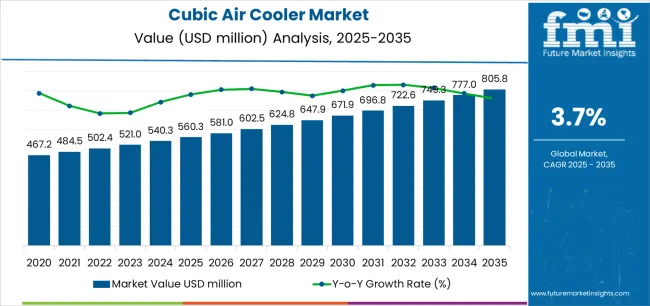

The global cubic air cooler market is projected to grow from USD 560.3 million in 2025 to approximately USD 805.7 million by 2035, recording an absolute increase of USD 245.4 million over the forecast period. This translates into a total growth of 43.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing industrial refrigeration requirements, growing demand for energy-efficient cooling solutions in cold storage facilities, and rising adoption of natural refrigerant systems driving equipment procurement across food processing, pharmaceutical storage, and cold chain logistics applications.

Industrial expansion in emerging markets continues to drive equipment demand, particularly in regions experiencing cold storage infrastructure development and food processing capacity additions. The transition toward natural refrigerants and environmental compliance requirements are reshaping equipment specifications, with manufacturers prioritizing ammonia-based and CO2 systems that deliver operational efficiency while meeting regulatory standards. Commercial refrigeration modernization programs across retail chains and distribution centers are creating sustained demand for cubic air cooling systems that provide reliable temperature control and reduced energy consumption. Asia Pacific markets demonstrate particularly strong growth potential, supported by expanding cold chain networks and increasing pharmaceutical storage requirements that necessitate precise temperature management capabilities.

Commercial refrigeration modernization programs across retail chains and distribution centers are creating sustained demand for cubic air cooling systems that provide reliable temperature control and reduced energy consumption. Asia Pacific markets demonstrate particularly strong growth potential, supported by expanding cold chain networks and increasing pharmaceutical storage requirements that necessitate precise temperature management capabilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 560.3 million |

| Market Forecast Value (2035) | USD 805.7 million |

| Forecast CAGR (2025-2035) | 3.7% |

| INDUSTRIAL EXPANSION TRENDS | COLD CHAIN REQUIREMENTS | REGULATORY & EFFICIENCY STANDARDS |

|---|---|---|

| Industrial Refrigeration Development Continuous expansion of industrial refrigeration infrastructure across food processing, pharmaceutical manufacturing, and cold storage facilities driving demand for reliable cooling equipment solutions. Manufacturing Capacity Growth Growing emphasis on cold storage capacity additions and distribution center modernization creating demand for efficient air cooling systems. Temperature Control Precision Superior heat transfer capabilities and operational reliability making cubic air coolers essential for temperature-critical applications. |

Sophisticated Cooling Requirements Modern cold chain operations require equipment delivering precise temperature control and enhanced operational efficiency. Processing Efficiency Demands Food processors and pharmaceutical manufacturers investing in cooling systems offering consistent performance while maintaining energy efficiency. Quality and Reliability Standards Certified equipment with proven track records required for advanced cold storage applications. |

Environmental Compliance Standards Regulatory requirements establishing performance benchmarks favoring natural refrigerant systems and energy-efficient equipment. Energy Efficiency Property Standards Quality standards requiring superior cooling performance and resistance to operational stresses in demanding environments. Safety Compliance Requirements Diverse industrial requirements and quality standards driving need for sophisticated air cooling equipment inputs. |

| Category | Segments Covered |

|---|---|

| By Fan Configuration | Single-fan Units, Multi-fan Units |

| By Application | Commercial, Industrial |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

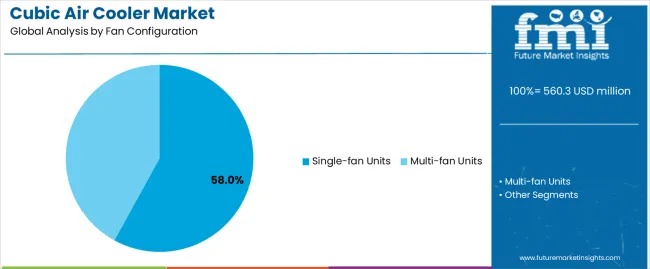

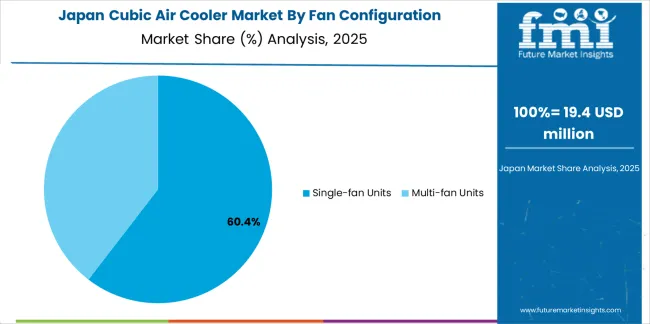

| Single-fan Units | Leader in 2025 with 58% market share projected to maintain dominance through 2035. Preferred for smaller cold storage facilities, food processing operations, and pharmaceutical storage applications requiring moderate cooling capacity. Lower initial investment, simpler maintenance requirements, and adequate performance for standard industrial applications drive adoption. Momentum: steady growth. Watchouts: capacity limitations in large-scale installations, competition from multi-fan systems in high-demand applications. |

| Multi-fan Units | Holds 42% market share in 2025 with growth driven by large-scale industrial refrigeration projects and high-capacity cold storage facilities. Superior cooling capacity, operational redundancy, and flexibility for staged operation provide advantages in demanding applications. Increasing adoption in distribution centers, large food processing plants, and pharmaceutical manufacturing facilities requiring precise temperature control across extensive spaces. Momentum: rising in large-scale industrial segments. Watchouts: higher capital costs, increased maintenance complexity, energy consumption considerations in efficiency-focused markets. |

| Segment | 2025 to 2035 Outlook |

|---|---|

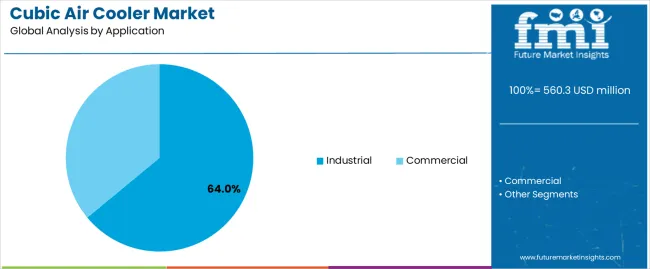

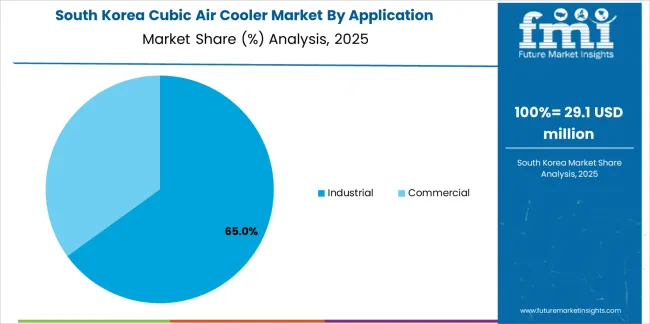

| Industrial | Dominant segment with 64% market share in 2025, driven by food processing, pharmaceutical manufacturing, and cold storage operations. Equipment requirements emphasize operational reliability, energy efficiency, and compatibility with natural refrigerant systems. Large-scale installations in meat processing, dairy production, frozen food storage, and pharmaceutical facilities drive volume demand. Momentum: steady growth supported by cold chain expansion and industrial capacity additions. Watchouts: economic sensitivity affecting capital investment cycles, increasing focus on total cost of ownership rather than initial purchase price. |

| Commercial | Commands 36% market share with applications including retail cold storage, restaurant walk-in coolers, and small-scale distribution facilities. Cost sensitivity balanced against reliability requirements characterizes procurement decisions. Growing adoption in supermarket chains, convenience stores, and foodservice operations upgrading refrigeration systems. Equipment specifications prioritize compact design, quiet operation, and ease of installation. Momentum: moderate growth driven by retail modernization and commercial food service expansion. Watchouts: competitive pressure from alternative cooling technologies, price sensitivity in cost-conscious commercial segments. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Cold Chain Growth Continuing expansion of cold chain infrastructure across established and emerging markets driving demand for industrial refrigeration equipment. Natural Refrigerant Adoption Increasing recognition of environmental compliance importance in refrigeration efficiency and regulatory sustainability. Energy Efficiency Focus Growing demand for equipment that supports both operational performance and energy cost reduction in industrial facilities. |

Equipment Cost Pressure Initial capital investment requirements affecting equipment adoption rates and procurement timing for facilities. Maintenance Complexity Specialized service requirements and technical expertise needs creating operational challenges for facility managers. Economic Cycle Sensitivity Industrial investment cycles affecting equipment procurement decisions and project timing across regions. Technology Transition Costs Migration toward natural refrigerant systems requiring facility modifications and training investments. |

Smart Control Integration Integration of IoT monitoring systems, automated defrost controls, and remote diagnostic capabilities enabling superior operational efficiency. Natural Refrigerant Systems Enhanced ammonia and CO2 compatibility, environmental compliance features, and energy optimization capabilities compared to synthetic refrigerant systems. Modular Design Innovation Development of flexible capacity configurations and scalable installations providing enhanced adaptability and simplified maintenance. Energy Recovery Applications Integration of heat recovery systems and waste heat utilization technologies for improved facility efficiency. |

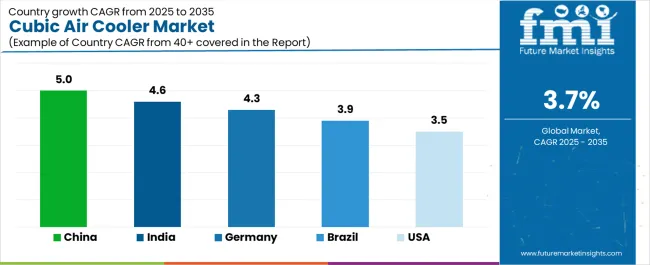

| Country | CAGR (2025-2035) |

|---|---|

| China | 5% |

| India | 4.6% |

| Germany | 4.3% |

| Brazil | 3.9% |

| United States | 3.5% |

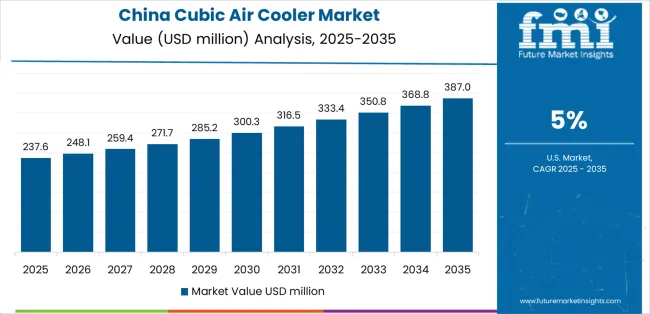

Revenue from cubic air coolers in China is projected to exhibit strong growth with a market value of USD 147.8 million by 2035, driven by expanding cold chain logistics infrastructure and comprehensive food safety modernization creating substantial opportunities for equipment suppliers across cold storage operations, pharmaceutical manufacturing facilities, and food processing sectors. The country's aggressive cold chain development programs and expanding pharmaceutical manufacturing capabilities are creating significant demand for both ammonia-based and CO2 refrigeration systems. Major cold storage operators and food processing companies are establishing comprehensive facilities to support large-scale operations and meet growing demand for efficient temperature control solutions.

Revenue from cubic air coolers in India is expanding to reach USD 116.2 million by 2035, supported by extensive agricultural processing development and comprehensive cold storage network expansion creating sustained demand for reliable refrigeration equipment across diverse food processing categories and pharmaceutical storage segments. The country's growing food processing sector and expanding pharmaceutical manufacturing capabilities are driving demand for cooling solutions that provide consistent temperature performance while supporting cost-effective operational requirements. Equipment buyers and facility operators are investing in modern refrigeration systems to support growing processing operations and storage capacity demand.

Demand for cubic air coolers in Germany is projected to reach USD 109.8 million by 2035, supported by the country's leadership in industrial refrigeration technology and advanced equipment manufacturing capabilities requiring sophisticated cooling systems for food processing and pharmaceutical applications. German industrial facilities are implementing high-efficiency refrigeration systems that support natural refrigerant technologies, operational precision, and comprehensive environmental protocols. The market is characterized by focus on operational excellence, energy efficiency, and compliance with stringent environmental and safety standards.

Revenue from cubic air coolers in United States is growing to reach USD 94.6 million by 2035, driven by food processing facility modernization programs and increasing cold storage capacity development creating sustained opportunities for equipment suppliers serving both industrial processing operations and commercial refrigeration contractors. The country's extensive food processing infrastructure and expanding pharmaceutical manufacturing base are creating demand for cubic air coolers that support diverse operational requirements while maintaining performance standards. Facility managers and refrigeration service providers are developing equipment strategies to support operational efficiency and regulatory compliance.

Demand for Cubic Air Coolers in Brazil is projected to reach USD 87.2 million by 2035, expanding at a CAGR of 3.9%, driven by agricultural processing growth and meat production capabilities supporting industrial cold storage development and comprehensive food safety applications. The country's established meat processing industry and growing food export market segments are creating demand for reliable cubic air coolers that support operational performance and hygiene standards. Equipment manufacturers and refrigeration suppliers are maintaining comprehensive service capabilities to support diverse processing requirements.

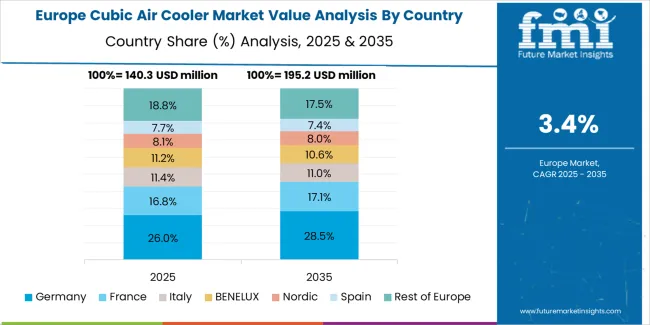

The cubic air cooler market in Europe is projected to grow from USD 158.4 million in 2025 to USD 231.6 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced industrial refrigeration sector and major food processing operations including meat processing facilities and pharmaceutical manufacturing centers.

Italy follows with a 21.6% share in 2025, projected to reach 22.1% by 2035, driven by comprehensive food processing infrastructure and cold storage modernization programs serving agricultural processing operations. Spain holds a 19.2% share in 2025, expected to reach 19.6% by 2035 supported by growing food processing exports. France commands a 16.8% share, while the United Kingdom accounts for 14% in 2025. The Rest of Europe region is anticipated to maintain momentum with its collective share moving from 10.1% to 10.7% by 2035, attributed to increasing equipment adoption in Nordic countries and Eastern European food processing facilities implementing refrigeration modernization programs.

German cubic air cooler operations reflect the country's engineering excellence and stringent environmental compliance frameworks. Major industrial refrigeration companies including GEA Group, Güntner, and Kelvion maintain comprehensive equipment qualification processes that emphasize natural refrigerant compatibility, energy efficiency validation, and operational reliability testing exceeding international standards. This technical rigor creates high barriers for equipment suppliers but ensures operational performance that supports premium positioning in global markets.

The German market demonstrates particular strength in ammonia-based refrigeration systems for large-scale food processing facilities, with equipment specifications emphasizing safety protocols, leak detection integration, and automated defrost capabilities. Companies require precise temperature control tolerances and humidity management specifications that differ from standard commercial applications, driving demand for customized engineering capabilities.

Regulatory oversight through environmental agencies emphasizes comprehensive refrigerant management and energy efficiency documentation that surpasses most international standards. The equipment certification system requires detailed environmental impact assessments and life-cycle cost calculations, creating advantages for manufacturers with transparent operational data and comprehensive technical documentation systems.

Supply chain management focuses on long-term equipment partnerships rather than transactional procurement. German facilities typically maintain multi-year service relationships with equipment suppliers, with contract negotiations emphasizing reliability metrics and total cost of ownership over initial purchase price. This stability supports investment in specialized equipment designs tailored to German operational requirements.

Italian cubic air cooler operations reflect the country's food processing heritage and growing pharmaceutical manufacturing sector. Major companies including cooperative meat processors, dairy manufacturers, and pharmaceutical producers drive sophisticated equipment procurement strategies, establishing relationships with European suppliers to secure consistent quality and technical support for their processing operations targeting both domestic and export markets.

The Italian market demonstrates particular strength in food processing applications, with companies integrating cubic air coolers into traditional production methods for cured meats, cheese aging facilities, and fresh produce cold storage. This application diversity creates demand for specific capacity ranges and humidity control specifications that differ from standardized installations, requiring suppliers to adapt equipment configurations and control strategies.

Regulatory frameworks emphasize food safety traceability and environmental compliance, with Italian authorities enforcing standards that often exceed minimum EU requirements. This creates preferences for established equipment suppliers who can demonstrate compliance capabilities and provide comprehensive documentation. The regulatory environment particularly favors manufacturers with HACCP-compliant designs and comprehensive maintenance protocols.

Supply chain efficiency remains important given Italy's geographic diversity and distributed food processing industry. Companies increasingly pursue regional equipment distributors with technical service capabilities to ensure reliable maintenance access while managing equipment costs. Cold chain investments support quality preservation during production and storage operations serving domestic and export markets.

Japanese cubic air cooler operations reflect the country's precision manufacturing standards and sophisticated quality expectations. Major food processing companies including Nippon Ham, Itoham Yonekyu, and pharmaceutical manufacturers maintain rigorous equipment qualification processes that emphasize operational precision, energy efficiency, and comprehensive safety protocols exceeding international standards. This creates substantial barriers for new suppliers but ensures equipment reliability that supports premium product positioning.

The Japanese market demonstrates unique application preferences, with significant demand for compact high-efficiency designs tailored to space-constrained facilities and strict temperature tolerance requirements for pharmaceutical storage and high-value food products. Companies require specific defrost cycle optimization and condensate management specifications that differ from Western applications, driving demand for customized equipment capabilities.

Regulatory oversight through the Ministry of Health emphasizes comprehensive safety documentation and energy efficiency validation that surpasses most international standards. The equipment approval system requires detailed operational testing and environmental impact assessments, creating advantages for suppliers with transparent performance data and comprehensive technical documentation systems.

Supply chain management focuses on relationship-based partnerships spanning equipment supply, installation supervision, and ongoing maintenance services. Japanese companies typically maintain long-term supplier relationships extending across facility lifecycles, with contract frameworks emphasizing equipment reliability and responsive technical support over pure cost optimization. This partnership approach supports investment in Japan-specific equipment configurations and service capabilities.

South Korean cubic air cooler operations reflect the country's advanced pharmaceutical manufacturing sector and expanding cold chain logistics infrastructure. Major companies including Samsung Biologics, Celltrion, and cold storage operators drive sophisticated equipment procurement strategies, establishing relationships with international suppliers to secure consistent quality and technical capabilities for their facilities serving both domestic production and export operations.

The Korean market demonstrates particular strength in pharmaceutical-grade temperature control applications, with companies requiring precise humidity management, validated temperature mapping, and comprehensive monitoring systems. This specialization creates demand for specific equipment certifications and validation protocols that differ from food processing applications, requiring suppliers to provide detailed qualification documentation and ongoing validation support.

Regulatory frameworks emphasize pharmaceutical manufacturing compliance and cold chain integrity, with Korean authorities enforcing standards aligned with international GMP requirements. This creates strong preferences for equipment suppliers who can demonstrate pharmaceutical industry experience and provide comprehensive validation services. The regulatory environment particularly favors manufacturers with established pharmaceutical client references and documented validation methodologies.

Supply chain efficiency remains critical given Korea's import dependence for specialized refrigeration equipment. Companies increasingly pursue long-term agreements with suppliers in Europe and North America to ensure reliable equipment access while managing foreign exchange risks and securing technical support capabilities. Investment in domestic service networks supports equipment maintenance and validation requirements during operational lifecycles.

Profit pools concentrate in engineered-to-specification equipment serving large industrial installations and application-specific solutions for pharmaceutical and high-value food processing operations where reliability and regulatory compliance command premium pricing. Value migrates from commodity unit sales to comprehensive system integration including controls, monitoring, and maintenance services where technical expertise and installed base relationships create switching costs. Several archetypes drive competitive dynamics: established European manufacturers leveraging engineering heritage and natural refrigerant expertise; diversified HVAC companies cross-selling into industrial refrigeration through distribution networks; specialized refrigeration equipment suppliers focused on food processing and pharmaceutical applications; and emerging Asian manufacturers pursuing volume through cost leadership in standard configurations.

Switching costs remain substantial due to facility integration complexity, refrigerant system compatibility requirements, and operational risk aversion in temperature-critical applications. Supply dynamics reflect consolidation among tier-one manufacturers while regional fabricators serve local markets with price competition. Natural refrigerant transition creates opportunities for technology leaders with ammonia and CO2 system expertise while challenging manufacturers dependent on synthetic refrigerant platforms. Equipment digitalization through IoT integration and predictive maintenance capabilities differentiates premium suppliers from commodity players. Consolidation continues as scale advantages in R&D and global service networks favor larger manufacturers, while acquisition activity targets specialized application expertise and regional market access.

| Items | Values |

|---|---|

| Quantitative Units | USD 560.3 million |

| Fan Configuration | Single-fan Units, Multi-fan Units |

| Application | Commercial, Industrial |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

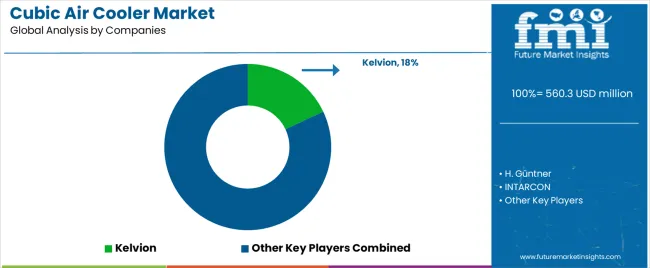

| Key Companies Profiled | Kelvion, H. Güntner, INTARCON, Refteco, Frigo Block, Stefani, Intersam, Friga-Bohn, Blaupunkt, LU-VE Group, Thermofin, Karyer, Dumai Cool, Enex, SAKATO, Walter Roller |

| Additional Attributes | Dollar sales by fan configuration/application, regional demand (NA, EU, APAC), competitive landscape, industrial vs. commercial adoption, natural refrigerant integration, and energy efficiency innovations driving operational enhancement, environmental sustainability, and reliability |

By Fan Configuration

The global cubic air cooler market is estimated to be valued at USD 560.3 million in 2025.

The market size for the cubic air cooler market is projected to reach USD 805.8 million by 2035.

The cubic air cooler market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in cubic air cooler market are single-fan units and multi-fan units.

In terms of application, industrial segment to command 64.0% share in the cubic air cooler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA