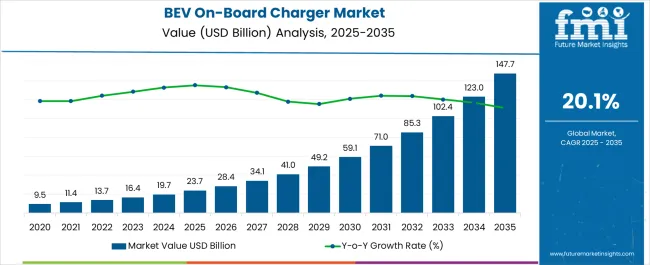

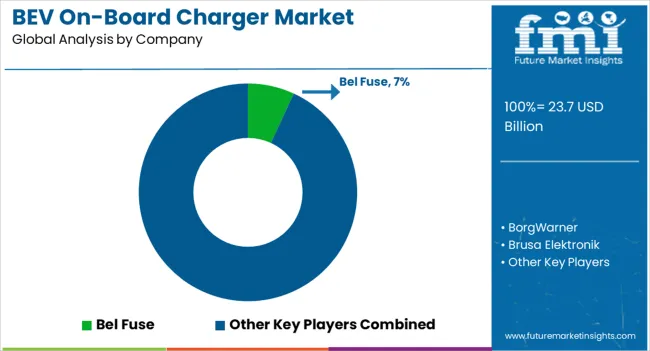

The BEV on-board charger market is expected to grow from USD 23.7 billion in 2025 to USD 147.7 billion by 2035, reflecting a 20.1% CAGR and an absolute dollar opportunity of USD 124.0 billion. Growth is driven by accelerating adoption of battery electric vehicles (BEVs), government incentives for clean mobility, expansion of charging infrastructure, and technological advancements in high-efficiency, fast-charging onboard systems. Increasing consumer demand for longer-range electric vehicles and faster charging solutions further strengthens market uptake across global regions. Peak-to-trough analysis highlights variations in market momentum across the forecast period.

From 2025 to 2027, growth accelerates rapidly, representing the initial peak phase, as early adoption in North America, Europe, and China increases due to supportive policies, fleet expansion, and the deployment of charging infrastructure. Between 2028 and 2031, the market experiences moderate deceleration as initial demand in mature regions stabilizes, while emerging markets begin adoption, creating a temporary trough in relative annual growth rates. From 2032 to 2035, the market enters another peak phase, driven by large-scale BEV penetration, premium vehicle launches with high-capacity onboard chargers, and integration of smart charging technologies. The multiplication factor of 6.23x underscores the transformative growth, while the peak-to-trough pattern reveals cyclical acceleration and moderation aligned with adoption waves, technology upgrades, and regional market maturation.

| Metric | Value |

|---|---|

| BEV On-Board Charger Market Estimated Value in (2025 E) | USD 23.7 billion |

| BEV On-Board Charger Market Forecast Value in (2035 F) | USD 147.7 billion |

| Forecast CAGR (2025 to 2035) | 20.1% |

The BEV on-board charger market is driven by five primary parent markets with specific shares. Electric passenger vehicles lead with 45%, as on-board chargers enable efficient AC-to-DC conversion for battery charging. Commercial electric vehicles contribute 25%, including buses, delivery vans, and trucks requiring reliable charging solutions. Two-wheelers and light electric mobility account for 15%, integrating compact chargers for urban mobility. Infrastructure and fleet operators represent 10%, installing standardized chargers for multi-vehicle charging stations. Industrial and utility vehicles hold 5%, using chargers for forklifts, airport vehicles, and specialized electric machinery. These segments collectively shape global demand for BEV on-board chargers. Recent developments in the BEV on-board charger market focus on higher efficiency, faster charging, and smart integration.

Manufacturers are introducing chargers with higher power ratings, bidirectional charging capability, and compatibility with multiple voltage standards. Integration with battery management systems and IoT platforms enables real-time monitoring, predictive diagnostics, and energy optimization. Lightweight, compact designs are improving vehicle efficiency and installation flexibility. Growth in electric vehicle adoption, expansion of charging infrastructure, and regulatory support for zero-emission transport are accelerating market adoption.

The BEV on-board charger market is advancing in alignment with the accelerating adoption of battery electric vehicles and the expansion of supporting charging infrastructure. Rising regulatory pressure to reduce carbon emissions, coupled with technological advancements in power electronics, is driving the integration of efficient on-board charging systems.

Automakers are increasingly prioritizing compact, lightweight, and high-efficiency charger designs to improve vehicle range and charging speed. The market benefits from a growing shift toward higher-capacity charging systems to support larger battery packs and extended driving ranges.

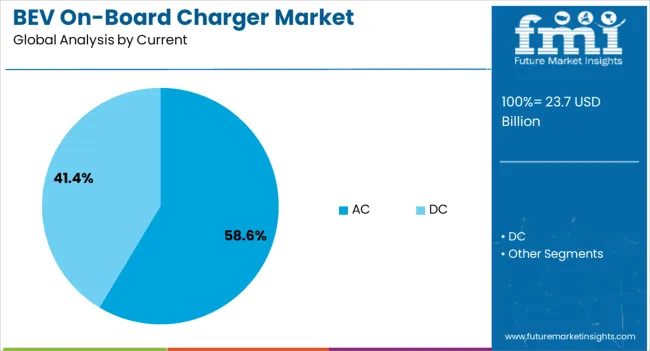

Current developments reflect a balance between AC and DC charging capabilities, with AC chargers retaining significant market relevance due to compatibility with widespread public and residential charging networks. The increasing penetration of fast-charging solutions and standardization of charging protocols are expected to enhance the market’s growth trajectory further, positioning on-board chargers as a critical component in the broader EV ecosystem.

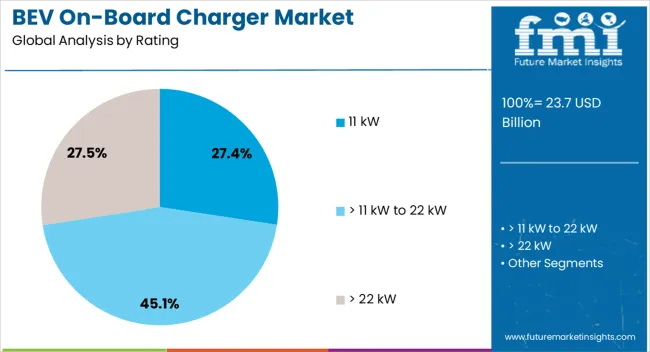

The bev on-board charger market is segmented by rating, current, and geographic regions. By rating, bev on-board charger market is divided into 11 kW, > 11 kW to 22 kW, and > 22 kW. In terms of current, bev on-board charger market is classified into AC and DC. Regionally, the bev on-board charger industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 11 kW segment accounts for approximately 27.4% share in the rating category of the BEV on-board charger market. This capacity range offers an optimal balance between charging time and infrastructure compatibility, making it a popular choice for mid-range passenger EVs.

Its adoption is supported by its ability to deliver overnight charging using residential AC supply while still offering faster replenishment compared to lower-capacity units. Manufacturers favor 11 kW systems for their versatility, cost-efficiency, and suitability for both single-phase and three-phase connections.

The segment has also benefited from regional regulatory incentives aimed at enhancing residential and workplace charging capabilities. As EV battery capacities continue to grow, 11 kW chargers are expected to retain market relevance, particularly in markets where home-based charging remains the dominant method.

The AC segment leads the current category with approximately 58.6% share, driven by the widespread availability of AC charging infrastructure in residential, commercial, and public spaces. AC on-board chargers offer cost-effective installation, lower hardware complexity, and compatibility with existing grid networks, making them a preferred solution for daily charging needs.

The segment’s dominance is reinforced by consumer habits that favor overnight or long-duration charging, especially in urban and suburban environments. Furthermore, AC chargers are less demanding on grid stability compared to high-power DC systems, which supports their continued use in regions with limited grid upgrade capacity.

Ongoing improvements in AC charging efficiency and thermal management are expected to sustain its leadership in the foreseeable future.

The global BEV on-board charger market is growing due to rising electric vehicle adoption, expanding charging infrastructure, and stricter emissions regulations. Asia Pacific holds over 50% of adoption, led by China, Japan, and South Korea, while Europe emphasizes high-performance chargers for premium electric cars. North America focuses on commercial fleets and passenger EVs. On-board chargers with power ratings of 3.3–22 kW dominate adoption. Increasing consumer preference for faster charging, integration with smart grids, and government incentives for electric mobility are driving measurable global market growth.

The primary driver of the BEV on-board charger market is the rapid adoption of electric vehicles. In China, over 10 million BEVs were registered in 2024, with significant expansion in urban charging networks. Europe’s regulatory framework mandates charging standards and interoperability, boosting on-board charger integration. North America sees growing adoption among commercial fleets, including delivery vehicles and public transport buses. On-board chargers allow controlled AC-to-DC conversion, ensuring safe and efficient charging from residential and public outlets. Expansion of renewable energy-powered charging stations, battery upgrades, and rising consumer demand for convenient home and workplace charging further drive market growth globally.

Opportunities in the BEV on-board charger market are driven by high-power AC chargers and integration with smart vehicle systems. Europe and North America are deploying chargers exceeding 11 kW in premium and commercial electric vehicles to reduce charging times. Asia Pacific is focusing on compact, modular chargers compatible with 3.3–7.7 kW AC grids in densely populated areas. Smart inverters allow vehicle-to-grid (V2G) capabilities, peak load management, and integration with renewable energy. Commercial fleet operators are adopting advanced chargers for buses and delivery vehicles to optimize downtime and energy efficiency. Manufacturers offering modular, high-efficiency, and IoT-enabled chargers can capture global opportunities across passenger, commercial, and fleet applications.

Key trends include vehicle-to-grid capabilities, IoT connectivity, and high-efficiency power electronics. Bi-directional chargers allow energy flow from the battery back to the grid, supporting renewable integration and energy cost optimization. Digital platforms enable real-time monitoring, predictive maintenance, and remote diagnostics. Europe is leading V2G adoption, while Asia Pacific focuses on compact, high-efficiency designs for urban EV fleets. North America is integrating chargers with smart energy management systems for commercial vehicles. Adoption of silicon carbide (SiC) and gallium nitride (GaN) semiconductors improves conversion efficiency and reduces size and weight. These trends reflect a global shift toward smarter, faster, and energy-optimized BEV charging solutions.

High costs and grid limitations remain key restraints for BEV on-board chargers. Chargers with power ratings above 11 kW are more expensive, limiting adoption in low-cost and entry-level vehicles. Residential electrical infrastructure in many regions cannot support simultaneous high-power charging, slowing adoption. Technical complexity, including thermal management and compliance with global charging standards, adds installation and maintenance challenges. In emerging economies, lack of standardized AC charging networks further restricts market penetration. Manufacturers must focus on cost-optimized, modular, and energy-efficient charger designs to address these barriers and expand adoption across passenger, fleet, and commercial electric vehicle segments globally.

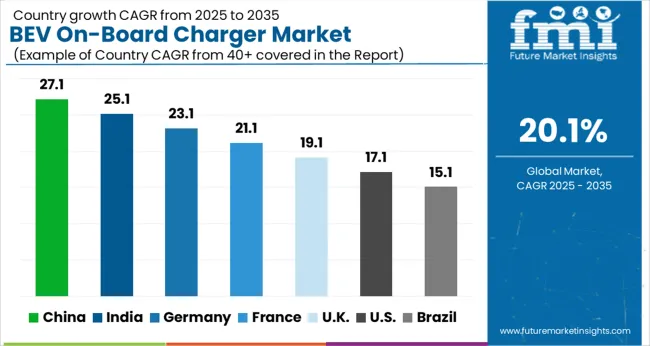

| Country | CAGR |

|---|---|

| China | 27.1% |

| India | 25.1% |

| Germany | 23.1% |

| France | 21.1% |

| UK | 19.1% |

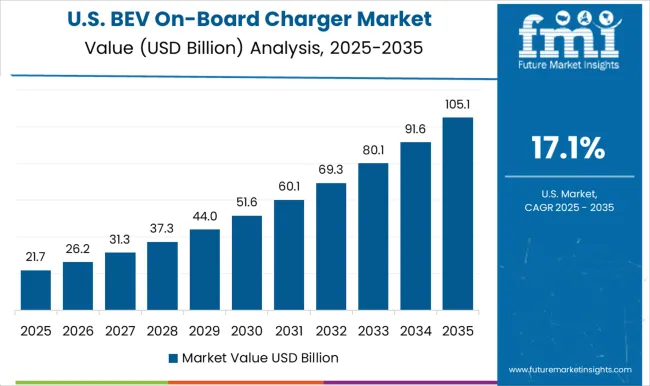

| USA | 17.1% |

| Brazil | 15.1% |

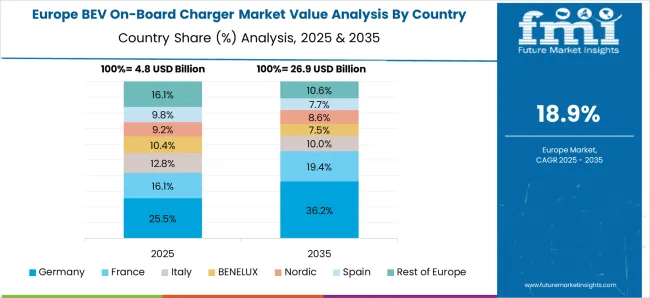

The BEV on-board charger market is projected to grow at a global CAGR of 20.1%, fueled by rising electric vehicle adoption, advancements in battery technology, and supportive government incentives. China leads with a CAGR of 27.1%, a 1.35× multiple of the global rate, driven by BRICS-backed EV manufacturing, infrastructure expansion, and regulatory support. India follows at 25.1%, a 1.25× multiple, reflecting growing urban mobility needs, government subsidies, and rising EV penetration. Germany records 23.1%, a 1.15× multiple, influenced by OECD-focused automotive innovation, renewable energy integration, and strong industrial applications. France posts 21.1%, slightly above the global average, supported by clean mobility initiatives and EV adoption. The United Kingdom stands at 19.1%, near the global rate, while the United States records 17.1%, 0.85× the benchmark, where EV infrastructure and fleet electrification drive demand. BRICS economies dominate expansion, OECD nations prioritize technological advancements and efficiency, and ASEAN contributes through urban mobility growth and EV deployment. This report includes insights on 40+ countries; the top markets are shown here for reference.

The BEV on-board charger market in China is projected to grow at a CAGR of 27.1%, driven by rising electric vehicle (EV) adoption, government incentives, and expansion of EV infrastructure. Leading players such as BYD, NIO, and CATL are supplying high-efficiency onboard chargers with fast-charging capability, compact design, and thermal management systems. Adoption is concentrated in passenger EVs, commercial electric fleets, and urban transport. Technological trends include bi-directional charging, silicon carbide (SiC) semiconductors, and integrated thermal management for enhanced efficiency. Government mandates supporting new energy vehicles and extensive charging infrastructure deployment accelerate growth. Rising consumer preference for fast-charging EVs and fleet electrification further strengthen adoption.

The BEV on-board charger market in the United Kingdom is expected to grow at a CAGR of 19.1%, supported by EV adoption, expansion of charging networks, and government incentives for low-emission transport. Leading suppliers including Delta Electronics, Siemens, and Bosch are providing compact, efficient, and high-performance chargers suitable for passenger EVs and commercial fleets. Adoption is concentrated in urban EV fleets, public transport electrification, and private passenger vehicles. Technological trends include fast-charging, modular design, and energy-efficient thermal management. Policies promoting EV adoption and fleet electrification enhance growth, while rising awareness of environmental concerns supports accelerated market uptake.

The BEV on-board charger market in the United States is projected to grow at a CAGR of 17.1%, driven by increasing EV adoption, federal incentives, and expansion of charging infrastructure. Key manufacturers such as Tesla, BorgWarner, and ABB supply high-efficiency, compact onboard chargers for passenger EVs and commercial fleets. Adoption is concentrated in metropolitan EV hubs, electric commercial delivery fleets, and public transport. Technological trends include silicon carbide-based chargers, bi-directional charging, and integrated thermal management for improved energy efficiency. State policies promoting clean transportation, combined with rising EV fleet deployment, support steady market growth.

The BEV on-board charger market in India is expected to expand at a CAGR of 25.1%, supported by rising EV sales, government incentives under FAME schemes, and increased charging network development. Key suppliers including Tata Motors, Mahindra Electric, and Bosch are delivering high-efficiency chargers for passenger EVs and commercial fleets. Adoption is concentrated in metropolitan areas and high-density cities with expanding EV fleets. Technological trends include fast-charging support, thermal management optimization, and modular charger designs. The government’s push toward electrification in public transport and last-mile delivery strengthens market growth. Consumer demand for efficient charging and fleet electrification drives further adoption.

The BEV on-board charger market in Germany is projected to grow at a CAGR of 23.1%, driven by EV adoption, government incentives, and automotive OEM initiatives. Manufacturers such as Bosch, Continental, and Siemens are supplying advanced chargers with high efficiency, integrated thermal management, and compact designs. Adoption is concentrated in passenger electric vehicles and commercial fleets. Technological trends include bi-directional charging, silicon carbide semiconductors, and smart grid integration for energy management. The government’s push for low-emission transport and rising EV registrations reinforce demand. Automotive fleet electrification, urban mobility projects, and advanced charging infrastructure contribute to market expansion.

Competition in the BEV on-board charger market is driven by automotive manufacturers, semiconductor companies, and power electronics specialists focusing on efficiency, safety, and fast charging capabilities. Tesla, Hyundai Motor, and Nissan Motor lead with integrated charger systems tailored for electric vehicles, emphasizing high power density, reliability, and compatibility with multiple charging standards in their brochures. BorgWarner, Brusa Elektronik, and Delta Energy Systems focus on modular designs and advanced thermal management, targeting both passenger and commercial EV segments. Bel Fuse, Eaton, Phinia, and Stercom Power Solutions provide flexible charging solutions with compact form factors, highlighting performance, safety certifications, and system integration. Infineon Technologies and STMicroelectronics strengthen competition with semiconductor-based solutions, emphasizing high efficiency, wide input voltage range, and long operational life. Innolectric and Ficosa Internacional target specialized EV applications, promoting lightweight and cost-effective designs. Brochures highlight technical specifications, charging efficiency, thermal performance, and compliance with global standards, guiding buyers in system selection. Marketing materials play a central role in market positioning, combining technical schematics, operational guidance, and real-world performance data. Frequent updates reflect evolving charging protocols, safety standards, and energy efficiency improvements. Larger firms leverage global presence and brand recognition, while smaller players emphasize agility, customization, and rapid deployment. Competitive advantage is defined by how effectively brochures communicate efficiency, reliability, and long-term value in BEV on-board charger solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.7 Billion |

| Rating | 11 kW, > 11 kW to 22 kW, and > 22 kW |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bel Fuse, BorgWarner, Brusa Elektronik, Delta Energy Systems, Eaton, Ficosa Internacional, Hyundai Motor, Infineon Technologies, Innolectric, Nissan Motor, Phinia, Stercom Power Solutions, STMicroelectronics, and Tesla |

| Additional Attributes | Dollar sales by charger type and vehicle application, demand dynamics across passenger EVs, commercial fleets, and two-wheelers, regional trends in EV adoption and charging infrastructure, innovation in charging speed, efficiency, and smart controls, environmental impact of production and energy use, and emerging use cases in bidirectional charging and V2G systems. |

The global bev on-board charger market is estimated to be valued at USD 23.7 billion in 2025.

The market size for the bev on-board charger market is projected to reach USD 147.7 billion by 2035.

The bev on-board charger market is expected to grow at a 20.1% CAGR between 2025 and 2035.

The key product types in bev on-board charger market are 11 kw, > 11 kw to 22 kw and > 22 kw.

In terms of current, ac segment to command 58.6% share in the bev on-board charger market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

AC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

BEV Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA