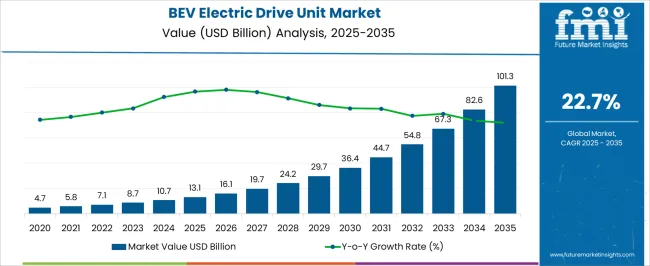

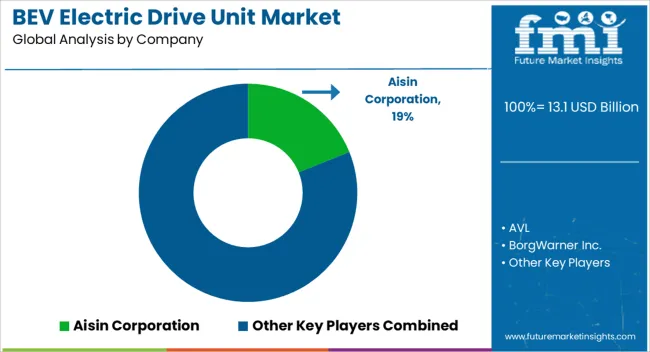

The BEV electric drive unit market is projected to grow from USD 13.1 billion in 2025 to USD 101.3 billion by 2035, with a CAGR of 22.7%. Inflection point mapping reveals key phases where market growth is accelerated or decelerated due to technological innovations, policy changes, and shifting consumer demands. Understanding these turning points is crucial for stakeholders to adjust investment and production strategies.

From 2025 to 2027, the market expands from USD 13.1 billion to USD 16.1 billion, driven by early adoption of high-efficiency electric powertrains and advancements in drive unit technologies. Inflection points during this period are shaped by increasing demand for electric vehicles, supported by government incentives, and technological improvements in motor efficiency and vehicle range. Between 2028 and 2031, the market sees a surge, moving from USD 19.7 billion to USD 29.7 billion. Growth inflection occurs as stricter emission regulations and consumer preference for greener transportation options push automakers to ramp up BEV production.

The market sees faster adoption of integrated electric drive systems, with innovations like regenerative braking and enhanced battery integration becoming mainstream. From 2032 to 2035, the market accelerates further, reaching USD 101.3 billion. Inflection points in this phase are driven by global electrification of transportation, advancements in autonomous vehicle technologies, and expanding infrastructure for EV charging, as well as increasing penetration in emerging markets.

| Metric | Value |

|---|---|

| BEV Electric Drive Unit Market Estimated Value in (2025 E) | USD 13.1 billion |

| BEV Electric Drive Unit Market Forecast Value in (2035 F) | USD 101.3 billion |

| Forecast CAGR (2025 to 2035) | 22.7% |

The BEV electric drive unit market is shaped by five interconnected parent markets, each contributing to overall demand and expansion. The automotive market takes the largest share at 40%, driven by the rising adoption of electric vehicles (EVs) and the growing demand for electric powertrains in passenger and commercial vehicles. The transportation sector follows with 25%, as electric drive units are pivotal for electrifying buses, trucks, and other heavy-duty transport systems. The renewable energy market contributes 15%, with electric drive units playing a key role in the development of sustainable energy solutions, such as electric-powered machinery in wind and solar power projects.

The industrial equipment sector accounts for 10%, as electric drive systems are increasingly used to power machinery in factories, warehouses, and manufacturing plants. Finally, the logistics and warehousing market holds a 10% share, with electric drive units gaining traction in automated guided vehicles (AGVs) and electric forklifts.

The automotive, transportation, and renewable energy sectors dominate the market, accounting for 80% of overall demand. This underscores the pivotal role of electric mobility and clean energy solutions in driving the growth of BEV electric drive units, while industrial and logistics sectors contribute to diversified demand opportunities globally.

The BEV electric drive unit market is experiencing accelerated growth due to the global transition toward electrification in the automotive sector. Increasing regulatory mandates to reduce emissions, alongside substantial investments from automakers in electric mobility platforms, are catalyzing the adoption of advanced electric drive units.

These units integrate the motor, power electronics, and transmission into a compact system, offering improved efficiency, performance, and reduced manufacturing complexity. Technological advancements in thermal management, lightweight materials, and integrated architecture are further driving market penetration across both premium and mass market vehicle segments.

The future outlook remains strong as manufacturers optimize for higher energy density and modularity, with a focus on delivering scalable electric drivetrain solutions tailored for diverse vehicle classes and performance profiles.

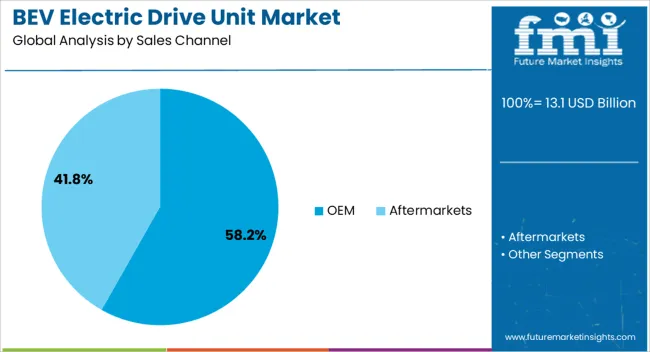

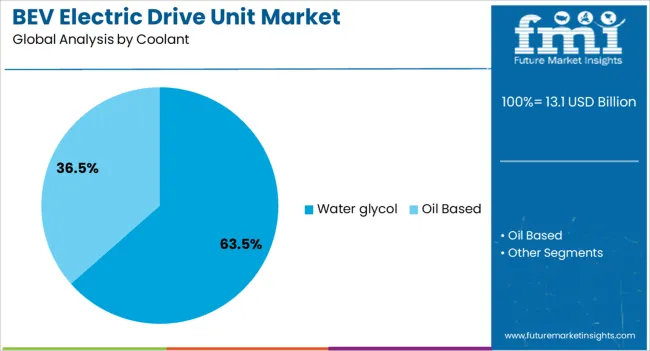

The bev electric drive unit market is segmented by sales channel, coolant, and geographic regions. By sales channel, bev electric drive unit market is divided into OEM and Aftermarkets. In terms of coolant, bev electric drive unit market is classified into Water glycol and Oil Based. Regionally, the bev electric drive unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The OEM segment is projected to contribute 58.20% of the total market revenue by 2025 under the sales channel category, making it the leading segment. This dominance is attributed to the direct integration of electric drive units during vehicle assembly by major automotive manufacturers.

OEMs have prioritized in house electrification strategies, allowing for better alignment between powertrain performance and vehicle design. The demand for customized drive unit configurations that meet specific torque and speed requirements has strengthened partnerships between automakers and drive unit suppliers.

Additionally, the trend toward vertical integration among leading EV manufacturers has increased internal production of electric drive components, reinforcing OEM control and volume scalability. This strategic alignment with evolving platform architectures has positioned the OEM channel as the dominant contributor to market revenue.

The water glycol coolant segment is expected to hold 63.50% of market revenue by 2025 within the coolant category, making it the most widely used cooling medium. This is primarily due to its effective thermal conductivity, corrosion resistance, and cost efficiency in regulating electric drive unit temperatures.

As power densities increase in compact drive units, maintaining consistent thermal performance has become critical to prevent overheating and ensure long term system reliability. Water glycol solutions provide a balanced approach to heat transfer, offering compatibility with aluminum and copper components widely used in electric drive units.

Furthermore, the widespread availability and established usage of water glycol across EV platforms have reinforced its selection as the preferred coolant. This widespread adoption reflects its proven performance under varied operational conditions, solidifying its leadership in the coolant segment.

The BEV electric drive unit market is propelled by growing demand, regulatory incentives, technological advances, and expanding charging infrastructure. These dynamics are contributing to rapid growth across key sectors.

The demand for BEV electric drive units has surged due to growing environmental awareness and the shift towards cleaner transportation solutions. Governments worldwide are introducing stricter emission norms and providing subsidies for electric vehicles, thereby accelerating adoption. The automotive sector is particularly driving growth, as electric vehicles (EVs) replace traditional internal combustion engine vehicles. Additionally, consumers' increasing preference for green and efficient technologies is contributing to the rising demand for BEVs. As EV adoption intensifies, the need for high-performance electric drive units, which offer improved efficiency and reduced maintenance costs, is becoming critical for the growth of the BEV market.

Government incentives and regulations play a crucial role in shaping the BEV electric drive unit market. Policies such as tax rebates, subsidies, and grants are fostering growth by reducing the upfront cost of EVs, making them more accessible to consumers. These incentives are especially prominent in key markets like China, the European Union, and the United States, where a significant focus is placed on reducing automotive emissions. Regulations mandating the transition to cleaner vehicles in public transport systems further drive the demand for electric drive units, enabling a rapid shift to electrified transportation and infrastructure development.

Recent improvements in electric powertrain technology have significantly enhanced the performance of BEV electric drive units. Innovations in battery technology, such as higher energy density and faster charging times, have played a key role in driving the efficiency of electric vehicles. Furthermore, advances in materials science have led to the development of lighter, more efficient electric motors and drive units, contributing to better overall vehicle performance. These technological strides are not only lowering operational costs but are also increasing the driving range of BEVs, making them more attractive to both consumers and fleet operators.

The growth of BEV electric drive units is closely tied to the expansion of charging infrastructure. The availability of widespread and accessible charging stations is a significant factor in enhancing the attractiveness of electric vehicles, particularly for long-distance travel. Governments, private sector players, and energy companies are investing heavily in building robust EV charging networks across urban and rural areas. As charging infrastructure expands, it alleviates concerns about range anxiety, thereby encouraging more consumers to transition to electric vehicles and further boosting the demand for BEV electric drive units.

| Country | CAGR |

|---|---|

| China | 30.6% |

| India | 28.4% |

| Germany | 26.1% |

| France | 23.8% |

| UK | 21.6% |

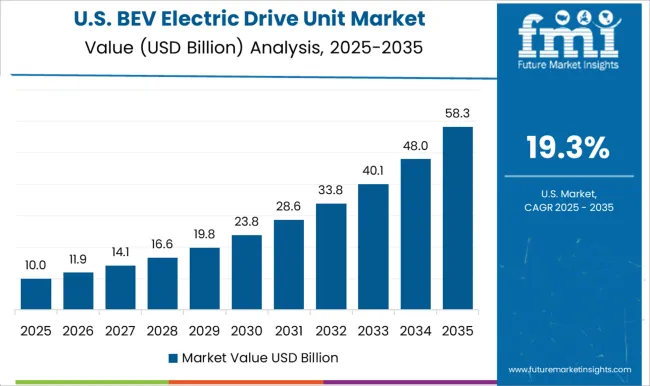

| USA | 19.3% |

| Brazil | 17.0% |

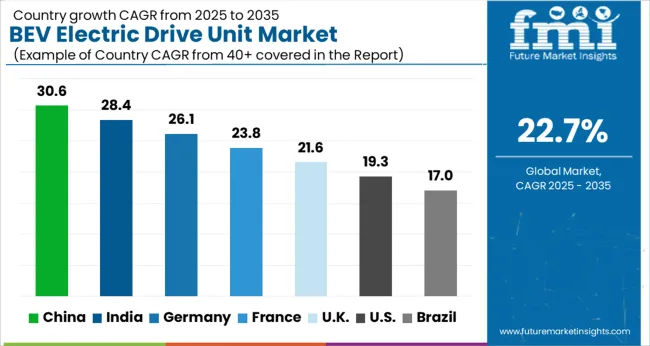

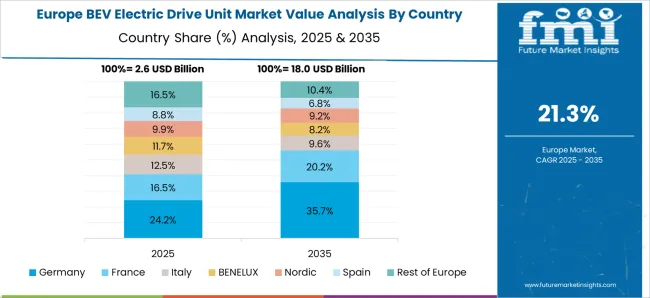

The global BEV electric drive unit market is projected to grow at a CAGR of 22.7% from 2025 to 2035. China leads at 30.6%, followed by India at 28.4%, Germany at 26.1%, the UK at 21.6%, and the USA at 19.3%. Growth is driven by consumer demand for eco-friendly transportation, government incentives, and advancements in electric vehicle technology. China dominates due to its large automotive sector and government policies promoting EV adoption, while India is rapidly expanding its electric vehicle infrastructure. Germany continues to innovate in powertrain technology, especially for high-performance electric vehicles. The UK and USA are focusing on public transportation electrification and growing urban EV adoption. Asia remains the fastest-growing region, while Europe and North America are increasingly focused on improving vehicle performance and charging infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

The BEV electric drive unit market in China is projected to grow at a CAGR of 30.6% from 2025 to 2035, driven by aggressive electrification plans, government policies, and the expansion of the domestic automotive sector. Key domestic manufacturers like BYD and NIO are investing heavily in electric drive unit technology to meet the rising demand for electric vehicles (EVs). The Chinese government's supportive measures, including subsidies and emission regulations, are accelerating the adoption of EVs. China’s rapidly expanding charging infrastructure is addressing consumer concerns regarding range anxiety, further boosting the market. The demand for electric buses and commercial vehicles is growing, contributing to the increasing adoption of BEV electric drive units.

The BEV electric drive unit market in India is expected to grow at a CAGR of 28.4% from 2025 to 2035, supported by government incentives, increasing environmental awareness, and the country’s push towards electrification in urban mobility. The Indian government’s initiatives, including tax rebates and subsidies for electric vehicles, are accelerating EV adoption across the country. Major players like Tata Motors and Mahindra & Mahindra are expanding their electric vehicle offerings, contributing to the rising demand for BEV electric drive units. India’s growing electric two-wheeler market is particularly notable, driven by the need for affordable and energy-efficient transportation. The expansion of EV charging stations further supports market growth, as urban areas witness increasing adoption of EVs.

The BEV electric drive unit market in Germany is projected to grow at a CAGR of 26.1% from 2025 to 2035, supported by the country’s strong automotive sector, regulatory measures, and demand for clean transportation solutions. Leading automakers such as Volkswagen, BMW, and Mercedes-Benz are making significant strides in electrifying their vehicle portfolios, driving the demand for electric drive units. Germany's strict emission regulations and government incentives are pushing the shift towards electric vehicles. Additionally, the country’s advanced charging infrastructure and integration with renewable energy sources are facilitating the growth of the BEV market. High-performance electric vehicles are gaining traction, leading to increased demand for electric drive units with improved efficiency and performance.

The BEV electric drive unit market in the UK is expected to grow at a CAGR of 21.6% from 2025 to 2035, driven by government policies aimed at reducing emissions and the country’s transition to cleaner mobility solutions. The UK is phasing out the sale of new petrol and diesel cars by 2030, accelerating the shift to electric vehicles. Domestic and international automakers, including Jaguar Land Rover and Nissan, are increasing production of electric vehicles, which will fuel demand for electric drive units. The growth of electric public transportation systems in the UK, along with an expanding charging network, is further boosting market adoption.

The BEV electric drive unit market in the USA is projected to grow at a CAGR of 19.3% from 2025 to 2035, supported by federal and state-level incentives and the increasing production of electric vehicles by domestic manufacturers. Leading automakers like Tesla, Ford, and General Motors are scaling up their electric vehicle production, driving demand for BEV electric drive units. The expansion of EV charging infrastructure across the country, especially along major highways, is addressing concerns around range anxiety and promoting EV adoption. Furthermore, the USA government’s focus on electrifying public transportation and commercial fleets is contributing to the growth of the market.

The BEV electric drive unit market is highly competitive, driven by rapid electrification in passenger and commercial vehicles. Global automakers and Tier-1 suppliers dominate, with companies like Bosch, Valeo, Magna International, and ZF Friedrichshafen holding significant shares through vertically integrated production, strong R&D capabilities, and long-standing partnerships with major vehicle manufacturers. These players focus on developing compact, lightweight, and high-efficiency drive units that combine the electric motor, transmission, and power electronics in a single module.

Competition also comes from emerging specialist suppliers in Asia, particularly from China, where cost-competitive solutions and high production capacity have allowed local firms to secure contracts with domestic EV makers. Intense rivalry revolves around performance efficiency, thermal management, modular architecture, and ease of integration with vehicle platforms. Strategic collaborations and joint ventures with battery and inverter companies help strengthen product portfolios and accelerate technological development. Pricing pressures and the race for energy efficiency continue to shape the landscape, with companies pursuing economies of scale and innovative designs to reduce production costs. Strong supply chain management, global manufacturing footprints, and software integration capabilities are becoming key differentiators for market leaders.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.1 Billion |

| Sales Channel | OEM and Aftermarkets |

| Coolant | Water glycol and Oil Based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin Corporation, AVL, BorgWarner Inc., DANA TM4 INC., ElringKlinger AG, Equipmake, FRIWO Gerätebau GmbH, hofer powertrain, LG Magna e-Powertrain, Magna International Inc., Magnetic Systems Technology Limited, MAHLE Polska Sp. z o.o, Nidec Corporation, Nissan Motor, Punch Powertrain nv, Robert Bosch GmbH, Saietta Group, Schaeffler AG, Toyota, Voith GmbH & Co. KGaA, Vitesco Technologies GmbH, ZF Friedrichshafen AG, and Zytek Automotive Ltd. |

| Additional Attributes | Dollar sales by product type, such as motors, inverters, and integrated powertrains, as well as market share of key players across regions like North America, Europe, and Asia. |

The global bev electric drive unit market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the bev electric drive unit market is projected to reach USD 101.3 billion by 2035.

The bev electric drive unit market is expected to grow at a 22.7% CAGR between 2025 and 2035.

The key product types in bev electric drive unit market are oem and aftermarkets.

In terms of coolant, water glycol segment to command 63.5% share in the bev electric drive unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA