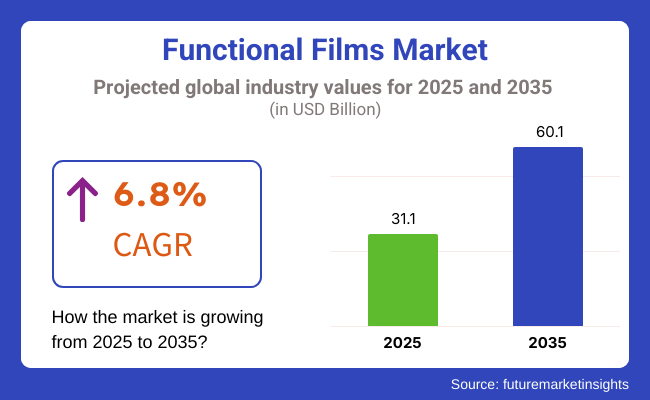

The global functional films market is estimated at USD 31.1 billion in 2025. It is expected to grow at a CAGR of 6.8% between 2025 and 2035, reaching USD 60.1 billion by 2035. This growth is being driven by increasing demand across electronics, packaging, automotive, and energy sectors. Applications in flexible displays, photovoltaics, and advanced packaging formats have intensified reliance on multi-functional films with barrier, optical, and conductive properties.

Transparent conductive films are being utilized in foldable screens and wearable interfaces. In its January 2025 investor disclosure, Sumitomo Chemical reported a 12% increase in R&D allocation toward touch-sensitive film materials used in next-generation consumer devices. Toyobo Co., Ltd., in its fiscal 2024 report, confirmed a 13% year-on-year rise in shipments of optical films for OLED displays. These films offer anti-glare, heat resistance, and long-term stability, making them integral to emerging device engineering.

In food-grade packaging, demand for barrier films is increasing. Toray Industries introduced a recyclable PET film in late 2024 designed to reduce oxygen permeability and extend product shelf life. According to a statement by the CEO during the company’s FY2024 sustainability briefing, this rollout supports Toray’s carbon-neutral roadmap and responds to evolving EU circular economy regulations. Leading dairy and snack producers in Germany and France have initiated bulk procurement.

The automotive industry is adopting IR-reflective window films to optimize thermal management in EVs. In March 2025, Saint-Gobain confirmed the deployment of its solar-control films across five European EV brands. During on-road testing, a 9% improvement in cabin cooling efficiency was achieved. These films are now part of OEM-level sustainability integration in France and the Netherlands.

Photovoltaic encapsulation films are experiencing expanded usage. DuPont Photovoltaic Solutions announced in April 2025 that orders for its ionomer-based solar films rose by 17% in Q1, driven by solar deployments in India, Vietnam, and Australia. These materials reduce delamination and thermal distortion, increasing module lifespan.

Recyclability challenges remain as a hurdle in the functional films industry. Cost parity with conventional plastics is still under pressure. However, new processes-plasma coating, nano-layering, and biopolymer blending-are being piloted to improve sustainability. According to DuPont’s 2025 clean materials division roadmap, commercial-scale trials are underway in Texas and Yokohama.

Optical and adhesive films command a considerable market share in functional films as a result of the need by firms for high-performance materials that can increase the functionality, durability, and efficiency of products. The films play vital functions in electronics, automotive, renewable energy, and packaging industries, where light management, surface protection, and adhesion technologies are vital.

Optical films have emerged as a pillar of contemporary display and optical technology to control light, increase color brightness, and reduce glare in devices from smartphones and TVs to automobile displays and solar panels. Industry players are now using anti-reflective (AR), polarizing, and diffusion films more and more to increase brightness, contrast, and energy efficiency in display systems.

The successful consumer electronics market continues to spur demand for advanced optical films, especially for OLED and LCD displays, whose manufacturers increasingly focus on energy efficiency and user convenience. High-end smartphone, tablet, and computer gaming monitor producers rely on multi-layer optical films to improve display functionality, power savings, and product durability.

Vehicle HUDs and clusters have also made automotive optical film demand higher due to the way automotive companies fit smart infotainment and augmented reality displays on modern cars. Anti-glare and light-diffusing optical films with higher performance offer superior readability and clarity in changing illumination conditions, thereby becoming a part of automotive display technology.

The photovoltaic cell enhancements and solar panel coatings are a top consumer of optical films, as light-trapping and anti-reflection coatings contribute to higher solar energy absorption and overall efficiency of photovoltaic systems. Governments and firms pumping money into clean energy infrastructure bode well for functional optical film demand in the solar segment.

Despite higher adoption of optical films, raw material costs and scalability in production impact producers. Developing cost-effective, high-performance coatings with extended longevity is on top of the agenda for industry players.

Adhesive films are today integrated into numerous industrial applications by means of secure adhesion, protective coating, and laminating solutions. Adhesive films find application in vehicle assembly, electronics production, food packaging, and industrial construction with enhanced strength, durability, and moisture resistance.

The packaging and printing sector is the biggest user of adhesive film, with the greatest interest from the manufacturers being in sealing and tamper-evident packaging products that are performing well. Green packaging has made more demand for biodegradable and environmentally friendly adhesive films, especially used in food and medical packaging.

The largest consumer of adhesive film is the packaging and printing industry, where the most interest from the manufacturers is in sealing and tamper-evident packaging products that perform well. The emphasis on green packaging has created more demand for environmentally friendly and biodegradable adhesive films, particularly employed in food and medical packaging.

Packaging businesses utilize increasingly multi-layer adhesive films to incorporate barrier protection against oxygen, water, and contamination in order to achieve longer shelf life of food. Pharmaceutical packaging products such as sterile blister packs, protective covering, and medical pouches depend on new technology adhesive film to protect against loss of product integrity and contamination.

Another dominant market for using adhesive films is the automotive industry as it applies them to use for interior trim, protective films, and the lightweighted parts assembly. The manufacturers of cars utilize pressure-sensitive adhesive films during production to use in attaching light components, lighten the weight inside a vehicle, and gain better fuel economy.

While firms move towards sustainable and high-performance adhesive film, manufacturers aim to create solvent-free, UV-curable, and bio-based adhesives with greater environmental compatibility and bonding strength. The low-VOC adhesives trend remains on top of market trends in the automobile, packaging, and industrial segments.

Although adhesive films are still much in demand, issues related to raw material price volatility, performance consistency, and compatibility with new substrates remain. Still, continuous development in polymer chemistry and the adhesion science will propel next-generation adhesive film solutions.

Packaging and print firms and automotive industries are driving the market for functional films, with companies spending money on high-performance material solutions to promote energy efficiency, product protection, and branding.

Printing and packaging continue to remain two of the biggest functional film market drivers, employing coating, adhesive, and optical films to enhance durability, appearance, and product security. The beverage, food, and pharmaceutical industries employ high-performance films to offer hermetically sealed barriers, tamper-proofing, and moisture packaging according to global standards of safety regulations.

With increased emphasis on sustainability, larger demand for biodegradable and recyclable packaging films is being felt. Firms are manufacturing bio-based adhesives as coatings and adhesives that maintain the integrity of the pack at a lower environmental expense. Stand-up pouches, vacuum packs, and clear wraps have functional films applied to them for short-life and high-value packs.

The internet trade also requires greater use of online protective functional films with light, tamper-evident, and abrasion-resistant packaging materials required by online shopping complexes. Anti-static, water-resistant, and UV-resistant coatings are becoming more common on corrugated cartons, plastic covers, and postal labels for secure storage and transportation of products.

Despite growing markets, cost pressure and regulation remain the biggest threats to the packaging film producers. Increased government regulations of single-use plastics and chemical additives are forcing manufacturers to put money into research and development of recyclable and compostable film alternatives.

Automobiles are among the biggest consumers of functional films for car interior treatment, exterior coating, and safety luxury items. Motor vehicle companies use optical, adhesive, and electric films on motor vehicle windshields, headlights, and sound displays on the motor vehicle in an effort to improve motor vehicle appearance, stiffness, and efficiency.

Anti-glare and ultraviolet-blocking coatings are also utilized in motor vehicle glazing in dashboards, sunroofs, and passenger side windows to ensure passenger comfort and vehicle longevities. Self-healing scratch protection is also utilized in protecting against paint surfaces and touch points to keep the vehicle in good appearance as well as provide resale value.

Additionally, expansion in electric and autonomous vehicles (EVs and AVs) has additionally driven need for functional films like battery protection, sensor guard, and smart display. Thin adhesive films are reducing vehicle weight, improving aerodynamics, and saving energy, as the globe seeks sustainability.

Automotive manufacturers also employ low-VOC, environmentally friendly film coatings in becoming more environmentally friendly and improving cabin air quality. Governments now enforcing stricter emission regulations, manufacturers now place greater priority on functional film technologies that save energy and decrease their environmental footprint.

Functional films have a prime market in North America due to high demand from the healthcare, electronics, and automotive industries. The region has the highest technology adoption with more usage of functional films in medical devices, smart packaging, and automotive displays in the United States and Canada.

Electric vehicle growth in the region is also stimulating demand for protective and conductive films that find application in battery protection, interior displays, and high-performance coatings.

Availability of leading electronics manufacturers and R&D centers is helping in the evolution of next-generation functional films with increased durability, heat resistance, and self-healing capabilities. North America's stringent regulatory environment regarding plastic waste and sustainability is also pushing firms to seek bio-based and recyclable film solutions.

But the market is challenged by high production expenses and price volatility of raw materials, which may slowdown growth unless cost-efficient manufacturing processes are instituted. Growth driven by the development of smart electronics, autonomous cars, and high-performance optical film requirements will most likely offer medium-term growth prospects for North American manufacturers.

Europe is in control of a high percentage of the functional films market, more specifically in Germany, France, and the UK, where top-end automotive and electronics sectors are creating demand. Germany's automobile sector, comprising dominant players BMW, Mercedes-Benz, and Volkswagen, is moving up its adoption of functional films for car interiors, display boards, and low-power consumption coatings.

The European packaging industry is another dominant contributor, and functional films are extensively applied in sustainable food packaging solutions with high shelf life and barrier properties. The regulatory thrust of the European Union towards the use of environment-friendly materials is driving manufacturers to create bio-based and biodegradable functional films.

Moreover, demand for functional films used in solar energy is also picking up pace, especially in nations such as France and Spain, whose governments are encouraging the use of renewable energy systems. Nevertheless, stringent environmental controls, exorbitant production costs, and changing compliance needs are a few issues that may hinder development.

Europe's venture into smart manufacturing, automation, and nanotechnology-based functional films will also alter market trends over the next decade in terms of introducing recyclable, energy-efficient, and high-performance film products.

Asia-Pacific is the dominant region of the functional film market, and China, Japan, South Korea, and India are the most influential production and consumption hubs. Regional leadership in electronics, automotive, and packaging markets is driving massive application of functional films for flexible display, semiconductor package, and protective coatings.

China, the global leader in consumer electronics production, is also a market growth leader with rapid investment in solar films, intelligent coatings, and OLED displays. Japan and South Korea, where market leaders in electronics such as Samsung, LG, and Sony are based, are also leaders in functional films, particularly in optical, conductive, and anti-reflective coatings.

India is witnessing top growth rates for the automobile and packaging sectors with the use of functional films being adopted in the applications of intelligent packaging, food packaging, and for car interior uses. Government policies of sustainability and rising demands for biodegradable packaging will ensure growth of the bio-based and recyclable films in the country.

Though leadership in the Asian-Pacific market, the sector is faced with challenges of a different kind as governments toughen up environmental regulation against plastic disposal and waste and chemical emissions. However, continuous investment in research and development, set-up of low-cost production sites, and high demand for functional films of high performance will guarantee that the trend of growth continues in the region.

Challenges

The functional films industry is confronted with a number of issues of crucial concern, such as the expense of production and intricate manufacturing processes. The high-performance films with excellent chemical, thermal, and abrasion resistance necessitate huge investments in advanced material science, nanotechnology, and coating technology, which increase the cost of production and affect prices.

Compliance with the regulation and sustainability is another hindrance, especially for nations that have implemented strict plastic waste regulation. The movement towards bio based and sustainable film is encouraging businesses to revisit current product portfolios and incur capital expenditures in new raw material expenses, in the short run potentially impacting profitability margins.

Second, market competition in the form of alternative materials such as graphene films and self-healing coating in the market will repress adoption of traditional functional films unless differentiation is done through performance enhancement and innovation.

Opportunities

The functional films market has huge growth prospects, especially in smart electronics, automotive, and green packaging applications. The growing use of OLED displays, flexible touchscreens, and energy-efficient coatings is driving the new demand for high-performance functional films in consumer electronics and automotive interiors.

The trend towards biodegradable and recyclable films is also a huge opportunity since governments and businesses are focusing on sustainability and green materials. High barrier functional films with antimicrobial properties, self-healing, and other functionalities are being applied in food packaging and healthcare.

In addition, smart coatings and films developed from nanotechnology will fuel market innovation to produce longer-lasting products, anti-fingerprint coatings, and increased conductivity in next-generation electronic devices.

Companies that make investments in frontier manufacturing technologies, hybrid materials, and multi-function coatings will be favored to leverage new market opportunities and establish a competitive foothold in the nascent functional films market.

Functional film market increased enormously from 2020 to 2024 as markets expanded in automobile, electronics, and healthcare, packaging, and renewable energy sectors. Protective, conductive, optical, and barrier functional films gained more significance in high-performance display panels, photovoltaic panels, flexible electronics, and medical devices.

As the pace of technology development accelerated, industries needed stronger, lighter, and more adaptable films to convert products into better performers and extend their lifespan. The availability of next-generation materials, nanocoatings, and AI-driven formulation technologies also led to accelerated market expansion with improved product quality and cost benefits.

Electronics market led the way in market growth in the semiconductor, display technology, and flexible electronics markets. The application of functional films was expanded through liquid crystal displays (LCDs), organic light-emitting diodes (OLEDs), micro-LED panels, and touch screens to improve the image quality, anti-glare, and durability against impacts. Expansion continued to be spurred on by increasing needs for foldable smartphones, augmented reality (AR) headsets, and transparent conductive films.

The automotive market also saw noteworthy application of functional films, primarily in light weighting of vehicle architectures, smart glazing, head-up displays (HUDs), and anti-fogging films. As there was emphasis among the manufacturers in electric vehicles (EVs), autonomous vehicles, and high-level infotainment, functional films came to bear heavily in heat management, ultraviolet (UV) protection, and glare attenuation.

The increase in the necessity of safety, efficiency, and appearance in the car required more advanced self-healing, scratch-proof, and water-repelling films. In addition, the incorporation of climate-adaptive advanced materials, infrared-reflective coatings, and noise-dampening smart films placed functional films as critical building blocks in future vehicles.

The healthcare sector employed functional films to a greater extent in biomedical sensors, diagnostic devices, and antimicrobial films. The COVID-19 pandemic created increased demand for antiviral and antibacterial film coating to offer enhanced protection and hygiene to patients.

Functional films were instrumental in wound dressings, drug delivery patches, and transparent protective wraps and made their mark in future medical application. In addition, bio-responsive coatings advances, self-sterilizing and biodegradable functional films introduced novel options for precision medicine, AI-aided diagnostics, and eco-friendly healthcare technology.

Though the industry was developing with a very rapid growth rate, the industry experienced supply chain disruption, variable raw material costs, and movie rule-making on aspects of sustainability and recyclability. The companies remained focused on low-emission processing technologies, loop recycling practices, and biomass-derived polymers in order to deal with these types of issues.

Use of AI-based material design, nanotechnology innovations, and intelligent coating formulations also improved the response ability of the market to new industrial needs. The growing application of recyclable polymer substrates, self-healing, and smart coatings contributed to accentuating the move towards a circular economy and green future of the sector.

Functional film market will experience exponential growth between 2025 to 2035, fueled by sustainability efforts, technology, and increasing use in smart industries. Functional films will lead the future of manufacturing, wearables, and sustainable packaging as industries continue to shift towards light, low-energy, and flexible materials.

The development of programmable surface properties, ultrathin nanofilms, and responsive coatings will revolutionize industry applications of functional films.

The semiconductors and electronics industries will continue to lead the market, with more widespread uses of transparent conductive films, self-dimming coatings, and ultra-thin flexible films. With advancing quantum computing, AI-enabled devices, and future-generation wearables, functional films with improved conductivity, better optical clarity, and enhanced moisture resistance will experience increased demand.

Moreover, nano-engineered functional films and roll-to-roll processing will transform display panel manufacturing, smart sensors, and photonic applications. Future developments will also involve 3D-printed nanofilm layers, artificial intelligence-based defect detection, and flexible coatings that are compatible with integrated circuits, further improving performance and cost-effectiveness.

The automotive industry will propel demand for adaptive, heat-reflective, and electrically conductive films in EVs, hydrogen fuel cell cars, and connected mobility systems. With the development of autonomous driving technologies and intelligent vehicle interiors, functional films will be instrumental in interactive displays, noise-reducing materials, and adaptive light-filtering windows.

Solar energy-integrated coatings and lightweight composite films will also improve vehicle efficiency and durability. Bio-inspired film structure innovations, anti-glare adaptive materials, and infrared-responsive layers will revolutionize the role of functional films in the future of mobility and transportation efficiency.

The functional films sector will see a major evolution in photovoltaic encapsulation films, energy-harvesting coatings, and transparent solar films. With governments enforcing net-zero emission policies and green energy incentives, functional films will make solar panels, thermal insulation products, and smart building systems more efficient.

Bio-based, self-healing, and fully recyclable films will change the function of functional films in sustainable energy storage and conservation. In addition, advances in electromagnetic shielding films, high-thermal stability coatings, and energy-conversion layers will allow for more effective power transmission and utilization in smart cities and industrial grids.

The medical and healthcare industries will keep on utilizing biocompatible, drug-loaded, and antimicrobial films for implantable devices, real-time health monitoring systems, and drug-release patches. The development of personalized medicine, AI-based diagnostics, and nano-therapeutics will propel the use of functional films in wearable biosensors, regenerative medicine, and AI-based telehealth solutions.

Flexible biopolymer films and intelligent wound dressings will also improve patient outcomes and medical treatment efficiencies. New technologies including real-time bio signal-responsive films, self-adaptive drug-release polymers, and AI-optimized film-based implants will shape the future of healthcare materials.

Sustainability will be a top concern, with manufacturers emphasizing bio-based, compostable, and closed-loop recyclable film production. The shift to green chemistry, low-energy processing, and digital supply chain monitoring will reduce the environmental footprint of functional film production.

AI-aided material discovery and blockchain-based material authentication will guarantee waste minimization, sustainable sourcing, and cost savings. Businesses will also invest in hybrid bio-nanocomposite films, water-repellent biodegradable coatings, and multi-use functional layers to maximize efficiency and ecological stewardship.

The functional films industry will also see improvements in smart coatings, shape-memory materials, and programmable surface functions. Self-healing, anti-reflective, and super hydrophobic films will open up applications in marine, aerospace, and construction sectors.

With industries shifting towards AI-driven automation, real-time monitoring, and IoT-integrated manufacturing, functional films will lead the charge in intelligent material engineering and next-generation industrial solutions. The growth in AI-driven film diagnostics, thermal-responsive film technologies, and high-durability coatings will also continue to drive the market growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments implemented recyclability and emission control laws for polymer-based films. |

| Technological Advancements | Firms introduced anti-glare, UV-stable, and high-barrier films for industrial applications. |

| Industry Applications | Functional films were applied extensively in electronics, packaging, and automotive. |

| Environmental Sustainability | Firms incorporated low-VOC manufacturing methods and closed-loop recycling technologies. |

| Market Growth Drivers | Display technologies, automobile innovation, and medical progress spurred demand. |

| Production & Supply Chain Dynamics | Supply chains were challenged by raw material price volatility and global trade volatility. |

| End-User Trends | Customers wanted high-durability, light, and optically improved films. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Future policies will require fully biodegradable, circular economy-aligned, and low-carbon manufacturing processes. |

| Technological Advancements | Future innovations will target self-dimming, AI-integrated, and ultra-durable multifunctional films. |

| Industry Applications | The market will spread to wearable computing, bio-responsive coatings, and AI-aided optical films. |

| Environmental Sustainability | Industry-scale implementation of bio-based polymers, energy-saving coatings, and carbon-neutral film processing. |

| Market Growth Drivers | Development will be spearheaded by smart materials, energy harvesting solutions, and adaptive self-regulating films. |

| Production & Supply Chain Dynamics | Businesses will invest in AI-driven logistics, blockchain-tracked monitoring, and localized sustainable film production. |

| End-User Trends | Future demand will focus on smart surfaces, dynamic optical coatings, and programmable material interfaces. |

The United States functional film market is expanding robustly, with expansion led by expansion in demand from electronics, automotive, packaging, and renewable energy industries. With fast expansion in display technology, semiconductor production, and energy-saving technology, high-performance functional films are increasingly in demand. The flexible display market in smartphones, tablets, and foldable mobile phones is especially driving demand for optical films, anti-glare films, and conductive films.

Yet another major industry driving growth is the automotive industry, where increased emphasis on lightweight materials, smart glass technology, and self-cleaning coatings is on the horizon. Functional films are the basis for solar control, anti-fog, and scratch resistance coatings for car windows and screens. Environmental concerns are also driving demand for recyclable and biodegradable functional films for renewable energy and packaging applications, mainly for solar panels and energy storage devices.

Government programs to drive local semiconductor manufacturing under the CHIPS Act are also driving demand for functional films in semiconductor fabrication and flexible electronics. The food and beverages industry is also exploiting the application of barrier films and antimicrobial coatings for shelf life extension, thus driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The United Kingdom functional films market is expanding on account of developments in flexible electronics, rising need for sustainable packaging, and development in automotive coatings. Rising demand for energy-efficient materials and smart buildings is also augmenting demand for UV-blocking, heat-resistant, and self-cleaning functional films.

As the UK has a robust automotive manufacturing industry, demand for solar control, scratch-resistant, and anti-glare films is on the rise. Emerging electronic display materials are also on the sights of companies, propelling transparent conductive film adoption in AR/VR and wearables.

In addition, the UK's sustainability and circular economy commitment is inspiring manufacturers to create recyclable and bio-based functional packaging films and consumer product films. Plastic waste legislation is compelling businesses to green up barrier films that substitute traditional plastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The market for functional films in Europe is expanding with significant R&D investment on general and advanced materials, increasing demand for renewable energy options, and regulatory support towards sustainability. Germany, France, and Italy are the dominant markets with focus on display technologies, car coatings, and intelligent packaging solutions.

The EU's Green Deal initiative is accelerating the use of energy-saving films in solar panels and smart glass. European automobile manufacturing giants are also employing self-healing, anti-fog, and heat-resistant films to make vehicles more durable and passengers more comfortable. The region's emerging semiconductor sector is also driving demand for functional films used in chip manufacturing and flexible circuits.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Japan's functional use market is advanced technology in the form of its country's leadership position in consumer electronics, automotive technology, and material science. Japanese technical expertise in high-definition display technology is propelling demand for optical film, anti-reflective coating, and OLED protective film.

While Japan is basking in the rapid acceptance of electric and autonomous vehicles, the nation is seeing an increased application of anti-fingerprint, anti-glare, and UV-resistant films on entertainment devices and car display screens. Functional films in flexible printed electronics, semiconductor manufacturing, and advanced robots are also its bets for Japan's leading production industry.

In addition, Japan is at the forefront of biodegradable film technology through government-backed efforts toward sustainability. As business giants like Toray and Mitsubishi Chemical invest in nanofilms with high performance, the market stands to experience a gigantic technology transformation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

South Korea functional films industry is progressing leaps and bounds with giant investment in consumer electronics, semiconductor technology, and flexible OLED display. South Korea holds the global display technology market by virtue of Samsung and LG, which have pioneered the world in high clarity optical films, polarizer films, and smudge-resistant coating.

Increased usage in 5G and IoT devices has also created demand for thin conducting films utilized in flexible circuits and in printed electronics. South Korea's strong automotive as well as EV market is also creating increasing applications of heat resistance and anti-glare films on future vehicles.

The nation is also seeing unprecedented advancements in green packaging technologies, with firms making investments in compostable and bio-based barrier films.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The functional films market is highly competitive, with key global players and specialized regional manufacturers contributing to industry growth. These companies focus on developing high-performance films used in industries such as electronics, automotive, packaging, and healthcare. Market leaders prioritize innovations in lightweight, flexible, and energy-efficient film technologies to meet the rising demand across various applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 10-15% |

| Eastman Chemical Company | 8-12% |

| Toray Industries, Inc. | 7-11% |

| Mitsubishi Chemical Holdings | 5-9% |

| DuPont de Nemours, Inc. | 3-7% |

| Other Companies (combined) | 50-58% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Develops high-performance functional films for optical, automotive, and electronics applications. Focuses on advanced coating technologies and sustainability. |

| Eastman Chemical Company | Produces specialty films with applications in safety, security, and high-performance packaging. Innovates in environmentally friendly film solutions. |

| Toray Industries, Inc. | Manufactures durable and lightweight functional films used in display screens, solar panels, and flexible electronics. |

| Mitsubishi Chemical Holdings | Specializes in high-barrier films for industrial and consumer applications, prioritizing energy efficiency and recyclability. |

| DuPont de Nemours, Inc. | Develops multi-functional films for medical, packaging, and photovoltaic applications. Strong focus on nanotechnology and bio-based materials. |

Key Company Insights

3M Company (10-15%)

3M leads the functional films market with its cutting-edge film technologies, widely used in optical displays, automotive coatings, and industrial applications. The company’s commitment to sustainability and advanced coating solutions strengthens its market presence.

Eastman Chemical Company (8-12%)

Eastman Chemical specializes in high-performance and safety-enhancing functional films, particularly in packaging and security applications. Its research focuses on biodegradable and high-durability films to meet regulatory standards and environmental concerns.

Toray Industries, Inc. (7-11%)

Toray Industries plays a crucial role in the functional films market, supplying lightweight and durable films for flexible electronics, solar panels, and OLED displays. The company continues investing in advanced polymer film technologies to enhance performance and sustainability.

Mitsubishi Chemical Holdings (5-9%)

Mitsubishi Chemical produces high-barrier and specialty films for various industries, including consumer electronics and food packaging. Its focus on energy-efficient materials and recyclability aligns with global sustainability trends.

DuPont de Nemours, Inc. (3-7%)

DuPont is a key innovator in multi-functional films, particularly in healthcare, photovoltaics, and advanced packaging solutions. The company is expanding its portfolio by integrating nanotechnology and bio-based materials into its film products.

Other Key Players (50-58% Combined)

Numerous regional and specialized manufacturers contribute to market growth through innovation, cost-effective production, and niche applications. These include:

The overall market size for functional films market was USD 31.1 Billion in 2025.

The functional films market is expected to reach USD 60.1 Billion in 2035.

The demand for functional film market is expected to rise due to its widespread use in chemicals, pharmaceuticals, and agriculture. Its role as an intermediate in fine chemicals, pesticides, and industrial solvents drives market growth. Advancements in chemical synthesis and the shift toward sustainable production further boost adoption. Additionally, increasing demand in coatings, resins, and fragrances supports market expansion.

The top 5 countries which drives the development of functional films market are USA, UK, Europe Union, Japan and South Korea.

Optical films and adhesive films to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by End-use Industry, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA