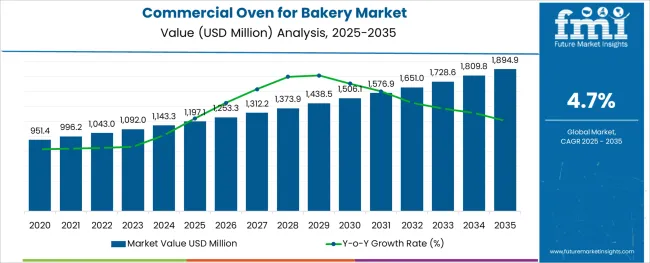

The Commercial Oven for Bakery Market is estimated to be valued at USD 1197.1 million in 2025 and is projected to reach USD 1894.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Operation Mode, Installation Type, Process, and Sales Channel and region. By Operation Mode, the market is divided into Electrically operated and Gas operated. In terms of Installation Type, the market is classified into Freestanding and Tabletop. Based on Process, the market is segmented into Batch and Process. By Sales Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

In a market analysis conducted by FMI experts, it has been revealed that the commercial oven market for bakeries has been experiencing unprecedented growth in recent years. From 2025 to 2025, the market is expected to grow by approximately USD 951.4 million. During the period 2020 to 2025, the market registered a 3.2% CAGR.

As a result of the demand for the high volume of bakery products such as cakes, pies, cooking, bread, brownies, and other pastries, there has been a spike in the sale of commercial ovens for bakeries. As consumers’ preferences and needs change, bakery manufacturers are working to improve their product offerings to meet these changes.

Electrically Operated- By Operation Type

It is identified that the electrically operated commercial oven for bakery is the most recognized in the operation type category and has accounted for major shares during the base year. Currently, the electrically operated segment is anticipated to propel at a substantial rate, registering a CAGR of 4.4%. The segment accounted for a historical CAGR of 3.7% during the base period of 2020 to 2025. The reasons attributing to the steady advancement of the electrically operated commercial ovens for the bakery are identified as follows:

An increasing number of restaurants and hotels produce a large volume of food that must be reheated and defrosted. These restaurants find a wide range of applications for ovens.

Process- By Process Type

FMI has analyzed that the process segment accounts for the highest market share in the global commercial oven for the bakery market. At present, this segment is moving forward at a moderate pace, recording a CAGR of 3.8%. The segment accounted for a historical CAGR of 3% during the period from 2020 to 2025.

| Country | United States of America |

|---|---|

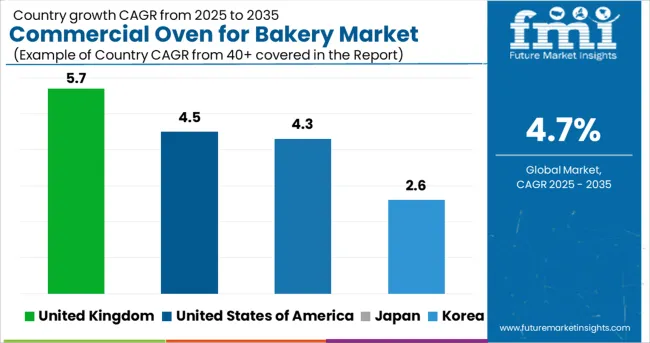

| Statistics | The commercial oven for the bakery market in the USA currently holds the maximum number of shares and has registered a market valuation of USD 1197.1 million in 2025. The market is projected to reach a valuation of USD 1894.9 million by the end of 2035. CAGR for 2025 to 2035: 4.5% Historical CAGR (2020 to 2025): 4% |

| Growth Propellants | The expanding market shares can be attributed to:

|

| Country | United Kingdom |

|---|---|

| Statistics | Europe is identified to hold a significant market share in the commercial oven for the bakery market. Currently, the UK is the leading country and is accountable for a market valuation of USD 48.9 million in 2025, advancing at a moderate-paced CAGR of 5.7%. The market valuation is expected to surpass USD 114.4 Million by 2035. Historical CAGR (2020 to 2025): 3.2% |

| Growth Propellants | Elements contributing to the growth of the market in the European region are:

|

| Country | Japan |

|---|---|

| Statistics | Japan is projected to advance at a rapid pace, registering a CAGR of 4.3% through the forecast period. The country is currently holding a market valuation of USD 35.3 million in 2025. FMI estimates valuation to surpass USD 103.1 million by the end of 2035. Historical CAGR (2020 to 2025): 3.2% |

| Growth Propellants | Factors contributing to the growth of the commercial oven for bakery market in Japan are:

|

| Country | Korea |

|---|---|

| Statistics | The Korean commercial oven for bakery market is anticipated to advance at a slow-paced CAGR of 2.6% during the forecast period. At present, the market is holding a valuation of USD 9.2 million in 2025. The analysts at FMI have projected a market value of USD 40.8 million by 2035. Historical CAGR (2020 to 2025): 2.5% |

| Growth Propellants | The factors attributing to the growth of the market in Korea are:

|

Emerging Companies Add an Edge to the Commercial Oven for Bakery Market Dynamics

The new entrants in the commercial oven for the bakery market are leveraging advances in technology to launch new products and gain a competitive advantage by leveraging advancements in technology. In order to remain competitive with consumer preferences and end-use industry demands, these firms invest continuously in research and development activities. As part of their efforts to strengthen their position within the forum and to assist in the further development of the bakery oven, efforts are being made to strengthen their foothold in the industry.

The Key Players are making an Effort to Revamp the Market Dynamics by Revising their Strategies

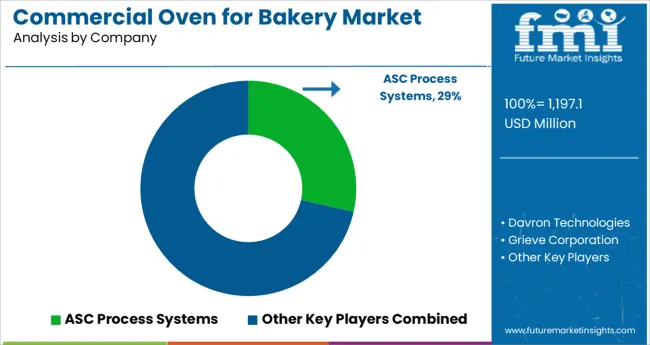

A statistical study conducted by Future Market Insights in the concerned machinery market reveals several successful business strategies deployed by the major vendors of commercial ovens in the industry. In order to compete in the highly fragmented bakery oven market, vendors are deploying both organic and inorganic growth strategies to compete against each other.

In order to provide the end users with the finest quality bakery products, the manufacturers invest a significant number of resources into research and development activities, which helps them acquire more shares of the global market as they continue to make technological advancements in the machinery.

Some Commercial Oven for Bakery Global Forums

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | billion for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Chile, Peru, Germany, UK, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Turkey |

| Key Segments Covered | Operation Mode, Installation Type, Process, Sales Channel, Region |

| Key Companies Profiled | ASC Process Systems; Harper International; Rowan Technologies; Wisconsin Oven Corporation; JPW Ovens; Davron Technologies |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

{Food Equipment Speciality Retailers, Brand Franchised Stores, Modern Trade, E-commerce Platforms, Others}

The global commercial oven for bakery market is estimated to be valued at USD 1,197.1 million in 2025.

It is projected to reach USD 1,894.9 million by 2035.

The market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types are electrically operated and gas operated.

freestanding segment is expected to dominate with a 68.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA