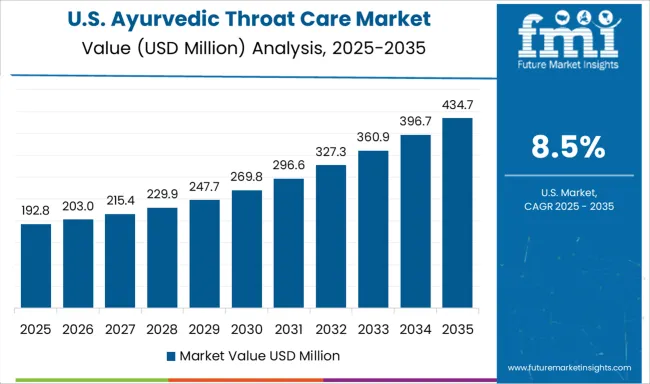

Demand for ayurvedic throat care in the USA is projected to grow at a CAGR of 8.5%, supported by the expanding wellness industry and consumer interest in alternative medicine. American consumers increasingly seek natural, holistic solutions for health management, particularly for conditions where conventional treatments may have limitations. The integration of ayurvedic principles into yoga studios, wellness centers, and natural health stores creates multiple touchpoints for product discovery.

Revenue from ayurvedic throat care in Brazil is projected to grow at a CAGR of 7.5% through 2035, driven by the country's openness to natural medicine and diverse healing traditions. Brazilian consumers' familiarity with herbal remedies and traditional medicine creates receptivity to ayurvedic concepts. The growing middle class and increasing health consciousness support demand for natural throat care alternatives.

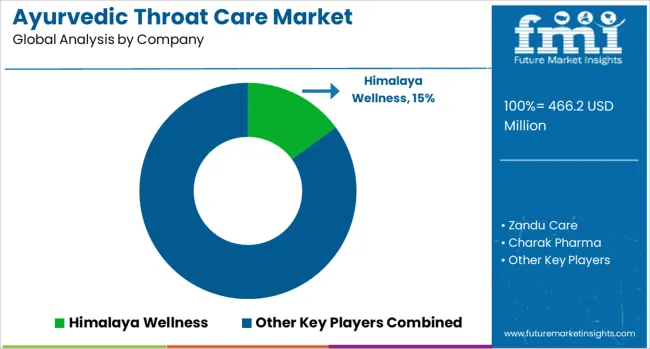

The ayurvedic throat care market is characterized by competition among established ayurvedic pharmaceutical companies, traditional medicine manufacturers, and emerging natural wellness brands. Companies are investing in research and development, clinical validation, modern manufacturing facilities, and brand building to deliver authentic, effective, and accessible ayurvedic throat care solutions. Product innovation, quality standardization, and distribution expansion are central to strengthening market presence and consumer trust.

Himalaya Wellness leads the market with 15.0% global value share, offering scientifically validated ayurvedic formulations with extensive clinical research backing and international quality certifications. The company's strong brand recognition and wide distribution network across multiple countries position it as a trusted name in ayurvedic throat care. Zandu Care, Charak Pharma, and Baidyanath Group represent traditional Indian ayurvedic companies with decades of expertise in classical formulations and strong domestic market presence.

Asvins Lifecare and Multani focus on premium ayurvedic products with modern packaging and marketing approaches targeting urban consumers. Kuka specializes in innovative delivery formats and convenient packaging for on-the-go throat care solutions. Maharishi Ayurveda emphasizes authentic vedic formulations with strict adherence to traditional preparation methods. Kottakkal Arya Vaidya Sala maintains its reputation through classical Kerala ayurvedic traditions and physician-prescribed formulations. Honeywise combines honey-based traditional remedies with modern processing techniques. Hamdard leverages its Unani-Ayurvedic heritage to offer unique throat care formulations. Innovative Pharma focuses on research-driven product development and standardization of ayurvedic actives.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 466.2 million |

| Product Outlook | Syrups, Lozenges, Tablets/Capsules, Oils & Nasya Drops, Teas/Kadha, Sprays, Balms & Rubs |

| Target Consumers Outlook | Adults, Children, Elderly, Others |

| Distribution Channel Outlook | Pharmacies, Supermarkets, Online |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Himalaya Wellness, Zandu Care, Charak Pharma, Baidyanath Group, Asvins Lifecare, Multani Kuka, Maharishi Ayurveda, Kottakkal Arya Vaidya Sala, Honeywise, Hamdard, and Innovative Pharma |

| Additional Attributes | Dollar sales by formulation type and herb combinations, regional demand patterns, competitive landscape analysis, consumer preferences for traditional versus modern formats, integration with preventive healthcare trends, innovations in taste masking, bioavailability enhancement, and sustainable sourcing of medicinal herbs |

North America

The global ayurvedic throat care market is estimated to be valued at USD 466.2 million in 2025.

The market size for the ayurvedic throat care market is projected to reach USD 1,207.0 million by 2035.

The ayurvedic throat care market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in ayurvedic throat care market are syrups, lozenges, tablets/capsules, oils & nasya drops, teas/kadha, sprays and balms & rubs.

In terms of target consumers outlook, adults segment to command 62.0% share in the ayurvedic throat care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ayurvedic Supplement Market Size and Share Forecast Outlook 2025 to 2035

Ayurvedic Products and Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Throat Sprays Market Analysis - Size, Share & Forecast 2025 to 2035

Sore Throat Lozenges Market Size and Share Forecast Outlook 2025 to 2035

Strep Throat Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Cold, Cough, and Sore Throat Remedy Market Analysis – Size, Share & Forecast 2024-2034

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA